Base Ecosystem AI Gold Rush: Beyond Virtuals, a Comprehensive Look at Hidden Gem Projects You Might Have Missed

TechFlow Selected TechFlow Selected

Base Ecosystem AI Gold Rush: Beyond Virtuals, a Comprehensive Look at Hidden Gem Projects You Might Have Missed

Trying to find more AI Agent-related projects on Base.

Written by: TechFlow

Introduction

Everyone is raving about AI Agents, and the Solana ecosystem is undoubtedly a treasure trove.

But beyond Solana, Base has also been one of the key birthplaces of this latest wave—don’t forget that Virtuals even has a higher market cap than ai16z.

One reason people love the Base ecosystem is that it’s less hyper-competitive (PvP) compared to Solana, making it easier to discover hidden gems. However, due to fragmented information, relatively lower name recognition for some projects, and echo chambers, spotting opportunities on Base isn't always straightforward.

Besides the previously hyped tokens around Virtuals and Clanker, and the widely known AIXBT, what other potential hidden gems might you have missed on Base?

The editorial team at TechFlow has decided to embark on a major gold rush, seeking out more AI Agent-related projects on Base to map out the full landscape of opportunities within the ecosystem.

We’ve categorized and highlighted several standout projects recently gaining traction, grouped by their development direction and themes, for your reference.

Rising Stars Within Virtuals

Beyond AIXBT and the GAME framework, the Virtuals ecosystem hosts numerous promising projects with market caps under $100M that have performed notably well in recent months. Some worth watching include:

TAO CAT: An AI Agent Powered by Bittensor and Masa

$TAOCAT

CA:

0x7a5f5ccd46ebd7ac30615836d988ca3bd57412b3

Market Cap: $44M

Backed by renowned AI projects Masa and Bittensor, TAOCAT boasts strong credentials and resources.

As a native AI agent within the Bittensor ecosystem, TAOCAT is built directly on Bittensor subnets:

-

SN42: For real-time data related to superintelligence.

-

SN19: For LLM/inference and advanced language capabilities.

In terms of functionality, TAOCAT can process and analyze real-time social data, interpret insights using AI technology, and provide market analysis and decision-making support.

Recent highlights: Listed on Binance Alpha; TAOCAT also received investment from DWF Labs as part of its $20 million AI agent fund.

Polytrader: AI-Powered Prediction Assistant for Polymarket

$POLY

X: @polytraderAI

CA:

0x2676E4e0E2eB58D9Bdb5078358ff8A3a964CEdf5

Market Cap: $17M

Polytrader helps users make smarter, data-driven decisions on Polymarket by analyzing market sentiment and delivering actionable insights.

You can let Polytrader analyze trending topics across social platforms before placing bets on event outcomes—essentially serving as a prediction market advisor. It's a niche yet timely AI Agent tailored to Polymarket, which gained popularity during recent election speculation.

To access all features, users must hold a certain amount of POLY tokens, giving the token practical utility.

During major global events, POLY may benefit not only from the AI narrative but also from increased activity driven by the events themselves.

Acolyte: The Oracle for AI Agents

X: @AcolytAI

CA:

0x79dacb99A8698052a9898E81Fdf883c29efb93cb

Market Cap: $37M

Acolyt provides reliable research and engineering data through infrastructure, offering high-quality analysis and actionable insights to individuals and companies.

Currently, Acolyt is being trained to map and understand metrics impacting the AI agent ecosystem, providing comprehensive insights into each agent and its role.

In the future, Acolyt aims to become a leading oracle, supplying high-quality data to AI agents, traders, venture capital firms, index funds, AI accelerators, and educational institutions. It will be capable of analyzing and generating probabilistic outcomes for any project—even before launch.

Freya: Merging AI Agents with Gaming

$Freya

X: @Freya_Starfall

CA:

0xF04D220b8136E2d3d4BE08081Dbb565c3c302FfD

Market Cap: $14M

Integrating AI agents into games to create more intelligent and imaginative characters remains a hot topic.

Freya stands out as a representative example. Backed by the popular Japanese-style game Starfall Chronicles (built with Immutable’s tech), Freya uses AI to enrich character interactions within the game.

Thus, Freya functions both as a token and as an in-game AI character, positioning itself at the intersection of AI Agents and GameFi.

Recent developments:

Listed on Binance Alpha; on January 6, the game’s developer participated in ai16z’s meetup in Japan, discussing Freya’s roadmap and its implementation via elizaTEE.

DeFAI

DeFAI refers to leveraging AI capabilities within DeFi to optimize various stages of DeFi transactions—pre-trade, execution, and post-trade—and has become one of the most discussed trends on social media recently.

For a deeper dive into this sector, see our previous article: "AI + DeFi" Trend Emerges: These DeFAI Projects Are Worth Watching.

Kudai: A DeFAI Agent Born from the GMX Community

$kudai

X: @Kudai_IO

CA:

0x288F4Eb27400fA220d14b864259Ad1B7f77C1594

Market Cap: $19M

Kudai is an AI agent born from the GMX Blueberry Club community, built using the well-known @EmpyrealSDK framework, aiming to deliver an experience that blends community-driven ethos with DeFi, AI, and innovative features.

Note that currently, Kudai has only launched its token, with many promised functionalities still undeveloped. However, according to its recently released whitepaper, Kudai plans to purchase and stake GMX to generate additional revenue streams and invest in GMX’s GM pool to boost returns.

The ultimate vision is for Kudai to autonomously run multiple strategies (leveraged trading, arbitrage, farming negative funding rates, etc.) on GMX V2, sharing positions, profits, and losses in real time.

Think of it as a potential AI ambassador for GMX—but most features are still in progress.

AI Agent Frameworks

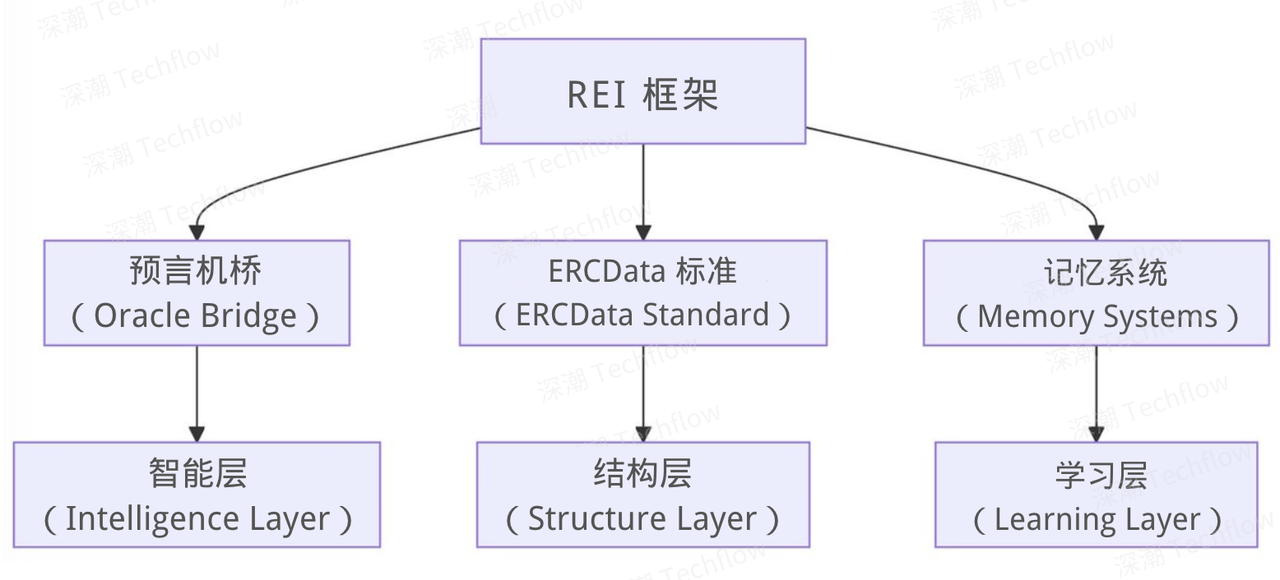

REI: A New Framework Enabling Efficient Collaboration Between Blockchain and AI

X: @ReiNetwork0x

CA:

0x6B2504A03ca4D43d0D73776F6aD46dAb2F2a4cFD

Market Cap: $104M

Rei Network is a core framework layer dedicated to maximizing the synergy between AI and blockchain.

Through its three-layer architecture, Rei achieves a critical goal: enabling AI to operate beyond blockchain’s technical constraints while allowing low-cost verification and on-chain storage of data. Rei’s uniqueness lies in transforming AI’s probabilistic outputs into deterministic, verifiable data structures.

As the first project adopting this approach, Rei has quickly established a leading position thanks to its first-mover advantage.

While technical details of framework-level projects are beyond the scope here, the market generally sees REI’s key benefit as:

Designing blockchain and AI to work together efficiently through separation rather than forced integration—emphasizing collaboration over fusion.

Several AI agents built on the Rei framework are already emerging. Due to space limitations, they won’t be listed here. For detailed analysis, refer to: In-Depth Analysis of Rei Network and $REI: Another Unmissable AI Project in the Base Ecosystem.

Investment / Incubation DAOs

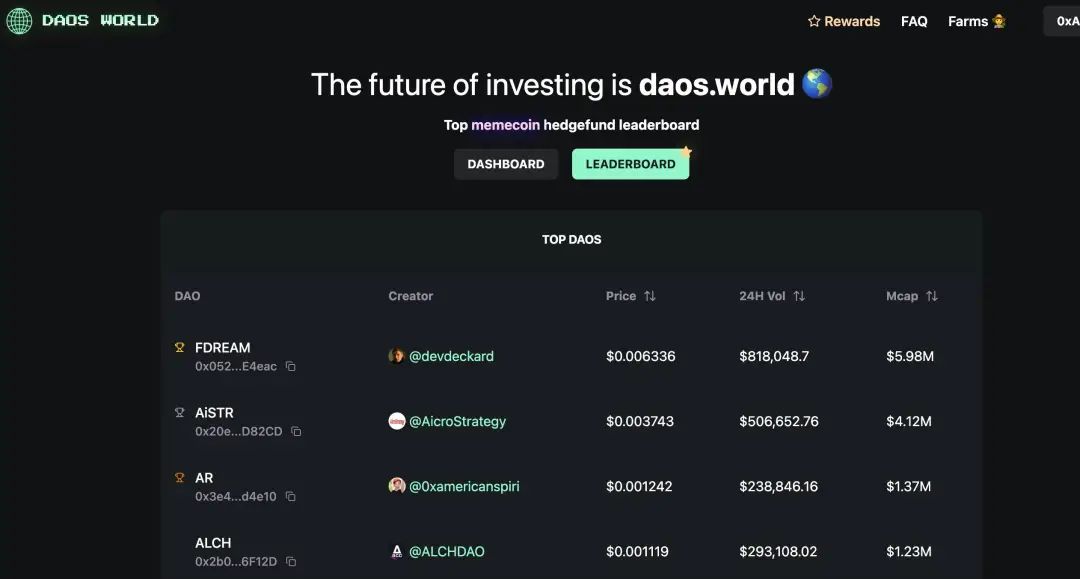

daos.world: A New Take on Decentralized Investment Funds

Following the rise of Daos.fun—a decentralized fund management platform initiated by ai16z—the concept of “investment DAOs” has started gaining acceptance: decentralized hedge funds managed by humans or AI agents that raise capital, generate returns, and distribute profits back to DAO token holders.

On Base, a similar investment DAO is daos.world.

Users can raise funds through the platform to easily launch and manage their own DAO hedge funds, executing trades via trustless smart contracts. Each DAO manager raises ETH to kickstart the fund and can freely trade and invest the ETH as they see fit.

Each DAO also issues its own token; holding these tokens represents “fund shares,” entitling holders to a portion of the fund’s investment returns based on their shareholding.

On the asset side, the platform explicitly states these hedge funds focus on meme coins and AI-related tokens.

Additionally, daos.world’s current product is based on the Base chain, with plans to expand to Ethereum, Hyperliquid, and others based on user demand.

Currently, four funds are live on daos.world. Below is an overview.

Note: DAO tokens within daos.world have recently seen a broad market correction—please exercise caution and do your own research (DYOR).

1.DR3AM DAO: AI-Assisted Fund Targeting AI Sector Opportunities

$FDREAM

X: @DR3AM_AI

CA:

0x0521AaA7C96E25afeE79FDd4f1Bb48F008aE4eac

Market Cap: $7M

DR3AM DAO is an AI-assisted investment fund targeting large, medium, and small-scale AI opportunities. Supported by DREAM’s proprietary datasets and algorithms, it combines human expertise with AI analysis to identify transformative projects across the crypto-AI landscape.

However, judging from DR3AM’s current holdings, it primarily invests in other investment DAO tokens, such as WAI and TRUST (introduced later).

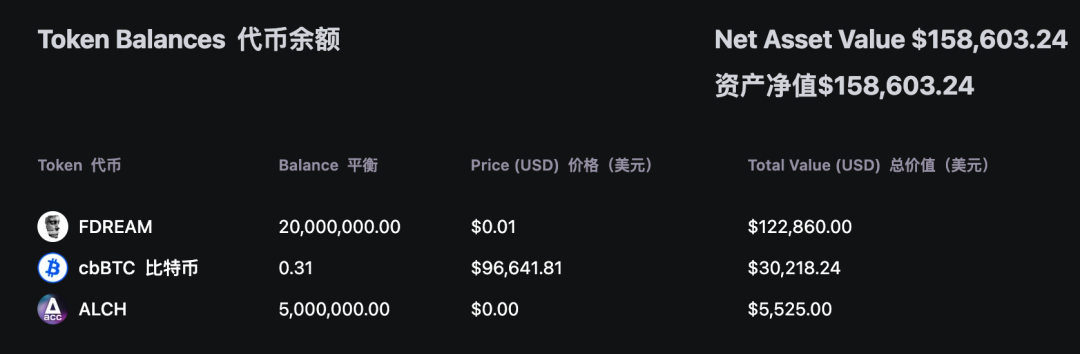

2.Alchemist Accelerate: Holding Only BTC and ETH?

$ALCH (Not the one on Solana—be careful to distinguish)

X: @ALCHDAO

CA:

0x2b0772BEa2757624287ffc7feB92D03aeAE6F12D

Market Cap: $1.2M

This DAO claims to invest in transformative projects, create multilingual educational resources, and offer mentorship and connections to empower global communities.

Aside from holding FDREAM tokens (from the neighboring DAO mentioned above), ALCHDAO’s largest holdings are Bitcoin and Ethereum—indicating a very conservative investment strategy.

3.AicroStrategy: A Chain-Based Parody of MicroStrategy, Mainly Buying cbBTC

$AiSTR

X: @AicroStrategy

CA:

0x20ef84969f6d81Ff74AE4591c331858b20AD82CD

Market Cap: $4.2M

AicroStrategy is an AI hedge fund aiming to maximize Bitcoin exposure through cbBTC holdings. Raised funds will be used to buy cbBTC, which will then be deployed into carefully selected DeFi protocols to maximize security and leverage.

The initial plan involves depositing into Aave, borrowing USDC, buying more cbBTC, and repeating the cycle. AI algorithms will determine the optimal leverage level for execution.

The DAO’s holdings confirm its focus on cbBTC—though it holds even more of the sister DAO token $FDREAM.

4.Alameda Research V2: Playing on the FTX Bankruptcy Meme, With the Most Diversified AI Token Portfolio

$AR

X: @AlamedaV2DAO

CA:

0x3e43cB385A6925986e7ea0f0dcdAEc06673d4e10

Market Cap: $1.5M

The name and logo ooze satire and humor, clearly referencing the FTX bankruptcy and SBF’s relationship with Alameda Research.

The DAO’s description adds to the joke: “V2 is a leading trading firm operated from SBF’s prison cell… We use internally developed technology and our team’s deep crypto expertise to trade thousands of digital asset products.”

Judging from portfolio holdings, it is indeed the most diversified among the listed DAOs, holding nearly all major AI-related tokens on Base.

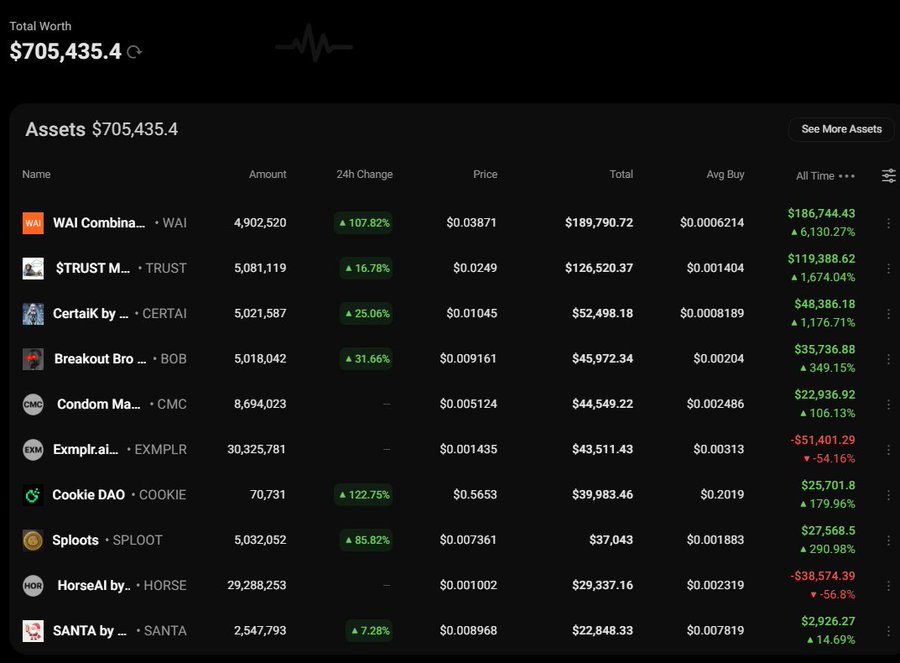

wai combinator: The On-Chain Y Combinator Pun, an AI Project Incubator on Base

$WAI

X: @wai_combinator

CA:

0x6112b8714221bBd96AE0A0032A683E38B475d06C

Market Cap: $17M

WAI Combinator is also built on the Virtuals protocol but leans more toward investment and incubation.

Its core mission is to function as an experimental “Agent + Human” investment DAO, combining AI agents with human expertise to make investment decisions that create value for token holders.

The name clearly pays homage to the famed startup accelerator Y Combinator, and its business model is similar—except it focuses exclusively on early-stage projects within the Base ecosystem, particularly those still in the bonding curve phase on Virtuals.

Its assets under management (AUM) grew from $50K to over $700K in less than two weeks, with portfolio value now significantly increasing (currently $500K). Through its ongoing “Velocity” program, WAI continues deploying new investments—projects receiving its backing are worth monitoring.

WAI has also published its asset management address (Click here), allowing interested users to track its moves.

Like other investment DAOs, holding WAI tokens allows users to share in the fund’s returns. However, compared to others, WAI Combinator offers more value-add services:

Providing AI technical support and integration to help portfolio projects optimize decision-making processes; assisting projects in connecting with the Virtuals ecosystem to foster collaboration and resource sharing.

So it acts more like a strategic investor and上市 project incubator rather than just a passive fund.

Note: A comparable investment DAO often mentioned alongside WAI is Vader AI:

$VADER

CA:

0x731814e491571A2e9eE3c5b1F7f3b962eE8f4870

trustmebrosfun: Incubated by WAI Combinator, Preparing to Launch New Token $DATDAO

$TRUST

X: @trustmebrosfun

CA:

0xC841b4eaD3F70bE99472FFdB88E5c3C7aF6A481a

Market Cap: $12M

WAI Combinator has successfully incubated a project called trustmebrosfun—an AI initiative running on Base. The name comes from the crypto community’s common phrase “Trust me bro,” used ironically to highlight trust issues in crypto markets.

The existing token $TRUST serves both as a meme and as the social media AI agent for "trust."

The key development is that founder @Degen__Ape__ recently released the DATDAO whitepaper based on trustmebrosfun. DATDAO is defined as an innovative decentralized autonomous organization focused on investing in other tokens and participating in PVP airdrop farming on Hyperliquid.

DATDAO will soon launch its own token $DATDAO. To qualify for the whitelist in the public round, users must hold at least 100K TRUST tokens, which will entitle them to $1 ETH worth of $DATDAO, with a personal cap of 5 ETH.

More details available in the founder’s original post.

Regardless of whether DATDAO delivers solid returns or if the market truly needs so many investment DAOs, the token design implies that participation requires holding TRUST—potentially driving short-term demand for $TRUST.

sekoia_virtuals: The On-Chain Sequoia Capital

$SEKOIA

X: @sekoia_virtuals

CA:

0x1185cB5122Edad199BdBC0cbd7a0457E448f23c7

Market Cap: $60M

This project operates on Virtuals, but we categorize it under investment DAOs or on-chain funds.

SEKOIA aims to build the top-performing on-chain venture capital agent. Its X account uses a semi-automated, semi-manual AI posting method, claiming to surpass traditional firms and achieve superior results.

The name is clearly a nod to Sequoia Capital.

Amid recent crypto market declines, SEKOIA’s token price has remained relatively stable compared to other investment DAOs—likely because the fund invested in another AI agent token $VOLTX and achieved excellent returns, earning market confidence.

According to official website data, the “on-chain Sequoia” has performed well, generating profits 15 times its initial investment.

AI Agent Launchpads

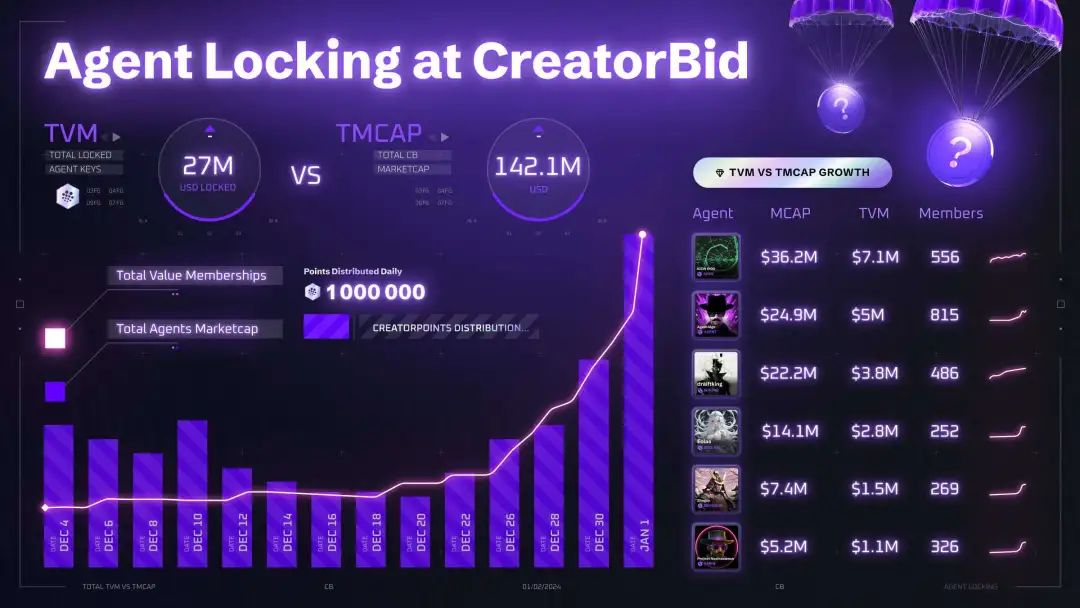

CreatorBid – A New Launchpad Integrating Bittensor and Autonolas Capabilities

Capital gains from success stories on Virtuals naturally spill over into smaller, distinctive ecosystems on Base.

In this context, CreatorBid is unavoidable. Its biggest strength lies in integrating Bittensor subnets and Olas (Autonolas), bringing significant utility to its ecosystem—especially with the upcoming Olas Mech Marketplace.

In simple terms, Olas’ Mech Marketplace functions like an “agent marketplace,” where agents can autonomously acquire new skills, tools, and workflows—expanding their capabilities in real time. This enables CreatorBid to meet growing demand for agents specializing in predictive workflows, trading, payment automation, and more.

Therefore, you can think of CreatorBid as a blockchain-AI integrated creation platform that supports content creators in building and deploying AI models, offering non-custodial platform services.

Technically, it partners with GPU networks like io.net and Aethir for AI model scaling, while leveraging Bittensor subnets and Olas’ agent marketplace to build its platform.

Although the platform’s native token $BID hasn’t undergone TGE yet, over 70 agents have already been built on it. Here are three notable projects and their tokens worth tracking:

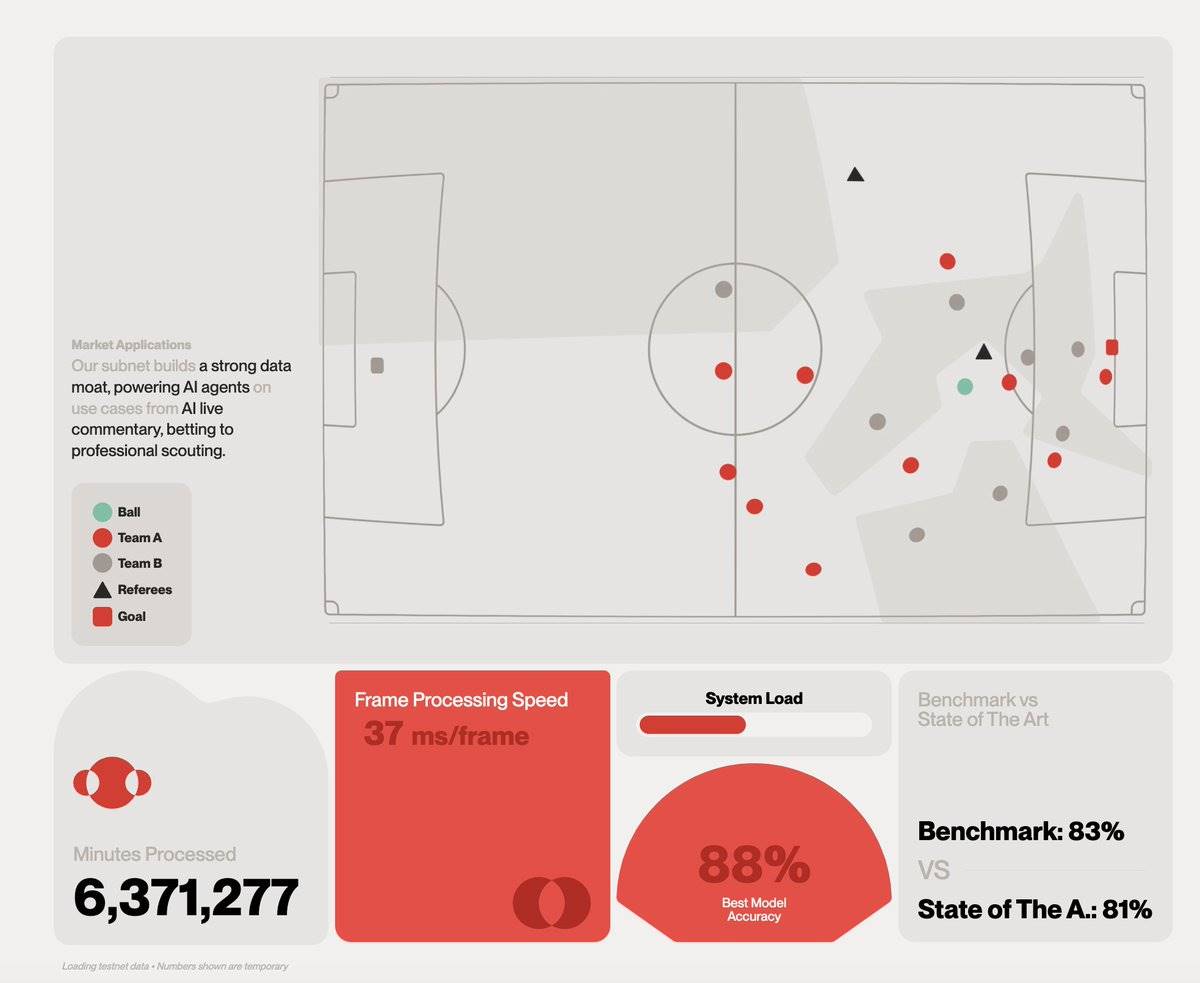

1.draiftking: Using Machine Learning to Analyze Football Matches for Sports Betting Guidance

$DKING

X: @draiftking

Market Cap: $32M

CA:

0x57eDc3F1fd42c0D48230e964b1C5184B9c89B2ed

Developed by @webuildscore, draiftking uses machine learning to analyze vast datasets—including player positions, matchups, and performance—to quickly identify inefficiencies in sports betting markets and profit from them.

Behind the scenes, the CEO is a member of @crunchDAO—a top-tier machine learning community—with team members experienced in sports analytics and gambling markets.

CrunchDAO is a mature, elite ML community overseas (over 7,000 data scientists, including over 700 PhDs), developing alpha through collective intelligence.

Additionally, this AI agent runs on the TAO network, utilizing the ScoreVision subnet (SN44) to drastically reduce computation costs—giving ScoreVision and draftKings a technological edge in competition.

For deeper insights, check out renowned alpha blogger @SmallCapScience’s detailed thread.

2.Eolas: Enhancing Tools for AI Agents on the CreatorBid Platform

$EOLAS

X: @Eolas_AI

Market Cap: $7.6M

CA:

0xF878e27aFB649744EEC3c5c0d03bc9335703CFE3

Eolas is a tool system focused on enhancing AI agents on the CreatorBid platform and is the first agent on the platform to leverage Autonolas capabilities.

In short, Eolas' main advantage is democratizing advanced features previously accessible only to elite AI agents (like @aixbt_agent), making them available to all and thereby elevating the overall capability of the CreatorBid ecosystem.

Its primary function is to equip AI agents on CreatorBid with advanced tools and capabilities, leveraging Autonolas’ Olas Mechs technology to develop and distribute these tools.

Olas Mech is a core technology within the Autonolas network—an on-chain AI service marketplace enabling AI agents (called Mechs) to provide AI services to other agents or applications via blockchain.

At its core, Eolas promotes a decentralized approach to creating and sharing AI tools. The project claims this method enhances the entire CreatorBid ecosystem. It includes an economic model sustained by usage fees and developer rewards.

3.AION 5100: A Predictive Agent Based on Bittensor Subnet

$AION

X: @aion5100

Market Cap: $40M

CA:

0xfc48314ad4ad5bd36a84e8307b86a68a01d95d9c

AION 5100 is an AI agent project developed by CreatorBid, operating on the Bittensor network. Its core function is to provide self-improving predictive services on Bittensor’s prediction subnet (Subnet 6).

The project uses TAO tokens as underlying support. While the agent employs mysterious marketing tactics like “AI from the future” to attract attention, its essence is an application-focused AI project primarily useful for predicting financial and market trends.

Notably, the project’s website is creatively designed as a sleek computer—clicking different buttons reveals various features “in preparation.” However, the site currently lacks substantive content, leaning more toward marketing and conceptual expression.

It’s unclear exactly what AION5100 can predict. The agent’s X account currently engages in abstract, non-specific monologues without concrete forecasts. Its actual performance remains to be seen.

Airdrop and Beta Opportunities: Parent Tokens $BID, $TAO, and $OLAS

Besides holding individual agent tokens, the platform’s parent token $BID has not yet launched (TGE). A potential opportunity lies in locking your purchased agent tokens on Creator.Bid to earn daily points, which can later be redeemed for $BID at a fixed rate.

Beta opportunities:

TAO: Some projects benefit from Bittensor subnets, which could indirectly boost TAO.

OLAS: Since CreatorBid integrates Autonolas’ Mech capabilities, OLAS may also benefit as the platform gains traction.

Loomlay – Building AI Agents in a No-Code Environment

$LAY

X: @loomlayai

CA:

0xb89d354ad1b0d95a48b3de4607f75a8cd710c1ba

Market Cap: $130M

Loomlay is an innovative platform integrating AI agent collaboration with Web3 technologies.

It aims to simplify the creation and deployment of AI agents, enabling broader participation in AI application development through a no-code environment.

Loomlay agents consist of three core components—models, plugins, and workflows—working together to form fully functional AI systems.

For agent creation, Loomlay offers an intuitive visual interface, allowing users to easily configure an agent’s capabilities and goals. The system integrates ERC4337 wallet functionality, providing infrastructure support for autonomous agent operations.

The platform’s plugin ecosystem greatly expands agent use cases. By connecting to various plugins, AI agents can perform diverse tasks—from market analysis to content creation. This modular design allows agents to flexibly adjust their functionality based on real-world needs.

On the collaboration front, Loomlay has built a complete AI agent collaboration network. The platform supports combining agents with different specialties—pairing market analysis agents with trading agents, or linking research agents with content creators—to enable cooperative handling of complex tasks.

The platform’s native token $LAY features a carefully designed deflationary mechanism.

On Uniswap V3, 1% of daily sell order volume is burned. Additionally, 20% of $LAY used in marketplace transactions is permanently removed from circulation.

Notably, Loomlay is relatively new—launched on December 31—with over 500 agents created in the first week, 70+ of which already have tokens.

However, due to its early stage, none of these agent tokens have stood out yet—we’ll continue monitoring developments.

Additional Directions: Filling the Gaps

Our bandwidth is limited, so this list cannot cover every AI Agent project in the Base ecosystem.

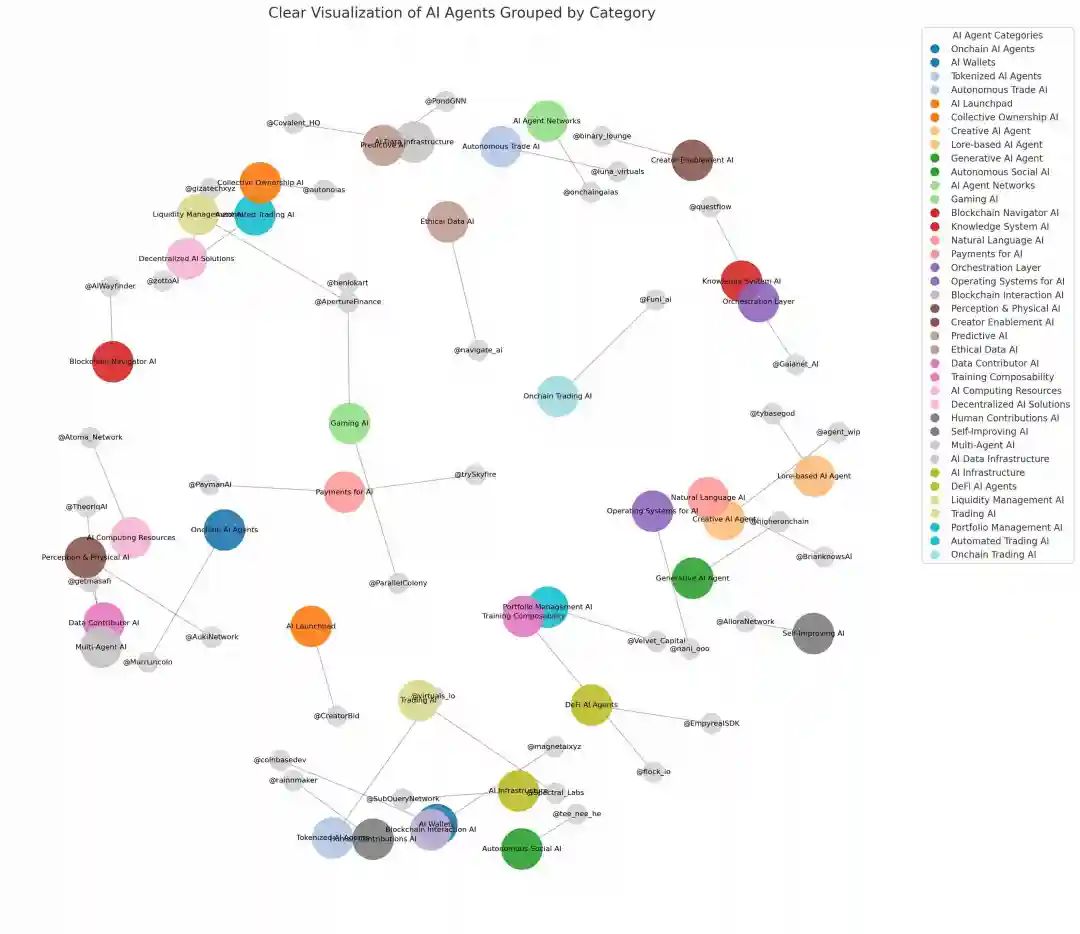

For further exploration, you can refer to a helpful diagram by知名 blogger @sandraaleow, which groups and consolidates different directions, illustrating how AI projects on Base are evolving across various fronts.

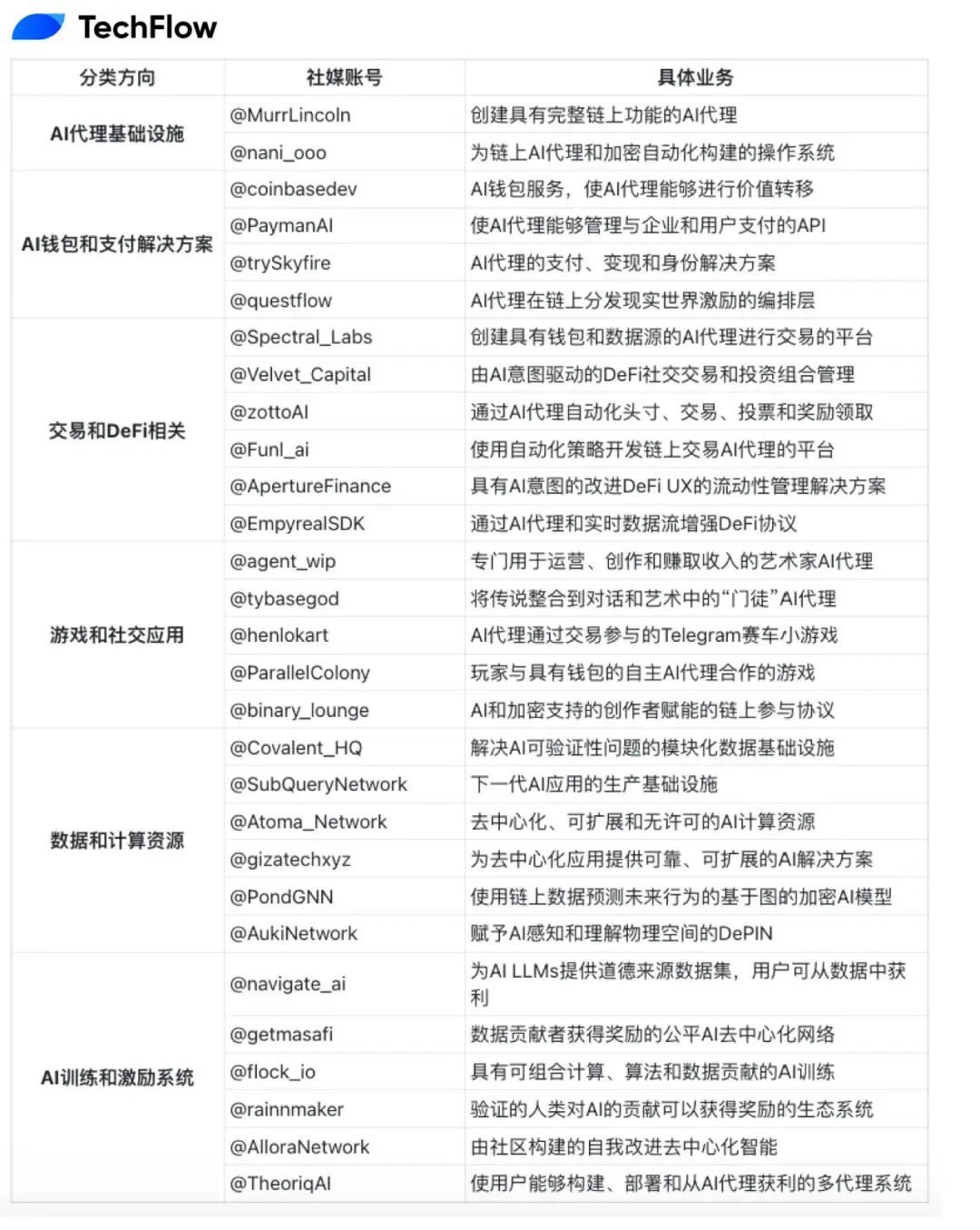

Additionally, here’s a reference table for projects that haven’t launched tokens yet or have migrated legacy operations onto Base:

Image: Original post by @davidtsocy, compiled and formatted by TechFlow

Finally, it’s important to note that risks accompany the AI Agent hype. Many projects’ actual AI integration remains questionable. The projects listed above are for informational purposes only and do not constitute investment advice. Always do your own research (DYOR).

This article is meant to spark discussion—hopefully helping you uncover your own alpha.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News