PolyFlow Insight: Can Tornado Cash's Legal Victory Serve as a Litmus Test for PayFi?

TechFlow Selected TechFlow Selected

PolyFlow Insight: Can Tornado Cash's Legal Victory Serve as a Litmus Test for PayFi?

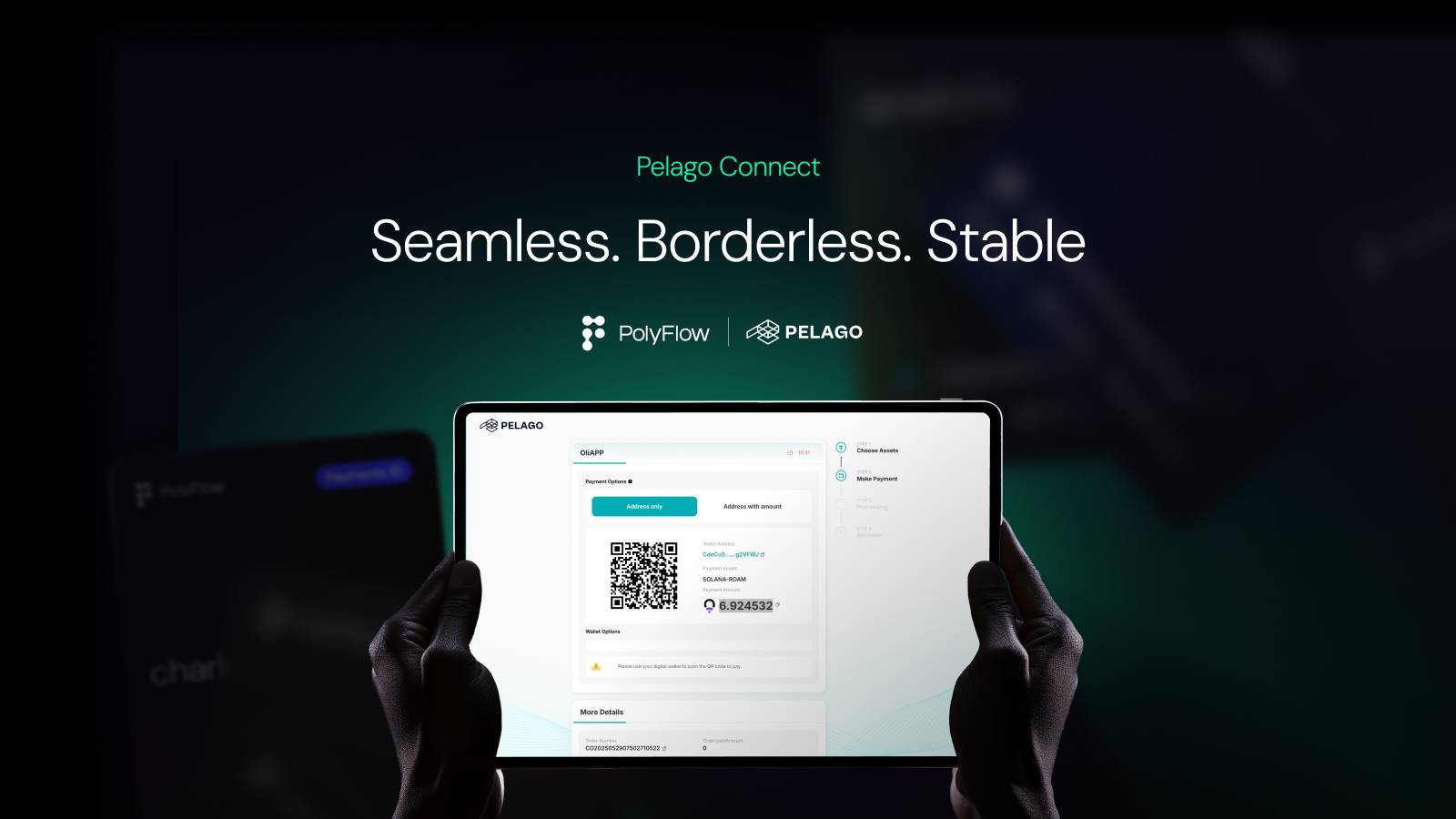

PolyFlow provides the essential infrastructure for building PayFi scenarios, ensuring compliance, security, and seamless integration of real-world assets to drive the establishment of a new financial paradigm and industry standards.

As Russian President Putin stated at the Russia Calling forum on December 4: "Who can ban Bitcoin? No one. Who can ban other electronic payment methods? No one either. Because these are all new technologies." It is neutral smart contracts that support these emerging technologies, and it is precisely the recent appellate court ruling on Tornado Cash that has clarified the definition of smart contracts and provided them with legal protection.

A technically neutral smart contract cannot completely prevent malicious use by criminals. However, through compliance onboarding and fund custody tools offered by PolyFlow—the infrastructure underlying PayFi—smart contracts can keep bad actors out while ensuring secure custodial management of funds and enabling free global value transfer and financial inclusion for users worldwide.

1. Background of the Tornado Cash Case

On November 26, 2024, a U.S. appellate court ruled that the U.S. Department of Treasury's OFAC sanctions against Tornado Cash were unlawful—a historic victory for the crypto industry and digital freedom advocates. The court found that OFAC had exceeded its statutory authority, as Tornado Cash—an open-source, immutable smart contract—does not constitute a "property" or "entity" subject to blocking under existing law.

Tornado Cash is an Ethereum-based coin mixing application that protects user privacy by obfuscating transaction details. However, it has also been used for money laundering, prompting sanctions from OFAC. In response, Tornado Cash users funded by Coinbase appealed the decision, arguing that OFAC lacked the authority to sanction a decentralized software protocol.

The district court initially sided with OFAC, defining Tornado Cash as an "entity" and its smart contracts as "property," sparking widespread controversy in the industry. Fortunately, the appellate court overturned this decision, emphasizing that immutable smart contracts cannot be classified as "property" or "contracts" because they have no ownership and are not controlled by any single party or group. The court further noted that smart contracts are merely tools providing services and do not themselves establish contractual rights or service relationships.

This ruling holds significant implications for the development of decentralized networks, clarifying the legal status of immutable smart contracts and offering guidance to the crypto industry amid complex global regulatory landscapes. Although OFAC may appeal the case to the Supreme Court, the appellate decision has already paved the way for the advancement of decentralized systems.

2. Paving the Way for PayFi Development

As Coinbase puts it: On Chain is the New Online.

With the growing adoption of blockchain technology and the evolution of decentralized networks, stablecoins are playing an increasingly vital role as transactional mediums in global finance. More and more PayFi use cases are being developed, with decentralized networks built on smart contracts serving as the foundational layer for these applications.

2.1 What Is PayFi?

PayFi, or Payment Finance, refers to an innovative model that integrates payment functions with financial services using blockchain and smart contract technologies. At its core, PayFi leverages blockchain as a settlement layer, combining the strengths of cryptocurrency payments and decentralized finance (DeFi) to enable efficient and unrestricted value movement.

PayFi aims to fulfill the vision outlined in the Bitcoin whitepaper: creating a peer-to-peer electronic cash system that operates without trusted third parties. By harnessing DeFi capabilities, PayFi seeks to build a new financial market—offering novel financial experiences, developing sophisticated financial products and use cases, and ultimately forming an entirely new value chain.

2.2 The PayFi Cryptocurrency Payment Network

PayFi represents an advanced, expanded, and deepened version of cryptocurrency payment networks. Built upon blockchain and smart contract technologies and enhanced with DeFi integration, PayFi creates a new financial ecosystem that enables globally accessible, payment-related financial derivative services such as lending, wealth management, and investment.

We see evidence of this in Stripe’s $1.1 billion acquisition of Bridge, a stablecoin infrastructure provider. After integrating Bridge, Stripe’s network effects extend beyond its own ecosystem into the entire stablecoin market. Similarly, a PayFi ecosystem powered by DeFi transcends geographical limitations inherent in traditional financial services, enabling free cross-border value transfer and promoting global financial inclusion—a direction PayPal is actively pursuing following its launch of stablecoins.

It is precisely these PayFi cryptocurrency payment networks—constructed from multiple interconnected smart contracts—that enable seamless integration between crypto payments and DeFi, unlocking the full potential of PayFi applications. The Tornado Cash ruling has helped clarify the compliant nature of these foundational smart contracts, thereby clearing a path for the growth of decentralized networks based on smart contracts.

In this emerging PayFi financial market, users benefit not only from the efficiency advantages of crypto payments over traditional finance—including instant settlement, lower costs, transparency, and global reach—but also gain access to the core principles of decentralized finance (DeFi): decentralization, permissionless access, self-custody of assets, and personal sovereignty.

3. Beyond Technically Neutral Smart Contracts: What Else Does PayFi Need?

Innovative applications like Tornado Cash, which are technologically neutral, can help legitimate users protect transaction privacy. However, they cannot inherently prevent misuse by malicious actors—for instance, when used in real-world money laundering activities.

For PayFi applications rooted in real-world use cases, two elements are crucial: (1) compliant user onboarding and (2) secure fund custody. These two aspects represent key distinctions between PayFi and DeFi, and they directly address the limitations of tools like Tornado Cash in preventing illicit usage.

3.1 Compliant Onboarding

It is widely recognized that compliant user onboarding is essential for fostering healthy development within financial payment ecosystems and services. The fundamental requirement here is ensuring that all transactions and fund flows comply with KYC, AML, and CTF regulations, while also aligning with local jurisdictional laws and requirements.

3.2 Fund Custody

Fund custody is critical in both on-chain and off-chain financial contexts. For traditional off-chain payment applications, custodial operations typically require licensing and strict adherence to regulatory standards. For blockchain-based on-chain payment applications, considerations shift toward ensuring smart contract security, private key management, and interoperability with both traditional finance and DeFi systems.

4. How PolyFlow Enables PayFi Application Deployment

PolyFlow is an innovative PayFi protocol designed to bridge real-world assets (RWA) with decentralized finance (DeFi). As an infrastructure layer for the PayFi network, PolyFlow integrates traditional payments, cryptocurrency payments, and DeFi to handle real-world payment scenarios in a decentralized manner.

PolyFlow provides essential infrastructure for building PayFi use cases, ensuring compliance, security, and seamless integration of real-world assets—helping drive the creation of a new financial paradigm and industry standards. Its two powerful components include:

-

PID (Payment ID), serving as the gateway for on-chain compliance onboarding, binds encrypted, privacy-preserving KYC/KYB credentials and links to users’ verifiable credentials across multiple platforms. This enables secure cross-platform identity verification, protects user data privacy, and empowers individuals with control over their digital identities. The introduction of PID brings transformative advantages—it bridges traditional finance and DeFi ecosystems while offering users a flexible and reliable method to manage digital identity, engage in cross-platform transactions, and build on-chain creditworthiness.

-

PLP (PolyFlow Liquidity Pool), acting as the entry point for on-chain fund custody, uses smart contract addresses to receive funds from payment transactions. This more decentralized approach offers PayFi applications a convenient, secure, and compliant custody solution while seamlessly connecting to the broader DeFi ecosystem. This decentralized architecture allows flexible integration with DeFi, enabling PayFi applications to adapt to the evolving digital asset landscape.

Through PolyFlow’s innovative PayFi infrastructure, technically neutral smart contracts can effectively exclude malicious users from PayFi applications, ensuring secure on-chain fund custody while advancing free global value circulation and financial inclusion for users around the world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News