Exploring Initia: Maximizing L1 Capital Efficiency Through Built-in Liquidity

TechFlow Selected TechFlow Selected

Exploring Initia: Maximizing L1 Capital Efficiency Through Built-in Liquidity

Built-in liquidity is a crucial link connecting the entire network ecosystem and one of Initia's core mechanisms.

Author: Initia

Compiled by: TechFlow

The crypto industry doesn't need another generic L1; what it truly needs is dedicated infrastructure capable of fulfilling the promise of a multi-chain network. And that’s exactly Initia’s mission—to bring the “Eden” of multi-chain ecosystems into reality.

Building a multi-chain network presents unique challenges that fundamentally reshape L1 architecture. Take Ethereum, for example—supporting its rollup-centric roadmap required a complete rethinking of its architectural design. Fortunately, Initia has learned from established projects like Cosmos, Polkadot, and Ethereum from day one. Their successes and struggles have provided crucial insights that guide Initia’s own design decisions.

As the orchestration layer for interwoven rollups, Initia’s L1 fulfills three core responsibilities:

-

Economic Security

Rollups deployed via the interwoven stack inherit not only infrastructure but also battle-tested security from the L1. This means economic security benefits not just Initia itself, but safeguards all interwoven rollups built on top of it. Furthermore, through MilkyWay’s Modular Restaking, rollups can further enhance their security by integrating additional economic stake.

-

Reliable and Accessible Liquidity

History shows that multi-chain networks without a centralized liquidity hub often fail, suffering severe liquidity fragmentation that leads to poor user experience.

Even Ethereum—the most liquid blockchain—has failed to solve this problem for its L2s. Despite operating atop the highest-liquidity chain, Ethereum’s rollups still need to bootstrap liquidity from scratch.

To address this pain point, Initia’s L1 is designed as the central liquidity hub for the interwoven economy. Through specialized mechanisms, it provides deep liquidity for blue-chip assets and simplifies how rollups access liquidity.

For instance, Echelon’s interwoven rollup will rely on Initia DEX’s liquidity for clearing, enabled via non-fully atomic cross-chain flash loans.

-

Economic Synergy: Making the Whole Greater Than the Sum of Its Parts

In an ideal multi-chain network, the whole should be greater than the sum of its parts. But in reality, the opposite often occurs. For example, ongoing debates within Ethereum about L2 value capture highlight misaligned economic incentives.

Initia’s Vested Interest Program (VIP) is specifically designed to fix this issue. By creating positive-sum economic synergy, it ensures that users of Initia care about rollups, and rollup users, in turn, pay attention to Initia.

Enshrined Liquidity: Triple-Win Capital Efficiency

Now let’s discuss Initia’s “secret sauce”—Enshrined Liquidity. This is a vital link connecting the entire ecosystem and one of Initia’s core mechanisms.

At the L1 level, Initia features its native DEX—Initia DEX. This serves not only as the liquidity foundation for the entire interwoven economy but also as the primary routing engine for cross-rollup swaps. For example, if you want to swap ETH on Echelon for USDC on Zaar, Initia DEX and unified interoperability standards make the process simple and efficient.

Interestingly, the native DEX presents users with an important choice: Do you provide liquidity with INIT to earn trading fees, or do you stake INIT with validators to earn staking rewards, governance voting power, and VIP privileges? This decision impacts not just yield strategy, but directly shapes how users engage with the network.

Why not do both?

When you provide liquidity for whitelisted trading pairs on Initia DEX, you can stake your LP tokens with validators. In doing so, users not only contribute to the network’s economic security but also simultaneously earn staking rewards and gain governance voting rights! This level of capital efficiency is rare among L1-native tokens.

(Original image from Initia , compiled by TechFlow)

Take Jennie, for example. She just received some INIT tokens and wants to pair them with USDC bridged natively to provide liquidity. By staking her INIT/USDC LP tokens, Jennie achieves triple benefits:

-

She earns trading fees through LP;

-

She earns staking rewards from the INIT portion;

-

She gains governance voting rights and participates in VIP decisions.

-

If Jennie wants to go further, she could even sell her voting rights to the highest bidder via bribe protocols like Cabal , earning extra income.

But beyond these direct benefits, what truly drives enshrined liquidity?

Improved Capital Efficiency

With enshrined liquidity, the same amount of INIT can serve dual purposes. That is, Y units of INIT now generate the same value as 2Y units would without enshrined liquidity.

This creates a virtuous cycle: Higher capital efficiency → More attractive yields → More liquidity providers (LPs) → Stronger network security and deeper liquidity pools.

Unlike traditional L1s, where staking rewards typically incentivize native token holding for a single security budget, Initia’s staking mechanism also rewards liquidity providers for contributing to security.

This is a win-win design.

Enhanced Network Security: Unlocking the Potential of Liquid Assets

As mentioned earlier, enshrined liquidity incentivizes not only native token staking but also LP asset participation. This capital-efficient design significantly expands network security by enabling assets previously idle in liquidity pools to actively contribute to network safety.

More importantly, Initia’s economic security protects not only the L1 but the entire network—including all interwoven rollups. This is undoubtedly a major breakthrough.

Deep and Persistent Liquidity: Say Goodbye to Short-Term Capital Flows

Traditional liquidity mining is often expensive and highly unstable.

Once incentives end, liquidity quickly drains away.

In contrast, enshrined liquidity is a permanent form of liquidity mining baked into the chain’s mechanism. Its incentives are more sustainable, encouraging long-term participation from liquidity providers and forming a more stable liquidity base.

Best of all, this mechanism saves interwoven rollups significant funds. They no longer need to spend large amounts on liquidity mining programs—they can directly leverage the deep liquidity pools provided by Initia DEX.

The Role of INIT as a Connector

Enshrined liquidity does not apply to all trading pairs. To qualify, a pair must meet two conditions:

-

Approved through Initia governance.

-

One of the tokens in the pair must be INIT.

This is not arbitrary—it's a game-theoretically sound design.

Consider what this means for interwoven rollups wanting their native tokens whitelisted: they must accumulate sufficient voting power themselves or influence existing voters, ensuring alignment across the network’s economic goals.

There’s another clear benefit: by requiring every whitelisted pair to include INIT, the L1 builds a rich network of trading routes centered around INIT. This helps optimize tokenomics and significantly improves cross-rollup transaction efficiency.

While the role of staking yield from enshrined liquidity is already evident, the importance of voting rights within the interwoven economy deserves deeper exploration.

Why Are Voting Rights Important?

In Initia, economic alignment is the core principle and central focus. Such alignment brings broad benefits to the entire interwoven economy.

This isn’t just theoretical—it has been proven in practice. In the Cosmos ecosystem, individual chains developed their own economies independently, with minimal connection to the Hub. While IBC enables communication, economic ties are missing. ATOM holders aren’t truly invested in any single chain’s success, and chain users have little reason to care about the Hub. This disconnect leads to mutual indifference.

Economic alignment is precisely why the VIP (Voting Incentive Protocol) was created—and why voting rights matter so much!

VIP gauge voting occurs every two weeks, where voting right holders decide which rollups receive enhanced incentives. It’s a massive capital coordination game. The best part? Those making decisions are the ones most aligned with the system’s interests.

The VIP mechanism creates a powerful feedback loop, tightly binding the interwoven rollup network. Voters must carefully assess which rollups deserve support, while rollups must demonstrate their value to these voters. Even more interestingly, through protocols like Cabal, rollups can directly reward voters, further strengthening economic alignment.

How to Get Voting Rights? It’s Simple:

-

Stake INIT

-

Stake INIT/X LP tokens via Enshrined Liquidity

The principle is clear: the more closely tied you are to INIT’s success, the greater your say in the network’s direction. But could this lead to whale-dominated oligarchy, leaving small holders behind?

Don’t worry—Initia also cares about the “small fish.” It offers a way to amplify voting power, making competition fairer.

Vote Locking—Empowering the Committed

(Original image from Initia , compiled by TechFlow)

The truth is, commitment should mean something tangible—not just words, but measurable impact. After all, one goal of blockchain is to build “Money Legos,” composable financial modules.

You can think of commitment in layers. Some users may want to dip their toes in, while others are ready to dive deep. Shouldn’t their influence reflect the depth of their commitment? That’s exactly where vote locking adds value—quantifying influence based on users’ commitment level.

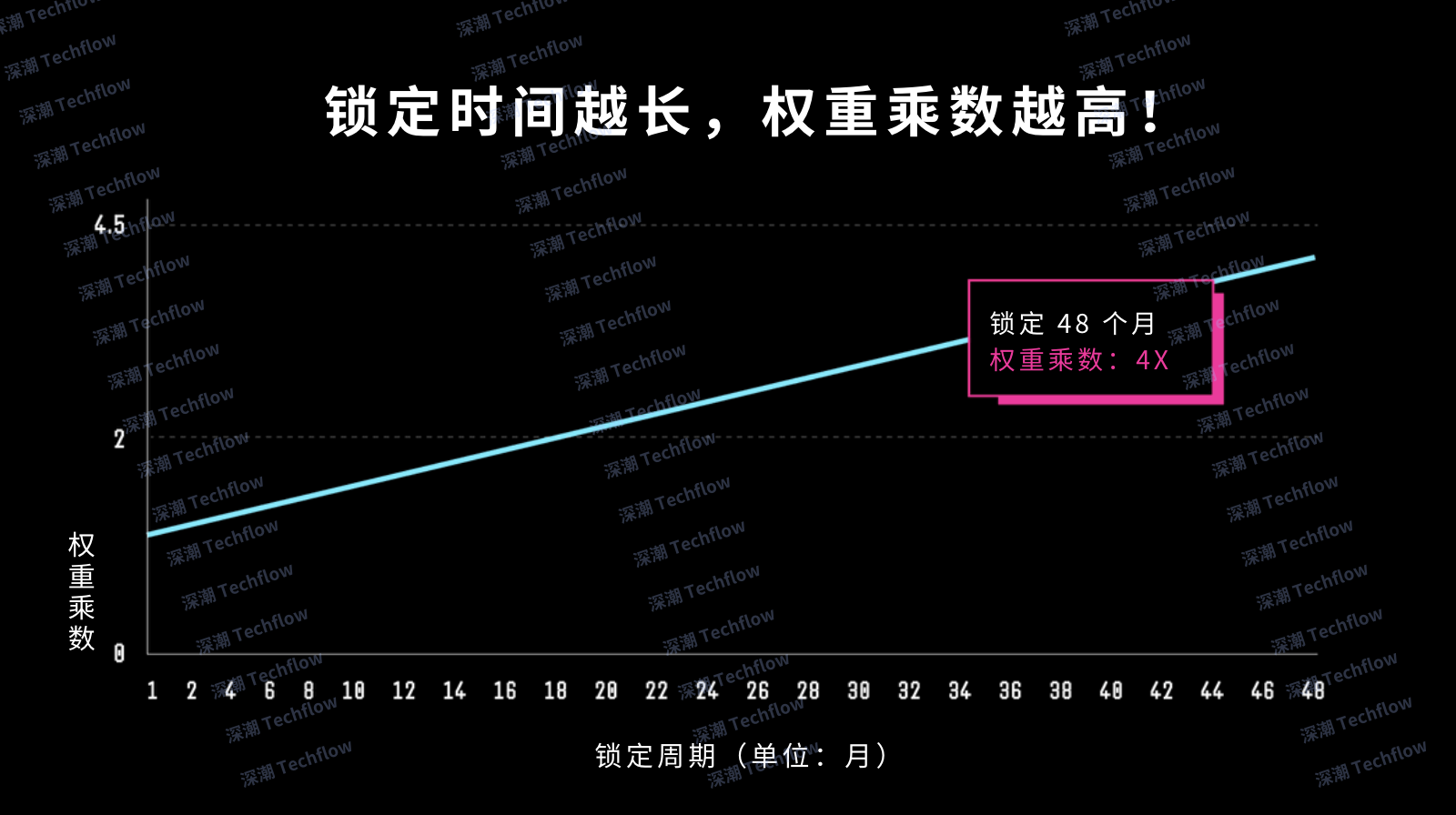

When you stake tokens—either directly or via enshrined liquidity—you can choose to lock your position from 1 month up to 4 years to gain boosted voting power. The longer you lock, the greater your influence in the network.

The voting power boost (voting buff) depends directly on your chosen lock duration, calculated as: (3×months/48)+1

Here are a few examples:

-

Lock for 1 month: 1.063x voting power: ((3∗1)/48)+1((3∗1)/48)+1

-

Commit for 1 year: 1.75x voting power: ((3∗12)/48)+1((3∗12)/48)+1

-

Lock for 4 years: maximum 4x boost: ((3∗48)/48)+1((3∗48)/48)+1

For example, 25 INIT locked for 4 years gives the same voting power as 100 INIT simply staked. This design allows users to express genuine long-term commitment to Initia through on-chain actions, injecting greater trust and stability into network governance.

(Original image from Initia , compiled by TechFlow)

Let’s revisit our furry friend Jennie. She holds 100 INIT and wants to optimize her position.

Jennie decides to directly stake 50 INIT and vote-lock the other 50 for 4 years. As a result, her voting power increases from 100 (simple staking) to 250. At the same time, she retains flexibility to adjust her strategy based on risk tolerance, rather than putting all her chips on one approach.

Vote locking empowers true believers with greater influence, while preserving enough flexibility for every user to participate in their own way.

Conclusion

The right way to build a multi-chain world relies not just on technology, but on achieving value alignment. This is why past attempts have failed—lacking consensus across layers, sometimes even creating alienation. At Initia, we place special emphasis on designing value flows and incentive flywheels, ensuring every participant in the network has a clear path to contribute and be rewarded accordingly.

Initia’s core mechanisms—Initia DEX, Enshrined Liquidity, Vote Lock, and VIP—work together synergistically to create an ecosystem where users naturally gravitate toward beneficial behaviors. Higher capital efficiency makes LPs happier while building deeper liquidity pools, which in turn attracts more users seeking governance power. These positive effects ripple across Initia’s rollup network, enabling seamless cross-chain transactions and rewarding users through VIP for sustained rollup usage.

Want to learn more? Check out our documentation:

These mechanisms are already live on testnet. We encourage you to try them out:

-

Provide liquidity on Initia DEX

-

Stake your LP tokens with validators—and choose the longest lock possible!

-

Participate in the VIP voting mechanism

Visit Initia Testnet Apps to get started, and join the Discord community to explore Initia with fellow developers and users. The Eden of multi-chain is growing—come help build it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News