RWA Harvest Year: A Top Project's Achievements and Outlook

TechFlow Selected TechFlow Selected

RWA Harvest Year: A Top Project's Achievements and Outlook

Propy has launched a new on-chain real estate lending product that allows buyers to unlock scalability by obtaining instant on-chain loans using BTC as collateral.

Author: Weilin, PANews

2024 was a pivotal year for real-world asset (RWA) tokenization in the real estate sector, especially as integration with Web3 technologies deepened. As one of the leading projects in this space, Propy achieved significant milestones—starting with the March launch of PropyKeys on Base, successfully minting over 285,000 property addresses and advancing the digital transformation of real-world assets. PropyKeys integrated Chainlink Automation on BuiltOnBase to deliver secure staking rewards, with further developments expected ahead.

In addition, Propy partnered with Coinbase to launch an escrow service, offering a more secure and efficient solution for real estate transactions.

Looking ahead to 2025, Propy is accelerating its global strategic initiatives. The company has launched a new on-chain real estate lending product that allows buyers to obtain instant on-chain loans using BTC as collateral, unlocking scalability. This move removes barriers for consumers seeking real estate ownership and enables purchases using USDC, ETH, or BTC, while also offering an option for 100% instant crypto-backed loans. This product streamlines real estate transactions, staying true to Propy's founding mission.

Building on this success, Propy is now actively seeking lending partners to further expand its crypto-backed lending model. By collaborating with innovative lenders, Propy aims to create greater opportunities for buyers, making real estate ownership more accessible and achievable through blockchain technology.

2024 Achievements: Launch of PropyKeys, Strategic Partnerships, and Key Leadership Additions

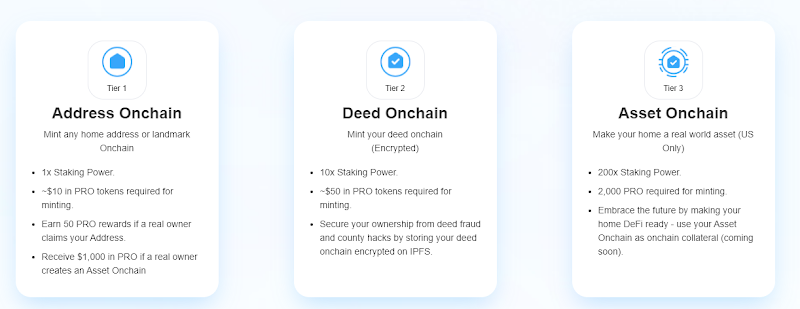

In 2024, Propy made breakthroughs across multiple fronts. In March, its innovative product PropyKeys officially launched on Base, enabling users to mint digital addresses and deeds for real-world properties—surpassing 285,000 mints to date. Subsequently, PropyKeys introduced AI-generated landmark NFTs and a novel staking mechanism, creating a gamified experience that makes property ownership more accessible, secure, and interactive.

Propy then successfully deployed Chainlink Automation technology to distribute staking rewards. After integrating Automation into PropyKeys, developers can now automate critical on-chain functions at scheduled intervals or in response to external events. Leveraging Chainlink Automation, Propy achieves highly reliable, high-performance, and decentralized automation, ensuring fast transaction identification and confirmation even during periods of severe network congestion.

Additionally, Propy announced a strategic partnership with Parcl, a decentralized real estate derivatives protocol, to enhance on-chain property analytics and valuation quality. Propy leverages Parcl’s API to improve valuation and analytical capabilities associated with PropyKeys.

On the user experience front, Propy collaborated with Coinbase to launch a third-party cryptocurrency escrow service. Homebuyers holding Bitcoin can securely place funds into escrow via Propy’s licensed title escrow service for real estate transactions, converting only upon closing. This avoids unnecessary fees and tax implications.

Propy has also strengthened its team, welcoming two prominent figures to its board: Dr. Michael Piwowar, former SEC commissioner and financial regulation expert, and Michael Casey, Chief Content Officer at Coindesk, blockchain pioneer, and media veteran.

Over the past year, Propy has received broad industry recognition. It was cited in the Messari blockchain report and participated in numerous high-profile events, sparking a discussion on blockchain-based property rights by Vitalik Buterin at EthCC. Through technological innovation and leadership, Propy’s CEO Natalia Karayaneva was awarded the 2024 Inman Top Real Estate Tech “Entrepreneur” Award.

Propy also hosted Propy Summit 2024—an event that was more than just a summit, but a glimpse into co-building the future. The gathering brought together leading innovators and visionaries from both blockchain and real estate industries, including Senator Cynthia Lummis, Mayor Francis Suarez, Tim Draper, Anthony Scaramucci, and other industry leaders.

2025 Vision: Launching RWA On-Chain Assets, DeFi Lending, and Global Market Expansion

In this new year, Propy will expand its blockchain-based real estate solutions, launching its DeFi lending program in Q1.

Propy will accelerate its presence in the U.S. market, aiming to become a nationwide blockchain-powered title and escrow company by year-end. By securing additional licenses and advancing its blockchain-based settlement services, Propy is poised to become the first fully blockchain-licensed title and escrow provider in the United States. According to IBISWorld, the U.S. title insurance market was valued at $22.6 billion in 2023. Meanwhile, data from software firm Debut Infotech predicts that blockchain adoption in real estate will grow at a compound annual growth rate (CAGR) of 64.8% through 2028. Propy is well-positioned to lead the industry into this new era, delivering greater efficiency, transparency, and innovation.

From the perspective of the Propy token, PRO will be an asset benefiting from dual tailwinds in both the U.S. real estate and crypto markets. With upcoming U.S. government policy proposals—including the potential elimination of capital gains taxes on domestic crypto transactions—the U.S. could emerge as the next major crypto hub. Currently, crypto investors face long-term capital gains taxes of 20% or up to 37% for short-term gains, depending on holding period and income level. According to Investing in the Web, 13.22% of Americans (approximately 44.96 million people) currently own cryptocurrency, and real estate is increasingly seen as a way to diversify crypto investment portfolios. Eliminating capital gains taxes would significantly increase the volume of crypto-enabled real estate transactions.

As the first blockchain-based real estate token in the U.S., the PRO token will drive crypto adoption in RWA transactions and incentivize investors to use cryptocurrency for investments, supporting a broader tokenized real estate ecosystem.

At the same time, Propy will begin its global expansion, entering non-U.S. markets, with announcements expected in Q1 2025. This expansion comes at an ideal time, particularly in regions like Asia and Latin America where property fraud is rampant. For example, in India, 66% of civil cases stem from real estate disputes, while in Indonesia, around 40% of property documents are affected by fraud. Similarly, Argentina faces longstanding issues with property corruption and irregular documentation; historically unreliable registries and bureaucratic opacity have undermined property rights and hindered economic progress.

Through blockchain technology, Propy addresses the need for trust, efficiency, and integrity in property governance. For governments struggling with outdated systems and public distrust, Propy’s technology offers a path toward modernization and accountability—simplifying processes while protecting citizens’ rights. As countries seek to attract foreign investment, improve transparency, and align with global best practices, they are increasingly open to partnering with innovators like Propy.

On January 29, Propy launched a new loan option enabling buyers to purchase a Hawaii apartment using crypto collateral. Priced from 250,000 USDC, this on-chain RWA asset allows buyers to bypass traditional 30-day transaction timelines, completing nearly instantaneous purchases via crypto payments. Buyers reluctant to sell their mainstream crypto holdings can instead use Bitcoin or Ethereum as collateral to finance the purchase, paying a 10% interest rate.

This is a two-year loan. If the value of the provided cryptocurrency drops by more than 50%, buyers must post additional margin; in worst-case scenarios, the crypto assets may be liquidated and the property auctioned. However, if cryptocurrency prices double, buyers can easily repay the loan using their gains. Interest and principal payments can be made in Bitcoin, Ethereum, or USDC. This presents an attractive option for buyers wishing to retain their crypto assets.

On February 2, Propy announced the successful sale of Hawaii’s first on-chain real estate asset—completed through multiple on-chain offers and finalized via the first Bitcoin-backed loan.

Beyond this, Propy has expanded its service scope, building partnerships with real estate developers to offer comprehensive, tailored title and escrow solutions for their residential projects.

In community development, Propy will launch the “Web3 Property Rights – Trailblazer Spotlight” series, showcasing industry innovation leaders each week. This weekly program will highlight pioneers who believe that putting property rights on-chain can change the world. From blockchain innovators and investors to tech thinkers, the series will spotlight individuals driving transformative change.

Looking back at 2024, Propy not only achieved numerous breakthroughs in real estate tokenization but also helped redefine asset ownership and value within the industry. In 2025, with the launch of on-chain RWA assets and the rollout of its DeFi lending program, Propy is poised to continue driving innovation and transformation across global real estate markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News