PolyFlow AMA: In-Depth Analysis of the U.S. Stablecoin Bill, A Conversation Reshaping the Crypto Future

TechFlow Selected TechFlow Selected

PolyFlow AMA: In-Depth Analysis of the U.S. Stablecoin Bill, A Conversation Reshaping the Crypto Future

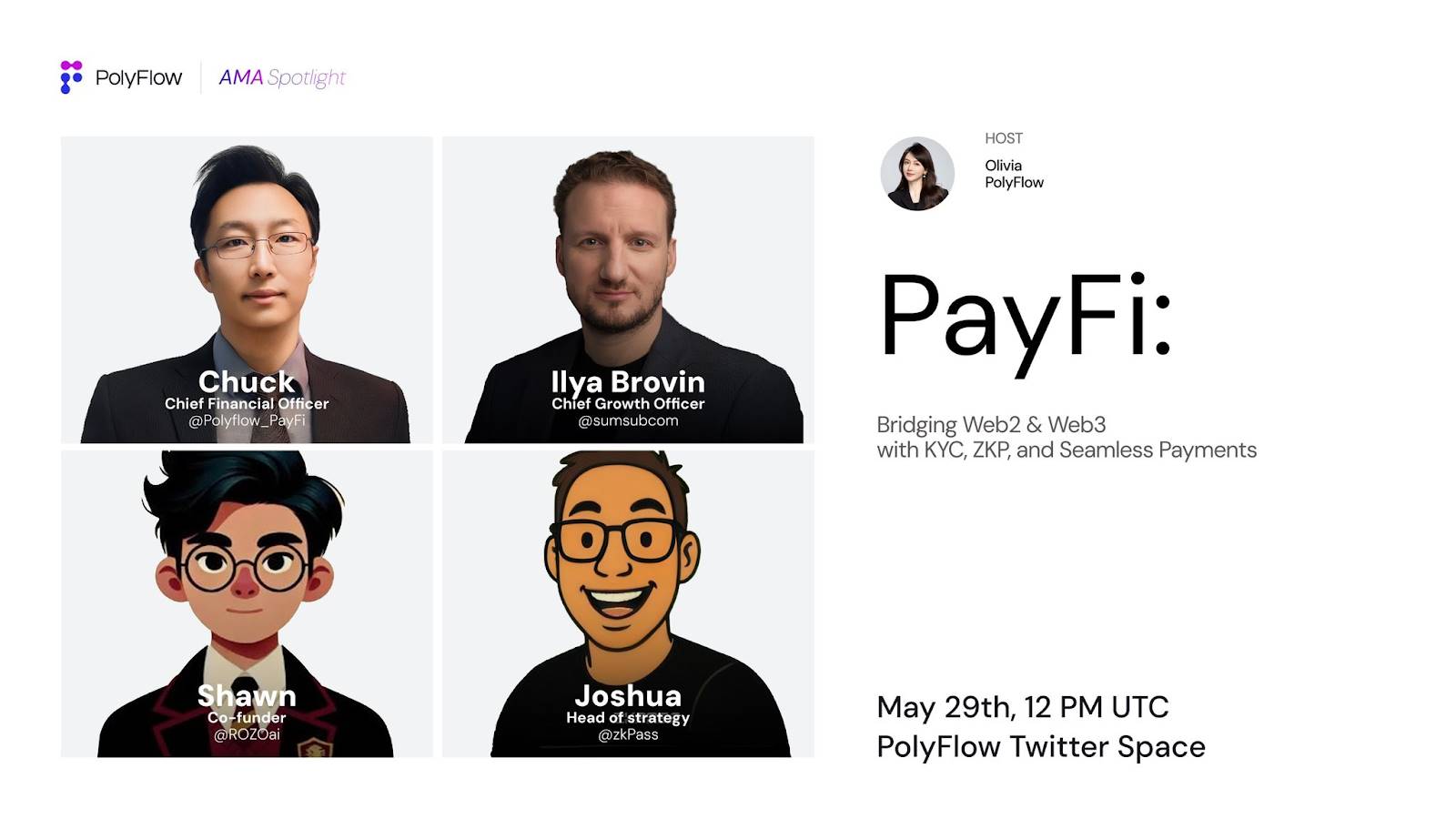

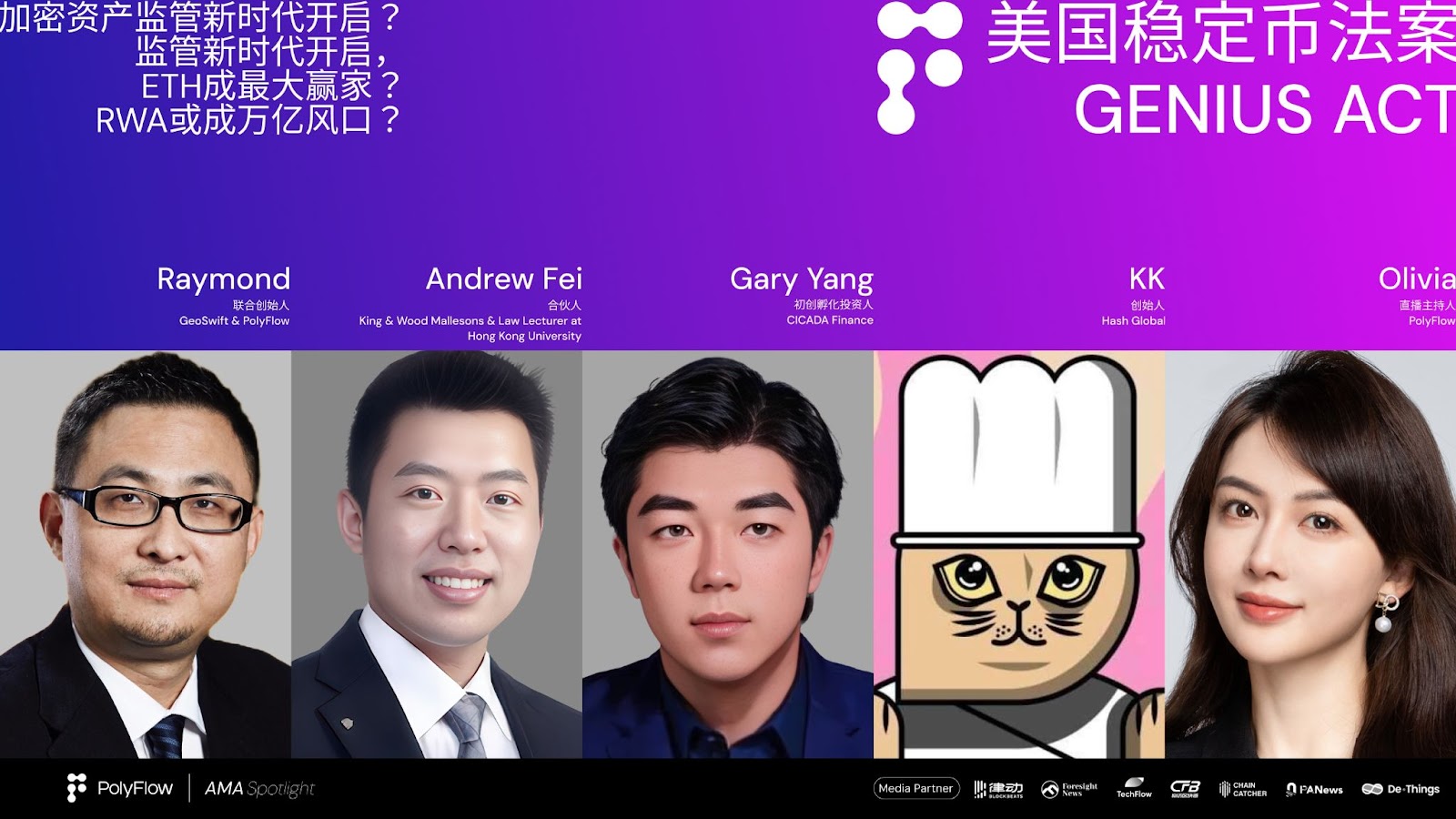

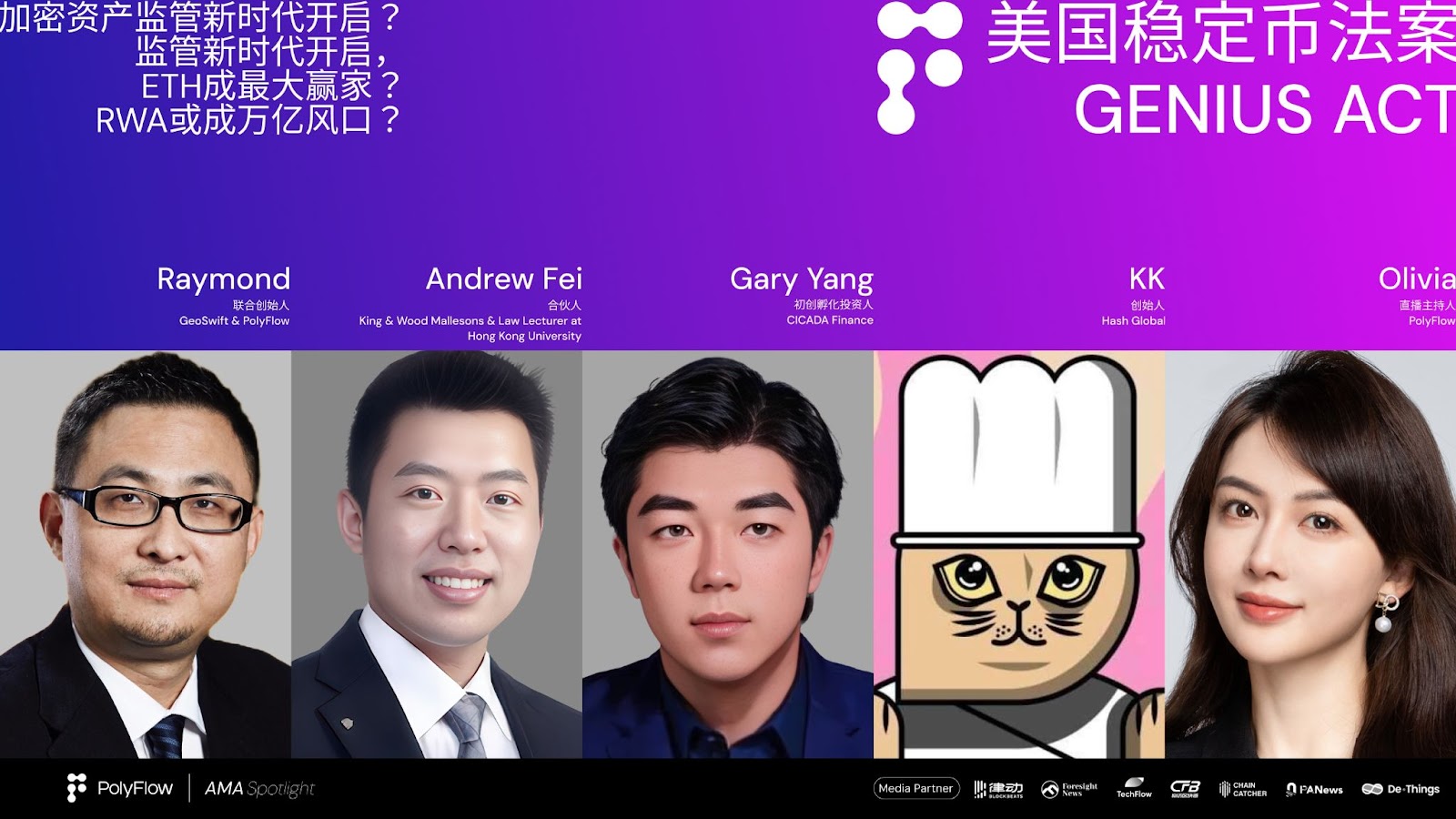

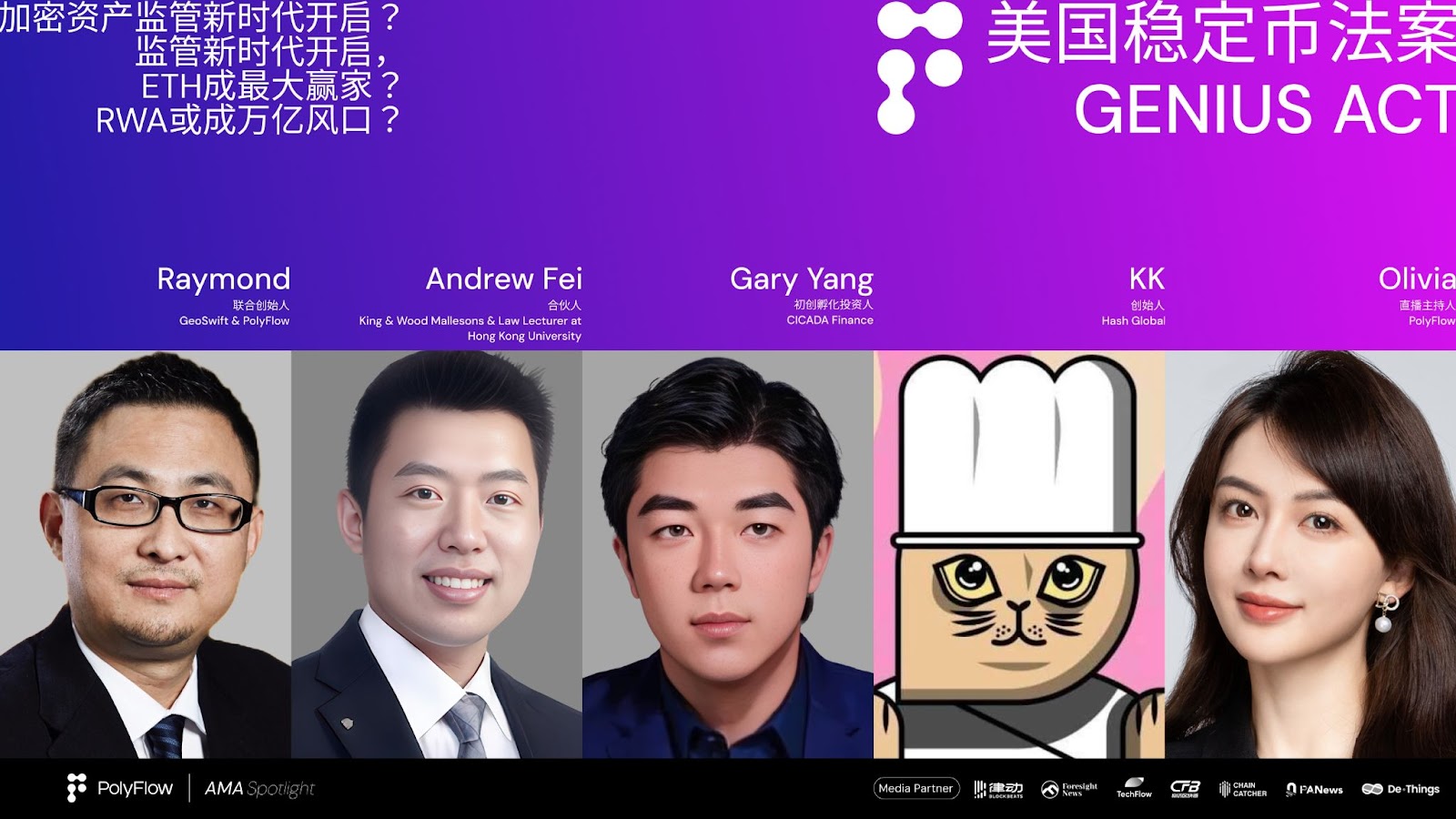

This AMA brought together four industry pioneers from different fields to discuss the bill's profound implications and future opportunities.

Innovative PayFi protocol PolyFlow recently hosted a Special Asia AMA focused on the "U.S. Stablecoin Bill."

Amid Bitcoin breaking its all-time high of $110,000, the crypto industry is accelerating its integration into traditional financial systems. The advancement of the U.S. Stablecoin Bill (commonly known as the "GENIUS Act") is seen as a pivotal step in reshaping the global financial landscape.

This AMA brought together four pioneering figures from diverse fields to explore the bill's deeper implications and future opportunities.

Meet the Speakers: Four Industry Leaders

Raymond

Founder of cross-border payment company GeoSwift, co-founder of PolyFlow, and early believer in the crypto industry. Raymond entered Bitcoin investing as early as 2011 and was also an early investor in Ripple, having witnessed the crypto market evolve from zero to a multi-trillion-dollar scale, with deep expertise in cross-border payments and stablecoin applications.

Andrew

Partner at King & Wood Mallesons Hong Kong, licensed U.S. attorney, and adjunct professor at the University of Hong Kong Faculty of Law. He specializes in legal matters including digital assets, structured finance, syndicated loans, financial regulation, capital markets, and asset securitization, and has been deeply involved in financial policy research in both the U.S. and Asia.

Gary

Investor at CICADA Finance and seasoned practitioner transitioning from traditional VC/PE to crypto. With 15 years of investment experience, Gary drives the transformation of asset management from traditional models to on-chain protocol-based systems, focusing on DeFi and RWA sectors.

KK

Founder of Hash Global and early-stage investor in the crypto space. Focused on stablecoins and payment赛道, he has led investments in over 80 Web3 projects, promoting the integration of technology with real-world business scenarios.

1. Introduction to the U.S. Stablecoin Genius Act

Attorney Andrew first introduced the basics of the Genius Act.

The act aims to establish a comprehensive U.S. legal and regulatory framework to support the development and widespread adoption of stablecoins. As a bridge between the crypto market and traditional finance, stablecoins offer stable value and flexibility, redeemable one-to-one for fiat currency. However, due to their close ties to traditional financial systems, governments and regulators worldwide are concerned about potential risks. This bill could be placed under regulatory oversight and, after a Senate vote, may be sent to the U.S. President for signing into law.

Key Provisions of the Genius Act

Definition and Characteristics of Stablecoins: The Genius Act defines payment stablecoins as digital assets pegged one-to-one to national fiat currencies, used for payments and settlements. These stablecoins maintain stable value, making them suitable as payment tools in Web3 and serving as a bridge between crypto and traditional finance. Their reserve assets include bank deposits and government bonds.

Regulatory Framework: The bill establishes a dual-layer federal and state regulatory structure. Issuers with less than $10 billion in issuance can opt for state-level regulation; others must comply with federal rules. Key federal regulators include the Federal Reserve, the Office of the Comptroller of the Currency, and the FDIC.

Licensing System: The act requires stablecoin issuers to proactively apply for licenses. Only licensed entities may issue payment stablecoins in the U.S. Digital asset service providers are prohibited from offering or selling unlicensed stablecoins to U.S. persons. Qualified foreign issuers may be exempt but must register with the U.S. government.

Accounting and Financial Requirements: Stablecoins issued by U.S.-licensed issuers can be treated as cash in accounting, usable as margin in derivatives trading and for interbank settlement. Licensed issuers must maintain 100% qualified reserve assets and disclose the size and composition of reserves monthly, subject to auditor review. CEOs and CFOs must certify the accuracy of disclosures. Issuers with over $50 billion in circulation must produce audited annual financial reports.

Compliance and Risk Management: The bill imposes requirements on business activities, capital liquidity, risk management, anti-money laundering (AML), and compliance. Issuers must adhere to U.S. economic sanctions, AML, counter-terrorism financing, and KYC laws. All stablecoin issuers must have the technical capability to comply with lawful U.S. government directives.

In summary, the introduction of the Genius Act reflects the U.S. government’s recognition and support for stablecoin development. By establishing a robust legal and regulatory framework, the act aims to ensure the stability and security of stablecoins while promoting their broad use in finance. This not only advances the crypto market but also presents new opportunities and challenges for traditional finance. As the bill progresses, stablecoins are poised to play a more significant role in the global financial system.

2. The Historical Origins of Stablecoins

Raymond, as one of the earliest industry participants, provided a historical perspective on why stablecoins emerged and how they evolved. The core value of the U.S. Stablecoin Bill lies in boosting market confidence and fostering industry consensus—the very driving force behind crypto’s rapid growth from nothing.

Evolution of Stablecoins

The development of stablecoins can be divided into several phases. In 2010, someone famously bought pizza with Bitcoin, marking the first time crypto served as a medium of exchange—a landmark event. By 2013, various crypto payment methods had already appeared: Bitcoin ATMs in Vancouver, Canada, and merchants in Tokyo accepting Bitcoin. However, Bitcoin’s price volatility limited its use as a payment tool, positioning it more as an investment asset.

To address this, some began experimenting with stablecoins. In the stablecoin 1.0 era, fiat-collateralized coins like USDT and USDC emerged, backed one-to-one by dollars or equivalent assets to ensure stability. In the 2.0 era, people started using crypto assets like Bitcoin or Ethereum as collateral. Collateral ratios increased to 1.2:1 or 1.15:1 to account for crypto price fluctuations.

Later came algorithmic stablecoins such as Luna and UST, which used their own native tokens as collateral. However, this model proved fragile and vulnerable to market shocks. These events underscored that the core of stablecoins lies in the stability of their underlying assets.

Core Elements of the U.S. Stablecoin Bill

The U.S. Stablecoin Bill centers on clearly defining stablecoins and their issuance requirements. It mandates that stablecoins must be issued at a 1:1 ratio with fiat currency to ensure stability. This clarifies misconceptions in the market and sets a clear standard. Some project teams previously attempted to back stablecoins with customer funds, which does not align with the true definition. Stablecoins must be backed by the issuer’s own assets, not customer deposits.

From an industry-wide perspective, the bill’s greatest contribution is enhancing market confidence and expectations for future growth. This confidence stems from growing consensus on the value of stablecoins. Just as gold became valuable due to widespread recognition, stablecoins gain acceptance through consensus. This collective belief has driven the stablecoin market from near zero to a current scale of $3–4 trillion.

3. Multidimensional Analysis of Policy Drivers Behind Stablecoins

Gary, drawing from his frontline experience in finance, offered an in-depth analysis of the essence of U.S. dollar stablecoin policy.

Dollar Expansion to Strengthen Global Influence

One core goal of the U.S. stablecoin policy is enabling countries to issue dollar stablecoins backed by U.S. dollar assets and Treasuries. This strategy is tied to a large-scale balance sheet expansion. Unlike previous direct monetary issuance by the Fed, this approach delegates minting rights to other entities—effectively ceding part of M2 issuance authority. Why would the U.S. make this choice? The fundamental aim remains balance sheet expansion and enhanced global influence.

Yet this raises questions. If the goal is expansion and influence, why relinquish issuance—and potentially settlement—rights? SWIFT’s share is declining, so logically the U.S. should tighten control. Yet the policy appears to loosen it. For example, if Japan’s Financial Services Agency issues USDJ meeting the Genius Act’s criteria, it could circulate domestically, meet demand, and even over-issue like stablecoins. By allowing other nations to issue and promote such stablecoins abroad, the U.S. seems to be giving up potential minting and settlement powers.

Declining Dollar Control and Emerging Trends

It is undeniable that the U.S. has gradually lost global monetary control over recent years. From 2019 to 2023, the U.S. money supply expanded by 40%, leading to significant depreciation. Attempts to reclaim excess liquidity through higher interest rates and reserve requirements have had limited success. Many regions are now building independent settlement systems outside U.S. oversight—evidenced by increasing discussions around Hong Kong’s M-bridge.

Over the past five years, the dollar’s global influence has rapidly declined. This year saw crises in Treasuries, dollar assets, and exchange rates. Investors are turning to currencies like the Swiss franc, Singapore dollar, and yen. When asked at Berkshire Hathaway’s annual meeting whether to buy U.S. stocks, bonds, or dollars, Buffett encouraged investment—but personally allocated $90 billion to Japanese bonds, signaling perceived dollar risks.

Two main factors explain the weakening dollar dominance. First, since 2019—particularly during the失控 of Covid—the U.S. lost key leverage in global monetary control. Second, emerging trends are now beyond U.S. control.

Over the past four years, crypto-based settlements have surged. In Nigeria, with 223 million people, over 50% use crypto for settlements. Though these are technically USD-denominated, they are independent of U.S.-issued dollars and不受 FDIC or other U.S. regulators. This is a major trend. Countries like India, Brazil, and institutions like Bangladesh University are seeing exponential growth in daily consumer finance settlements.

The same applies to supply chain finance. I invested in a North American company with a multi-billion market cap. In 2022, I suggested using USDT for settlements, but it was deemed illegal then. By 2023, usage reached 0.5%; in 2024, it rose to 5%. This shows a rapid increase in crypto settlements among SMEs—assets previously outside the U.S. monetary system. The company expects natural growth to push crypto settlements above 15% by 2025, a clear trend.

Overall, both internal flaws in the traditional financial system and the rise of crypto point to one fact: the dollar’s global control is rapidly eroding. This forms the foundational context for the Genius Act. Without action, the dollar’s influence will continue to decline.

Deep Logic and Impact of U.S. Stablecoin Policy

This year, the Senate pushed this policy aggressively, demonstrating the U.S. system’s flexibility and adaptability. It appears to be a strategic “retreat to advance”—the U.S. voluntarily gives up part of its dollar minting and settlement rights, delegating them to the market. After implementation, U.S. financial institutions serve merely as “models,” showing countries like Japan, Vietnam, and the Middle East that anyone holding U.S. Treasuries or dollar assets can issue their own dollar-pegged stablecoins at a 1:1 ratio.

The U.S. dislikes uncontrolled expansion but accepts it as the foundation for balance sheet growth. Historically, the dollar relied on gold, reserves, and credit. Now, other nations are entering a new phase anchored on U.S. dollar assets and Treasuries. The policy’s essence is to abandon absolute issuance control, exchanging Treasuries for global anchoring—similar to how gold once backed currencies.

This mirrors the Web3 Restaking model. Restaking involves staking currency against an asset to create shadow money that circulates and supports ecosystem assets—the core innovation behind crypto’s growth in recent years. The U.S. government and financial system have quickly learned and applied this concept, effectively addressing the decline in dollar dominance.

Once implemented, this policy will trigger a “financial earthquake” in the U.S. system. In the short term, dollar assets will fluctuate sharply, impacting traditional financial institutions’ issuance and circulation. But long-term, it will further extend the dollar’s value. Wall Street is abuzz, and Hong Kong securities firms are rushing to Singapore for partnerships—revealing numerous new opportunities.

4. The Critical Role and Market Impact of Stablecoins in Finance

Having reviewed the U.S. Stablecoin Bill’s background and drivers, let’s examine its potential market impact.

Stablecoins—RWA of Fiat Dollars

From an investor’s perspective, how does KK of Hash Global view this stablecoin legislation?

In finance, stablecoins are a highly visible and long-anticipated赛道. We began investing in RWA exchanges three years ago and engaged with licensed institutions in Singapore, though progress was slow. We believed that this year, stablecoins and money market funds would stand out in the Web3 market.

Stablecoins matter because they represent the Web3 version of fiat dollars, with real-world assets directly tied to the U.S. dollar. Money market funds, meanwhile, meet the actual needs of on-chain capital. The introduction of the stablecoin bill, I believe, will accelerate the flow of capital onto chains. Only when there is sufficient capital will there be liquidity, and only with liquidity can we attract high-quality assets to move on-chain.

Earlier this year, many expected the U.S. and Hong Kong to pass stablecoin bills. Now that the bill is advancing, we see traditional financial institutions—including the world’s two largest payment networks, Visa and MasterCard—actively embracing stablecoins to solve cross-border and endpoint payment issues. They will put stablecoin capabilities into practical use.

I’ve discussed this with friends: issuing stablecoins today is akin to banks launching credit cards decades ago. Every bank wanted to enter credit card services to capture revenue in payment and settlement networks, whether as issuers or acquirers. Now that regulations allow it, and conditions are met, why wouldn’t institutions issue stablecoins? With use cases and users, profits follow. This process will accelerate capital inflow into Web3’s on-chain financial world. Only with sufficient capital and institutional participation can the Web3 market truly grow.

Integration of Stablecoins with Traditional Finance

Raymond, with 20 years of experience in cross-border payments, shared his profound observations on the evolution of crypto—or rather, stablecoins and Web3 payments—toward mainstream adoption.

At the recent Consensus conference in Toronto, the atmosphere was notably different from previous years, with far greater attention on Web3 payments. This signals that payments have become a hot topic in the industry. As practitioners, we’ve already positioned ourselves early and held productive discussions. For instance, in 2022, as a traditional payment company, we launched the PolyFlow platform to actively develop the Web3 payment赛道.

Historically, there was clear tension between traditional finance and crypto. Traditional finance viewed crypto with skepticism, while crypto practitioners valued freedom and resisted strict regulation. However, as the industry matures, interactions have intensified, and growing market demands are pushing both sides to collaborate on integration.

We’re currently engaging in meaningful experiments with industry giants. For example, a few months ago, we partnered with Ripple to explore interoperability between XRP, stablecoins, and fiat currencies within global payment and clearing networks. Similarly, Circle, the issuer of USDC, launched its CPN project, starting from two ends of financial institutions to build compliant on-ramp/off-ramp clearing networks. We also see major exchanges launching their own payment tools, such as OKX Pay.

In this process, we must recognize not only the efforts of crypto practitioners but also active involvement from traditional financial titans like Visa. We recently signed an agreement with Visa to explore using their network for cross-border payments, leveraging our global payment infrastructure. Decades of crypto development converge on one core insight: stablecoins and blockchain are not just accounting systems—they are vital tools for efficient asset transfer.

The key challenge now is how to further enable such efficient transfers within a compliant and legal framework. This is where our entire industry is focused. As an advisor to both the Canadian Development Bank and the People’s Bank of China, I frequently engage with regulators and banks. I often ask them: Are all traditional financial funds “clean”? Clearly not. Then, are all incoming external funds “dirty”? Again, no. If all crypto flows were “dirty,” the industry could never have grown this far or attracted so many investors and talented individuals. This proves the sector addresses real needs for legitimate cross-border capital movement.

With this understanding, we can see that stablecoin bills from the U.S. and Hong Kong do more than boost confidence—they encourage the creation of practical, problem-solving solutions. That is my view.

Major Transformation in the U.S. Banking and Financial System

Gary sees this as a massive opportunity—a transformation from traditional finance to stablecoins and then to crypto finance.

Essentially, traditional finance developed a set of rules over the past century, some of which have become complex and rigid, hindering faster financial innovation. Meanwhile, the crypto industry, over the past 16 years, has made significant progress—especially in payment and settlement systems. However, due to lack of effective regulation, it has also faced non-compliant and sometimes “unclean” practices.

Therefore, the current juncture calls for regulatory frameworks to formalize financial development under national systems, combining flexible financial assets to integrate traditional and emerging finance. This is not only necessary but increasingly a trend. The launch of the stablecoin bill is a milestone event. These changes exceed expectations of many in both traditional and emerging finance, with the pace of progress over the past year being particularly striking.

As the bill rolls out, traditional finance gains a pathway to connect with emerging finance. Banks and financial institutions are becoming akin to “public blockchains,” capable of issuing their own currencies and currency-backed assets. This shift has been brewing for years and has now reached a critical point. In a sense, banks are building compliant, transparent, traceable asset and yield-generating systems on blockchain, moving traditional assets on-chain. This is not just technological progress but a fundamental shift in financial paradigms. Over the past five years, banks like Goldman Sachs and Citigroup have already adopted blockchain under pressure from regulators like the Fed and FDIC to ensure transparent and verifiable accounting.

Going forward, integration between banks and blockchain ecosystems will deepen. Banks issuing their own stablecoins and developing proprietary assets and ecosystems will greatly accelerate convergence between traditional and emerging finance. Within the next month, major U.S. asset managers and financial institutions will undergo dramatic shifts, rapidly adjusting strategies to lead in this transformation.

Beyond Hong Kong’s stablecoin legislation and implementing rules, other regions—including Japan, Singapore, and Dubai—are expected to swiftly respond with similar laws. Those who fastest align with these regulations and integrate them into their financial systems will gain a competitive edge. Rapidly activating ecosystems through shadow currencies presents a historic opportunity. Thus, calling this change “Genius” is entirely justified.

About PolyFlow

PolyFlow is the first modular PayFi infrastructure, dedicated to connecting real-world assets (RWA) with decentralized finance (DeFi). As the foundational layer of the PayFi network, PolyFlow integrates traditional payments, crypto payments, and DeFi to decentralize real-world payment scenarios. It provides the essential infrastructure for building PayFi applications, ensuring compliance, security, and seamless RWA integration, helping shape the next generation of financial paradigms and industry standards.

Learn more: X|Telegram|Medium| DAPP| Website

Media contact: media@polyflow.tech

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News