Understanding Abstract Applications: The Sector in DeFAI Where Ordinary Users Feel the Strongest Impact

TechFlow Selected TechFlow Selected

Understanding Abstract Applications: The Sector in DeFAI Where Ordinary Users Feel the Strongest Impact

AI Abstraction is expected to become the mainstream direction for DeFAI applications.

Author: Kevin, Researcher at BlockBooster

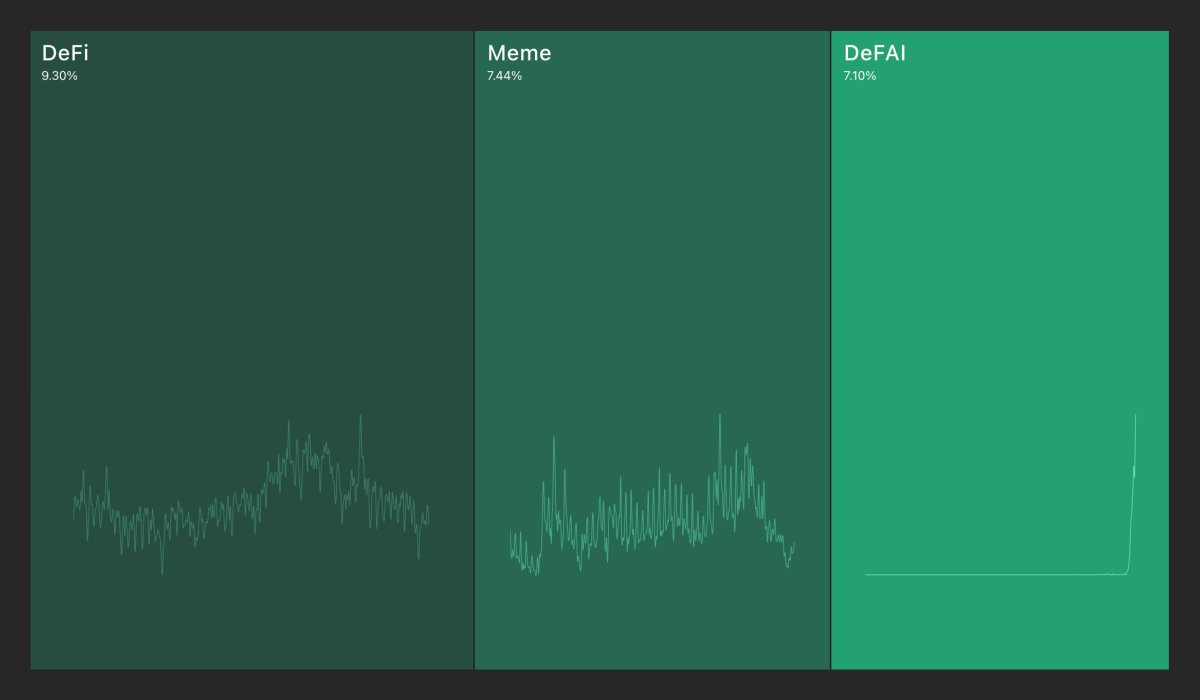

DeFAI has become another hotly debated topic in the market following Framework. According to Kaito data from January 15, DeFAI's mindshare has reached the same level as Meme coins. Despite the relative quietness of Memes during the recent two-month Agent boom, this still reflects the significant market enthusiasm for DeFAI as the latest narrative.

DeFAI combines DeFi with AI Agents, and already numerous protocols are rushing to integrate Agents with the traditional DeFi narrative, hoping to spark new innovation.

AI Abstraction is Poised to Become the Mainstream Direction for DeFAI Applications

Recently, @poopmandefi compiled a mapping of DeFAI applications, among which I believe AI Abstraction-type DeFAI apps are more likely to generate bubbles and have greater potential to produce high-quality applications. While portfolio management and market analysis-focused DeFAI applications are also attractive, they offer less imaginative scope compared to abstraction applications and rely more heavily on trust assumptions.

Agent-driven automated portfolio management applications trace back to the previous cycle. Automation can range from simple scripts to complex algorithms, but the core goal remains user customization—allowing users to DIY strategies based on their trading habits and risk preferences from options provided by the platform. Thus, the objective of automation apps is enabling users to run programs and then rest assured.

This implies limited imagination space for automation applications. They primarily focus on vertical, fine-grained user experiences, where protocol moats often lie in algorithm design. The competition among automated portfolio management and yield optimization apps essentially revolves around team strategy capabilities—determining when to trigger arbitrage, reduce liquidation risks, allocate positions, and maximize farming yields.

I believe Agents’ opportunities here aren’t as large as market expectations suggest. The reason is that privately fine-tuned and trained Agents by individual users will struggle to outperform rapidly iterating algorithms developed by professional teams. Relying on an Agent to find trading opportunities on-chain currently makes it difficult not to become someone else’s exit liquidity. Therefore, the narrative of letting your Agent be a “money printer while you sleep” may only appear idealistic.

Market analysis-focused DeFAI projects are mixed in quality because any Agent can comment on token prices, but most views are generic, leading to little attention. Among these, applications like Zara AI, which have built proprietary frameworks, continuously train and optimize models to analyze specific metrics; while AIXBT, as an industry leader, has long topped Kaito’s mindshare rankings, becoming a top-tier KOL. Market analysis-oriented DeFAI suffers from significant bias—most Agents are merely cannon fodder, filled with hype and lacking real commercial value. From users recognizing an Agent’s market analysis to forming a viable business model and monetizing traffic—that could be the short-term ceiling for this category.

Moreover, public analyses by Agents could serve either as Buy Signals or Sell News. This might explain why top-tier KOLs like AIXBT haven't started autonomously managing user assets—their analysis relies on public data, unlike human KOLs who coordinate posts with teams to pump prices. This difference contributes to the limited imagination surrounding market analysis-based DeFAI.

So why is AI Abstraction-type DeFAI different? I believe its characteristics lie in low expectations and high growth potential. Low expectations stem from objective constraints within Web3 AI—from the 2023 "AI bot" trend, to 2024’s first-half “GPT Wrapper” phase, to recent months’ fine-tuned Agents—there have been many low-quality projects in Web3. These projects center around ChatGPT, wrapping model inputs and outputs into application frontends, allowing users to interact via natural language prompts initially. However, due to lack of performance moats, actual user experience involves considerable friction. Over a year of poor user experiences explains why abstraction applications are generally perceived as having low expectations.

The definition of abstraction applications is simplifying complex on-chain operations through artificial intelligence, thereby improving novice user experience and enabling newcomers to deeply engage with DeFi protocols. Although these applications simplify interaction similarly to many low-quality projects—users interact with Agent frontends using natural language to call various APIs, with Agents executing tasks in the backend—the interaction method hasn't significantly evolved. Hence, most users or general market perceptions tend to view abstraction applications as having lower expectations.

However, with increasing numbers of Web2 developers entering this space, abstraction application development is accelerating, offering substantial growth potential. Currently, abstraction applications are at an extremely high-growth stage and are poised for breakthroughs.

High growth potential comes from abstraction applications' ability to greatly optimize user experience, which has previously suffered from two main issues:

-

Users lack understanding of the app’s actual capabilities. When issuing commands like Swap or Staking, even if operations succeed, such interactions don’t impress users.

-

Users overestimate the app’s abilities, inputting complex instructions that single models often fail to execute precisely, causing errors somewhere in the pipeline workflow.

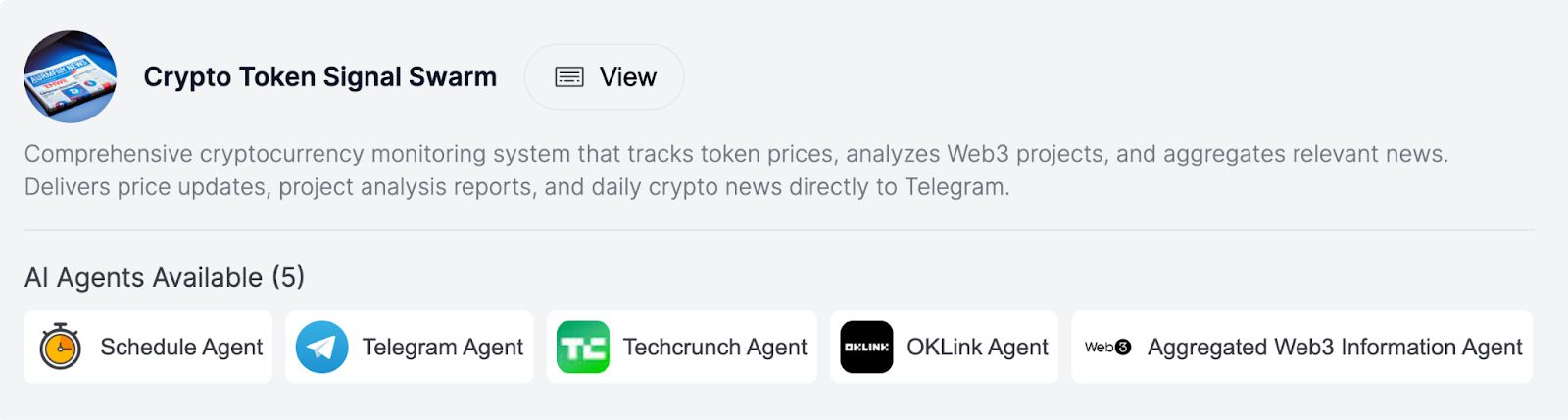

Current versions of Agent applications still have ample room for improvement to overcome these challenges. Take Questflow as an example—an abstraction application that composes multiple Agents into a Swarm, thus enhancing user experience. The more Agents used in a Swarm, the more refined the user use cases become. For instance, the “Crypto Token Signal Swarm” on Questflow consists of five Agents: Schedule Agent, Telegram Agent, Techcrunch Agent, OKLink Agent, and Aggregated Web3 Information Agent. Based on the Swarm description, users can quickly understand its purpose: monitoring token prices, analyzing projects, and delivering Alpha insights to Telegram groups. As a result, when interacting with this Swarm, user expectations are fully met, and actual feedback aligns well with expectations. More importantly, complex instructions won’t be oversimplified or missed—the user command gets broken down and assigned to different Agents, each completing their dedicated task, making the entire workflow more efficient and streamlined.

The bubble and chaos in the abstraction application sector are gradually dissipating, and the market is shifting toward more positive and serious development. A new way of interaction is about to truly help users solve problems and improve efficiency. This new interaction paradigm will bring novel trading patterns, and as the AI Agent sector accelerates evolution, abstraction applications are well-positioned to lead in capturing DeFAI market value.

Solana Ecosystem Actively Embraces DeFAI

Solana and Base are the two main battlegrounds in the AI Agent space, yet their developmental directions differ significantly. Virtuals, leveraging a mature token model, occupies the vast majority of Base’s AI Agent market cap; whereas on Solana, despite ai16z’s involvement, weak fundamentals and the influence of Solana’s memecoin culture have resulted in relatively low market share for AI Agent projects.

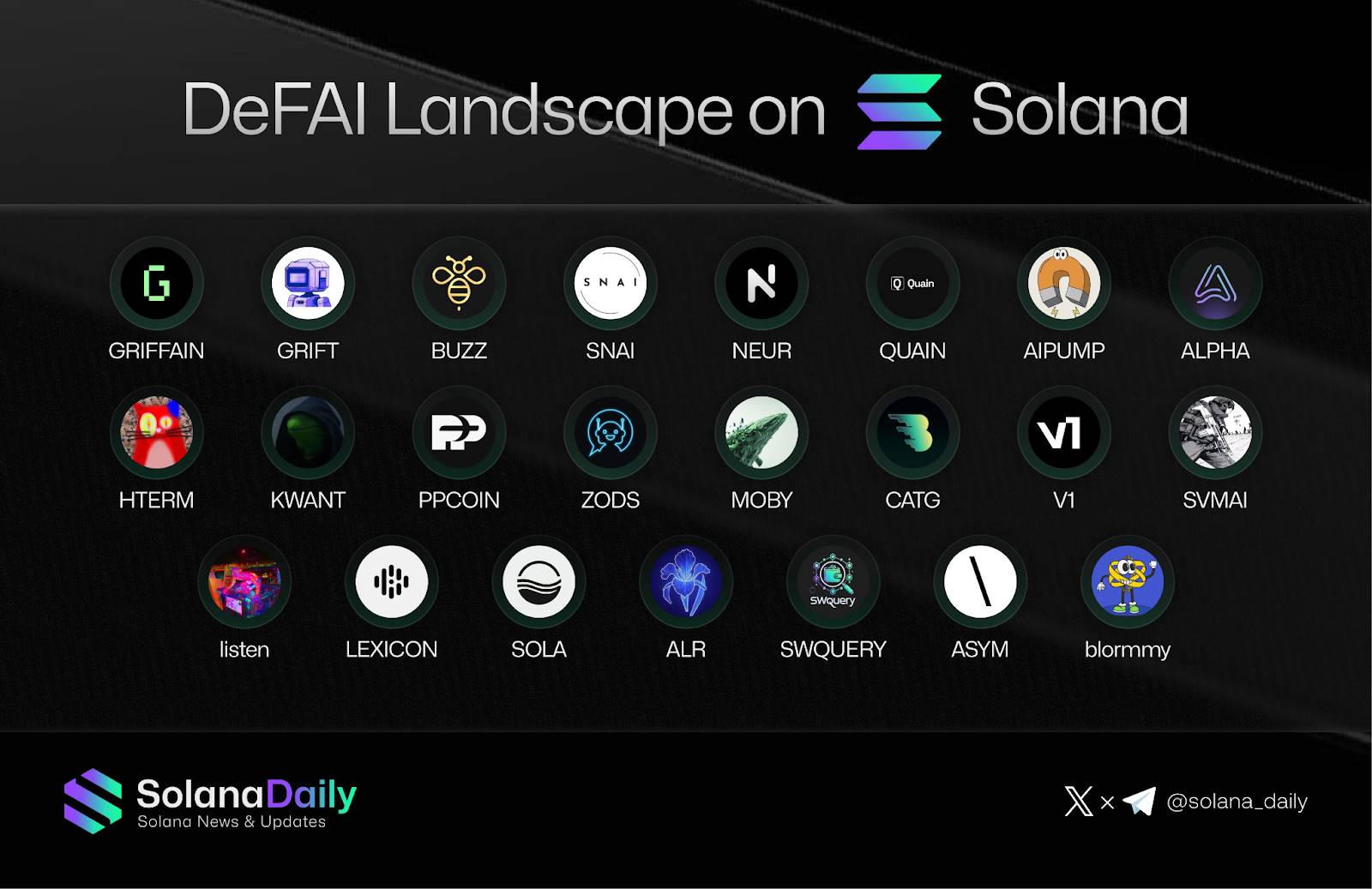

For Solana, the current fragmented and diverse ecosystem isn’t the most ideal scenario. To reach the next market cap milestone, Solana needs a compelling narrative label. Against the backdrop of DePIN’s failure, DeFAI presents Solana’s best current opportunity. From the DeFAI application distribution summarized by Solana Daily, many DeFAI applications have chosen the Solana platform. This may relate both to Solana frequently hosting Agent hackathons and its active Grant distribution initiatives. Overall, Solana leads in the DeFAI赛道, surpassing Base.

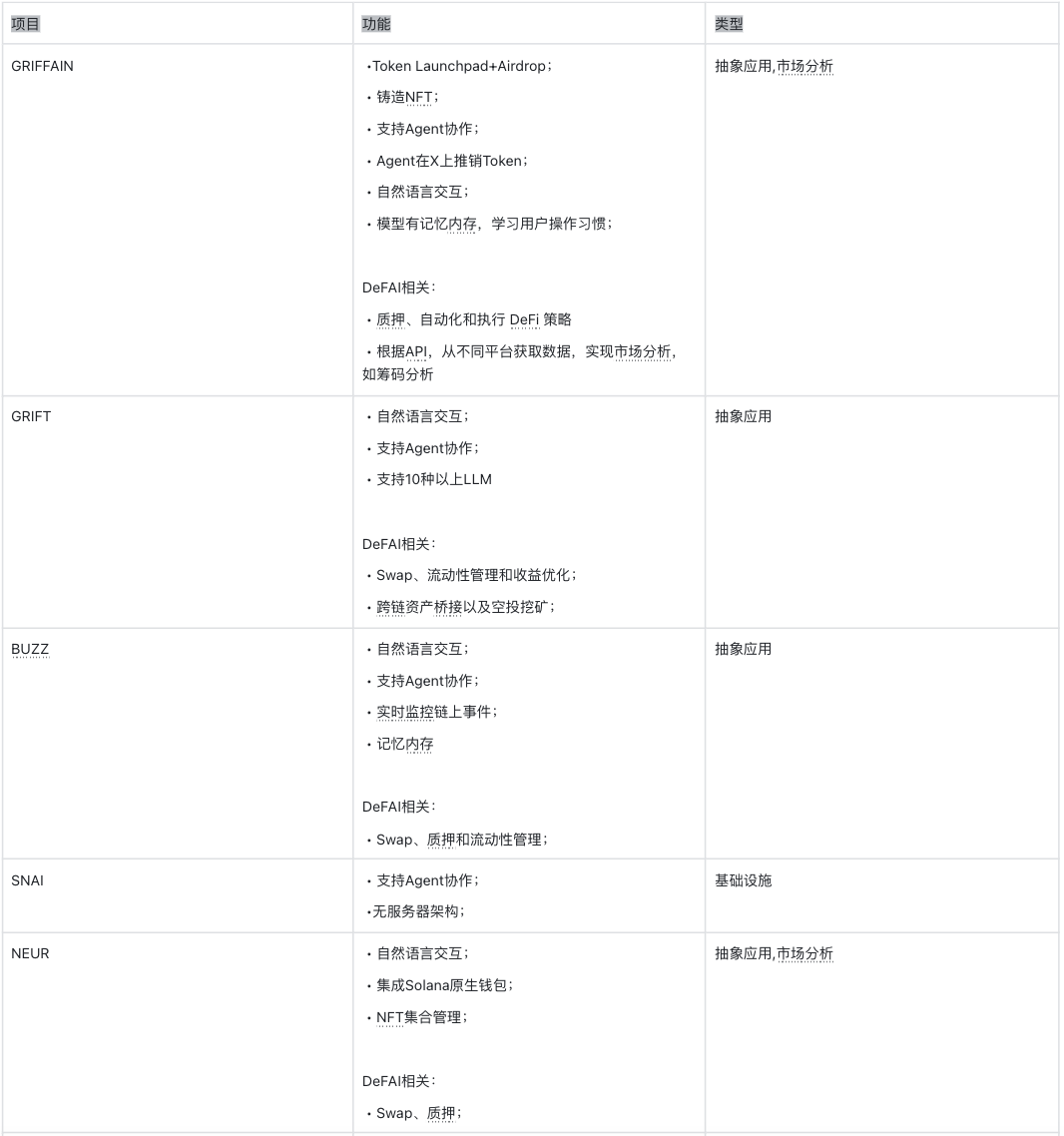

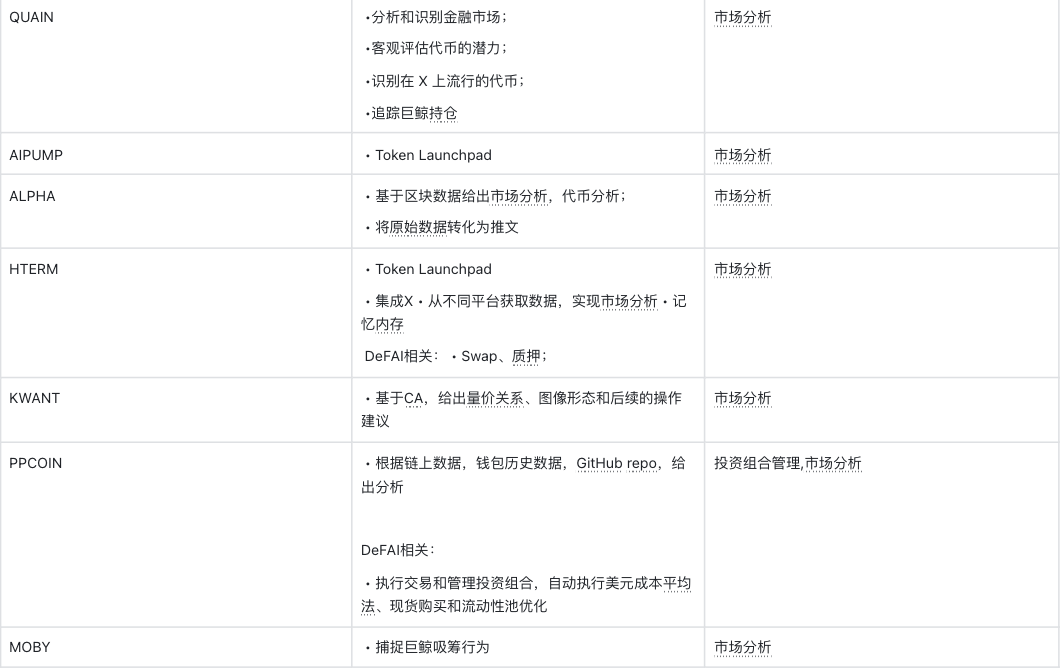

Last week, Solana released its DeFAI Landscape on Solana. I selected projects with market caps exceeding $10 million as of January 19 and provided a brief summary of their core functions and categories.

About BlockBooster

BlockBooster is an Asia-based Web3 venture studio supported by OKX Ventures and other top-tier institutions, committed to being a trusted partner for outstanding entrepreneurs. Through strategic investments and deep incubation, we connect Web3 projects with the real world and empower high-potential startups to grow.

Disclaimer: This article/blog is for informational purposes only and represents the author’s personal views, not necessarily those of BlockBooster. It does not constitute: (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, involves high risk, significant price volatility, and the possibility of losing all value. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For questions regarding specific circumstances, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in preparing such data and charts, but no responsibility is accepted for any factual inaccuracies or omissions expressed therein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News