Solana Virtual Machine Landscape: Who Will Prevail—Sonic SVM, SOON, or Eclipse?

TechFlow Selected TechFlow Selected

Solana Virtual Machine Landscape: Who Will Prevail—Sonic SVM, SOON, or Eclipse?

By combining Solana's speed with Ethereum's ecosystem advantages, innovative SVM-based projects are creating entirely new experiences for developers and users.

Author: jk, Odaily Planet Daily

As the demand for high performance and scalability becomes increasingly urgent, Solana Virtual Machine (SVM) is emerging as a key driver in advancing decentralized ecosystems. By combining Solana's speed with Ethereum's ecosystem strengths, innovative SVM-based projects are creating new experiences for developers and users alike, breaking through the performance bottlenecks of traditional blockchain architectures.

Not long ago, the launch of Move raised significant expectations for the virtual machine sector. After MoveVM, the next major hotspot in VM innovation is undoubtedly SVM.

This article will explore three representative SVM projects—Sonic SVM, SOON, and Eclipse. While they share certain technical similarities, they differ significantly in design and vision. Odaily Planet Daily has compiled and analyzed publicly available information on these three projects, starting with the first—Sonic, which recently completed its token generation event (TGE).

Sonic SVM: A Gaming-Focused SVM That Could Spawn the Next "Sheep No.1 Game"

According to its official website, Sonic SVM is the first atomic SVM chain designed to support sovereign gaming economies on Solana by enabling aggregation and settlement within the Solana ecosystem.

Built on HyperGrid—the first concurrent scaling framework for Solana—Sonic represents the inaugural Grid instance managed by this framework. Both HyperGrid and Sonic SVM originate from the same team behind Sonic (formerly Mirror World), meaning the team has developed both the underlying infrastructure and the product itself, similar to the relationship between Virtuals and Luna.

HyperGrid was designed to deliver high customizability and scalability while maintaining native composability with Solana. As explained in developer documentation, applications supported by HyperGrid can be written using EVM tooling but ultimately execute on Solana, with final settlement occurring on Solana. This approach enables EVM-native dApps to be ported to Solana—a direction fundamentally different from MoveVM, which settles on Ethereum.

It’s also important to note that Sonic SVM is entirely distinct from another project named Sonic developed by the Fantom team. Readers should carefully distinguish between the two projects and their respective tokens.

The team's vision: Sonic was created to unlock new experiences for developers and players alike. “We designed Sonic to become an incubator for high-performance decentralized games, offering a stark contrast to traditional in-game asset trading experiences,” the team stated.

On its website, Sonic SVM highlights several key advantages:

-

Ultra-fast and low-cost: Leveraging SVM technology, Sonic delivers exceptionally fast on-chain gaming experiences across all game-dedicated L1 chains.

-

Atomic interoperability: Transactions on Sonic do not require redeployment of Solana programs or accounts, allowing direct access to Solana’s base-layer services and liquidity.

-

Write for EVM, Execute on SVM: Through HyperGrid’s interpreter, dApps can be seamlessly deployed from EVM chains to Solana.

-

Composable game primitives and sandbox environment: Built on an on-chain ECS framework, Sonic offers native composable game primitives and extensible data types. Developers can use game engine sandbox tools to build business logic directly on-chain.

-

Monetization infrastructure: Sonic natively supports growth, traffic, payment, and settlement infrastructure tailored for games, empowering developers.

In terms of investors, Sonic was led by Bitkraft, with the full list shown below:

Source: Sonic SVM Official Website

Problems Addressed and Solutions Offered

As infrastructure for gaming, Sonic SVM specifically targets performance pressures on Solana’s lower-level game execution layer. The team articulates the issue as follows:

From 2022 to 2023, wallet account numbers grew from 100,000 to 1 million, projected to surpass 5 million in 2024, and potentially reach 50 million in the coming years. Accompanying user growth has been explosive activity in dApps and DeFi. Daily transaction volume increased from 4 million in 2022 to 200 million in 2024, conservatively expected to exceed 4 billion by 2026—and possibly reach tens of billions.

This trend places immense strain on Solana’s performance. Currently, under 2,500–4,000 TPS conditions, latency fluctuates between 6 and 80 seconds, typically averaging around 40 seconds. When TPS exceeds 4,000, transaction success rates drop to 70%–85%. With future TPS potentially reaching tens of thousands, performance bottlenecks will become even more pronounced.

The situation is especially severe in gaming scenarios. Fully on-chain games (FOCG), high-concurrency mini-games, and large-scale titles may generate sudden transaction spikes during special events. Such pressure affects not only Solana’s mainnet performance but also directly impacts gameplay and user experience. For the gaming industry, poor UX could prove fatal.

To address these challenges, Sonic’s innovative design focuses on handling high concurrency and burst transaction demands typical in gaming, delivering smooth and efficient on-chain experiences for developers and players.

Sonic x TikTok: What Sparks Will Web2 Mass Adoption Bring?

SonicX is Sonic’s first TikTok Mini App and serves as its gaming platform on TikTok. With over 1 billion monthly active users, TikTok offers Sonic a vast pool of potential users who can transition directly into the Web3 gaming world—an onboarding path very similar to Telegram’s model.

How does Sonic achieve this? First, users must log in with a real TikTok account (not Douyin), bypassing regions where TikTok is unavailable. These KYC-verified users can then complete games and tasks via SonicX, interacting with Sonic SVM’s underlying infrastructure. In essence, SonicX functions similarly to most Telegram mini-programs, but with the advantage of drawing users directly from TikTok, eliminating the need for separate KYC processes and ensuring most users are genuine.

Source: SonicX

A natural question arises: If most users come from the Web2 platform TikTok, do they need to relearn Web3 concepts? How would they understand wallets or private keys? This is precisely where SonicX excels. Most operations within SonicX—except when transferring tokens to external wallets—are fully abstracted. Users are largely unaware of the existence of a wallet. From tap-to-earn mechanics to task completion and other games in the game center, SonicX automatically generates a wallet tightly bound to the user’s TikTok account, requiring no Web3 knowledge to interact. Even profile avatars are imported directly from TikTok. In theory, this infrastructure supports full account abstraction, allowing users to enjoy the experience without understanding crypto until they choose to sell their account or withdraw game tokens to exchanges.

Sonic states in its blog: “TikTok’s popularity among KYC-verified users gives us unique insights into user preferences, creating a powerful environment for Sonic games to gain visibility. Through carefully designed user flows, we provide new Web3 players with an accessible path to explore and enjoy blockchain gaming, seamlessly integrated with their existing TikTok experience.”

With simple login, incentivized on-chain actions, and user-friendly guidance, SonicX has strong potential to leverage TikTok for user acquisition. One drawback is that current game designs—including SonicX itself—remain relatively basic, lacking standout mechanics like those seen in viral mini-program hits. However, infrastructure always comes first in game development, and leveraging Web2 platforms remains the most viable path to success for Web3 games today.

This is currently Sonic SVM’s most distinctive strategic advantage. Imagine you’re a developer who builds a mobile game—you could seamlessly deploy it on Solana at the backend and on TikTok at the frontend. If a video about your game goes viral, users could click through from the official account to play instantly, without registering a wallet, while in-game tokens remain real on-chain assets. Could this lead to the next on-chain version of “Jump” or “Sheep No.1 Game”? Might this be the breakthrough mechanism for Web3 gaming?

These are easy questions to imagine—but what’s surprising is that they actually built a “Sheep No.1 Game.”

In late October 2024, Sonic SVM announced a strategic partnership with Mahjong Verse. Formerly known as Mahjong Meta, Mahjong Verse is a veteran Web3 gaming project backed by top-tier investors including Dragonfly and Folius. On Sonic SVM’s TikTok platform, they launched a clone of “Sheep No.1 Game,” replacing the match mechanic with collecting three identical mahjong tiles. Otherwise, the level structure mirrors the original—with stacked tiles requiring skill and luck to clear.

This mahjong-themed game is the first title on Sonic Applayer and is now available in Sonic X’s Game Center. According to Sonic’s announcement: “Integrating Mahjong Verse into our ecosystem demonstrates how our infrastructure supports complex gaming experiences while preserving the ease of use expected by TikTok users.” This reflects the broader vision for Sonic Applayer going forward.

In summary, Sonic SVM focuses on foundational gaming infrastructure, already demonstrating concrete use cases through TikTok Applayer. Having reached the token issuance stage, attention now turns to what kind of game will emerge next on Sonic SVM—and whether it can break into mainstream awareness via TikTok’s massive traffic channel.

Timeline

In June, Sonic announced a $12 million Series A round led by Bitkraft Ventures, with participation from Galaxy Interactive and Big Brain Holdings. Its fully diluted token valuation during this round reportedly reached $100 million. Mirror World Labs, the legal entity behind Sonic, developed a proprietary technology called the HyperGrid Framework, enabling horizontal scaling via rollups on Solana.

In September, Odaily reported that Sonic SVM revealed details about the sale of HyperFuse Guardian Nodes—the first node sale in Solana’s ecosystem.

According to the official announcement, HyperFuse Guardian Nodes are essential components of the security and functionality of the Sonic Hypergrid framework within the SVM ecosystem. Node operators help validate state transitions and improve network efficiency. Early adopters had the opportunity to purchase SONIC tokens at prices below those offered to VCs during Sonic’s $12 million Series A. This node sale is a critical component of Sonic’s strategy to grow the SVM ecosystem and advance the Solana gaming sector. The company also disclosed partnerships with over 40 game studios and more than 2 million active wallets on its platform.

By the end of December, Sonic SVM announced it would airdrop SONIC tokens to all users who joined its games on the Solana blockchain. Snapshots had not yet been taken, with distributions scheduled for January.

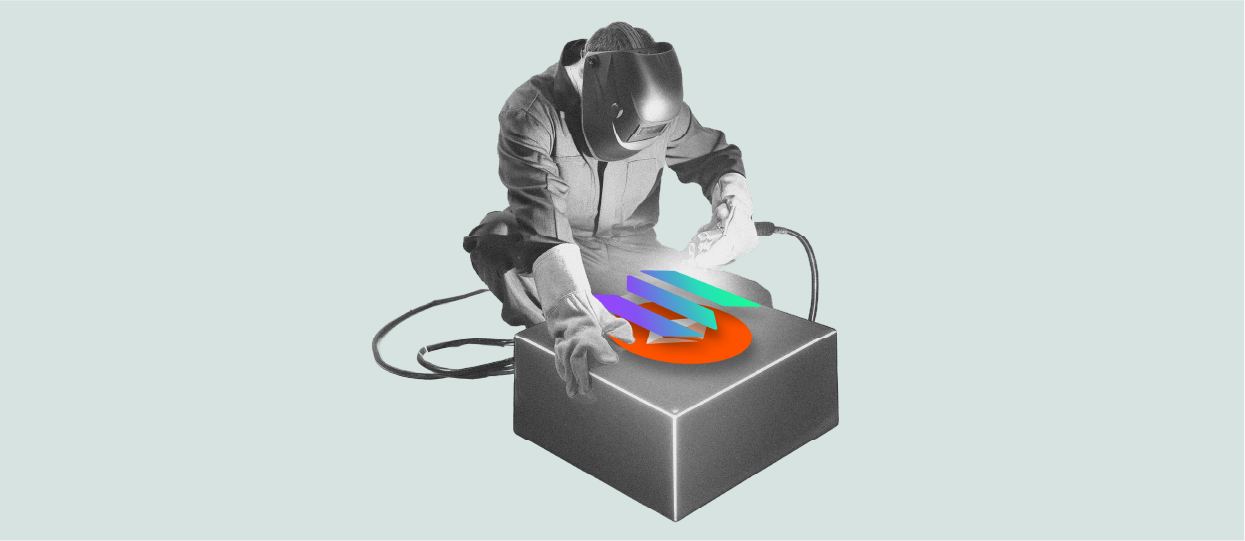

Additionally, Sonic SVM released the tokenomics for its native $SONIC token. With a total supply of 2.4 billion, 57% is allocated to the community, broken down into community and ecosystem development (30%), initial claims (7%), and HyperGrid rewards (20%).

Sonic SVM Tokenomics. Source: X

On January 3, Sonic SVM announced on X that the initial claim for SONIC would soon open, rewarding supporters and contributors. The SONIC eligibility checker was also launched, allowing users to verify their qualification.

On January 7, Sonic SVM officially launched its TGE, with confirmed listings on OKX, Upbit, Bybit, KuCoin, Backpack, and others.

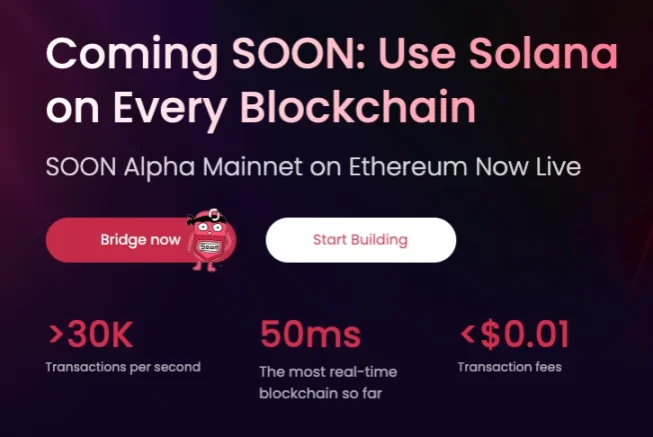

SOON: A VC-Free Project Aiming to Be Ethereum’s Most Powerful Execution Layer

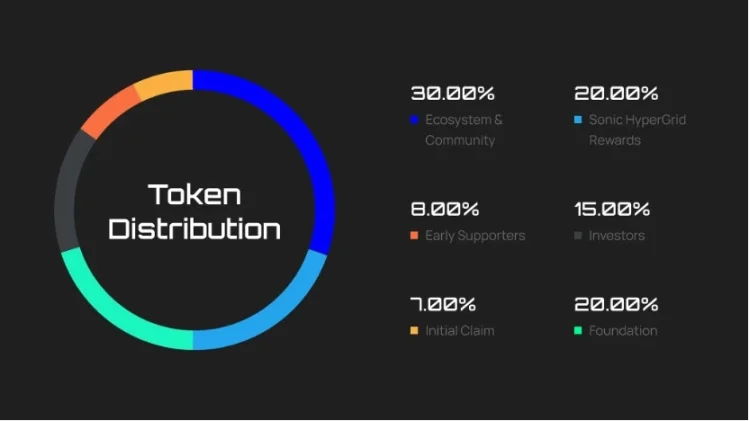

Over 30K TPS. Source: SOON Official Website

SOON’s product suite is called the Super Adoption Stack, consisting of SOON Stack and the SOON mainnet.

SOON Stack is a Rollup framework based on OP Stack and a unique Decoupled SVM (dSVM), designed for maximum performance and enabling SVM Layer 2 deployment on any base Layer 1. Chains deployed via SOON Stack are referred to as SOON chains. Currently, SOON Stack supports Ethereum as the settlement layer, Avail as the data availability (DA) layer, and integrates support from Caldera and Altlayer.

The SOON mainnet is a SOON chain deployed on Ethereum using the SOON Stack, aiming to become Ethereum’s highest-performance L2.

InterSOON is a cross-chain messaging protocol designed to ensure seamless interaction between networks. It enables interoperability between the SOON mainnet, SOON Stack (SOON chains), and other Layer 1 blockchains, connecting all networks through a unified interface. InterSOON’s underlying cross-chain messaging is powered by Hyperlane.

Core Advantages of SOON

Many scalability-focused projects today build on SVM, but SOON stands out as an optimized SVM Rollup framework engineered specifically for peak performance. By decoupling SVM from its Transaction Processing Unit (TPU), SOON achieves true performance gains and maximized efficiency.

Why did SOON choose decoupling instead of forking SVM?

Limitations of Forked SVM:

-

Inefficient default architecture: Many projects using SVM outside Solana L1 rely on forked versions of the Solana client, adjusting only minor parameters without modifying critical components like the TPU or TVU (Transaction Validation Unit).

-

Poor data availability efficiency: The biggest flaw of forked SVM lies in inefficient blob space usage for data availability (DA). For example, even with just one sequencer node, each block still generates vote transactions, consuming substantial resources.

SOON adopts a customized, decoupled SVM, removing vote transactions and P2P network overhead to optimize transaction processing and DA usage. Especially in environments without L1 consensus mechanisms like Proof of History or Leader Schedule, dSVM allows greater flexibility in optimization.

Key benefits of decoupling:

-

Support for Fraud Proofs: The decoupled SVM provides native support for fraud proofs on L2, a cornerstone of L2 security. Fraud proofs verify user transactions originating from L1 deposits (export pipeline) and L2 sequencers to secure the L2 state.

-

Enhanced performance and security: By optimizing transaction processing and DA usage, SOON Stack drastically reduces resource waste while strengthening network security, meeting Web3 applications’ demands for high throughput and robustness.

The SOON team detailed their analysis of decoupled SVM in a blog post (in English), recommended for interested readers.

Mission and Vision of SOON

The SOON Stack aims to achieve the following goals:

-

Deliver high-performance Rollup solutions across any L1 ecosystem.

-

Reduce transaction costs by 10x.

-

Promote widespread adoption of SVM.

-

Unlock innovative cross-ecosystem application scenarios.

Addressing the Problem: Why Higher-Performance Rollups and Tech Stacks Are Needed

The issues targeted by SOON differ fundamentally from those addressed by Sonic SVM. SOON’s tech stack ultimately settles on Ethereum’s mainnet, targeting limitations in Ethereum’s own performance. What specific problems does it aim to solve? Summarized from SOON’s blog:

-

Single-thread bottleneck limits scalability: Most current Rollup frameworks operate in single-threaded environments, leading to inefficiencies and network congestion during peak demand, resulting in high fees and severely limiting dApp scalability.

-

Developer ecosystem gap: The quality of dApps and developer capabilities in the EVM ecosystem lag noticeably behind SVM. The SVM ecosystem attracts higher-caliber developers, fostering a stronger engineering culture and better tooling to produce superior products like Jupiter.

-

Liquidity fragmentation in EVM: The multi-chain nature of the EVM ecosystem forces developers to redeploy the same products repeatedly, degrading product quality and reducing user appeal. In contrast, Solana’s unified environment concentrates resources, significantly improving product and community experiences.

-

Ethereum’s fee market issues: Ethereum’s global fee market causes high-demand transactions (e.g., NFT mints) to spike fees for all users, making routine transactions economically unfeasible. SVM’s localized fee markets resolve this by calculating fees independently, preventing unrelated transactions from affecting one another.

-

Complexity of zk-VMs: Despite their potential in privacy and scalability, zk-VMs face high development barriers and operational costs, hindering broad adoption and limiting near-term scalability.

-

Rust advantages empower SVM: SVM uses Rust as its smart contract language, offering higher performance and safer development environments. Compared to Solidity, Rust addresses memory safety and concurrency issues, making it better suited for high-performance blockchain applications.

-

Parallel processing boosts performance: EVM’s sequential processing limits network throughput, whereas SVM’s parallel execution allows simultaneous processing of multiple transactions, greatly enhancing performance and ensuring fast, low-cost responses even under heavy load.

In short, while Sonic SVM and SOON both operate in the SVM space, they aren’t direct competitors. Sonic SVM addresses Solana’s performance constraints, settling on Solana. SOON, however, builds an L2 on Ethereum, targeting Ethereum’s performance bottlenecks.

Applications in the SOON Ecosystem

Setting aside infrastructure tools, let’s examine interesting consumer-facing (toC) applications on SOON. The largest category is DeFi.

SOON’s website features six DeFi applications, most of which appear to be native DeFi protocols. Their followings on X are modest, though they cover core DeFi needs: Portal Finance (lending), Raptor (AMM), Alita (native DEX), Sponge (staking). Two others have notable traction:

EnzoFi, a cross-chain liquidity management hub offering lending, bridging, staking, and yield features, along with its own points system. It’s already live on Solana, Sui, Eclipse, SOON, and Movement, with 163K followers on X.

Blendy—a particularly interesting project—is a money market service focused exclusively on meme coins and AI agent-related assets, accepting meme coins as collateral, aligning perfectly with current trends. Still in testnet phase, the team announced on Twitter that transaction count has exceeded 150,000.

Other user-accessible applications on SOON include:

-

Aeronyx: A DePIN protocol on SOON that connects millions of devices and tokenizes computing resources, promoting distributed computing.

-

Gigentic: A collaborative platform on SOON where AI agents work together and earn rewards via on-chain mechanisms, bridging humans and AI.

-

CoindPay: A multifunctional payment and DeFi app supporting cross-industry payment scenarios on SOON, delivering efficient payment solutions.

-

Polyquest: A decentralized prediction market where users can forecast events and explore new models of blockchain-based predictive economies.

Timeline:

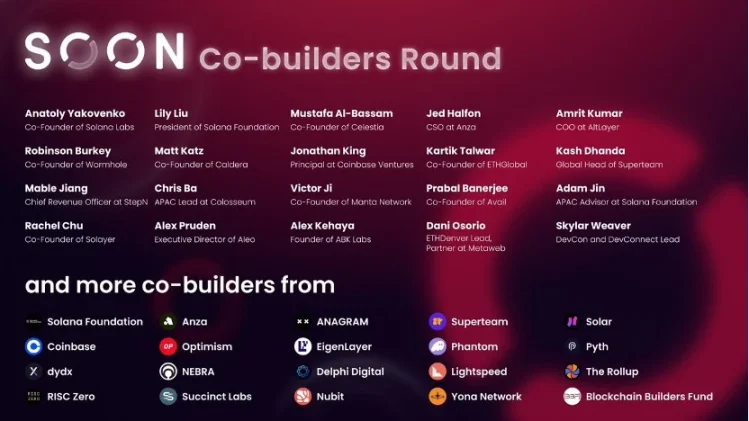

On August 27, according to The Block, Solana Optimistic Network (SOON) closed a co-builder funding round. Participants included Lily Liu (Chair of Solana Foundation), Anatoly Yakovenko (Co-founder of Solana Labs), Jonathan King (Head of Coinbase Ventures), Mustafa Al-Bassam (Co-founder of Celestia Labs), Robinson Burkey (Co-founder of Avail), and co-founders of Wormhole Foundation, among others. Specific funding amount was not disclosed.

SOON Co-Builder Round. Source: SOON

This round was exclusively for builders, with no venture capital firms involved. SOON has only this single fundraising event, meaning no VC capital has entered the project.

On November 8, SOON announced the public launch of its testnet, benchmarked at 30,000 TPS with a 50ms block time. SOON encouraged all Genesis Hackathon participants to migrate their projects to the new public testnet.

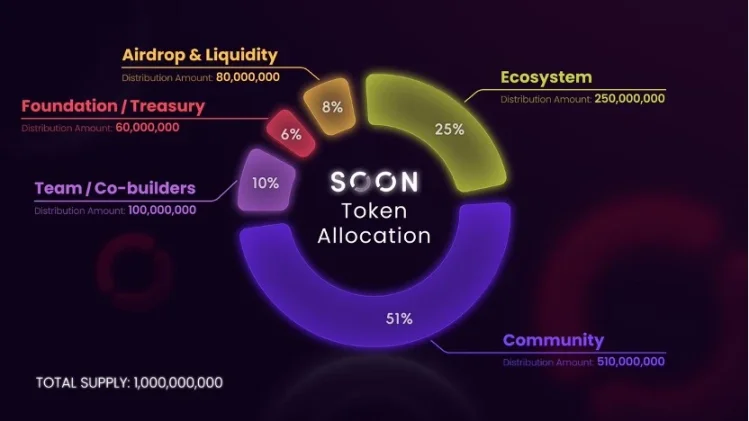

On January 3, SOON announced the launch of its Alpha mainnet and revealed the $SOON tokenomics. Initial total supply is 1 billion (3% annual inflation), with 51% allocated to the community through a fair launch. Additional allocations include 25% for ecosystem, 8% for airdrops and liquidity, 6% for foundation/treasury, and 10% for team and co-builders.

SOON Tokenomics. Source: SOON

In the Alpha mainnet announcement blog, SOON wrote:

"$SOON token distribution follows a fair launch model: no pre-mine, no pre-allocation to team or private investors, and no special rights or opportunities for VCs. This approach resembles infrastructure token launches from the 2017 ICO era, such as Solana, Polkadot, and Avalanche. Everyone participates at the same time, with the vast majority of tokens going to builders and the community. More details will be shared next week—stay tuned!"

Eclipse: The First SVM to Launch, Yet Has Not Issued a Token

Eclipse competes directly with SOON, also being an SVM-based L2 on Ethereum. According to its website, Eclipse is research-driven and ecosystem-focused, with a distinctive architectural style. In terms of development stage, Eclipse is not behind the two aforementioned competitors—its mainnet is already live—yet it has chosen not to issue a token, adopting a unique strategic stance that positions it closely within the Ethereum ecosystem, delivering pure “Solana-speed experience on Ethereum.”

As described on its site:

Eclipse is Ethereum’s first Layer 2 based on the Solana Virtual Machine (SVM), combining Solana’s speed with Ethereum’s liquidity. This innovative architecture offers users a high-performance L2 solution that leverages Ethereum’s rich liquidity while maintaining strict verifiability constraints. Through this design, Eclipse achieves a balance between performance and security, providing robust technical support for decentralized applications.

Eclipse uses Celestia for data availability (DA).

A key distinction: Eclipse has not issued its own token. Instead, it uses Ethereum as the gas token for the entire L2, effectively anchoring itself firmly to Ethereum’s ecosystem. Additionally, Eclipse issues re-staked Ethereum tokens to drive L2 adoption.

Turbo ETH (tETH) is a Unified Restaking Token (URT) launched in collaboration between Eclipse and Nucleus, aiming to consolidate returns from top-yielding protocols on Ethereum into a single, easy-to-use default yield-bearing token. tETH offers users a convenient way to earn restaking rewards while eliminating liquidity fragmentation and complex operations.

Users can mint tETH by depositing any of five Liquid Restaking Tokens (LRTs): WETH, weETH, ezETH, rswETH, apxETH, and pufETH. tETH’s design diversifies risk and maximizes rewards through a unified yield mechanism, introducing a novel liquidity management tool for on-chain users.

tETH is an accrual token with an increasing exchange rate over time, similar to Compound’s cTokens or Lido’s wstETH. The ETH-denominated value grows gradually, while non-ETH rewards can be claimed separately through a dedicated interface.

At the time of writing, according to DefiLlama data, Eclipse’s total value locked (TVL) stands at $19.33 million—not particularly high. It has 195,000 followers on X.

Eclipse Ecosystem

In DeFi, Eclipse’s largest DEX is Orca, with $9.2 million in TVL. The lending protocol Save follows with $3.55 million, and second-largest DEX Invariant has $3.25 million—all showing significant growth over the past month.

Looking at consumer-facing applications, here are the more prominent ones on Eclipse (by X follower count):

-

After School Club: An NFT collection and Eclipse’s genesis NFT;

-

SEND Arcade: A platform where users can play games to win ETH;

-

Dscvr.one: A social protocol with approximately 80,000 followers on X;

-

HedgeHog: A prediction market also present on Solana;

-

AllDomains: Eclipse’s domain name service;

-

Moonlaunch.fun: Eclipse’s version of Pump.fun;

-

Blobscriptions: Inscriptions on Eclipse.

Timeline:

In September 2022, Eclipse announced it raised $15 million in Pre-Seed and Seed rounds at a valuation exceeding $100 million. The $9 million Seed round was co-led by Tribe Capital and Tabiya, with participation from Caballeros Capital, Infinity Ventures Crypto, Soma Capital, Struck Capital, and CoinList. The $6 million Pre-Seed round was led by Polychain Capital, with additional investors including Tribe Capital, Tabiya, Galileo, Polygon Ventures, The House Fund, and Accel. Eclipse aimed to develop customizable rollup stacks to become a “universal Layer 2” platform compatible with multiple L1 blockchains.

In February 2023, Eclipse launched its SVM-based scaling solution for Solana, enabling compatibility with Polygon. This allowed dApps built for Solana to migrate or go multi-chain via Polygon SVM, opening doors for communities building across different blockchains.

In December 2023, Eclipse opened its testnet to the public.

In March 2024, Eclipse Labs announced a $50 million Series A round co-led by Placeholder and Hack VC, bringing total funding to $65 million. Other participants included RockTree Capital, Polychain Capital, Delphi Digital, Maven 11, DBA, Apollo-managed funds, Fenbushi Capital, ParaFi Capital, and strategic investments from Flow Traders, GSR, Auros, and OKX Ventures. Angel investors included researchers and developers such as Barnabé Monnot (Ethereum Foundation), John Adler (Celestia Labs), Austin Federa (Solana Foundation), ZachXBT, and Meltem Demirors.

In May 2024, Neel Somani, founder and CEO of Eclipse, stepped down amid sexual harassment allegations, succeeded by Vijay Chetty, previously Chief Growth Officer. Chetty brings over a decade of native crypto experience, with prior leadership roles at Uniswap Labs, dYdX Trading, and Ripple Labs, in addition to his background at BlackRock.

In July 2024, Eclipse opened its developer mainnet.

In September 2024, Eclipse announced the launch of its restaking token tETH, powered by Nucleus.

In November, Eclipse announced Ben Livshits joined as Chief Technology Officer. Ben holds a PhD from Stanford and brings over two decades of research experience, having worked at Intel, Microsoft, Brave, and Matter Labs.

Also in November, Eclipse launched its mainnet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News