Debunking Market Consensus: Rationally Assessing Whether Berachain Can Be the Endgame for DeFi?

TechFlow Selected TechFlow Selected

Debunking Market Consensus: Rationally Assessing Whether Berachain Can Be the Endgame for DeFi?

Can Berachain Achieve "Perpetual Motion"?

Author: Andy; Eureka Partners

TL;DR

-

What is the endgame of DeFi, and why do some projects hit dead ends?

The endgame of DeFi is essentially the beginning of the next DeFi. Most projects ending in dead ends simply follow the natural life cycle of a scheme, reaching their respective collapse triggers, with other projects naturally inheriting their liquidity. From a high-dimensional view, the entire Web3 industry remains "everlasting," indicating that the relationships between schemes within the Web3 ecosystem align with a healthy ecology. Applying this logic to various ecosystems, projects, and protocols, we observe that their lifespans become shorter as dimensionality decreases—a reasonable phenomenon. Therefore, a scheme’s "turnover rate" reflects the health of a project, while a project’s "turnover rate" reflects the health of an ecosystem. Next time, avoid hastily claiming “no one will take over,” and instead carefully examine each project's failure, abstractly decoupling business logic and no longer being intimidated by seemingly grand concepts.

-

Can Berachain achieve perpetual motion?

Berachain's main collapse point lies in: BGT staking yield < BGT-to-Bera conversion yield. This implicitly assumes the on-chain ecosystem can no longer support additional bubbles, meaning that unless systemic risks emerge, Berachain’s native assets (BGT, Bera, Honey) are cushioned by the ecosystem. However, reality is more complex—participants don’t all have full global information or make perfectly rational decisions, and not all participants are investors; some project teams may purchase BGT to vote and gain BGT emission rewards for potential liquidity. Thus, the collapse point should be revised to: In a rational market, project team bribe rewards < liquidity acquisition cost (bribing, direct BGT purchase) / BGT staking yield < BGT-to-Bera conversion yield.

-

DeFi Liquidity Game: Has Berachain fundamentally changed anything?

Has Berachain fundamentally broken through technical bottlenecks in the liquidity market? The answer is clearly no—only partial improvements. But Berachain chose the right application scenario—public chains. Focusing solely on mechanisms might lead us to underestimate its potential as merely protocol-level, but in reality, BGT’s vote-bribery rewards can revitalize other ecosystem projects, even serving as a narrative on par with Restaking.

-

What is happening with Berachain, and what is the best way for users to participate?

The author observed 103 projects and summarized the following characteristics of Berachain:

-

High native strength, diverse GTM strategies: Most projects deployed on Bera are not multi-chain compatible but natively built on Berachain, with a native-to-non-native project ratio of approximately 10:1 (note:不排除 certain products originate from the same team). Contrary to intuition, not all non-NFT-native project teams prefer issuing NFTs for cold starts; most still follow the pure-play approach.

-

Complex economic flywheels, yet consistent core principles: Most projects deployed on Berachain leverage Infrared to create economic flywheels, with some building multiple layers of VE(3,3) atop BEX, such as Berodrome. However, the core idea remains unchanged—every incentive is token-denominated. Users only need to understand the fundamentals and market-making capabilities of the project behind the token. Flywheels between projects should be coupled, but the collapse of a single project doesn't necessarily break the entire flywheel effect. As long as surrendered tokens can generate excess returns, users will continue supporting the scheme and allow other projects to fill the gap.

-

Most highly funded projects issue NFTs: Among the top 10 highest-funded projects, 7 belong to Community/NFT/GameFi categories, all issuing NFTs.

-

Fragmented community热度, yet active cross-referrals: Native Berachain ecosystem projects average 1,000–2,000+ Twitter viewers, with some projects showing underestimated viewership (followers/view count ratio < ecosystem average). For example, Infrared has over 7,000 followers and averages over 10,000 views per post. Many native ecosystem projects collaborate in diverse ways, such as participating in economic flywheels or surrendering tokens.

-

Ongoing innovation, but not disruptive narratives: In the NFT sector, some project teams prioritize BD capability over utility hype, e.g., HoneyComb, Booga Beras. In DeFi, some deepen liquidity solutions (e.g., Aori), while others optimize past VE(3,3) models (e.g., Beradrome). In Social, some use peer-to-peer methods to audit project quality (e.g., Standard & Paws). In Launchpad, some experiment with token rights splitting and LP sharing for Fair Launch (e.g., Ramen, Honeypot). In Ponzi/Meme, some attempt floor price pools for "sustainable economics" (e.g., Goldilocks).

Where should Berachain’s breakout points lie, and which ecosystems show potential?

The author believes LSDFI and tokenized NFT assets are Berachain’s breakout points. The former builds more diversified economic flywheels, creating larger economic bubbles and safety nets for Berachain. The latter splits more liquidity for project teams and gains more users by participating in ecosystem flywheels.

Preface

After recently experiencing Berachain products, I discussed product experiences and project development prospects with several friends. Below are the core viewpoints gathered:

-

Berachain’s POL mechanism isn’t truly innovative and raises user entry barriers, though it doesn’t dampen early users’ FOMO.

-

Berachain’s rise and fall hinges on a single token, not the “three-token model.”

-

Berachain’s NFTs, not tokens, are the real shovels.

-

Berachain is the endgame of DeFi.

The first three viewpoints are unremarkable, but the fourth gives me pause—I want to leave more imaginative space for DeFi rather than confine it to one ecosystem’s golden age. To avoid baseless claims, I wrote this article for readers to judge independently.

What is the endgame of DeFi, and why do some projects hit dead ends?

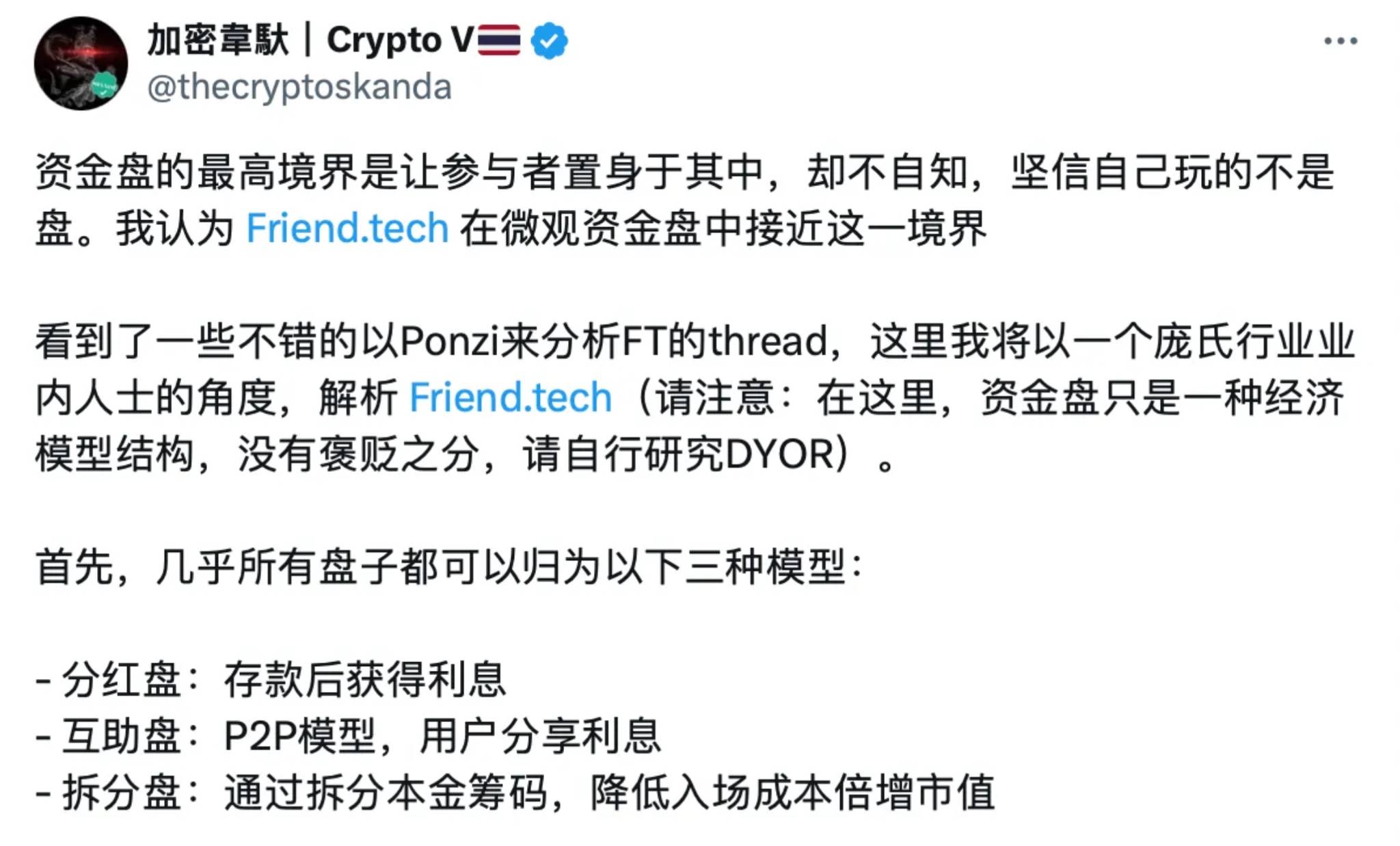

First, we must reach consensus on DeFi’s essence—that DeFi consists of schemes, endlessly recurring ones. If schemes are crudely understood as “new money covering old,” key ignition points in DeFi are overlooked. I find @thecryptoskanda’s three-scheme theory valuable for understanding schemes.

https://x.com/thecryptoskanda/status/1702031541302706539

The three schemes are:

-

Dividend Scheme: Earn interest after depositing, e.g., Bitcoin mining, Ethereum POS, LP yields.

-

Mutual Aid Scheme: P2P model, emphasizing cash flow mismatch, e.g., memes.

-

Split Scheme: Split principal chips to lower entry costs and multiply market cap, e.g., Ethereum ICO.

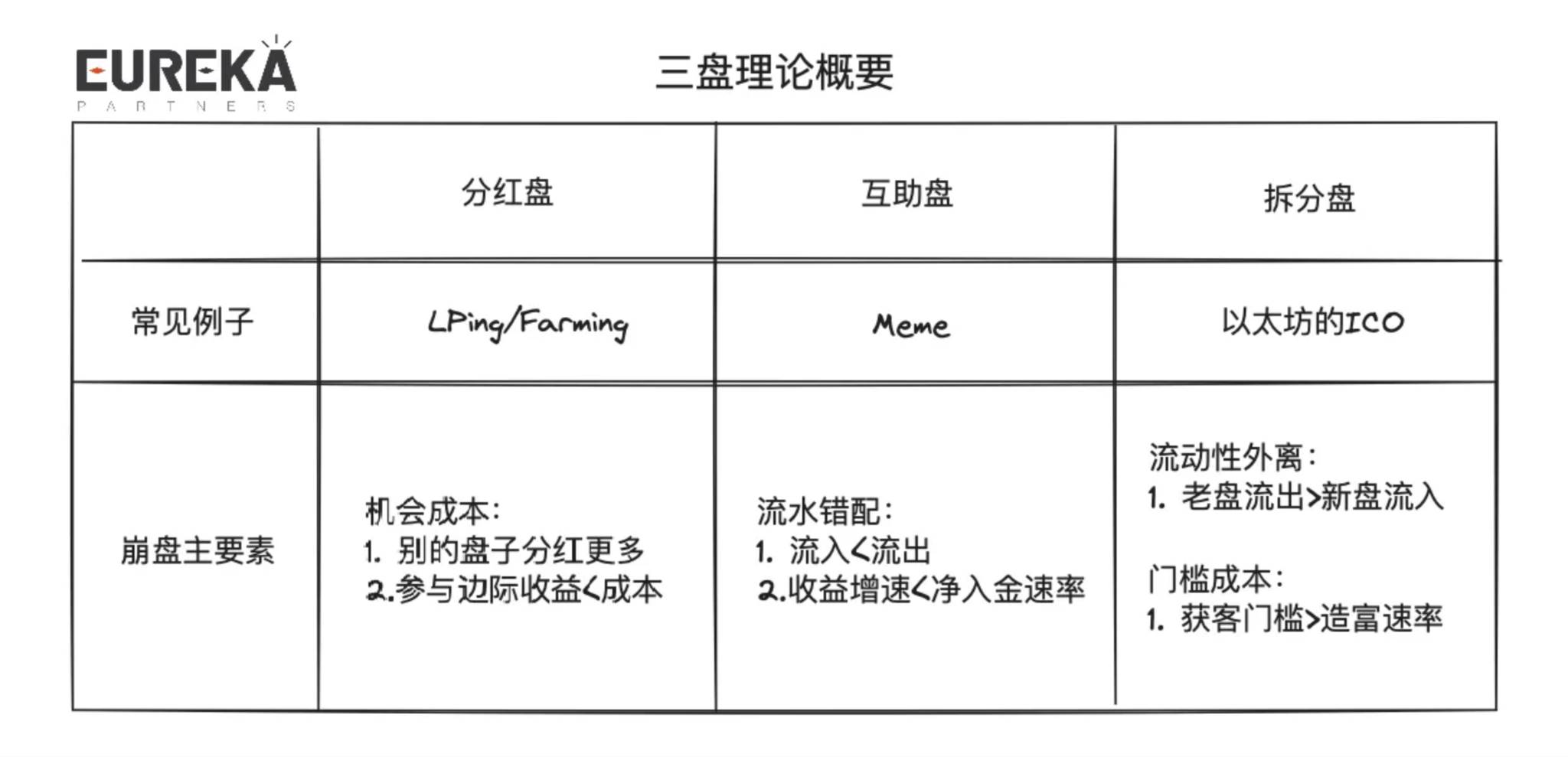

Below outlines collapse triggers for different schemes:

An ordinary scheme’s lifecycle inevitably ends in a death spiral or lack of successors, but a healthy scheme recurs cyclically, possibly combining or serializing different schemes like an ouroboros. Thus, understanding a project should be modular—deconstructing by scheme type—otherwise, post-narrative FOMO may mislead future trajectory assessments.

As the saying goes: one begets two, two beget three, three beget myriad things. The three-scheme theory isn’t limited to “three schemes” but emphasizes coupling between schemes to achieve true perpetuity.

I briefly illustrate cases of different combined schemes:

-

Dividend-Dividend: LRT. Users’ ETH is first staked in POS (first-layer dividend), then authorized to AVS (second-layer dividend).

-

Dividend-Mutual Aid: Pool-based lending. Users first stake tokens for initial collateral yield, then borrowers withdraw collateral, boosting the user’s collateral yield.

-

Dividend-Split: ICO on POS chains. Participate in P2P networks with native tokens to earn block rewards, deploy non-native/forked token contracts on the network to capture other users’ liquidity.

-

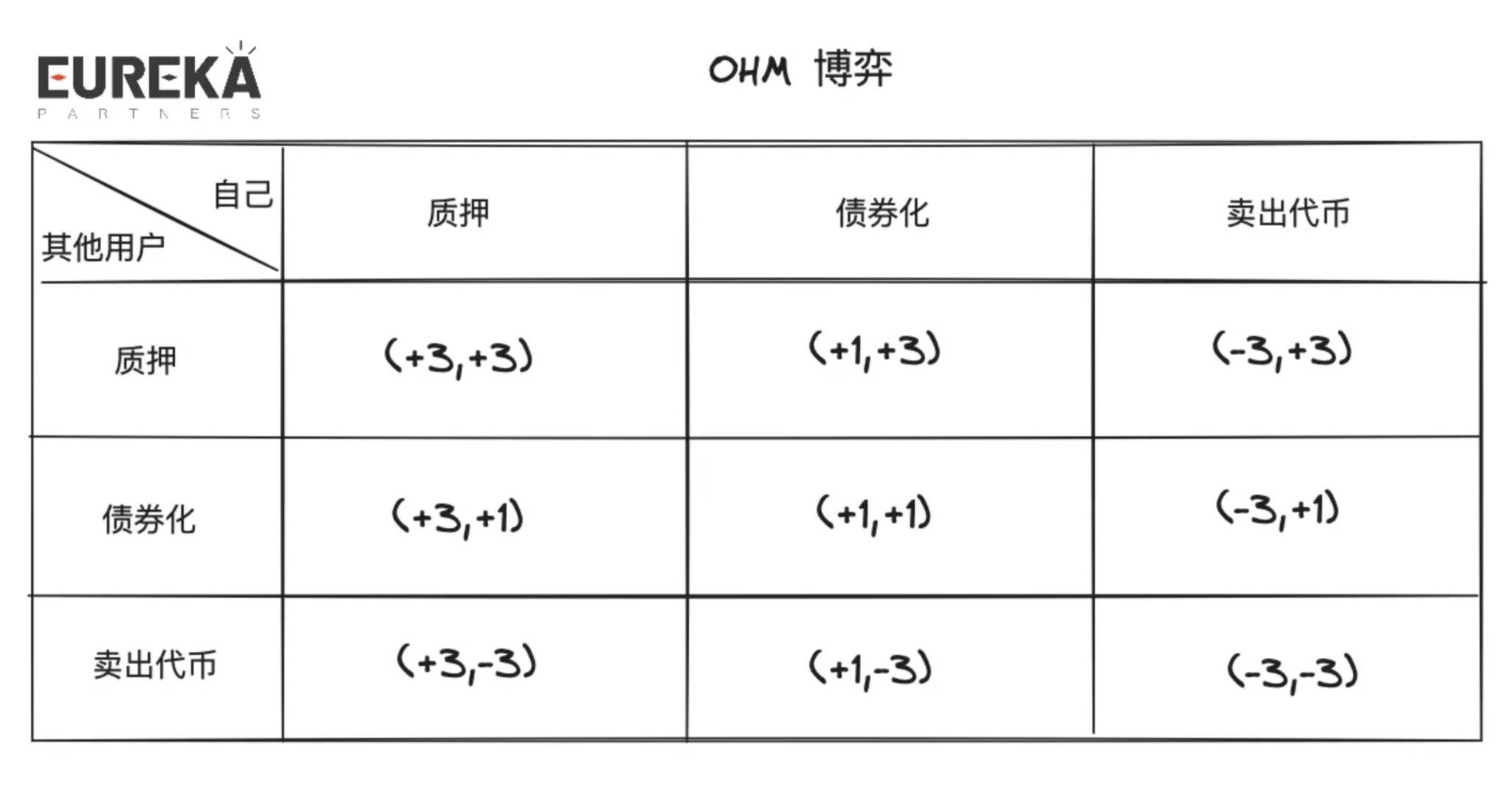

Mutual Aid-Dividend: OHM/Reserve Currency. OHM theoretically pegs at $1; after premium purchases, other stakers earn higher dividends.

-

Mutual Aid-Mutual Aid: Hybrid lending. Borrowers first match P2P lenders; if liquidity is insufficient, they match pool-based lenders.

-

Mutual Aid-Split: Runestone. Users first hype Runestone, then holders receive airdrops from various projects.

-

Split-Dividend: Non-native yield-bearing assets on-chain. Non-native assets originate from ICOs and pay dividends via other tokens/native tokens.

-

Split-Mutual Aid: frend.tech. Users low-barrier launch new assets, still adhering to “new money covering old.”

-

Split-Split: Bong Bears. Bong Bears is a continuously rebasing NFT series: Bong Bears → Bond Bears → Boo Bears… followed by Baby Bears and Band Bears.

Clearly, combining and judging different schemes is relatively subjective. In practice, a project may involve more than 1–2 scheme combinations—possibly 4–5. But does more always mean better? This depends on a project’s allocatable resources, or bluntly—operational capability. Allocatable resources determine how inter-scheme relationships are handled, i.e., parallel or serial (borrowing computing thread processing concepts).

Parallel: Different schemes within a project’s operations don’t conflict and can realize multiple logics separately. For example, diverse protocols flourish in a public chain ecosystem, with non-essential business couplings between them.

Serial: Different schemes within a project’s operations may conflict, requiring sequential business logic. For instance, LRT protocols use serial processing—users’ ETH must first be staked in POS, then authorized to AVS to earn dual yields.

Understanding DeFi’s essence, let’s return to the question: What is DeFi’s endgame, and why do some projects hit dead ends?

The endgame of DeFi is essentially the beginning of the next DeFi. Most projects ending in dead ends simply follow the natural life cycle of a scheme, reaching their respective collapse triggers, with other projects naturally inheriting their liquidity. From a high-dimensional view, the entire Web3 industry remains "everlasting," indicating that the relationships between schemes within the Web3 ecosystem align with a healthy ecology. Applying this logic to various ecosystems, projects, and protocols, we observe that their lifespans become shorter as dimensionality decreases—a reasonable phenomenon. Therefore, a scheme’s "turnover rate" reflects the health of a project, while a project’s "turnover rate" reflects the health of an ecosystem. Next time, avoid hastily claiming “no one will take over,” and instead carefully examine each project's failure, abstractly decoupling business logic and no longer being intimidated by seemingly grand concepts.

Does this mean Memes are the healthiest, given their low startup costs and high project turnover? By this logic, technological breakthroughs aren’t important—any accepted narrative can sustain indefinitely. Is this true?

If we limit our dimension to the Meme sector, endless new schemes replacing old ones can be seen as healthy operation. But if we elevate to the entire public chain ecosystem level, can a chain be considered healthy if only the Meme sector achieves perpetual motion? You likely sense something odd—though practically, when a sector booms, we jokingly say “xx chain is rising,” treating it as a sufficient but unnecessary condition. Yet, thoughtful consideration reveals such booms may drastically reduce liquidity in other chain sectors or tightly bind the native chain’s price fate to one sector—something most chain builders don’t desire (excluding Appchains). Thus, in most cases, a sector boom should be a necessary but insufficient condition—sector traffic cannot infer overall chain development, whereas chain trends should reverse-infer ecosystem traffic.

Can Berachain achieve “perpetual motion”?

After reading the above, I believe many readers have begun preliminary interpretations of Berachain. Let’s not rush to interpret projects—step back and consider what truly matters for a chain.

Yes, liquidity. As the nutrient of everything, liquidity determines subsequent ecosystem development and reflects a chain’s popularity. Traditional pure-play public chains often neglect this, focusing solely on marketing to “drain liquidity” from other chains—then what? Nothing. They never planned how to better manage users’ funds.

“Retaining liquidity—isn’t that the project team’s job? What should the chain do? We can only provide the best dev toolkit; the rest depends on luck.”

Ideally, a chain could also generate narratives for the ecosystem to inherit this liquidity, but scale-wise it’s rarely chain-level. Currently, the ideal narrative capable of bearing chain-level liquidity is LRT+AVS, while other chains struggle to escape reliance on sector-level narratives, limiting themselves to specific asset developments—e.g., BTCL2 constrained by inscriptions and runes.

At this moment, we can reposition Berachain. I believe the best way to understand Berachain is as a “liquidity navigator.” Unfamiliar readers can find numerous online articles explaining Berachain’s three-token model + POL; I won’t repeat them, only briefly introducing Berachain’s token model:

-

Three Tokens: BGT (governance), Bera (gas), Honey (algorithmic stablecoin)

-

Key Process: BGT can be earned in Berachain’s native apps (may expand to more protocols post-mainnet); BGT can “guide” BGT emission amounts across different LP pools. BGT is non-transferable but can be converted 1:1 to Bera. Defi-savvy friends can roughly equate this to a ve(3,3) variant.

-

Note: BGT is currently only obtainable via officially deployed protocols (BEX, BERPS, BEND), but post-mainnet will open to all protocols on Berachain.

I believe Berachain’s token model should be viewed in conjunction with its ecosystem, not rashly as a standalone product. Here, I explain Berachain’s positive ecosystem development flow using the three-scheme theory:

-

Dividend Scheme: Users/ecosystem project teams stake assets as LP, earning BGT emission rewards.

-

Split Scheme: BGT can be staked as governance or delegated to other governors; BGT governors decide BGT emission amounts for different LP pools.

-

Mutual Aid Scheme: Ecosystem project teams offer bribery rewards to attract BGT governors, gaining potential increased liquidity from higher BGT emissions.

-

Split Scheme: Users buy different project tokens from LP pools.

-

Dividend/Split/Mutual Aid Schemes: User assets flow in and out across different ecosystem project teams.

Thus, Berachain’s main collapse point lies in: BGT staking yield < BGT-to-Bera conversion yield. This implicitly assumes the on-chain ecosystem can no longer support additional bubbles, meaning that unless systemic risks emerge, Berachain’s native assets (BGT, Bera, Honey) are cushioned by the ecosystem. However, reality is more complex—participants don’t all have full global information or make perfectly rational decisions, and not all participants are investors; some project teams may purchase BGT to vote and gain BGT emission rewards for potential liquidity. Thus, the collapse point should be revised to: In a rational market, project team bribe rewards < liquidity acquisition cost (bribing, direct BGT purchase) / BGT staking yield < BGT-to-Bera conversion yield.

Notably, this is a seesaw mechanism. When Bera/BGT implied value is high, BGT’s potential conversion pressure increases. Once BGT stakers decrease, BGT staking absolute yield should rise, boosting staking willingness and lowering Bera/BGT implied value. Conversely, with more stakers, yield space shrinks, pushing Bera/BGT implied value higher again… cycling perpetually. A healthy Berachain ecosystem should maintain long-term Bera/BGT positive premium, implying higher trading volume and “should” offer more bribe rewards to BGT stakers. Practically, bribe reward budgets for liquidity acquisition aren’t a “dark forest.” Rational project teams can reference competitors’ pricing or collude to let the free market determine liquidity attractiveness, ultimately converging to a “market equilibrium” average yield line.

Additionally, Berachain harbors another hidden collapse point: LP staking yield below self-formed LP yields at other DEXs in the ecosystem, risking user loss due to “vampire attacks.” Practically, this issue is minor for two reasons:

-

Berachain’s native DEX should have the most trading pairs, making it the go-to choice for small projects’ cold starts/IDOs. Thus, user experience offers the broadest trading routes, preventing massive liquidity outflows.

-

Berachain’s native DEX has the strongest brand power, unmatched by others. Consider Uniswap’s rapid rebound after Sushiswap’s vampire attack—brand power significantly influences user trading psychology.

DeFi Liquidity Game: Has Berachain fundamentally changed anything?

For DeFi, despite varied forms, the core element remains liquidity. Thus, how product structures attract and allocate liquidity becomes a sustainability benchmark—especially for public chains. Below, I briefly review past liquidity solutions and compare whether Berachain’s approach fundamentally solves liquidity issues.

Solution One: Liquidity Mining

Subsidize LPs with project-native tokens where only fee income exists. Suitable for early DeFi when users weren’t overwhelmed by complex product models, this simple effective subsidy helps quickly capture liquidity. The classic case is Sushiswap’s vampire attack on Uniswap, capturing $1.4 billion in liquidity short-term via LP mining subsidies in $SUSHI. But problems are obvious—this dividend isn’t USD-denominated, and more liquidity means fewer dividends. Early users mined tokens only to rapidly exit on secondary markets, accelerating project collapse. Nansen’s 2021 report already noted that among LPs entering on the day liquidity mining launched, 42% exited within 24 hours, ~16% within 48 hours, and 70% by day three. Even today, these numbers aren’t surprising—who would stick around without diamond hands or deep faith in the project?

Solution Two: CLMM/Other AMM Variants

Improve capital efficiency by altering standard AMM (CPMM—Constant Product Market Maker) models for liquidity concentration. The most famous algorithm is CLMM, conceptually resembling countless independent liquidity pools at different price intervals, seamlessly integrated for users. This balances order books and CPMM, enhancing capital efficiency while ensuring sufficient liquidity depth. For further details, readers can directly refer to Uniswap V3 or existing V3 forks—no need for deeper explanation here. This iterative solution doesn’t harm platform tokens, so it’s nearly universal.

Solution Three: Dynamic Distribution AMM

Adjust liquidity intervals passively/actively, aiming for maximum capital efficiency. For detailed content, refer to Maverick Protocol. Conceptually, it resembles manually repeatedly redeploying CLMM intervals. This enables lower-slippage trades but creates a “price buffer zone,” raising potential costs for project teams’ market cap management (e.g., harder pumps). Thus, token pairs using dynamic distribution AMM exhibit high correlation, e.g., LST/ETH.

Solution Four: VE Model

The classic VE model, pioneered by Curve, allows users who stake governance tokens to receive credentials (VE tokens) determining liquidity mining reward proportions across different LP pools—i.e., governance token dividends. In short, governance tokens decide governance token distribution in LP pools. Since governance tokens control liquidity mining allocation, a project team demand emerges—guiding liquidity to ensure deeper trading depth and sufficient liquidity capacity. Thus, project teams willingly offer extra “bribe” rewards to relevant governors, typically in native tokens. Early projects outsourced to bribe platforms, but newer solutions increasingly integrate bribe modules internally.

Solution Five: Reserve Currency/OHM Clones

Sell bonds at a discount to collect liquidity, issue stablecoins with this liquidity. Since stablecoins theoretically peg $1, any excess purchase turns residual liquidity into profit, distributed to stablecoin stakers. Theoretically sustainable, but users don’t treat these tokens as stablecoins—they overbuy and stake to capture treasury surplus yields. Combined staking, bond issuance, and secondary market purchases push the stablecoin’s value far beyond justified levels. Massive profit-taking triggers further bank runs, potentially dropping below $1. This OHM game dynamic is known as the (3,3) model—since users all choose staking, expressed in a 3x3 matrix as (3,3).

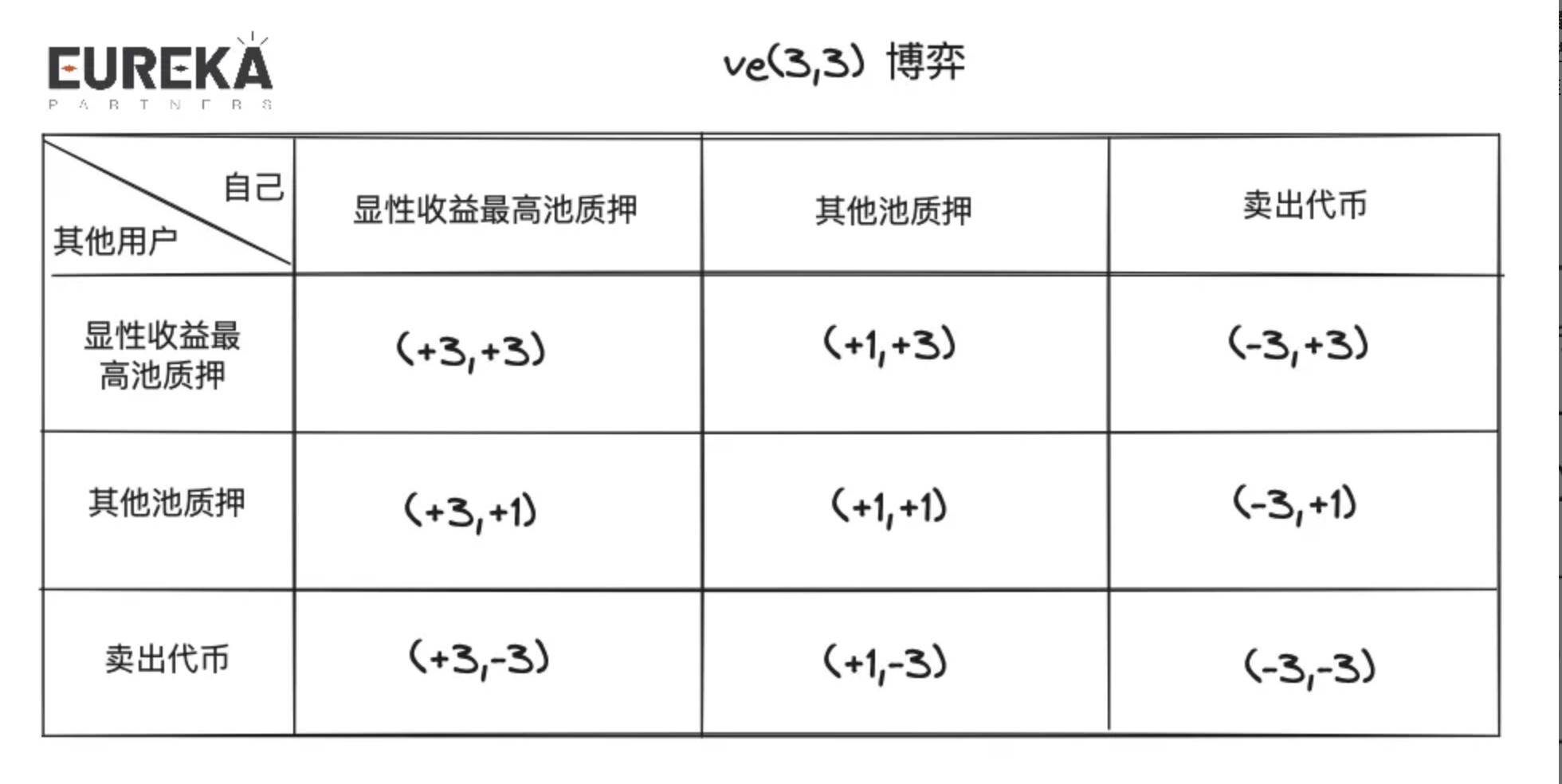

Solution Six: VE(3,3) Model

Unlike standard VE models, VE(3,3) emphasizes local optimal consensus. Project teams create environments guiding governance token holders toward locally optimal choices. In standard VE models, LP fees are globally distributed—i.e., all stakers earn. But in VE(3,3), LP fees mostly go only to voters of that pool—stakers must estimate future LP fee splits before voting. Thus, bribe platforms also provide local consensus, enabling users to actively maximize gains. Whether isolating LP fees or bribe markets, both foster internal competition in liquidity markets, attempting to attract liquidity under “single-blind” conditions—uncertain how much liquidity providers will commit, remaining opaque. Additionally, the key difference between bribe markets and LP fees lies in reward denomination—bribe markets use project tokens, while LP fees are typically USD-denominated. Thus, the former acts as a DEX buffer, maintaining governance token prices until reward bubbles burst.

Solution Seven: Reverse VE(3,3) Model

Forward (3,3) prioritizes globally optimal gains, while reverse (3,3) uses loss mechanisms to increase unstaking/holding costs. Readers might think token holders face depreciation risk, but such projects are common in friend circles, euphemistically called native deflation mechanisms. Conventional market projects adopt this conservatively—e.g., GMX doesn’t cause principal depreciation upon unstaking but may reduce part of dividends. Refer to GMX analyses online. Using this model requires project teams to fully understand their business, lifecycle, and design logic—otherwise, it accelerates project death. Neither excessively high nor rapidly depreciating token values suit long-term development.

Solution Eight: Liquidity Direction

Liquidity direction involves two roles: LP & LD (Liquidity Director). LPs still provide liquidity, while LDs decide where it goes. Tokemak is one of few market solutions using this approach. Its v2 iteration employs internal algorithms to find optimal liquidity guidance paths, giving LPs optimal staking yields and allowing liquidity buyers to know exactly how much liquidity a certain amount “rents.” Though the liquidity marketplace hasn’t launched, it’s already accumulated over $8M in liquidity. Historically, this narrative gained attention only during the last DeFi Summer, underperforming in bear markets and the current bull run. Whether liquidity markets need transparency remains unproven. I believe liquidity markets need some degree of “clear pricing”—blind spots make bidding inefficient and prevent many idle rewards from correctly reaching incremental capital. Such solutions act as terminators in liquidity games, akin to MEV-boost in the MEV dark forest.

Solution Nine: VE-LP / Proof of Bond (POB)

Finally, the highlight of this section—and why I believe Berachain’s POL isn’t the core innovation.

VE-LP/POB’s core idea introduces liquidity as a project’s entry ticket and rear guard. The former appears in Balancer, the latter in THORchain. Balancer allows users to form LPs with BPL/WETH, whose LP receipts can be further staked to earn veBAL for fee sharing and governance. THORChain’s POB requires node operators to stake native tokens as underwriting capital, deducting 1.5x the staked asset upon LP loss, capping total network liquidity at 1/3 of governance tokens. When the network becomes unsafe/inefficient, it seeks balance via liquidity mining <> node operator reward distribution—e.g., increasing next-period node rewards (governance tokens) if staked assets are insufficient to cover on-chain liquidity losses. No matter how details change, these solutions face core entry barrier issues—setting appropriate difficulty to maintain sufficient liquidity is key.

Revisiting Berachain’s POL + three-token model, it’s essentially a VE(3,3) + VE-LP variant. As introduced earlier, BGT bribe markets apply the VE(3,3) model, while POL applies VE-LP. The former focuses on governance token market cap management, the latter on entry barriers. Typically, VE model governance tokens trade freely on secondary markets, letting project teams easily acquire liquidity—but exposing the project itself to token volatility risks. POL slows BGT acquisition, granting more control time/space, while allowing multi-token staking to lower partial entry barriers for more potential liquidity.

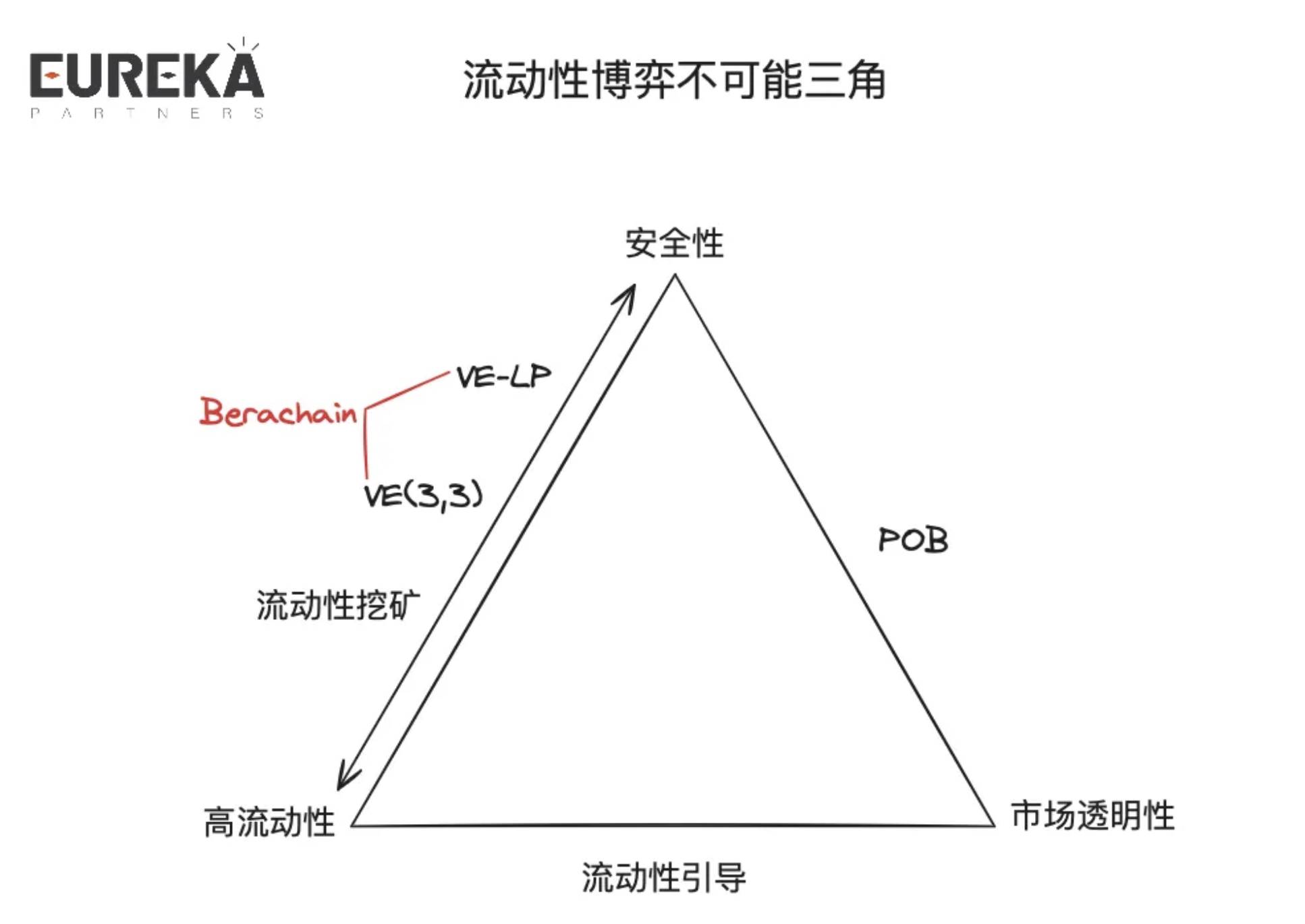

From this series of liquidity solutions, we derive the impossible trinity of liquidity gaming: security, high liquidity, market transparency.

Security: Whether the solution provides project teams a rear guard for liquidity—e.g., if VE(3,3) bribe rewards’ bubble bursts, VE projects face collapse risk.

High Liquidity: Whether the solution attracts absolutely high-value liquidity—e.g., if project teams surrender most governance tokens, the yield attracts short-term liquidity.

Market Transparency: Whether the solution makes liquidity demand transparent—e.g., POB project liquidity capacity depends on total node assets.

Back to the original question: Has Berachain fundamentally broken through technical bottlenecks in the liquidity market? Clearly not—only partial improvements. But Berachain chose the right application scenario—public chains. Focusing only on mechanisms might misjudge its potential as protocol-level, but BGT’s bribe rewards can actually revitalize other ecosystem projects, even serving as a narrative on par with Restaking. Imagine you’re a project team lacking sufficient reserves for early liquidity mining rewards, yet you’ve still created a trading pair on BEX (Berachain’s native DEX) with some initial liquidity. Your project can now earn BGT rewards from these staked assets, and BGT decides future emission amounts for that pool. Given the small pool size, even modest BGT emissions offer higher yields than blue-chip token LPs, indirectly attracting liquidity. Thinking this way, Berachain’s POL mechanism resembles the Restaking sector. Just as Restaking’s AVS integrates part of ETH’s security, Berachain’s small projects integrate part of BGT’s “security,” providing more abundant liquidity for project development.

What is happening with Berachain, and what is the best way for users to participate?

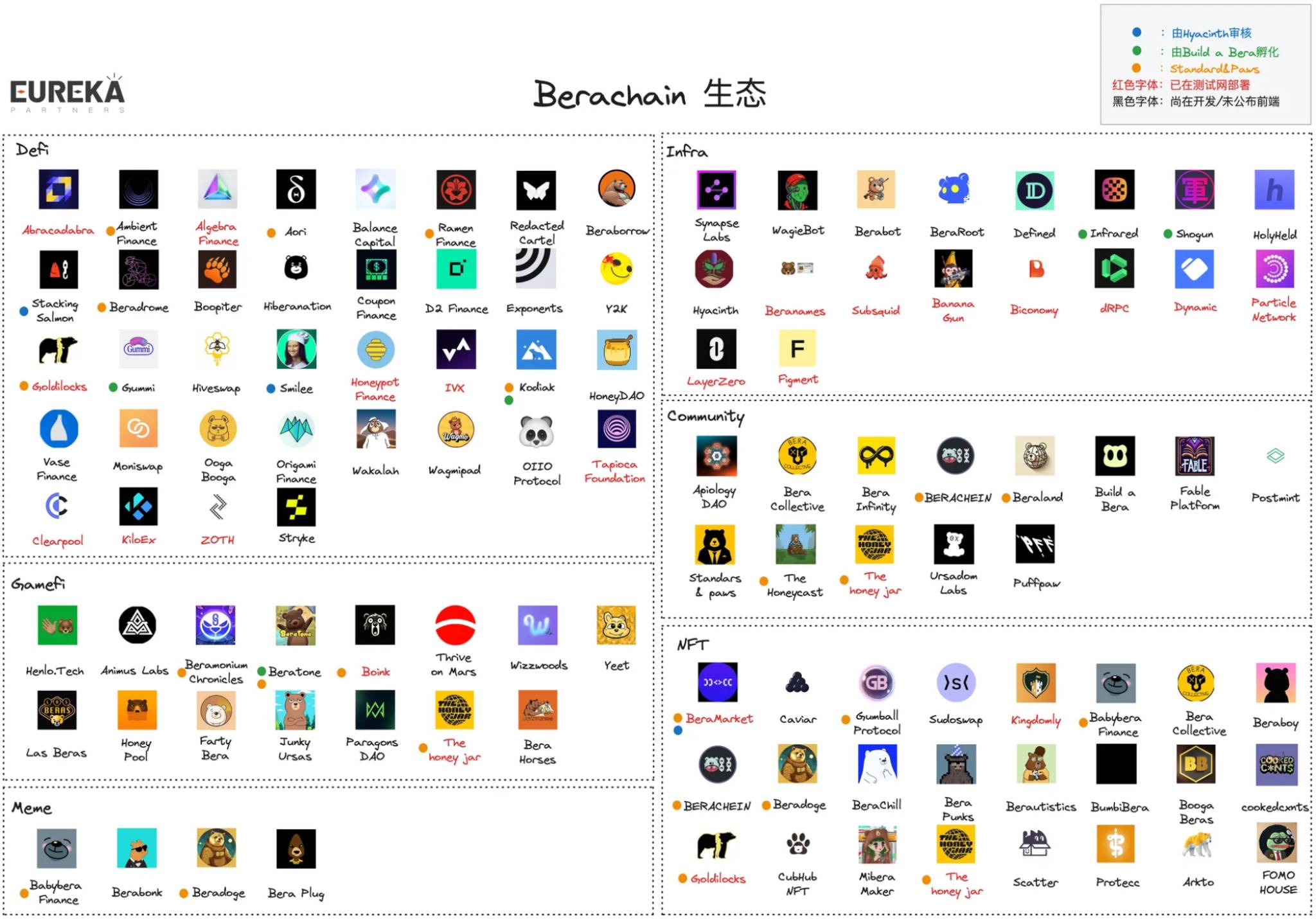

As of May 3, 2024, according to Beraland and the author’s compilation, there are approximately 103 projects, with DeFi and NFT dominating. Since projects may have multiple businesses, those with overlapping functions are categorized under relevant business types. Specific ecosystem distribution:

-

DeFi: 36

-

GameFi: 15

-

Meme: 4

-

Infra: 18

-

Community: 13

-

NFT: 24

Currently, most projects are DeFi and NFT products. Berachain’s ecosystem is complex—I’ll selectively introduce key projects (relatively subjective).

-

The Honey Jar (THJ)

“The Honey Jar is an unofficial community NFT project, situated at the heart of the Berachain ecosystem, which hosts a number of games.”

This is the official positioning—essentially a hybrid project combining NFT + GameFi + Community + Gateway + Incubator. Its NFT, named Honeycomb, enables governance within the project. All Honeycombs have been minted, with a floor price of 0.446 ETH and an initial mint price of 0.099 ETH. Holders can participate in platform games and potentially earn mystery rewards from other Berachain ecosystem projects (as of February 22, 2024, HJ has accumulated 33 project collaborations, with about 10 offering airdrop rewards). Berachain ecosystem partners can “locate” valuable high-net-worth users through these NFT holders, potentially increasing the project’s future participability (high-net-worth users may invest more). In short, this is an NFT requiring “project teams to deliver.”

Additionally, The Honey Jar launches a new mini-game each quarter, allowing users to mint new NFTs, totaling six rounds. These NFTs differ from Honeycomb, named Honey Jar (Gen 1-6), with generation number determined by round. Buyers participate in games—understood as NFT raffles—and winners claim prizes (NFTs + cash) after all NFTs in that round are minted. Two rounds have concluded, with the remaining four announced in Q2 2024 and deployed across four different EVM chains.

THJ incubated six organizations:

First, Standard and Paws. This project is a rating system aiming to prevent garbage projects in the ecosystem.

Second, Berainfinity—think of it as Berachain’s Gitcoin, helping developers/project teams achieve sustainable development.

Third, ApiologyDAO. Positioned as Berachain ecosystem’s investment DAO.

Fourth, Mibera Maker. Positioned as Berachain’s Milady.

Fifth, The Apiculture Jar. Positioned as THJ’s Meme/Artist division.

Sixth, Bera Baddies. Positioned as a female community on Berachain.

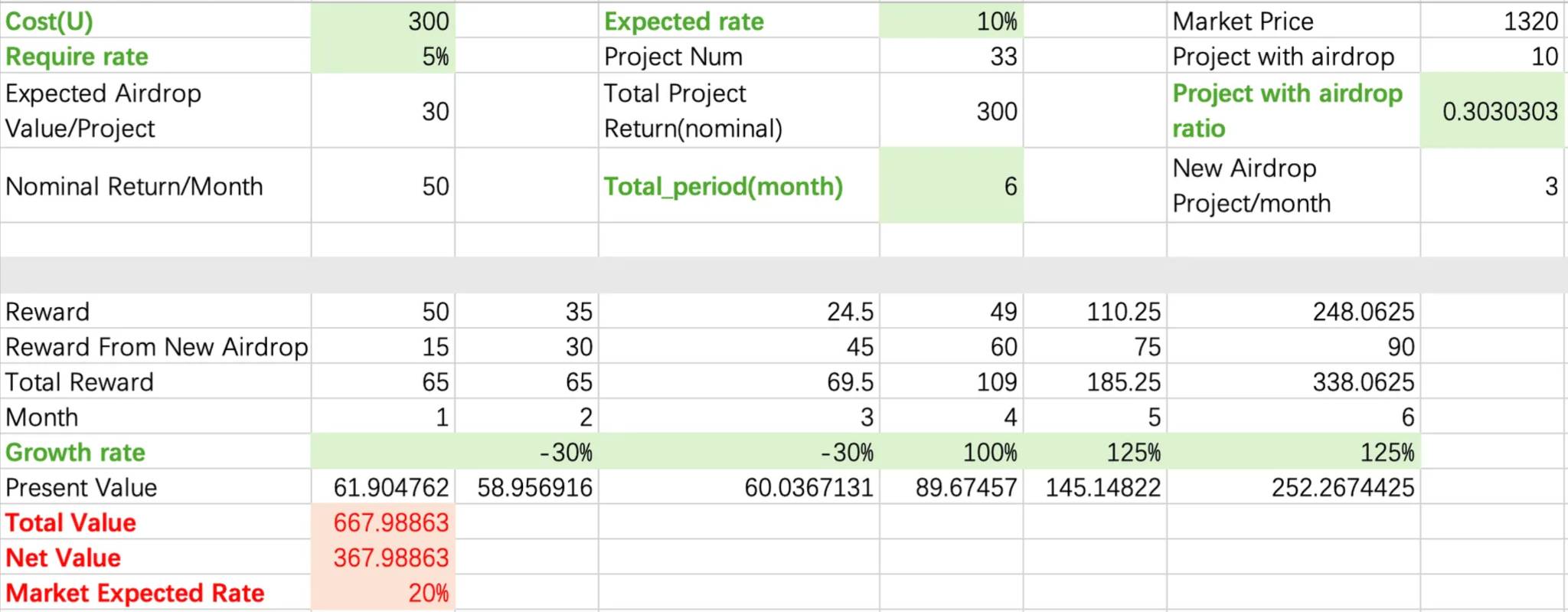

Evaluation: I believe early participation value is high—no one dislikes “shovels.” But such narratives often price in early, so we must clearly identify core collapse/risks beyond systemic risks (e.g., poor Berachain mainnet performance):

First, project teams must have sufficient bargaining power, BD capability, and “hold OGs hostage to command project teams.” If proven Honeycomb fails to truly capture high-net-worth users, subsequent project teams won’t offer high-value benefits to NFT holders.

Second, the total potential reward value offered by other project teams to NFT holders must be ≥ NFT floor price. Let’s conservatively estimate Honeycomb’s price:

1) Honeycomb cost: 0.099 ETH ≈ 300U

2) Expected returns: Risk-free on-chain yield is ~5% (POS). Currently, 10 projects commit to airdrops, distributing over ~6 months, with initial value ~30U (10% expected rate), theoretical total value ~300U (30U*10), meaning ~50U disbursed monthly. Assume 3 new projects monthly offer airdrops to NFT holders.

3) Return growth rate: Assume first three months involve project team churning, accumulating buys before pumping. Subsequent three months pump 1x, 1.25x, 1.25x respectively. Assume institutional breakeven at 5–10x TGE price, 12-month vesting—teams need to pump 2.5–5x within 6 months (equivalent to 1x, 1.25x, 1.25x in last three months).

Final estimated NFT net value: 367U. Based on current floor price (0.446 ETH), the market predicts individual project return value must sustain ~20%. This estimate is for fun—actual reference value is low.

-

Build a bera

“Build-a-Bera is a results-driven partner with the Berachain Foundation designed to provide Bera-oriented founders with the tools, mentorship, and resources needed to thrive in a competitive market.”

Per official definition, Build-a-Bera is a foundation partner aiding ecosystem project teams’ development—essentially an incubator. Each cohort admits 5 project teams for 12 months. Currently, five confirmed teams on the website: Infrared, Gummi, Kodiak, Shogun, Beratone.

Evaluation: I believe selected project teams are highly likely to receive more Berachain support, and incubatee projects more easily collaborate (which is factually evident). Thus, I’ll subsequently introduce the aforementioned selected projects.

-

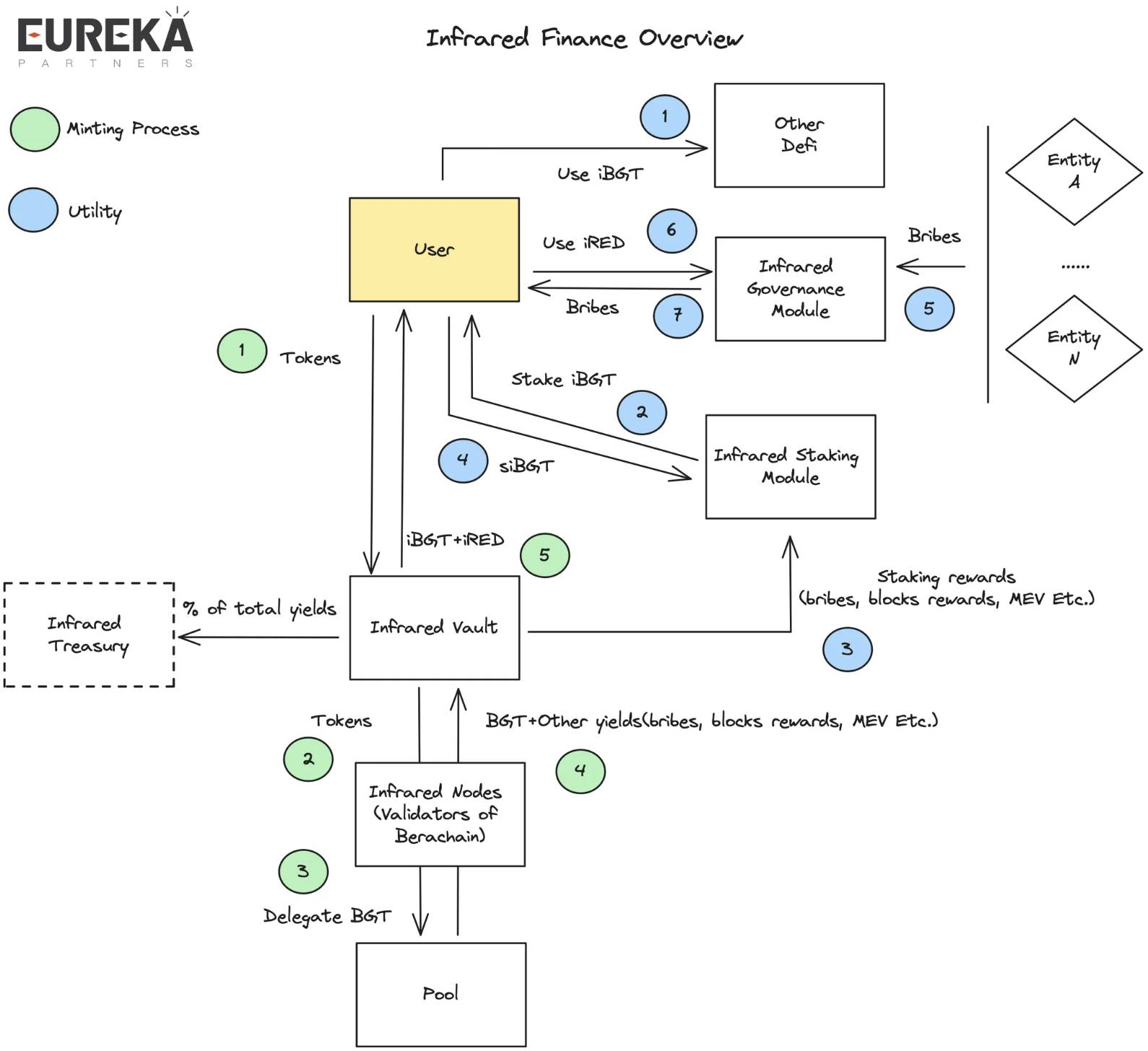

Infrared Finance

Defi-savvy users can view this as a combination of Frax (frxeth+sfrxeth) and Convex. Briefly, Infrared Finance is an LSD project aiming to solve BGT liquidity issues.

Main process: Users stake tokens with Infrared Finance, which then stakes them in BEX liquidity pools, while BGT rewards are authorized to Infrared validators. Infrared validators return subsequent BGT emission rewards + other rewards (block rewards, bribes, MEV, etc.) to the Infrared Vault. Infrared treats part of other rewards as treasury income and mints cumulative BGT rewards into iBGT + iRED for users.

Token model: iBGT is 1:1 staked from BGT; users can use iBGT in other Berachain products; users can stake iBGT to earn siBGT, which receives BGT rewards from Infrared validators (e.g., bribes, block rewards); iRED governs the platform, e.g., directing Infrared validators to increase BGT emissions for specific LPs.

Evaluation: Another “holding the emperor to command the empire” project. On the surface, it solves BGT liquidity, but actually shifts the bribery battle from BGT to iRED. For instance, Infrared controls 51% of LP, meaning absolute say in BGT emission distribution—thus iRED becomes the “imperial seal” commanding the empire. On this basis, if project liquidity demand remains unchanged, Infrared’s theoretical bribe income exceeds other validators, further intensifying its control over Berachain. Practically, this may resemble reality—as Convex once approached 50% influence over Curve—plus Berachain currently lacks other Build-a-Bera-supported LSD projects and boasts extensive ecosystem collaboration. If user demand centers on stable BGT returns + partial excess gains, Infrared is likely the preferred gateway post-launch. Additionally, the project’s dual-token “seesaw” mechanism further amplifies siBGT holder returns—since not all users sacrifice liquidity, this staking yield should exceed typical BGT LSD products, sourced entirely from “real yields.” While seemingly a win-win, we must acknowledge its collapse points/core risks:

First, iRED depreciation risk. Each iRED emission increases total supply, indirectly reducing iRED value. iRED’s implied value represents bribe income—if potential projects (e.g., pursuing decentralization) prefer offering high bribes directly at Berachain BGT Station, iRED’s implied value drops, accelerating depreciation. If Infrared controls majority liquidity, it essentially reverts to Berachain’s POL mechanism—strictly speaking, a systemic risk.

Second, Infrared’s centralization risk. Despite multifaceted support, including foundation-backed incubation, potential malicious risks remain. Currently, Infrared hasn’t clarified validator entry thresholds. If fully operated internally, it poses greater single-point failure risks than Lido.

-

Kodiak

“an innovative DEX that brings concentrated liquidity and automated liquidity management to Berachain.”

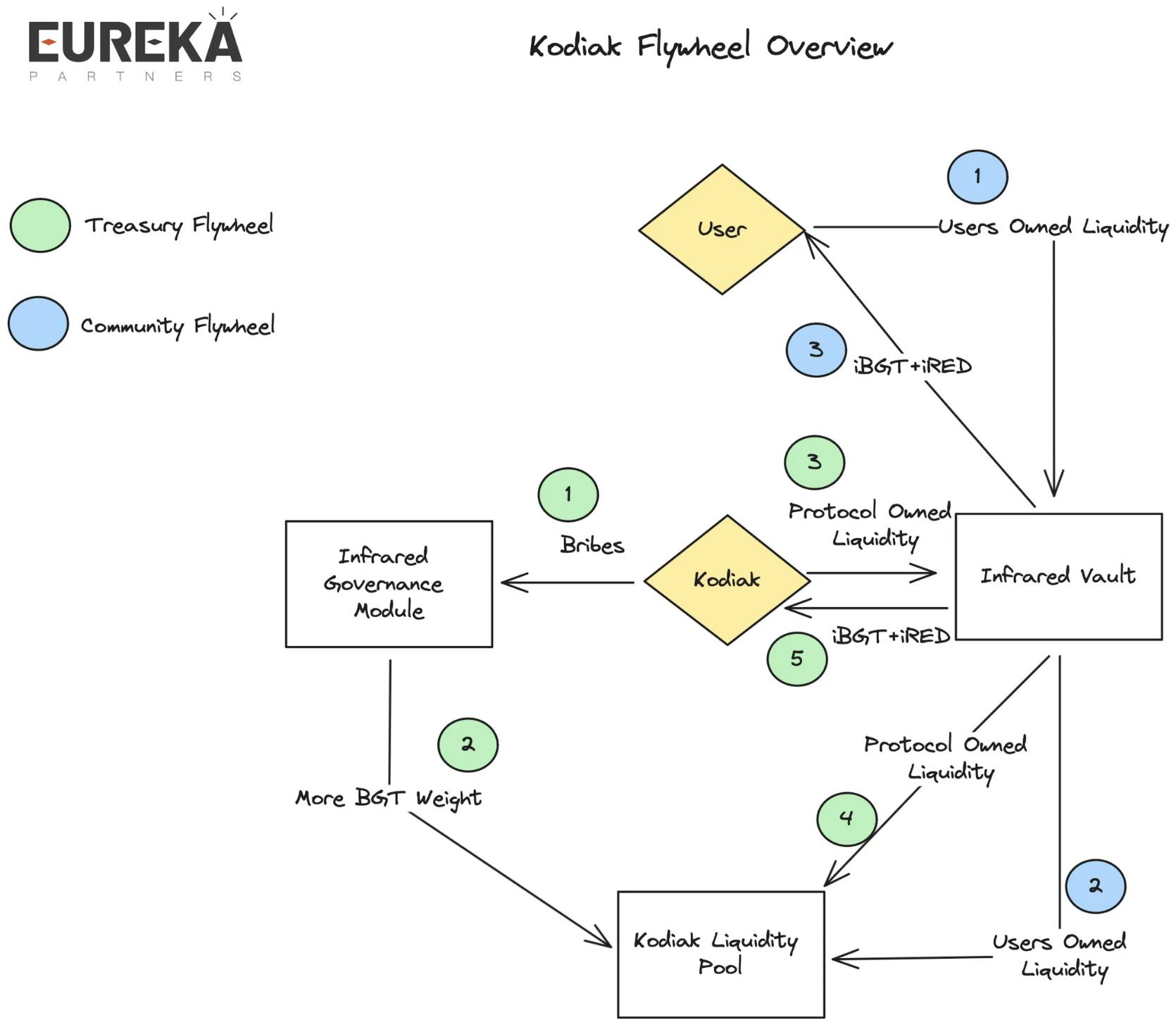

Kodiak positions itself as a DEX offering automated liquidity management services (refer to dynamic AMM overview in liquidity solutions above), plus one-click token creation. Officially, Kodiak isn’t a direct BEX competitor but an ecological complement, since BEX lacks concentrated liquidity features. Notably, Kodiak collaborates with Infrared, proposing two economic flywheels:

First, Treasury Flywheel. Kodiak first bribes Infrared to boost BGT emissions for Kodiak LPs. Then, Kodiak stakes treasury liquidity in Kodiak LP pools, pledges LP tokens to Infrared, granting Infrared control. Infrared then stakes in Kodiak LP pools to earn iBGT+iRED rewards from Infrared.

Second, Community Flywheel. Users stake Kodiak LP tokens to earn iRED+iBGT rewards from Kodiak.

Evaluation: Suitable for yield-bearing vs. native asset pairs, but less so for siBGT & iBGT scenarios. This flywheel demands high mid-late-stage control capability. As mentioned, dynamic distribution AMM suits highly correlated token pairs—e.g., LST/ETH. LST (non-rebasing tokens) accumulates validator rewards, should price higher than iBGT, but since yields are stable, volatility is low, making price buffer zones easier to form, preventing divergence. However, siBGT’s native yield differs from POS—diverse sources, higher volatility—so price buffer zones反而 reduce price discovery efficiency, potentially undervaluing siBGT’s true market return. Additionally, the project’s core collapse point: bribe rewards (iBGT+iRED+liquidity stability) < bribe costs (likely Kodiak’s native token). This plagues all bribe projects, implying Kodiak’s token implied value should ≤ bribe rewards—otherwise, the project runs deficits (similar to Lido’s current state). Conversely, if Kodiak’s native token value is too low, it can’t attract enough liquidity—insufficient BGT emissions. *Early on, most LP thinking should be token-denominated—a bullish signal*, with bribe costs ≥ bribe rewards. Mid-later stages, ecosystem fatigue forces LPs to think USD-denominated. Kodiak then faces two choices: maintain bribe levels USD-denominated or continue token-denominated bribes. The former accelerates potential market sell pressure; the latter reduces platform liquidity appeal—both near collapse points. Without new narratives, it reaches lifecycle’s end.

-

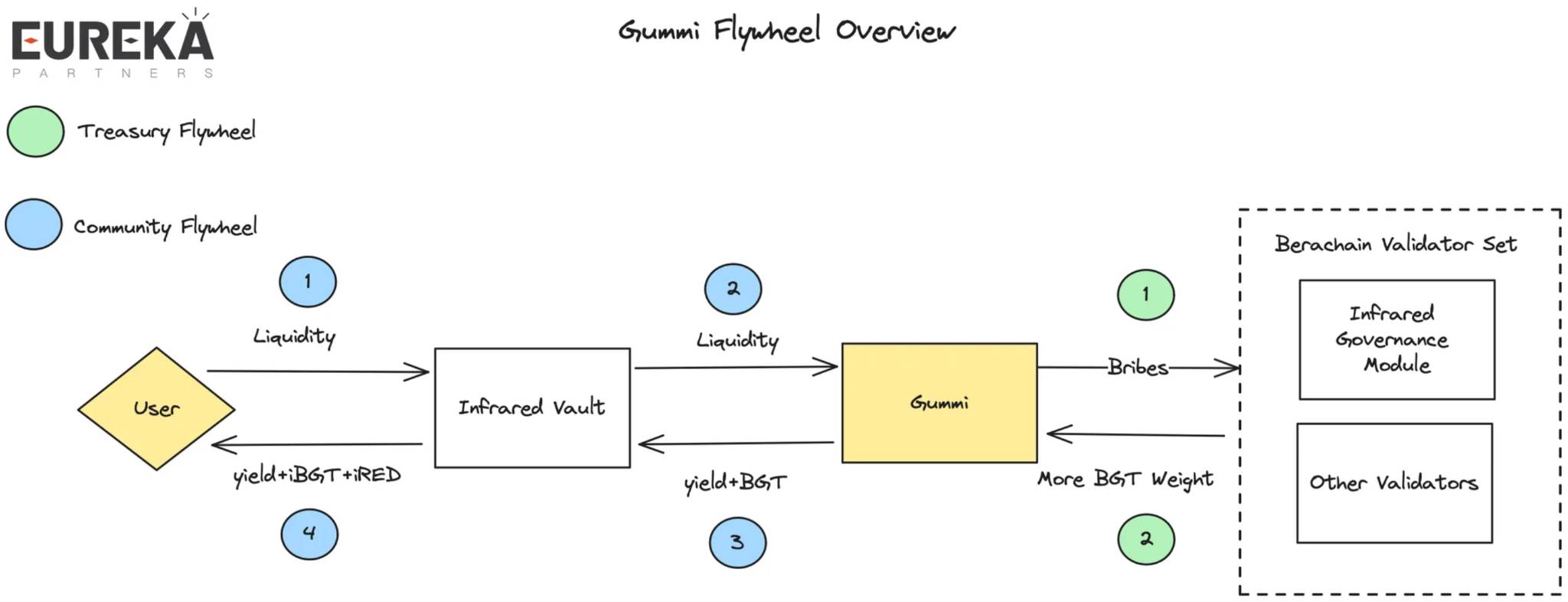

Gummi

“A sweet treat for those sers interested in something a little stronger than honey.”

Per official description, Gummi positions itself primarily as a money market. Details are scarce, but likely a lending protocol supporting leveraged lending.

Their collaboration with Infrared resembles Kodiak’s—though Gummi doesn’t specify bribing Infrared validators or all validators, likely the former.

Evaluation: Limited discussion space currently due to unclear product details. Mentioned here due to Build-a-Bera incubation + Infrared ecosystem partnership.

BeraBorrow

“Beraborrow is a decentralised protocol at the forefront of the Berachain ecosystem, providing interest-free loans using the iBGT token as collateral.”

Defi-savvy users recognize this as a Liquity clone. Per official description, BeraBorrow is a collateralized debt protocol (CDP) allowing users to borrow NECT stablecoins at 0% interest with 110% collateralization using iBGT. The stablecoin theoretically pegs $1.

Why interest-free: No protocol is truly “interest-free.” Our focus should be where the protocol extracts revenue. BeraBorrow charges fees whenever users borrow or redeem NECT. Redemption fees dynamically adjust based on redemption frequency within 12 hours—the more redemptions (indicating NECT overvaluation), the higher the fees.

Peg mechanism: Hard and soft pegs. The former provides a 1:1 redemption mechanism between iBGT and NECT—when NECT is overvalued (> $1.1), users can exchange 110% collateralized iBGT for NECT worth 1 BGTi, then sell NECT for arbitrage profit. When undervalued (< $0.9), users buy on secondary markets and redeem 1:1 for iBGT, profiting from the spread. The latter refers to NECT’s theoretical peg value ($1), with the platform adjusting overvalued NECT via dynamic redemption fees.

Max leverage: 11x. With a 110% platform collateral ratio, theoretical max leverage is 11x (1 + 1/0.1 = 11).

Other risk controls: Future rollout of a stability pool for platform liquidations, with liquidation proceeds going to the pool’s LPs.

Evaluation: Stablecoin projects are本质上 bonds—users care about APY, not stablecoin use cases (more trading pairs). If using stablecoins, why not use Honey? Currently, only the stability pool offers potential yield, though不排除 iBGT staked on-platform may later be further staked in Infrared vaults for potential returns. For users, if short-term bearish on iBGT, they can amplify leverage, wait for position liquidation to capture potential liquidation spreads.

Liquity’s max liquidation value = debt value - (collateral quantity * current price * <10% * user share in stability pool).

Roughly estimating with an example: Suppose a position holds 500 iBGT, owes 10,000 NECT, with current collateral ratio at 109%—iBGT price at 21.8 U (109% * 10,000 / 500). If the user holds 50% of the stability pool, they earn ~450U profit (500 * 50% * 21.8 - 10,000 * 50%). Based on this example, the user’s key profit drivers are current stability pool share + liquidation frequency.

Additionally, if users are medium-to-long-term bullish on iBGT, they might amplify leverage to earn up to 11x siBGT returns—though this isn’t currently specified in BeraBorrow’s official documents. For such users, the key risk lies in downward volatility of BGT.

Beratone

“BeraTone offers an intricate life-sim and farming system, reminiscent of beloved classics like Stardew Valley, allowing players to cultivate and manage their dream farmstead.”

Officially, Beratone is an MMORPG where players embody bears farming together in a simulated world—fans can reference Stardew Valley. One creator is PixelBera, artist behind Bit Bears (the fifth-generation rebased derivative NFT of Bong Bears). Leveraging Bit Bears’ popularity, PixelBera aimed to add “utility” to Bit Bears, birthing Beratone. A game demo is expected in Q2 2024, with the full version launching in Q1 2025. NFT sales begin in Q3 2024—Founder’s Sailcloth NFTs already sold, offering in-game buffs like expanded inventory. Notably, the game will be accessible to all—no entry barriers. Thus, Q3 NFTs aren’t tickets but similar to Founder’s Sailcloth NFTs.

Evaluation: Art style closely follows Web2 games, but TBH, Web3 users prioritize APY—games are本质上 massive Defi. But as a GameFi project team, a rare advantage is designing the economy as a single-blind model—users uncertain of returns, paired with appropriately long-cycle systems and in-app purchases, extending game lifespan beyond imagination. Additionally, GameFi returns calculated in NFT terms can fabricate inflated market caps via lower turnover rates, attracting users to grind for profits—though harder to manipulate than USD/token-denominated systems. In short, if you’re a Bera enthusiast, consider joining—the odds are favorable, but estimate secondary market turnover rates and hedge via pre-market trades or OTC when necessary.

The above project introductions are relatively introductory, insufficient for ecosystem-level insights. Thus, I conducted brief research on all projects in the ecosystem map—ranging from one hour to 5–10 minutes. Below are my summaries:

Project native strength high, GTM strategies diverse: Most projects on Bera aren’t multi-chain compatible but natively built on Berachain, with native-to-non-native ratios ~10:1 (note:不排除 certain products originate from the same team). Contrary to intuition, not all non-NFT-native project teams favor NFT issuance for cold starts—most still follow pure-play approaches.

Complex economic flywheels, yet consistent core principles: Most Berachain-deployed projects leverage Infrared for economic flywheels, with some building additional VE(3,3) layers atop BEX, e.g., Berodrome. Core idea unchanged—every incentive is token-denominated. Users only need to grasp the project team’s fundamentals and market-making ability behind the token. Project flywheels should be coupled, but a single project’s collapse doesn’t necessarily break the entire flywheel effect—ensuring surrendered tokens yield excess returns keeps users supportive, allowing other projects to fill gaps.

Highly funded projects mostly issue NFTs: Among the top 10 highest-funded project teams, 7 are Community/NFT/GameFi, all issuing NFTs.

Fragmented community热度, yet active cross-referrals: Native Berachain ecosystem project teams average 1,000–2,000+ Twitter viewers, with some exhibiting underestimated viewership (follower/view count ratio < ecosystem average). E.g., Infrared has 7,000+ followers, averaging 10,000+ views per post. Many native ecosystem project teams collaborate diversely—participating in economic flywheels, surrendering tokens, etc.

Projects still innovating, but not disruptive narratives: In NFT, some teams prioritize BD capability over utility hype, e.g., HoneyComb, Booga Beras. In DeFi, some deepen liquidity solutions (e.g., Aori), others optimize past VE(3,3) models (e.g., Beradrome). In Social, some use peer-to-peer methods to audit ecosystem quality (e.g., Standard & Paws). In Launchpad, some experiment with token rights splitting and LP sharing for Fair Launch (e.g., Ramen, Honeypot). In Ponzi/Meme, some attempt floor price pools for “sustainable economics” (e.g., Goldilocks).

Where should Berachain’s breakout points lie, and which ecosystems show potential?

I believe readers now have a comprehensive grasp of Berachain, making two potential paths imaginable: LSDFI and tokenized NFT assets.

First, LSDFI refers to all economic flywheels related to Infrared—essentially Berachain’s economic moat. From earlier observations, many projects already collaborate with Infrared Finance’s ecosystem, delegating LPs to Infrared for excess returns. Thus, the ecosystem will likely mirror Ethereum’s path—e.g., stablecoins or interest-rate swaps using siBGT as collateral. But unlike Ethereum’s staking threshold, Berachain’s threshold lies in liquidity size. Thus, LSD protocols like Puffer Finance that lower staker entry barriers might replicate differently on Berachain—amplifying liquidity via leveraged lending, etc.

Second, tokenized NFT assets aren’t necessarily tied to a specific protocol like ERC404, but encompass all potential NFT assets and NFT fractionalization solutions. This fits because Berachain natively offers liquidity bribes—both the Achilles’ heel for every token-issuing ecosystem project and Berachain’s own rear guard. NFT project teams can attract new buyers via tokenization (rebasing thinking—split scheme), simultaneously participating in other ecosystem flywheels—e.g., Infrared Finance mentioned earlier.

Readers can explore these two directions independently. During my research, I discovered individual cases, but since this article serves analysis—not investment advice—I won’t mention them here.

Epilogue

Later, discussing Berachain with friends, we revisited whether projects can succeed.

One said: “Berachain has strong community support, current data looks good, many NFTs sold—should be able to pull through.”

Another countered: “Berachain is just a massive DeFi—once this narrative ends, it’ll quickly collapse. Without fundamental ecosystem-level narratives, it can’t succeed.”

I’ve always believed “successful project” definitions are complex

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News