Initia: Breaking the EVM Shackles, Ushering in a New Era of Full-Stack Applications and AltVM

TechFlow Selected TechFlow Selected

Initia: Breaking the EVM Shackles, Ushering in a New Era of Full-Stack Applications and AltVM

With Initia, full-stack applications are not only within reach but also highly practical.

Author: Initia

Translation: TechFlow

Original image from @initia, translated by TechFlow

Imagine this: after a rollercoaster day of on-chain trading, you're winding down. Going long on ETH earned you $6,900. Investing in an AI agent token that claimed to "cure cancer" netted you a smooth 42x return. Yet, deep inside, you feel uneasy. Why? Because of the EVM.

Every time you use the EVM, you can't help but wonder: how did we get here? Each transaction feels like tiptoeing through a minefield. You ask yourself, why in 2025 are we still stuck with the clunky and dangerous "approve-deposit" model?

Worse, you live in constant fear—what if that infinite approval on your favorite decentralized exchange (DEX) gets exploited, or a honeypot scam wipes out your life savings? If these scenarios sound familiar, it means you’re still living in the past.

@dcfgod:

"Turns out, the flawed 'approve-then-swap' design has already caused nearly $100 billion in losses."

To be fair, the Ethereum Virtual Machine (EVM) isn’t all bad. Those dramatic complaints were just to grab your attention—the reality is more nuanced.

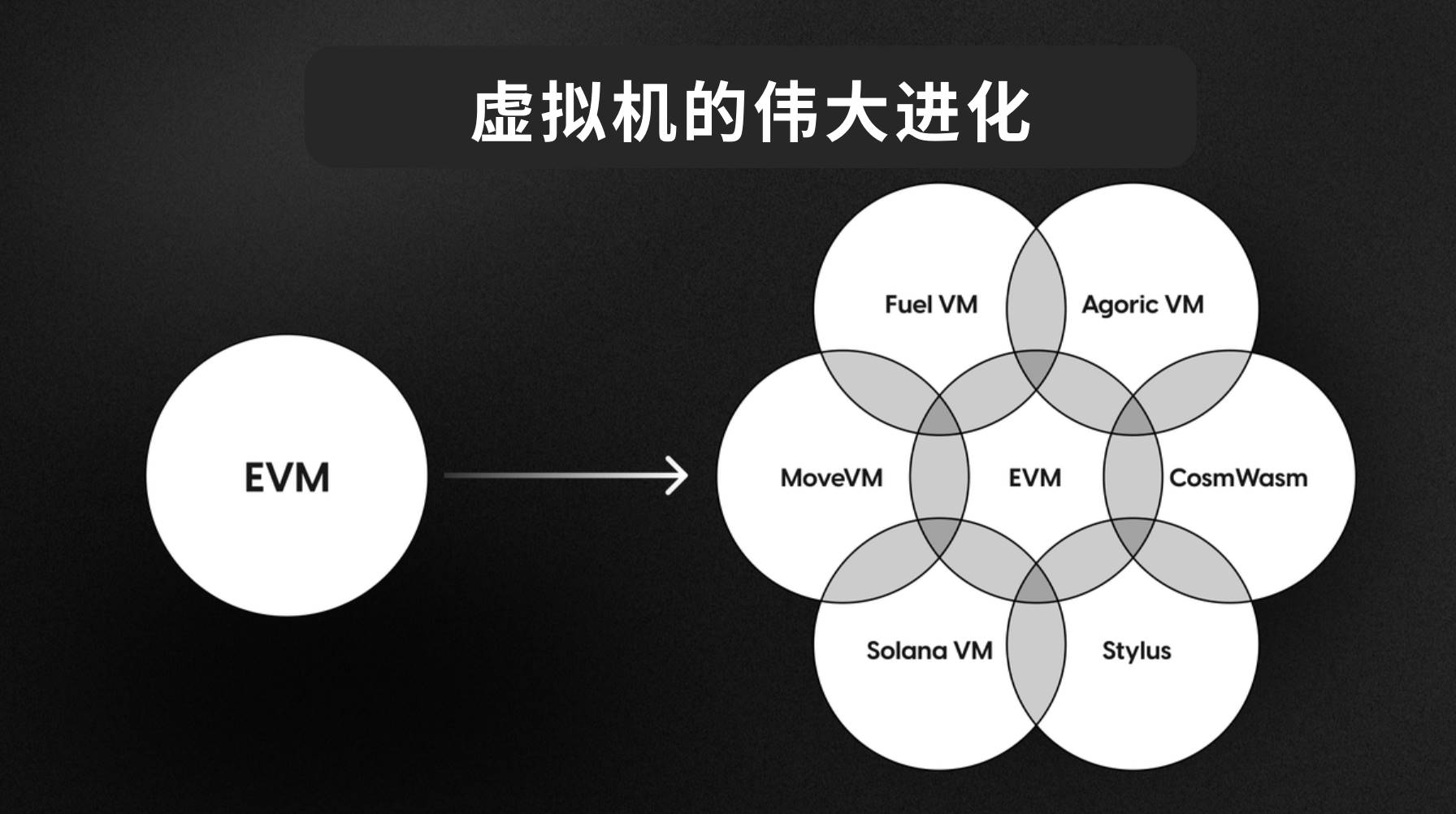

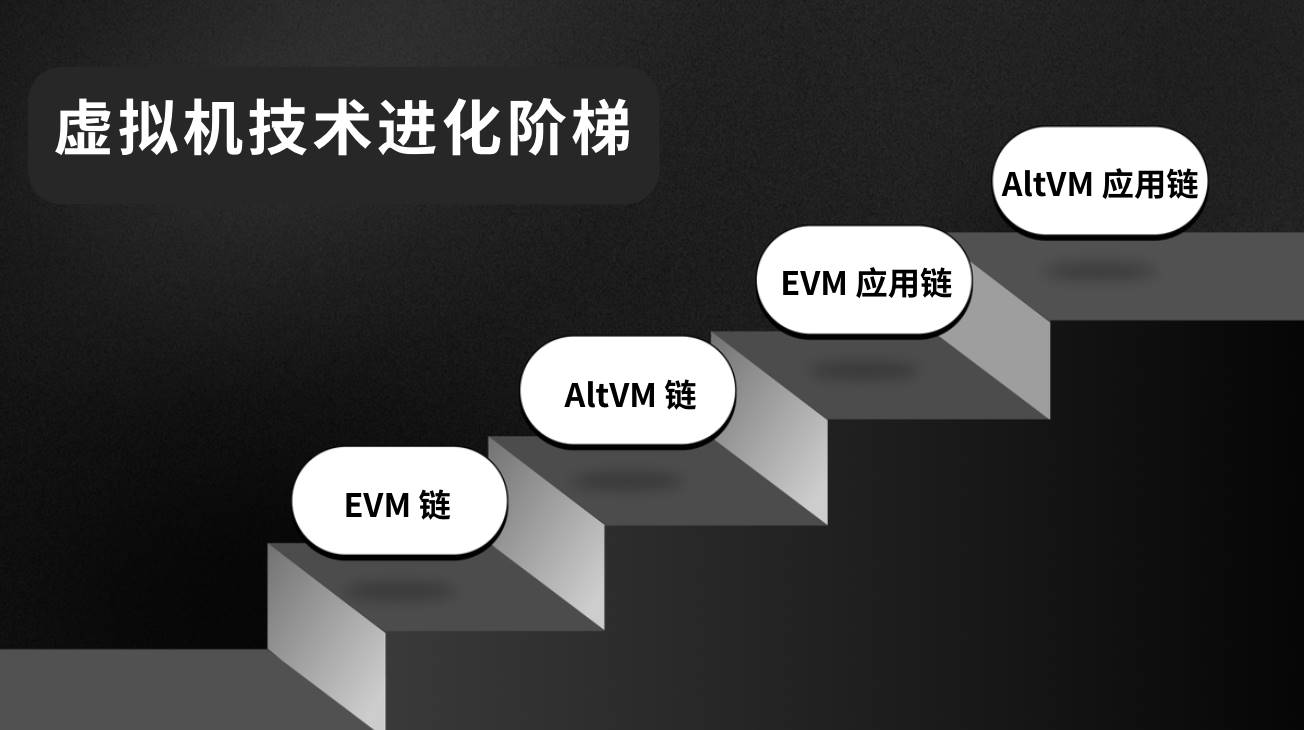

In fact, the EVM has long served as foundational infrastructure for programmable blockchains. Historically, many of the most useful and innovative decentralized applications (dApps)—like Uniswap, Aave, GMX, and CryptoKitties—were built in Solidity for the EVM. However, it’s now time for the EVM’s dominance to gradually give way to a new wave of promising alternatives.

New-generation virtual machines like MoveVM, CosmWasm, SVM, FuelVM, and Arbitrum Stylus are emerging, each with unique strengths and weaknesses. Developers are now choosing VMs based on actual needs rather than defaulting to one standard.

This isn’t mere trend-chasing—it’s a deliberate shift shaped by years of observation and reflection. Developers have carefully studied the EVM’s pros and cons, learned from its limitations, and built next-gen VMs from a higher starting point, delivering better solutions.

What Are the Advantages of EVM?

Original image from @initia, translated by TechFlow

-

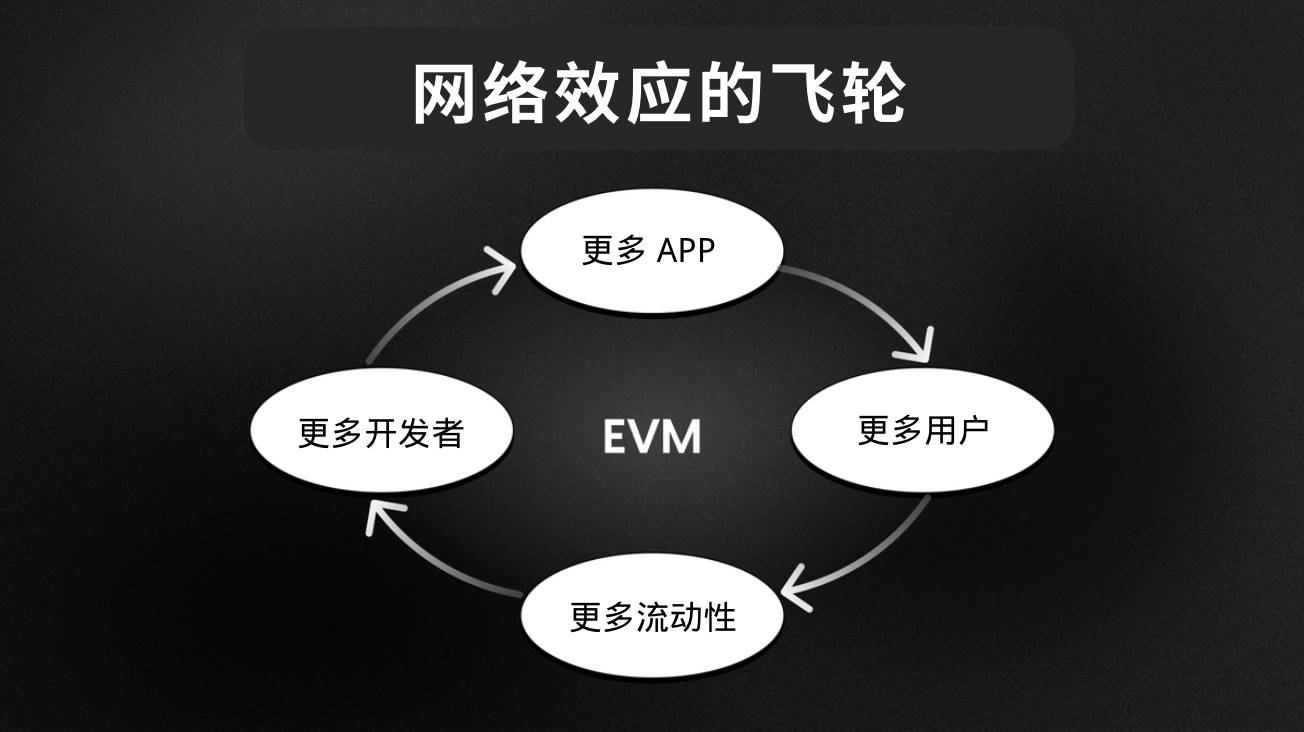

Network effects, ecosystem, and mature developer infrastructure. The EVM enjoys massive first-mover advantage, making it the default choice for most developers. It boasts a large user base, rich application ecosystem, deep liquidity, and development tools far surpassing those of other VMs.

-

Institutional integration. As blockchain scales, centralized exchanges (CEXs) and custodial services become essential. These third parties move slowly, but they’ve already integrated countless EVM-based chains, resulting in more mature support.

-

Battle-tested resilience. Despite repeated hacks, Solidity and the EVM have grown increasingly robust through real-world stress testing. Theoretical security matters, but nothing beats years of patching vulnerabilities in production.

-

Economic momentum. The EVM secures nearly $90 billion in DeFi assets—and counting. More emerging blockchains (e.g., Monad, Hyperliquid, MegaETH, Berachain) are adopting EVM compatibility, creating powerful economic incentives to keep improving it to meet liquidity demands.

Why Isn't EVM Perfect?

-

Inadequate security. Despite being battle-tested, the rise of altVMs shows there's room for improvement. These new VMs start from a higher security baseline, preventing many application- and protocol-level vulnerabilities. Even experienced Solidity developers can make mistakes in complex code, and auditors face endless potential attack vectors.

-

Suboptimal performance. Traditional EVM struggles with high-throughput use cases due to inefficiency. Projects like @monad_xyz and @megaeth_labs aim to fix this, but their approaches come with trade-offs. Monad fully rewrites the stack for speed but sacrifices proven reliability; MegaETH compromises decentralization.

Original image from @initia, translated by TechFlow

-

Gas optimization is hard. For developers, spending more time optimizing gas usage than designing core protocol logic is a serious problem. Significant improvements often require writing complex assembly code—a nightmare for many. Sometimes even reordering function definitions in a smart contract can reduce gas, which borders on black magic.

Despite these flaws, EVM continues to operate reliably and will remain dominant for years. But consider this analogy: Bitcoin dominates as a crypto asset, yet thousands of other assets coexist alongside it.

Moreover, the EVM developer ecosystem is actively improving UX through account abstraction, batch transactions, and even next-gen Solidity compilers. Every layer—from architecture to tooling—is undergoing refinement.

Still, if optimistic projections hold true, the number of crypto developers could grow 1,000-fold. We can't expect EVM to serve everyone. Think of Web2—no single programming language fits all use cases or pleases all developers. We shouldn’t expect EVM to either.

It’s Time to Expand the VM Landscape: AltVMs Beyond EVM

Original image from @initia, translated by TechFlow

We know changing mindsets isn’t easy. When your favorite crypto Twitter analyst tells you EVM is “good enough” and questions the need for altVMs, you might believe them. But let’s flip the script—address those doubts head-on and explore the potential of altVMs.

Controversies Around AltVMs

-

Why do we need altVMs? Isn’t EVM sufficient? If we always settle for “good enough,” we’ll never achieve better tech or experiences. AltVMs represent bold experimentation and technological evolution, pushing the frontier of dApp development. Competition breeds stronger solutions.

-

Some claim altVMs are just VC-driven hype. That’s not true, and evidence refutes it. CosmWasm has long been the go-to VM across Cosmos-based chains. Solana’s SVM supports massive scale and liquidity. Sui and Aptos, powered by MoveVM, already secure over $2.7 billion in total value locked (TVL). These reflect real user growth and product-market fit—not empty noise.

-

User adoption is tough. They must download new wallets, learn new block explorers, and adopt new mental models. But—

1. Users follow opportunity. AltVM-powered chains often harbor untapped potential—exactly what sparks user growth. If you make it worthwhile, users will climb the learning curve.

2. Initia offers a solution: BYOW (Bring Your Own Wallet). No matter which Interwoven Rollup you choose—or which VM it uses—you can stick with familiar wallets like Rabby, Phantom, or Keplr.

3. Chain abstraction is becoming real. Breakthroughs in gas sponsorship and cross-chain interoperability happened in 2024. By 2025, entry barriers to new apps—regardless of chain or VM—will be near zero.

-

Developer tooling is still lacking. We admit this—but recognize these tools are early-stage and rapidly evolving. Once they mature, developer experience will dramatically improve.

Why Will AltVMs Thrive Long-Term?

Now that we've addressed common concerns, let’s focus on the strengths of altVMs—there’s much to celebrate. AltVMs unlock fresh creativity and opportunities for blockchain apps. They introduce new development paradigms, innovative concepts, and stronger security guarantees. Let’s dive into what makes altVMs special:

Fresh Mental Models

Keen observers may have noticed: in the last cycle, most innovation in blockchain apps happened off-chain—in UIs, incentive designs, or bridges bringing external yields on-chain. On-chain innovation plateaued. We need more builders like fiveoutofnine, who dare to experiment on-chain and push technical boundaries.

EVM’s design constraints shape—and limit—how developers think, making it hard to break free from old patterns. AltVMs break these chains, offering greater flexibility and choice. They empower developers to rethink how on-chain apps are built.

This shift is especially visible in recent applications using Arbitrum Stylus and Sui Move.

Arbitrum’s Stylus is a WebAssembly (WASM)-based execution environment where developers can write smart contracts in Rust, C++, or any language compilable to WASM. This flexibility has already proven powerful.

Take Renegade, the first on-chain dark pool DEX, enabling slip-free, zero-MEV, private trades. After evaluating multiple options, Renegade chose Stylus because others were too costly for users. Read more about this case study.

Then there’s Sui’s MoveVM, introducing Programmable Transaction Blocks (PTBs). This allows developers to bundle interactions across multiple modules into a single transaction, finalized off-chain before submission. You don’t need account abstraction for batching, nor wait for a controversial EIP to land on EVM. Building on Sui gives you these UX benefits today. Learn more here.

Higher Security Baseline

Today, most altVMs treat security as a core design principle. They learn from EVM’s shortcomings and prevent those flaws at the architectural level. This doesn’t mean they’re invulnerable—future bugs or exploits may emerge—but currently, they outperform EVM in security.

Many altVMs are built on Rust, a language renowned for safety in mission-critical software. In essence, these VMs prioritize security from the ground up.

Still skeptical? Consider MoveVM—the VM powering Initia L1.

First, Move is the only language in crypto designed from scratch by a team with deep expertise in programming language theory.

Move enforces mandatory features that encourage deeper thinking about program design and allow states to be modeled more realistically. For example:

-

Assets are treated as “resources” owned by addresses—contrasting sharply with EVM’s balance mapping approach—and better reflecting true ownership.

-

Move adopts Rust’s strict ownership semantics, requiring developers to explicitly define which parts of state can be modified, and where. This rigor significantly reduces potential bugs in program logic.

Even so, what if developers still make mistakes? Move offers formal verification to mitigate risk. Its built-in verifier lets developers mathematically specify expected behavior, then checks whether code complies. This drastically reduces logical errors.

Built for Performance

AltVMs are designed for peak performance. The original EVM and Solidity weren’t optimized for speed. While EVM has improved over time, it still can’t match purpose-built altVMs.

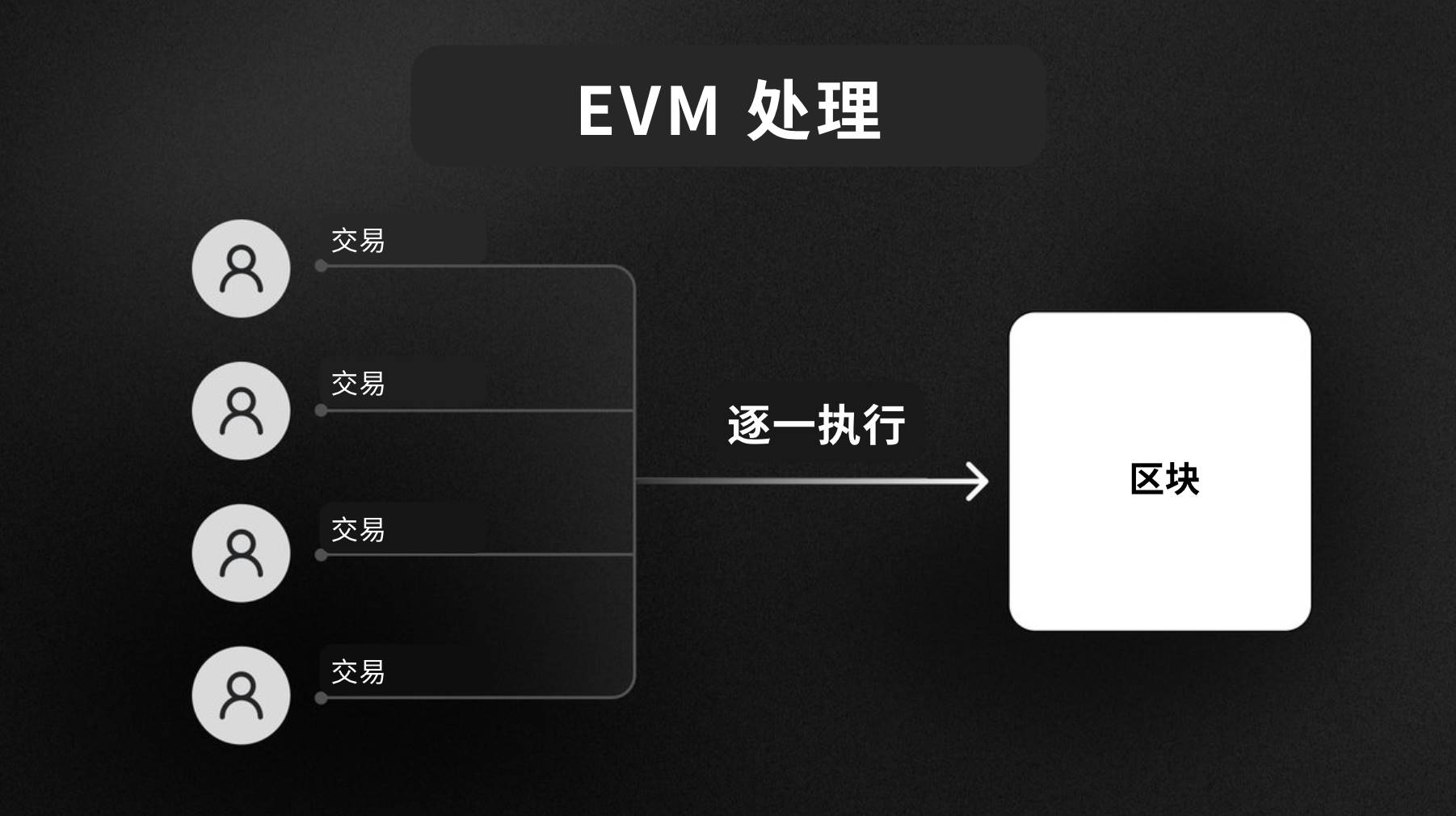

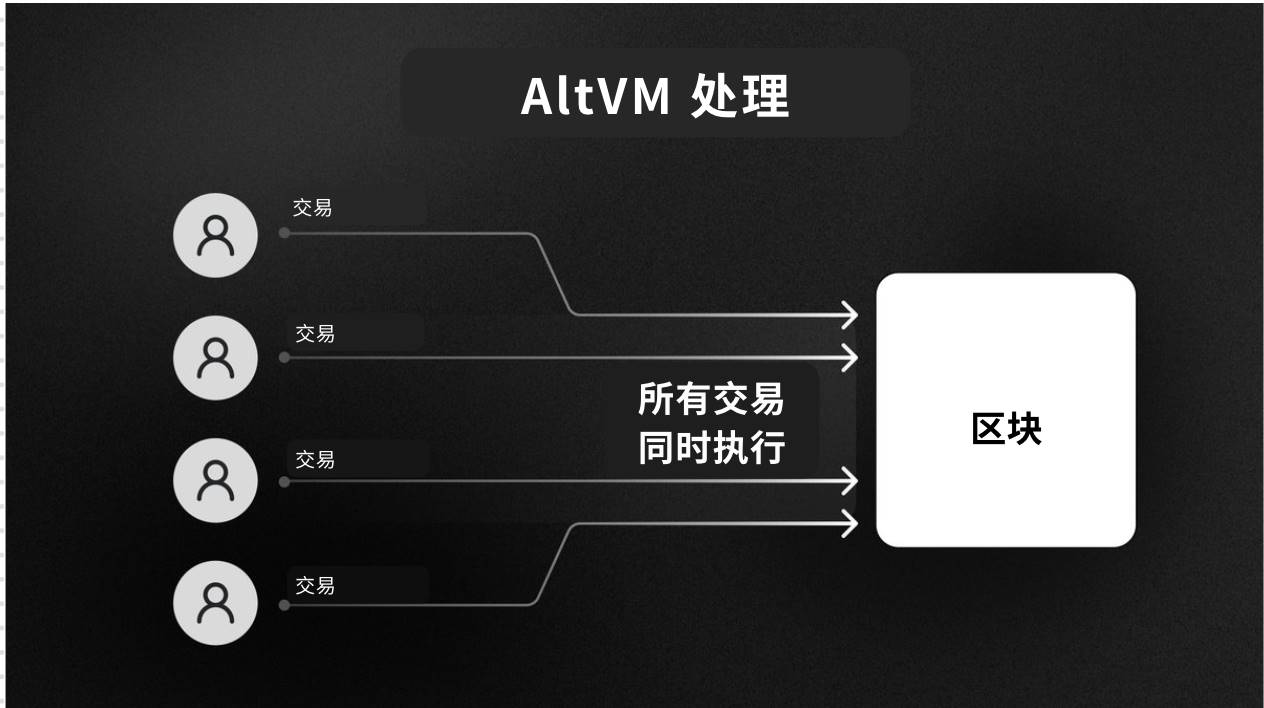

Traditional EVM performs poorly at parallelization—the most effective way to boost blockchain throughput. Parallel execution is possible on EVM, but achieving high efficiency often requires massive engineering effort, such as rebuilding the entire system from scratch.

What is parallelization? Simply put: instead of processing transactions one-by-one, process many simultaneously to greatly increase efficiency.

Original image from @initia, translated by TechFlow

Modern VMs are designed with parallelization in mind and excel in such environments. Programming models used by Move and Solana’s VM make parallel execution efficient and seamless.

In SVM (Solana Virtual Machine), all data is grouped into separate accounts. Developers can flexibly assign data across accounts, decoupling data from program logic. Each transaction must declare which accounts it reads from or writes to. This separation allows the VM to identify non-competing transactions and execute them in parallel efficiently.

Having addressed doubts about altVMs and systematically outlined their advantages, you should now see why altVMs offer significant positive expected value (EV+) for crypto and future applications.

This isn’t a tribal war or a call to “pick a side.” Each VM has strengths and trade-offs. Ultimately, developers should be free to choose the best tool for their needs. Innovation and experimentation benefit the entire industry!

When building apps, these choices matter—which is why Initia currently supports MEWing: MoveVM, EVM, and CosmWasm.

In truth, our exploration of the altVM space has only just begun. From zkVMs (zero-knowledge proof-based VMs) to hybrid VM environments, to attempts like FuelVM tackling state bloat, the future of applications is full of possibilities. Imagine how future apps will leverage these tools to create novel experiences at lower costs—an exciting prospect.

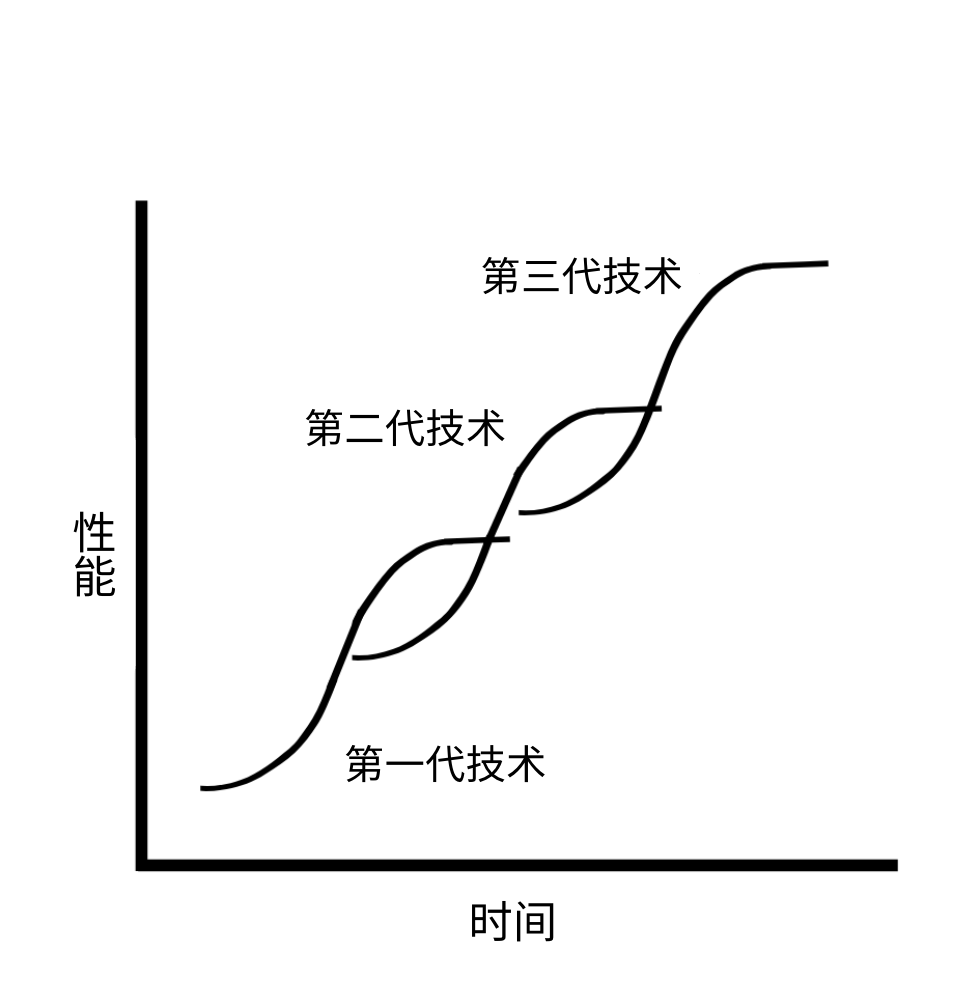

The development of altVMs is only at the very beginning of the S-curve.

Original image from @initia, translated by TechFlow

Beyond AltVMs: The Era of Full-Stack Applications

Let’s step back: what’s the ultimate goal of these tools and discussions? The real objective is to build products and experiences that deliver immense value to users—whether through extreme performance, strong security, or seamless UX.

At the end of the day, VMs are just tools in a developer’s toolbox.

But are they the best tools available? They’re part of the puzzle—but not the whole picture. In shared general-purpose chains, neither EVM nor altVMs fully meet the needs of ambitious applications.

As @ItsAlwaysZonny puts it:

"EVM or altVM—general-purpose chains are just mediocre.

Have a clear goal. Build dedicated app-specific chains."

Applications built on shared-state monolithic chains struggle to compete with those running on dedicated, custom infrastructure.

The real breakthrough lies in the rise of full-stack applications.

A full-stack application means selecting the right VM for your use case and pairing it with a bespoke application chain. It empowers developers with full control over the execution environment—no compromises. It ushers in a new future: instead of picking a blockchain, developers build a custom chain tailored to their app, from dedicated blockspace to customized transaction execution and ordering—all centered around optimal user experience. Full-stack apps represent freedom and the next stage of technical evolution.

Original image from @initia, translated by TechFlow

At Initia, we believe full-stack applications are the key catalyst for breakthrough innovations. That’s why we’re building the best framework for developers to create them: choose the ideal VM based on your vision—Move for high security, EVM for mature ecosystems, or CosmWasm for flexibility. With LayerZero and IBC, achieve instant interoperability. Use Cosmos SDK to freely customize the underlying chain stack. All necessary tools are integrated into the Interwoven Stack—including oracles, Celestia data availability (DA), block explorers, native USDC support, fiat on-ramps, wallet components, and cross-chain bridge UIs.

With Initia, full-stack applications aren’t just within reach—they’re practical and powerful.

Finally, stay tuned for more on full-stack apps and app chains. This article sets the stage for the next piece, which will take you even deeper into the boundless potential of this space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News