Deciphering Trump's Coin Launch: The "Marius' Stick" That Will Radically Transform America

TechFlow Selected TechFlow Selected

Deciphering Trump's Coin Launch: The "Marius' Stick" That Will Radically Transform America

If he truly only aimed at "harvesting leeks"... then that would be fine.

Author: Xiaoxi Cicero, Dante by the River of Forgetfulness

Hello everyone. Yesterday we reflected on Biden's legacy (The Final Day of the "Biden Era"). Today, I'd like to discuss the incoming Trump presidency—specifically his high-profile launch of a namesake memecoin just before taking office. As widely reported, this coin surged over 20,000% within hours and now boasts a market capitalization exceeding $20 billion.

To be honest, it took me an entire day to confirm this wasn't one of Trump’s usual “Fake News” claims, because the whole idea seemed utterly absurd: a president-elect choosing to launch his own memecoin on the eve of inauguration? The spectacle is no less jarring than a pious, respected nun publicly announcing she’s about to enter the adult film industry right before being canonized by the Vatican. For a moment, I genuinely wondered if Trump had decided not to take office at all.

Yet upon deeper reflection, I realized he may indeed have a calculated plan—though if successful, that plan could plunge America—and perhaps humanity itself—into an unknown, high-risk abyss.

Please allow me to walk you through a long-form analysis of Trump’s logic, and the potential costs and risks involved.

Before diving in, let me offer apologies and clarifications to two groups of readers I know this article will inevitably offend.

The first group consists of die-hard Trump supporters in China.

If you're a regular reader, you know I’ve generally been one of the more moderate and sympathetic voices toward Trump in the Chinese-language media space. Many of my earliest readers are Trump sympathizers, even staunch supporters. But while supporting Trump is fine, idolizing him is not. If your support evolves into something like, “Whatever Trump endorses, we must back unconditionally; whatever he opposes, we must denounce without question,” then what separates your stance from the very extreme personality cults you despise? Such blind allegiance betrays the principles of free conservative thought and represents the greatest rejection of modern democratic and legal values.

We should believe in ideas and institutions—not individuals. This truth transcends all ideological divides. Those who reject it lack modernity. Characters like Li Kui from *Water Margin*, who blindly obeys Song Jiang whether it means killing or murdering children, better fit such a mindset.

The second group likely includes so-called “crypto gurus.”

In this piece, I will argue that memecoins (note: only memecoins, not all cryptocurrencies) hold little to no positive value.

Even with this nuance, I expect backlash from crypto enthusiasts: “How dare you say that? Clearly, you don’t understand economics!”

Well, of course—they’re already invested, literally and emotionally. I usually refrain from dismissing memecoin value, just as I wouldn’t tell a friend returning from a certain southwestern region of China that their expensive “silver comb” or “chicken-blood jade” souvenirs are basically worthless trinkets.

But I still find such inevitable accusations surreal—since when did believing in memecoins, shitcoins, or vaporware become a symbol of economic literacy?

This is a classic logical fallacy. Does not playing mean you don’t understand? By that logic, someone criticizing drug use could be labeled as not knowing how to enjoy life, someone condemning prostitution could be accused of being a eunuch, and if followers of the Peoples Temple or Aum Shinrikyo returned from the dead, they might well accuse those who condemn their mass murders and suicides of “not knowing what the true god is.”

I may sound harsh, but I want to emphasize: meaningful discussion cannot happen through name-calling. In this article, I’ll lay out my reasons for viewing memecoins negatively. If anyone can rationally and logically refute them, please leave comments.

But I won’t accept any opening line of “you just don’t get it.”

The two easiest labels to slap on others are “you don’t understand” and “you have ulterior motives”—in other words, the infamous “either stupid or evil.”

I often suspect those who love using these labels are themselves either stupid or evil.

Alright, armor on. If you accept these two premises, let’s begin our intellectual journey.

I. Memecoins Are Not Real Money

First, for those unfamiliar with crypto, a quick primer: While Trump’s newly launched memecoin (Memecoin) falls under the umbrella of digital cryptocurrencies like Bitcoin, their underlying mechanisms are fundamentally different.

Think of it this way: Bitcoin resembles physical gold. Its total supply is mathematically capped by its algorithmic design. Even Satoshi Nakamoto, Bitcoin’s creator, couldn’t arbitrarily decide how many bitcoins to issue. Instead, new bitcoins are generated through mining—a decentralized process powered by computing power across the globe.

Memecoins, however, are entirely different. Strictly speaking, they aren’t even real currencies. They’re more like digital trading cards or commemorative tokens. The number of memecoins issued is entirely up to the issuer—the “coin master”—who acts as both sole miner and manufacturer.

In fact, memecoins began as an internet joke among tech enthusiasts. Take Dogecoin, launched in 2013 by Billy Markus and Jackson Palmer, featuring the famous Shiba Inu meme dog. The creators were almost openly admitting it was a prank—buyers were essentially paying for the humor.

But due to the internet’s anything-goes speculation culture, a few memecoins accidentally retained trading value.

Today, memecoin issuance and trading remain highly akin to online gambling. Users first exchange dollars for Solana (a kind of voucher), register a memecoin wallet on a platform, and then start trading or launching coins—with zero effective vetting of issuers.

Theoretically, anyone—even a literal dog—can launch a “coin” on such platforms. A memecoin’s value depends solely on how many people are willing to pay for it. In other words, its value hinges entirely on building a “consensus” within a fanbase, driven primarily by the fame of its promoter. It’s simply a tool for monetizing celebrity clout.

Does this sound less like currency and more like signed photos, collectible stamps, or commemorative medals sold by celebrities to fans? Exactly. Strip away the flashy tech veneer, and that’s precisely what memecoins are. Unlike Bitcoin, they have nothing to do with blockchain fundamentals or decentralization—in fact, their issuance mechanism is far more centralized than traditional money, centered entirely on the issuer.

Highlight this—it’s crucial for later.

Because of this, on the Solana-based platform where Trump launched his coin, millions of memecoins are created annually. Yet fewer than one in ten thousand retain any trading value beyond the first month. 99.9999% of memecoins are pure pump-and-dump schemes and gambling games.

In sum, compared to real currencies, memecoins lack every essential attribute of actual money.

First, they lack reserve backing. While some memecoin issuers have promised to redeem coins at face value if prices drop, no one has ever actually done so. All eventually cash out and disappear.

Second, there is no central bank oversight.

Whether a memecoin suffers from insider trading (“rat warehouses”) or whether the issuer will abruptly dump all holdings depends purely on the issuer’s conscience. Faced with massive profits, no memecoin creator has resisted cashing out completely within three years. Human morality hasn’t evolved enough to replace central bank regulation with a mere “gentleman’s agreement” between a网红 and their fans. Don’t test human nature.

Third, and most importantly, unlike fiat or even Bitcoin, memecoins lack intrinsic scarcity.

Fiat money requires reserves—over-issuance causes hyperinflation. Bitcoin’s supply is mathematically fixed—unless 1+1 stops equaling 2, no one can mint extra bitcoins.

But what guarantees a memecoin’s scarcity? Nothing. It’s entirely up to the issuer’s mood.

For example, Trump announced he’d initially issue 200 million “Trump coins,” later increasing to 1 billion. That number is arbitrary—based solely on his whim and integrity.

This is why most memecoin creators eventually cash out and vanish—human nature fails under zero structural constraints.

And notice Trump’s own words—they’re quite transparent. Look at his tweet: he’s issuing this coin to “celebrate” his victory.

When do you celebrate by issuing currency? With autographs or commemorative medals, yes. But when does a country print extra legal tender to “celebrate”? Even if it happens, such a nation is already collapsing.

So memecoins aren’t real money. Their nicknames—shitcoins, scamcoins—reveal their true nature.

But here arises a key question—if Trump truly understands all this, why would he still launch a memecoin?

Trump isn’t short on money. Could he really be doing this just to “harvest another round of韭菜” and pocket some quick cash? If that were the case, he should wait four years to do it again.

Of course not. His ambitions run much deeper—

so deep that years from now, Americans might look back and wish: “Mr. Trump, if only you had merely wanted to harvest韭菜 and make a quick buck… that would’ve been better!”

II. Is Trump Just Trying to 'Harvest韭菜'?

Let me first correct a common myth. After this event, many in Chinese cyberspace claimed “Trump launched a coin and instantly made (or ‘cashed out’) tens of billions of dollars.” This is inaccurate, often spread maliciously to attack Trump.

Whether $24 billion or the latest claim of hundreds of billions, these figures refer to the current market cap of the “Trump Coin.” Anyone familiar with stocks knows market cap doesn’t equal “cashed-out profit.” Having a million-dollar house doesn’t mean you have a million in liquid cash. If Trump tried to dump all his “Trump Coins” at once—like a stock market crash—the coin’s value would plummet. His profit margin would shrink along with his credibility. While the final amount cashed out would still be huge, it would be far below the current market cap.

Besides, Trump has his own business empire. He’s not some broke influencer desperate to monetize fame. Attributing his motivation to personal retirement funds is laughable—according to 2024 estimates, Trump’s net worth stands at $3.2725 billion.

Tell me, what practical difference is there between spending $3.2 billion versus the rumored $24 billion “profit”?

Thus, claims that Trump “made tens of billions overnight” reflect shallow, ridiculous analysis.

It’s like a peasant dreaming of becoming emperor and declaring, “All the village manure shall belong to me.”

This is projecting petty influencer greed onto Trump. Quite amusing.

So why is Trump launching a coin despite having no financial need?

Based on current information, I believe his goal is—to hijack or privatize Republican campaign financing.

Campaign funds are the lifeblood of America’s two-party system. The battles within and between Democrats and Republicans are ultimately fights over money.

The 2024 U.S. election set a new record as the most expensive in history, with both parties spending a combined $15.9 billion. This is the scale at which “Trump Coin” could actually play a role.

Ultimately, campaign funds come from supportive voters or corporate giants. But how the money is raised, managed, and spent determines internal power dynamics.

Recall the 2016 election: a curious internal Democratic scandal occurred. Then-President Obama held a list of his top donors. Traditionally, he should have handed this critical “donor list” directly to Hillary Clinton, his presumed successor.

But Obama didn’t. He gave it to the Democratic National Committee, which then passed it to Clinton.

This delay caused complications. Some blame Obama for Clinton’s loss—and the two reportedly grew bitter afterward.

Why did Obama do this? Interpretations vary.

Some say it reflects long-standing tensions between the Obama and Clinton families—Obama was unwilling to lend his reputation to fundraise for her.

Others argue he aimed to end the Democratic Party’s tradition of powerful families privately controlling fundraising rights—ending the “godfather” model resembling New York mafia clans.

Regardless, whoever controls fundraising holds ultimate power—deciding which candidates live or die.

This rule applies equally to both parties.

Within the Republican Party, after being betrayed by GOP establishment figures during the 2021 “Capitol riot,” Trump’s 2024 comeback focused on transforming the traditional GOP into a MAGA party loyal solely to him. And last year, he nearly succeeded.

His biggest achievement? In the 2024 election, Republican campaign funds no longer flowed into the official RNC account—but into a private account controlled by Trump’s campaign team. Now, decisions on ad strategy, spending, and endorsements required only Trump’s signature.

To be fair, he spent the money more efficiently than the GOP establishment

As a result, in 2024, no unnecessary or counterproductive projects—ones Trump deemed wasteful—were funded.

Imagine if this model continues. Even if term limits prevent Trump from running again in four years, his successor will undoubtedly come from his inner circle—effectively, the MAGA party.

But how can he ensure this ideal future?

Possibly—through the Trump Coin.

As explained earlier, memecoins (I’ll call them “meme coins” from now on for brevity) have no intrinsic value. Historically, they’ve only served influencers seeking to monetize fame—“harvest韭菜 and run.”

But Trump may be pioneering a new use—using meme coins to absorb and redirect the intermittent wave of Republican voter enthusiasm into a permanent, personal base of support and worship.

Let’s simplify:

Suppose you’re a center-right or right-wing American voter who supports Republican ideals and broadly agrees with Trump. Previously, your main ways of showing support were donating to party accounts during elections or volunteering to canvass.

Now, with the Trump Coin, anytime you feel patriotic fervor—shouting “USA! Trump King!” or “Make America Great Again!”—you can log onto Solana, spend real money buying Trump Coins, and tell yourself: “I’ve taken concrete action to support Trump!”

This converts support into a tangible, tradable asset.

American right-wing passion, previously fleeting, is now conveniently stored—or more accurately, “charged up.”

But note: the beneficiary is no longer the Republican Party, but Trump personally.

Four years later, when the GOP needs to raise funds for a new campaign, they may find traditional methods ineffective. Supporters will say: “I already put my money into Trump Coins!” The party will then have to beg Trump—who has already captured and stored right-wing funding—for financial support.

Whether the money is given, and to whom, depends entirely on “Emperor Trump’s” mood.

We can even imagine a more extreme scenario (though based on current economic understanding, this seems sci-fi):

What if, four years later, the Trump Coin hasn’t collapsed like typical memecoins, but remains actively traded at high value?

The result? It could become a de facto “universal token” for allocating campaign funds within the American right-wing political ecosystem.

For example, if a local candidate earns Trump’s favor, he might reward them with thousands of “Trump Coins,” which the candidate can exchange with supporters for real campaign cash—possibly securing election.

If this becomes reality, Trump won’t just control presidential election finances—he’ll dominate funding for state legislators, governors, and even right-wing media operations.

Such granular control—such mobilization power and dictatorship—would surpass any previous U.S. president.

Hence Trump’s vision is sharp. As Part I explained, meme coins differ fundamentally from Bitcoin: they are not decentralized, but hyper-centralized. Trump sees precisely this feature—and chooses this seemingly absurd tool—to pursue his ambition.

Roman emperors stamped their faces on gold coins—a symbolic claim to monetary sovereignty. But they couldn’t actually control political funding flows.

But if Trump’s “Trump Coin” succeeds, it could wield unprecedented, terrifying control over American politics.

Yet the pursuit of any strongman’s ambition always comes at a cost.

So what price will America pay for Trump’s actions?

III. America’s ‘Marius’ Rod’

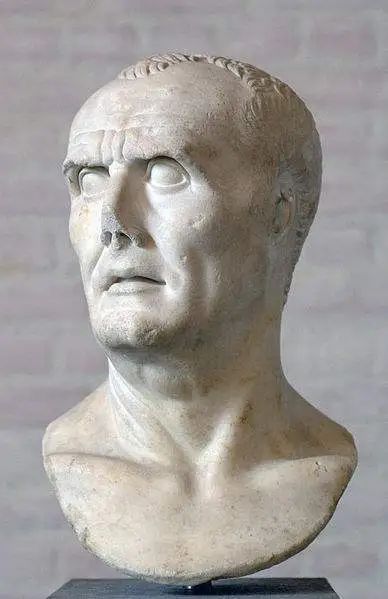

In Roman history, there’s a famous concept called “Marius’ Rod,” said to have triggered Rome’s transformation from Republic to Empire.

Briefly, ancient Rome originally followed a citizen-soldier model: citizens farmed or worked in peacetime, and during war, they dropped everything, armed themselves, and defended the homeland.

But as wars grew longer and fiercer, the citizen-soldier system faltered. After devastating conflicts like the Second Punic War and Jugurthine War, Consul Gaius Marius introduced military reforms—now known as the “Marian Reforms.”

Marius replaced mandatory citizen service with professional volunteers—including landless poor. The state funded weapons and wages, distributed through provincial governors or wartime dictators.

Short-term, these reforms massively boosted Rome’s military power, fueling rapid expansion.

Long-term, however, they fatally altered the army’s character. Soldiers were no longer citizens tied to homes and families, but mercenaries loyal only to generals who paid them, fed them, and promised rewards.

Rome’s financial structure also changed. Previously, armies were funded haphazardly by citizens. Now, governors concentrated financial power—becoming soldiers’ literal “bread providers.”

Soldiers began calling governors “Dominus” (Lord/Master), pledging absolute personal loyalty.

Thus, governors grew too powerful. Eventually, figures like Caesar crossed the Rubicon, marched on Rome, and became lifelong dictators.

“Marius’ Rod” emerged then: soldiers hung their food bags and pay on a stick, carrying it everywhere—jokingly calling it “Marius’ Rod.”

Loyalty to home and family was replaced. Soldiers now served only the rod—and the Dominus who fed them.

This stick ultimately cracked Roman history apart.

Now, compare past and present: Trump’s “Trump Coin” may become America’s version of “Marius’ Rod,” prying open a historical fissure.

Traditionally, political figures like presidents wield immense influence—but it’s not immediately convertible to cash.

A president’s appeal requires an entire apparatus—party machinery, allied media, foundations, and especially financial systems—to mobilize supporters and convert influence into political power.

During this process, the president’s influence is checked. Elites involved in mobilization ask: Is this call legal? Does it align with norms? Does it serve our interests?

If not, mobilization fails.

This creates a powerful constraint, preventing leaders from acting arbitrarily.

The clearest example is the 2021 “Capitol riot.”

Trump could rally supporters to “storm the tower,” but couldn’t activate the government or party machinery to legitimize or sustain the effort. Thus, the movement failed.

Even Trump’s Twitter account was suspended afterward.

But Trump’s new tactic bypasses this established oversight system—by directly converting his influence into cash. As discussed, this system will replace the GOP’s traditional fundraising infrastructure, “charging up” right-wing support. When needed, Trump can distribute funds directly to loyalists via Trump Coins.

This instantly converts political support into financial power, then back into political force—directly nourishing Trump’s core base. Like the electric transmission in Hitler’s favored Porsche Tiger tank, it bypasses America’s elite-controlled checks and balances.

The result? Just as provincial governors escaped republican control after Marius’ reforms, Trump finally breaks free from the “deep state” (i.e., existing party machinery) he despises.

But just as Marius’ Rod paved Caesar’s path across the Rubicon, no one knows what Trump will do with his now-unchecked “Marius’ Rod.”

Remember: a convenient shortcut that bypasses institutional constraints is always invented by an ambitious visionary—and ultimately twisted and ruined by greedy opportunists.

During Rome’s “Crisis of the Third Century,” the Praetorian Guard auctioned off the imperial throne to the highest bidder. The mighty Roman state became a cash cow for emperors and guards alike. Noble public service devolved into vulgar commerce—an inevitable outcome of the governor-funded military system established by Marius.

Similarly, if Trump’s coin model succeeds, future U.S. presidential elections may descend into farce:

Someone runs for president with extreme policies, gains notoriety, then announces a “coin launch,” harvests韭菜, becomes rich, and vanishes.

Politics ceases to be governance. Slogans, especially radical ones, become tools for profiteering.

I believe Trump himself doesn’t aim for this—his goal is likely revenge against Democrats and GOP elites, fulfilling his own “crossing the Rubicon,” and seizing full control.

But make no mistake: he will be the originator—for打通 (opening) a conversion channel between politics and money that should never have existed, planting the seeds of systemic corruption in America.

Let me repeat: any shortcut bypassing institutional checks is created by a bold visionary, but always ends up distorted and corrupted by greedy speculators.

What is political influence meant to be?

It should be a public good. It doesn’t belong solely to Trump. People support him because he represents a segment of America’s political aspirations.

But when Trump monetizes this public influence through coin issuance, the money he gains is private. Even if he reinjects it into politics, the resulting influence reflects only his personal will.

This is the most sophisticated form of “influence laundering” and the most brazen act of turning public assets into private wealth.

Can American institutions stop Trump’s runaway train? Currently, unlikely.

Congress could pass laws like “Presidents or president-elects cannot issue memecoins.” But such laws require presidential signature and Supreme Court approval to survive constitutional scrutiny.

In other words, the legislation must squeeze through the holes of three institutional “cheeses”—legislative, executive, judicial—to patch this loophole the Founding Fathers never imagined.

But during Trump’s term, given his influence and stubbornness, he’ll certainly block any self-incriminating bill.

Moreover, this coin launch may only be the first of many similar experiments. Trump is a brilliant businessman, aided by Musk. Frankly, I doubt politicians can outmaneuver this duo-led team.

Thus, a new clash between populism and institutional order—between imperator and Senate—is about to begin as Trump returns to the White House.

The stakes? America’s trajectory and fate for centuries to come.

Two thousand years ago, a similar struggle unfolded in Rome. After Marius’ reforms, Caesar’s Rubicon crossing, and the crowd’s desperate cry for a “new Caesar” at Caesar’s funeral amid hunger and Antony’s rhetoric, the Republican faction lost to the Caesarians. Rome gradually shifted from Republic to Empire, rapidly decayed, and ended absurdly with barbarian guards auctioning the throne.

This time, will the Republican resistance be stronger and more determined? Or is a new Augustus ascending to the throne?

The overture has ended.

The theater curtain is rising.

We watch and wait.

End of article

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News