Bear Market Survival Guide: Three Crypto Profit Strategies That Don't Depend on Market Conditions

TechFlow Selected TechFlow Selected

Bear Market Survival Guide: Three Crypto Profit Strategies That Don't Depend on Market Conditions

Deeply analyze three profit models that do not rely on market trends from technical and strategic perspectives.

Author: The DeFi Investor

Translation: Yuliya, PANews

Despite the recent downturn in the cryptocurrency market, there are still profit opportunities that do not rely on token price appreciation. In fact, beyond traditional traders and investors, many participants have achieved substantial returns through alternative methods in this space. This article will analyze in depth three market-trend-independent profit models from technical and strategic perspectives.

1. Airdrops and Yield Farming

In the current DeFi ecosystem, liquidity mining and airdrop mechanisms centered around top assets such as BTC, ETH, and SOL are becoming increasingly mature. Taking the Pendle protocol as an example, its smart contracts support stablecoin asset locking to achieve a fixed annual percentage yield (APY) of 19%, and a fixed annual return of 12% for BTC assets. By optimizing strategy combinations and capital efficiency, professional operators can achieve annualized yields of 50–80% on stablecoins.

2. Shorting High-FDV New Tokens for Arbitrage

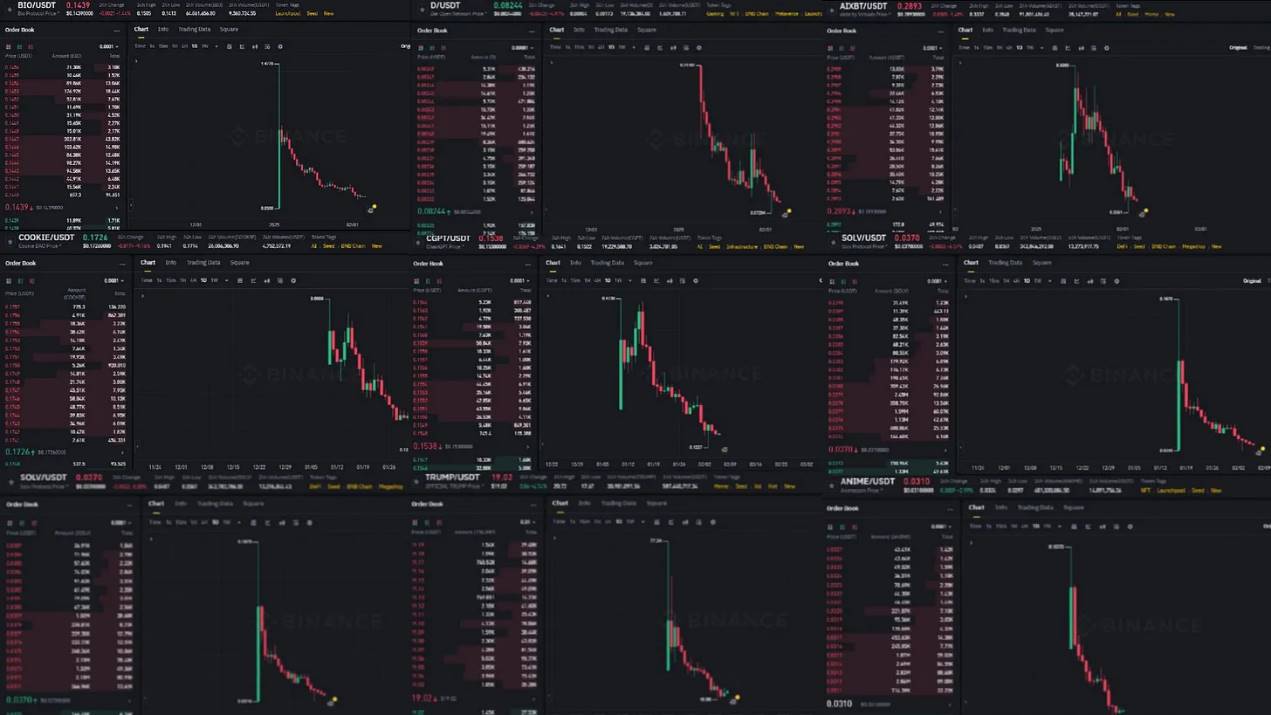

New tokens recently listed on Binance

Technical analysis of new tokens launched on Binance indicates that the vast majority exhibit a clear downward trend after TGE. This market phenomenon primarily stems from two core factors:

-

Severe token dilution: On-chain data shows hundreds of thousands of tokens are issued daily

-

Imbalanced valuation structure: Projects tend to use high valuations to enable early investor exits

As the market often says: "Opportunities often lie within chaos." This market inefficiency provides significant shorting opportunities for professional traders. Derivatives trading platforms like Hyperliquid offer effective channels for shorting strategies by quickly launching perpetual contracts on new tokens. However, given the high volatility of newly issued tokens, it is recommended to adopt low-leverage strategies to optimize risk-return ratios and accumulate strategy experience through small-scale testing.

3. Funding Rate Arbitrage (Delta-Neutral Strategy)

In the pricing mechanism of perpetual contracts, the funding rate—serving as a periodic settlement between long and short sides—provides arbitrageurs with significant profit potential.

-

When the funding rate is positive, long positions pay short positions;

-

When the funding rate is negative, short positions pay long positions.

Professional traders can capture funding rate spreads by constructing delta-neutral portfolios. Specifically, when a significantly positive funding rate is observed, one can simultaneously establish a $1,000 spot long position in BTC and a $1,000 futures short position (funding rates can be monitored via platforms like Coinglass), thereby generating stable returns through a market-neutral strategy.

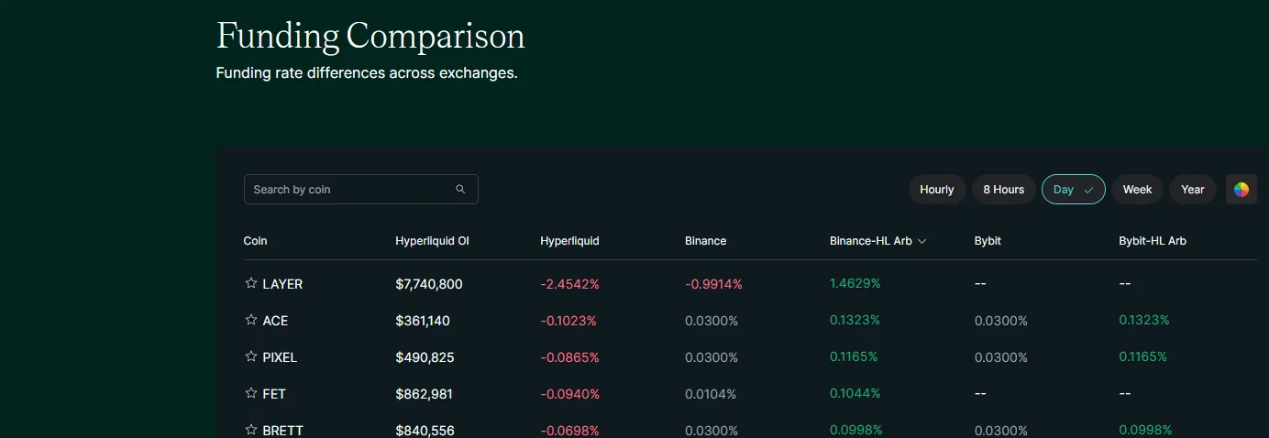

Currently, protocols such as Ethena and Resolv have developed automated funding rate arbitrage systems to provide users with passive income. Nevertheless, manually executing multi-asset arbitrage strategies, although more time-consuming, may still yield higher returns. Investors can use the "Funding Comparison" feature on the Hyperliquid platform to identify arbitrage opportunities.

Conclusion

Even during market downturns, numerous opportunities remain in the cryptocurrency space. Contrary to common perception, the crypto market still exhibits considerable inefficiencies, offering abundant profit potential for arbitrageurs. Every participant should aim to identify a specific area where they excel and can generate profits, continuously refining their expertise to become specialists in that domain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News