The New Frontier of Fully On-Chain Gaming: Decoding Initia's "Gravitational Field Effect"

TechFlow Selected TechFlow Selected

The New Frontier of Fully On-Chain Gaming: Decoding Initia's "Gravitational Field Effect"

Why did they all go to Initia?

Author: Gink5814.eth

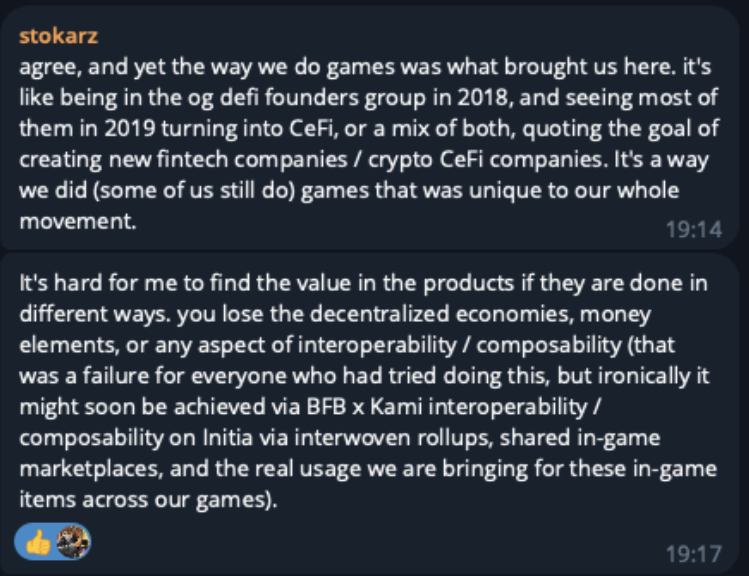

Last night's fierce debate involving Stokarz is still fresh in my mind, and now I can finally talk about what I'm best at—on-chain gaming. As I've repeatedly emphasized in previous articles, the flow of liquidity during a bull cycle follows a clear pattern: starting with animal-themed meme coins, moving to celebrity tokens, then to less liquid ERC-20s like Friend.tech, followed by NFTs and staking, and finally reaching GameFi.

One of the screenshots from last night’s battle in the English FOCG group

Over the past year, I've witnessed many teams pivot. But it's precisely how we build games that makes on-chain gaming a distinct vertical—a unique game design paradigm. This reminds me of 2018, when many early DeFi founders shifted toward CeFi or hybrid models by 2019, claiming they were building new fintech or crypto-CeFi companies.

The rise of fully on-chain gaming feels similar to DeFi’s early days. Everyone is experimenting—some teams stay true to their vision, while others take a more “pragmatic” path. Regardless, FOCG has become an undeniable sector. @arbitrum @Starknet, established chains, along with newcomers like @megaeth_labs, @initia, and @SoniSVM, are all setting the stage for fully on-chain games. As for appchains like @HappyChainDevs, @B3dotfun, and @redstonexyz, they’re more like supporting actors—minor roles, yet essential.

However, for half of these chains, I struggle to see real value—they feel more like another server room. When you move most computation off-chain, you lose decentralization, economic incentives, liquidity, and even interoperability and composability. Sure, some might argue those don’t matter much since few people actually play these games. But as the bull market progresses, Play-to-Earn will resurge, and interoperability and composability are exactly what enable mutual support ecosystems.

Developer-friendliness, high performance, and interoperability seem to form FOCG’s “impossible triangle.” Indeed, no one who previously attempted this achieved major success. For games, chain performance and scalability are critical, which is why Initia redesigned its architecture around a modular multi-chain system combining L1 + appchain L2 + DA—to handle more users and traffic. Liquidity can be shared while network conditions remain independent yet closely connected.

A system of many many rollups that can easily talk to each other

But now, through @battleforblock and @kamigotchiworld’s implementation on Initia, we see hope—via interconnected rollups, shared in-game markets, interwoven rollups, and real utility赋予 to in-game items. Those who have persisted longest in building on-chain games consistently convey the same value proposition: without this technology, we cannot achieve the open economies we need. Of course, you may doubt whether players truly care. Then why not just launch on Epic or Steam and compete in Web2? There’s already a massive base of standard gamers there.

The most enduring Web2 game—EVE—is going fully on-chain too

The reason Initia caught my attention is simple—it was born with a “halal aura” (I hate this term, but不得不 admit it’s a great meme). Unlike MegaETH, @biomesAW saw multiple games migrate to Initia.

Kamagotchi’s team is, without exception, my top favorite. We met once in person at last year’s ETHCC in Brussels, and afterward I felt they truly possessed the secret to success.

@0xl3th3, AW’s leading critic, has offered profound insights into lattice. @jb0x_, a Korean-American, asked me during our first meeting if I wanted to take a pill. @0xstellate clearly has aesthetic taste, visible even from Twitter. And there’s a community manager who’s been around since the OHM era—an OG from the DeFi days. I think many overlook the fact that game makers differ from contract engineers; making games is an art and form of self-expression. This is a team with something to say, and their own understanding of the playbook. From lethe, I heard for the first time a precise DAU number—5,000. Their logic makes sense: a small exchange only needs 500 contract gamblers to profit; a game only needs 500 core players plus 4,500 supporting ones to sustain itself.

@0xCitadel and Battle For Block have also been steadfast allies for over two years. Citadel holds 1kx and Peterpan’s largest FOCG position, raised $3.3 million in seed funding in 2023 led by 1kx, with participation from Shima Capital, Hashed, Matchbox DAO, Ready Player DAO, and several angel investors. Remarkably, Peterpan allowed them to go to Initia instead of Abstract. They’ve committed to releasing 100% of tokens to the community—a strong start, ensuring fairness even with VC investment. Players earn tokens simply by playing. Their economy designer comes from EVE Online; I interviewed the team last year. From ARB Nova’s @rhascau to today’s BFB, Stokarz and his @minters have wandered for years before finally choosing Initia—proof of Initia’s strong ecosystem and BD team. But why exactly are so many teams flocking to Initia? What makes it so attractive?

Breakthrough technical architecture – partially solving sharding

-

Multi-VM support (EVM, MoveVM, WasmVM) allows developers to choose the optimal development environment

-

20M gas per block capacity and 250ms block times sufficient for complex game logic

-

Rollup-based scalability reaching 140M gas/sec, providing ample compute power for large-scale games

Innovative interoperability solution –

-

Seamless cross-chain asset and data interaction via IBC + Celestia DA

-

Interoperability between games enables a true shared in-game marketplace

-

Projects like BFB and Kami have already demonstrated cross-game asset portability on Initia

Maximized economic efficiency

-

90% reduction in gas costs significantly lowers game operating expenses

-

Reasonable valuation ($350M post-money) offers greater growth headroom for ecosystem projects

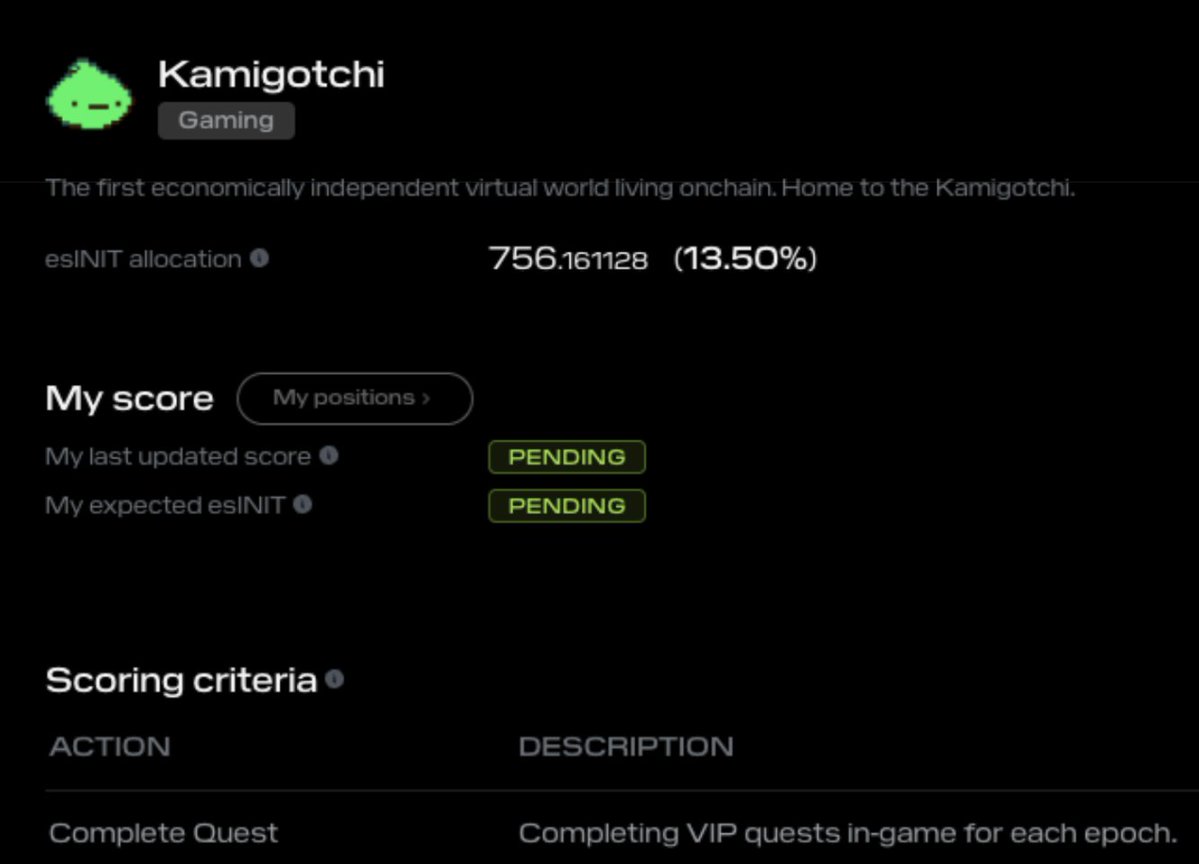

These features, aside from reasonable valuation (compared to Starknet’s $8B), aren’t strong enough selling points in today’s modular blockchain landscape. In my view, the key differentiator is the VIP (Vested Interest Program) mechanism, which ensures game developers receive direct revenue shares from protocol earnings.

When I saw the VIP mechanism, I realized it’s essentially a market-driven incubation and acceleration model, unlike OP Superchain. Initia’s Move-based L1 allows apps to freely roll up interwoven rollups using EVM/Wasm/Move. Last year, while designing tokenomics for a project, we created a so-called “three-body problem” based on on-chain transaction count, volume, and TVL, letting users vote with their feet for favored dApps. Initia takes a more direct approach—very LUNA-like—I care only about TVL; the higher a rollup’s TVL, the more esINIT it receives.

With initia-vip, it becomes double P2E: rewards from the game itself plus VIP rewards. Even if a game has no token or built-in rewards, as long as it’s fun and players meet certain KPIs while enjoying themselves, they can still earn INIT incentives from initia-vip. This gives Initia a competitive edge over standalone game apps or other dedicated gaming L1s/L2s.

For users, minitia will share its incentives with those providing TVL to maximize its own TVL and esINIT accrual. From a project standpoint, if your product can’t outperform basic bribery protocols in user acquisition, it means your product adds no extra value—it’s hollow. You should step back, reflect, and adjust early. From Initia’s perspective, this better tests market response and real-world performance of interwoven rollups, enabling targeted incubation and acceleration to grow the entire ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News