Trump's Return: Stablecoins or Bitcoin—Which Can Solve the U.S. Debt Crisis?

TechFlow Selected TechFlow Selected

Trump's Return: Stablecoins or Bitcoin—Which Can Solve the U.S. Debt Crisis?

In the foreseeable future, we will see a larger scale of U.S. Treasury bonds being tokenized, and more projects based on tokenized U.S. Treasury bonds will emerge in the DeFi ecosystem, gaining favor from users and the market, gradually transforming on-chain wealth management and investment methods.

Authors: HedyBi, JasonJiang|OKG Research

Introduction

Trump's re-election has elevated the intertwining of politics and economics to unprecedented levels. This "Trump phenomenon" is not merely a reflection of his leadership style but symbolizes a comprehensive restructuring of economic interests and political power. In economic terms, this complex structural transformation is known as "political economy intertwining." As the world’s largest economy and issuer of the global reserve currency, every policy shift in the United States serves as a benchmark for global capital flows. Looking ahead to 2025, with the Trump administration embracing the crypto sector, the ripple effects of "Trumponomics" will rapidly extend into the on-chain world. The cryptocurrency market is swiftly transitioning from a marginal innovation to one of the key markets in global finance.

OKG Research launches a special series titled “Trumponomics,” offering an in-depth analysis of the core logic and future trends of this transformation. The first installment, *Trump’s Re-Election: Bitcoin, Oil, and Gold in the New Era of Economic Policy*, focuses on Bitcoin’s impact on the international financial landscape. This article shifts focus to U.S. Treasury bonds—the cornerstone of traditional finance—and examines how blockchain technology and crypto-native tools can further strengthen and expand the dollar’s dominance in the global financial system.

Coinbase CEO Brian Armstrong recently stated during an interview at the World Economic Forum in Davos, Switzerland, that upcoming U.S. stablecoin legislation may require issuers to fully back dollar-denominated stablecoins with U.S. Treasuries. While we believe that unless over-collateralization is mandated, a strict 100% Treasury requirement is unlikely due to the utility of cash reserves, Armstrong’s comment still reflects the crypto market’s strong demand for and preference toward U.S. Treasuries.

The growth trajectory of the U.S. Treasury market is staggering: it took over 200 years to reach the first $1 trillion, but only 40 years to grow from $1 trillion to $36 trillion. This explosive expansion traces back to 1971 when the Nixon administration abandoned the gold standard, decoupling the dollar from gold and ushering in an era of unconstrained money printing—leading to runaway debt accumulation in the United States.

As U.S. Treasuries rapidly “inflate,” OKG Research observes that investors who have long shouldered the $36 trillion Treasury market are gradually losing interest—on-chain markets may become the new engine to revitalize Treasury demand.

U.S. Treasuries Enter Hard Mode in 2025

In 2025, the U.S. Treasury market enters “hard mode,” with nearly $3 trillion in Treasury securities maturing, mostly short-term bills. Meanwhile, the U.S. Treasury’s net issuance reached $26.7 trillion in 2024, a year-on-year surge of 28.5%.

Against the backdrop of Trump’s return to the political stage, his inclination toward loose monetary policy could further amplify market uncertainty. During his previous term, Trump repeatedly pressured the Federal Reserve to cut interest rates, treating rate policy as a central tool to stimulate the economy and boost market confidence. If he succeeds in pushing for rate cuts, this could significantly depress Treasury yields, weaken their appeal to foreign investors, intensify downward pressure on the dollar, and thereby disrupt the global foreign exchange reserve allocation landscape. At the same time, Trump’s growth-centric policy agenda may drive increased government spending, widening fiscal deficits and placing additional strain on Treasury supply.

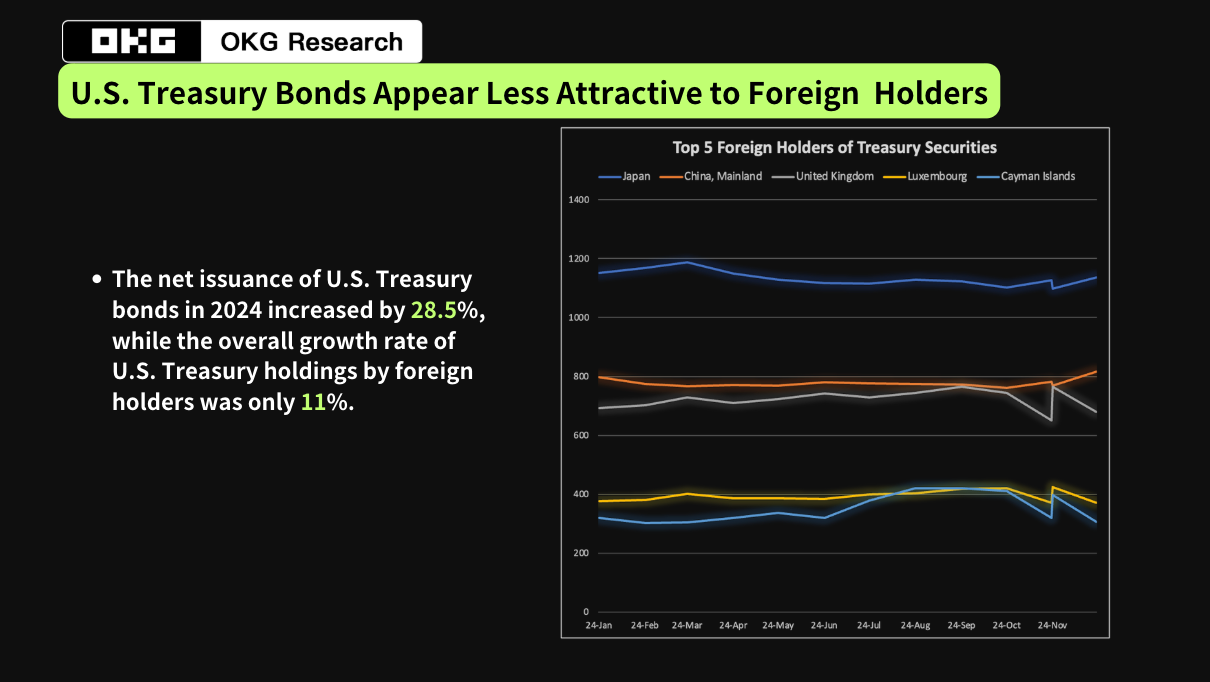

Yet on the demand side—especially among foreign central banks—the attractiveness of U.S. Treasuries appears to be waning. According to the latest data from OKG Research, foreign central banks increased their Treasury holdings by only 11%, falling short of the 28.5% growth in Treasury issuance. Among the top 20 Treasury-holding nations, only four—France (35.5%), Singapore (31%), Norway (40%), and Mexico (33%)—increased their holdings faster than the pace of 2024 Treasury issuance.

Moreover, some foreign central banks are actively reducing their Treasury positions. Since April 2022, China’s Treasury holdings have remained below $1 trillion, dropping another $2.6 billion to $772 billion by September 2024. In the same month, Japan reduced its holdings by $5.9 billion to $1.1233 trillion—still the largest foreign holder, yet again declining. As countries increasingly diversify their foreign reserves, global demand for U.S. Treasuries continues to weaken.

The combination of rapidly growing debt and weakening overseas demand places the Treasury market under dual pressure, making a rise in risk premiums almost inevitable. In the future, if markets fail to absorb these debts effectively, it could trigger broader financial volatility.

The crypto market may already be offering innovative solutions to absorb this debt more efficiently.

Stablecoins Could Become Top 10 Global Holders of U.S. Treasuries by 2025

As one of the world’s safest assets, U.S. Treasuries are playing an increasingly critical role in the crypto ecosystem. Stablecoins serve as the primary vehicle through which Treasuries penetrate the crypto market. Over 60% of on-chain activity now involves stablecoins, and most major stablecoins use U.S. Treasuries as their primary collateral.

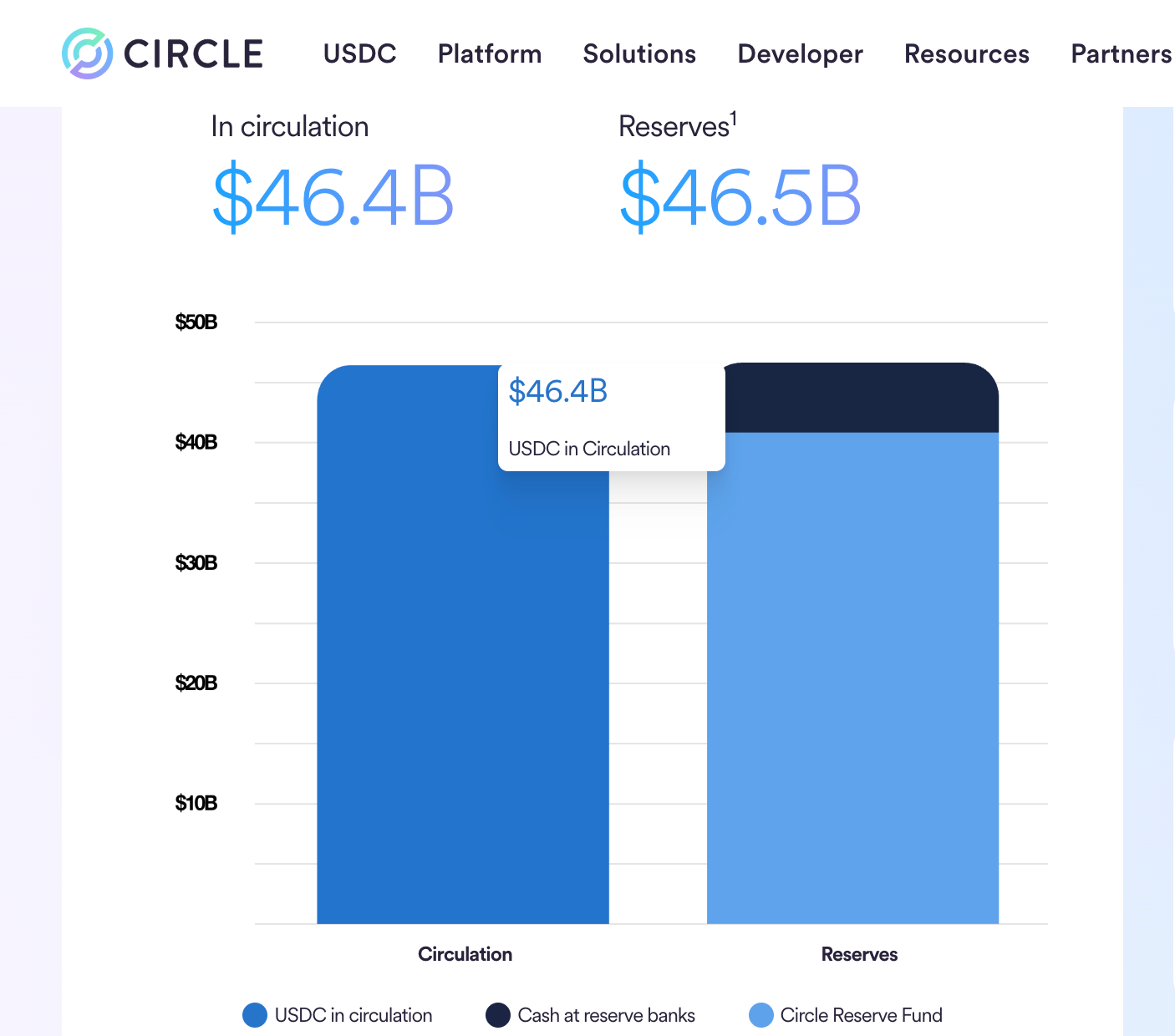

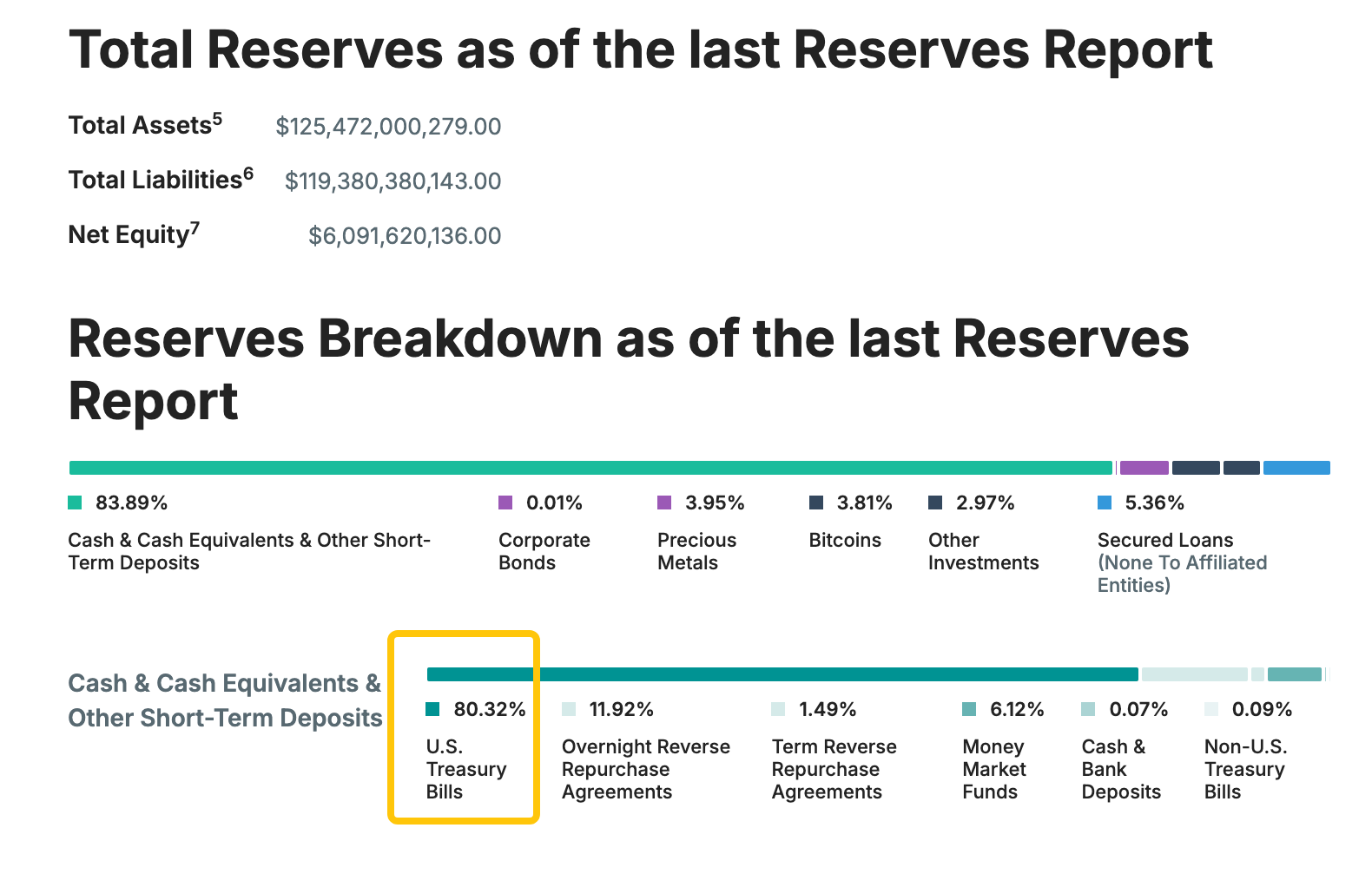

Take the two largest stablecoins globally—USDC and USDT—as examples. Their issuance mechanisms require 1:1 backing by high-quality assets, with U.S. Treasuries forming the bulk of this collateral. To date, USDC holds over $40 billion in Treasuries, while USDT’s Treasury-backed reserves exceed $100.7 billion. The existing scale of stablecoins alone has absorbed approximately 3% of the upcoming short-term Treasury maturities—an amount surpassing the holdings of both Germany and Mexico, ranking them 19th among foreign central bank holders.

Although the Trump administration might establish a strategic Bitcoin reserve, leveraging government investment to attract international capital and drive up Bitcoin prices—generating profits to alleviate debt burdens—this approach would only yield limited fiscal benefits. Even if Bitcoin reaches $200,000, giving it a total market cap exceeding $4 trillion, and the U.S. accumulates 1 million BTC starting today, the resulting gain would be around $100 billion.

In contrast to Bitcoin’s indirect debt mitigation, stablecoins like USDT and USDC are creating direct demand for U.S. Treasuries. On January 22, stablecoin market capitalization surpassed $210 billion, hitting a new all-time high. Driven by accelerating U.S. regulation and rising global adoption, OKG Research optimistically projects that stablecoin market cap will exceed $400 billion by 2025—generating over $100 billion in new Treasury demand—potentially elevating stablecoins to the ranks of the top 10 global holders of U.S. Treasuries.

If this trend continues, stablecoins could become the most important “invisible pillar” of the Treasury market, generating direct Treasury demand that exceeds the indirect returns from investing in Bitcoin. A senior investment strategist at Bitwise previously noted on social media that stablecoins’ holdings of U.S. Treasuries could soon reach 15%. A prior report from the U.S. Treasury Department also highlighted that sustained stablecoin growth will create structural demand for U.S. short-term Treasuries.

As Trump’s economic stimulus policies take effect, stablecoins—and the mix of cash and predominantly U.S. Treasuries backing them—will function as a new form of dollar expansion. Since the dollar is the global reserve currency, foreign central banks and institutions widely hold U.S. Treasuries. Issuing Treasuries allows the U.S. to effectively “export inflation” using its creditworthiness, indirectly making the world pay for its debt—a mechanism akin to “expanding the money supply.” This not only reinforces the dollar’s dominance but also poses challenges to other countries’ regulatory frameworks, particularly in taxation.

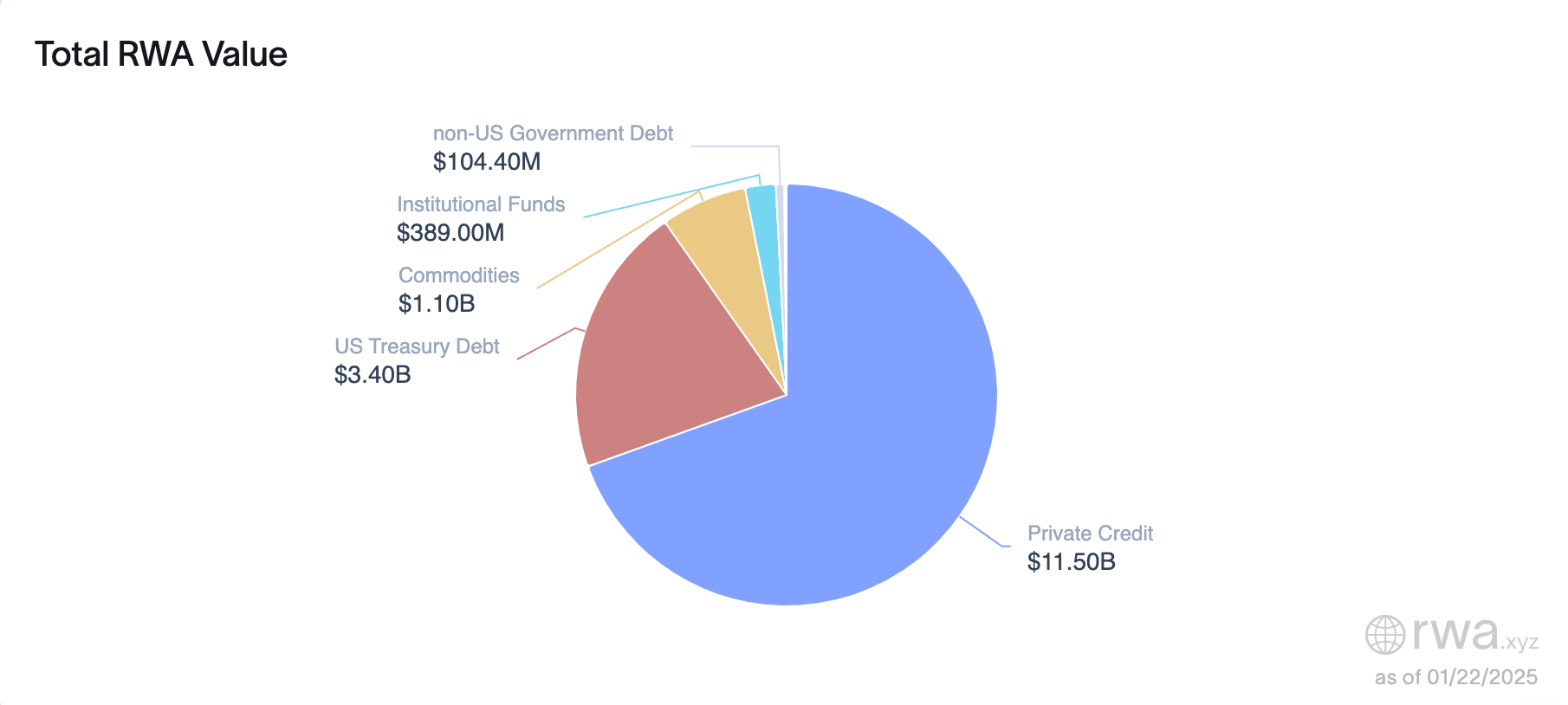

Mass-Scale Tokenization Brings Global Liquidity to U.S. Treasuries

Beyond serving as the preferred underlying asset for mainstream stablecoins, U.S. Treasuries are also among the most popular asset classes in the current wave of tokenization. According to RWA.xyz, the tokenized U.S. Treasury market was valued at $769 million at the beginning of 2024 and had grown to $3.4 billion by early 2025—a more than fourfold increase. This rapid growth not only highlights the potential of on-chain financial innovation but also underscores market recognition and demand for tokenized Treasuries.

Through tokenization, U.S. Treasuries are rapidly integrating into DeFi. Whether used as risk-free yield-generating assets on-chain or leveraged through staking and lending for derivative transactions, the DeFi ecosystem is becoming increasingly grounded in real-world fundamentals. These tokenized Treasuries not only provide more reliable underlying assets but also capture stable real-world returns, distributing them directly to on-chain investors. Ondo’s short-term U.S. Treasury fund (OUSG), for example, previously offered yields as high as 5.5%.

More importantly, bringing Treasuries on-chain offers familiar asset classes to traditional investors, helping attract institutional capital and accelerate the maturation and institutionalization of the DeFi ecosystem. Projects utilizing tokenized Treasuries are often seen as “low-risk innovations” and are thus more likely to obtain regulatory approval.

For U.S. Treasuries, tokenization provides a novel tool to alleviate debt pressures. It enables Treasuries to enter the on-chain world, facilitating seamless cross-border and cross-chain transactions, breaking down geographical barriers inherent in traditional finance. It also opens access to new buyer pools, enhancing the global liquidity and appeal of U.S. Treasuries. This emerging on-chain liquidity could position U.S. Treasuries as a core asset in global financial markets.

Given widespread expectations that the Fed may slow the pace of rate cuts in 2025 under a Trump administration, short-term Treasury yields have risen while risk appetite has declined—making safer assets more attractive. In the foreseeable future, we expect to see even larger-scale tokenization of U.S. Treasuries, with more DeFi projects built on tokenized Treasuries gaining user and market traction, gradually reshaping on-chain wealth management and investment paradigms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News