Open Source Scythe Open Rug 24 - Kaito's Three-Disc Model Analysis

TechFlow Selected TechFlow Selected

Open Source Scythe Open Rug 24 - Kaito's Three-Disc Model Analysis

Kaito is essentially a veToken-model-based dividend and pyramid scheme similar to Curve/Berachain/TABI.

Author: Patrick Bush, VanEck

Before talking about Kaito, let's answer a few questions first

We all know the most important thing in launching a project is the audience. So what’s the key to capturing that audience?

1. Storytelling. Endorsements, TVL stacking, technical CX, systems, and mechanisms—all are ultimately just stories told to the audience, creating an illogical, conditioned reflex path in their minds—e.g., "Jack Ma’s on board? Buy!" or "Qin Shi Huang launched it? Send money!"

If you still don’t get it, Google “Pavlov’s dog.”

2. Community leaders, or propagation nodes. Collective unconsciousness is like a virus—the role of community leaders is to spread this “misconception” to as many people as possible.

So how do you capture these “community leaders”?

Traditional CX tactics rely on equity shares + subsidies: shareholders hold market share and drive explosive sales through operational centers using subsidies and entertainment budgets. In crypto, projects typically use KOL procurement models.

The common flaws of both approaches:

-

Money is spent before any real effect is seen

-

Dissemination nodes are extremely fragmented; negotiation and onboarding take high time costs and depend heavily on intermediaries

-

Too many farmers (users farming rewards), but very few with influence who can sustainably propagate the message

Hence, the ultimate form of traditional models becomes something like the Myanmar-North industrial parks—controlling human trafficking victims to minimize cost and maximize output.

To buy off dissemination nodes, Lord Huang’s method works best: invite them to dinner, behead them, then recruit the survivors as dogs.

This is exactly what KAITO does—an “infrastructure” designed to mass-buy influence nodes and reduce launch costs.

First, decapitation and turning people into dogs

In my view, the only part of KAITO AI that actually involves AI is “decapitation” and “turning people into dogs.”

What does “decapitation” mean? It means seizing life-and-death power—taking control of pricing authority.

Previously, how much a KOL charges was a black box—based on self-promotion, peer hype, or agency endorsement.

Now, I use AI to quantify KOL value across multiple dimensions: number of smart followers, whether they’re inner circle, which projects/narratives their tweets cover, bullish or bearish tone, hardcore or fluff content, engagement levels?

Then add a global ranking system on top.

Knowing KOLs better than agencies do, this immediately seizes pricing power. It intimidates KOLs into striving for higher scores and rankings, even altering their writing styles and outputs according to Kaito’s scoring criteria. This is another form of “Pavlov’s dog”—after all, millions depend on it for income.

The rest will be poured into the three-tier scheme.

If you want to be a good dog, or at least an informed one, please read on carefully to understand how Kaito, as next-gen Ponzi infrastructure, operates.

Kaito’s Three-Tier Analysis – As a Dividend Scheme

Kaito is essentially a veToken model incorporating elements of dividend distribution and mutual aid.

First, it functions as a dividend scheme. Point-based schemes are almost always dividend schemes. Key considerations here include sunk cost, payout ratio (withdrawable returns), and external liquidity.

Why would Kaito adopt a dividend model?

The goal of such models is usually to build up significant asset or traffic accumulation, enabling exit liquidity—examples include Plustoken’s direct rug pull, Filecoin selling mining machines, or Pi monetizing ads.

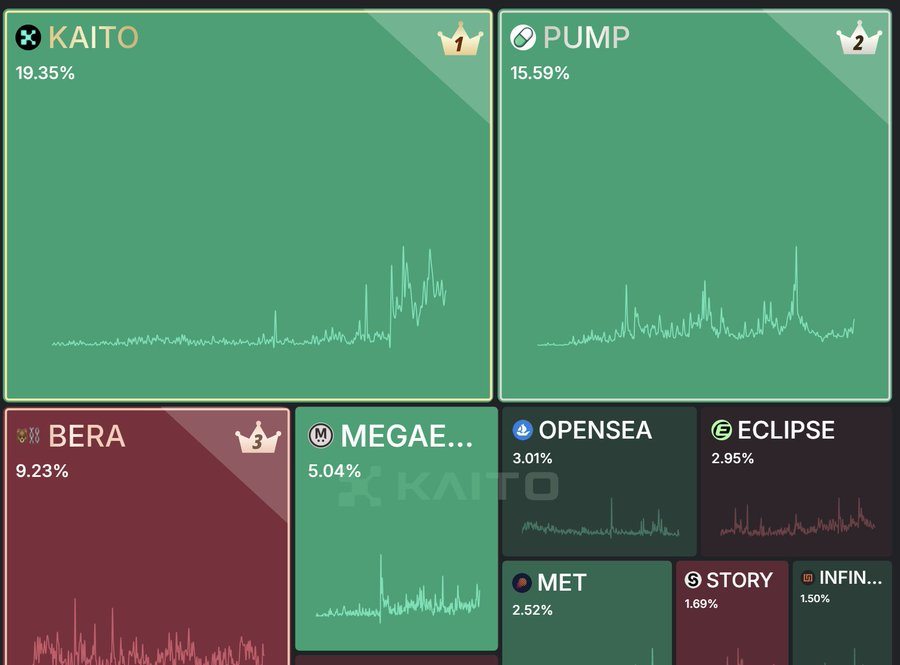

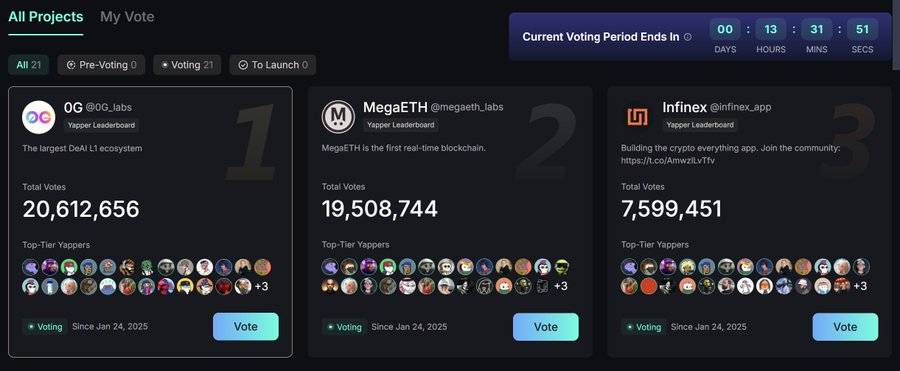

Kaito uses dividend points to “appeal to profit,” attracting the largest CT KOL market globally. Mindshare via dividends becomes a de facto “operational index,” replacing Galxe as a must-use tool for projects.

Traffic makes Kaito’s listing valuable; value enables bribery, using project funds to provide exit liquidity for the otherwise meaningless Yap points.

Kaito Sunk Cost

Kaito adopts a Pi-coin-style sunk cost mechanism, where users invest time and effort rather than money to earn points.

Fixed Sunk Cost: The number of smart followers acts like Kaito’s mining machine cost—it's hard to increase quickly and represents quantified personal social capital.

Incremental Sunk Cost: While posting content earns points without incremental cost, Connect introduces external liquidity via project bribes that price the points. Periodic locking controls the supply of new points per voting round, effectively establishing a floor price.

Black Box & Training KOLs with AI

Unlike previous transparent, linear-rule dividend schemes, Kaito’s control over sunk cost relies on two “AI-powered” black boxes:

• Definition of who counts as a “smart follower” → akin to “mining hardware cost”

• Evaluation standards for engagement volume and content quality → prevents mass exploitation by bot farms

The black box may seem unfair, but history shows most people don’t care about fairness—they care about whether they can gain an advantage. As long as kept within reasonable bounds, this mechanism effectively prevents farming and inflation.

Meanwhile, the opaque point-distribution mechanism subtly guides KOLs to change their content and delivery methods, indirectly controlling public discourse.

Kaito also cleverly frames “sunk cost” as “brand influence building,” similar to StepN packaging “playing a scheme” as “fitness + health.” By aligning the scheme’s goals with individual aspirations, users come to believe: “Even without Kaito, I should still Yap.”

This psychological conditioning doubles the impact of sunk cost, making user exit harder. Technology disciplines human behavior—the best way to make humans accept AI is to educate them to fit AI’s interface standards. Under AI’s framework, human actions become predictable.

Payout Ratio & External Liquidity

In terms of funding alone, thanks to Kaito Connect (to be discussed below), Kaito’s dividend payouts aren't solely dependent on future token issuance expectations. Instead, external liquidity comes from OTC deals and airdrops generated by project listings.

Projects need KAITO listings, so they bribe—and thus become external liquidity providers while simultaneously setting the price for Yap points.

Theoretically, Kaito could operate a no-payout dividend scheme—we only care about how much one Yap is worth, regardless of whether it's priced via project bribes or token airdrops.

We might even boldly speculate that $KAITO won’t issue airdrops based on Yap, or at least won’t follow a 1:1 mapping. They may intentionally separate Yap and $KAITO tracks, preventing future coin prices from affecting KOL participation or project spending. Yap could become rarer than $KAITO, since it serves as currency to buy mindshare across the network—and buying total influence doesn’t require 700k Yap holders.

The $KAITO airdrop logic deserves its own dedicated analysis later.

Kaito’s Three-Tier Analysis – As a Mutual Aid Scheme

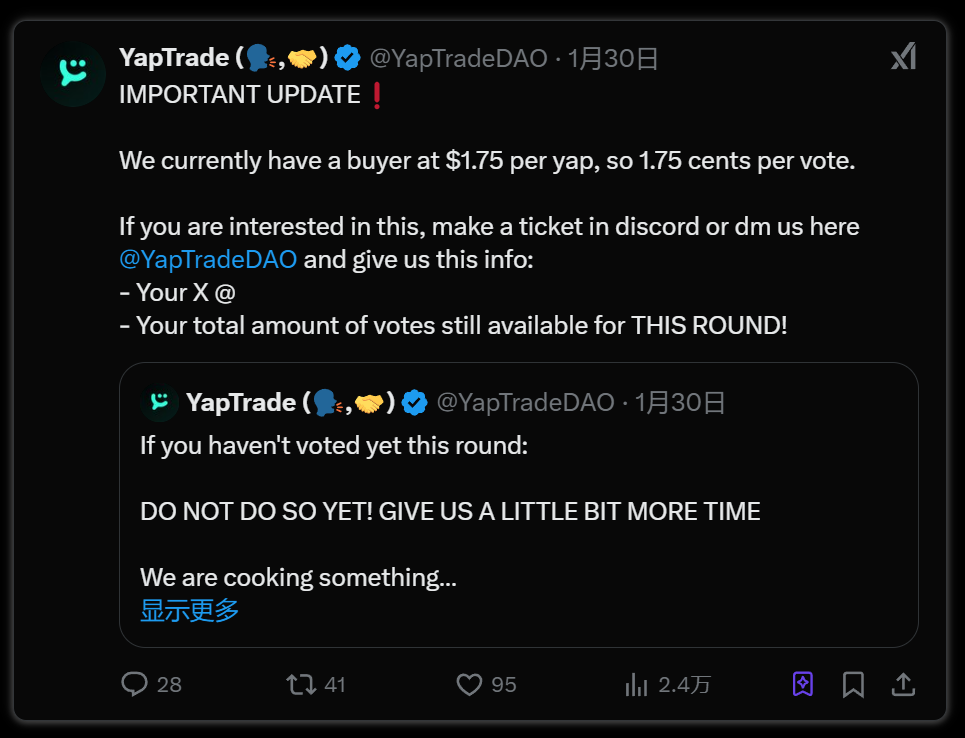

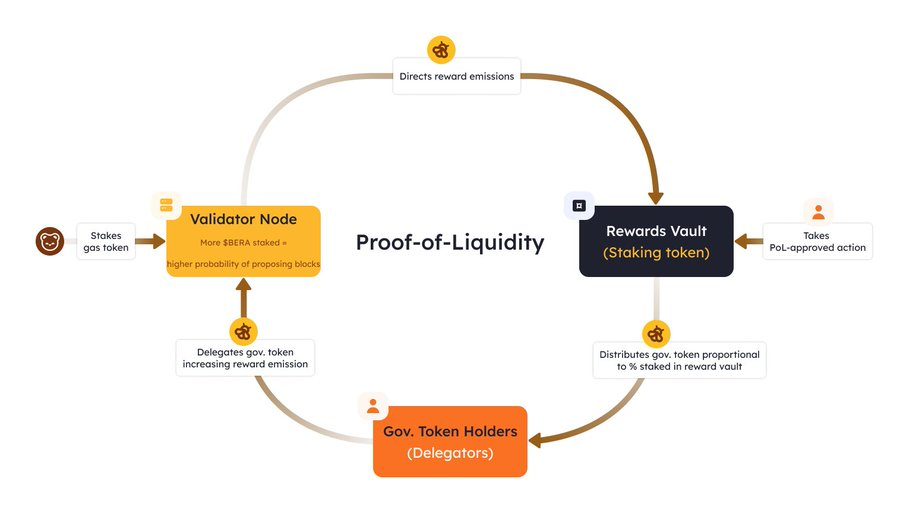

As mentioned earlier, KAITO’s Yap points are artificially created assets used to bribe global KOLs. Their liquidity and valuation are provided by projects through Connect-driven bribes. The veTOKEN bribe model itself constitutes a mutual aid scheme.

Traditional veToken Mutual Aid Model

How veToken mutual aid schemes work:

• Projects offer bribes to LPs in exchange for veToken voting rights (LPs must lock tokens).

• Projects use votes to obtain yield from main protocols (e.g., CRV, BERA, TABI).

• Project profit = yield from main protocol – bribe payout provided.

Breakdown Logic

• Successful bribe payouts (debt) are determined by the market, not controllable by projects.

• If expected bribes > project-offered bribes + obtainable main protocol yield, systemic debt exceeds liquidatable assets, leading to collapse.

This fits the three-tier theory’s mutual aid collapse model:

Systemic Debt > Liquidatable Assets + External Liquidity → Collapse

Kaito’s Mutual Aid Model:

- Projects (pre-TGE) offer bribes to obtain KOL votes (KOL votes locked for 7 days)

- KAITO listing eligibility functions as PoL (Proof of Liquidity) yield

- Main project return =投放 ROI – bribe payout

投放 ROI ≈ mindshare ROI generated by Kaito listing—not only from buyer traffic, but potentially also from KOL influence on exchange listing decisions.

This model cannot grow infinitely:

Twitter as an advertising channel has inherent ROI limits:

- Even if every KOL shills daily, market purchasing power and ROI remain finite.

- This implies bribe payouts won’t rise indefinitely—they’ll stabilize at equilibrium between market demand and ROI.

Moreover, 投放 ROI correlates with secondary market performance of selected projects:

- If a project listed via Kaito crashes or rugs on the secondary market:

-

Exchanges and retail investors lose trust in Kaito listings.

-

投放 ROI drops, reducing bribe payouts → increasing risk of Kaito mutual aid scheme collapse.

Kaito cannot allow systemic debt (bribe payouts) to rise endlessly nor crash suddenly—it needs a delicate balance. If this debt is measured in Yap units, either Yap must not be tokenized/freely tradable, or Yap must have anti-inflation mechanisms proving incremental scarcity.

Kaito’s Current Solutions

- Ongoing Launchpad releases: Maintain market freshness, prevent any single project from dominating attention.

- Yap vote lock-up for 7 days: Sets a 7-day opportunity cost, acting as a liquidation threshold for the mutual aid scheme.

Benefits:

✅ Prevents excessive FOMO around a single project, avoiding overheating backlash.

✅ Faster velocity, encouraging KOLs to act swiftly without hesitation, forming a short-term efficient pump logic.

Drawbacks:

❌ Hard to cultivate long-term loyal community KOLs; participants lean toward short-term arbitrage.

❌ More red-pilled individuals like me will emerge; KOLs increasingly favor short-term gains over long-term community building.

Kaito’s Three-Tier Analysis – Possibility as a Split Scheme

As previously stated: Either Yap cannot be tokenized/freely circulated and remains merely a KOL metric, or if it is monetized, it must include anti-inflation mechanisms. Assuming the former, and treating $KAITO as a separate token independent of Yap pricing, this token may well feature a split-scheme mechanism.

Current split-scheme strategies are already quite clear: one must pump the parent coin while issuing new assets priced against it.

Connect itself is essentially a launchpad. Its current popularity isn’t definitive success, but feasibility has been at least validated.

Recall Hyperliquid’s earlier auction-based listing mechanism. Due to slow splits and rapidly rising systemic debt in its mutual aid bribery model, Hyper eventually fizzled out—but it did prove viable as a PUMP competitor.

Could it be possible for projects to list via Yap voting, use $KAITO as whitelist entry tickets, or even quote pools in $KAITO?

Summary

Kaito is fundamentally a veToken-based dividend + mutual aid scheme, similar to Curve/Berachain/TABI models. Its core asset is Yap points, not the future $KAITO token. Kaito leverages AI algorithms to quantify KOL influence and seize pricing power over dissemination nodes, forcing KOLs into its dividend scheme. Meanwhile, the opaque point system influences KOL behavior and public opinion while controlling point inflation—a systematic “Pavlovian dog training” for KOLs.

Thanks to traffic monopoly, Kaito uses the Connect bribery mechanism to make external projects compete for listing rights, thereby establishing pricing and liquidity for Yap points—not relying purely on $KAITO airdrops. This is a clever design for a no-payout dividend scheme.

However, Kaito depends on Twitter ad campaign ROI, which has limited upside, resulting in:

-

Systemic debt (market bribery expectations) cannot grow infinitely, meaning Yap points must either have anti-inflation mechanisms or abandon monetization and free circulation altogether

-

If a high-profile selected project collapses on the secondary market, the entire scheme faces double jeopardy: falling ROI and rising bribe costs

To mitigate this, Kaito implements a 7-day lock-up + continuous new launches mechanism, reducing market expectations around individual projects and increasing Yap vote turnover rate—preventing systemic risks caused by accumulating opportunity costs.

Given that Yap OTC trading has already emerged, closely monitoring indicators related to these collapse models can effectively guide Yabao when to cash out. It's nice to be with you on this ride, but I never forget what is my ultimate goal.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News