Focusing on the liquidity lifeline: Will Pundi AI's upcoming token upgrade shake up the AI Agent competition landscape?

TechFlow Selected TechFlow Selected

Focusing on the liquidity lifeline: Will Pundi AI's upcoming token upgrade shake up the AI Agent competition landscape?

Multiple core products are on the way, making 2025 a pivotal year for Pundi AI's vision to materialize.

Written by: TechFlow

In Q1 2025, the crypto trending topics were dominated by token launches:

After Berachain, Story, Solayer, and MyShell announced their TGEs, multiple top-tier projects including Initia and Lens hinted at mainnet or TGE arrivals via posts on their social media.

The community is buzzing about the potential wealth hidden within these launches. At the same time, another project’s major token update has also sparked widespread discussion and attention:

According to official social media announcements, decentralized AI project Pundi AI will undergo a rebranding and token upgrade on February 25, 2025, with its ecosystem token $FX officially upgrading to $PUNDIAI at a ratio of 100:1.

This milestone, comparable to a new token launch, has already allowed sharp investors to sense the massive opportunities presented by the token upgrade process.

Beyond the token upgrade, Pundi AI’s upcoming innovative product—its Virtual-like AI MM Agent—will further complete Pundi AI’s puzzle of “providing full-lifecycle services for AI development,” significantly heightening community expectations for its future growth.

With the swap approaching, why should we pay attention to this Pundi AI token upgrade?

As the AI Agent narrative continues, what fresh innovations will Pundi AI’s upcoming AI MM Agent bring?

From data and AI Agent issuance to liquidity optimization, how does Pundi AI build a comprehensive product matrix around its vision of “providing full-lifecycle services for AI development”?

To address these questions, this article aims to uncover the truth.

Token Upgrade: Is Pundi AI Bringing the Next 100x Opportunity in 2025?

How exactly will Pundi AI’s token upgrade work?

First, the token upgrade is confirmed for February 25, during which $FX tokens will be upgraded to $PUNDIAI at a 100:1 ratio.

Throughout this process, Pundi AI aims to deliver a seamless, frictionless upgrade experience for holders:

For users of Pundi AIFX Omnilayer (formerly F(x) Core), their $FX holdings will automatically upgrade to $PUNDIAI without additional action required, and staked tokens will continue earning rewards post-upgrade;

For users on Base and Ethereum networks, although manual upgrade via a designated portal is required, they may alternatively bridge their tokens back to Pundi AIFX Omnilayer for automatic conversion;

For exchange users, this token upgrade is supported by major exchanges including Upbit, Coinbase, Bithumb, Kucoin, Gate.io, and CoinEX, enabling automatic $FX to $PUNDIAI conversion. Currently, Upbit has announced it will suspend Function X (FX) deposits, withdrawals, and trading to better prepare for the upgrade, with dates for other exchanges pending.

Beyond the technical details of the upgrade, a more crucial question arises: Why should we care about this token upgrade?

First, an almost obvious reason:

$$FX will officially upgrade to $$PUNDIAI at a 100:1 ratio—an effective 100x deflation, and typically, according to supply-demand dynamics, when asset quantity decreases, its unit intrinsic value increases. Thus, deflation often correlates with rising token value, giving $PUNDIAI significant room for 100x valuation growth.

This precedent exists:

In April 2021, the Pundi team conducted a token upgrade for its PayFi product line at a rate of 1000 NPXS = 1 PUNDIX, achieving a 100x performance. What level of opportunity might this $FX to $PUNDIAI upgrade unlock? The community eagerly awaits.

More importantly, amid the AI wave sweeping through the crypto ecosystem: On one hand, $PUNDIAI, as a newly branded token focused on the AI sector, brings fresh narratives and pricing, potentially offering early investors gains from positioning in AI; on the other hand, among AI projects listed on Upbit and Coinbase, $PUNDIAI stands as one of the smallest market cap AI projects, leaving substantial room for growth.

Certainly, positive sentiment toward $PUNDIAI surrounding the token upgrade stems not only from market trends but also from the project's fundamentals:

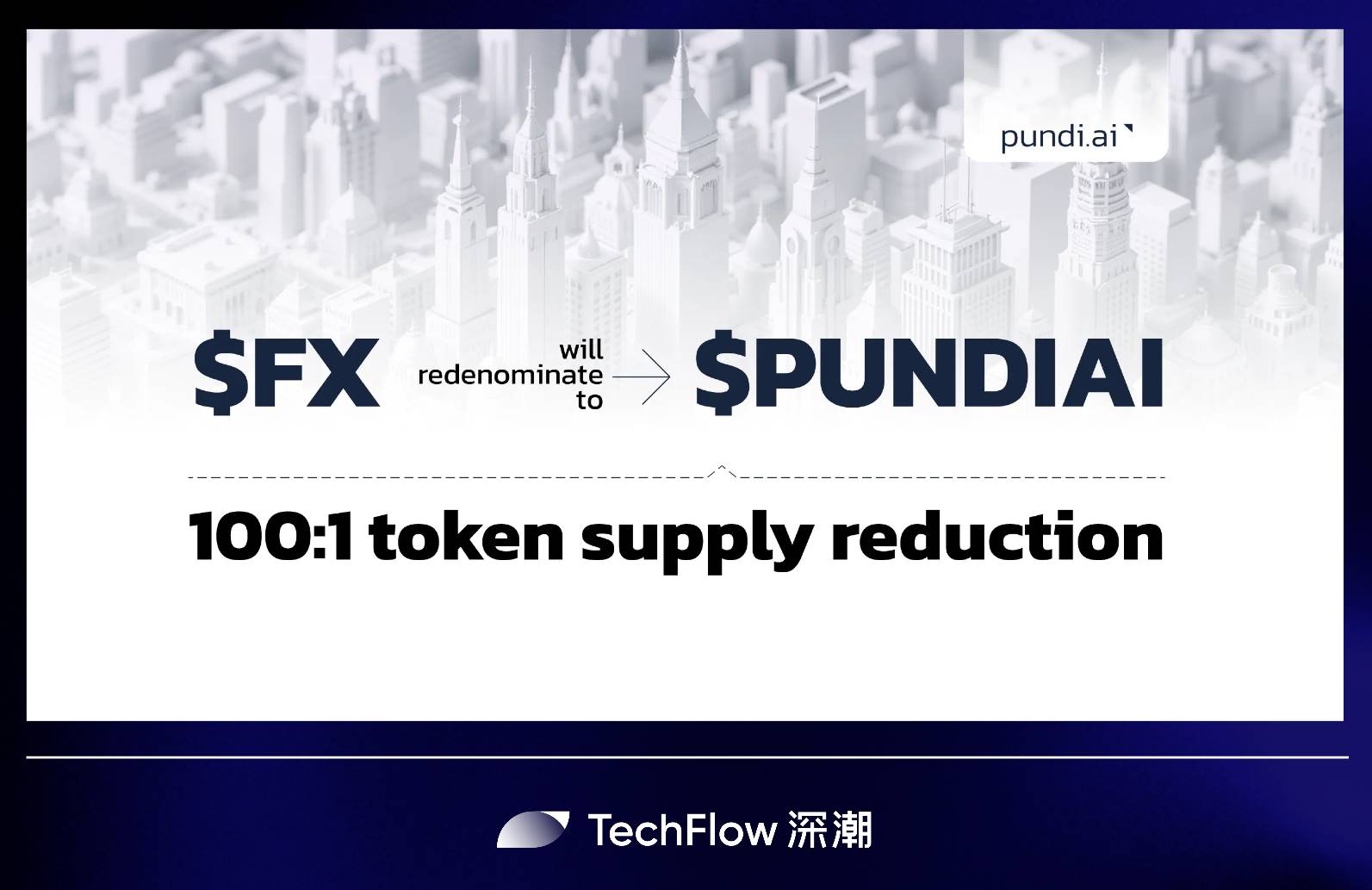

Notably, in a cycle where VC tokens generally underperform, $PUNDIAI has never raised funds and has no future fundraising plans, aiming to build a purely community-driven and fully decentralized AI community;

In this context, compared to many VC tokens facing massive future unlocks, $PUNDIAI is already fully unlocked—its FDV equals actual circulating market cap—further alleviating community concerns.

On the other hand, products are the primary vehicles and ultimate endpoints of growth. With multiple core products set to launch throughout 2025, they will not only draw renewed industry attention to this token upgrade but also heighten expectations for Pundi AI’s 2025 performance.

Focusing on the Lifeline of Liquidity: Pundi AI MM Agent Launch Imminent

From its initial vision of “becoming the world’s largest decentralized AI data layer” to now championing the slogan “building end-to-end services across the entire AI lifecycle,” years of groundwork have clarified Pundi AI’s AI product matrix:

AI Data Layer:

-

Pundi AI Data Platform

-

PURSE+ Browser Extension

-

Pundi AI Data Marketplace

AI Agent Issuance Layer:

-

Pundi Fun AI Agent Launcher

AI Agent Liquidity Layer:

-

Pundi AI MM Agent

Infrastructure Support:

-

Pundi AIFX Omnilayer

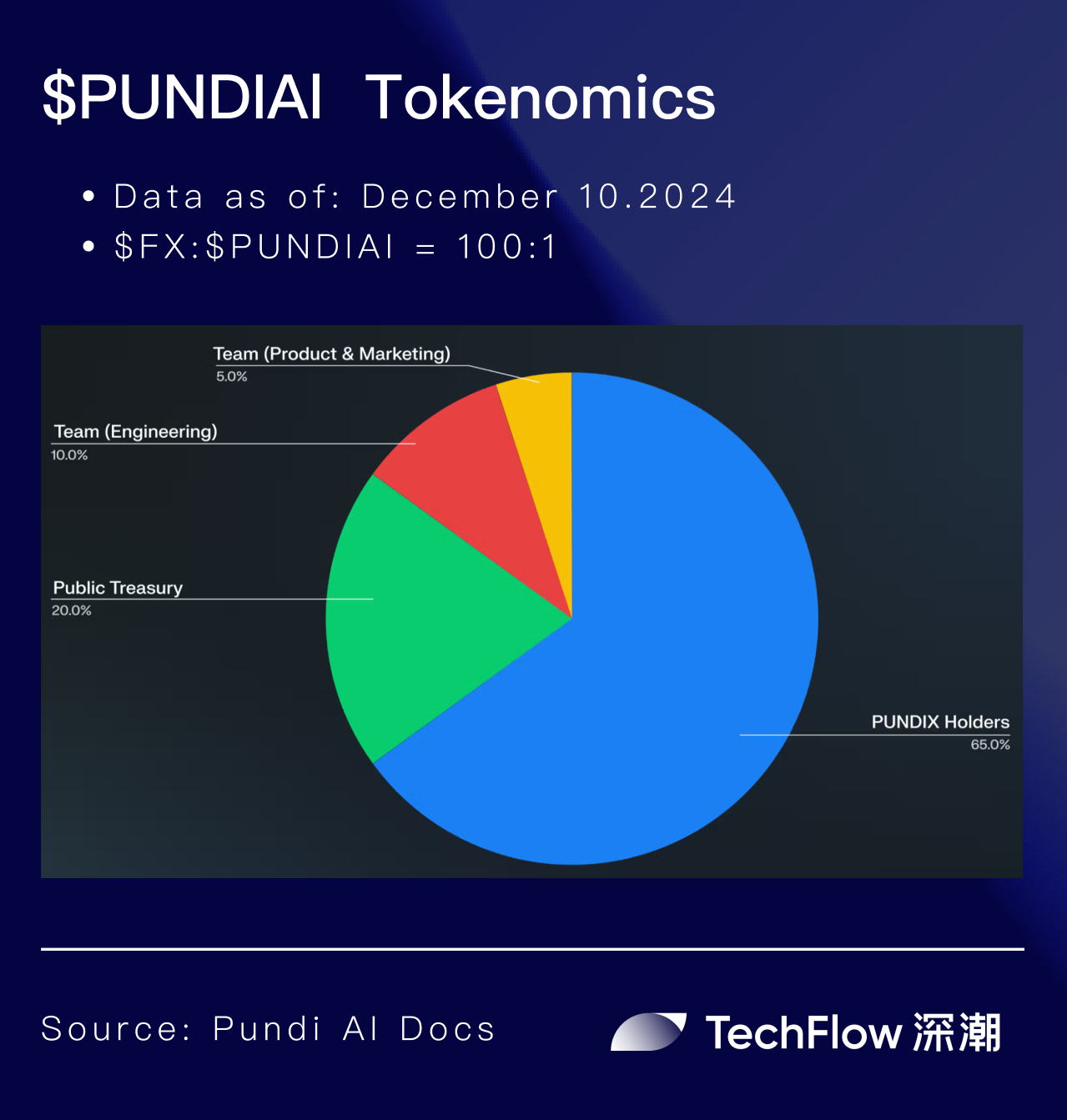

We know data is the fuel for AI development. Pundi AI’s initial product design heavily emphasized data, aiming to create a fair, rewarding decentralized AI data layer—from data acquisition, labeling, to trading.

On data acquisition, Pundi AI aims to aggregate rich data sources from both Web2 and Web3: Users can upload and contribute data via the Pundi AIData platform, while the browser extension PURSE+ allows users to contribute data by completing labeling tasks on Web2 social platforms like X (Twitter).

On data processing, Pundi AI is building a decentralized crowdsourced data labeling marketplace: AI projects needing data can create requests on the Pundi AI Data platform, while users participate in labeling via the platform, earning rewards through token incentives to encourage broad participation.

On data trading, Pundi AI advocates that “labeled data = intellectual property”: Data as assets can be listed on the Pundi AI Data Marketplace, where buyers efficiently search by category and pay to download. Contributors receive ongoing revenue shares—including known, future, and dividend earnings—throughout the data’s lifecycle.

Months ago, following Pundi X’s rebranding to Pundi AI and accelerated expansion into the DeAI space, we published an article detailing Pundi AI’s transformation journey and product architecture at the time—including Pundi AI Data Platform, PURSE+, Pundi AI Data Marketplace, and Pundi AIFX Omnilayer. We won’t repeat those details here; interested readers can click the link below for deeper insights:

Having addressed AI data layer challenges, what comes next in AI development?

As AI Agents rise in prominence, issuance and liquidity have become key battlegrounds in crypto AI competition. Pundi AI’s imminent launch of Pundi Fun AI Agent Launcher and Pundi AI MM Agent naturally becomes our next focus.

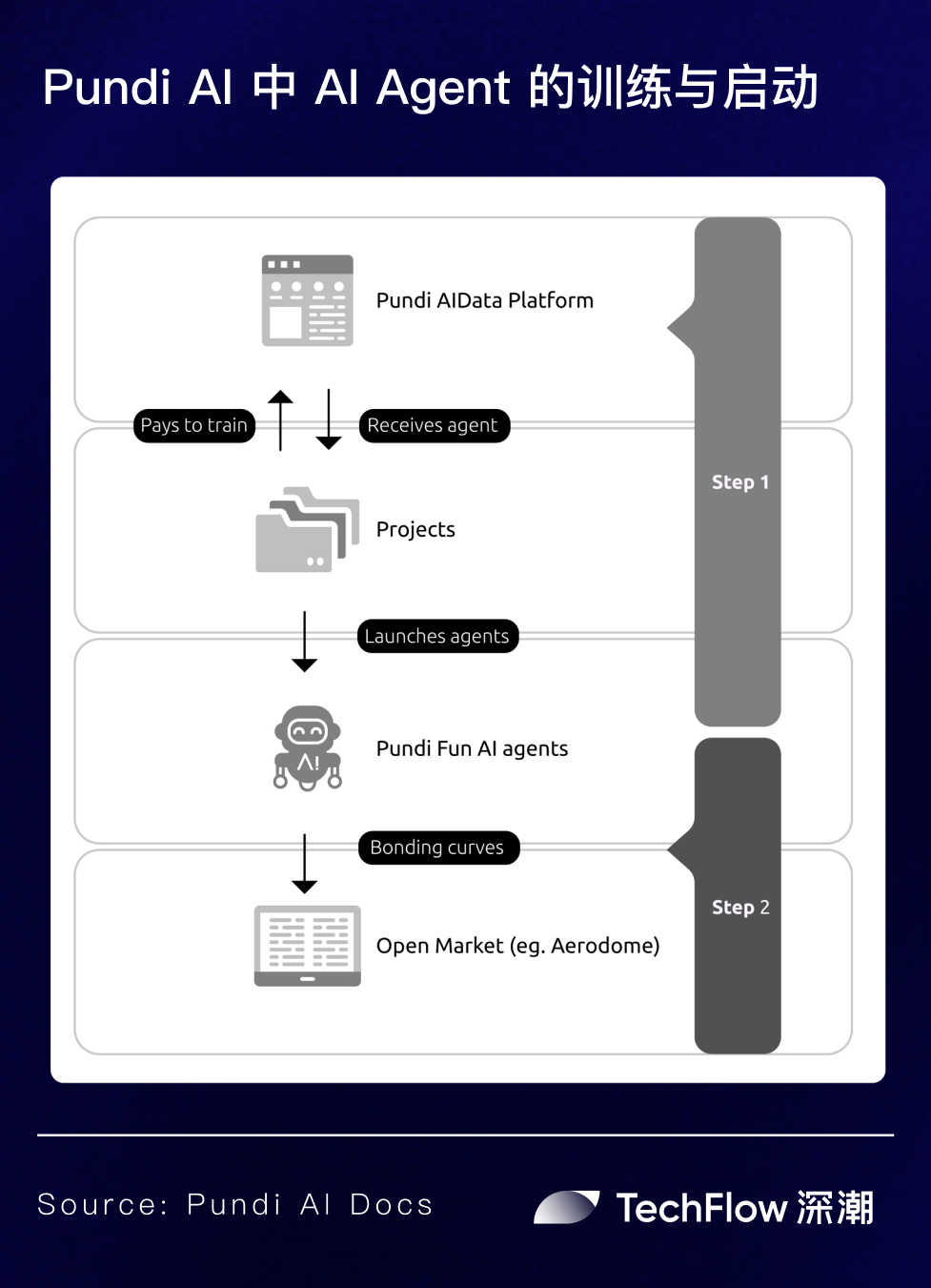

As the name suggests, Pundi Fun AI Agent Launcher focuses on AI Agent issuance.

If you’re familiar with Virtuals, the mechanics of Pundi Fun AI Agent Launcher will feel familiar.

Through Pundi Fun AI Agent Launcher, you can efficiently create your personalized AI Agent within minutes, with all product design centered on delivering simple, intuitive, seamless experiences.

Meanwhile, whenever an AI Agent is created, its corresponding AI Agent DAO token is simultaneously launched. This DAO token represents ownership rights over the AI Agent, with 100% of tokens placed into the pool. Once the DAO token’s FDV exceeds $65,000, liquidity will be deployed on public markets like Aerodrome.

So far, the mechanics seem indistinguishable from the well-known Virtuals model. How then does Pundi AI differentiate its offering?

First, by integrating with its existing data-layer products, you can pay to purchase high-quality data from the Pundi AI Data Platform to train your AI Agent, making it smarter and enhancing its service capabilities.

Second, AI Agent asset issuance is essentially a battle for on-chain liquidity—liquidity wins markets—so ensuring ample market depth and market-making is unavoidable.

Within the broader context of decentralized AI, the centralization issues of traditional market-making cannot be ignored. While AMMs dazzled during DeFi Summer, we must acknowledge current AMM shortcomings: low capital efficiency, LP positions going out of range, difficulties in cross-exchange or cross-chain arbitrage, and rebalancing challenges.

Pundi AI MM Agent is specifically designed to optimize AI Agent liquidity: It aims not only to combine the flexibility of traditional market-making with the accessibility of AMMs for improved capital efficiency but also to function as a profit-maximizing machine through dynamic liquidity allocation, adaptive rebalancing, and MEV capture.

Specifically:

The Pundi AI Foundation will fund AI Agents by purchasing their DAO tokens and injecting liquidity in the form of AI Agent token / $PUNDIAI pairs.

Simultaneously, the Pundi AI MM Agent continuously scans the market, adjusting parameters in real-time based on performance to maintain efficient liquidity and seize market opportunities.

Thus, compared to other AI Agents, those launched via Pundi Fun AI Agent Launcher gain a distinct liquidity advantage thanks to Pundi AI MM Agent, laying a solid foundation for long-term project health and holder value protection.

However, some details remain unclear, such as:

Among so many AI Agents, which ones will the Pundi AI Foundation choose to fund?

Where does the Pundi AI Foundation’s funding come from?

Given liquidity is injected in AI Agent token / $PUNDIAI pairs, how does this mechanism empower $PUNDIAI holders?

All answers begin with the ingenious economic model design of $PUNDIAI.

Dual-Token Design Under ve Model: $PUNDIAI Has Real Utility

Regarding tokenomics—a core element touching the soul of project development—Pundi AI adopts a ve model.

In short, Pundi AI features a dual-token system:

-

$PUNDIAI: The utility token of the Pundi AI ecosystem, widely used across numerous Pundi AI products such as Pundi AI Data, Pundi AI Data Marketplace, Pundi AIFX Omni Layer, and Pundi Fun AI Agent Launcher. Contributors earn $$PUNDIAI rewards and can use $$PUNDIAI to pay for services.

-

$vePUNDIAI: The governance token of the Pundi AI ecosystem, obtained by locking $PUNDIAI. Holders participate in liquidity governance for Pundi AI MM Agent, with Pundi AI encouraging long-term value creation—longer lock periods yield higher reward weights.

Now that we understand each token’s role, let’s address the operational mechanics behind Pundi AI MM Agent’s innovative system.

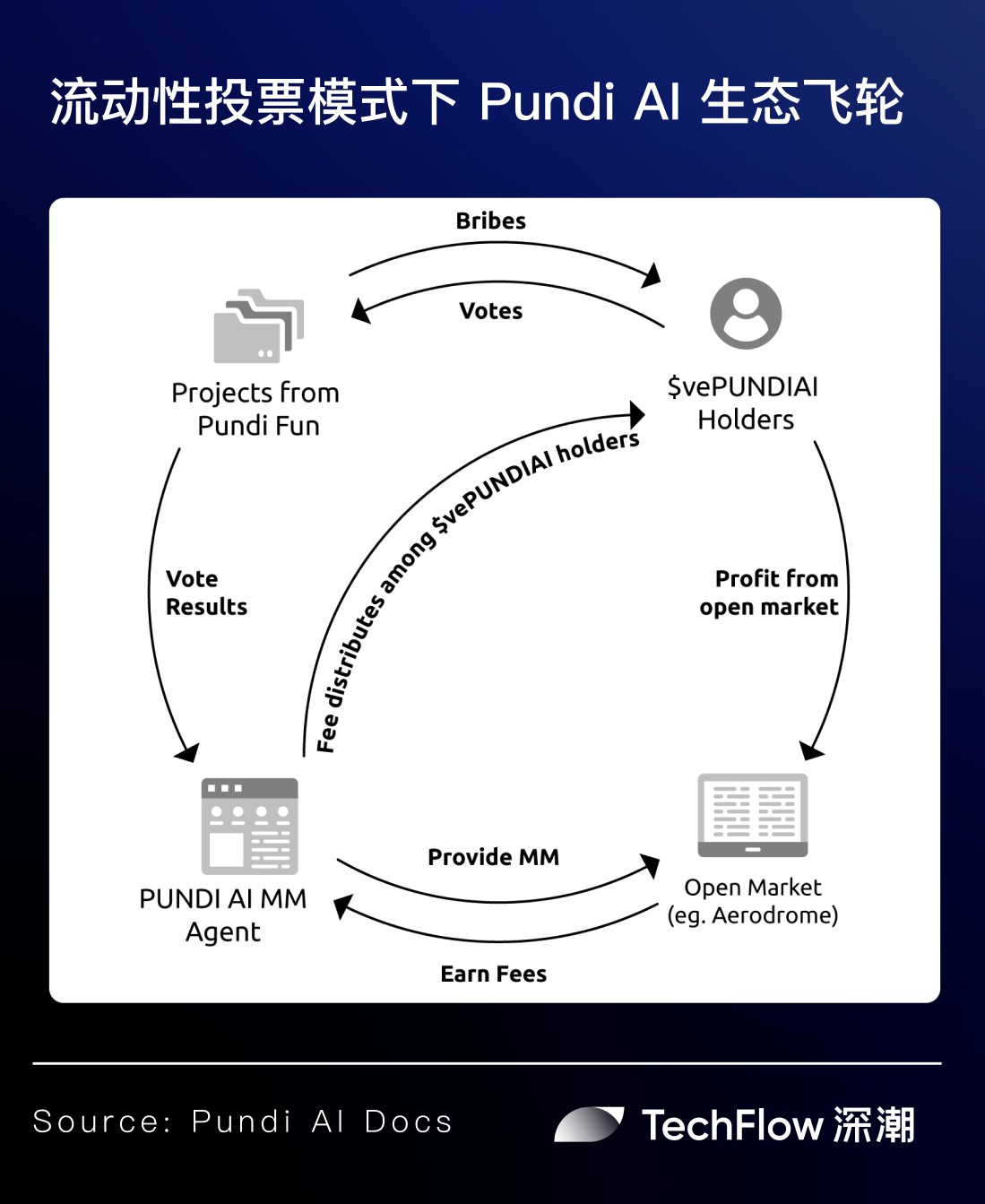

First, how does the Pundi AI Foundation decide which AI Agent to support?

Simply: Through $vePUNDIAI-based liquidity governance of the AI MM Agent.

On a weekly cycle, $vePUNDIAI holders vote for preferred AI Agents, and based on voting results, the Pundi AI Foundation injects liquidity into those agents on public markets.

Then, what motivates $vePUNDIAI holders to participate in voting?

Beyond supporting ecosystem stability, $vePUNDIAI holders also earn substantial returns.

First, AI Agent creators must pay a fee to request inclusion in the liquidity incentive whitelist, with 10% of this fee distributed back to $vePUNDIAI holders via the protocol pool.

Second, to attract votes, AI Agents must compete vigorously—improving their quality and sharing part of their revenue with voters. The richer the rewards for voters, the stronger their voting motivation.

Most importantly, where does the Pundi AI Foundation’s funding come from?

Pundi AI has established a Pundi AI Protocol Pool.

According to Pundi AI’s official Gitbook, 10% of revenue from data purchases on the Pundi AI Data Platform and 10% of transaction volume from the Pundi AI Data Marketplace flow into the protocol pool.

Additionally, within the Pundi Fun AI Agent Launcher: 10% of the portion AI Agents allocate to “bribe” $vePUNDIAI holders for increased support goes into the protocol pool; 1% of transaction fees enter the pool; meanwhile, the foundation earns ongoing fees from LP trades between AI Agent tokens and $PUNDIAI, which also flow into the pool.

Multiplying revenue streams accumulate within the Pundi AI Protocol Pool, empowering the ecosystem via the foundation. This resolves the question of how AI Agent development is deeply tied to $PUNDIAI holders—the voting-based liquidity allocation mechanism passively involves AI Agents in “vote-buying,” fostering healthy competition, encouraging broad governance participation, increasing holder governance rewards, and creating a positive flywheel effect for the Pundi AI ecosystem.

Multiple Core Products Arriving: 2025 Could Be Pundi AI’s Breakout Year

2025 could be the pivotal year for Pundi AI’s vision to materialize.

For Pundi AI, approaching multiple milestones, this statement isn’t an exaggeration.

On February 25, 2025, the $FX → $PUNDIAI token upgrade officially begins, and the wealth opportunities embedded in this 100xdeflation will inevitably draw more attention to Pundi AI.

Pundi AI is preparing thoroughly for this critical moment, with multiple ecosystem products ready to launch.

According to the official roadmap, during the first two quarters of 2025: The Pundi AI data labeling platform will release a whitelisted test version; Pundi AI Marketplace will launch its Alpha version; Pundi Fun AI Agent Launcher and Pundi AI MM Agent will soon debut; additionally, data labeling tools will roll out browser and mobile apps, enabling easier user participation.

At the same time, Pundi AI has designed engaging, rewarding mechanisms based on its products, aiming to deliver rich ecosystem engagement experiences:

First, Pundi AI will introduce a “Tag-to-Earn” model, allowing users to earn rewards through interactive participation; second, Pundi AI will launch a referral program to attract more new users into the ecosystem. Additionally, staking pools will be introduced on the AI Marketplace.

From AI data acquisition, labeling, and trading to AI Agent training, issuance, and liquidity support, every step Pundi AI takes demonstrates its deep understanding and forward-thinking strategy for a decentralized AI ecosystem.

Standing at the intersection of the AI wave and blockchain technology, as promised from the start—“providing full-lifecycle services for AI development”—with major core products and key features arriving consecutively, can Pundi AI become a significant player in decentralized AI in 2025, delivering long-term value to the market, investors, and participants?

Starting from the February 25 rebranding and token upgrade, we join the community in watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News