VC's Dilemma: Liquidity Transformation and the Reshaping of Trust Mechanisms

TechFlow Selected TechFlow Selected

VC's Dilemma: Liquidity Transformation and the Reshaping of Trust Mechanisms

Whether in China or the U.S., the best days for VC as an investment asset class are over.

Author: YettaS

The biggest takeaway from Consensus HK was how tough it is for VCs right now—so much so that "widespread despair" wouldn't be an exaggeration, especially when contrasted sharply with the P-generals. Some VCs can't raise their next fund, some have lost half their team, others have shifted to strategic investments instead of independent ones, and a few are even considering launching Memes just to raise capital...

Many VC peers have chosen to exit altogether—some joining project teams, others transitioning into KoLs—options that seem far more cost-effective. Amid this upheaval, everyone is searching for new ways to survive. And I’ve been asking myself: what exactly went wrong with VC? And how can we break through?

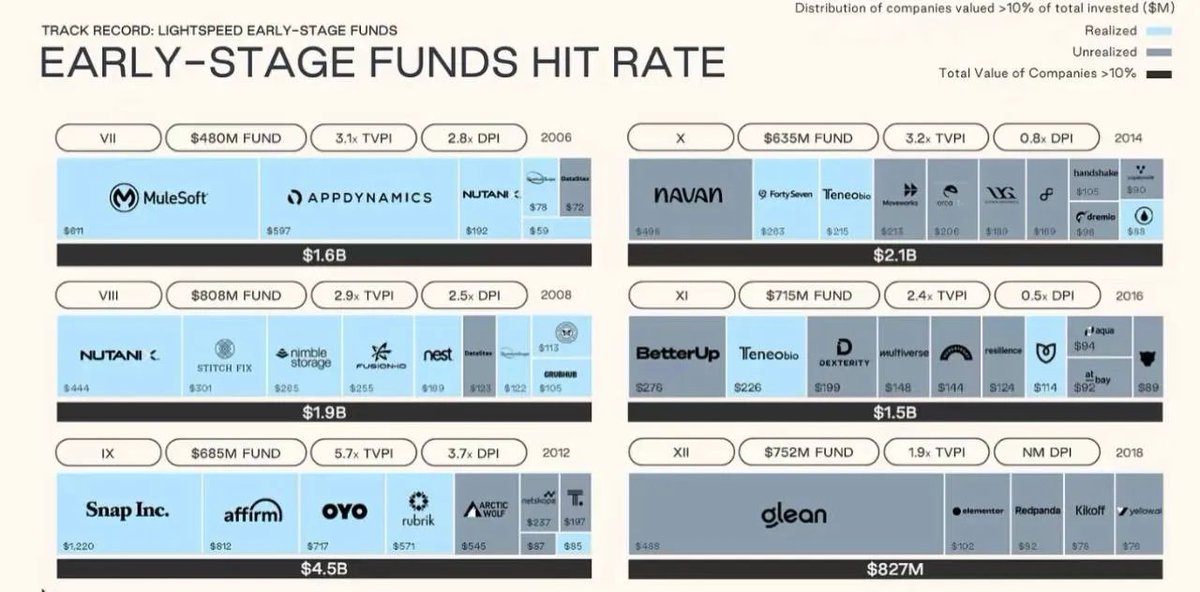

First, we must acknowledge that whether in China or the U.S., the golden era for VC as an asset class is over. The chart below shows Lightspeed’s fund returns over several vintages. Their best-performing fund, from 2012, invested in Snap, Affirm, and OYO, achieving a DPI of 3.7x (DPI measures distributed returns without relying on valuations, reflecting actual cash returns). Of course, that pales in comparison to simply buying BTC. But after 2014, even breaking even became a challenge.

Chinese VCs followed a similar path. Riding on demographic dividends, mobile and consumer internet boomed, giving rise to giants like Alibaba, Meituan, and ByteDance. 2015 marked the last high point. Afterward, tightening regulations, reduced liquidity, fading industry tailwinds, shifting industrial cycles, growth bottlenecks, and constrained IPO exits led to a sharp decline in VC returns, driving many professionals out of the field.

Crypto VCs are no exception. With macro shifts, evolving market structures, and declining capital returns, they face immense survival challenges.

It’s All About Cost and Liquidity

In the past, the VC value chain was clear: projects brought innovative ideas, VCs provided strategic support and resources, KoLs amplified visibility at critical moments, and final value discovery happened on CEXs. Each party contributed different value at different stages, assumed corresponding risks, and received commensurate rewards—a “relatively fair” value chain.

As VCs, our value has never been limited to just writing early checks. We help projects quickly access key ecosystem resources to accelerate development, provide timely advice during market shifts to adjust strategies, and even assist in building core teams. To maintain long-term alignment with founders, we often accept lockups lasting up to a year post-TGE, followed by 2–3 years of vesting—demonstrating our desire to play a non-zero-sum PVE game together.

Yet today, the core issue is extreme illiquidity and intensified market gaming, making the traditional VC model unsustainable.

The Shifting Capital Flow: Where Did VC Go Wrong?

This bull cycle has been primarily driven by U.S. spot Bitcoin ETFs and strong institutional inflows. However, the capital transmission path has fundamentally changed:

-

Institutional capital flows mainly into BTC, BTC ETFs, or even indexes—but rarely spills over into broader altcoin markets;

-

Without real technological or product innovation, altcoins struggle to sustain high valuations.

This directly undermines the current relevance of the VC model. Retail investors believe VCs enjoy unfair advantages—accessing tokens at lower costs and possessing critical market information. This asymmetry erodes trust and further drains liquidity. In a PvP environment, retail demands “absolute fairness.” In contrast, secondary funds don’t generate such strong opposition because retail could theoretically enter at the same price—after all, they were once offered “absolute fairness.”

The massive FUD against VCs today is essentially a backlash of “absolute fairness” against “relative fairness,” triggered by liquidity scarcity.

The Rise of Meme Funding Models

If previously I viewed Memes as a cultural phenomenon, now we must recognize them as a novel fundraising mechanism. Its core value lies in:

-

Fair participation: Retail can track on-chain data and acquire early tokens under relatively fair pricing;

-

Lower entry barriers: During DeFi Summer, we backed many solo devs who drove value through product innovation. Now, Meme models lower the bar even further, allowing developers to “have assets before products.”

There’s nothing inherently wrong with this logic. Looking back, many blockchains conducted TGEs without mature ecosystems or mainnets—why can’t Memes follow the same path, first capturing attention, then advancing product development?

At its core, the “asset-first, product-later” trajectory reflects the sweeping wave of populist capitalism across the financial landscape. The dominance of attention economics, catering to mass desires for quick wealth, breaking monopolies of traditional finance, lowering capital thresholds, and promoting transparency—all are unstoppable trends of this new populist era. From GameStop retail vs. Wall Street, to the evolution from ICOs to NFTs to Memes, these are financial manifestations of the same zeitgeist.

That’s why I say, Crypto is merely a microcosm of our times.

The VC’s Role in the New Model

No funding model is perfect. The biggest problem with Meme-based fundraising is its extremely low signal-to-noise ratio, creating unprecedented trust challenges:

-

Extremely low signal-to-noise ratio: Fair launches drastically reduce issuance costs, flooding the market with junk.

-

Lack of transparency: For highly liquid Meme projects, everyone can enter early, making long-term commitment less relevant than short-term profit-taking.

-

Soaring trust costs: High liquidity means high gaming. Day-one circulation means no structural alignment between investors and founders for long-term success. Everyone becomes each other’s exit liquidity—an unstable and unsustainable trust framework.

I fully agree with @yuyue_chris’s take on differing mindsets among participants:

Meme players believe: narrative > tokenomics ~ community or sentiment > product & tech;

Primary market believes: narrative > product & tech ~ tokenomics > community or sentiment;

The Meme model is essentially a darker version of the on-chain world. Without product or tech foundation, “absolute fairness” is often just a facade. Look at Libra—every orchestrated public利好 by the cabal behind the scenes ultimately turns us into precisely targeted victims. They always anticipate your moves. In such a hyper-competitive environment, genuine long-term Builders become nearly impossible to identify.

I don’t believe VCs will disappear, because massive information and trust asymmetries still exist. For example, collaboration resources like ARC are simply inaccessible to ordinary developers.

But in the face of this populist capitalist wave, it's unrealistic for VCs to keep profiting passively through information asymmetry as they did before. Adapting isn't easy—especially when market paradigms shift entirely and proven methodologies rapidly become obsolete. The rise of Meme fundraising isn’t accidental; it’s the result of deeper liquidity transformations and a restructured trust mechanism.

When Meme-driven high liquidity and short-term gaming meet VC’s long-term support and value empowerment, finding a balance between the two is the critical challenge facing VCs today. On one hand, Primitive is fortunate to have the flexibility to adapt to market changes. But recognizing structural shifts and transforming investment strategies is anything but simple.

Yet no matter how the market evolves, one thing remains unchanged—long-term value will always be defined by exceptional founders with vision, extraordinary execution, and relentless commitment to building.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News