DeFAI keeps falling—does it still have a chance?

TechFlow Selected TechFlow Selected

DeFAI keeps falling—does it still have a chance?

You may have misunderstood the opportunity of DeFAI all along.

Author: Squid

Translation: Luffy, Foresight News

After the market experienced a sharp downturn, let's take a look at where the real opportunities lie.

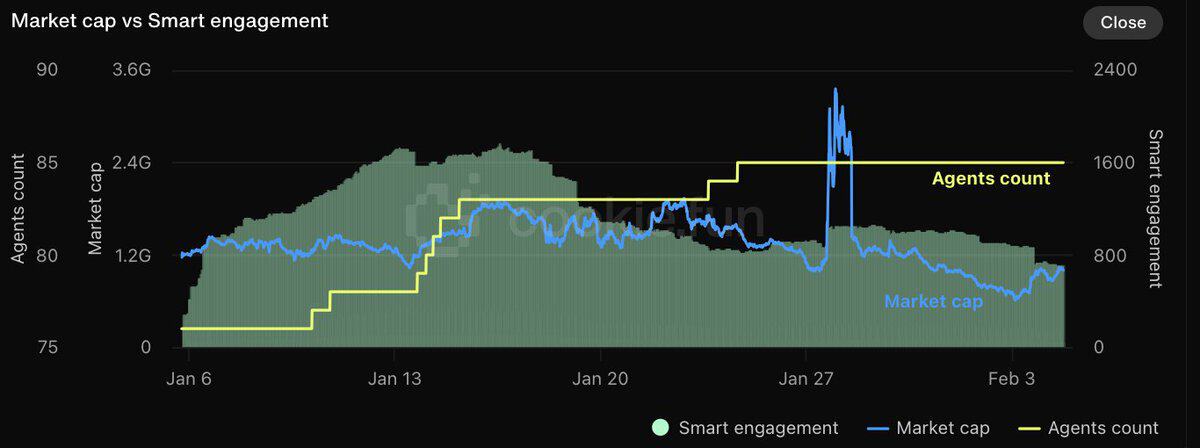

Over the past two weeks, the market cap of DeFAI has dropped over 50% from mid-January and as much as 70% from its peak in late January. Data sourced from @cookiedotfun.

Decentralized finance (DeFi) is now a $125 billion market. Assuming DeFAI captures 10% of that, it implies a 15x growth opportunity. In reality, I believe the opportunity within the DeFAI market is even greater because current valuations across sub-sectors are不合理.

Recently, we witnessed an epic crypto liquidation event. During this period, assets were sold off indiscriminately. Artificial intelligence (AI) and DeFAI were among the hardest-hit areas.

Now is the time to hunt for treasures—let’s dive deeper.

Why is DeFAI so compelling? First, zooming out: the convergence of crypto and AI represents a $10 billion market desperately seeking "utility," and DeFAI appears to be the most promising space to find it.

For most of these crypto agents, the product *is* the token. As such, we’ve seen the highest product-market fit (PMF) in frameworks and launchpads that allow teams to easily spin up tokenized social agents. With token supply growing exponentially, the market is becoming saturated, demand for social agent tokens and launchpads will decline, and communities must work hard to envision new directions.

Skate to Where the Puck Is Going

At a macro level, DeFAI makes sense—it sits at the intersection of crypto’s strongest use case, DeFi, and one of AI’s most unmet needs: finance.

That said, just because the space makes sense macroscopically doesn’t mean every project will succeed. Let’s dig deeper to see where the opportunities might lie.

Looking at the recent DeFAI landscape, most launched projects have limited utility on the DeFi side. I attribute this to the novelty of the space and the time required to build. People want tokens, and most current projects are targeting the lowest-hanging fruit with minimal utility.

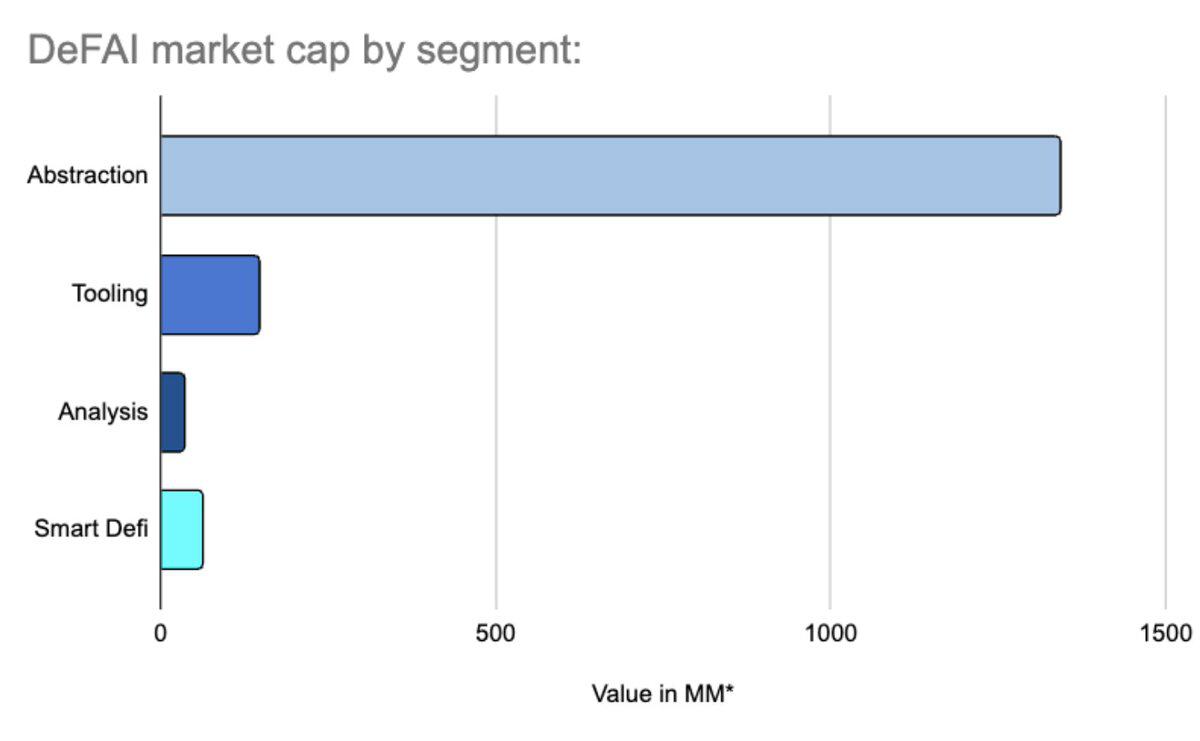

Valuation landscape—project snapshot from @cookiedotfun earlier this month; valuations are much lower now

The majority of DeFAI market value is concentrated in the “abstraction” category. Abstraction mostly refers to text-based alternative user experiences (UX). This category is low-hanging fruit because it leverages existing DeFi projects and large language model (LLM) APIs, with limited logic primarily intent-based. Given the current number of projects and their valuations, winners may already have emerged, and I believe opportunities here are limited compared to other categories.

I also encourage investors to try these products firsthand. For me, most abstraction projects do not deliver a good user experience.

Interestingly, this market structure creates some opportunities for traders…

Recent sharp drops in DeFAI valuations seem to validate skeptics… Product development takes time, and given the stage of these projects, I think the valuation correction is largely justified. That said, as prices fall, attention fades—I believe opportunities may emerge for those watching closely.

So where exactly are the opportunities?

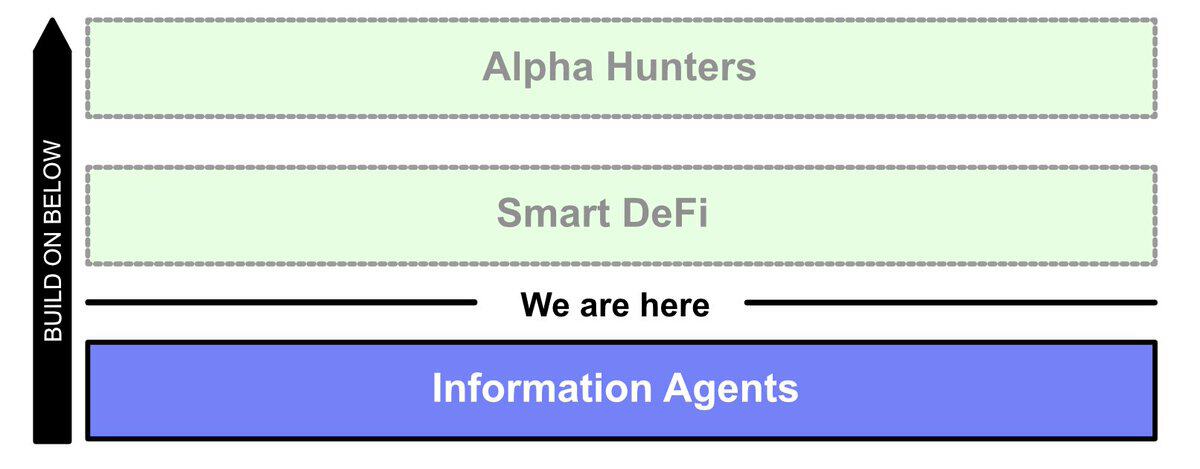

First, I believe most opportunities lie in yet-to-be-launched tokens. That said, these sub-sectors already exist, and some projects are live. To capture opportunities, you must stay alert and prepared. To help identify focus areas, let’s revisit a framework for thinking about the DeFAI landscape.

Information Agents

This is the era of AI agents mining information and fulfilling simple intents.

Large language models excel at processing and communicating via text. Since most AI agents today rely on APIs from existing models, their strongest application lies in natural language processing (NLP). I won’t go deep here—many other resources cover this—but there are two high-level categories:

Alternative UIs / Abstraction: Chat-based interfaces that aggregate and abstract DeFi protocols or even blockchains. They provide macro insights, discover projects, and execute simple actions, e.g., “I want to buy SOL → Buy SOL via Jup.” Ultimately, these tools will use existing DeFi primitives, aggregators, and cross-chain bridges to execute. I suspect the “winners” may already be emerging, and we’ll likely see market consolidation into a few dominant platforms. Growth will come from improving AI, integration, and expanding user bases—still an unproven market. Personally, I’m not convinced text-based interfaces truly improve DeFi UX.

Analytical Tools: Assistive tools helping traders process information. This is a diverse category including code review, token analysis, and sentiment analysis. These tools will grow increasingly sophisticated and play a critical role in the evolving crypto/AI ecosystem. AI-driven analytics compete directly with traditional tools. Overall, crypto analytics still has vast room for growth. I believe specialized analytical tools will capture more value than general-purpose ones.

Projects to watch:

-

Abstraction: griffain, neur, The Hive, Venice, etc…

-

Analytics: Cookie DAO, Kaito AI, Hiero Terminal, etc…

Smart DeFi

Moving from information to action—agents that gather information and act upon it.

Currently a $200 million market, I believe it will eventually dominate DeFAI. Assuming a $12 billion market size and Smart DeFi capturing 50%, that’s still a 30x opportunity. Again, I believe the winners haven’t emerged yet…

Where does utility (value) lie? Initially, it comes from continuous monitoring and automation, enabling users to exploit minor market inefficiencies they’d otherwise miss or deem too small to bother with. This market already exists. As the field evolves, LLMs will enable DeFAI protocols not only to automate but also adapt and expand market reach to further boost returns. Over time, return enhancement will scale with advances in intelligence, reasoning, and infrastructure.

Teams succeeding here will need to build or use custom models, DeFi infrastructure, and data pipelines. This deeper integration requirement is why the space is underdeveloped compared to abstraction. Building this takes time.

Smart DeFi isn’t a new market, but AI can enhance and extend it. Existing examples include yield optimizers like Lulo and Carrott, and aggregators like Ranger and Jupiter.

Current products thrive in deterministic environments—for example, “The cheapest rate between X protocols is Y, so use Z.” Eventually, LLM-powered operations may enhance these protocols via alternative UX or enriched information, but existing projects are unlikely to be disrupted.

How can Smart DeFi expand into new markets?

LLMs are probabilistic. In fixed markets, this leads to poor performance—for instance, when comparing trade prices, the cheapest option is always best.

Yet, this probabilistic nature and ability to process diverse information offer advantages, allowing DeFi to enter new, more dynamic markets.

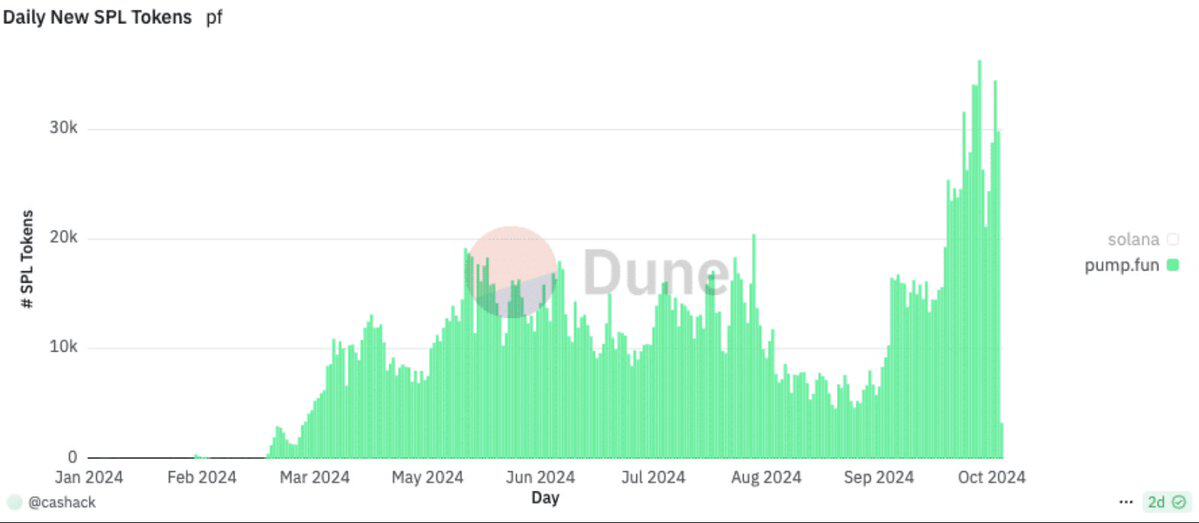

Over 50,000 new tokens are created daily. I know this data is a bit old, but the trend continues…

In the long tail of the market, trading volume and value constantly shift across new assets. Due to volatility, existing DeFi primitives struggle to serve this segment. As we continue “tokenizing the world,” this market keeps growing.

Moreover, tokens aren’t equity—they can be structured in countless ways to represent value. The extreme diversity of assets in the market is another advantage for intelligent systems.

Smart DeFi can help expand DeFi into this space by:

-

Mining and evaluating new assets

-

Dynamically monitoring, understanding, and acting on new market narratives

-

Synthesizing on-chain, off-chain, and social data to reason and execute multiple actions

Macro synergy exists—but where are the opportunities?

Let’s examine a promising sub-sector: Smart Liquidity Provision (Smart LPing).

Liquidity provision is difficult because each pool has unique risk profiles and returns vary widely across assets. Currently, some tools help users allocate capital based on investment theses, but composability and automation remain limited.

The vision for liquidity provision agents is to dynamically optimize returns by adjusting risk parameters and selecting assets/pools based on combined on-chain and social data. This could ultimately create a new asset class that dynamically harvests yield from long-tail markets, increasing overall market efficiency.

Raydium fees, as an indicator of on-chain trading volume

Why native AI teams?

Yes, realizing this vision takes time. That said, I believe native AI teams are more competitive in areas with lower market efficiency and smaller absolute returns, where more of the return can be attributed to intelligence. Native AI teams are smaller, move faster, and focus more deeply on the “intelligence” component.

Some teams worth mentioning: Cleopetra, Alris agent, and Voltr.

Other areas I won’t explore deeply include smart dollar-cost averaging, execution agents, and social-signal-based products. As intelligence improves, the share of returns attributable to humans will gradually erode in favor of AI tools.

Project Plutus has shown interesting early results in smart limit orders—I’m excited to test it personally.

Next, Alpha Hunters

Can an agent generate alpha?

Here are common responses from industry professionals. While I agree we’re far from this goal, I believe dismissing alpha agents entirely is shortsighted. Believe in something…

Generating alpha is hard.

In traditional markets, hedge funds spend billions annually collaborating with the brightest minds to gain edges. But systemic friction means crypto markets are far less efficient than traditional ones—making alpha generation by agents more feasible. New asset classes and narratives emerge weekly, meaning strategies from traditional finance don’t directly apply.

Why give up on alpha?

I firmly believe “alpha hunters” won’t emerge from zero to one overnight, but will evolve incrementally. In the foreseeable future, alpha will remain human-driven and AI-augmented. Over time, returns will increasingly be attributed to agents. Once a tipping point is reached, we may see true “alpha hunter agents” that employ or collaborate with humans.

Tokens will help bootstrap, coordinate, and integrate emerging ecosystems.

Two current protocols using interesting approaches:

-

Almanak: Integrates boutique data pipelines, advanced risk engines, and AI-powered agents to generate and execute diverse financial strategies under human oversight. It’s an agent/strategy platform that continuously identifies alpha and serves users in a secure, non-custodial environment.

-

Allora: Its inference system intelligently aggregates and weights AI predictions based on real-time accuracy. Human participants act as workers, providing predictions and evaluating reasoning quality to refine market forecasts—with the goal of applying them to markets.

Crypto-native teams focused on model development will also play a crucial role. Ultimately, intelligence is key.

Other protocols I like: Pond (focused on building crypto-native models using on-chain data) and Nous Research (doing significant work toward developing the first decentralized training of optimal models, and exploring “demand” for agents).

The space is still early—watch teams with potential to scale.

As the marginal cost of intelligence continues to fall and the number of newly created markets rises daily, agents are poised to enter an emerging niche—one too fleeting for humans and too dynamic for robots. Believe in something.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News