Initia Research Report: Exploring Interesting DeFi and Consumer-Grade Crypto Applications in the Initia Ecosystem

TechFlow Selected TechFlow Selected

Initia Research Report: Exploring Interesting DeFi and Consumer-Grade Crypto Applications in the Initia Ecosystem

The design of Initia VIP aims to effectively "organize your resources."

Author: woogieboogie

Translation: TechFlow

An extremely comprehensive report on Omnitia has finally arrived.

This is an update to the original "launch report," featuring new additions including PKS, VIP, public testnet results, and most importantly—Minitias.

Here’s a discussion of the new content.

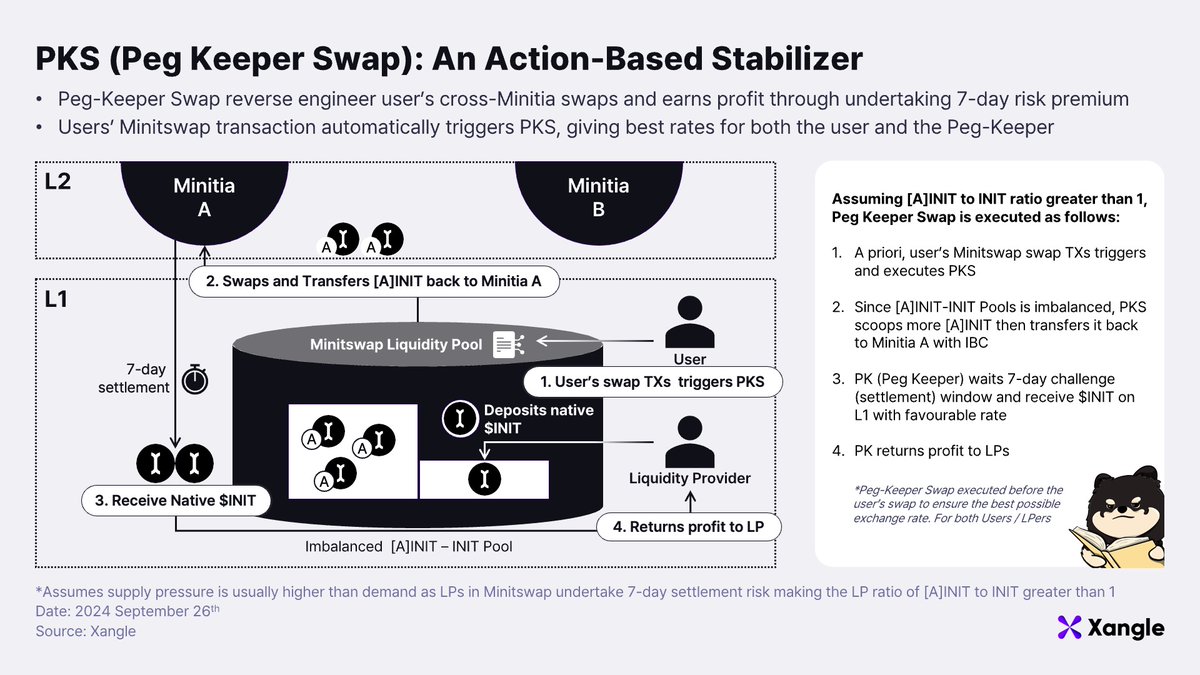

PKS (Peg-Keeper-Swap)

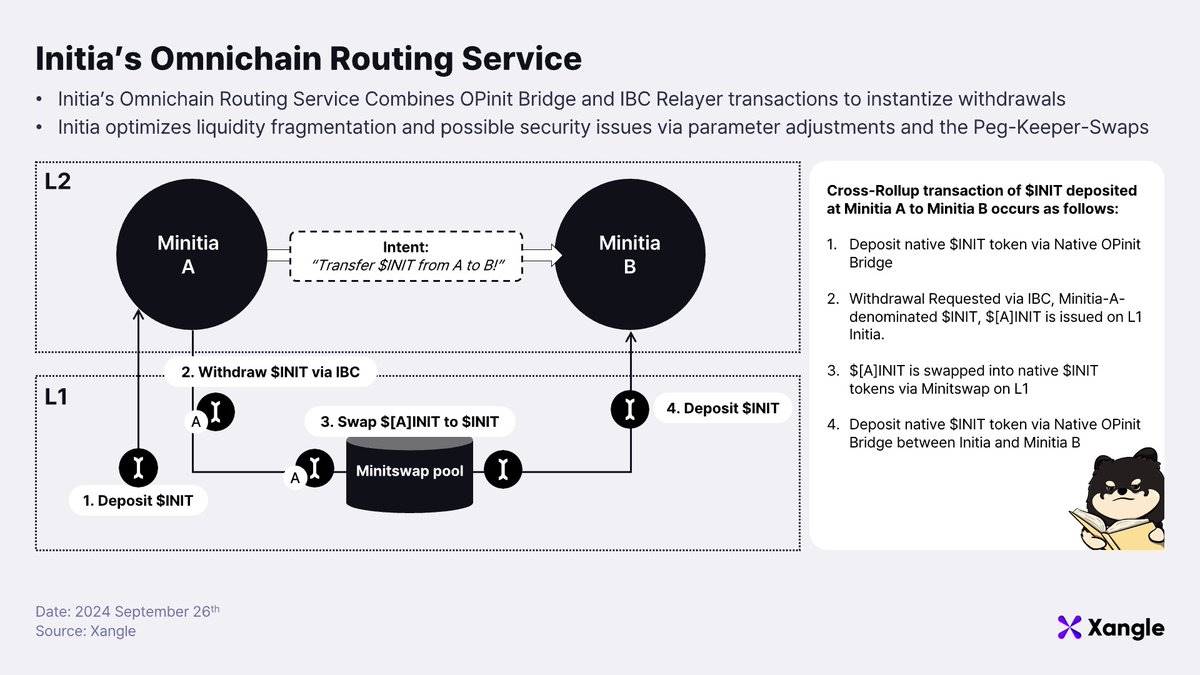

First up: PKS. Remember how Initia combined IBC and Minitswap to enable fast withdrawals for cross-rollup transactions?

This method was practical but could lead to higher exchange rates due to exit liquidity imbalances.

PKS makes exchange rates more stable.

By reverse-engineering the entire process, PKs (Peg Keepers) can swap at more favorable rates during periods when Minitswap becomes unbalanced. Thus, PKs take on risk and earn higher returns, with a 7-day challenge period applicable to Optimistic rollups as a scaling solution.

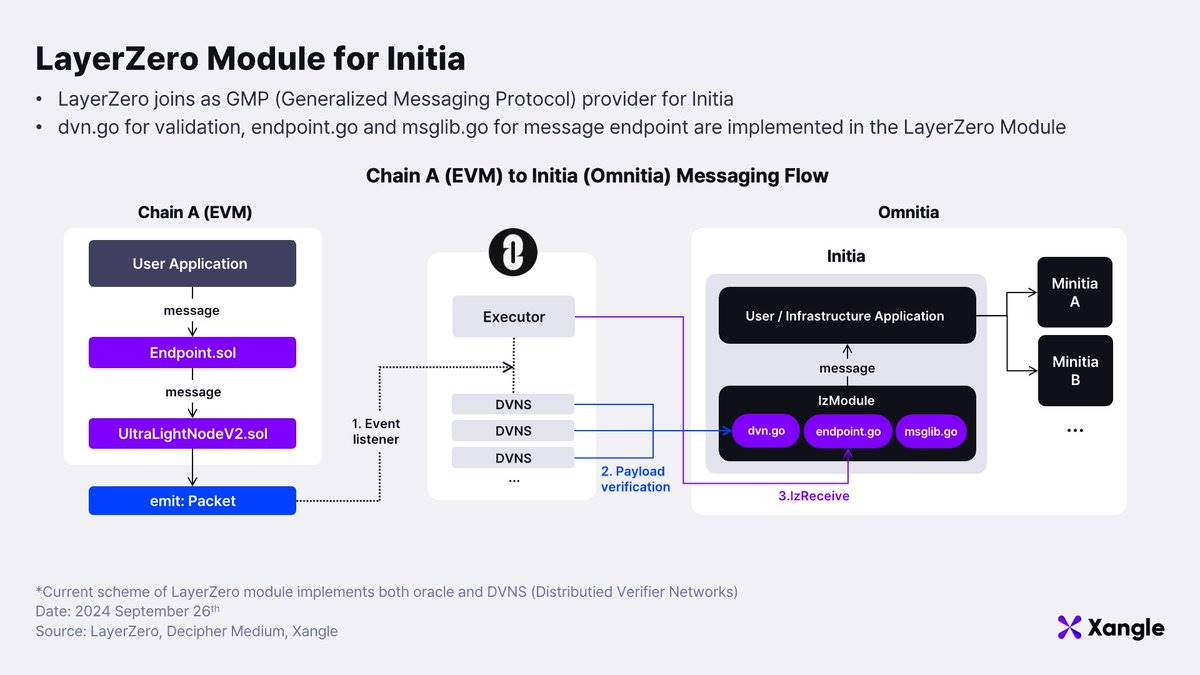

In collaboration with @LayerZero_Core

In July this year, LZ-Initia completed integration (details here). With the introduction of customizable security stacks, this integration is expected to bring LayerZero's Omnichain Messaging Protocol (OMP) and Omnichain Fungible Token (OFT) standard to Omnitia.

Now it’s time to meet some Minitia Gents.

I could summarize them in one sentence, but here we’ll dive deeper into their unique characteristics.

Because—Minitias are not decentralized applications (dApps), but sovereign chains akin to rollups!

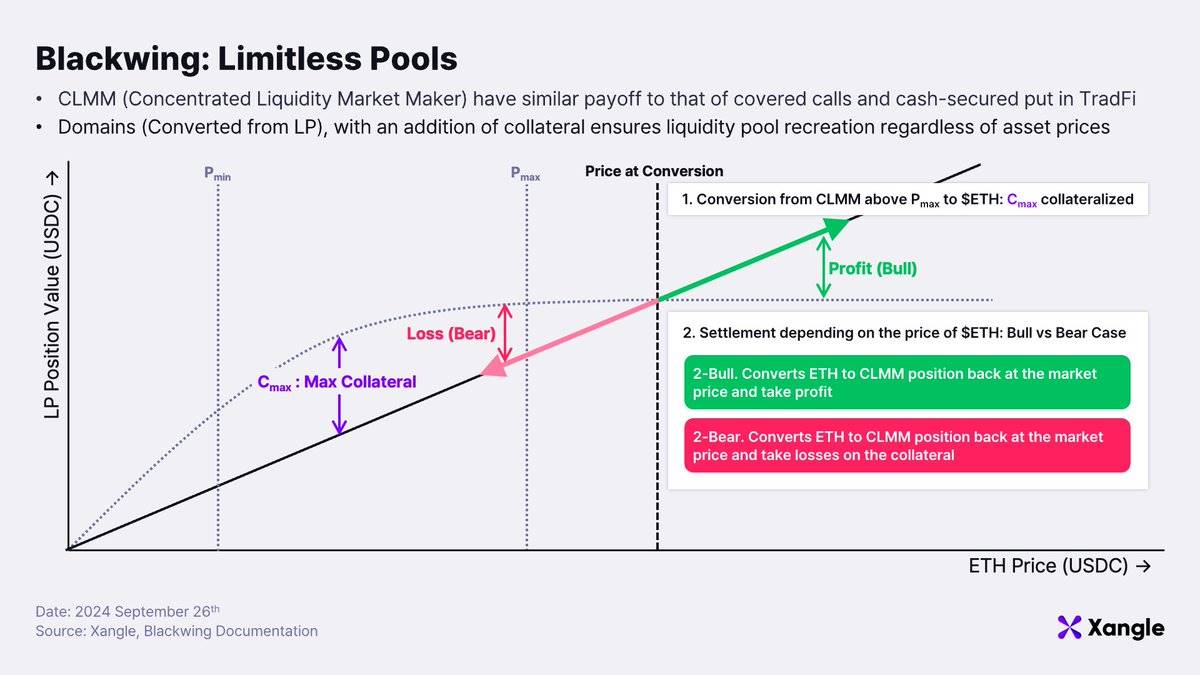

First up—is @blackwing_fi.

Blackwing introduces **liquidation-free** perpetual trading for highly volatile assets such as $PEPE.

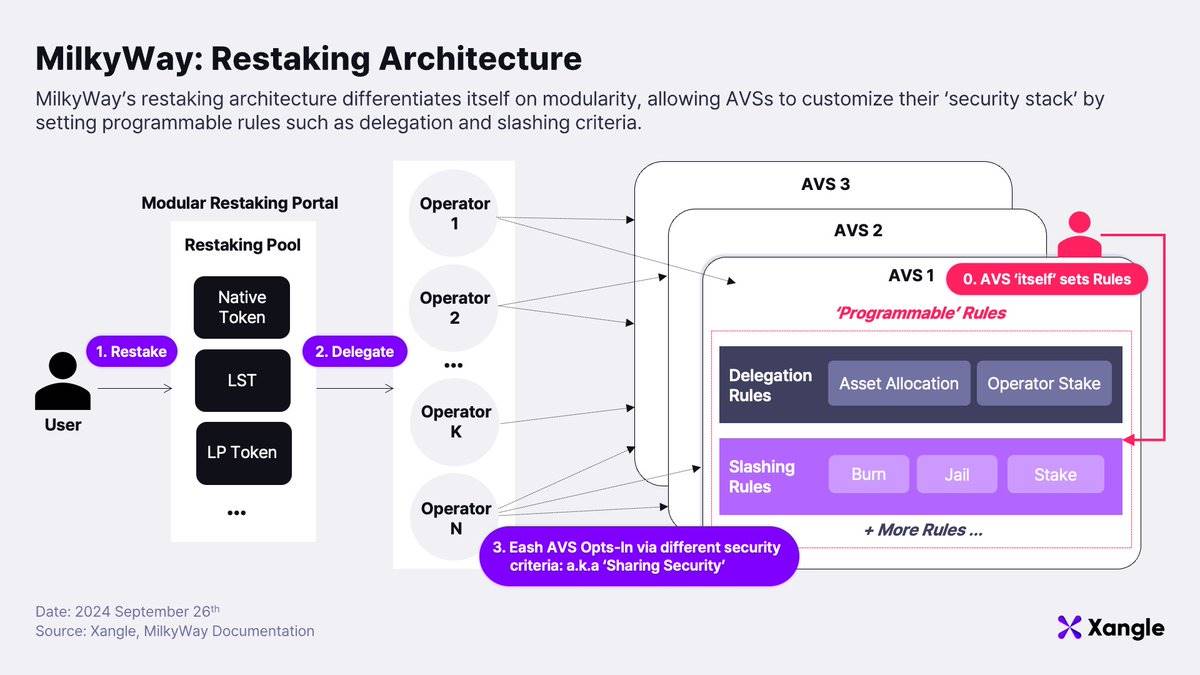

@milky_way_zone modular restaking platform.

It offers users customizable delegation and provides AVSs with programmable security stacks—an architecture more compelling than EigenLayer’s. Moreover, they appear to have deeply integrated many Minitias (like Tucana and Inertia) from the start.

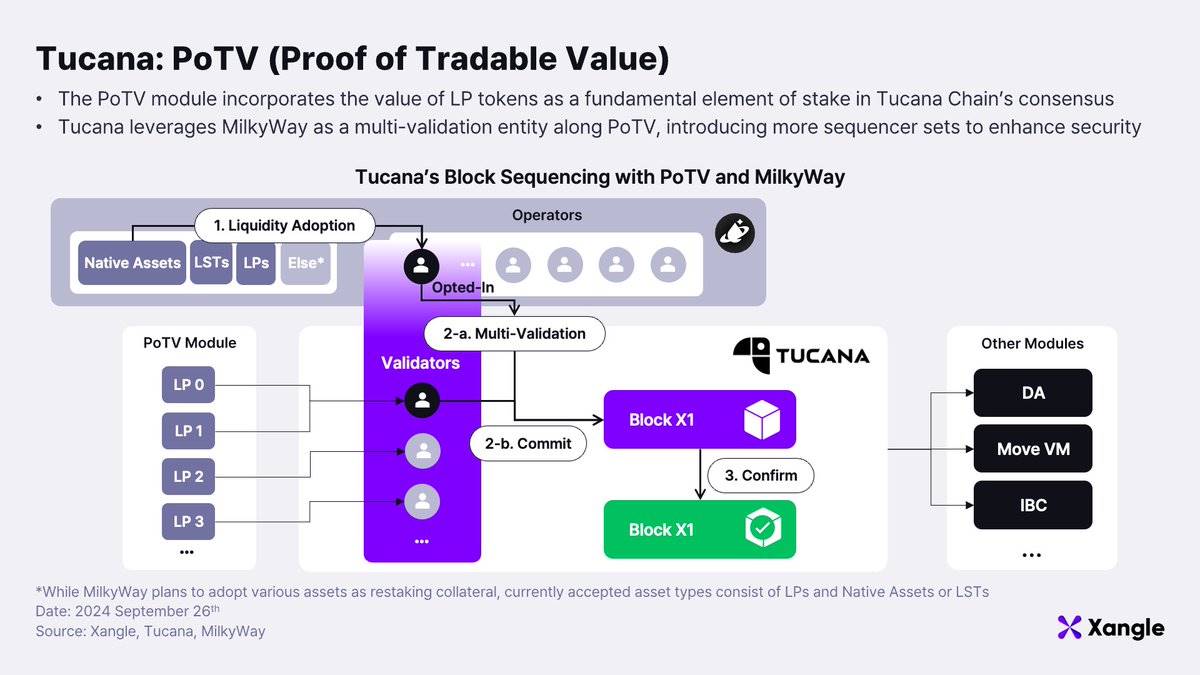

@TucanaNetwork Cosmos liquidity layer.

It uses Proof of Tradable Value (PoTV) to unlock liquidity from centralized exchanges (CEXs) and Proof-of-Stake (PoS) validators for consensus, working alongside MilkyWay mentioned earlier. Beyond consensus, it acts as a modular liquidity layer with intent-centric swapping and perpetual trading capabilities.

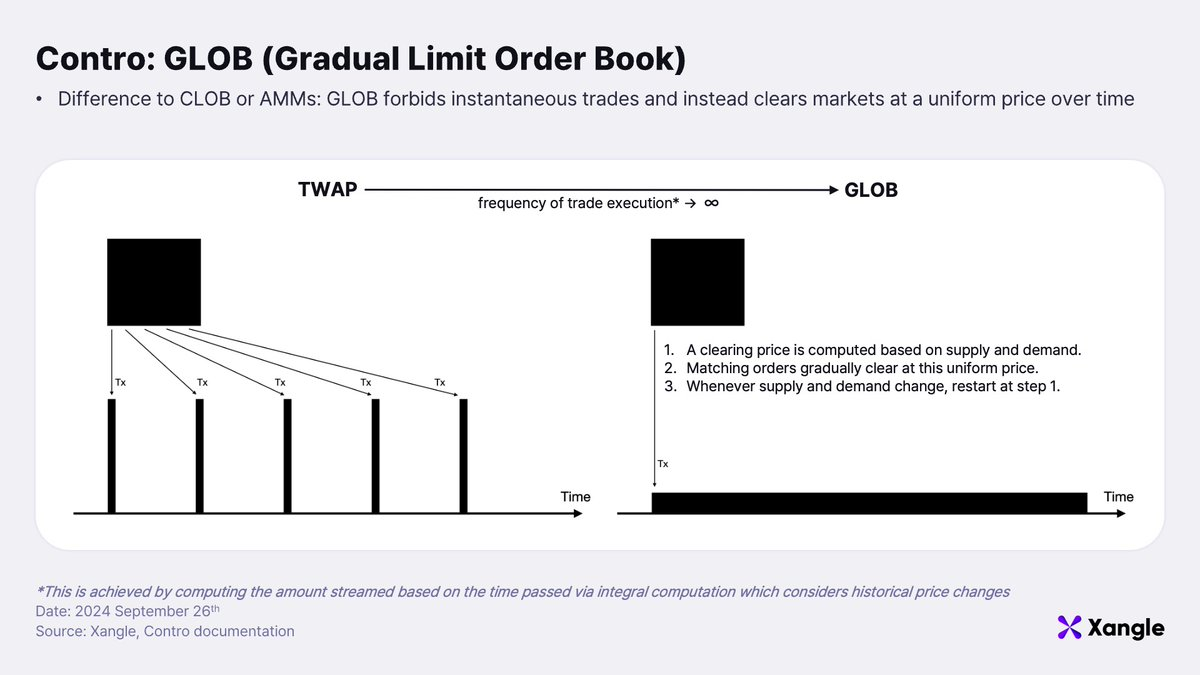

Next, let’s look at @controrg

At its core is GLOB (Gradual Limit Order Book), powering the prediction market AcroBet.

GLOB resembles TWAP but operates at infinite frequency. Orders are filled gradually at the same price over time, making it an ideal solution for prediction markets by mitigating the impact of high-frequency traders (HFTs).

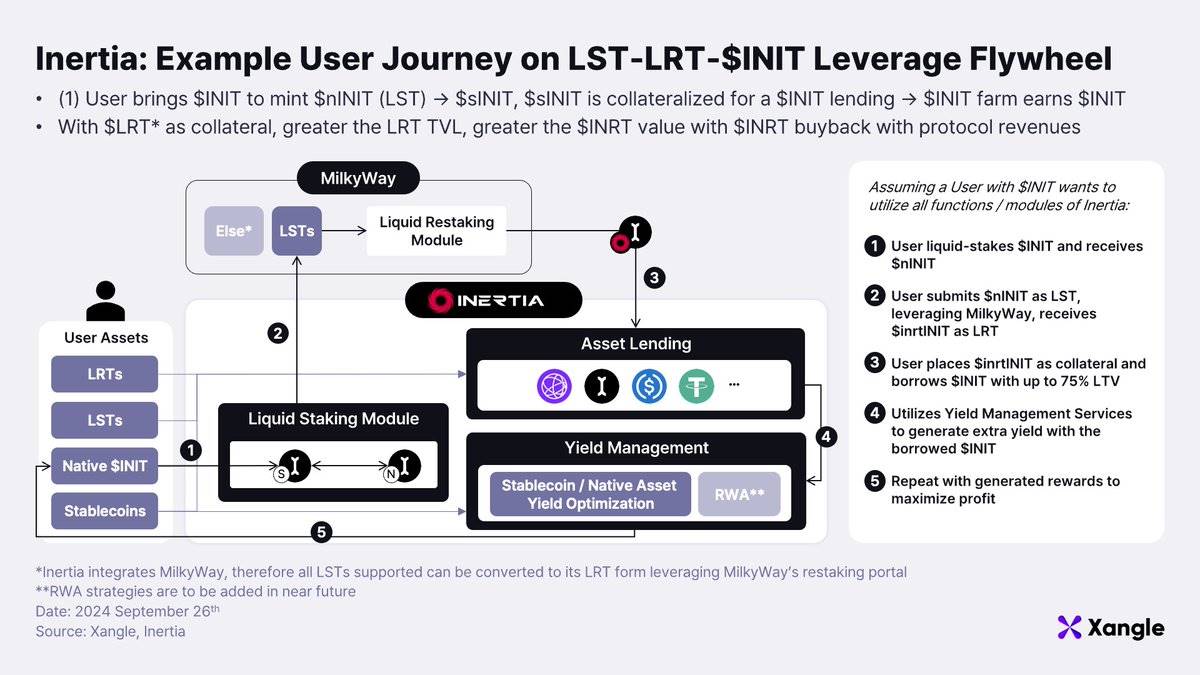

@Inertia_fi – Integrated LRT DeFi

Inertia focuses on LRT and lending, integrating with MilkyWay to facilitate restaking—enabling borrowing using staked assets! Imagine an exciting flywheel strategy!

Remember: $INIT - $sINIT - lend - repeat.

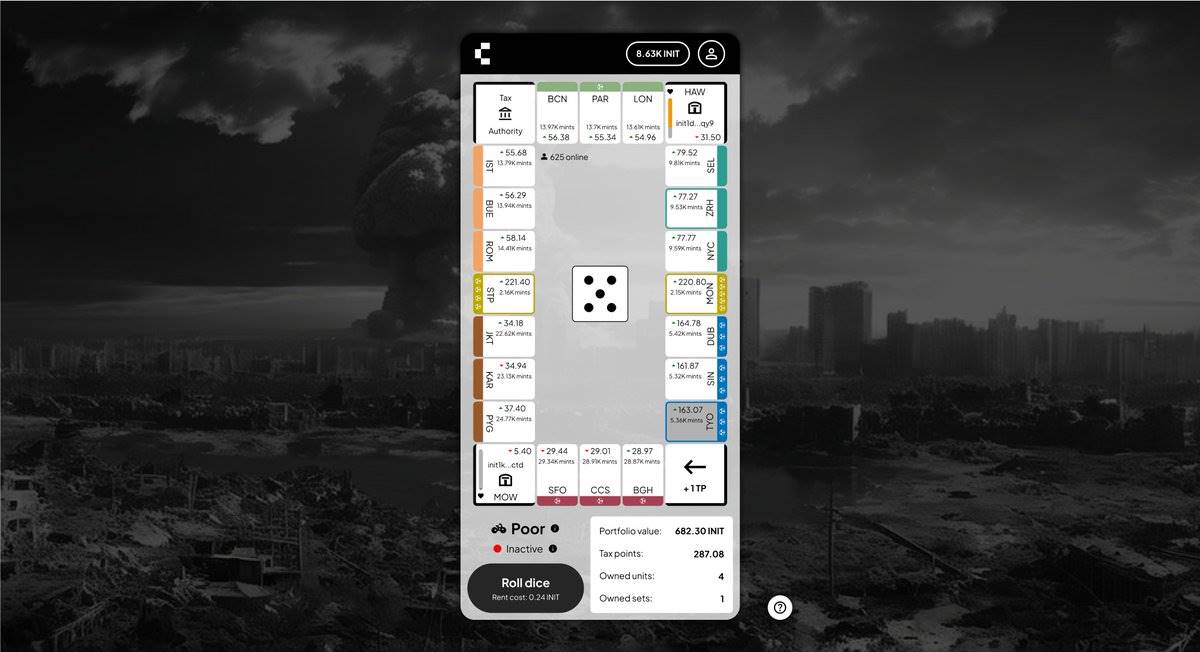

@civitiaorg – Crypto Monopoly

A GameFi where players acquire land, mint cities, earn yields, and engage in destruction. Users earn $GOLD and pay taxes via tax points. Many new features are expected! During the testnet phase, it was the most interactive app, so anticipate some cool functionalities.

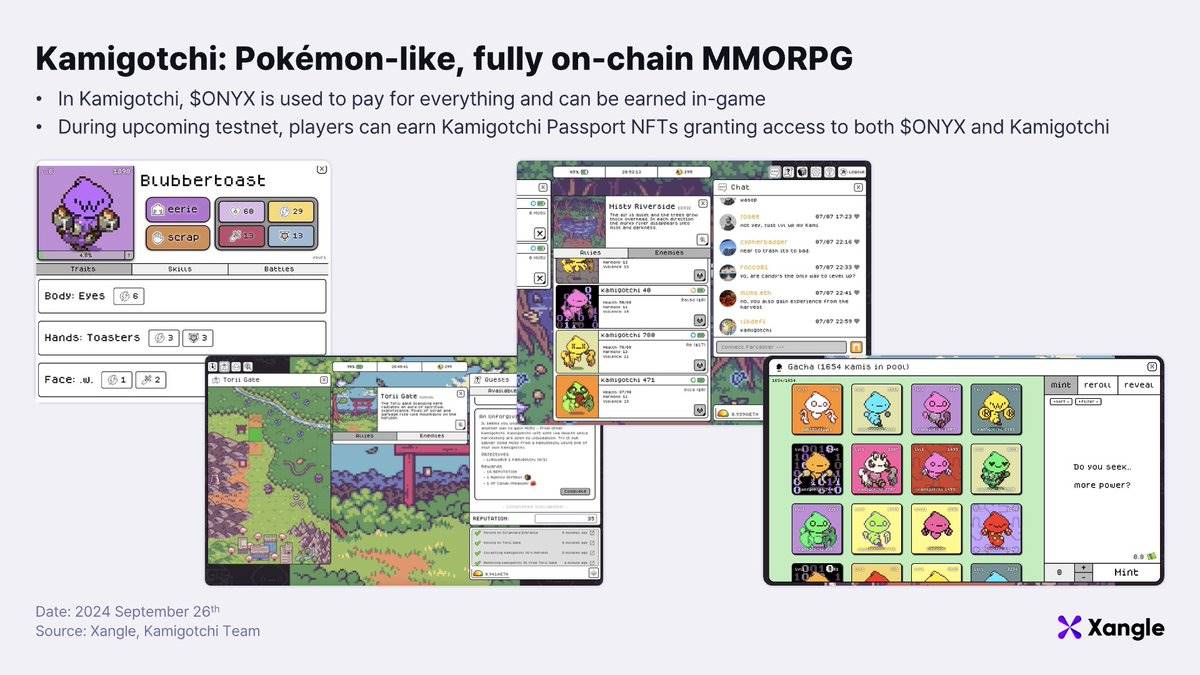

@kamigotchiworld – On-chain Pokémon

An on-chain game combining Pokémon and Tamagotchi elements, featuring PVP mechanics. What’s the catch?

Each Kamigotchi is an NFT with unique attributes and types, inhabiting a vast world to explore. Remember: Insect beats Ghost, Ghost beats Waste, Waste beats Insect.

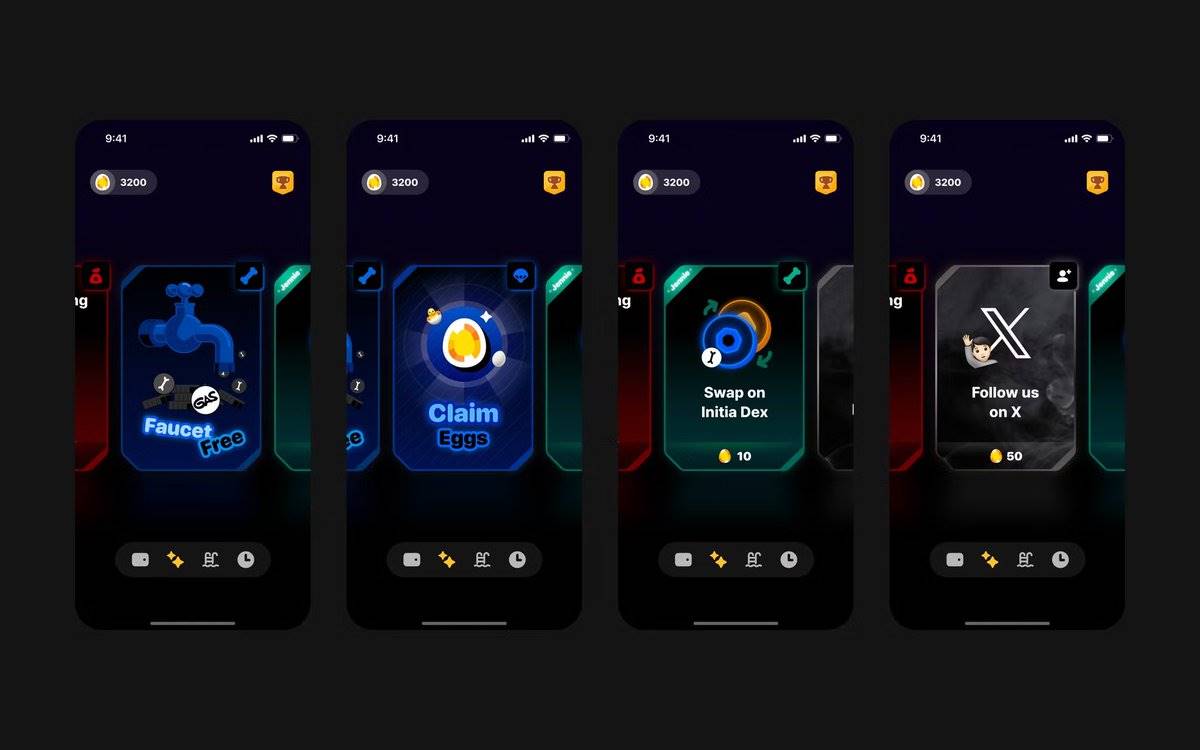

@lunch_xyz – Mobile-first crypto trading

Lunch is a mobile-first platform focused on tasks and liquidity management in crypto. Its mobile nature grants inherent resistance to Sybil attacks—a major advantage.

Users earn Eggs by completing tasks, which can be redeemed for rewards or $LUNCH tokens.

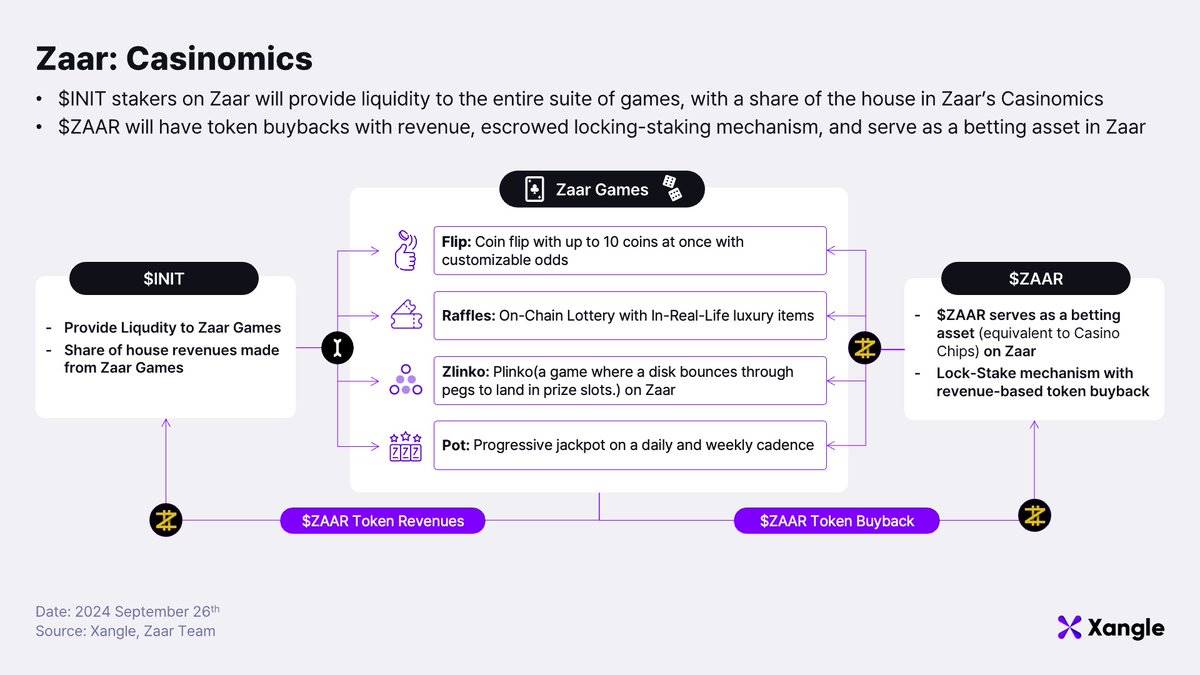

@zaar_gg – On-chain casino platform

Formerly Protectorate Protocol, now a mobile-friendly casino. If you want to play, choose among four games: Flip, Zlinko, Raffles, and Pot.

You can also become a house player—stake to earn Zaar XP, level up your VIP status, and receive $esINIT rewards.

So—aside from more Minitias yet to launch, Omnitia will gather a diverse set of stakeholders.

However, if we reflect on Ethereum's evolution toward becoming a hub for aggregated ecosystems, aligned incentives are crucial. Therefore, Omnitia’s success hinges on a well-designed incentive alignment plan.

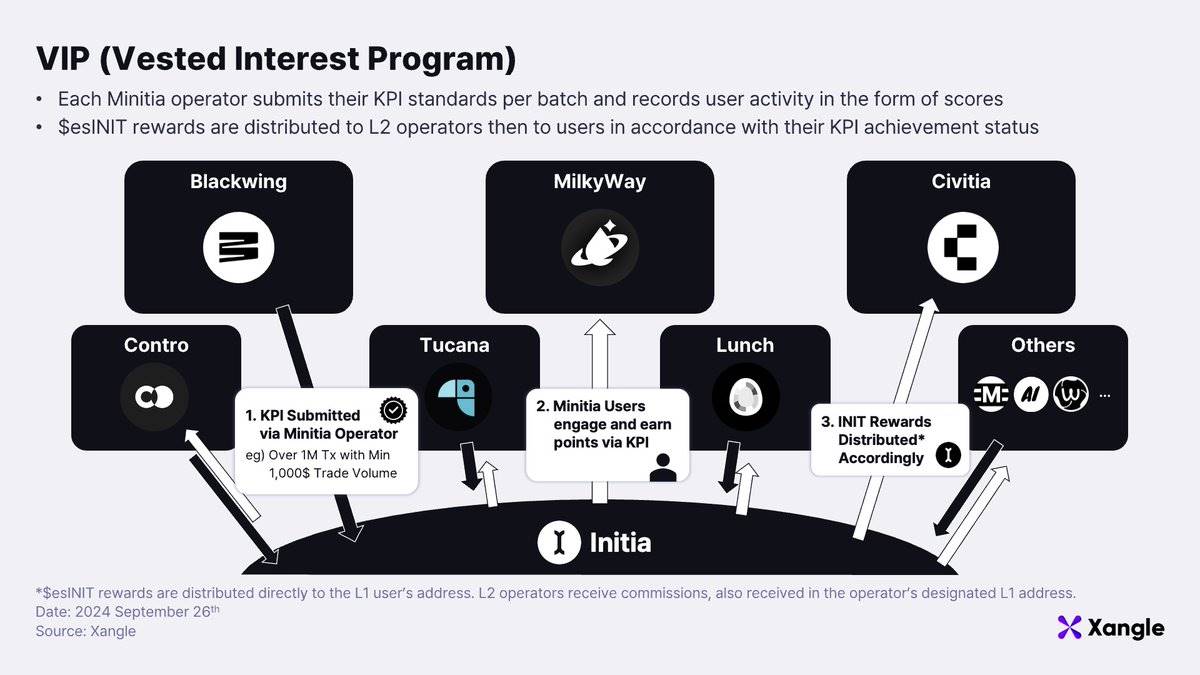

Initia VIP is designed to effectively “organize your resources.”

1. Distribution of $INIT tokens depends on user TVL and governance participation.

2. Rewards are distributed based on pre-defined Key Performance Indicators (KPIs) for each Minitia, creating long-term incentive alignment for all participants.

There’s also plenty of fun to look forward to.

Remember the Curve Wars of 2021—when protocols raced to accumulate more $CRV?

Omnitia operates at the scale of app-chains competing for $INIT, with a broader and richer variety of participants than seen in traditional DeFi.

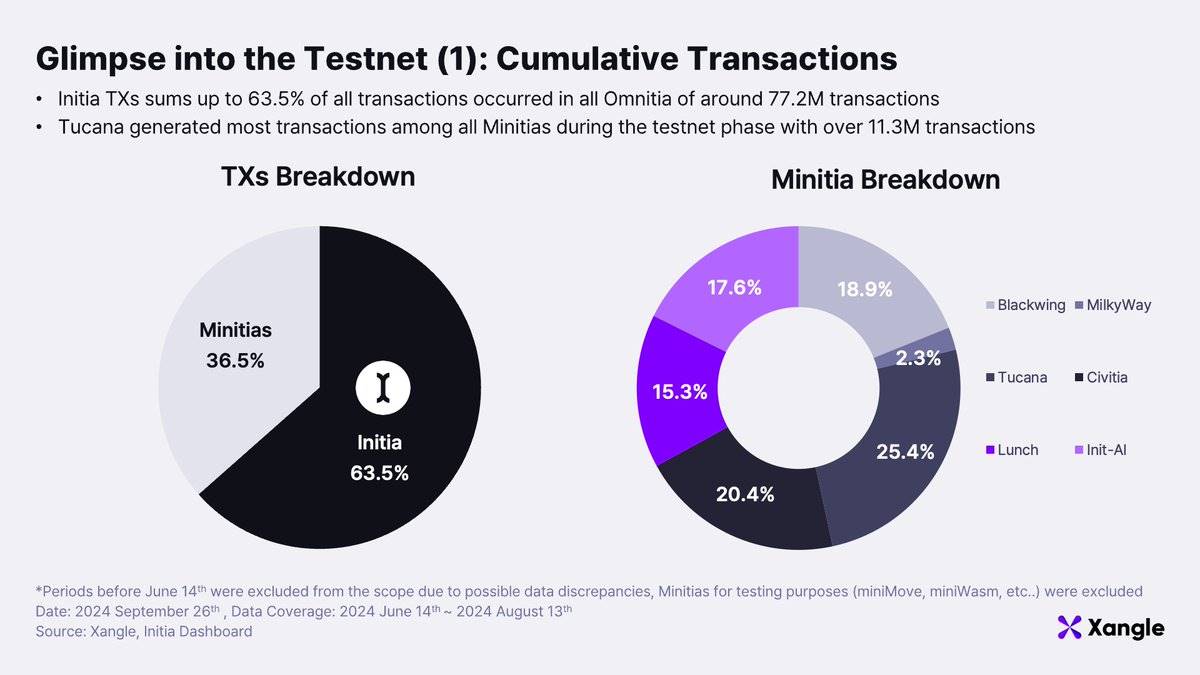

Now let’s review testnet performance.

Beyond raw statistics, here's a simple overview:

63.5% of transactions occurred on Initia, 36.5% on Minitias.

Tucana accounted for 25% of transactions within Minitias.

Initia’s daily transaction share gradually declined from 59.3% at the end of August to 32.1%.

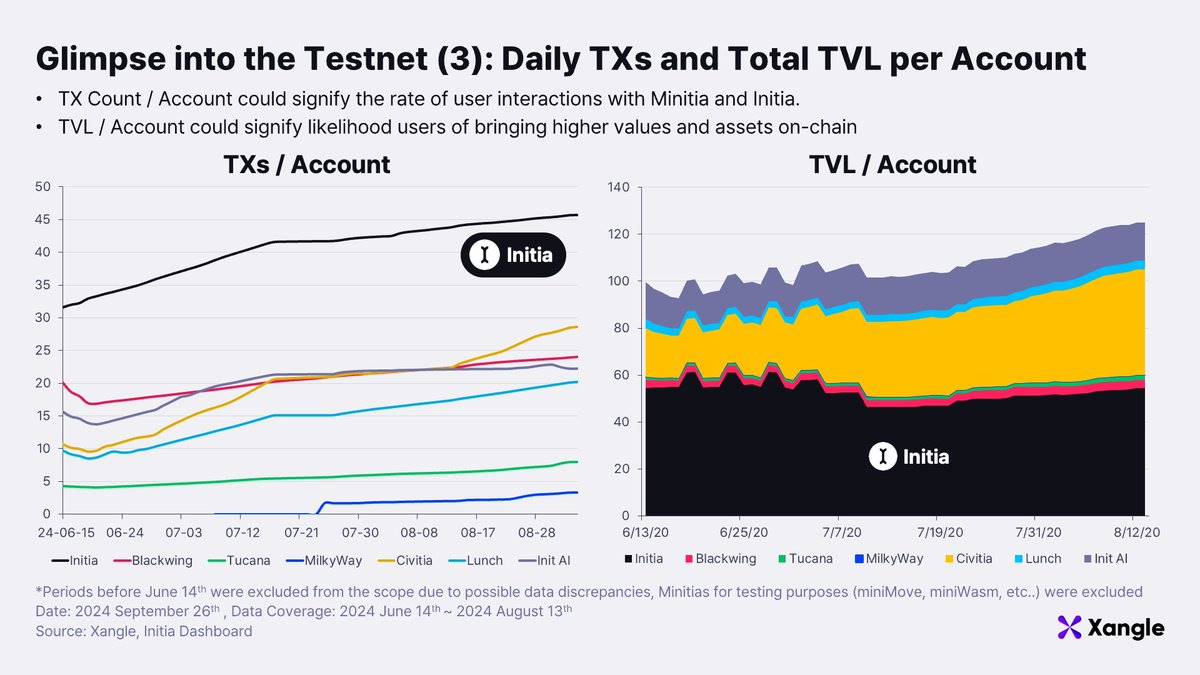

Next, a user-centric analysis.

Transactions per account: Initia leads, but Minitias like Blackwing and Lunch are growing, with Civitia showing the largest increase.

Total Value Locked (TVL) per account: Higher TVL may be critical for VIP rewards; Initia, Civitia, and Blackwing are key contenders.

That concludes our preliminary analysis of the report.

If you’d like to dive deeper into Initia and its broader Omnitia ecosystem, brew a cup of coffee and read through the full report carefully.

Special thanks again to @initiaFDN for research support, and to all the Minitias who provided feedback.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News