Year-End Review and New Year Outlook of a Web3 Entrepreneur

TechFlow Selected TechFlow Selected

Year-End Review and New Year Outlook of a Web3 Entrepreneur

From wilderness to universality, from chaos to order, from depression to bubble, from conservatism to transformation.

Author: @Web3_Mario

Abstract: Thank you all for your support over the past year. Apologies that this year-end review comes a bit late—time was delayed by personal matters, and I also spent considerable time reflecting on how best to share my insights. Ultimately, I decided to speak from the perspective of an ordinary Web3 entrepreneur still fighting on the front lines, as it feels more authentic. Overall, looking back at 2024 and forward to 2025, I believe four phrases capture the essence: from wild west to mainstream, from chaos to order, from depression to bubble, and from conservatism to transformation. Below, I will use several representative events to share my reflections and outlook.

From Wild West to Mainstream: The Approval of Bitcoin Spot ETFs Ushers in the Era of Crypto’s Broad Acceptance

Looking back at 2024, the most significant shift in the crypto world has been its evolution from a niche subculture into a widely recognized asset class. This transformation can be traced to two landmark events: first, on January 10, 2024, after three months of speculation, the SEC officially approved Bitcoin spot ETFs. Second, on November 6, 2024, pro-crypto candidate Donald Trump won the U.S. presidential election, becoming the 47th president. These developments are clearly reflected in Bitcoin's price movements: the former lifted BTC from the $30,000 range to $60,000, while the latter played a crucial role in pushing it from $60,000 to $100,000.

The most direct impact of this shift is seen in liquidity. Greater liquidity naturally benefits risk assets, though the mechanism and motivation differ from the 2021 bull run. Back then, the primary driver was crypto’s deregulated nature, which enabled higher capital efficiency and allowed the sector to efficiently absorb excess liquidity from the Biden administration’s $1.9 trillion pandemic relief package, resulting in outsized speculative returns.

In contrast, the current bull market reflects a changed dynamic. Influential capital attracted during the 2021 cycle, along with newly formed vested interest groups, have begun exerting significant political influence—through lobbying organizations and substantial political donations. As analyzed in my previous article, "In-Depth Analysis of World Liberty Financial: A New Option Amid Trump’s Campaign Funding Disadvantage," this shift is now evident.

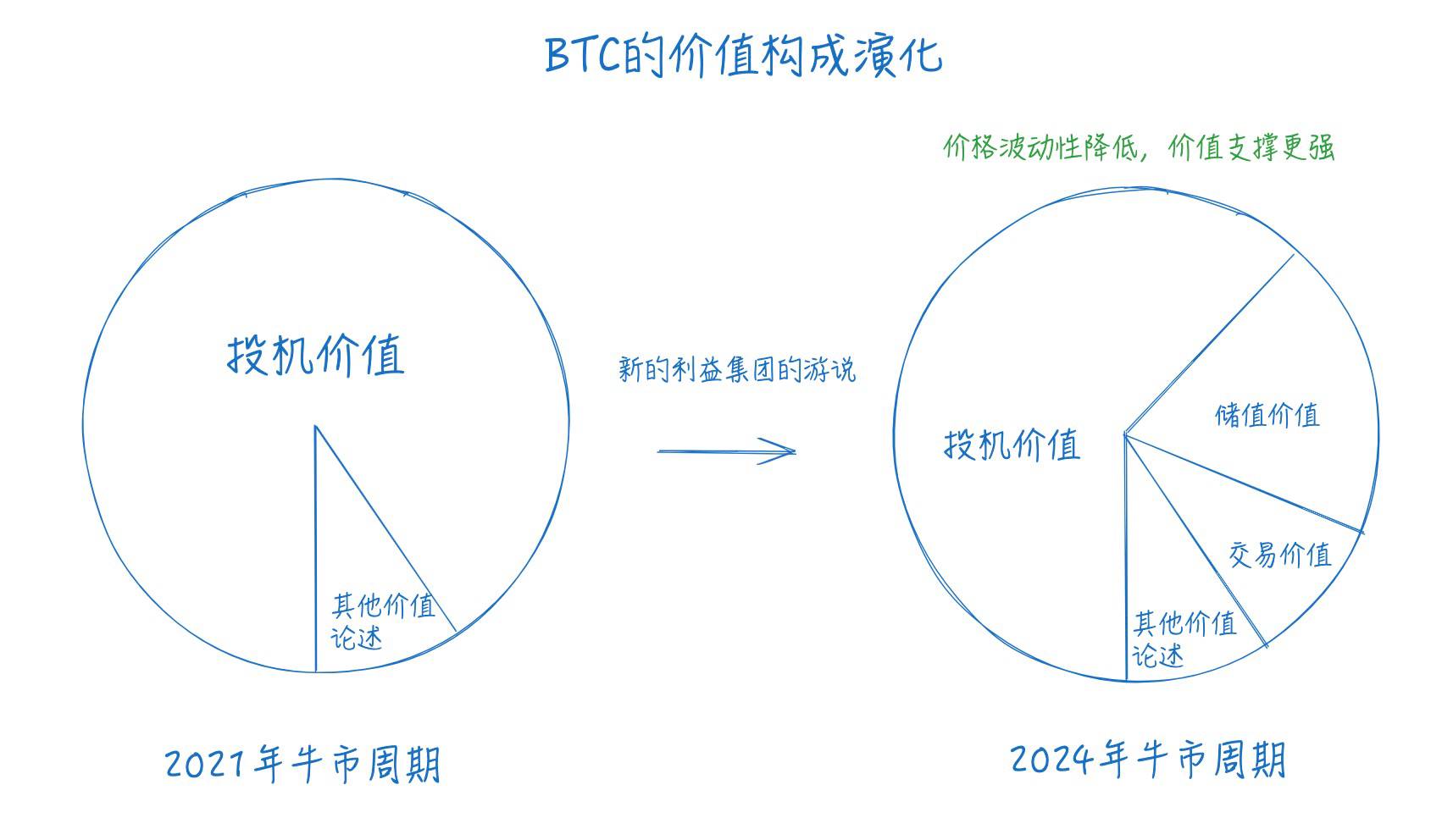

This political engagement has made the mainstream adoption of crypto more achievable. Consequently, narratives around crypto’s value are evolving. More traditional elites and mainstream media outlets are now openly branding themselves as “crypto-friendly.” This transition—from fringe to mainstream—has fundamentally altered the motivations behind capital inflows. Beyond pure speculation, terms like “store of value” and “inflation hedge” are increasingly central to Bitcoin investment rationale (as discussed in earlier pieces such as "Deep Dive Into the Underlying Causes of Current Market Volatility: Value Growth Anxiety After BTC Reaches New Highs"). While these arguments may lack full empirical backing, their growing presence helps reduce the cyclicality and volatility associated with speculative behavior, leading to more stable value foundations. Currently, only a few blue-chip assets like BTC enjoy these benefits, but through multiplier effects, the broader crypto market stands to gain. The following chart illustrates this transformation more clearly:

Beyond macro-level impacts, this evolution has brought a profound positive psychological shift for many of us in the industry. For example, when friends or family outside the space ask about our work, we no longer need to nervously justify that we’re not criminals or overnight millionaires. Now, we can confidently present our professional identities. This change reduces friction across multiple fronts—recruiting talent, finding co-founders, seeking partnerships with traditional industries—and ultimately accelerates talent inflow. On this basis, I remain highly optimistic about the industry’s future.

Looking ahead to 2025, discussions around the value proposition of crypto assets, particularly BTC, will become even more prominent. As previously analyzed, BTC’s store-of-value narrative may succeed AI as the core engine driving U.S. equity growth. Therefore, staying alert to related developments is essential, including:

- Progress on national, regional, organizational, or corporate-level legislation regarding Bitcoin reserves;

- Statements or views expressed by politically influential figures;

- BTC allocations on the balance sheets of U.S. public companies.

From Chaos to Order: Global Sovereign Regulatory Frameworks for Crypto Will Further Mature, Enabling Web3 Use Cases to Break Into the Mainstream

My second observation centers on the shift “from chaos to order.” For a long time, a key narrative in the crypto space has been censorship resistance enabled by decentralization and anonymity—a theme prevalent across most Web3 applications in the last cycle. While this provided early justification for Web3’s value, it also invited harm, including fraud and money laundering.

However, I believe the industry is now evolving beyond this phase—not abandoning Web3 ideals entirely, but pragmatically transitioning from chaos to order, driven by increasingly mature regulatory frameworks from sovereign nations. In 2024, much attention focused on the potential transition of SEC Chair Gary Gensler. Under his leadership, the SEC filed lawsuits against major U.S. crypto firms like Ripple and Consensys, hindering their operations. In my prior article, "Buy the Rumor Series: Rising Expectations for Regulatory Improvement – Which Cryptos Benefit Most?", I used Lido as a case study to illustrate progress in this area.

With Trump’s return and his deregulatory stance, combined with expected changes in SEC leadership, a more lenient and crypto-friendly regulatory environment appears imminent. Recent legal developments in cases like Ripple and Tornado Cash suggest this new framework may arrive sooner than expected.

The immediate benefit of this shift is that Web3 use cases can now expand into mainstream domains without bearing excessive legal risks. In 2025, I’ll be closely monitoring developments such as court rulings in ongoing litigation, proposed or advancing legislation, SEC personnel appointments, and statements from key decision-makers. Two application areas particularly stand out to me:

- Ce-DeFi Scenarios: Bridging traditional finance with on-chain tools to improve capital efficiency and reduce transaction frictions. These can be divided into two flows: one moving capital from traditional finance into on-chain crypto assets (e.g., MicroStrategy’s financial innovation), and the other channeling crypto assets back into traditional finance—such as bond-based RWAs, blockchain financing platforms like Usual Money, and stablecoins within TradeFi.

- DAO Applications in Off-Chain Business Management: This idea might sound far-fetched, but given Trump’s relaxed regulatory approach and his “America First” agenda aimed at boosting domestic demand, could more off-chain, traditionally oriented businesses adopt DAO models for internal governance to access cheaper financial services? For instance, someone opening a Chinese restaurant might choose to operate via a DAO, integrate stablecoin-based payments, achieve full cash flow transparency, and—if regulations continue to loosen—even manage fundraising and dividend distributions through DAO mechanisms.

From Depression to Bubble: Traditional Web3 Development Focuses on Three Axes—More Compelling Narratives, Stronger Revenue Models, and More Balanced Incentive Structures

My third observation is the trajectory “from depression to bubble.” In 2024, traditional Web3 business focus underwent a notable shift. The first half was dominated by EigenLayer and the Liquid Restaking Token (LRT) market, reflecting characteristics of a depressed market. With limited profit opportunities, capital clustered together in infrastructure sectors—areas with large potential markets but distant real-world applications. Projects relied on high valuations and “points programs” to avoid token dilution, effectively extracting value from users. I explored this phenomenon in depth in my article "Web3 Oligarchs Are Exploiting Users: From Tokenomics to Pointomics."

However, as market conditions improved mid-year and LRT tokens underperformed, attention shifted toward application-layer innovations like TON Mini Apps. Compared to infra projects, apps offer more diverse options, lower development costs, faster deployment cycles, and easier iteration-driven hype, making them more attractive to capital. The market quickly emerged from its depressive state.

In the second half, as the Fed entered a rate-cutting cycle and concerns over VC tokens (VC coins) intensified, traditional exit routes broke down. The market rapidly inflated, with capital chasing increasingly speculative, asset-light opportunities—especially meme coins—for faster turnover. Beyond meme coins themselves, launch platforms like Pumpfun and emerging tools incorporating narratives like AI Agents gained traction.

Looking ahead to next year, I expect traditional Web3 development to follow this bubble-cycle pattern:

- More Compelling Grand Narratives: Capital gravitates toward high-growth sectors due to their vast imaginative potential and tolerance for delayed delivery, allowing larger valuation bubbles to form. Such narratives attract traders and new capital, enabling investors to exit via secondary markets at favorable times. Regardless of whether a sector’s long-term value is justified, any logically coherent story can become a vehicle for speculation during a bubble. Hence, sensitivity to such trends is crucial from a capital gains perspective.

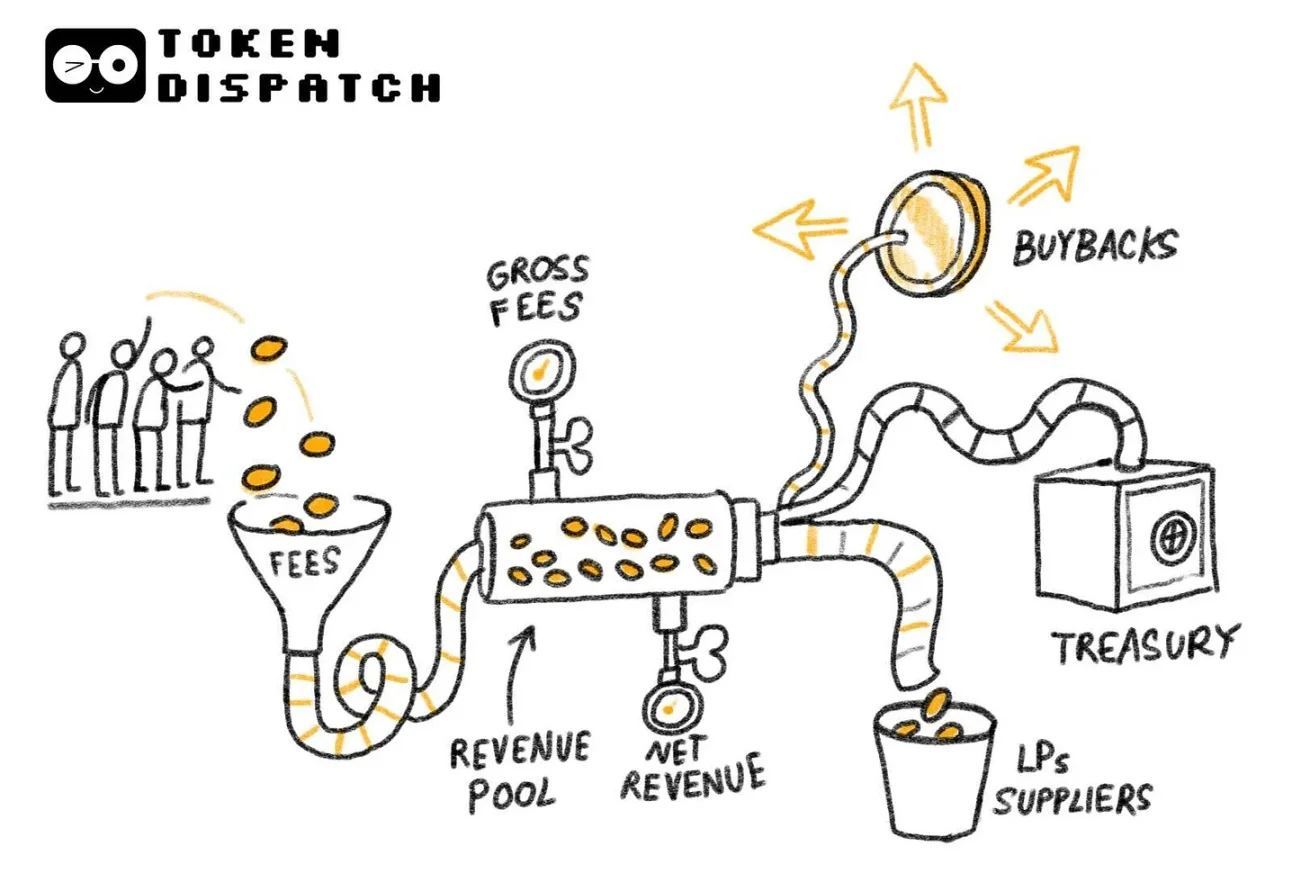

- Stronger, Sustainable Revenue Models: For maturing sectors, valuations will eventually normalize, shifting focus toward actual revenue generation. This demands deeper insight into commercially viable use cases. Successfully identifying such niches could unlock immense market potential. I’m especially interested in DeFi or Ce-DeFi, particularly interest rate trading markets—readers with similar interests are welcome to connect.

- More Balanced Incentive Models: The current backlash against traditional VC tokens stems largely from flawed funding models that create prisoner’s dilemma dynamics between project teams, VCs, and retail investors—each acting in self-interest, assuming others will betray. In this new environment, exploring better incentive structures becomes critical. I suspect HyperLiquid may have uncovered part of this puzzle, which will be a key focus of my upcoming research.

From Conservatism to Transformation: Rare Opportunity for Risk Assets Amid Extreme Uncertainty

My fourth lens is “from conservatism to transformation.” Note that both terms here are neutral: conservatism refers to adherence to existing rules, while transformation implies breaking them. The dominant theme of 2025 will be sweeping economic and cultural shifts triggered by political change, marked by the collapse of old orders and high uncertainty—including U.S.-China government debt crises, monetary policy shifts, changing social values, and geopolitical instability.

This uncertainty fuels extreme volatility in risk markets. When sector rotation favors your field, volatility creates opportunity; otherwise, it brings danger. A recent news item sparked my interest in this direction: FTX’s restructuring plan took effect on January 3, allowing users to begin receiving repayments.

We know that during the previous cycle, the tech industry leaned heavily toward Democratic politics. Many major players who entered during the last bull market may now face challenges under Trump’s return. It’s understandable, therefore, that some may try to inflate asset prices during the interim period before his inauguration, using it as an escape route to offload risky holdings. Slightly conspiratorially, one might argue that certain Deep State capital suffered massive losses from FTX’s collapse and the broader crypto downturn. Following Trump’s victory, they may resort to various political tactics to inflate crypto prices to absurd levels—reviving failing balance sheets and avoiding further damage.

The FTX case offers valuable lessons. In 2025, I am particularly intrigued by the potential revival of the NFT sector, which shares certain parallels. Combined with emerging speculative narratives like AI Agents, a second spring for NFTs is certainly possible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News