Foresight Ventures PayFi Report (Part 2): New Paradigm in the Sector – AI Payments, Micropayments, and Innovative Deposit/Withdrawal Solutions

TechFlow Selected TechFlow Selected

Foresight Ventures PayFi Report (Part 2): New Paradigm in the Sector – AI Payments, Micropayments, and Innovative Deposit/Withdrawal Solutions

PayFi innovatively solves the long-standing inefficiencies in traditional finance and also opens up vast market opportunities.

Author: Alice @Foresight Ventures

In our previous article, we analyzed the overall ecosystem landscape of the PayFi sector. This time, let's dive deeper into several highly promising new application scenarios: AI payments, consumer-facing micropayments, and innovative on/off-ramp solutions.

(1) AI Payments

We firmly believe that the convergence of AI and crypto payments holds immense market potential. AI-powered payments could disrupt multiple industries beyond traditional finance—such as data labeling, model training, and content creation. As AI agents become increasingly embedded in daily life, crypto payments will expand into mainstream sectors, enabling your AI assistant to autonomously order food delivery, purchase clothing and groceries, or book a ride for meetings.

Market Opportunities

-

Revenue streams for AI payment platforms: Transaction fees, subscription models, and micro-payment systems for various AI services all represent viable income channels.

-

Advantages of stablecoin settlements: Stablecoins enable 24/7 real-time cross-border transactions at significantly lower costs and faster speeds than traditional banking—making them ideal for AI-driven micropayments.

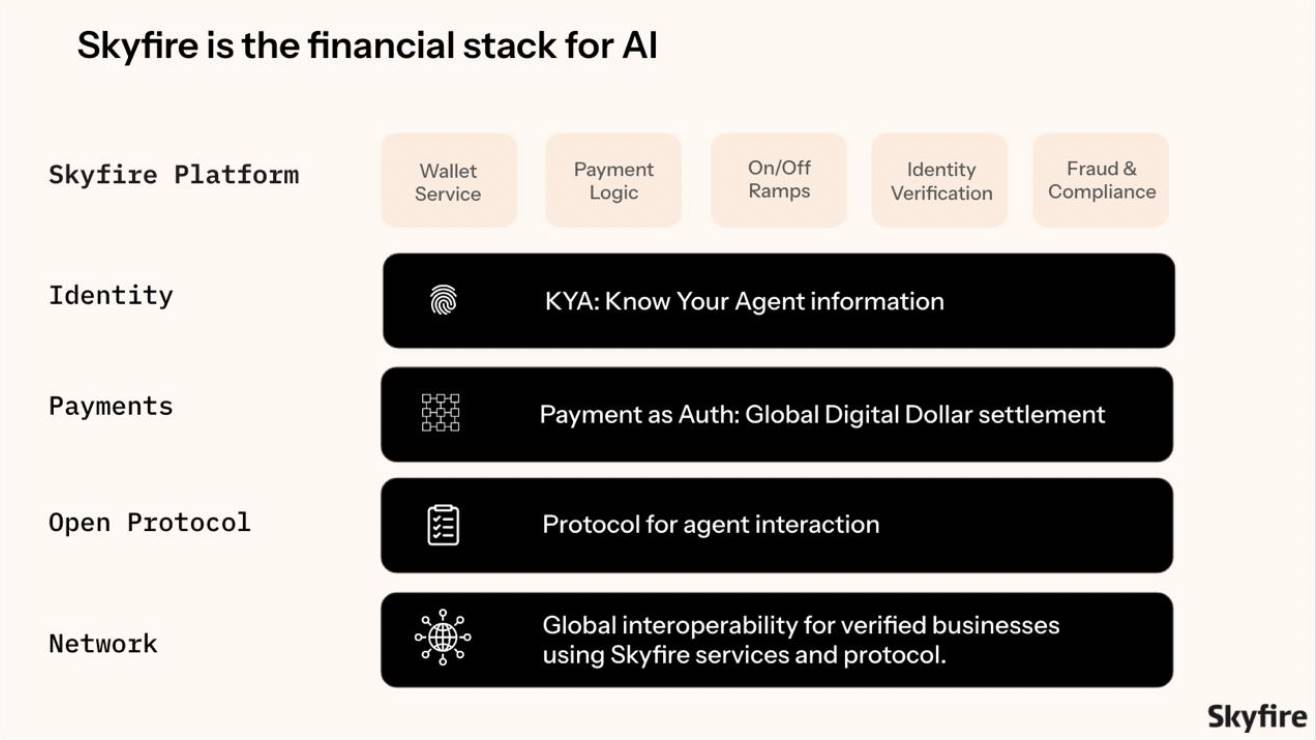

Case Study: Skyfire

Skyfire is building a robust and scalable payment infrastructure tailored for both AI agents and users, consisting of several core components:

Payment & Wallet Infrastructure:

-

Skyfire Wallet Service: Provides seamless fiat on/off-ramps for global transactions.

-

Payment-as-Auth: Enables real-time USDC settlement.

-

Microtransaction Support: Empowers AI agents to conduct permissionless, high-frequency, low-value transactions.

Open Protocol (AI Marketplace): Integrates all AI-related products and services. AI agents can access required resources via the Skyfire Open Protocol (marketplace), and use Skyfire APIs to pay for services such as decentralized compute markets, decentralized data labeling platforms, automated datasets, and AI model APIs.

Identity & Verification Layer: Assigns unique identities (KYA – Know Your Agent) to each AI agent, establishing digital identity for all users, agents, and enterprises using Skyfire. KYA enables transaction history tracking, ensures compliance and accountability, and verifies agent identity for every transaction, enhancing security.

Integration Tools: Supports over 160 large language models (LLMs), offers API access to datasets, premium content, and web services, and provides developer tools to facilitate integration of Skyfire into third-party systems.

Key Success Factors

Network Effects of the AI Payment Layer: Skyfire functions as both an AI marketplace and a payment layer. By aggregating diverse AI services and providers, it attracts more users and AI agents. Simultaneously, it generates revenue opportunities for Web2 and Web3 AI service providers through efficient stablecoin transactions—creating a powerful two-sided flywheel effect.

Compliance and Security: Verifiable identities (KYA) and auditable transaction histories enhance security and prevent fraud. The Payment-as-Auth system further strengthens trust in transactions.

Strong Developer Community: Strategic partnerships with LLM providers, data marketplaces, and enterprise AI companies strengthen its ecosystem. Over 1,500 developers are already leveraging Skyfire’s tools and services.

(2) Consumer-Facing Micropayments

Crypto-based consumer micropayments—exemplified by innovative models like Moonshot (buying/selling meme coins with cryptocurrency) and Sidekick (Web3 payment gateway for streamers)—highlight the transformative potential of instant global settlement and decentralized protocols. By eliminating intermediaries and reducing costs, this model could disrupt industries including crypto trading, content creation, gaming, and live streaming—especially in emerging markets where low fees, seamless cross-border payments, and high mobile penetration make cryptocurrencies an ideal solution.

Market Opportunities

-

Target Markets: Everyday consumer transaction scenarios such as ride-hailing, gaming, digital media, live streaming, content creators, and online communities.

-

Revenue Streams: Transaction fees, revenue sharing with content platforms, and integration income from decentralized finance (DeFi).

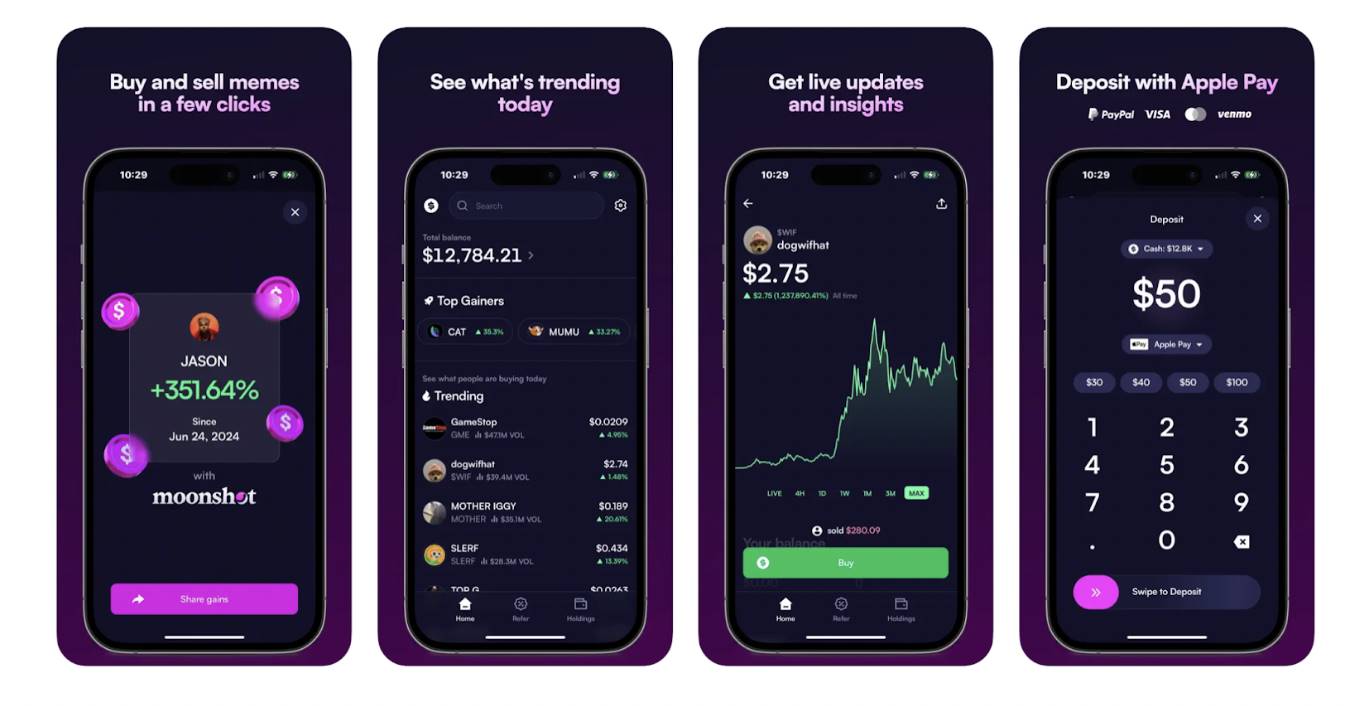

Case Study: Moonshot

Moonshot is a trading platform allowing users to buy and sell meme tokens via Apple Pay and other methods. Key features include:

-

Self-Custodial Wallet: Users can create accounts using email and password, enhanced with Touch ID, Face ID, or device passcode. Moonshot leverages Turnkey.com’s multi-party computation (MPC) technology to generate embedded wallets across supported blockchains.

-

Pricing Structure: Moonshot charges transaction fees to cover operational costs and ensure smooth user experience. Fees are tiered based on transaction size, with network fees covered by the platform to prioritize order execution. For example, transactions between $1–$250 incur a 2.5% fee (minimum ~$0.40), while transactions above $250 are charged 1%.

-

Referral Program: Users earn rewards by inviting friends. Both referrer and referee receive incentives upon completing verification. Currently available only to iOS users in select regions.

Key Success Factors

User-Friendly Interface: Moonshot’s clean, intuitive design simplifies the process of buying and selling meme cryptocurrencies. Support for fiat payment methods like Apple Pay, credit cards, and PayPal lowers the barrier to entry for new users.

Speed of Token Listings: Rapid deployment of trending meme tokens is crucial. The listing of MOODENG, for instance, significantly boosted user engagement and trading volume—demonstrating Moonshot’s ability to capture market trends swiftly.

Effective Referral Mechanism: The reward-based referral system drives user acquisition, enhances community interaction, and accelerates platform adoption.

Compliance and Security: The platform complies strictly with local regulations and implements strong security measures—including identity verification and transaction processing via MoonPay. These efforts build user trust and lay the foundation for sustainable growth.

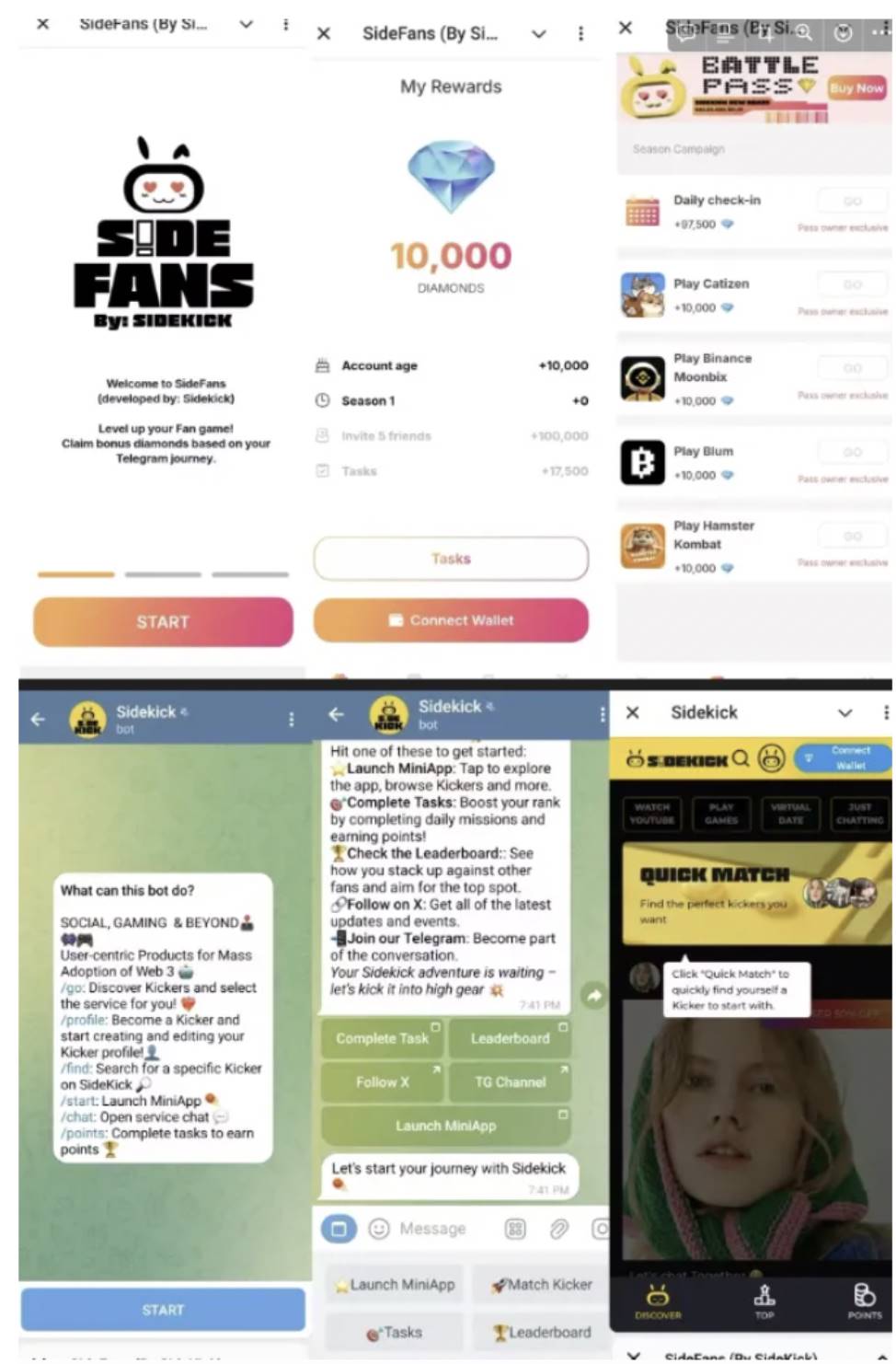

Case Study: Sidekick

Sidekick is a Web3 gaming companion platform and payment gateway, enabling streamers to receive crypto-based micropayments and tips.

Key Success Factors

Solving Creator Payment Challenges: Traditional streaming platforms (e.g., YouTube, Twitch, TikTok) charge up to 30% commission, have long payout cycles (often weeks), and impose geographic restrictions. Sidekick addresses these pain points with instant, low-cost blockchain payments—particularly beneficial for global content creators underserved by legacy financial systems.

Lower-Cost Transactions Enable Fairer Earnings: By removing Web2 platform fees, Sidekick allows mid-tier influencers to retain more of their earnings, promoting fairer income distribution. This is highly attractive to gig economy participants seeking better revenue splits and faster payouts.

Scalability Through Web3 Infrastructure: Built on Web3 protocols, Sidekick’s payment gateway is decentralized, scalable, and secure. Blockchain transparency and immutability establish trust for both creators and users, while enabling Sidekick to scale from small volumes to millions of transactions per day.

The Future of the Creator Economy: As the creator economy evolves, platforms like Sidekick lead in decentralized, crypto-native monetization. With growing adoption of NFTs, digital assets, and Web3 applications, Sidekick can serve as a comprehensive payment solution—enabling streamers and creators not only to earn from live content but also to monetize influence through tokenized content and fan tokens.

(3) Innovative On/Off-Ramp Solutions

Efficient on/off-ramp solutions are critical for mass crypto adoption. These platforms bridge the gap between fiat-dependent users/institutions and the world of digital assets or decentralized finance (DeFi).

Market Opportunities

-

Rising Demand for Stablecoins: The increasing use of stablecoins (e.g., USDC, USDT, DAI) in remittances, DeFi, and cross-border trade fuels demand for seamless fiat-to-stablecoin conversion. Post-U.S. elections, clearer regulatory frameworks may unlock even greater growth potential.

-

Layer-2 and Multi-Chain Expansion: On/off-ramp platforms can integrate with Layer-2 networks (e.g., Optimism, Arbitrum) and support multi-chain ecosystems (e.g., Solana, Avalanche), reducing costs and accelerating transaction speeds—allowing users to access a broader range of crypto ecosystems.

-

Improved Accessibility: Embedded payment solutions and wallet-less access (via email or phone number) simplify onboarding for newcomers, driving wider adoption.

-

Emerging Market Potential: Mobile-first on/off-ramp platforms thrive in emerging markets with underdeveloped financial infrastructure. By offering enterprise tools and partnering with traditional payment giants like Visa and Stripe, they can penetrate institutional and conventional payment networks.

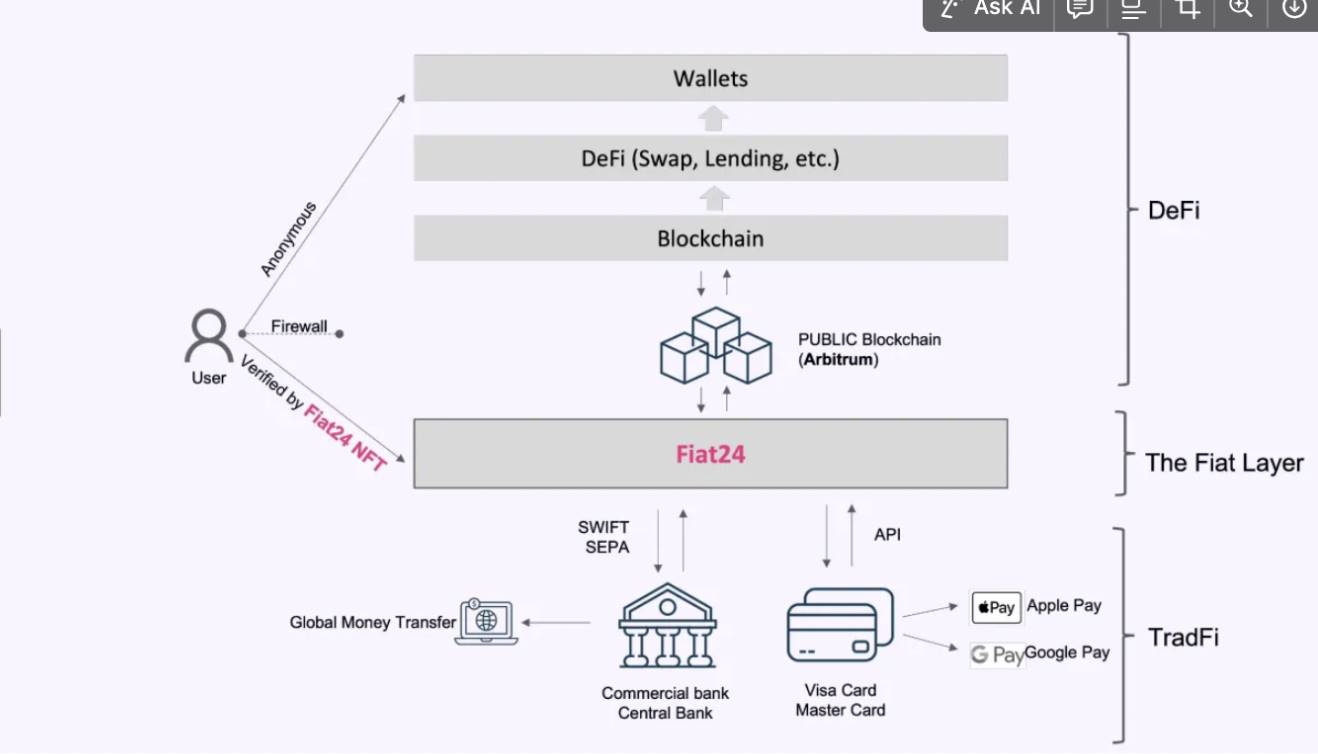

Case Study: Fiat24

Fiat24 is a Web3 neobank offering users seamless, zero-cost conversion between fiat and cryptocurrencies. Key product features include:

-

Tokenized Deposits: Fiat currencies (CHF, EUR, USD, GBP) are represented as ERC-20 tokens on Ethereum, each backed 1:1 by custodied fiat reserves—ensuring stability and trust. This enables instant, transparent transactions and native integration with DeFi services.

-

NFT-Based Account Access: Users receive a unique non-fungible token (NFT) as their digital identity for accessing Fiat24 accounts. This replaces traditional usernames and passwords, enhancing security and user control. The NFT resides in the user’s Arbitrum (Ethereum) wallet and grants access to Fiat24 services.

-

Visa Debit Card Integration: Fiat24 issues Visa debit cards linked to user accounts, accepted at over 40 million merchants worldwide. Users can top up their cards via Fiat24’s decentralized app (dApp) and view balances in their preferred currency.

-

Regulatory Compliance: Operated by SR Saphirstein AG and regulated by the Swiss Financial Market Supervisory Authority (FINMA), Fiat24 adheres to anti-money laundering (AML) requirements and undergoes regular financial and compliance audits by Grant Thornton Switzerland—ensuring fund safety and regulatory integrity.

Key Success Factors of Fiat24

Powerful Network Effects: Fiat24’s success hinges on establishing its tokenized deposits as a universal standard. This foundational role fosters interoperability and creates a self-reinforcing ecosystem bridging traditional finance (TradFi) and decentralized finance (DeFi).

Regulatory Advantage and Cost Leadership: Holding a Swiss banking license grants Fiat24 legitimacy within traditional finance and access to SWIFT/SEPA networks. This regulatory standing enables highly competitive pricing, positioning it as a trusted and efficient Web3 banking solution.

Fusion of Fiat and Crypto: Through tokenized bank deposits (e.g., USD24), instant fiat-crypto conversion, and synchronized on-chain/off-chain ledgers, Fiat24 seamlessly connects TradFi and DeFi—delivering a fluid, user-friendly experience.

Scalable Partnerships: Fiat24 offers an integrated Web3 banking solution that easily integrates with major wallets and exchanges. Revenue-sharing models help expand its reach, drive network growth, and enhance platform utility.

Conclusion

We believe blockchain holds tremendous potential to redefine the global payment system. From AI-driven micropayments and consumer-facing microtransactions to fiat-to-crypto conversion solutions, PayFi innovations address long-standing inefficiencies in traditional finance while unlocking vast new market opportunities. The convergence of cryptocurrencies, stablecoins, and decentralized finance paves the way for scalable, secure, and cost-effective financial solutions.

PayFi serves as a bridge toward a more inclusive, transparent, and efficient financial future. While regulatory and infrastructure challenges remain, the path forward is clear—and the future is bright.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News