MiCA's Impact on Stablecoins: Can USDT Maintain Its Footing in the EU?

TechFlow Selected TechFlow Selected

MiCA's Impact on Stablecoins: Can USDT Maintain Its Footing in the EU?

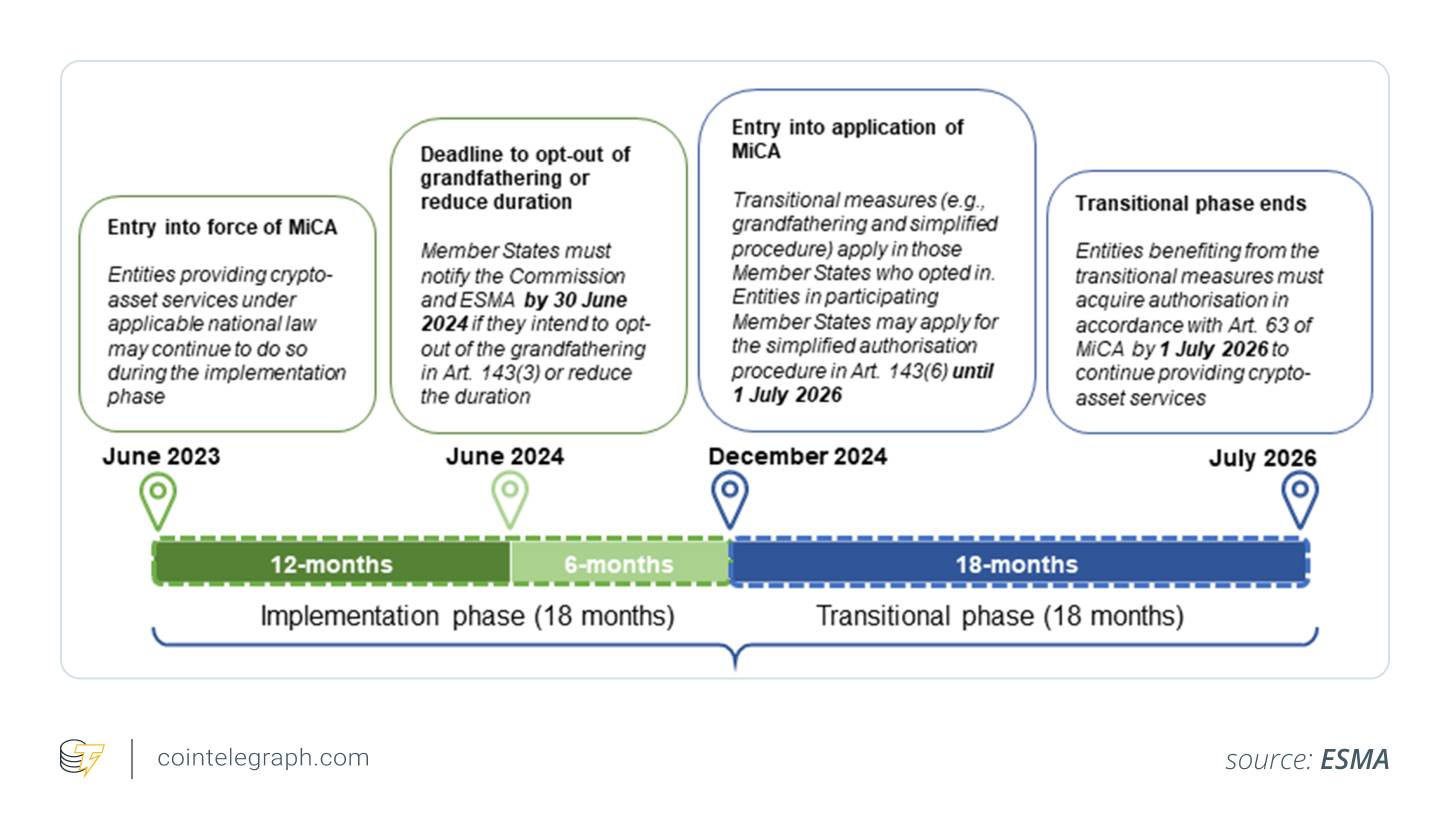

MiCA's implementation will reshape the EU's cryptocurrency market through strict compliance standards and a ban on algorithmic stablecoins.

Author: Cointelegraph

Compiled by: TechFlow

Key Takeaways

-

MiCA divides stablecoins into two categories: Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs). These tokens must be fully backed 1:1 by liquid reserves and meet strict transparency and regulatory requirements to operate legally within the EU.

-

Algorithmic stablecoins, which lack tangible backing and rely on market mechanisms to maintain value, are considered high-risk assets and are explicitly prohibited under MiCA.

-

Stablecoin issuers must satisfy several stringent requirements, including registration as an Electronic Money Institution (EMI) or Credit Institution (CI), publishing a detailed white paper, holding reserve assets with EU-authorized third-party custodians, and integrating Digital Token Identifiers (DTIs).

-

It remains unclear whether Tether's USDT complies with MiCA. During the MiCA transition period, its availability and usage in the EU may face certain restrictions.

If you follow the cryptocurrency space, you’ve likely heard of the European Union’s comprehensive regulatory framework known as Markets in Crypto-Assets (MiCA).

But what does MiCA mean for stablecoins like Tether’s USDT?

What Is MiCA?

MiCA is a comprehensive set of cryptocurrency regulations introduced by the European Union to regulate crypto assets, including stablecoins. Its core objectives are to uphold the EU’s authority over its monetary system, ensure financial stability, and protect consumer rights.

You can think of MiCA as the EU’s official stance: "We welcome cryptocurrencies, but they must operate in a responsible and secure manner."

Stablecoins Under MiCA

Stablecoins are a special type of cryptocurrency designed to maintain stable value by being pegged to traditional assets such as fiat currencies (e.g., U.S. dollar, euro), commodities (e.g., gold), or even other cryptocurrencies.

Under MiCA, stablecoins are classified into two main categories:

-

Asset-Referenced Tokens (ART): Tokens backed by a basket of multiple assets—such as various currencies or commodities.

-

E-Money Tokens (EMT): Tokens pegged to a single currency, functioning similarly to traditional electronic money.

To ensure safety and stability, MiCA mandates that all stablecoins must be fully backed by sufficient liquid reserves at a 1:1 ratio with their underlying assets.

Did You Know?: MiCA requires international stablecoin issuers to use EU-authorized custodians. For example, Circle has established a French subsidiary to issue USDC in Europe, aligning with MiCA’s regulatory framework.

Ban on Algorithmic Stablecoins

A key provision of MiCA is the prohibition of algorithmic stablecoins across the EU. Unlike ARTs and EMTs, algorithmic stablecoins do not have clear, tangible asset backing. Instead, they rely on complex algorithms and market incentives to maintain their peg.

Due to the absence of identifiable and physical asset support, MiCA does not classify algorithmic stablecoins as asset-referenced tokens. As a result, these tokens are effectively banned throughout the EU.

Compliance Requirements for Stablecoins Under MiCA

If your company plans to issue a stablecoin in the EU, you must comply with the following conditions:

-

Register as an Electronic Money Institution (EMI) or Credit Institution (CI): Issuers must obtain either an EMI or CI license to meet required financial and operational standards. For instance, issuing or publicly offering EMTs requires an EMI license, while publicly offering or listing EMTs for trading necessitates a CI license.

-

Issue a White Paper: You must publish a detailed document outlining how the stablecoin operates, its asset backing, associated risks, and organizational structure.

-

Custody of Liquid Reserves: You must hold sufficient liquid reserves through trusted third-party custodians within the EU, ensuring each token is fully backed 1:1 by real-world assets.

-

Regular Reserve Reporting: You must issue periodic transparency reports so users and regulators can clearly see the status of the stablecoin’s reserves.

-

Digital Token Identifier (DTI): The DTI acts as the stablecoin’s “digital passport.” It must be clearly stated in the white paper and provides information about the ledger where the token resides, helping regulators trace accountability.

The Role of Digital Token Identifiers (DTI)

A DTI is a unique identifier assigned to digital tokens, developed by the International Organization for Standardization (ISO) under ISO 24165. It assigns a distinct and permanent code to each digital asset.

Just as traditional securities use International Securities Identification Numbers (ISINs) to identify stocks and bonds, DTIs bring order to the crypto market. These alphanumeric codes ensure every digital asset can be uniquely identified.

The DTI system is managed by the Digital Token Identifier Foundation (DTIF), whose primary goal is to enhance market transparency, support compliance, and improve interoperability between blockchain networks and traditional financial systems.

By simplifying the tracking and management of digital assets, DTIs offer several benefits:

-

More Efficient Risk Management: Helps businesses and regulators better monitor asset-related risks.

-

Streamlined Reporting Processes: Simplifies the generation and submission of compliance reports.

-

More Reliable Market Data: Provides accurate asset information, increasing market trust.

If you’re a stablecoin issuer, here’s how to apply for a DTI:

-

Submit an Application: Visit the DTI website and submit detailed information about your token.

-

Technical Verification: DTIF will review the technical foundation of your token.

-

Receive Your DTI: Upon approval, your stablecoin will be assigned a unique DTI code.

For full details, refer to the official MiCA guidelines and the DTI Quick Guide.

Is Tether (USDT) Compliant With MiCA?

MiCA stipulates that if a stablecoin like USDT is categorized as an E-Money Token (EMT), its issuer must obtain a license as a Credit Institution (CI) or Electronic Money Institution (EMI) and meet a series of compliance standards. However, Tether has not yet fulfilled these requirements, raising questions about USDT’s legal standing in the EU.

There is ongoing debate about USDT’s compliance status. Some believe it may face restrictions, while others argue it could continue operating during MiCA’s transitional period.

Juan Ignacio Ibañez, a member of the MiCA Crypto Alliance’s Technical Committee, told Cointelegraph: “While no regulator has explicitly stated that USDT is non-compliant, that doesn’t mean it is compliant.”

He added that Coinbase’s decision to delist USDT could be seen as a precautionary move. However, there is currently no formal directive requiring other exchanges like Binance or Crypto.com to follow suit. He predicts that as MiCA is fully implemented, the regulatory landscape for stablecoins will become clearer, and other platforms may eventually face similar delisting decisions.

On social media, discussions around USDT’s position in Europe have gained traction. Some observers note that while USDT hasn’t been outright banned, MiCA requires it to achieve compliance during the transition period. This means USDT may not disappear from the EU entirely, but its liquidity and usability could be significantly affected by MiCA enforcement.

One perspective suggests that after December 30, USDT may no longer be tradable across Europe.

Notably, Tether supports StablR, a Malta-based stablecoin firm focused on two main projects: StablR Euro (EURR), pegged to the euro, and StablR USD (USDR), pegged to the U.S. dollar. These tokens leverage Tether’s tokenization platform Hadron, enhancing flexibility and accessibility in stablecoin transactions.

Nevertheless, uncertainty remains regarding whether USDT meets MiCA’s compliance criteria. To date, no regulatory body has officially confirmed whether USDT satisfies MiCA or other applicable laws. Until official statements are released, any claims about its compliance or potential ban lack solid grounding.

Did You Know?: Tether CEO Paolo Ardoino revealed at the PlanB event in Switzerland that Tether’s reserves include $100 billion in U.S. Treasury bills, 82,000 bitcoins (worth $5.5 billion at the time), and 48 tons of gold backing the USDT stablecoin.

Will USDT Still Be Usable on DEXs After December 30?

Decentralized Exchanges (DEXs), due to their decentralized nature, may not be directly subject to MiCA regulations. However, EU users must still adhere to new regulatory requirements. This means users should verify whether USDT complies with MiCA standards. Using non-compliant tokens could expose individuals to legal risks.

Which Stablecoins Are Compliant With MiCA?

Compliant stablecoins adhere to relevant laws, regulations, and standards set by authorities in their respective jurisdictions.

Compliance typically involves maintaining transparency, implementing robust anti-money laundering (AML) practices, and enforcing proper Know Your Customer (KYC) procedures. Additionally, compliant stablecoins must have verifiable reserves and undergo regular audits, fostering trust within the market.

Here are some stablecoins that meet MiCA requirements:

-

EURI: Issued by Banking Circle, registered in Luxembourg as a Credit Institution (CI), DTI code LGPZM7PJ9, available on Ethereum and BNB Smart Chain.

-

EURe: Issued by Monerium, authorized as an Electronic Money Institution (EMI) by Iceland’s central bank, available on Ethereum, Polygon, and Gnosis networks.

-

USDC and EURC: Issued by Circle Internet Financial Europe SAS (Circle SAS), registered as e-money tokens; however, as of December 26, their white papers did not list DTI codes.

-

EURCV: CoinVertible by SG Forge, registered as an EMI in France, based on Ethereum, DTI code 9W5C49FJV.

-

EURD: Issued by Quantoz Payments, headquartered in the Netherlands, DTI code 3R9LGFRFP, built on the Algorand blockchain.

-

EUROe and eUSD: Issued by Membrane Finance Oy, based in Finland, supported across multiple blockchains including Concordium, Solana, Arbitrum, Avalanche, Ethereum, Optimism, and Polygon.

-

EURQ and USDQ: Launched by Quantoz Payments with backing from Tether, Kraken, and Fabric Ventures. Fully backed by fiat reserves and licensed as e-money tokens by the Dutch Central Bank (DNB).

-

EURØP: A euro-backed stablecoin issued by Schuman Financial, fully backed by cash and cash equivalents. EURØP obtained its e-money token license through its subsidiary Salvus SAS from France’s Prudential Supervision and Resolution Authority (ACPR). It plans to launch on Ethereum and Polygon and expand to major centralized crypto exchanges in Europe. Notably, the token will be restricted in 107 high-risk jurisdictions, including Iran, North Korea, and Venezuela (source).

The Future of Stablecoins in the EU

MiCA will reshape the EU’s cryptocurrency market by imposing strict compliance standards and banning algorithmic stablecoins.

While this presents challenges for established players like USDT, it also opens opportunities for compliant euro-denominated stablecoins. The EU is setting a global regulatory benchmark, and other regions may follow suit, paving the way for a more unified and secure global crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News