Three Sigma: How to Build and Accurately Identify Successful Airdrop Projects from a Psychological Perspective?

TechFlow Selected TechFlow Selected

Three Sigma: How to Build and Accurately Identify Successful Airdrop Projects from a Psychological Perspective?

Integrate airdrop design closely with community values, making users feel valued rather than exploited.

Author: Three Sigma

Translation: TechFlow

What Is the Secret to a Successful Airdrop?

We dive deep into the behavioral patterns behind user participation and how to turn fleeting hype into lasting loyalty. Want to learn how to spot real value signals? Click to explore full insights!

1. Introduction & Concept

Airdrops have become a powerful tool for blockchain projects to attract communities, rewarding users while incentivizing broader network engagement. They also accelerate token circulation, enabling wider access and usage.

However, community reactions to airdrops vary significantly based on perceived value, timing, and whether they are seen as a “gift” or a “reward.” This article explores the acceptance and impact of airdrops through psychological, philosophical, and historical lenses, helping you better understand the underlying logic.

Introduction

Airdrops were originally designed to distribute tokens widely and promote decentralization. Today, their role has evolved—they now serve as key tools for incentivizing network activity. The surge in user behavior not only generates valuable data metrics but also helps attract investors and paves the way for fundraising around the Token Generation Event (TGE).

Yet viewing airdrops merely as capital injections is too narrow. In reality, they have become essential marketing instruments—drawing in new users and motivating them to engage with the project to build user bases. While initial interactions are crucial, only sustained user retention unlocks an airdrop’s true long-term value. Users must recognize the significance of holding and participating, rather than simply claiming tokens and dumping them for short-term gains. In this process, "mindshare"—the collective awareness and emotional connection within the community—plays a pivotal role.

Imagine an explorer who stumbles upon an unknown path filled with hidden treasures. These treasures haven’t yet been valued, but the explorer realizes that one person alone cannot fully unlock their potential. So he gathers friends to join the expedition, sparking a wave of exploration and attracting more participants. As excitement builds, surrounding markets begin to take notice. Though no clear market value exists yet, rising anticipation signals that once unearthed, these treasures could be extraordinary.

This collective attention and involvement lay the foundation for high initial valuations when the treasures enter the market. It also creates strong network effects, enhances the project's reputation, and delivers substantial future returns for all participants. But what if the final treasure fails to meet expectations? Would the arduous journey feel disappointing? And how would the community’s emotional bonds be affected?

In this process, “mindshare” is critical—it serves as the glue binding user participation. Only when users form genuine emotional connections with a project will they view their tokens as long-term opportunities rather than short-term arbitrage tools. This sense of belonging helps prevent immediate sell-offs and reduces price volatility. Projects that successfully cultivate strong mindshare often make users feel part of something meaningful, encouraging active governance participation, feedback, and organic promotion within personal networks. This deeper engagement transforms passive recipients into active contributors, laying a solid foundation for long-term stability and growth.

Introduction to Community Sentiment and Mindshare

“Community sentiment” or “mindshare” is a key metric measuring a project’s standing within the crypto ecosystem. It reflects the collective awareness, perception, and emotional connection among community members.

In the context of airdrops, this sentiment becomes especially important. When users maintain long-term emotional attachment, the impact of an airdrop is amplified. Therefore, to maximize airdrop effectiveness, project teams must deeply understand how to foster positive mindshare and identify factors that drive lasting community sentiment.

Research shows that a sense of community belonging rests on four core elements: membership, influence, fulfillment of needs, and shared emotional connection. When aligned with project goals, these elements create tight-knit bonds, making users feel integral to the project’s success. By designing airdrops that embody these principles—such as assigning specific roles or setting shared milestones—projects can shift users from passive token recipients to active community members.

The Importance of Community Sentiment in Airdrops

An airdrop is often a user’s first interaction with a project, making their initial experience crucial. Studies show that users’ dependency on a community correlates strongly with its future growth potential and quality of social interactions. If an airdrop offers tangible utility or a clear path to participation, users feel like they belong, fostering long-term loyalty. Research further suggests that cultivating optimistic expectations about the future and creating more social opportunities deepen user engagement, helping build enduring relationships beyond the initial airdrop.

From an economic perspective, the perceived value of a gift largely depends on the intent behind it.

The meaning of gifts—and by extension, airdrops—depends on whether they are seen as sincere gestures or purely transactional acts. If recipients perceive them as strategically motivated, they may feel like marketing tactics rather than goodwill, potentially eroding trust. Conversely, if airdrops are designed with clear value-add intentions—such as granting meaningful governance rights or exclusive privileges—they are more likely to receive positive responses and boost community engagement.

The Psychology and Sociology of Gift Perception

Gift perception is shaped by psychological and social contexts, directly influencing whether an airdrop is viewed as a “gift” or just a “reward.” Research highlights that the essence of gifting lies in a cycle of “giving–receiving–reciprocating,” which strengthens social bonds. When airdrops are distributed unexpectedly, they often trigger strong positive reactions—similar to how surprise bonuses increase employee loyalty and trust. Studies confirm that unexpected incentives generate greater goodwill and motivation than anticipated rewards. Applied to airdrops, surprise token distributions make recipients feel genuinely valued, encouraging higher levels of reciprocal engagement.

Additionally, perception hinges on whether the airdrop feels like a “right” or a true “gift.” Research indicates that incentive mechanisms perceived as contractual tend to lose motivational power. If an airdrop feels routine, it may fail to ignite community enthusiasm. In contrast, unexpected airdrops significantly enhance the user experience because recipients feel sincerely appreciated, increasing their inclination to support the project long-term. Thus, well-crafted “surprise airdrops” help maintain positive community sentiment while avoiding fixed expectations of regular distributions.

Key Factors Influencing Airdrop Community Sentiment

Many factors affect airdrop outcomes, with timing and distribution method being particularly significant. Research shows that airdrops aligned with core community values and offering clear practical use cases are more effective at boosting loyalty and engagement. Historical performance also shapes community expectations. Past high-return airdrops raise return expectations; repeated underperformance leads to disappointment. To manage these dynamics, projects should design each airdrop with unique value propositions—preserving trust while avoiding overly predictable patterns.

Another critical factor is transparency around airdrop purpose. Clear communication about goals reduces the likelihood of immediate token selling. When users understand the true intent—such as encouraging governance participation or building an active user base—they are more likely to feel a sense of value and mission, strengthening identification with the project and enhancing long-term loyalty.

Understanding and enhancing community sentiment is key to designing successful airdrops. Drawing from theories in community psychology and gift-giving behavior, projects can forge stronger community ties, build trust, and inspire sustained user engagement. When thoughtfully designed, airdrops go beyond simple token distribution—they become profound expressions of user recognition and community value.

Based on existing research, here are several key considerations for crafting airdrop strategies that establish deep, lasting connections with users:

-

User mindshare as a driver of loyalty: Research indicates that cultivating strong community sentiment (user mindshare) enhances users’ sense of belonging, boosting loyalty and long-term retention⁷.

-

Transforming recipients into active participants: Community belonging studies suggest that incorporating elements like membership identity and shared milestones can turn passive reward recipients into active contributors.

-

The importance of first impressions: Community psychology emphasizes that airdrops offering real value and engagement create positive initial experiences, driving long-term participation and loyalty².

-

Balancing sincerity and strategy: Economic research shows that when users perceive airdrops as sincere “gifts” rather than transactional tools, trust and positive sentiment increase, leading to deeper engagement.

-

The motivational power of unexpected rewards: Psychological studies find that surprise rewards (e.g., sudden airdrops) significantly boost user motivation and loyalty. Transparent communication helps prevent dumping, supporting sustained engagement.

2. Background

Understanding human behavior in specific environments—and users’ psychological traits at individual and group levels—is fundamental to analyzing airdrop effectiveness. Empirical research allows us to assess different airdrop performances and user behavior patterns, identifying commonalities and differences between successes and failures. This requires collecting relevant metrics and observing conditions during launch periods.

In recent years, numerous airdrops have launched, each with unique designs and varying outcomes. To gain deeper insight into their impacts, we focus on representative case studies across different sectors.

In this study, we analyze airdrop strategies in three key areas: Layer 2 Networks, Perpetual Exchange Protocols (PerpDEX), and Liquid Restaking Protocols. These categories are vital components of the blockchain ecosystem, offering valuable lessons on early growth, user acquisition, and long-term engagement.

Ethereum-Based Layer 2 Solutions

L2 projects play a crucial role in scaling the blockchain ecosystem. By alleviating congestion and high fees on Layer 1 networks like Ethereum, they dramatically improve efficiency. These solutions enhance throughput while preserving security and decentralization of the base layer. Due to their scalability potential and ability to drive broader adoption, L2s often attract significant venture capital. A notable feature of L2s is their high Fully Diluted Valuation (FDV), reflecting their ambition to replicate Layer 1 success while providing infrastructure for decentralized applications.

This study analyzes the following four L2 projects:

Arbitrum

Arbitrum (ARB)’s airdrop aimed to reward users actively engaged in its Layer 2 network. Eligibility focused on users who bridged funds to @Arbitrum and completed transactions within its ecosystem. Unlike others, Arbitrum emphasized broad distribution to maximize user participation. By targeting early adopters, the project successfully cultivated loyalty and engagement, laying a strong foundation for governance. Additionally, rewarding diverse dApp activities made Arbitrum’s airdrop stand out for inclusivity and driving mass adoption.

Starknet

@Starknet’s airdrop targeted users of zk-rollup technology, particularly those involved in testnet and mainnet activities. Qualification depended on interactions with dApps and experimentation with innovative scaling solutions. Starknet’s uniqueness lies in prioritizing technological adoption, rewarding users who tested protocols during development and provided feedback. This strategy not only incentivized participation but also nurtured a tech-oriented community aligned with its zk-rollup vision.

zkSync

@zkSync focused its airdrop on early adoption of its zk-rollup-based Layer 2 solution. Users qualified by bridging assets, interacting with dApps, and exploring zero-knowledge-proof-enabled features. By incentivizing broad network activity, this airdrop attracted a community highly invested in the protocol’s development and long-term vision.

Perpetual Decentralized Exchanges (PerpDEX)

Perpetual trading markets are becoming one of the most dynamic and promising directions in DeFi. Compared to the massive volumes on centralized exchanges, perpetual trading in decentralized domains still has vast untapped potential. As DeFi evolves, perpetual protocols leverage innovative technologies to decentralize and democratize futures trading, carving out a new niche. These protocols use airdrops strategically to attract traders, liquidity providers, and early users, positioning themselves as credible alternatives to centralized platforms. In this study, we examine three representative projects to explore their strategies and impacts:

Aevo (formerly Ribbon Finance)

Aevo originated from @RibbonFinance, which previously conducted an airdrop. During rebranding and token migration, @Aevoxyz launched a new platform focused on derivatives trading, particularly options. To encourage migration, Aevo allocated part of its treasury as airdrop rewards, prioritizing early users demonstrating consistent trading activity (e.g., placing and executing trades). Aevo stands out for its specialization in options trading—a niche allowing it to precisely target specific trader types.

Drift Protocol

Drift’s airdrop targeted active traders on its decentralized perpetual exchange. Eligibility centered on trading volume and frequency, ensuring rewards reached loyal users contributing to platform liquidity and activity. @DriftProtocol distinguishes itself with professional-grade trading tools—rare in decentralized frameworks—making it highly attractive to advanced traders. The goal was to reinforce its user base through rewarding loyalty and encouraging continued participation in the derivatives ecosystem.

Jupiter Exchange

Jupiter’s airdrop rewarded users of its Solana-based aggregator platform who sought optimal trading routes and liquidity options. Users qualified by interacting with routing tools and actively swapping tokens. Unlike Drift and Aevo, which focus on derivatives, @Jupiter Exchange emphasizes usability and liquidity aggregation, targeting everyday DeFi users. This airdrop not only encouraged continued usage but also cemented Jupiter’s status as the go-to swap tool on Solana.

Liquid Restaking

Liquid restaking protocols represent a rapidly emerging segment in DeFi, rooted in EigenLayer’s restaking model. Their original aim was to increase capital efficiency by enabling staked assets to secure multiple networks simultaneously, unlocking additional value from idle funds.

As they evolve, these protocols expand beyond their initial scope, exploring innovative uses to further enhance protocol and token value. Initially relying on EigenLayer’s Ethereum restaking infrastructure, Liquid Restake Token (LRT) protocols are now building independent ecosystems. By developing unique use cases and expanding utility, they aim to reduce reliance on EigenLayer and become multifunctional, sustainable solutions.

LRT projects generally benefit from EigenLayer’s incentive structure. While users pursue EigenLayer rewards, LRTs offer additional points or tokens, amplifying total returns. Those who stake directly on EigenLayer without engaging with LRTs miss out on these extra benefits.

Ether.fi

Etherfi’s airdrop promoted its decentralized Ethereum staking protocol, primarily targeting users actively staking ETH or participating in governance. Unlike others, @Ether_fi emphasizes full user control over assets, allowing custody retention while using LRTs. Eligibility criteria included staking activity and governance contributions, prioritizing users aligned with the protocol’s decentralization ethos and active participation.

Puffer Finance

Puffer’s airdrop aimed to lower barriers to liquid restaking by deeply integrating with EigenLayer to attract users. Eligibility required interaction with EigenLayer’s restaking infrastructure, targeting both newcomers and experienced users exploring modular staking solutions. Unlike Etherfi or Renzo, @Puffer_finance emphasizes simplicity, reducing technical hurdles while maximizing returns via advanced restaking mechanisms. This strategy makes Puffer an ideal entry point for users exploring Ethereum staking or seeking innovative approaches.

Renzo Protocol

Renzo’s airdrop targeted users engaging in liquid restaking via its platform, with eligibility based on restaking assets and contributing to liquidity pools. This ensured rewards went to users actively supporting ecosystem liquidity and security. @RenzoProtocol excels in capital efficiency, enabling users to earn rewards while deploying staked assets across other DeFi applications. This dual utility appeals to users aiming to optimize yields in flexible staking environments.

Community Mindshare

Analyzing community mindshare is highly challenging. Beyond obvious indicators like social media activity, it involves intangible aspects such as private conversations and underlying emotional shifts. While some tools attempt to quantify sentiment by aggregating posts and interactions, accuracy remains limited due to bot interference and insufficient historical data. Hence, we propose a new method to evaluate community mindshare.

Our approach combines quantitative and qualitative analysis. Quantitative data measures user engagement and activity metrics, while qualitative insights capture emotions and perceptions around airdrop execution. By comparing data before and after TGE (Token Generation Event), we aim to uncover behavioral patterns and reveal the real impact of airdrops.

Quantitative Metrics

The following metrics provide data support across user engagement, economic activity, and platform performance, aiding analysis of how airdrops drive participation and ecosystem adoption:

Layer 2 Solutions

Daily Active Users (DAU)

DAU measures the number of unique addresses interacting with the protocol daily. For L2 solutions, DAU is a key indicator of network appeal, reflecting user engagement driven by low fees, fast transactions, and seamless dApp integration. A pre-airdrop DAU surge typically signals rising interest, while post-airdrop growth reflects trust and functional validation.

Monitoring DAU helps determine whether an airdrop translates into long-term retention or merely attracts short-term “airdrop farmers.” This analysis is crucial for consolidating stickiness and network vitality after TGE.

Daily Netflows

Daily netflows measure the volume of assets bridged from Ethereum to the L2 network. Pre-airdrop inflows usually reflect users moving assets to qualify for rewards, while sustained post-airdrop inflows indicate trust and long-term adoption intent.

If capital continues flowing in after the airdrop, it signals success in driving ecosystem growth. Research shows predictable rewards (like airdrops) can attract users, but only provision of real value ensures sustained engagement.

Total Value Locked (TVL)

TVL reflects the total value of assets locked in the protocol, serving as a key indicator of economic trust. Pre-airdrop TVL often rises as users meet qualification requirements, while post-airdrop changes reveal whether users treat the protocol as a long-term investment or a short-term reward grab.

Steady post-airdrop TVL growth indicates growing confidence and long-term value. Users only commit capital long-term if they believe the platform offers reliable services and innovation opportunities.

Perpetual Decentralized Exchanges (PerpDEX)

Trading Volume

Trading volume reflects the total traded value on a PerpDEX, serving as a core metric for platform activity and liquidity. A pre-airdrop spike often stems from speculative trading to meet eligibility, while sustained post-airdrop growth indicates successful attraction of long-term active traders.

Ongoing volume reflects user trust and the platform’s ability to maintain sufficient appeal and liquidity within the ecosystem.

Open Interest (OI)

Open Interest reflects the number of unsettled contracts on a PerpDEX, indicating active trader participation. OI typically increases pre-airdrop as users build positions. Stable or growing OI post-airdrop signals successful retention of core users and ongoing engagement in derivatives trading.

Post-airdrop OI growth marks not only user stickiness but also lays the foundation for a sustainable trading ecosystem.

Daily Active Users (DAU)

For PerpDEX platforms, DAU measures trading activity and the number of unique traders. A pre-airdrop DAU spike often relates to speculative trading, while post-airdrop stability directly reflects user trust.

DAU analysis reveals whether users continue trading after claiming rewards or exit immediately—critical for assessing long-term airdrop effectiveness.

Liquid Restaking Tokens (LRT)

Total Value Locked (TVL)

In LRT protocols, TVL represents the total value of staked and restaked assets. Pre-airdrop TVL growth usually indicates users deploying funds to meet eligibility, while post-airdrop performance reflects trust in the staking mechanism and confidence in future rewards.

For LRT projects, post-airdrop TVL stability is a key success metric. Research shows users are more likely to stay invested when rewards feel genuine and valuable. Sustained economic participation fosters stronger community belonging, promoting healthier ecosystem development.

User Count

In LRT protocols, DAU measures the activity of stakers and restakers. Pre-airdrop spikes reflect speculative interest, while post-airdrop stability indicates long-term trust in the staking mechanism and reward system.

DAU is a key indicator of whether an airdrop successfully turns passive participants into active community members. Research shows protocols maintaining post-airdrop user activity often build deeper emotional connections through incentives. Such bonds not only boost loyalty but also encourage deeper governance participation.

Qualitative Metrics

To comprehensively assess airdrop impact and community influence, we analyze design choices and user feedback from multiple angles. Key characteristics and their implications include:

-

Percentage of total supply allocated to airdrop: Reflects the project’s commitment to decentralization and rewarding early users.

-

Total airdrop value ($): Financial value at distribution time, directly affecting user interest and sentiment.

-

Number of airdrop recipients: Total addresses receiving the airdrop. Broad distribution may signal efforts to attract more users, while narrow allocation implies higher scarcity.

-

Was the distribution fair? Examines whether a few users dominate allocations, assessing fairness.

-

Was this the first airdrop? First-time airdrops typically generate greater attention and anticipation.

-

Did users participate for the airdrop or actual need? Distinguishes between reward-driven and product-value-driven participation, assessing authenticity.

-

Duration of activity: Time between campaign start and airdrop distribution, indicating user commitment length.

-

Was participation time-consuming? Evaluates time cost for users; excessive demands may deter average participants.

-

Was participation expensive? Assesses financial costs including gas fees or required investments, impacting accessibility.

-

Did it require maintaining long-term liquidity? Requiring at least one month of liquidity lock-up may reduce short-term speculation and encourage longer-term ecosystem involvement.

-

Had PMF been achieved before the airdrop? Ensures the airdrop complements an already valuable ecosystem rather than serving purely as user acquisition.

-

User satisfaction with the project? Gauges non-monetary appeal through feedback on core products like dApps and blockchains.

-

Were there similar prior airdrops? Existing comparable airdrops may shape user expectations and behaviors.

Collateral Airdrops

In our research, we examined whether users could earn additional rewards while farming a primary airdrop. Such additive incentives may significantly boost interest and engagement.

To better understand subjective factors in airdrop mechanics, we surveyed over 150 airdrop participants via Telegram and X, gathering real-user feedback. The survey focused on three key questions:

-

Was the airdrop fairly distributed?

-

Did you participate for the reward or actual product need?

-

How was your experience with the product or project?

By analyzing these responses, we aim to uncover the real-world impact of airdrops on community engagement and user stickiness.

3. Data Presentation

In this section, we divide data into quantitative and qualitative categories, presenting measurable platform metrics alongside insights into community sentiment. Together, they offer a clearer view of user behavior trends before and after airdrops.

Quantitative Metrics

To visually present data, we designed charts centered on the airdrop date, extending three months before and after. This layout helps capture behavioral shifts and trends around the event.

Layer 2 Solutions:

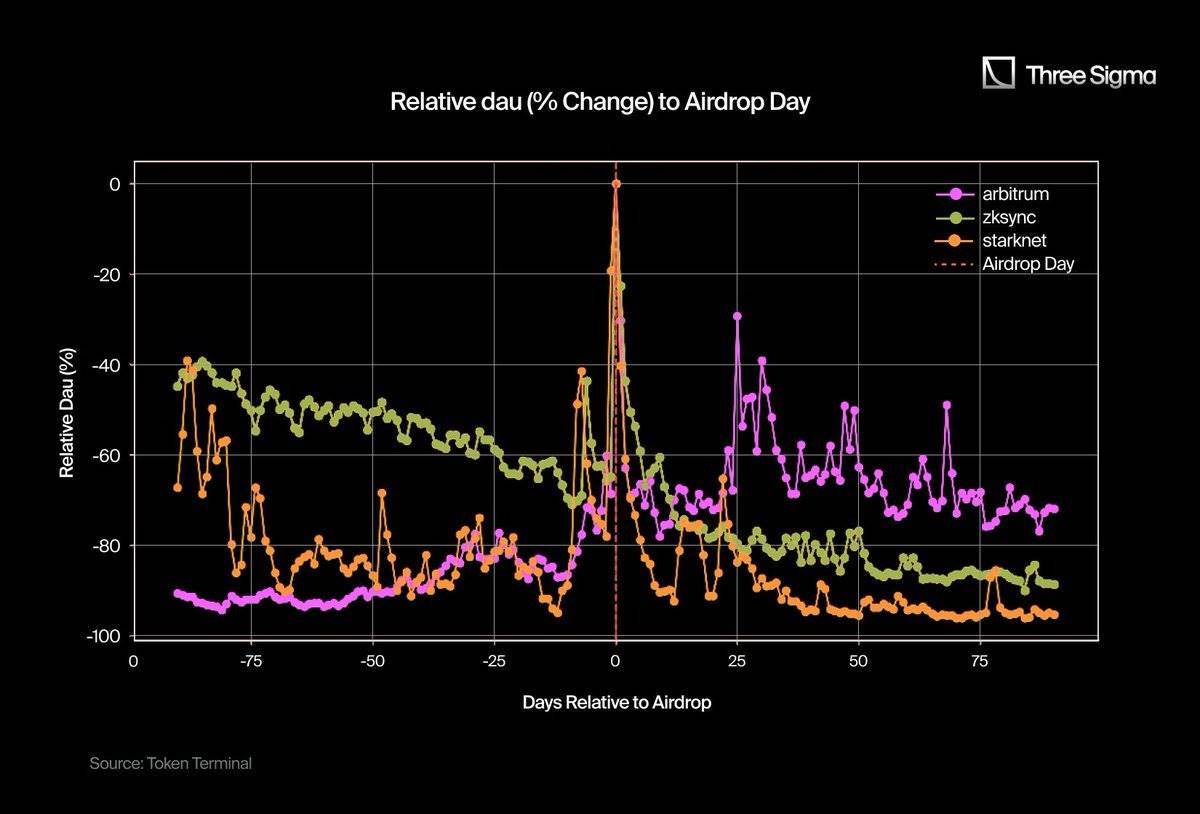

Daily Active Users (DAU): DAU reflects the number of unique addresses interacting with the network daily. Pre-airdrop, user activity remained stable or slightly increased, indicating gradual adoption. On airdrop day, all networks saw sharp DAU spikes, showing concentrated bursts of activity.

However, post-airdrop, StarkNet and zkSync experienced rapid declines in activity, suggesting waning interest once incentives ended. Arbitrum showed smaller drops, indicating stronger user retention.

Notably, Arbitrum’s pre-airdrop activity rose steadily, even though the team only officially announced plans one week before redemption. This strategy effectively drove growth. In contrast, StarkNet and zkSync publicly disclosed plans early, leading to prolonged farming periods and user attrition due to long wait times.

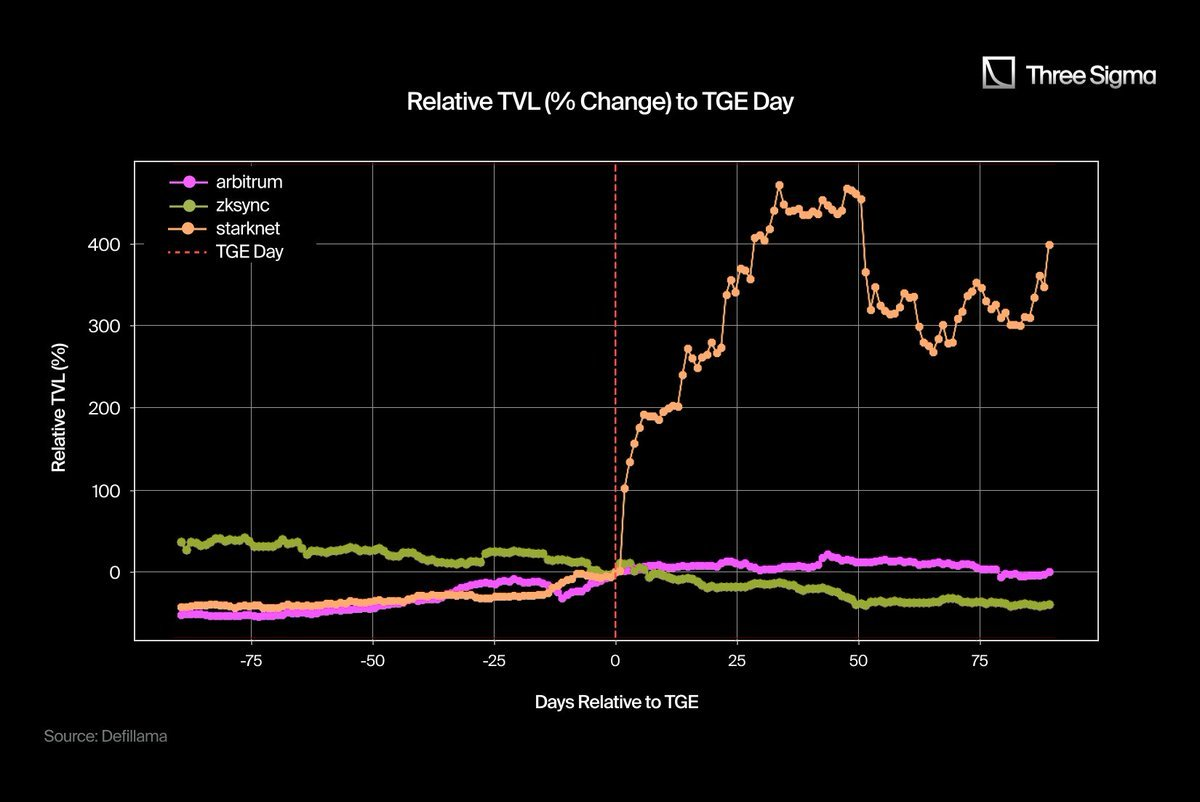

This chart shows that prior to TGE, projects maintained relatively stable TVL with slight growth, reflecting steady participation. After TGE, Starknet’s TVL surged sharply as users deposited capital; Arbitrum’s TVL also increased, though far less than Starknet. In contrast, zkSync saw a decline in TVL post-airdrop, continuing a downward trend. These differences highlight varying levels of capital inflow across networks during this period.

As shown, Starknet’s TVL spiked significantly. To understand this, we analyzed on-chain data and found the surge was driven by rapid growth in Nostra, a leading Starknet protocol. Just one month after TGE, Nostra’s TVL jumped from $15M to an ATH of $220M, accounting for 68% of the network’s total TVL at the time. This growth was fueled by whale deposits and the launch of STRK (tokens airdropped to protocols and users) DeFi markets.

Within Nostra, the top 30 wallets on the ETH market (currently holding $95M) control 68% of supply, along with lending markets for STRK and USDC. This suggests most TVL came from large deposits, driving post-TGE growth. These contributions helped stabilize the protocol and solidify its role as a key participant in the Starknet ecosystem.

Prior to TGE, Arbitrum and zkSync showed fluctuating netflows with noticeable inflow peaks, possibly reflecting user preparation. Starknet remained relatively stable with minor changes. Post-TGE, Arbitrum exhibited a significant traffic peak, indicating increased capital activity, while zkSync and Starknet showed more consistent trends, suggesting more stable capital flow dynamics.

Perpetual Decentralized Exchanges (PerpDEX):

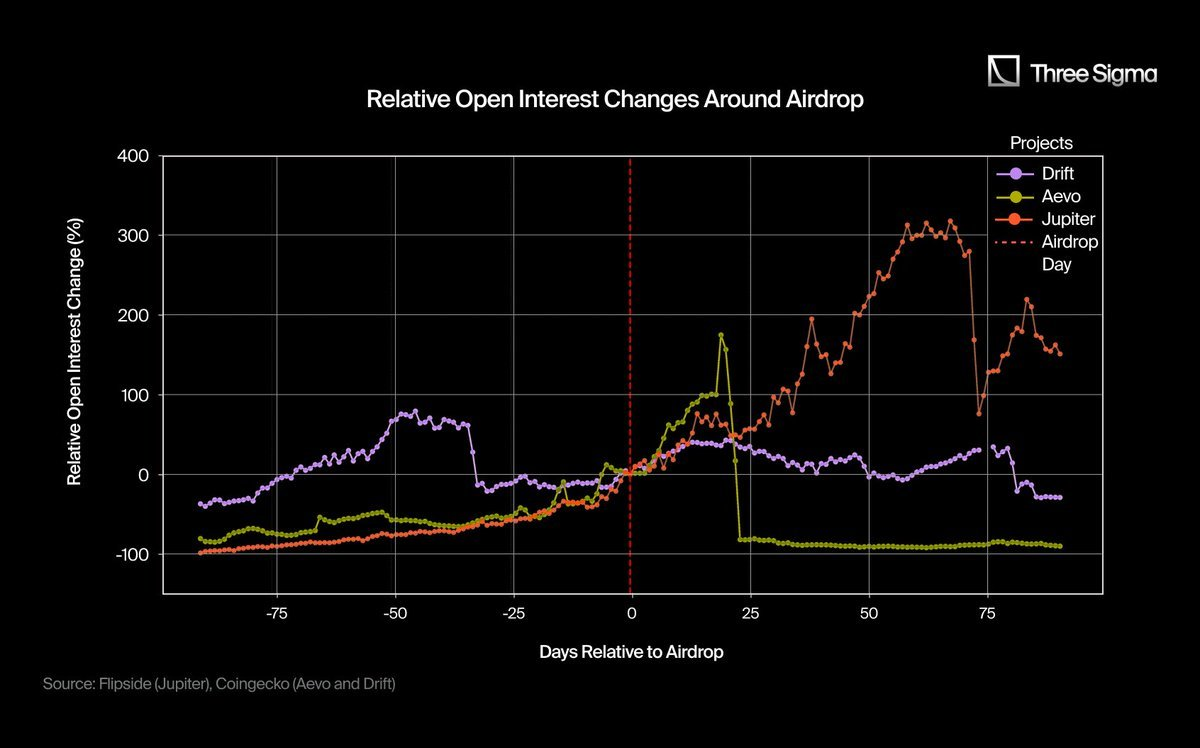

Open Interest (OI)

Pre-airdrop, Drift and Aevo showed steady OI growth, indicating users gradually increasing positions. Jupiter’s OI fluctuated less, showing a more stable upward trend. Post-airdrop, Drift maintained high OI levels, signaling ongoing market participation, while Aevo declined.

In contrast, Jupiter saw a significant post-airdrop OI increase, reflecting growing user engagement and confidence.

Aevo’s sharp post-airdrop position drop relates to its decision to weaken trading reward programs. After TGE, Aevo launched a 16-week reward program paid in AEVO tokens. This led to extensive wash trading, inflating both volume and open interest.

In response, Aevo weakened the reward structure to curb wash trading, causing a visible drop in trading activity and a sharp reduction in open interest. While intended to address unsustainable activity from over-incentivization, this adjustment directly impacted participation metrics and market engagement.

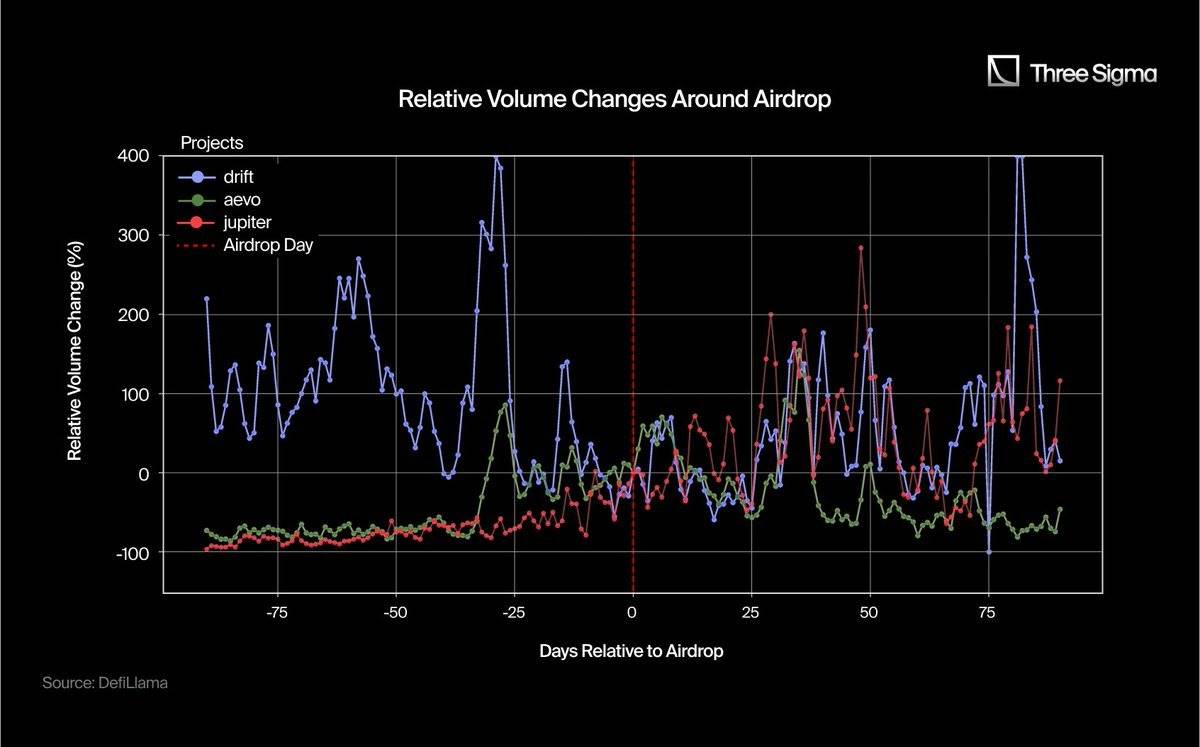

Pre-airdrop, Drift’s trading volume showed significant volatility and a sharp rise, indicating speculative activity ahead of the airdrop. Aevo and Jupiter displayed more stable, gradual increases.

Post-airdrop, Drift maintained high volume amid fluctuations, while Jupiter showed continuous growth, highlighting sustained activity. However, Aevo stabilized at a lower level, indicating reduced trading participation.

Liquid Restaking Projects:

-

Total Value Locked (TVL): Refers to the total value locked on-chain, excluding native token portions. Data comparisons are based on TVL at the time of the airdrop.

Pre-airdrop, users deployed funds in anticipation, resulting in significant TVL growth for both Etherfi and Renzo. Renzo’s growth reflected gradually increasing interest, while Etherfi’s was more pronounced. In contrast, Puffer saw slower but steadier asset growth.

Post-airdrop, Etherfi’s TVL grew significantly, driven by continued inflows and user trust. Renzo initially showed small, stable increases but later declined gradually. Puffer’s TVL dropped shortly after TGE, possibly indicating reduced engagement or fund withdrawals.

In terms of Daily Active Users (DAU), Etherfi showed high volatility and significant pre-airdrop growth, indicating intense user activity. Renzo and Puffer had smoother, less volatile trends, reflecting consistent but lower interaction levels compared to Etherfi.

Post-airdrop, Puffer’s DAU briefly spiked after the event, but this didn’t last and quickly fell below pre-airdrop levels.

Renzo performed relatively steadily with minimal fluctuation, but post-airdrop activity was lower than pre-airdrop, only seeing moderate growth after about two months. Etherfi’s DAU continued to show periodic peaks, although their intensity gradually weakened over time.

Qualitative Metrics:

The table below summarizes qualitative data collected on-chain and off-chain.

4. Conclusion

Combining quantitative and qualitative data, we identify recurring patterns and summarize shared characteristics of successful and failed airdrops across sectors. These insights offer valuable guidance for future airdrop design and execution.

4.1. Layer 2 Solutions (L2)

Success Case: Arbitrum

Quantitative Analysis:

Arbitrum’s Daily Active Users (DAU), Total Value Locked (TVL), and Netflows remained stable or showed positive growth post-airdrop, indicating sustained user engagement and trust.

Qualitative Analysis:

-

First-mover? No—Arbitrum wasn’t the first L2 airdrop, coming after Optimism. This meant users already had expectations and baseline understanding. Despite lacking novelty, Arbitrum succeeded due to strong fundamentals.

-

Airdrop Distribution: Fairly distributed, avoiding accusations of inequity.

-

Participation Cost & Complexity: Low barrier to entry, requiring neither significant time nor capital.

-

Product-Market Fit (PMF): Yes—achieved PMF before the airdrop, giving users confidence that the airdrop was a reward, not an experiment.

-

User Sentiment: Strong affection for Arbitrum and its dApps drove organic adoption, not just economic incentives.

Conclusion:

Arbitrum demonstrates that fair distribution, low participation barriers, clear PMF, and strong user sentiment can overcome lack of novelty. Even without being first, Arbitrum leveraged an active community and solid fundamentals to transform its airdrop into sustained user engagement.

Moreover, Arbitrum’s ecosystem grants spurred innovation, delivering real on-chain value and further improving user retention.

Failure Cases: Starknet and zkSync

Quantitative Analysis:

Both zkSync and Starknet saw sharp post-airdrop declines in DAU. Starknet’s TVL initially rose but then plateaued, reflecting insufficient engagement. This growth was mainly driven by incentives from Nostra Finance, which accounted for 68% of network TVL—but proved unsustainable.

Netflows remained stable but showed little fluctuation, lacking the significant growth seen with Arbitrum.

Qualitative Analysis:

-

Distribution: Unequal rewards led to perceptions of unfairness.

-

Participation Motive: Users participated primarily for rewards, not genuine product use.

-

Participation Cost: Though not expensive, requiring at least one month of liquidity added operational complexity.

-

PMF & User Feedback: Neither achieved PMF before the airdrop, leading to low user approval.

-

Impact of Multiple Airdrops: Neither was first-to-market, facing higher user expectations and competition from other L2 airdrops, diluting appeal.

Conclusion:

Unfair distribution and lack of PMF were primary reasons for the failure of zkSync and Starknet airdrops. Additionally, higher participation barriers (e.g., liquidity requirements) limited broader user involvement, ultimately leading to declining post-airdrop activity.

4.2. Perpetual Decentralized Exchanges (PerpDEX)

Success Case: Jupiter

Quantitative Analysis:

Jupiter saw steady post-airdrop growth in DAU, OI, and trading volume, indicating rising user engagement and confidence.

Qualitative Analysis:

-

Distribution: Fair distribution avoided concentration in a few addresses.

-

First-mover? Not the first in category, but among the earliest major airdrops in the Solana ecosystem.

-

Participation Complexity: Though requiring time and capital, most participants were organic users with real product needs, linking usability to positive feedback.

-

User Sentiment & PMF: Positive reception toward Jupiter’s aggregator platform, with established PMF giving users confidence to stay long-term.

-

Additional Airdrops: Jupiter users earned extra rewards from other projects while farming. This synergy enhanced overall activity.

Conclusion:

Jupiter proves that even non-first movers can succeed if users truly value the product. Additional airdrop opportunities further boosted community engagement.

Timing mattered too—Jupiter launched during Solana’s rapid growth phase, helping its token perform well in the market.

Failure Cases: Aevo and Drift

Quantitative Analysis:

Both Aevo and Drift saw declines in DAU and trading volume post-airdrop, indicating reduced participation and trading activity. Drift’s OI remained stable but showed no growth, while Aevo’s declined.

Qualitative Analysis:

-

Distribution & Cost: Unfair distribution (Drift’s fairness remains debated) and high barriers hindered average user participation.

-

PMF & User Feedback: Neither achieved PMF, and user sentiment was poor. Incentives alone couldn’t ensure long-term retention.

-

Novelty & Additional Rewards: Both lacked distinctiveness compared to peers. Users also received no extra airdrop benefits.

Conclusion:

High barriers, negative user feedback, and lack of PMF were key reasons for poor airdrop performance. In competitive environments, projects must differentiate through fair distribution and unique advantages—or risk being replaced by more appealing rivals.

4.3. Liquid Restaking Tokens (LRT)

Success Case: Etherfi

Quantitative Analysis:

Post-airdrop, Ether.fi saw continuous TVL growth driven by steady capital inflows and user trust. DAU also showed periodic peaks, indicating sustained interest.

Qualitative Analysis:

-

First-mover? Yes—as the first liquid restaking token airdrop, Etherfi captured attention and drove early user engagement through novelty.

-

Distribution: Fair distribution with low entry barriers, despite requiring capital and a one-month liquidity lock.

-

User Sentiment & PMF: Achieved PMF before the airdrop with strong user approval. This solid foundation amplified its first-mover advantage.

-

Additional Airdrops: Users earned extra rewards while farming Etherfi. Unlike others, this multi-airdrop model enhanced—not diluted—the experience due to Etherfi’s unique position and clear PMF.

Conclusion: Leveraging first-mover advantage, fair distribution, PMF, and strong user sentiment, Etherfi delivered a highly successful airdrop. Novelty complemented rather than replaced fundamentals. Additional airdrop opportunities further boosted ecosystem appeal, giving users more reasons to engage.

Etherfi also gained trust from large depositors through deep integrations with major protocols like Aave and Pendle. Its technological and ecosystem leadership secured a prominent market position.

Failure Cases: Puffer and Renzo

Quantitative Analysis:

Renzo’s TVL briefly stabilized post-airdrop but then declined, while Puffer’s TVL dropped rapidly. Both saw sharp reductions in DAU, indicating plummeting interest and engagement.

Qualitative Analysis:

-

Distribution & Barriers: Unfair distribution and capital locking deterred many potential users. Requiring at least one month of liquidity further increased difficulty.

-

User Sentiment & PMF: Though formally achieving PMF, both suffered from weak user interest, leading to rapid post-reward churn.

-

Lack of Novelty: Neither was first-to-market, lacking distinctiveness to sustain long-term attention.

-

Impact of Additional Airdrops: Although users could earn other airdrops, this didn’t improve retention. Unlike Etherfi, Puffer and Renzo failed to offer compelling reasons to stay.

Conclusion:

Puffer and Renzo failed due to weak sentiment, high participation barriers, and unattractive strategies. Unlike Etherfi, they couldn’t leverage novelty or multi-airdrop synergies, leading to rapid post-airdrop attrition. Delayed governance token distribution and falling token prices after TGE further undermined confidence, leaving them clearly behind in competition.

Key Insights Across Categories

-

Novelty and First-Mover Advantage: Being the first in category (e.g., Etherfi) can spark initial excitement, but without PMF and fair distribution, novelty alone won’t ensure long-term engagement. In mature fields, strong fundamentals matter more than being first.

-

Impact of Multi-Airdrop Models: When projects enjoy strong sentiment and PMF (e.g., Etherfi or Jupiter), additional airdrops enhance ecosystem appeal. For weaker projects (e.g., Renzo, Puffer), multi-airdrops may dilute attention and reduce loyalty and retention.

-

Fairness, Accessibility, and PMF Are Core to Success: Successful airdrops (e.g., Arbitrum, Jupiter, Etherfi) typically feature fair token distribution, low participation barriers, and clear utility or PMF. These factors build trust and promote long-term engagement.

-

User Sentiment and Participation Patterns: When users hold positive sentiment and value a project (e.g., Jupiter, Etherfi), airdrops act as catalysts for growth. When users feel skeptical or dissatisfied (e.g., Drift, Aevo, Renzo, Puffer), airdrops become brief peaks with no lasting impact.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News