Trump Calls for Cryptocurrencies to Be Included in U.S. Strategic Reserve—How Is Cardano Using Narratives to Create a Bull Market Illusion?

TechFlow Selected TechFlow Selected

Trump Calls for Cryptocurrencies to Be Included in U.S. Strategic Reserve—How Is Cardano Using Narratives to Create a Bull Market Illusion?

Through the ups and downs of the volatile crypto market, the veteran public blockchain Cardano always comes with built-in BUFF, powering through like a game cheat.

Author: Nancy, PANews

Weathering the ups and downs of crypto market cycles, veteran blockchain Cardano always seems to come with built-in buffs, powering through. In this cycle, the old-timer is reinventing itself, aligning with the Bitcoin L2 narrative, and recently gaining widespread visibility as a potential U.S. crypto reserve asset, an ETF filing candidate, and a favored institutional investment—boosting its market presence significantly.

Ecosystem Metrics Lag Behind, but Policy Buff Points to "Insider Status"

On March 2, Trump posted that his executive order on digital assets directs a presidential working group to advance a strategic reserve including BTC, ETH, XRP, SOL, and ADA. However, this wasn't entirely unexpected. At the end of January, Ripple CEO Garlinghouse confirmed discussions with Trump about including XRP in the U.S. strategic reserve, emphasizing the need for diversification. It now appears this strategy has been in motion for some time.

The announcement instantly revived market sentiment overnight. ADA, in particular, surged dramatically—reaching a 24-hour peak gain of over 78.1% according to CoinGecko, topping trending charts. Yet amid the excitement, skepticism emerged: compared to other listed assets, Cardano's technological capabilities and ecosystem development appear weaker—why was it selected for inclusion in a national reserve?

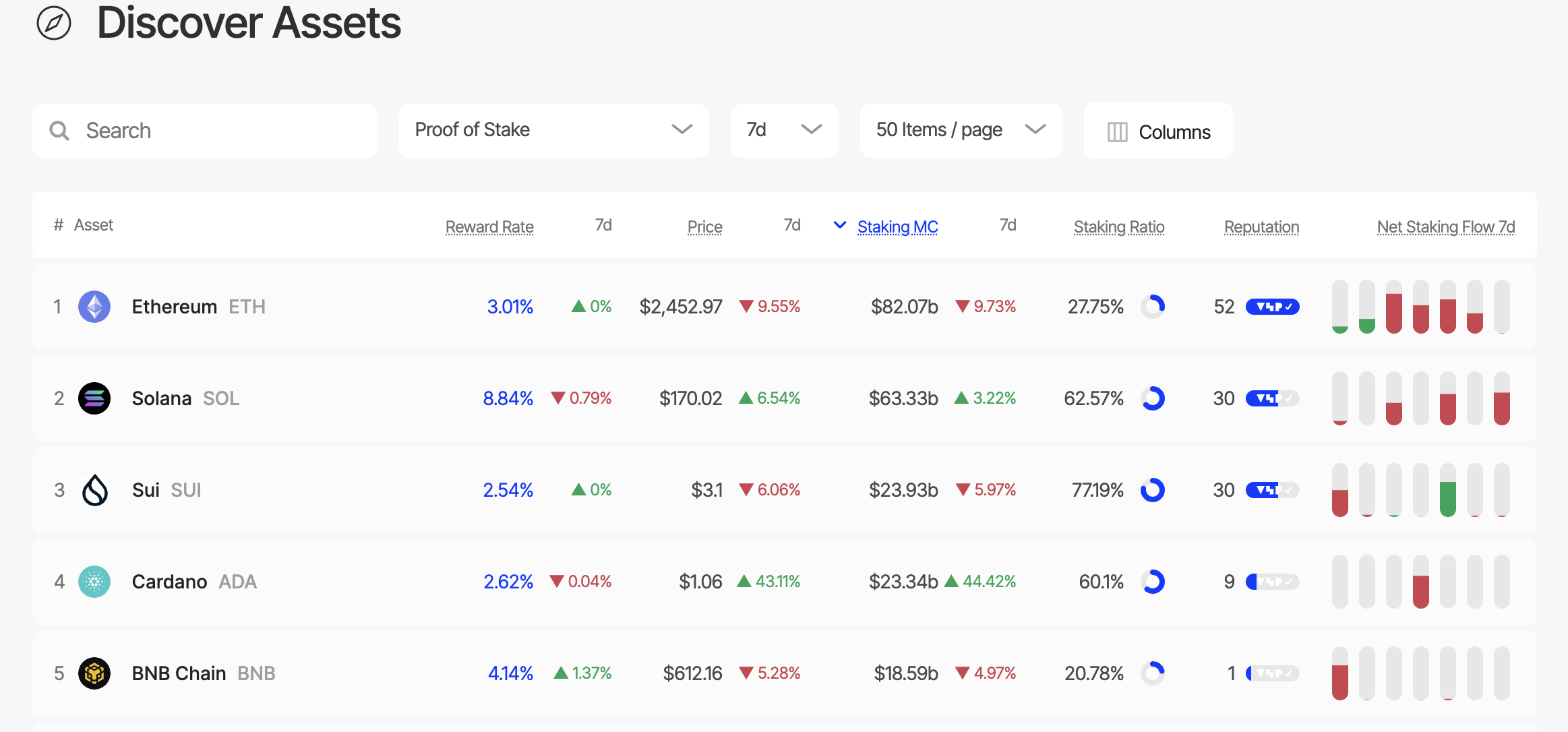

Cardano holders demonstrate strong long-term commitment, with over 60% choosing to stake their tokens to support the network, contributing to its overall health. According to staking data platform Staking Rewards, Cardano ranks as the fourth-largest PoS blockchain network, with $23.34 billion in staked value and a staking rate of 60.1%.

However, DeFiLlama data shows that as of March 3, Cardano’s TVL stands at approximately $508 million, with a stablecoin market cap of $22.55 million and just $3,024 in daily application revenue. In contrast, Solana’s TVL exceeds $8.38 billion, generating around $836,000 in daily income. From an ecosystem performance standpoint, Cardano lags behind other selected assets. Despite its impressive staking figures, ADA staking has not translated into robust dApp usage, indicating significant gaps remain in its ecosystem.

"So does this mean we have to change our name to 'American Digital Assets'?" joked Charles Hoskinson, founder of Cardano, in a recent tweet.

In reality, Cardano has long been mistakenly labeled the “Japanese blockchain,” but it is actually a U.S.-born project founded by American Charles Hoskinson—one of Ethereum’s original eight co-founders—who has invested heavily in blockchain, longevity science, and space exploration. In 2014, after disagreeing with Vitalik Buterin on Ethereum’s direction, Hoskinson left and established Input Output Global (IOG), headquartered in the U.S., launching Cardano shortly thereafter. Its popularity in Japan, where it’s sometimes called the “Japanese Ethereum,” stems largely from its early fundraising approach. Around 95% of participants in Cardano’s initial public sale were Japanese investors—a phenomenon dubbed “retirement investing.” This was due to Emurgo, a Japanese company, leading the offering during a period when Japan’s regulatory environment was more lenient than that of Europe or the U.S. As U.S. crypto regulations become increasingly open, Cardano is actively distancing itself from its Japanese association.

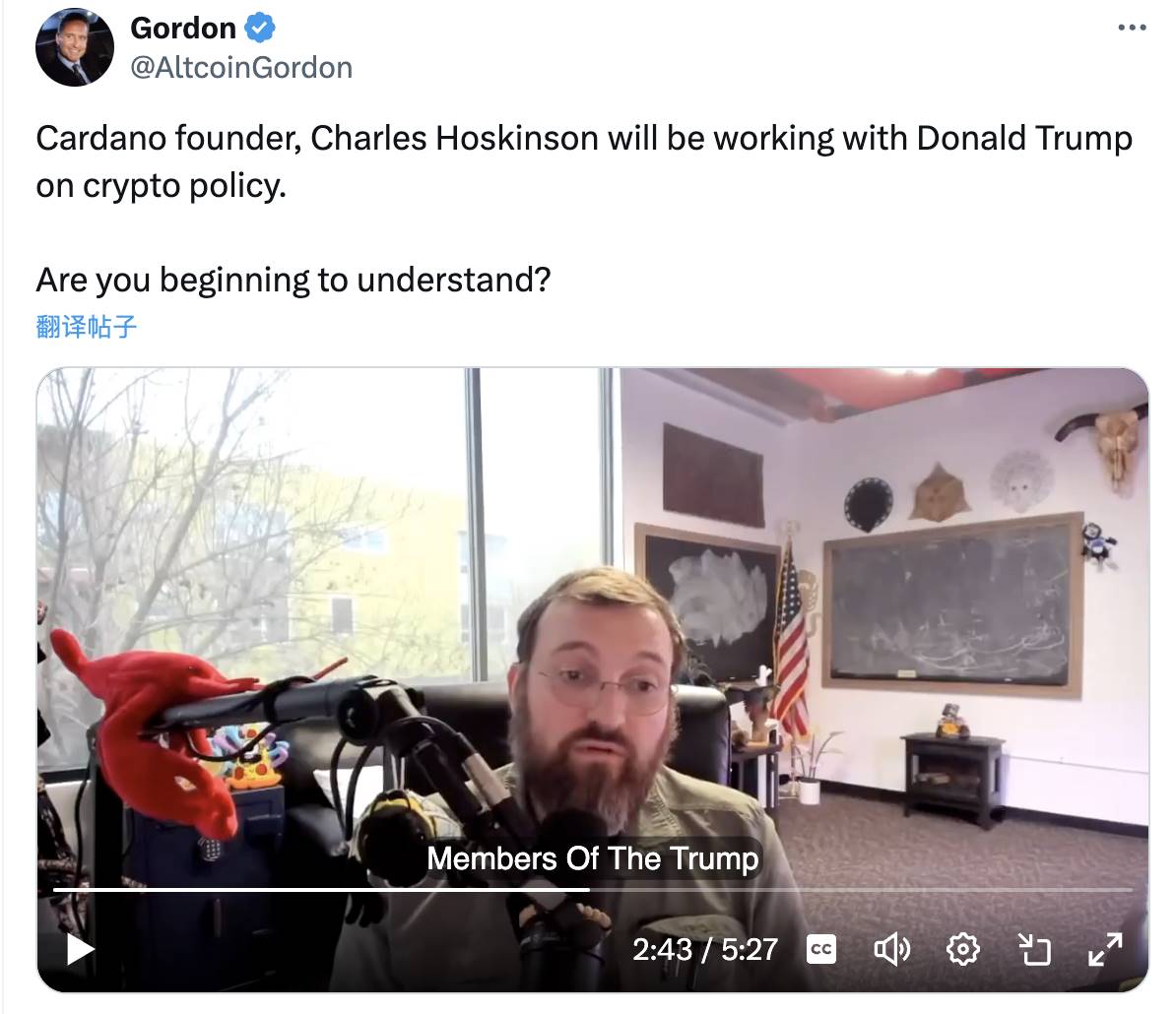

Many speculate that Cardano’s inclusion in the strategic reserve isn’t due to technical merit, but rather close ties with the U.S. government—especially given repeated hints from founder Charles Hoskinson. For instance, in November 2024, amid rumors that Trump was considering appointing him as a crypto policy advisor, Hoskinson mentioned having close connections within Trump’s team. He stated he would work with lawmakers and officials to help pass bipartisan legislation. IOG planned to establish a cryptocurrency regulatory policy office in early 2025 and intended to engage with “key leaders” in the U.S. government to shape legislative agendas around securities and commodities in crypto. However, no concrete progress has been disclosed, and there is currently no evidence confirming any official role within the U.S. government.

On March 2, Hoskinson clarified: “No one was appointed tonight to any administrative role related to cryptocurrency. Meetings don’t imply endorsement or confer magical new powers. The legislative process takes time and effort. I won’t comment further until there are clear, substantive developments tied to enacting new laws that allow this industry to survive and thrive in the United States.”

From Academic Roots to Bitcoin Sidekick: Cardano’s Narrative Reinventions Chase Trends

Fleeting narratives, enduring Cardano.

Recently, several developments have placed Cardano back in the spotlight. ADA ranks among the top three holdings in Grayscale’s Smart Contract Platform Fund, with an allocation of 18.23%. Grayscale’s spot ADA ETF application has been accepted by the SEC. Additionally, Cardano plans to integrate Ripple’s RLUSD stablecoin to strengthen its DeFi ecosystem while expanding use cases for RLUSD.

Notably, Charles Hoskinson recently revealed that Input Output Global (IOG) will prioritize developing Bitcoin DeFi ecosystems in 2025. The team plans to collaborate with multi-party computation protocol developer Fair Gate Labs, aiming to launch a demo version before the Bitcoin Conference in May 2025. Fair Gate Labs’ technology will form the foundation of BitcoinOS, requiring no new token issuance—cross-chain transactions will be conducted solely using Bitcoin. The project will also partner with community initiatives and wallet providers to achieve its goal of “awakening the sleeping giant.”

Leveraging the momentum from the strategic reserve announcement has clearly provided Cardano with additional policy tailwinds, injecting fresh capital flows and attention into the market.

Looking back at Cardano’s journey, across multiple market cycles, it has consistently excelled at crafting compelling narratives to build a unique market identity, often leveraging external events to boost visibility.

From being marketed as a “research-driven third-generation blockchain,” to positioning itself as the “green Ethereum killer” with an eco-friendly angle, then highlighting smart contract deployment as a pivotal moment, Cardano is now rebranding once again—as a “Bitcoin Layer 2.” These narratives aren’t always rooted in technical achievements; they’re often propelled by external events and media momentum. Bull markets amplify these promises, and Cardano’s strong price rallies quickly capture investor attention.

Yet, despite evolving successfully from academic origins to a supporting role for Bitcoin, Cardano still faces its biggest weakness: lack of real-world adoption. Whether it can transcend its historical reputation as a bull-market-only illusion—even with a boost from U.S. policy momentum—remains to be seen.

Accused of Being Mere Rhetoric, Implementation Path Remains Unclear

Beyond accusations of favoritism, the inclusion of ADA and other altcoins in a potential U.S. strategic reserve lacks clarity on implementation methods, timelines, specific scale, and funding sources. Market observers widely view it as still being at the intention stage, with execution remaining highly uncertain. (Related reading: Trump Announces Crypto Reserve Plan: Five Assets Included, But Faces 'Advertising Slot' Criticism Amid Implementation Uncertainty)

Udi Wertheimer, founder of Taproot Wizards, argued: “The best take I’ve seen so far on the strategic reserve is that this is classic Trump negotiation tactics. To actually establish such a reserve, Trump must convince Congress—he cannot do it alone. Whenever Trump needs to persuade other stakeholders, he starts by making an absurd demand so he can later walk it back. So in Trump’s chess game, this simply means he’s telling Congress: if you won’t agree to a Bitcoin reserve, then I’ll propose even crazier terms.”

Arthur Hayes, co-founder of BitMEX, pointed out: “There’s nothing new here—just talk. Come back and tell me when they get congressional approval to borrow money or raise the gold price. Without those, they have no funds to buy Bitcoin or altcoins.”

“Just investing in Bitcoin might be the best option—it’s simple, and the logic of Bitcoin as gold’s successor is clear. If people want more diversification, they could construct a market-cap-weighted crypto index to maintain neutrality,” said Brian Armstrong, co-founder and CEO of Coinbase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News