A Letter to You in the Bear Market: Use Leverage Thinking to Build an "Antifragile" Life

TechFlow Selected TechFlow Selected

A Letter to You in the Bear Market: Use Leverage Thinking to Build an "Antifragile" Life

所谓 "leverage" can be capital, technology, brand, network effects, or even team management.

Author: Route 2 FI

Translation: TechFlow

(Original image from Route 2 FI, translated by TechFlow)

If you invest X hours, you will earn Y amount and produce Z units of product or service.

This sounds simple, but it’s the linear way most people view the world.

But is this really the right way to think?

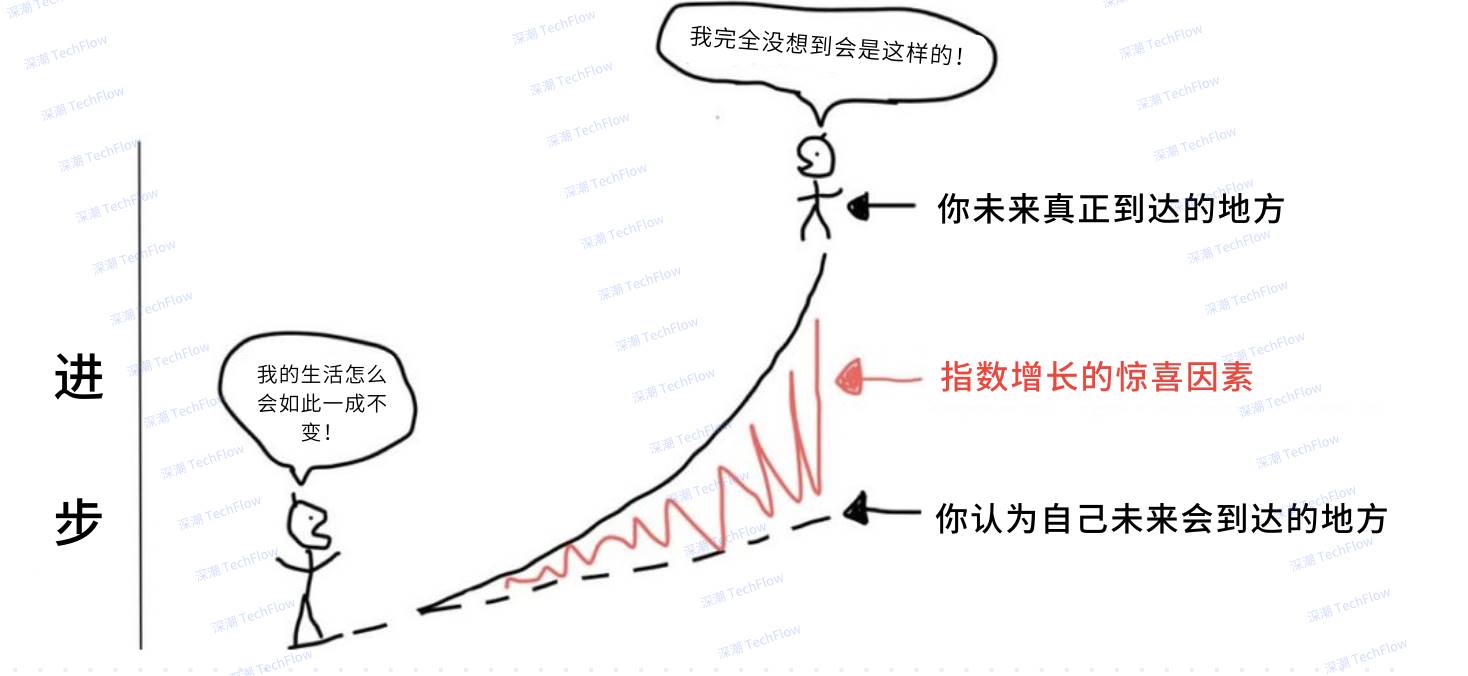

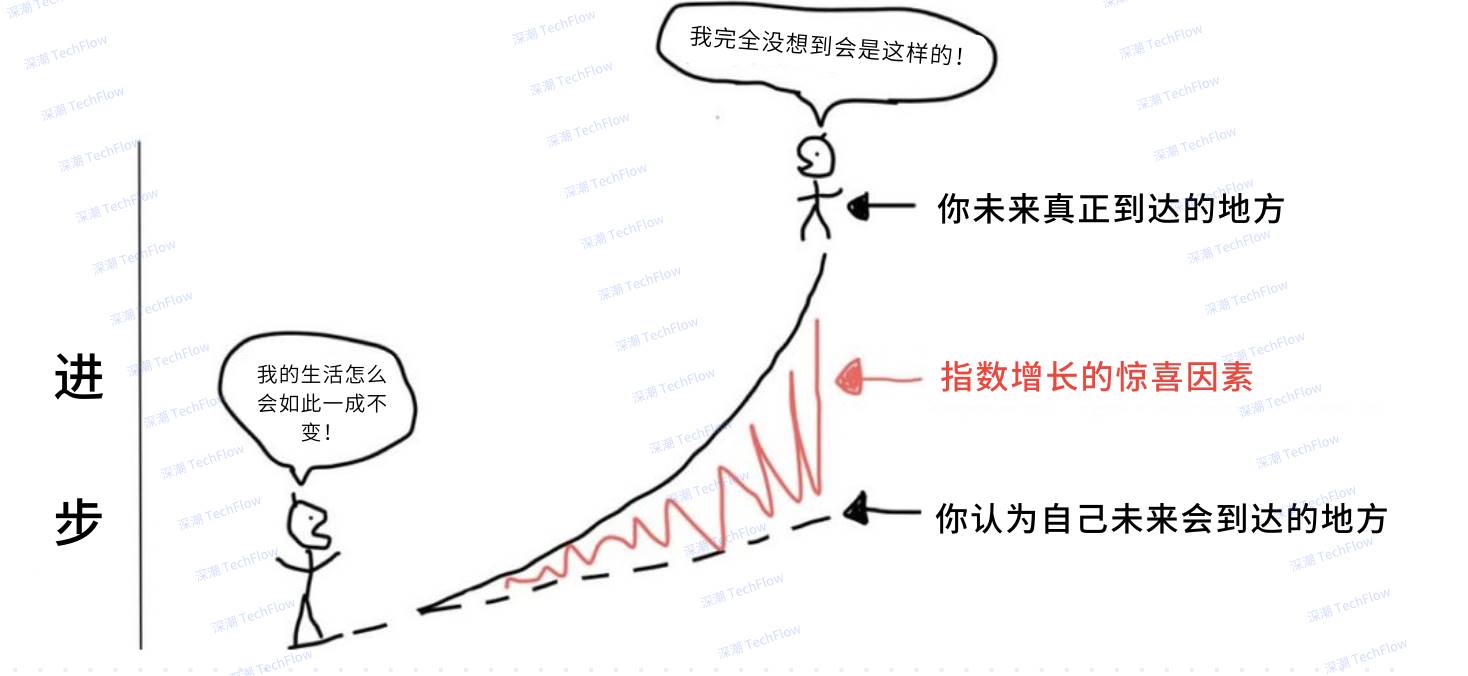

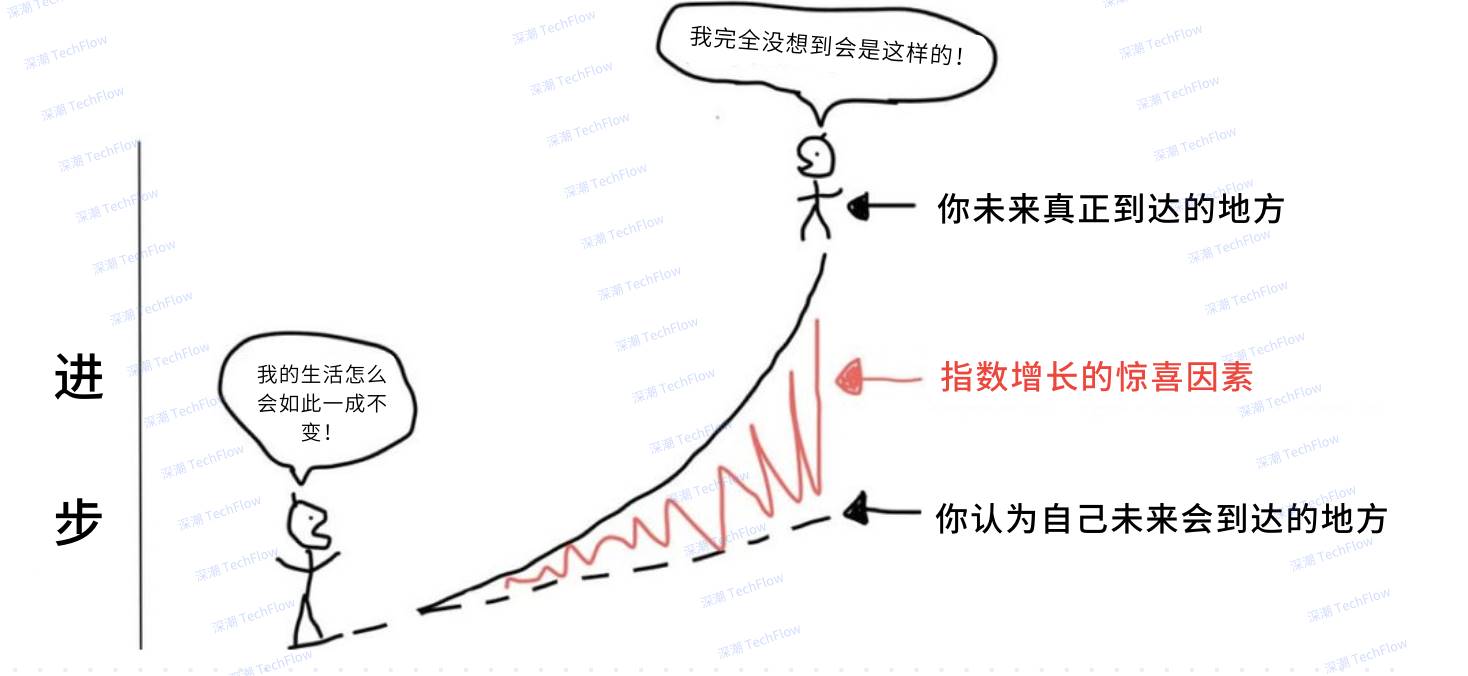

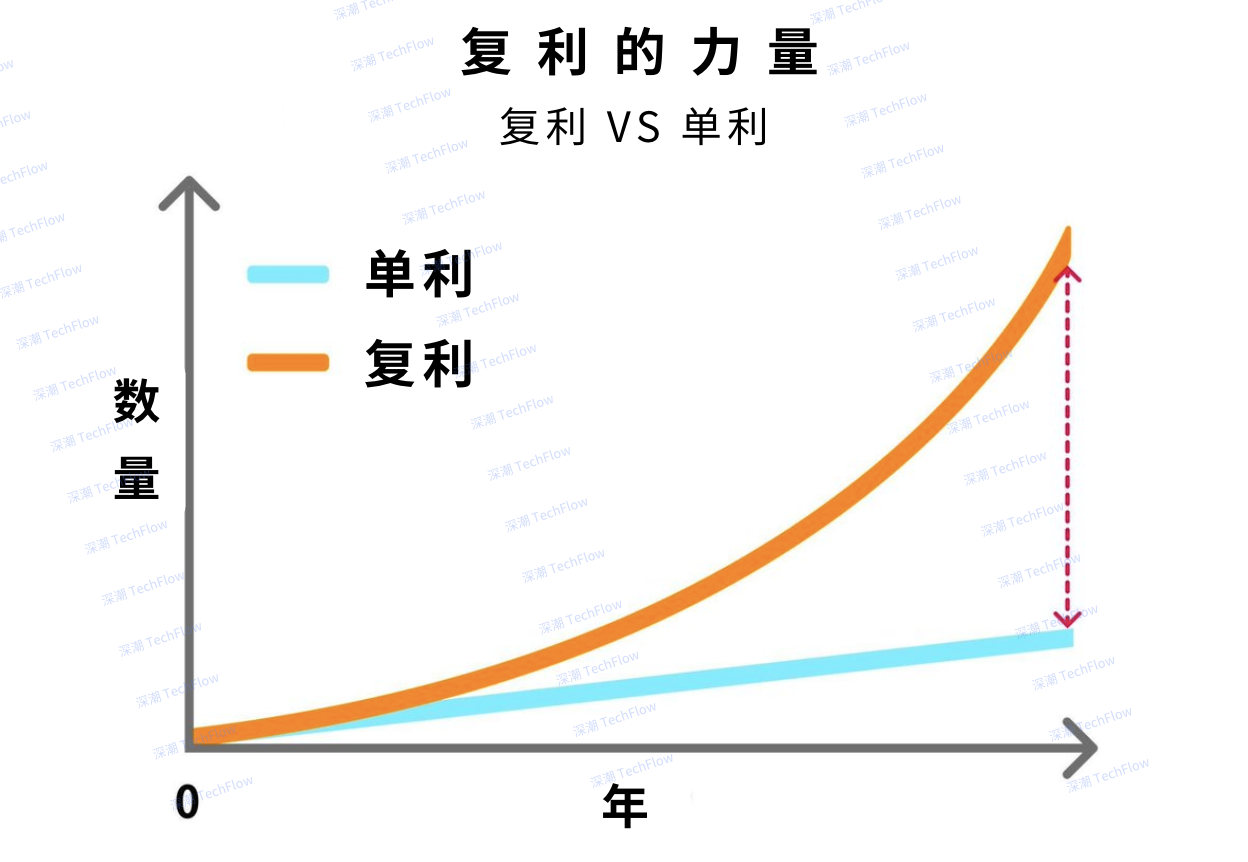

If you learn to leverage time and leverage itself, you can experience the miracle of compounding. With compounding, your efforts build upon each other over time.

Take a simple example: 10 + 10 + 10 + 10 + 10 + 10 + 10 + 10 + 10 equals 90—that’s intuitive.

But if I ask you to calculate how much an investment grows at 10% annual interest over 40 years, most people might assume it's just adding 10% forty times, totaling 400%.

Yet the actual answer is far more than 400%.

The answer is: 4,525%.

This means a $100,000 investment would grow to $4,525,000 after 40 years.

I know this might sound boring in the context of crypto, but please bear with me.

(Original image from Route 2 FI, translated by TechFlow)

The example above illustrates the power of compounding.

I won’t dive into the math details—I just want to use it to highlight the importance of “exponential thinking.”

How to Use Leverage to Take Your Life Further

Many people are too “realistic” in their outlook on life, always viewing their growth path through linear thinking. But in reality, leverage allows you to shift from linear to exponential growth.

Leverage can come in many forms—capital, technology, brand, network effects, or even team management.

If you’re skilled at using these resources, you can break free from the limitations of linear progress.

In life, you should dare to take risks and choose a career path that applies leverage and compounding. For instance, a traditional 9-to-5 job without equity incentives often has limited upward mobility.

Instead, consider starting your own business or joining a startup team to find a role with room for flexible development. This not only accelerates professional growth but also offers equity incentives and lets you apply learned skills to future ventures.

In today’s world, I believe nothing leverages better than building a personal brand. That’s exactly what I’ve done. When I look back at my journey, I feel immense pride in what I’ve created.

People read my content because these ideas are written by me personally.

If you want to learn about investing, crypto, and the latest yield opportunities, you’d rather learn from someone actively involved than from a university professor.

In everything you do, learn to apply leverage and adopt a long-term perspective on how your knowledge, skills, and mindset can compound through exponential growth.

Expand your vision. Those who believe they can change the world are the ones who eventually do.

About Risk-Taking and Asymmetric Investments

Once your basic living needs are met, you should dare to take bigger risks. I strongly support the FIRE (Financial Independence, Retire Early) concept, which uses the formula: monthly expenses × 12 months × 25.

This number represents the ability to live off the 4% rule—drawing 4% annually from your portfolio without depleting principal (assuming a 10% annual return).

However, if you're young and have few financial burdens, I believe it's worth taking risks even without substantial savings.

Ask yourself: What’s the worst that can happen? In most cases, the worst outcome is simply returning to square one. But if you dare to take the risk, you might multiply your current resources tenfold. This applies not only to money but also to skills and opportunities.

Target “asymmetric investment opportunities”—choices with high upside and low downside. If successful, returns could be 10x or even 100x, while failure results in minimal loss.

Avoid options with huge risks but limited rewards.

In life planning, prioritize long-term gains (achievable over years or decades) over short-term comforts like monthly salary. Of course, survival comes first—but settling for comfort alone limits your potential.

Many become complacent due to stable jobs and rising salaries, gradually losing motivation to pursue greater gains.

They fear the risks of new opportunities, worrying about losses if things go wrong. But in reality, most people (especially those in resource-rich environments) can return to similar jobs with little pay difference even after failure.

So, the real question is: What kind of life do you want?

You may have heard this quote:

“Give me six hours to chop down a tree, and I will spend the first four sharpening the axe.”

The point is, preparation and planning are crucial when making major life decisions or choosing your career direction.

If you're still uncertain about what to focus on next or what to prioritize in the coming year, take a few days in a quiet environment to thoughtfully plan your strategy instead of blindly following trends.

As Alice in Wonderland said: “If you don't know where you're going, any road will get you there.”

Spend more time reflecting on your true life goals. Believe in yourself—most people are capable of creating something meaningful if they’re willing to act.

In today’s social media-driven era, short videos (like Reels and TikTok) spread countless ideas about improving life, yet very few actually implement them.

Many watch these videos and do nothing. While you might feel like you're learning, it’s no different from watching TV—it’s just short-term dopamine stimulation.

Ask yourself: Are you truly investing in long-term growth? Or are most of your activities focused on short-term pleasures (like food, entertainment, sports, short videos, music, socializing, gaming, or even alcohol and other stimulants)?

There’s nothing wrong with these activities, but don’t let them consume your entire life. After all, you’re human, not a monkey. Humans can delay gratification (think of the famous marshmallow experiment), but monkeys cannot.

Here are some examples of activities that bring long-term fulfillment:

-

Learning a new language

-

Starting a company or small business

-

Training for a marathon

-

Earning a degree

-

Living abroad for a period

-

Writing a book

-

Learning career-changing new skills

-

Starting to invest

-

Fitness and weight loss

-

Building a personal brand

These are choices that elevate your life beyond momentary pleasure.

Tips for Beginners in Crypto with Limited Funds

First, ask yourself: What are you good at? In this industry, perhaps the most important skill is persistence. Even if you’re not brilliant, spending 12–14 hours daily focused on learning and practice gives you a significant edge over most people. For those with limited capital, time is your most valuable asset.

Beyond that, you need the willingness to learn and the determination to keep improving. So, where should you start?

Crypto offers many opportunities: writing, trading on centralized exchanges (CEX), researching projects, memecoin trading, NFT investing, hunting airdrops, making YouTube videos, writing newsletters, running Telegram groups, or even hosting podcasts.

If you enjoy writing (like me), platforms like Twitter, newsletters, or Telegram might suit you. If you're better at speaking, YouTube and podcasts may be better fits. If you’re data-savvy and enjoy tracking market movements, focus on improving your trading skills and engage with traders you admire on Twitter. You might be surprised to find many excellent traders with only 500–2,000 followers—they aren’t necessarily big names like Hsaka, ENAS, or Nachi.

After identifying your strengths, ask: “Are my skills strong enough to generate income?”

If not → Consider internships. These could be at crypto companies, startups, venture funds, or family offices; assisting influencers (KOLs); or helping traders you admire. If you perform well, they may share insider information (“alpha”). Internships usually offer low pay, but their value lies in building experience and wisdom for the future.

If your skills are already strong → You have two paths: monetize independently or apply for jobs at crypto firms.

Self-monetization is a long and difficult road requiring great effort and perseverance. But if you believe in your abilities, it can be worthwhile—long-term rewards may far exceed regular employment.

Applying for a job at a crypto firm is a more stable option. You’ll receive a steady salary (often higher than traditional 9-to-5 roles) while still having time to work on your own projects. While you’ll have less time than a full-time founder, stable income helps you grow side ventures with peace of mind.

Here’s a tip: Many might think, “The bull market is here—I must focus on trading and don’t have time to apply for jobs.” But in fact, it’s easier to find jobs during a bull market. If you have limited funds, why risk everything on high-stakes trading? Instead, use the bull market to secure a stable job and build experience and capital.

If $SOL triples from its current price, your $1,000 becomes $3,000—roughly what you could earn working one week or month (at entry-level). Most people won’t be the one turning $1,000 into $1,000,000 via memecoins. If you had that ability, you probably wouldn’t be considering a job or reading this article.

Job Applications: If applying for a crypto job, choose a company you respect and aim to receive compensation in equity or tokens. If you believe in the company and your finances allow, request as much payment in tokens as possible. If the company succeeds, this could yield massive returns.

About Twitter: In crypto, one of the best ways to connect with top players is increasing your visibility on Twitter. Share topics you care about, research interests, or even lighthearted tweets; interact with people you admire. Post daily—even a simple “gm” (good morning)—and stay consistent.

Reach out via DMs, offer help without expecting anything in return. It’s a great way to build friendships and possibly future collaborations. Stay friendly, helpful, and visible every day.

Twitter is essentially the “resume” of the crypto world. You don’t need LinkedIn—your best credential for landing a job is the content you create on Twitter.

More importantly, recruiters often seek influential Twitter users and offer opportunities like partnerships, paid content, referral links, funded trading accounts, etc. As your influence grows, you might even gain access to angel investments or KOL funding rounds.

About Partnerships and Paid Content: There’s nothing wrong with participating in paid content as long as you disclose it openly. However, there are concerning trends—some merely share a memecoin contract address (CA) and claim it’s a “gem” or “must-buy.” I suggest sharing such info only in private circles, not publicly.

About Trading: Trading might be the hardest path into crypto, but if you’re exceptional and have an edge, it could also be the most rewarding. The key is finding your own trading approach—not blindly following conventional rules.

For example, a top CT (Crypto Twitter) trader once said he never used TradingView. This shows that over-relying on indicators or drawing imaginary “trend lines” isn’t always effective.

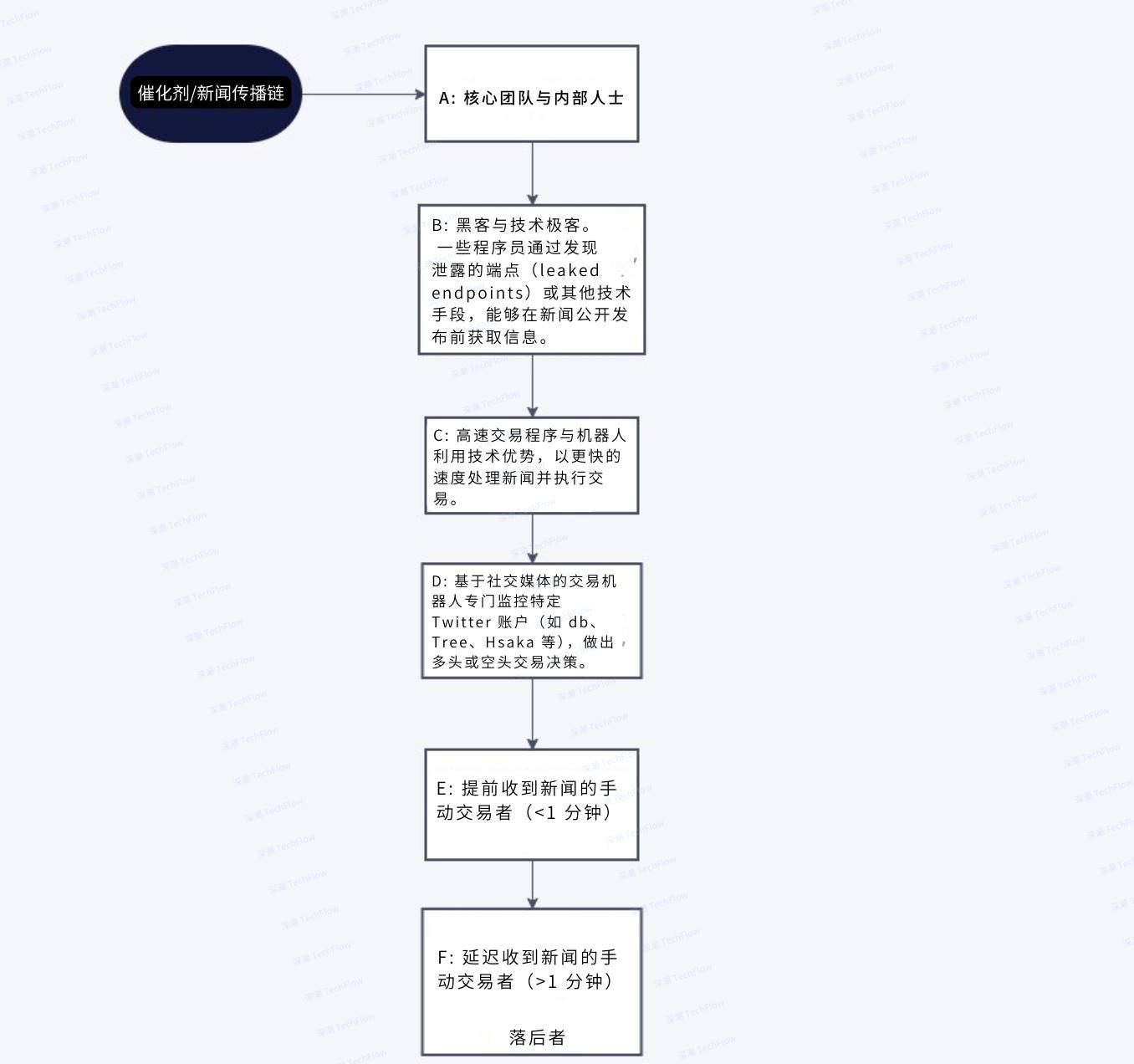

Crypto markets are inefficient, and smart traders exploit these inefficiencies. For instance, in March 2022, when Andre Cronje announced he’d focus on areas beyond DeFi, $FTM and $YFI only reacted 10–15 minutes later. This would be unthinkable in stock markets, where news reflects in prices within seconds.

As crypto matures, markets will become more efficient and trading harder. Therefore, cultivating traits like probabilistic thinking, common sense, self-awareness, resilience, patience, and delayed gratification becomes critical. Also, obsessive tendencies or mild autistic traits may not be disadvantages in trading.

Finally, remember that markets are cyclical. Only about 20% of the time is trending; 80% is range-bound. This matters because trend trading and range trading require completely different strategies.

If you think you’re “ahead of the curve” in trading, here’s bad news: you’re likely just in the “F group.”

(Original image from Route 2 FI, translated by TechFlow)

In trading, don’t expect anyone to guide you. We talk about making money, but the truth is, you’re taking money from others.

For example, when you go long on $BTC and profit, another trader shorting $BTC loses money. Trading is a player-versus-player (PvP) game—every win means someone else’s loss.

On Twitter, Discord, or Telegram, you might receive many trading tips. But pause and ask: Why are they sharing this? Are they genuinely helpful, or hoping FOMO will make you enter so they can exit to you?

Be especially cautious with suggestions when a token’s market cap (mcap) is small, as prices are easier to manipulate.

Learning & Growth: To become a better trader, learn from the best. For example, Cobie’s article on “probabilistic thinking” is a great starting point: Probabilistic Thinking.

Why Being Among the Best in a Field Is Worth It

Finding your ultimate goal brings not only fulfillment but also great rewards. I recall working 50–60 hours weekly at a corporate job, deeply disliking daily life. At first, I thought it was due to long hours, but later realized the real issue: I couldn’t invest time in things that directly impacted my own life.

Now, every hour I spend on Route2FI eventually yields some form of return. The outcome might be positive or negative, but either way, the gains and losses belong to me.

This autonomy fuels my motivation—no one else can turn this project into a success except me. If I quit, my efforts are wasted.

Becoming a top 10% performer in a field isn’t that hard—just requires time and effort. But reaching the top 1–2% demands smarter work.

This is where I’m constantly improving. Sometimes I wonder, if I outsourced more or spent less time writing tweets and newsletters, could I scale faster?

But I still enjoy the process. At this stage, my goal isn’t to extract maximum money from the market. I do it because it fulfills me. Writing is what I love, and I’ll keep doing it—no plans to outsource.

Life is long, so don’t settle. Whether in career, relationships, or friendships, strive for what you truly want. If you want luck to find you, create the conditions. Interestingly, when you work hard, luck often finds its way.

Pause for a second and ask yourself:

“What kind of life do I want?”

Chances are, your answer is something you don’t currently have or feel missing. Then ask another question:

“How much effort have I put toward these goals? How much time have I invested?”

If you want to build a successful CT (Crypto Twitter) account but haven’t started due to competition, reevaluate your mindset. Most delay action—or never begin—because they fail to set “small goals.”

They fixate on distant endpoints and conclude it’s impossible, giving up before even trying.

Learn Specific Knowledge

Naval said that to succeed, you need “specific knowledge”—unique skills or insights only you can possess. A simple way to build such knowledge is by creating your own personal brand.

As I mentioned earlier, people read my articles because I wrote them. If we posted the same content under an unknown Twitter account, it likely wouldn’t gain attention—not because the content is bad, but because the account lacks a follower base. Yet, if you consistently publish weekly for years, the right audience will eventually find you.

One of my biggest advantages is persistence. I know I’m not the best writer. I understand that spending more time refining articles—improving language, creating better visuals, or seeking feedback—would enhance quality. But rather than chasing perfection, I prefer to publish at 80% completion.

For me, this “move fast” approach is the only way to maintain consistent output. Looking back, I’ve written hundreds of articles—a source of great pride. Had I chased perfection, I might have produced only a tenth of what I have.

To master specific knowledge, you must boldly express your unique ideas. Don’t fear sharing views that seem “weird.” Someone will appreciate your distinct style. Learn to define yourself by your strengths, not weaknesses. Imagine how exceptional you could become by focusing on your natural talents!

In fact, you can absolutely become a top 1% in a niche. Instead of spending excessive time improving weak skills—say, raising sales ability from “45%” to “50%” (hypothetically)—focus on what you’re naturally good at. To become elite, leaning into your innate gifts is key.

Also, strive for financial freedom so you can make decisions based on interests and values, not economic pressure.

I believe the best work is driven by intrinsic motivation. When you truly love something, the work itself is enjoyable. Of course, you can find some internal drive in regular jobs, but most people would quit quickly without a paycheck.

A simple test to determine if you’re doing meaningful work is asking: “If money were no object, what would I choose to do?”

Alan Watts explored this in a video that deeply inspired me ten years ago.

You can watch it here:

Alan Watts: What If Money Was No Object?

If you lack passion for your work, it’s hard to excel.

More importantly, doing work you dislike often leaves you unfulfilled. Whatever your profession, strive to be your best. Especially early in your career, or during your 20s to 30s, be bolder, take risks, and open more possibilities for your life.

Try connecting with people who excel in their fields. For me, I’ve met many such individuals through Twitter and was fortunate to interact with them in person. Their perspectives and experiences greatly enriched mine.

Think about it—few people around you may share your deep interest in certain topics. But online, on platforms like Twitter, thousands share your passion and are eager to explore endless “rabbit holes” (fascinating, deep-dive interests).

Find these like-minded people and connect with them. Let them become your friends and companions.

Trust me, this effort is worth it—it brings tremendous value to your growth and worldview.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News