PolyFlow Research: April PayFi Industry Overview Report

TechFlow Selected TechFlow Selected

PolyFlow Research: April PayFi Industry Overview Report

With continued regulatory support in the United States, more and more fintech giants are entering the stablecoin race.

Author: PolyFlow

Despite ongoing market enthusiasm for PayFi, its foundation remains heavily reliant on the large-scale adoption of stablecoins. From April's market developments, as the U.S. regulatory framework becomes increasingly clear, more fintech giants are entering the space—whether by issuing stablecoins, building proprietary stablecoin payment networks, or entering via investments and acquisitions. Fintech companies are poised to dominate the future stablecoin market and further drive PayFi use case adoption. Below are key observations this month.

Data Insights

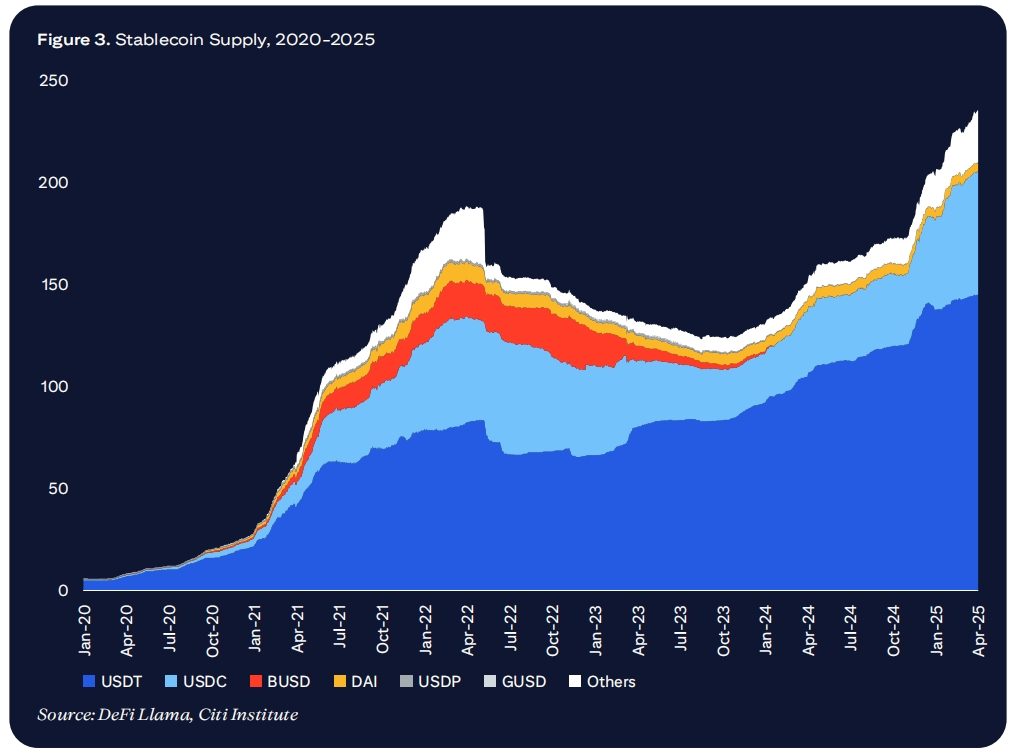

The latest report from Citi GPS shows that as of April 2025, the total circulating supply of stablecoins has surpassed $230 billion, a 54% increase year-on-year from April 2024. The market is currently dominated by two major players—Tether (USDT) and USD Coin (USDC)—which together hold over 90% market share in transaction volume and value.

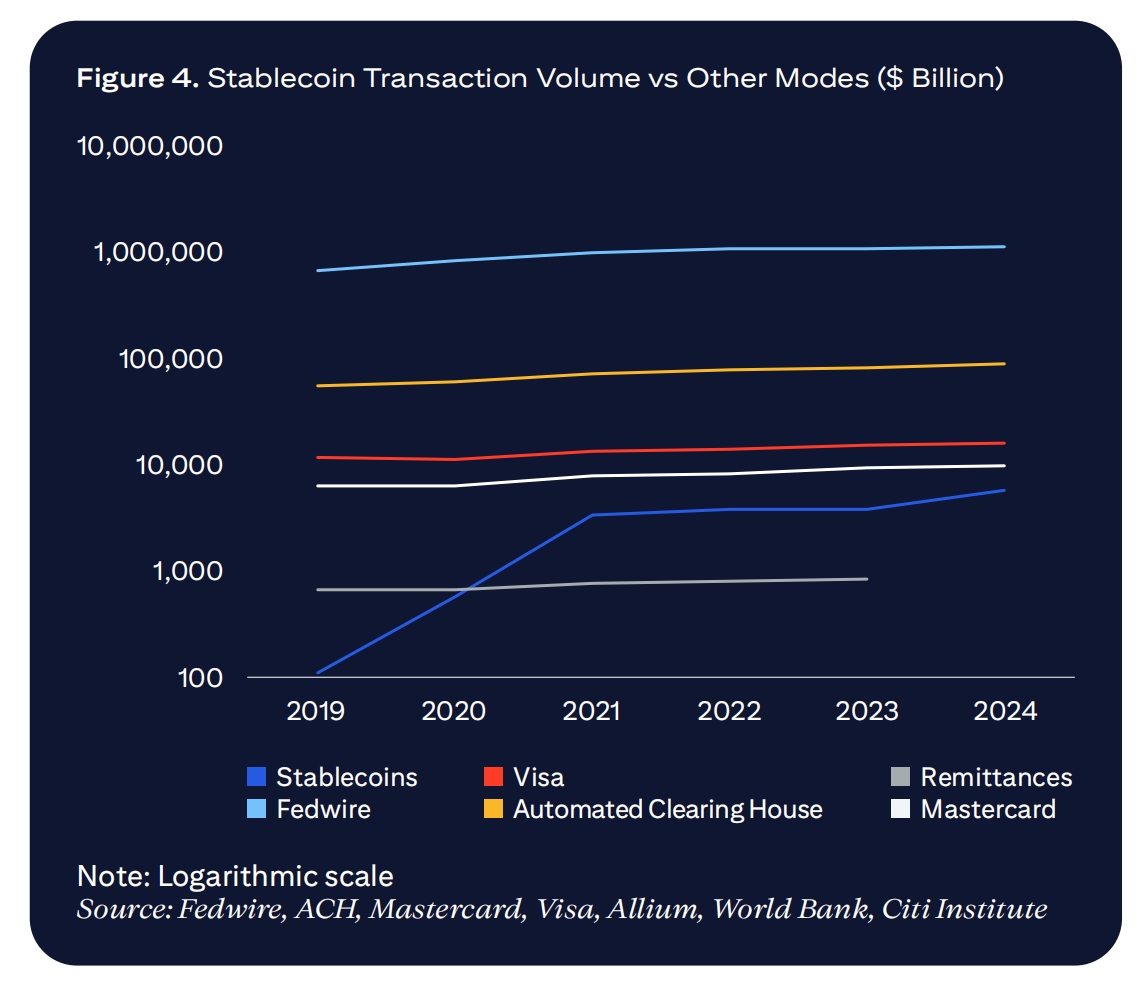

In recent years, stablecoin transaction volumes have grown rapidly. According to adjusted data, stablecoin monthly transaction volume reached $650–700 billion in Q1 2025, nearly double the levels seen from H2 2021 to H1 2024, with primary use cases still centered on supporting the cryptocurrency trading ecosystem.

Beyond crypto trading, stablecoins are also emerging as a key tool within cross-border payment systems. The Citi GPS report suggests that stablecoin transaction volumes could eventually surpass those of existing payment networks like Visa and Mastercard. While still in early stages, the trend is clear.

As Matt Blumenfeld, U.S. and Global Digital Assets Leader at PwC, noted, more banks and traditional financial institutions will enter the space. Dollar-denominated stablecoins are expected to maintain dominance, while the number of participants will depend on product diversity meeting various use case needs. The competitive landscape in the stablecoin sector may ultimately exceed that of today’s card networks.

Fintech Giants Accelerate Expansion

Changes in the U.S. digital asset regulatory environment are profoundly impacting corporate payments, fund flows, and asset management. The appointment of new SEC Chair Paul S. Atkins is expected to bring clearer regulatory expectations for the crypto industry, welcomed positively by market participants.

a16z stated that stablecoins have reached a level of adoption sufficient to transform global payment systems, much like WhatsApp revolutionized international communication. Financial giants are now converging to compete for the stablecoin payments market.

Circle Payments Network

Circle, issuer of USDC, officially launched the Circle Payments Network (CPN), aiming to address long-standing issues in cross-border payments such as multiple intermediaries, complex compliance, and fragmented jurisdictions—particularly targeting emerging markets with efficient, modern payment solutions.

CPN delivers an internet-like payment experience with real-time global settlement while ensuring compliance across licensing, AML/CFT, cybersecurity, and risk management. Initial partners include banks, fintech firms, payment and remittance providers, and USDC strategic allies. CPN aims to directly compete with traditional payment networks like Mastercard and Visa.

Additionally, CPN leverages smart contracts and modular APIs to enable third-party developers to build diverse financial service applications. It already collaborates with major global banks including Banco Santander, Deutsche Bank, Société Générale, and Standard Chartered.

Circle CEO Jeremy Allaire said CPN will make money transfers as simple as sending an email, reinforcing Circle’s position in global financial services and validating the transformative potential of stablecoins—efficient, compliant, and real-time payments.

Stripe Stablecoin Applications

Stripe has launched a new suite of AI-powered and stablecoin-based products to boost business payments. Its Payments Foundation Model leverages hundreds of billions of transaction records to improve anti-fraud measures and payment authorization rates, particularly effective at detecting card testing attacks.

Simultaneously, Stripe introduced Stablecoin Financial Accounts, enabling businesses in 101 countries to make payments using stablecoins (currently supporting USDC and USDB, with plans to expand to more currencies). Additionally, through its Bridge platform and collaboration with Visa, Stripe issues debit cards linked to stablecoin wallets, allowing users to spend stablecoins directly at Visa-accepting merchants. Bridge CEO Zach Abrams described this innovation as a critical step toward integrating stablecoins into everyday payments.

Stripe CEO Patrick Collison emphasized that AI and stablecoins are rapidly unlocking business value. In 2024, AI features contributed to a 38% growth in Stripe’s total payment volume.

Global Dollar Network (USDG)

Visa plans to join the Global Dollar Network (USDG) consortium led by U.S.-regulated stablecoin issuer Paxos, becoming the first traditional financial institution to participate. The alliance includes leading firms such as Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Bullish, and Nuvei, focusing on improving stablecoin interoperability, liquidity, and revenue-sharing mechanisms.

USDG launched its dollar-pegged stablecoin in November last year, aiming to increase global stablecoin adoption while generating economic returns for partners. Stablecoins are now evolving from crypto trading tools into practical financial infrastructure for B2B payments, capital markets settlement, and treasury management. Visa’s move aligns with its long-term strategy in digital payments.

Bank Charter Race Heats Up

As traditional banks tighten services for crypto clients, leading firms like Circle, Paxos, and Coinbase are applying for bank charters to enter the regulated banking system, aiming to accept customer deposits, custody stablecoin reserves, and offer banking services. Stripe has also applied for a special banking license, continuing the path previously explored by Fiserv.

Fintech companies seeking bank licenses aim to reduce transaction costs, expand business scope, and bypass limitations of the traditional banking system. Once crypto firms become compliant banks, they will gain greater trust from large enterprises. Fortune 500 companies may soon engage in deeper collaborations with stable, regulated crypto service providers. Business leaders should monitor the convergence of crypto assets and traditional finance and prepare accordingly.

April Investment Trends

-

Tether invests in Fizen

On April 15, 2025, Tether made a strategic investment in Fizen, a fintech company focused on self-custody wallets and digital payments, to enhance digital asset payment experiences. Fizen aims to address financial access challenges for the unbanked, improve blockchain infrastructure, and integrate stablecoins into broader payment scenarios—including real-time fiat settlement via QR codes and POS terminals. With global QR code payment volume expected to exceed $3 trillion by 2024, the Tether-Fizen partnership could accelerate stablecoin payment adoption.

-

Inflow raises $1.1M seed funding

Inflow secured funding from AllianceDAO, Rockstart, and GnosisVC, aiming to provide low-cost, real-time global payment solutions for freelancers and small businesses in emerging markets. Its platform will significantly reduce international payment fees and processing times, ensuring user financial freedom.

-

Zar raises $7M

Zar raised $7 million from Dragonfly Capital and a16z, planning to offer cash-to-stablecoin exchange services across 280,000 mobile payment agent locations globally, addressing cross-border payments and inflation hedging needs. It already has nearly 100,000 customers and 7,000 merchants pre-registered, operating in 20 countries including Pakistan, Bangladesh, Indonesia, Nigeria, Lebanon, and Argentina. Users can scan QR codes to exchange cash for stablecoins, which are instantly deposited into digital wallets.

April Summary

With continued regulatory tailwinds in the U.S., more fintech giants are entering the stablecoin arena. Circle maintains over 25% market share in stablecoins and continues expanding its payment network. Following its acquisition of Bridge, Stripe has fully integrated stablecoin payments.

The stablecoin market is transitioning from a phase of “new entrants staking claims” to one of competition over “payment channel control.” Advantage lies not just with issuers, but with those who control usage scenarios. Capital is flowing rapidly into real-world payment applications—those who dominate payment use cases will lead the stablecoin ecosystem.

About PolyFlow

PolyFlow is an innovative PayFi protocol connecting real-world assets (RWA) with decentralized finance (DeFi). As the infrastructure layer of the PayFi network, PolyFlow integrates traditional payments, crypto payments, and DeFi to serve real-world payment scenarios, delivering compliant, secure, and scalable financial infrastructure to advance new financial paradigms and industry standards.

Learn more: X|Telegram|Medium| DAPP| Website

Media Contact

E-mail: media@polyflow.tech

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News