A Comprehensive Review of 2024 Crypto Venture Capital: Infrastructure Project Funding Active, Fundraising Momentum Weak

TechFlow Selected TechFlow Selected

A Comprehensive Review of 2024 Crypto Venture Capital: Infrastructure Project Funding Active, Fundraising Momentum Weak

In Q4 2024, venture investors poured $3.5 billion into cryptocurrency- and blockchain-focused startups, a 46% increase quarter-over-quarter. However, the number of deals declined 13% sequentially to 416.

Author: insights4.vc

Translation: Felix, PANews

Driven by key milestones such as the launch of spot Bitcoin ETFs in January 2024 and the election of a crypto-supportive U.S. president and Congress in November, the cryptocurrency market experienced significant growth in 2024. The market capitalization of liquid cryptocurrencies surged by $1.6 trillion (up 88% year-on-year), reaching $3.4 trillion by year-end, with Bitcoin’s market cap alone increasing by nearly $1 trillion to approach $2 trillion. Bitcoin’s rise accounted for 62% of the total market growth, while the surge in Memecoins and AI tokens further fueled this momentum—these tokens dominated on-chain activity, particularly on Solana.

Despite market recovery, the crypto venture capital landscape remained challenging. Major trends like Bitcoin, Memecoins, and AI agent tokens offered limited venture opportunities, as they primarily leveraged existing on-chain infrastructure. Previously hot sectors such as DeFi, gaming, metaverse, and NFTs failed to attract substantial new attention or capital. With expectations of regulatory reforms under the incoming U.S. administration, infrastructure players at an advanced stage now face intensifying competition from traditional financial service intermediaries.

Emerging trends including stablecoins, tokenization, DeFi-TradFi integration, and the convergence of crypto and AI show promise but remain in early stages. Meanwhile, macroeconomic pressures—including high interest rates—have hindered risk-on allocations, disproportionately affecting the crypto venture capital sector. After the high-profile crypto market collapse in 2022, generalist VC firms have largely remained cautious and distanced from the crypto space.

According to Galaxy Research, venture investors deployed $3.5 billion into crypto- and blockchain-focused startups in Q4 2024, a 46% increase quarter-over-quarter. However, deal counts declined by 13% to 416 transactions.

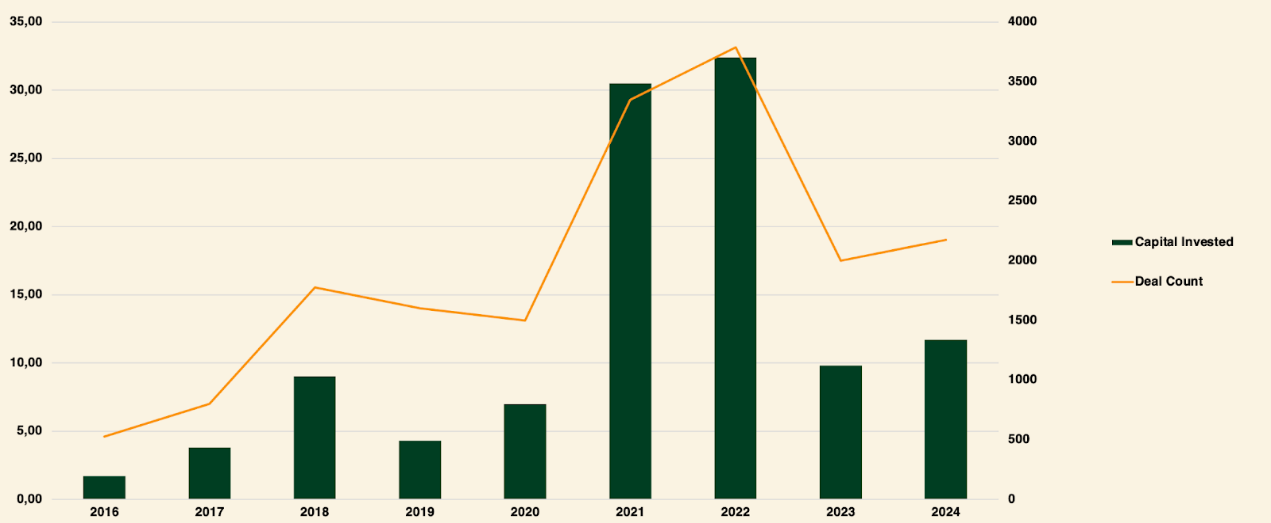

Annual Breakdown of Crypto Venture Investment (2016–2024)

Throughout 2024, venture capital investment into cryptocurrency and blockchain startups totaled $11.5 billion across 2,153 deals.

Robert Le, Senior Analyst at PitchBook, forecasts in the "2025 Corporate Technology Outlook" that annual investment in the crypto market will exceed $18 billion in 2025, with several quarters surpassing $5 billion. This represents a significant increase compared to 2024, though it remains notably below the levels seen in 2021 and 2022.

The growing institutionalization of Bitcoin, the rise of stablecoins, and potential regulatory progress on DeFi-TradFi integration are all key areas for future innovation. Combined with emerging trends, these factors could catalyze a revival in venture capital activity.

Capital Investment and Bitcoin Price

Historically, there has been a strong correlation between Bitcoin's price and the amount of capital invested in crypto startups. However, since January 2023, this correlation has clearly weakened. While Bitcoin has reached new all-time highs, venture investment activity has struggled to keep pace.

Possible Explanations:

-

Reduced allocation interest: Institutional investors may be hesitant due to regulatory uncertainty and market volatility

-

Shift in market narrative: The current narrative favors Bitcoin, potentially overshadowing other crypto investment opportunities

-

Venture outlook: The broader venture capital market is experiencing a downturn, impacting crypto investments

Infrastructure Dominated Crypto Venture Investment

Total Funding by Sector in 2024 (USD)

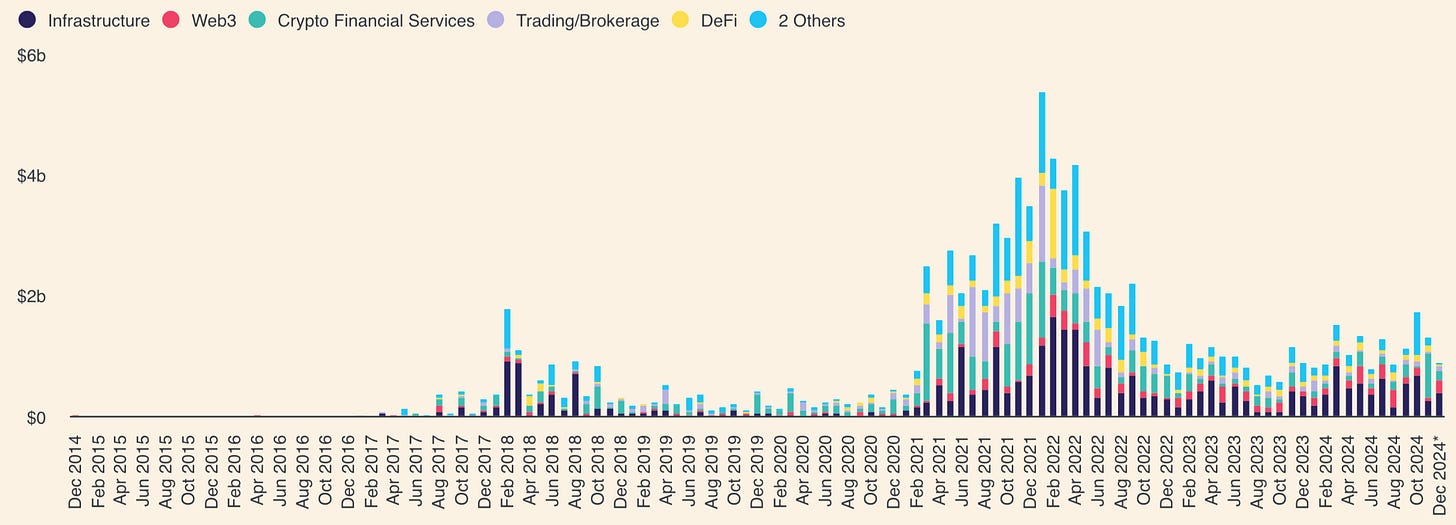

According to The Block, infrastructure dominated crypto venture investment in 2024, attracting over 610 deals and $5.5 billion—a 57% year-over-year increase. Investment focused on scaling blockchain networks through Layer 2 solutions to improve speed, reduce costs, and enhance scalability. Modular technologies such as data availability and shared sequencers attracted significant funding, while liquid staking protocols and developer tools remained key priorities.

NFT and gaming startups raised $2.5 billion, slightly above the $2.2 billion raised in 2023. Despite steady funding, NFT market activity declined as Memecoins gained traction. Although transaction volume has matured from its peak of 936 deals in 2022, NFTs and gaming remained focal points, exceeding 610 deals. Enterprise blockchain funding dropped sharply by 69%, falling from $536 million in 2023 to $164 million in 2024.

Web3 fundraising showed resilience, raising $3.3 billion over two years—close to the $3.4 billion raised during the 2021–2022 period. Growth was driven by emerging trends such as SocialFi, crypto AI, and DePIN. DePIN emerged as a rapidly growing vertical, attracting over 260 deals and nearly $1 billion in funding.

DeFi experienced a strong rebound in 2024, recording over 530 funding rounds—up 85% from 287 in 2023. DeFi use cases built on Bitcoin, including stablecoins, lending protocols, and perpetual contracts, were key drivers of this growth.

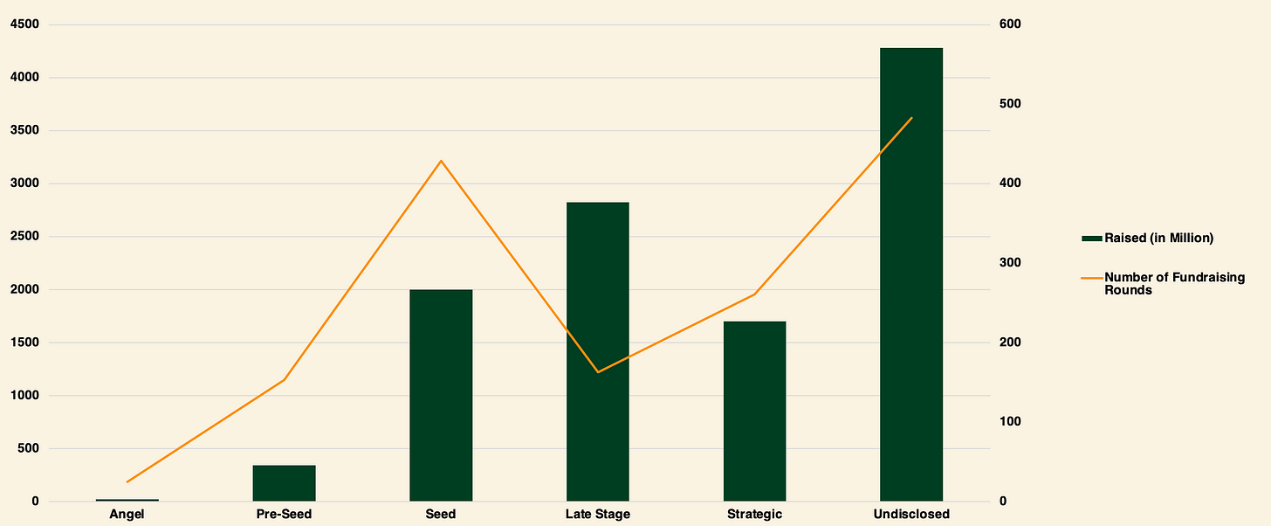

Crypto Venture Capital Investment by Stage

The chart above shows that, excluding undisclosed rounds, the crypto industry remains highly concentrated in early-stage financing. Early-stage deals attracted the majority of capital, accounting for 60%, while late-stage funding represented 40% of total capital—significantly up from 15% in Q3.

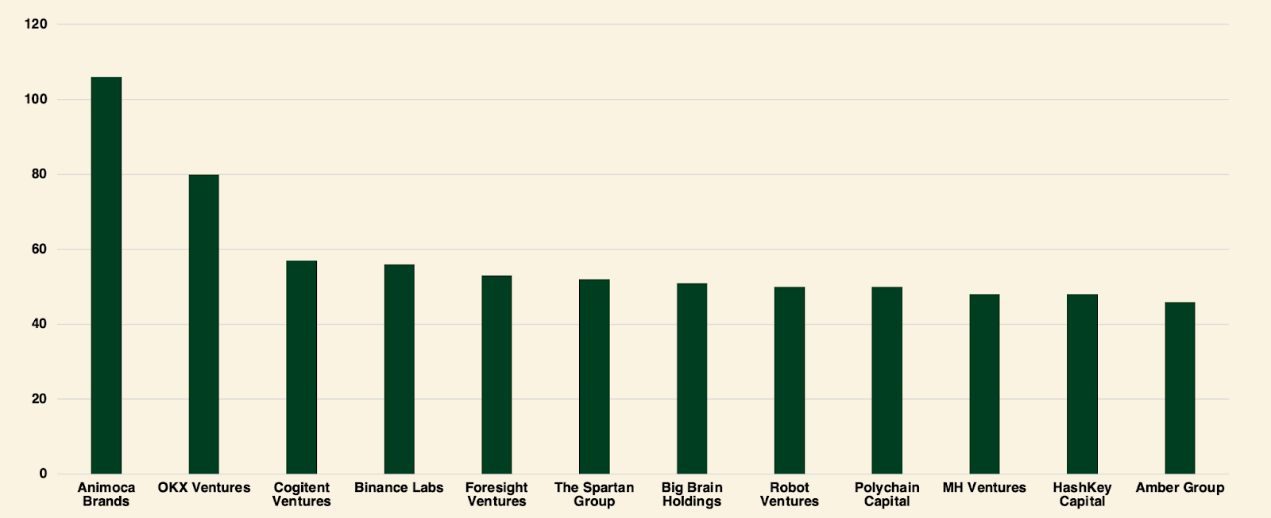

Most Active Investors

In 2024, Animoca Brands led venture activity with over 100 investments, followed by OKX Ventures with more than 80. Cogitent Ventures, Binance Labs, and Foresight Ventures each completed around 60 deals. The Spartan Group, Big Brain Holdings, and Robot Ventures executed over 50 investments, while major players such as Polychain Capital and Amber Group maintained active participation with over 40 deals.

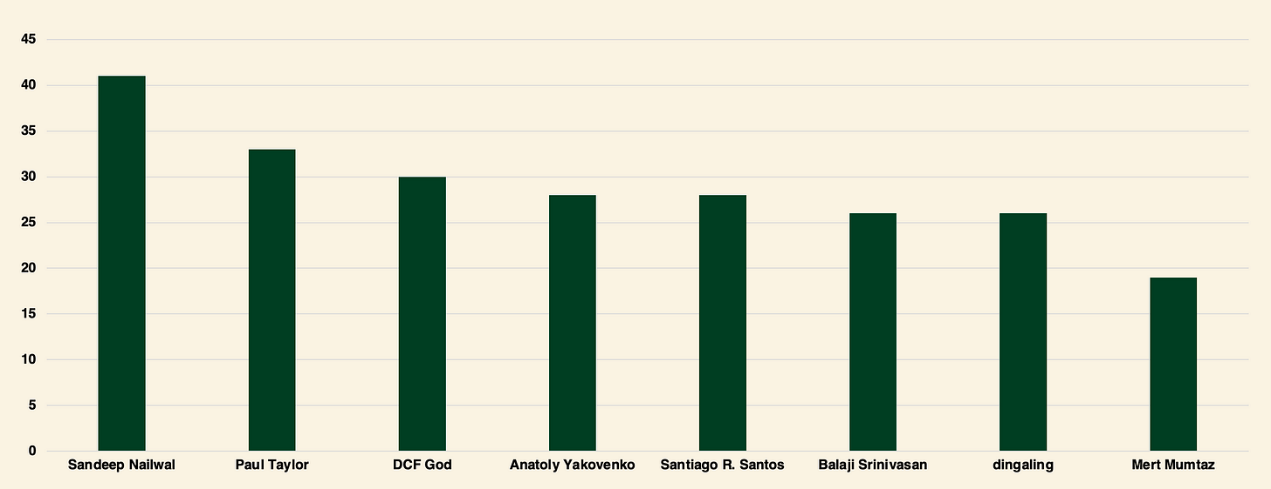

Funds in Focus

Among angel investors, Sandeep Nailwal (co-founder of Polygon) was the most active, participating in over 40 deals. Paul Taylor and DCF God followed with more than 30 each. Anatoly Yakovenko (Solana co-founder), Santiago R. Santos, and Balaji Srinivasan were also prominent, completing over 25 investments. Mert Mumtaz trailed slightly but remained actively involved.

Angel Investors

Crypto Venture Fundraising

Data from the Venture Capital Journal shows that fundraising by venture funds fell to a six-year low in 2024. A total of $104.7 billion was raised by 865 funds, down 18% from $128 billion raised by 1,029 funds in 2023.

Impacted by macroeconomic conditions and sustained market volatility from 2022 to 2023, crypto venture fundraising continues to face pressure. Limited partners reduced commitments to crypto-focused venture funds, reflecting a shift from the bullish sentiment seen in 2021 and early 2022. Although rate cuts were anticipated in 2024, meaningful reductions did not occur until the second half of the year, and capital allocation to venture funds continued to decline quarter-on-quarter since Q3 2023.

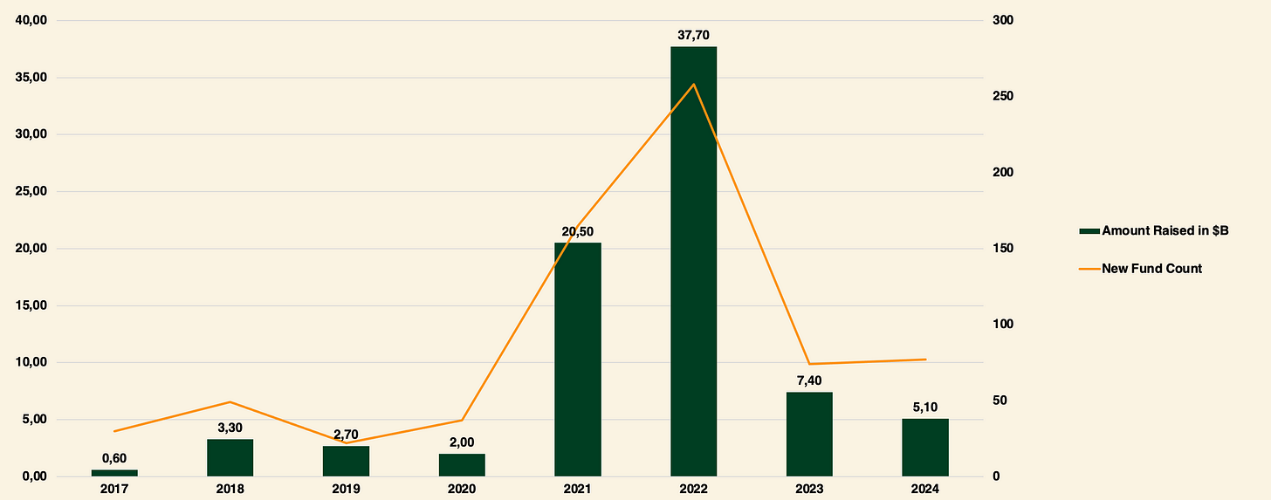

Crypto Venture Fundraising (2017–2024)

Crypto venture fund performance in 2024 was notably weak, with 79 new funds raising $5.1 billion—the lowest annual total since 2020. While the number of new funds increased slightly year-over-year, reduced investor interest led to significantly smaller fund sizes. Both median and average fund sizes in 2024 dropped to their lowest levels since 2017, highlighting the increasingly difficult fundraising environment.

Shift Toward Mid-Sized Funds

Historically, small funds (under $100 million) have dominated crypto venture fundraising, reflecting the industry’s early-stage nature. However, since 2018, there has been a clear shift toward mid-sized funds ($100 million to $500 million).

While large funds ($1 billion or more) saw rapid growth from 2019 to 2022, none emerged in 2023 or 2024 due to challenges including:

-

Deployment difficulties: Few startups require such large amounts of capital

-

Valuation risks: Large investments drive up valuations, increasing risk exposure

Nonetheless, notable funds such as Pantera Capital and Standard Crypto (both $500 million) remained active, expanding their scope beyond crypto—for example, into AI. Notably, Pantera Fund V, successor to Pantera Blockchain Fund IV, will begin fundraising on July 1, 2025, targeting $1 billion.

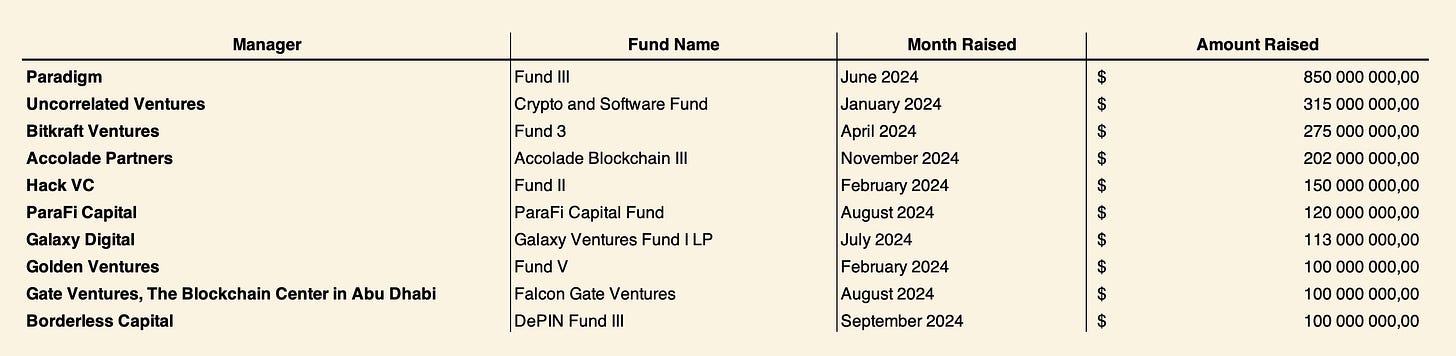

The table below summarizes the 10 funds that raised over $100 million in 2024. The largest closed-end fund raised in 2024 was Paradigm’s Fund III.

Crypto Venture Funds That Raised Over $100 Million in 2024

Notable Investments in 2024

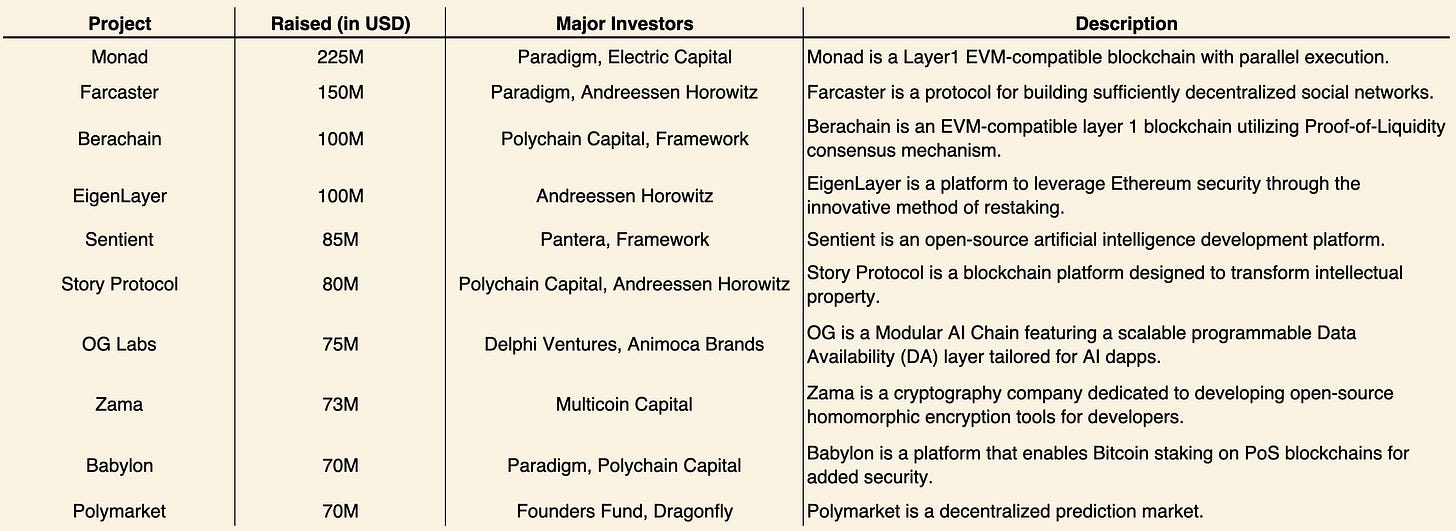

Top 10 Venture-Funded Projects in 2024

-

Monad: An EVM-compatible L1 blockchain achieving 10,000 transactions per second with one-second block times and single-slot finality. Its parallel transaction execution architecture ensures efficiency, making it a preferred platform for developers prioritizing speed and scalability.

-

Farcaster: A social network enabling user ownership of data. Its “fully decentralized” design allows interactions without network-wide approval, using a non-custodial social graph secured by Ethereum. The flagship app Warpcast highlights its potential to redefine social media.

-

Berachain’s Proof-of-Liquidity (PoL) consensus links network security with liquidity provision, allowing validators to stake liquid assets to enhance security and earn rewards. EVM compatibility simplifies DeFi application deployment, solidifying Berachain’s role within the DeFi ecosystem.

-

Story Protocol: Revolutionizes intellectual property management through on-chain registration, automated licensing, and monetization via ERC-6551 token-bound accounts. Leveraging both Ethereum Virtual Machine and Cosmos SDK, it empowers creators and fosters innovation.

-

0G Labs: Combines blockchain scalability with AI-driven processes, featuring a robust data availability layer and a decentralized AI operating system (dAIOS). It topped 2024 project fundraising with a $250 million raise, surpassing even Monad and cementing its leadership in the AI-blockchain space.

-

Polymarket: A decentralized prediction market that gained significant attention during the 2024 U.S. presidential election, demonstrating Web3’s potential for rapid adoption despite declining post-event metrics.

Blockchain Infrastructure

-

EigenLayer: Introduced a restaking market to maximize utilization of staked Ethereum assets, enhancing security and validator income.

-

Babylon: Combines Bitcoin’s proof-of-work with proof-of-stake blockchains, offering tamper-proof security and cross-chain interoperability.

Blockchain Services

-

Sentient: Enables decentralized AI applications by leveraging blockchain’s distributed network for scalable and private AI computation.

-

Zama: Implements homomorphic encryption for secure data processing on blockchains, ensuring privacy without sacrificing functionality.

Key Trends in 2024 and Beyond

AI integration, Bitcoin-based DeFi, and purpose-built blockchains dominate the blockchain landscape. Projects like 0G Labs and Sentient lead in AI, while Babylon strengthens Bitcoin’s role in DeFi. Mainnet launches for Monad, Berachain, and Story Protocol are expected in the near future.

Conclusion

The 2024 crypto venture capital landscape reflects cautious optimism, marked by a rebound in fundraising activity and growing institutional interest. The shift toward mid-sized funds and the continued dominance of emerging funds indicate an industry maturing and adapting to evolving market dynamics. Despite short-term declines in venture investment and elongated fundraising cycles, sustained focus on early-stage ventures and emerging trends like AI integration highlight a resilient ecosystem well-positioned for future growth. Overall, the crypto industry demonstrates underlying strength, suggesting new momentum may be on the horizon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News