RWA by the Numbers: On-Chain Assets Surpass $17.2 Billion, Over 25% of BUlDL Fund Assets Have Flowed Out of Ethereum

TechFlow Selected TechFlow Selected

RWA by the Numbers: On-Chain Assets Surpass $17.2 Billion, Over 25% of BUlDL Fund Assets Have Flowed Out of Ethereum

Tether Gold market cap surpasses $700 million, benefiting from rising gold prices.

Author: OurNetwork

Compiled by: TechFlow

BUIDL | Tether Gold | Franklin Templeton | Maple Finance | Superstate

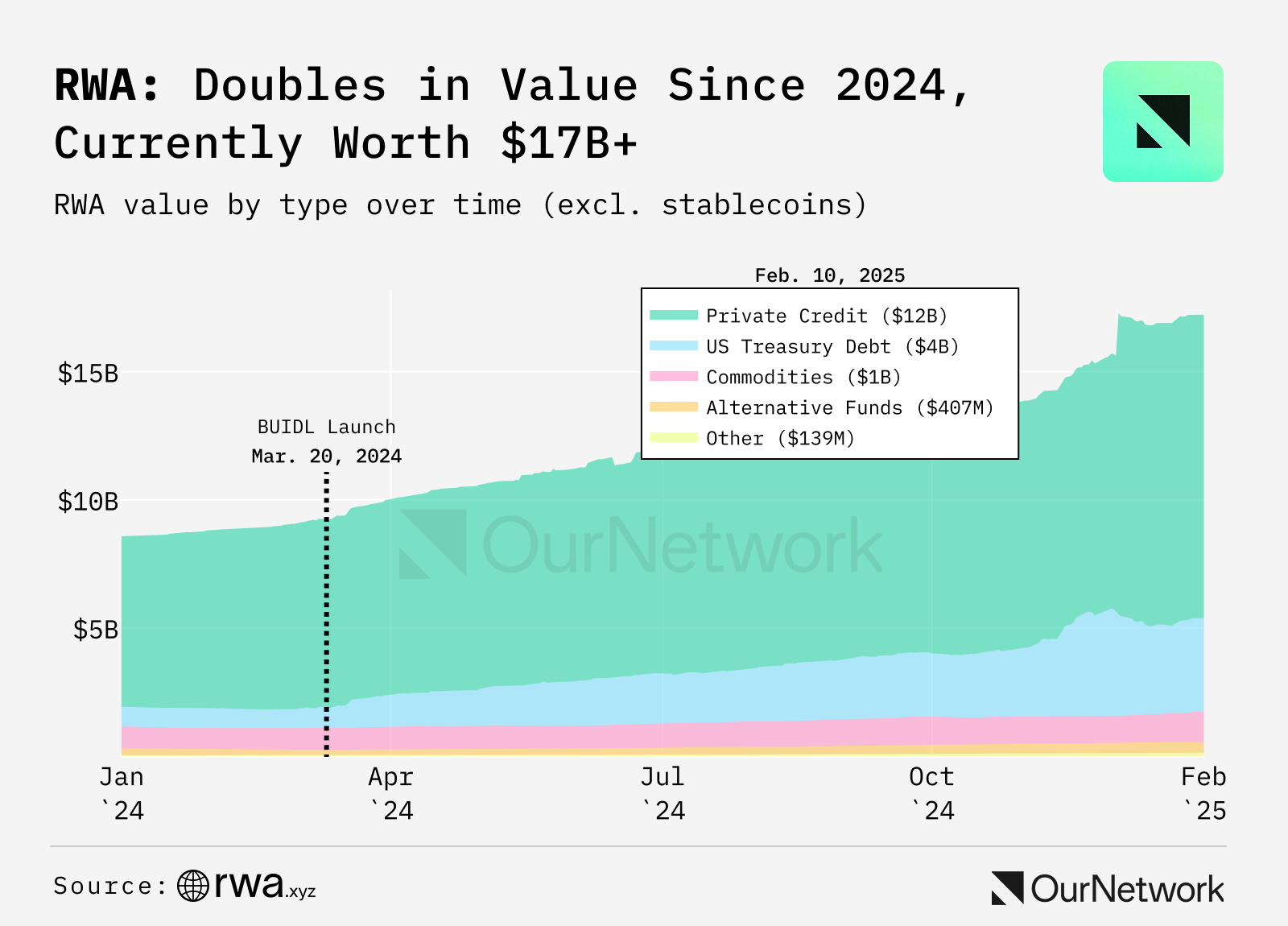

Tokenized RWAs – Excluding Stablecoins – Surpass $17.2 Billion On-Chain

-

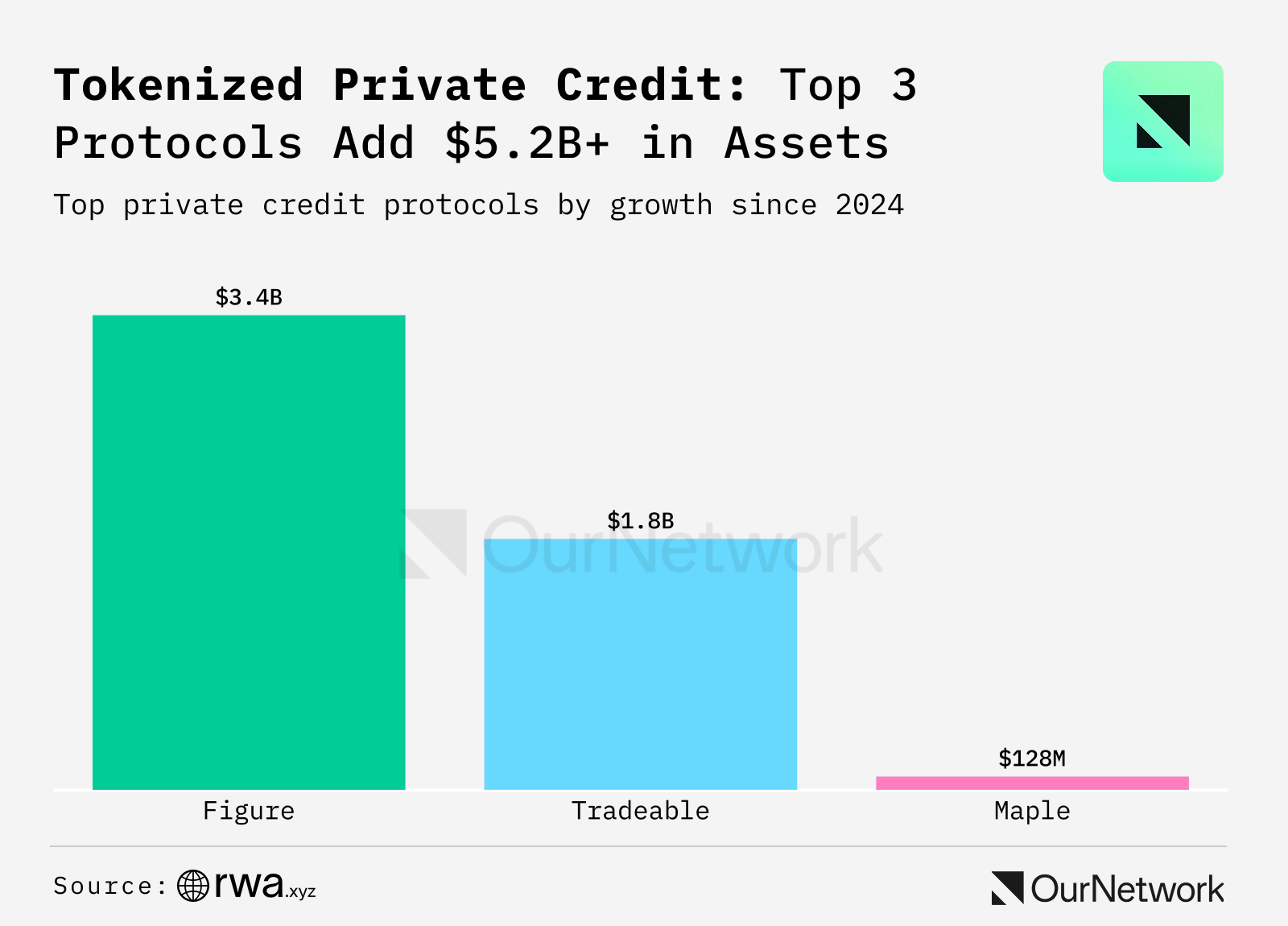

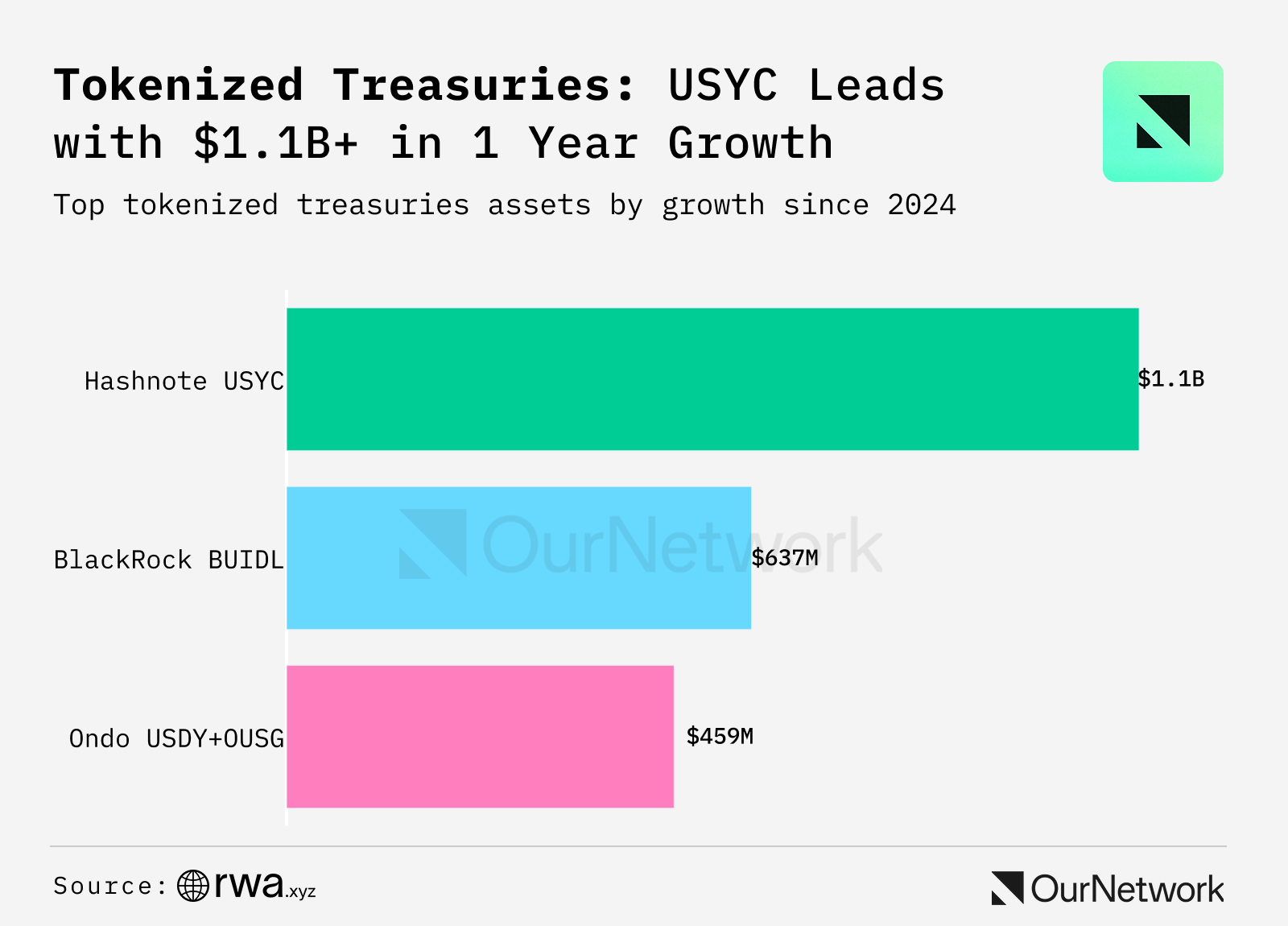

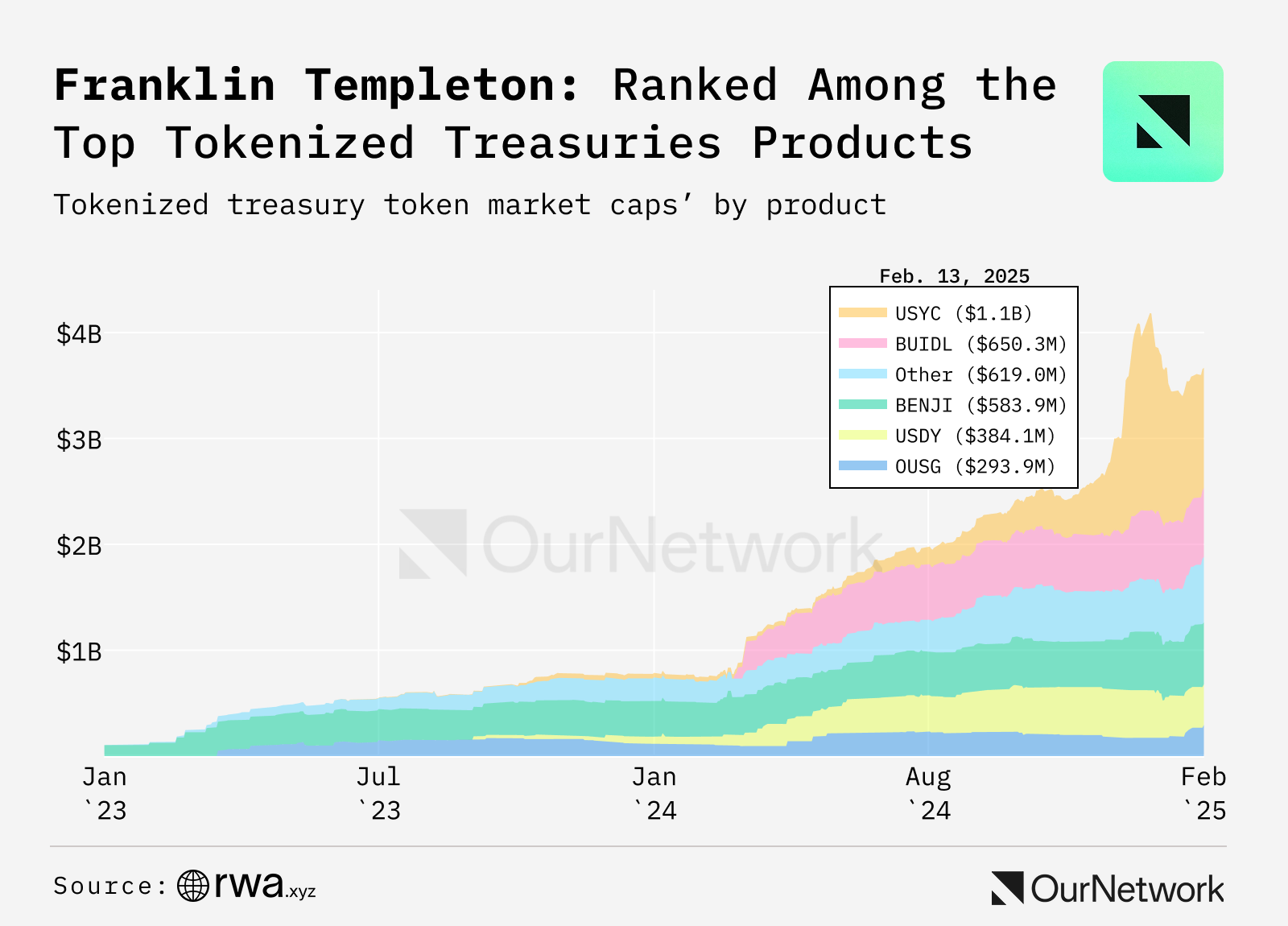

Since 2024, the tokenized real-world assets (RWAs) sector has doubled in size to $17.2 billion, driven primarily by private credit and tokenized treasuries. Growth in private credit is largely attributed to Figure’s consumer finance offerings and Tradable’s institutional platform. Tradable partnered with Victory Park Capital, an asset manager focused on privately-backed credit, to tokenize $1.7 billion in assets. Meanwhile, tokenized U.S. Treasuries have grown from $800 million to $3.6 billion, with standout performers including Hashnote’s USYC, BlackRock’s BUIDL, and Ondo’s related products. While early adopters favored traditional blockchain networks, institutional investors are now gradually shifting toward Ethereum and other emerging networks.

-

In private credit, Figure leads the space through its Provenance Blockchain, launching tokenized products based on home equity lines of credit (HELOCs). In January 2025, Tradable partnered with Victory Park to launch $1.7 billion in institutional-grade private credit assets on the Layer 2 network ZKsync Era. Additionally, Maple Finance has expanded the application of tokenized private credit via its decentralized lending platform.

-

In tokenized U.S. Treasuries, Hashnote’s USYC product and its integration with Usual Protocol’s yield-bearing stablecoin USD0 have become key growth drivers. At the same time, BlackRock’s BUIDL and Ondo’s USDY/OUSG offerings provide institutional-grade solutions and infrastructure for yield generation and treasury management.

-

Transaction Spotlight: On-chain data shows that USD0, the stablecoin launched by Usual Protocol, is backed by Hashnote’s USYC tokens. Users can directly redeem USD0 via the protocol and receive assets in the form of USYC. Additionally, on-chain records indicate that Usual Protocol’s treasury wallet is the largest holder of USYC.

BUIDL

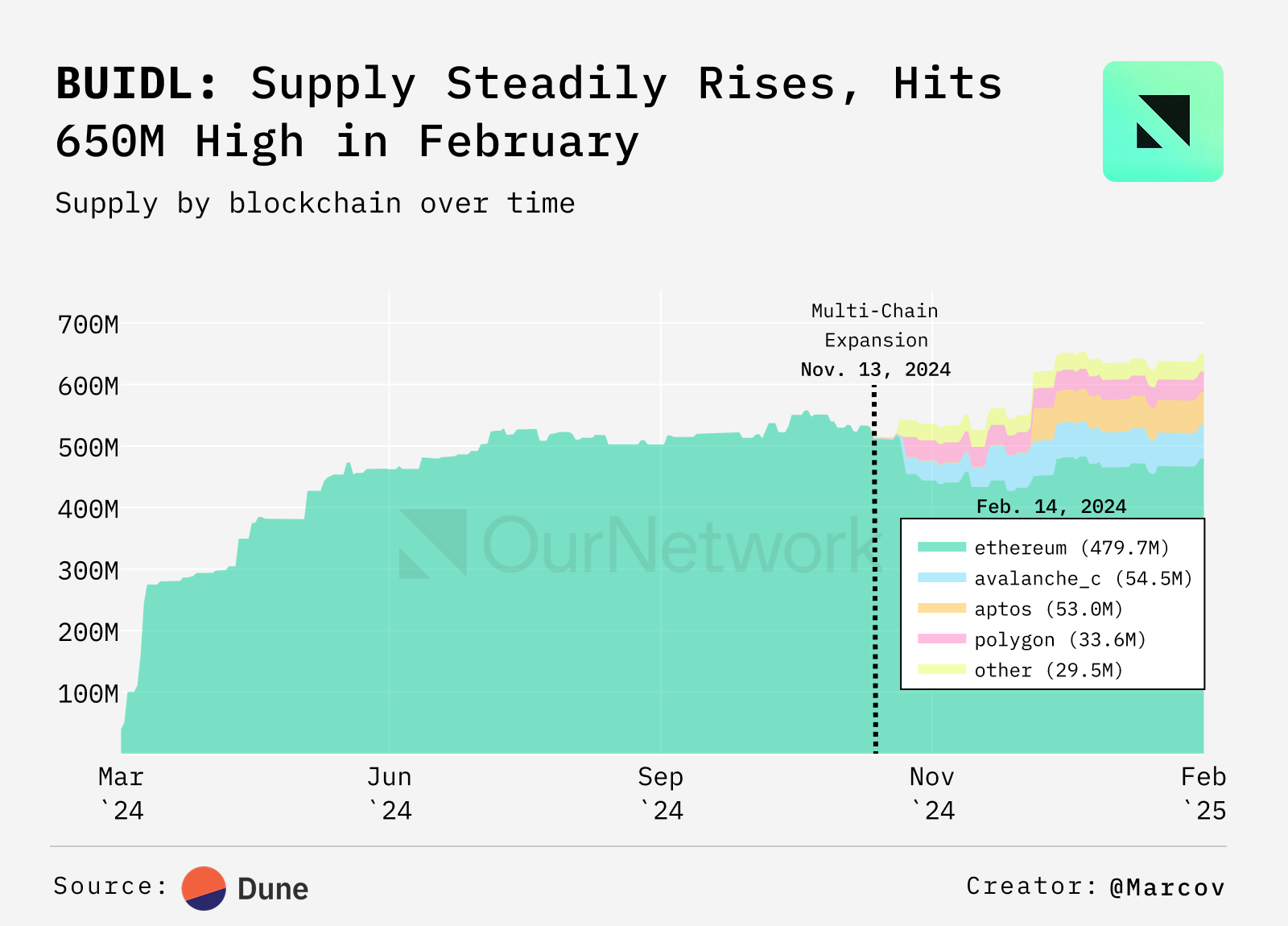

Over 25% of BUIDL Fund Assets Migrated to Blockchains Beyond Ethereum

The BUIDL fund managed by BlackRock and Securitize has maintained a stable supply over recent months, dipping slightly to $625 million at the end of January. The total supply has since rebounded to $650 million, matching its level at the start of the year.

-

Since achieving multi-chain support in November 2024, BUIDL fund assets have gradually shifted to blockchains beyond Ethereum. Currently, over 26% of assets are distributed across Arbitrum, Optimism, Polygon, Aptos, and Avalanche.

-

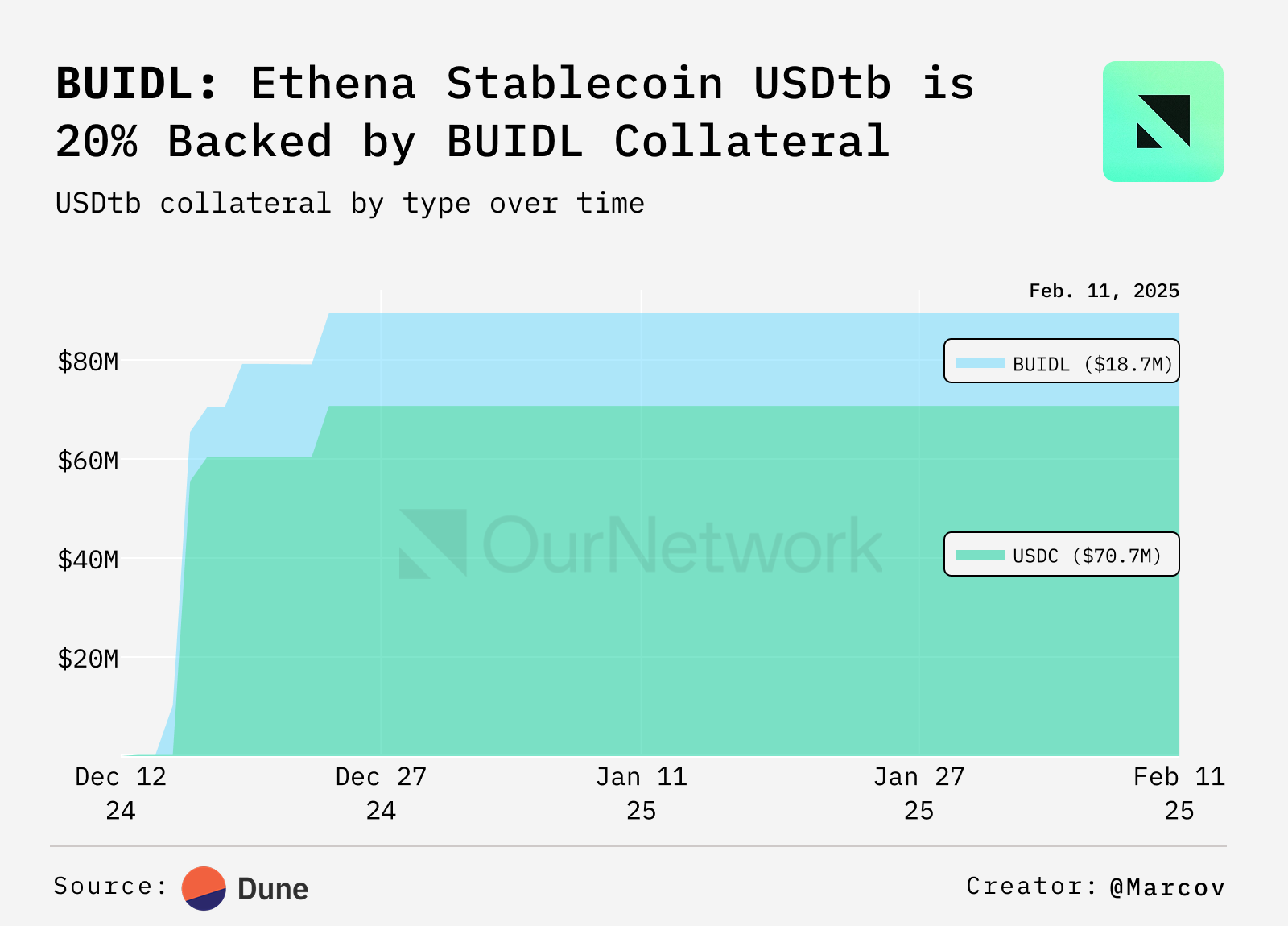

Notably, the synthetic dollar protocol Ethena has launched USDtb, a stablecoin backed by the BUIDL fund, broadening access to liquidity. To date, USDtb has a supply of $89 million, with $18.7 million backed by the BUIDL fund, and further growth is expected.

Tether Gold (XAUt)

Tharanga Gamage | Website | Dashboard

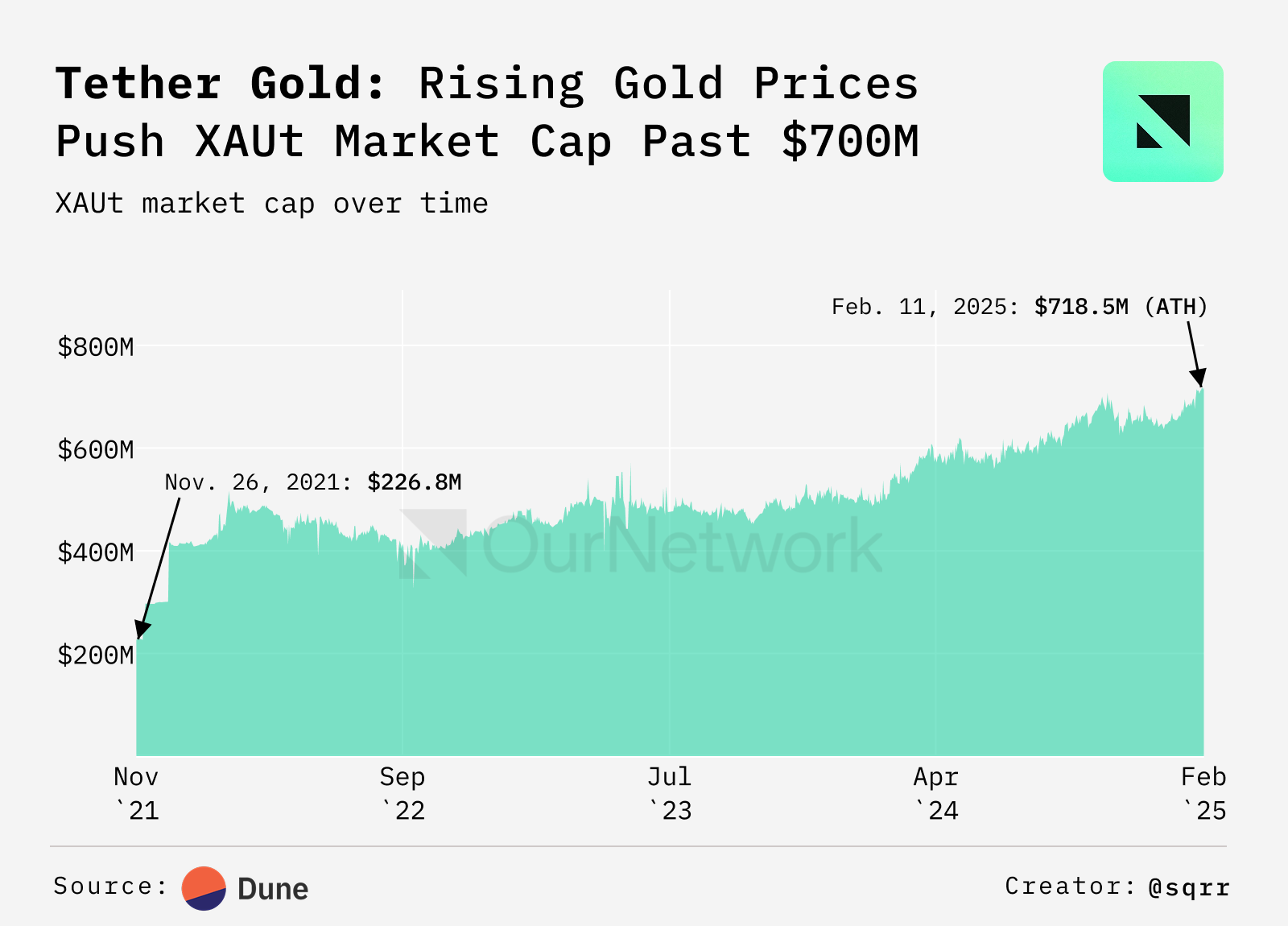

Tether Gold Market Cap Surpasses $700 Million Amid Rising Gold Prices

As the largest tokenized gold asset currently available, Tether Gold (XAUt) has seen its market cap surpass $700 million due to rising gold prices. XAUt is a token granting holders ownership of physical gold, with a minimum purchase requirement of 50 XAUt per verified buyer (approximately $146,608 as of February 14, 2025). XAUt now accounts for 41% of the total market cap in the tokenized gold sector.

-

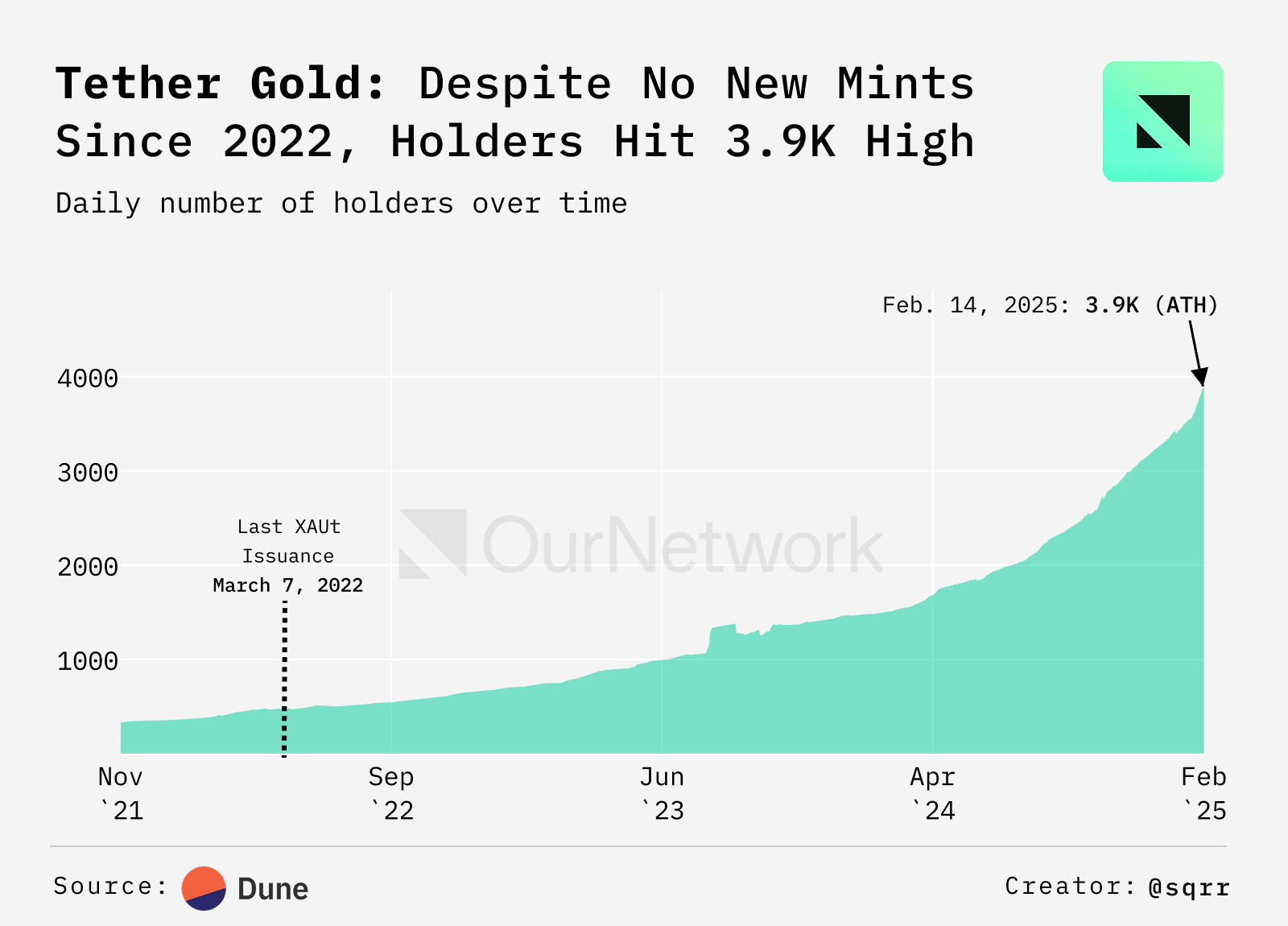

A total of 246,500 XAUt tokens have been issued on Ethereum, each representing one ounce of custodied gold. However, 24.7% of these tokens remain held in Tether’s treasury. The last on-chain issuance of XAUt occurred on March 7, 2022. The number of addresses holding XAUt has now grown to 3,888.

-

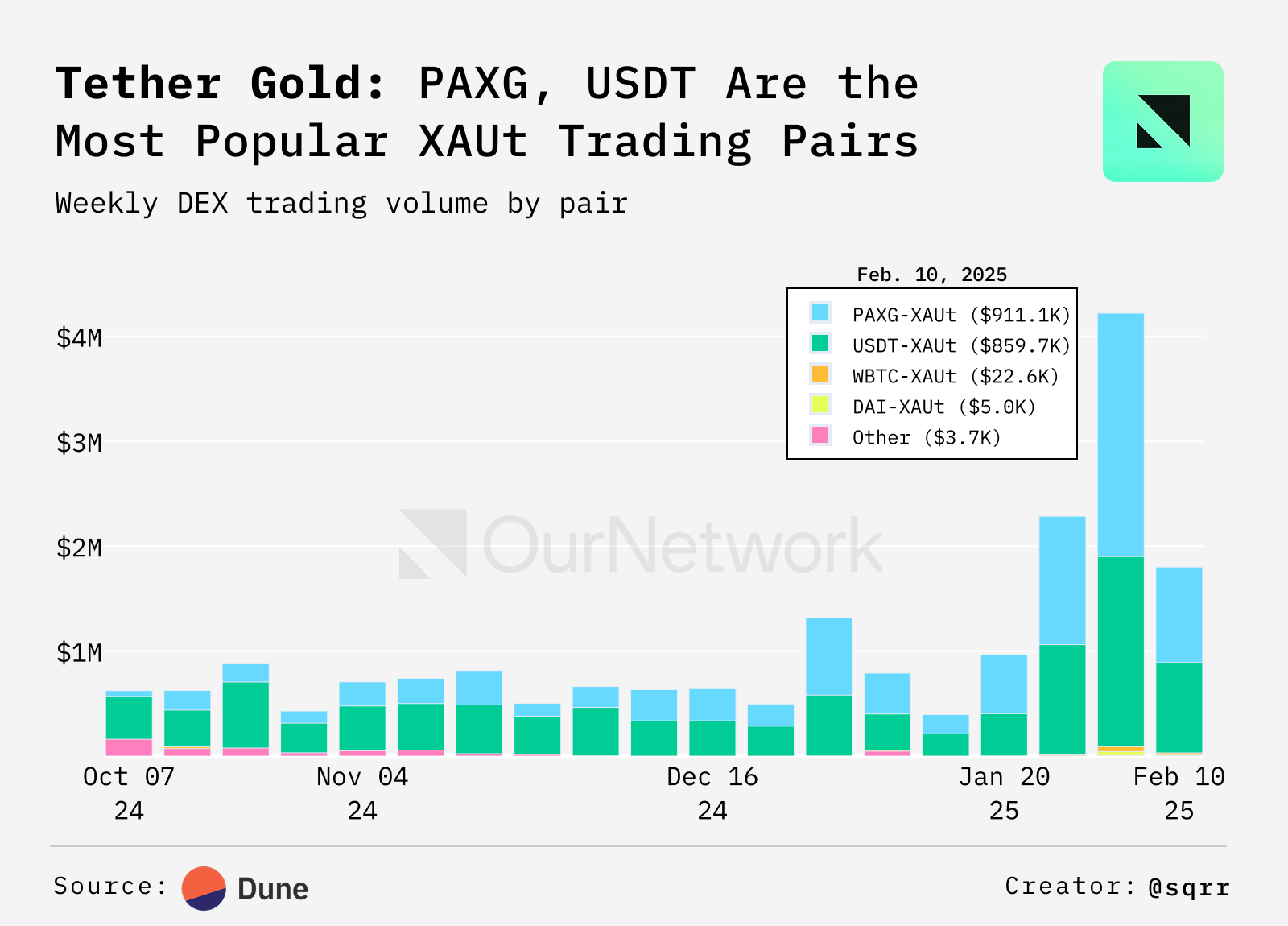

On decentralized exchanges (DEXs), cumulative trading volume for XAUt has exceeded $237 million, with the most active trading pairs being PAXG and USDT. As gold prices hit record highs, decentralized trading activity has significantly increased since the end of January 2025. Additionally, holdings on centralized exchanges (CEXs) suggest that XAUt’s trading volume may be even higher on CEXs.

Franklin Templeton

Biff Buster | Website | Dashboard

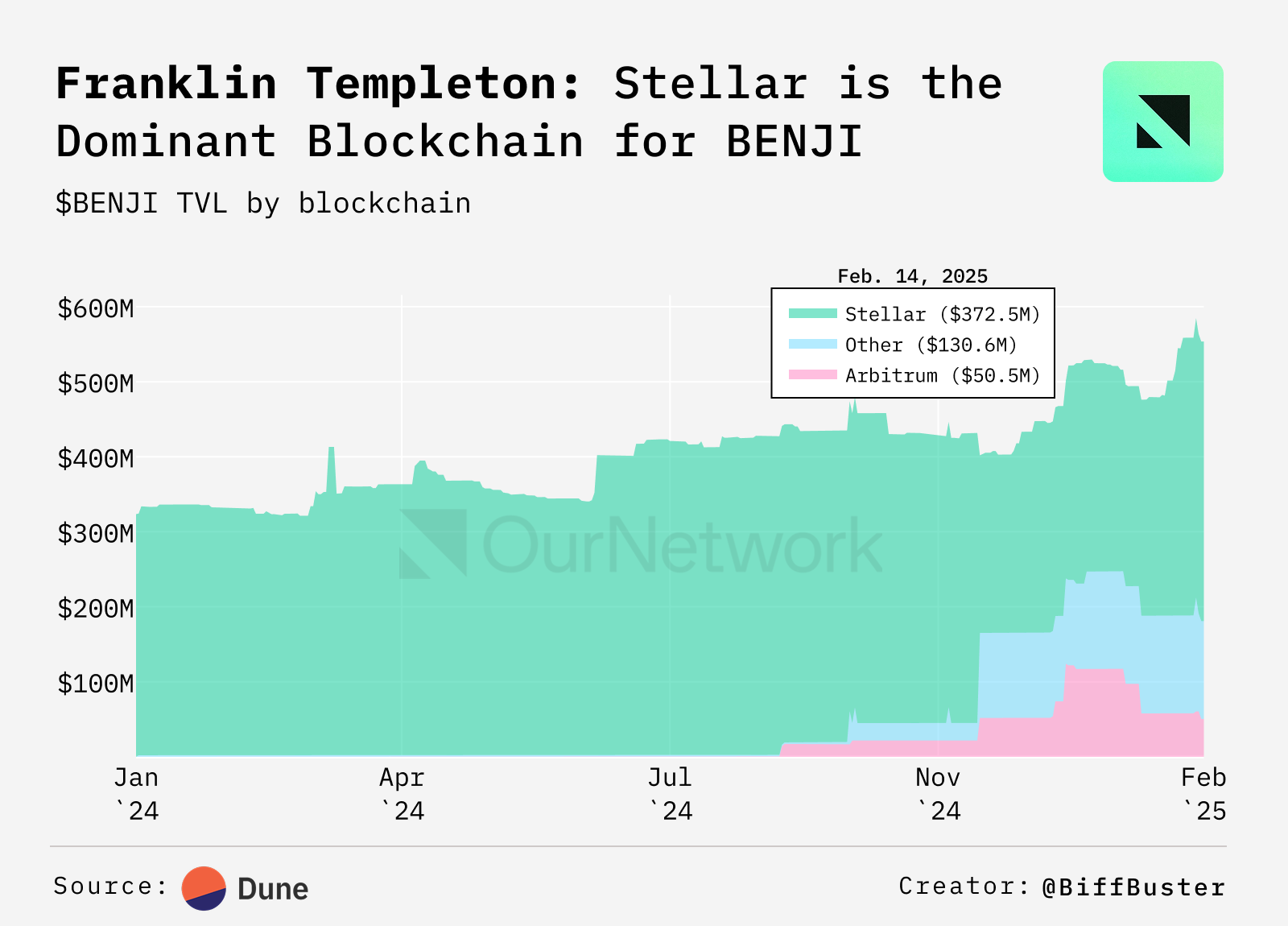

Franklin Templeton's On-Chain U.S. Government Money Fund (FBOXX) Nears $600 Million in AUM

Since 2021, Franklin Templeton has quietly built the largest tokenized U.S. money market fund to date. FBOXX, its on-chain U.S. government money fund, now manages nearly $600 million in assets, signaling growing institutional acceptance of blockchain-based financial products. FBOXX offers a regulated blockchain instrument allowing investors exposure to U.S. government bonds while maintaining a stable net asset value (NAV) of $1.

-

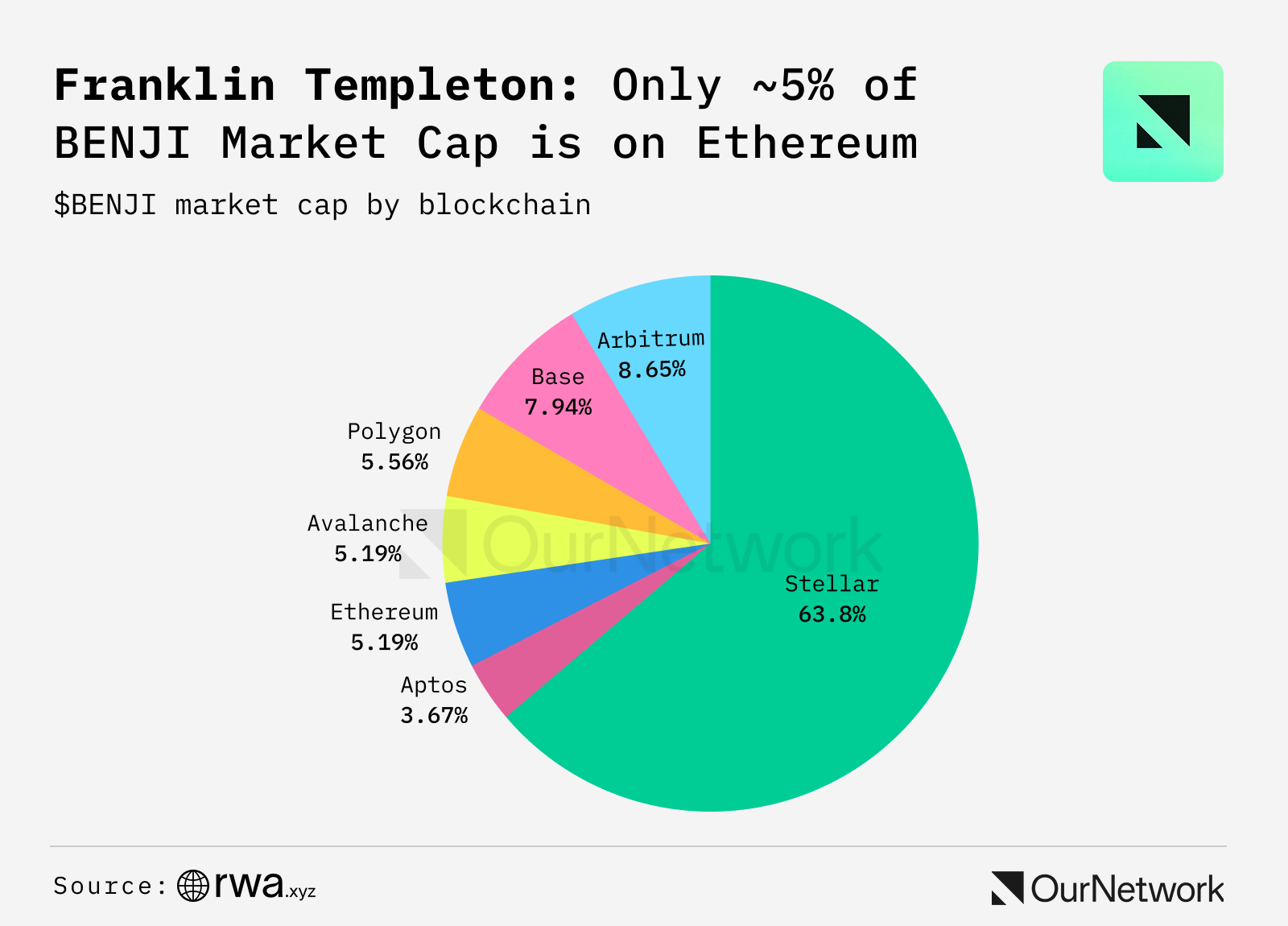

BENJI represents the on-chain tokenized form of FBOXX, enabling investors to transfer tokenized shares across multiple blockchains. The fund currently has 553 holders, offers a 4.55% annual percentage yield (APY), and charges a 0.15% management fee.

-

While Ethereum remains the dominant blockchain for tokenized real-world assets with a total market cap of $2.5 billion, Franklin Templeton’s early success on Stellar indicates that low-cost alternatives hold significant promise for tokenized treasuries.

-

Transaction Spotlight: Following the launch of BENJI on a new blockchain, substantial capital inflows typically occur the next day. For example, after BENJI’s money market fund launched on Aptos, $21 million in new deposits increased AUM by approximately 5%. With the Benji investment platform now live on Solana—a blockchain known for low costs and high throughput—AUM is expected to grow significantly over the next three months.

Maple Finance

Maple Finance TVL Surpasses $600 Million at Start of 2025

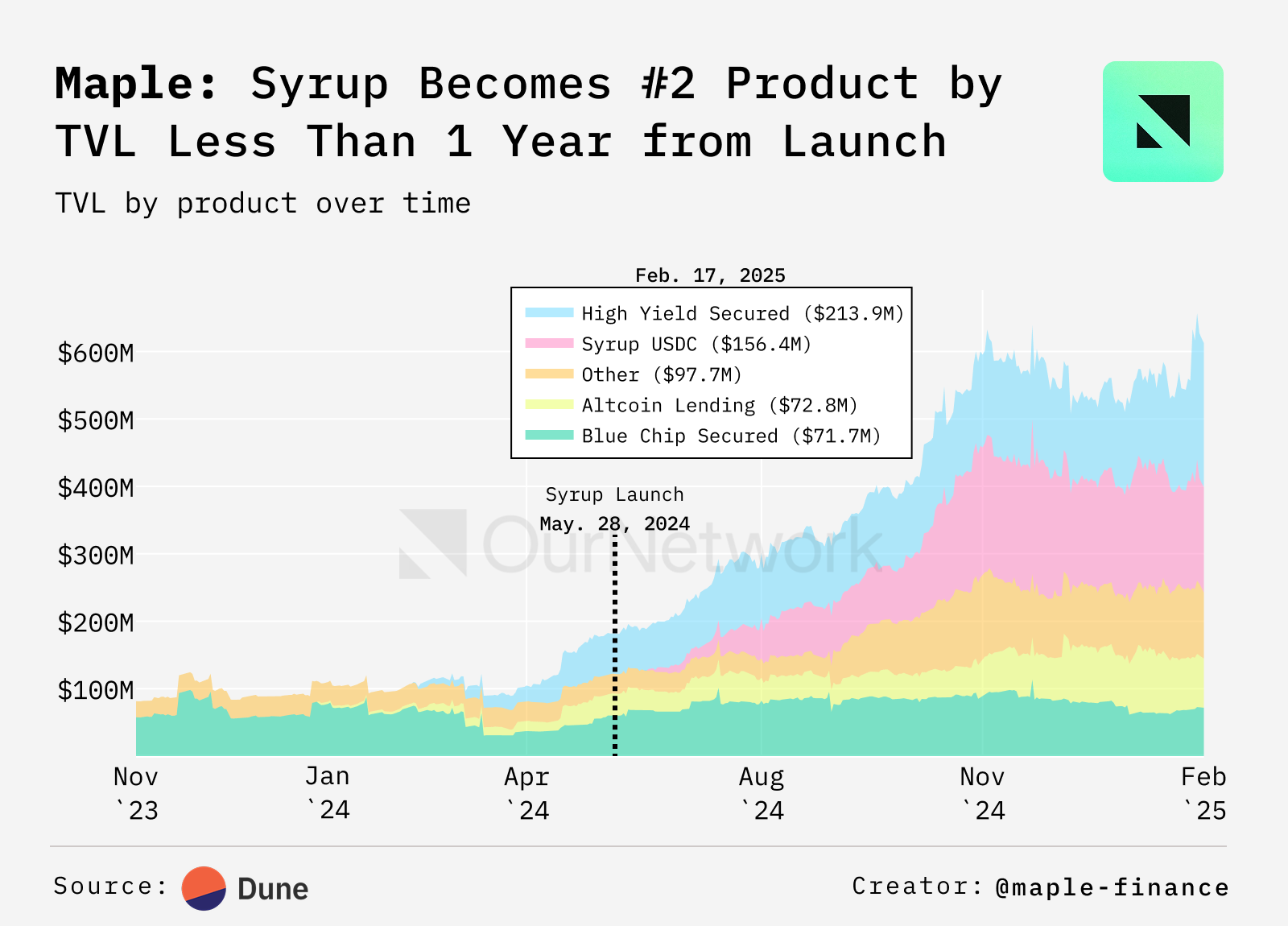

Maple Finance generates high-quality yields for lenders by providing loans to institutions collateralized in BTC, ETH, and SOL. Since August 2024, the platform’s total value locked (TVL) has more than tripled, with both Maple and Syrup products experiencing strong growth. Protocol revenue has followed a similar trajectory, reaching an all-time high in January 2025.

-

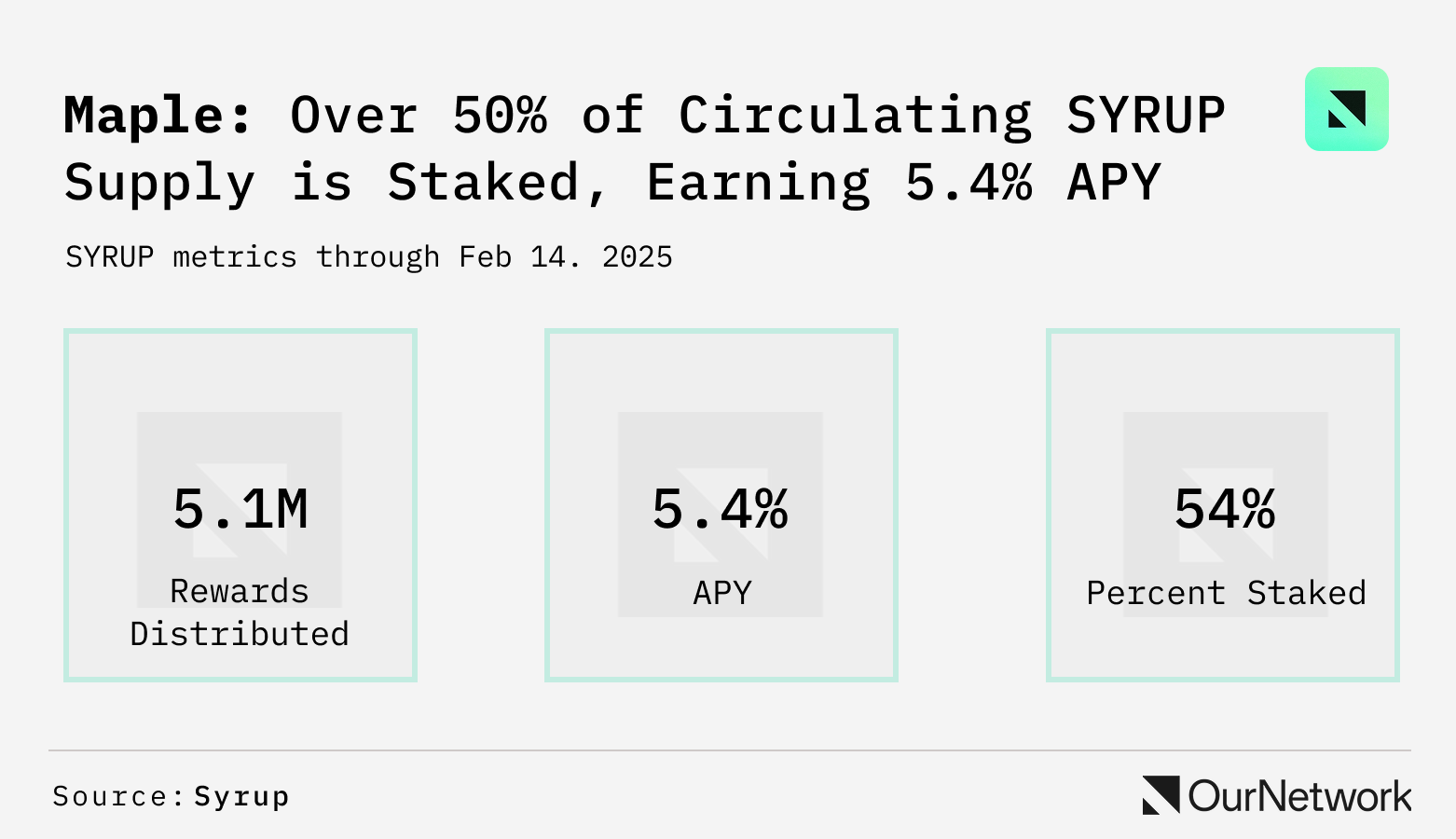

In November 2024, the migration from MPL to SYRUP began, along with the reintroduction of staking, allowing users to share in the growth of a leading DeFi institutional lending platform. To date, over 50% of the circulating SYRUP supply has been staked, and 20% of January’s revenue was used to repurchase SYRUP.

-

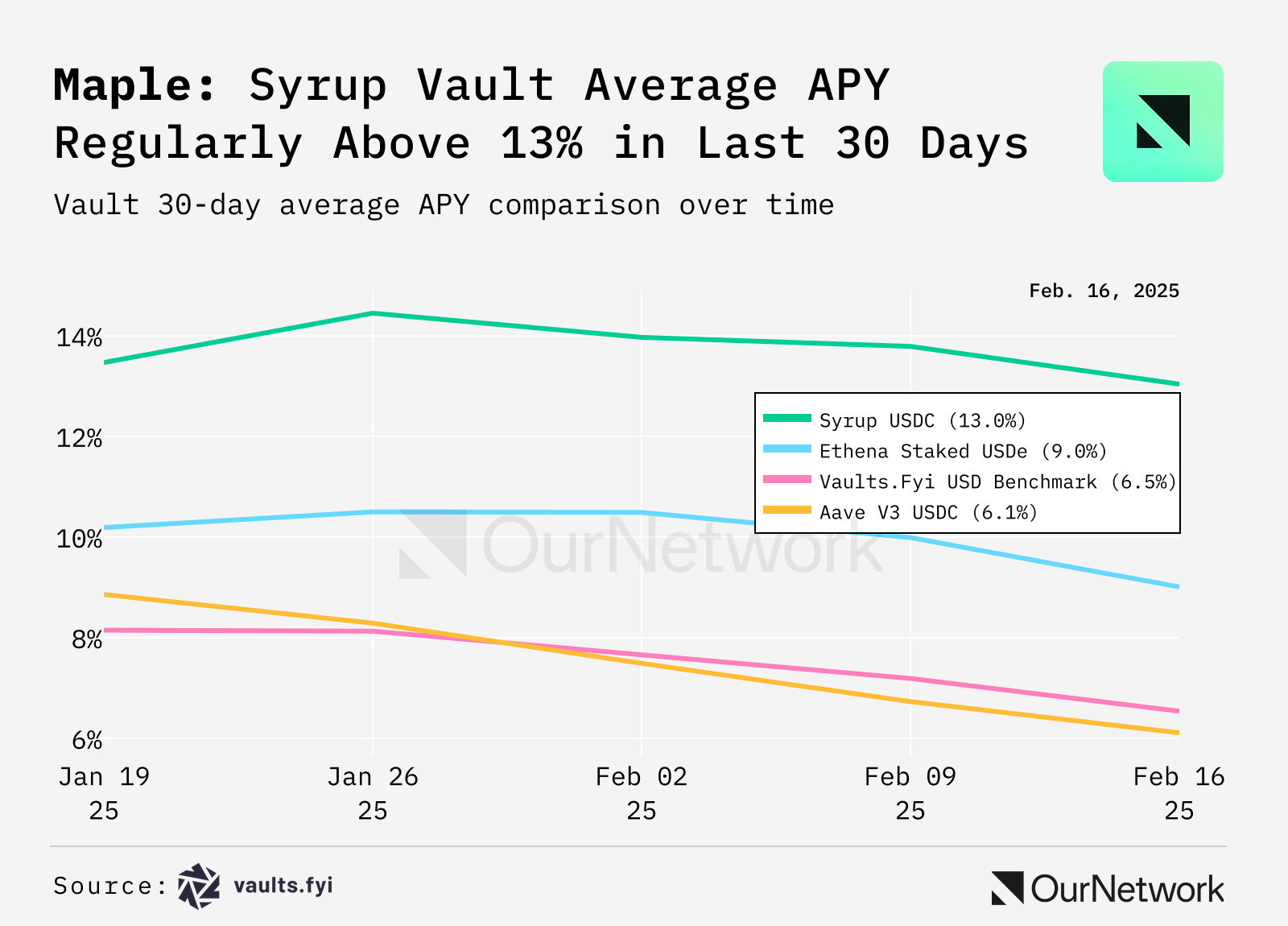

Amid widespread yield compression in DeFi, Syrup has significantly outperformed major competitors. Over the past 30 days, Syrup’s net yield has exceeded Aave’s by more than double and surpassed Ethena’s sUSDE by 50%, while maintaining a loan book with an average collateralization ratio above 165%.

-

Transaction Spotlight: Despite market volatility in early February causing liquidations to reach record highs, Maple and Syrup actually attracted nearly $40 million in new deposits. Many large holders are reallocating funds from protocols like Aave to Syrup in search of higher stablecoin yields.

Superstate

Emily Coleman | Website | Dashboard

Superstate Achieves Multi-Chain Expansion as Tokenized Fund AUM Surpasses $300 Million

-

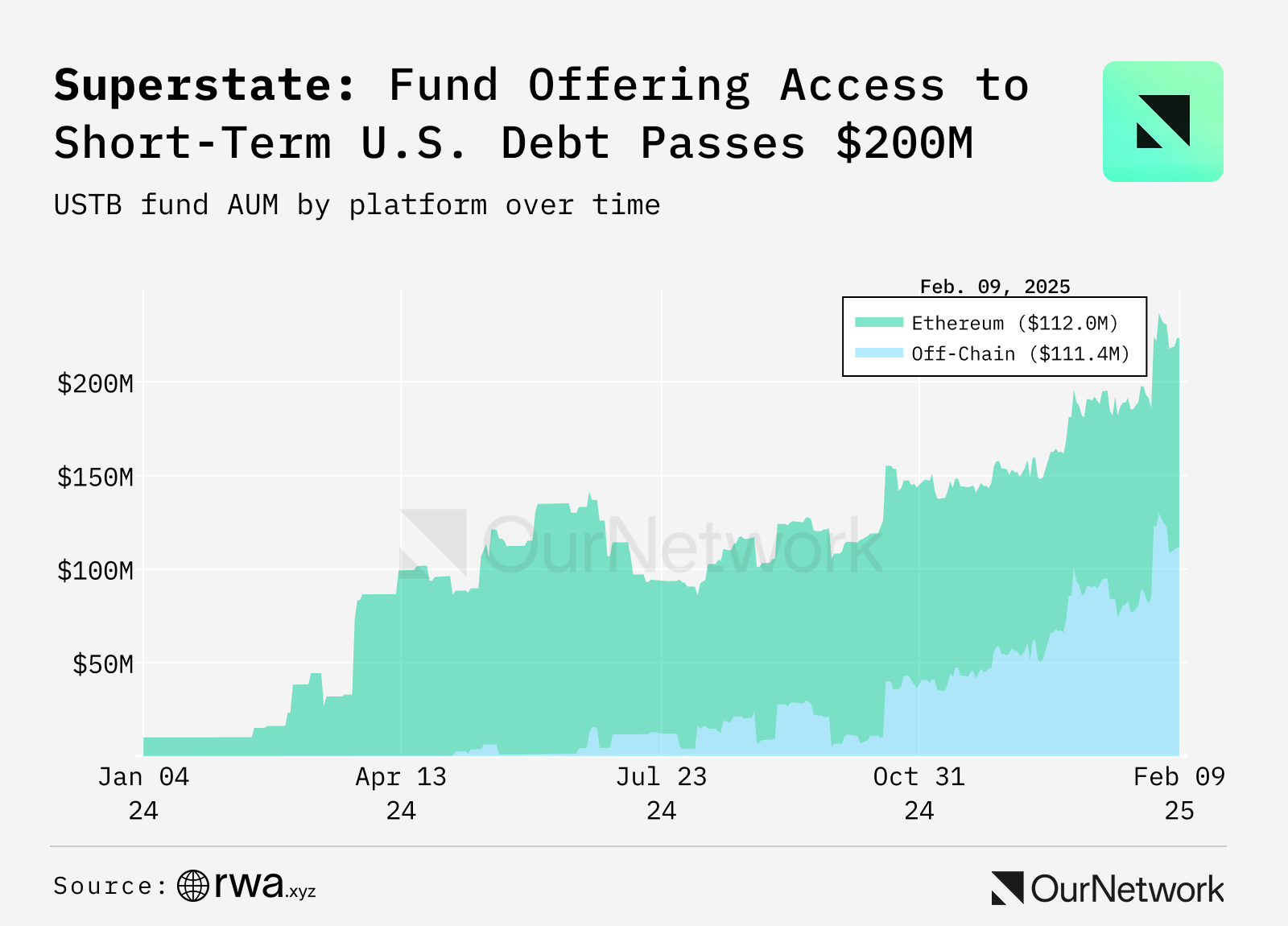

U.S.-based asset manager Superstate announced that its tokenized funds collectively surpassed $300 million in AUM in January 2025, further indicating rising institutional adoption of on-chain finance. Superstate’s USTB fund, focused on short-term U.S. Treasuries and agency securities, has surpassed $200 million in AUM. The fund introduced a 15 basis point management fee while continuing to offer access to traditional financial assets via tokenized infrastructure.

-

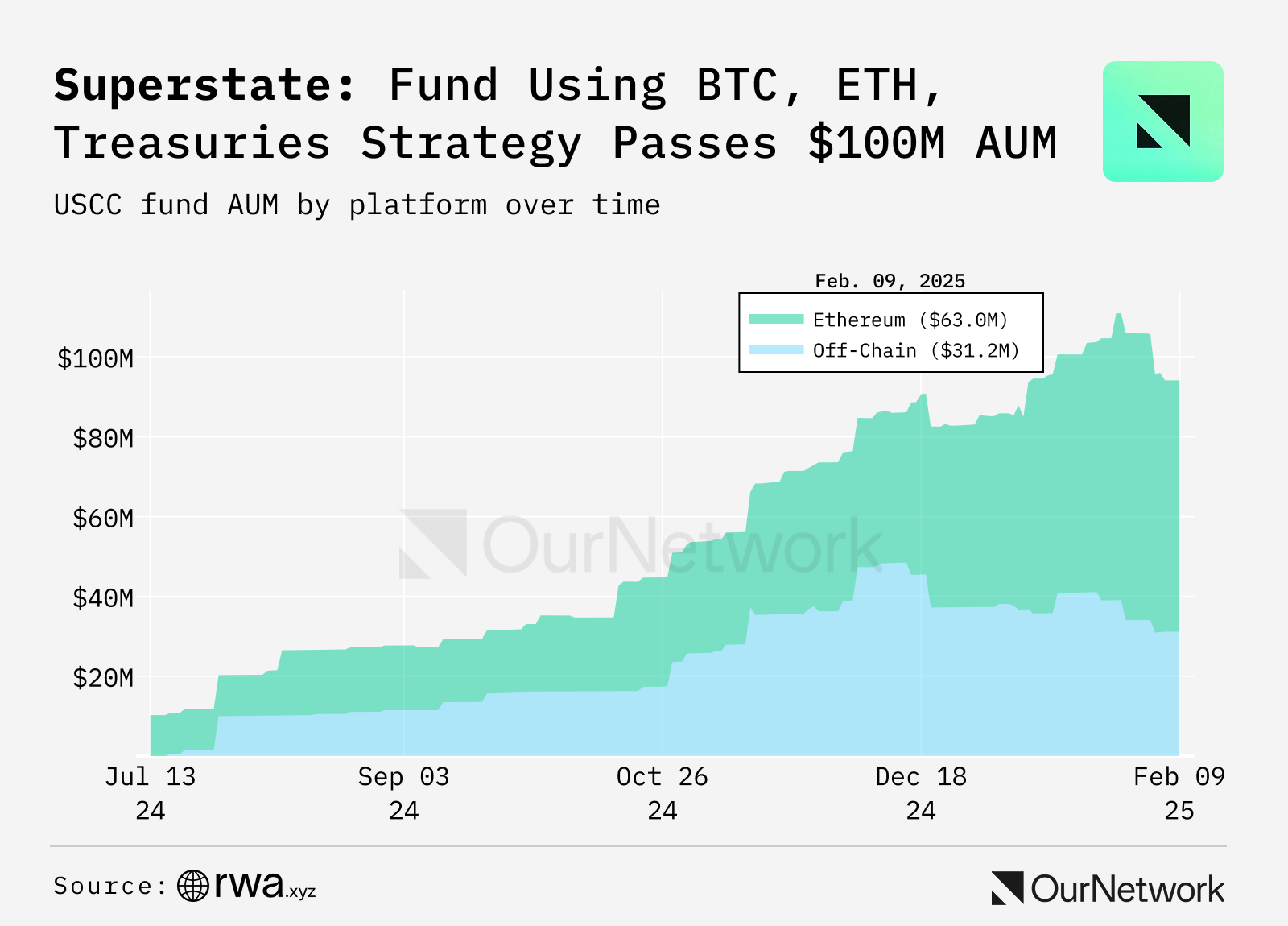

In addition, Superstate’s Crypto Carry Fund (USCC) has also surpassed $100 million in AUM, as investors allocate capital into crypto strategies encompassing BTC, ETH (including staked ETH), and U.S. Treasuries. Both funds support on-chain transactions on Ethereum as well as off-chain book-entry trading, with plans to expand to the Plume blockchain, a network designed specifically for tokenizing real-world assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News