Alea Research: Why We’re Bullish on ai16z?

TechFlow Selected TechFlow Selected

Alea Research: Why We’re Bullish on ai16z?

$ai16z is not only a narrative-driven investment opportunity, but also critical infrastructure supporting the deployment and scaling of on-chain AI agents.

Author: Alea Research

Translation: TechFlow

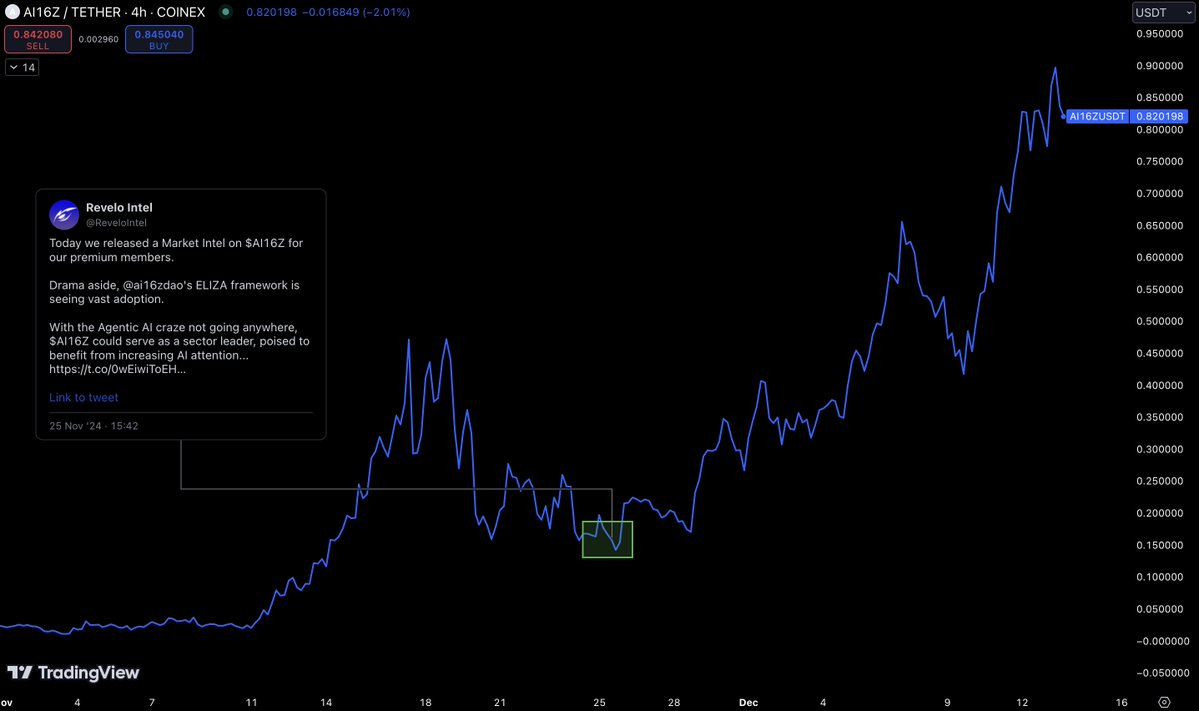

We first released our market intelligence report on $ai16z on November 25, just as its price hit rock bottom. Shortly afterward, $ai16z staged a rapid rebound and surpassed a $1 billion market cap.

Our core thesis has remained unchanged—and has been further validated by recent price action. Soaring from a low near $0.14 to a high of $0.90, $ai16z’s performance confirms our confidence in blue-chip assets within the Agentic AI space. Even amid widespread skepticism and weak market sentiment at the time, we identified an opportunity to accumulate high-quality assets.

Key Highlights

-

AI-Driven Onchain Interaction: AI agents are reshaping the crypto ecosystem, shifting onchain interactions from human-centric to AI-driven. ai16z's ELIZA framework sits at the heart of this transformation.

-

Network Effects from Open Source Ecosystem: As more developers adopt the ELIZA framework to deploy AI agents, capital inflows into the ecosystem will boost token value and expand influence.

-

Rising Market Attention: ai16z has emerged as a leader in onchain trading volume. With growing influence, it is only a matter of time before major exchanges list $ai16z.

-

First-Mover Advantage and Limited Competition: As the most popular onchain AI development framework, ELIZA has captured early developer attention and established dominance in the ecosystem.

-

Healthy Token Structure: With no unlock schedules or VC sell-off pressure, $ai16z’s performance aligns more closely with organic growth.

-

Potential Risks: Investors should remain cautious about rising competitors, potential forks threatening the ecosystem, and risks associated with heavy reliance on the founding team.

Silicon Valley Meets Solana

Unaffected by VC dumping, $ai16z has become an ideal vehicle for capturing the “AI Meme” narrative. Like GOAT—the first token launched via pump.fun to reach a $1 billion valuation—$ai16z has also crossed this threshold and attracted heightened market attention due to its uniqueness.

As a convergence point between two hot sectors—AI and Memes—$ai16z possesses viral potential. The project is not just a foundational layer for developers building ecosystems but is closely tied to open-source contributions, treasury growth, and network effects. Over 250 projects have already been built on the ELIZA framework. With increasing media coverage and rising onchain trading volume, we believe it is only a matter of time before $ai16z is listed on top-tier exchanges.

Agentic AI is steadily establishing itself as a mainstream trend, offering a new paradigm that combines the explosive virality of memecoins with actual infrastructure utility. Marc Andreessen publicly signaled support for this trend by donating 50,000 USD worth of Bitcoin to Truth Terminal—a move that lends institutional credibility and underscores long-term potential. As a representative project of this movement, ai16z carries cultural momentum while providing essential infrastructure for scaling onchain AI agents, positioning itself as a key driver in advancing this domain.

AI and Memes now account for approximately 60% of overall sentiment and attention in the cryptocurrency space.

Over the past year, artificial intelligence has consistently absorbed emerging trends, amplifying their value and impact—clearly becoming the foundation for the next major "meta" in crypto. Whenever a new wave captures attention—be it gaming, NFTs, or memecoins—AI agents (powered by frameworks like ELIZA) adapt faster, integrate more efficiently, and ultimately become indispensable infrastructure. This dynamic creates a positive feedback loop, reinforcing AI’s dominance, displacing competing narratives, and solidifying its central role across the ecosystem.

The core idea behind ai16z lies in the dynamism of its narrative. With each market cycle, AI-driven systems prove their ability to absorb and outperform other trends, ensuring that the AI-led meta remains relevant. Investing in ai16z is fundamentally a bet on this self-reinforcing dominance.

Overview: The $ai16z Blueprint

ai16z is an AI-driven decentralized autonomous organization (DAO) aiming to build the first AI-managed crypto venture fund. Its flagship product is the ELIZA framework, and the $ai16z token serves as the instrument for investing in and holding shares of the fund. Users who hold a certain threshold of tokens can submit investment proposals to Marc Aindreesen (@pmairca), who evaluates and acts upon them.

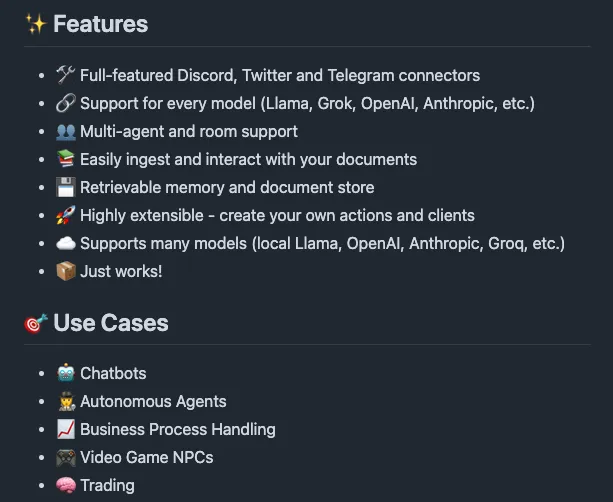

Through the ELIZA framework, ai16z can deploy multi-platform interactive agents capable of tasks such as summarizing conversations, reading documents, and executing onchain transactions.

ELIZA is an open-source framework specifically designed for building agents with onchain capabilities.

The project’s core goal is to create an ecosystem of AI agents while attracting more AI developers into the crypto space. By combining open-source development with the viral nature of memecoins, ai16z becomes highly appealing to both developers and general users. Whether crypto-native developers looking to deploy agents on blockchains like Ethereum L2 or Solana, or AI engineers new to crypto, all stand to benefit. For example, a Farcaster client based on ELIZA is already under development.

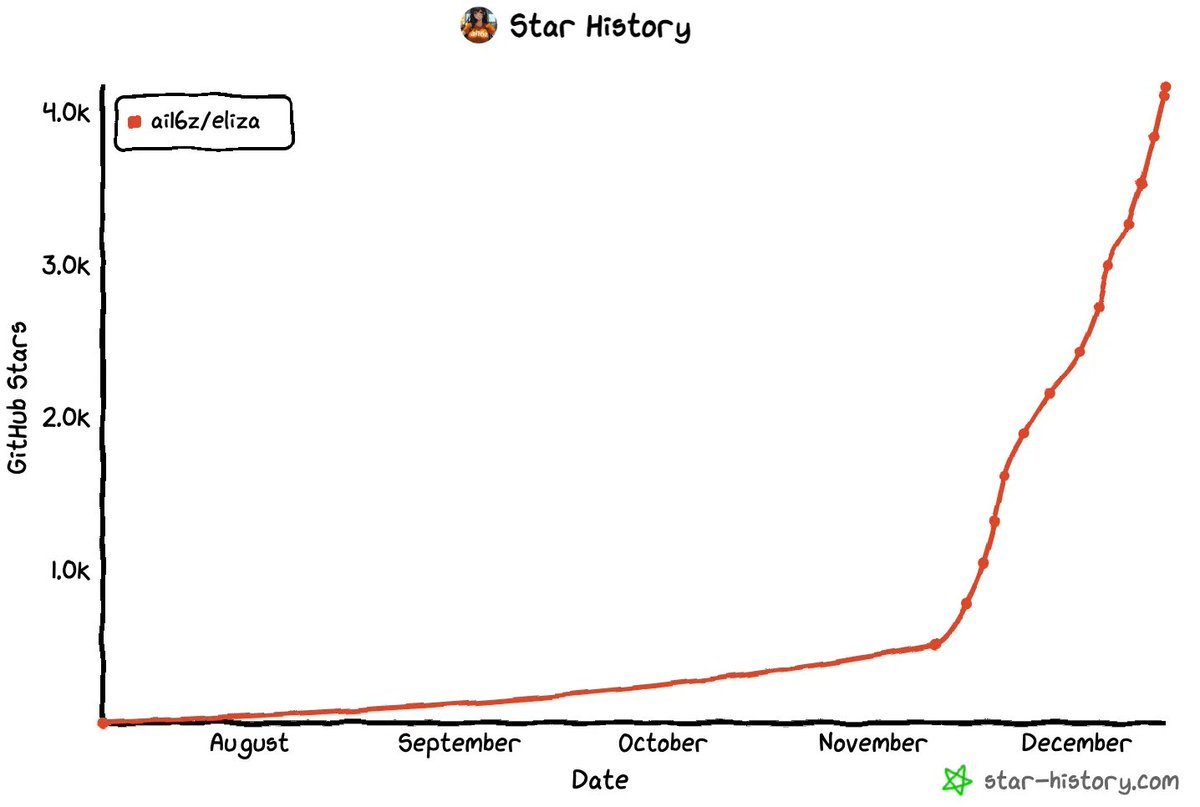

The ELIZA framework currently hosted on GitHub has garnered over 4,200 stars and 1,200 forks.

In addition, ai16z aims to become the central hub connecting entrepreneurs, investors, and enthusiasts across the crypto and AI domains—a critical advantage in maintaining its competitive edge.

Industry Outlook: The Convergence of AI Agents and Memes

During the memecoin supercycle, the emergence of “agent memes” has drawn the attention of nearly every participant in the crypto space. For fund managers and professional investors, this offers a compelling rationale for investing in internet culture and virality. While this narrative may appear to be a paradigm shift, it actually reflects tangible applications and real outcomes at the intersection of crypto and AI.

There is currently growing fatigue around investments in infrastructure projects and conceptual “AI x Crypto” products—projects that are rich in theory but poor in execution. In contrast, the “agentic AI” narrative is particularly attractive to liquidity token investors because it combines the rapid growth characteristics of memecoins with actual functionality and future potential.

Unlike typical memecoins, which often lack intrinsic value, agentic AI tokens like $ai16z are not merely story-driven investment opportunities—they also serve as critical infrastructure enabling the deployment and scaling of onchain AI agents. This sector has already attracted significant liquidity, as investors can allocate capital efficiently without concerns about illiquidity or long-term lockups. From a retail investor perspective, the atmosphere surrounding this narrative evokes memories of the early DeFi Summer and the golden age of liquidity mining.

In our view, ai16z is the trendsetter in this space and has become the de facto industry standard for deploying AI agents onchain. The ELIZA framework has become the go-to tool for developers creating agents with social personas and distinct personalities—agents capable of operating independently on platforms like X (formerly Twitter) or TikTok, which are crucial for community building.

The Investment Case for $ai16z

The current investment thesis leverages the network effects generated by the increasing adoption of the ELIZA framework for agent deployment. This drives capital inflows into the $ai16z fund and further strengthens its dominant position within the ecosystem. This growth forms a virtuous cycle: as the ecosystem expands, demand for the token increases, enhancing its value as a representative asset of the narrative.

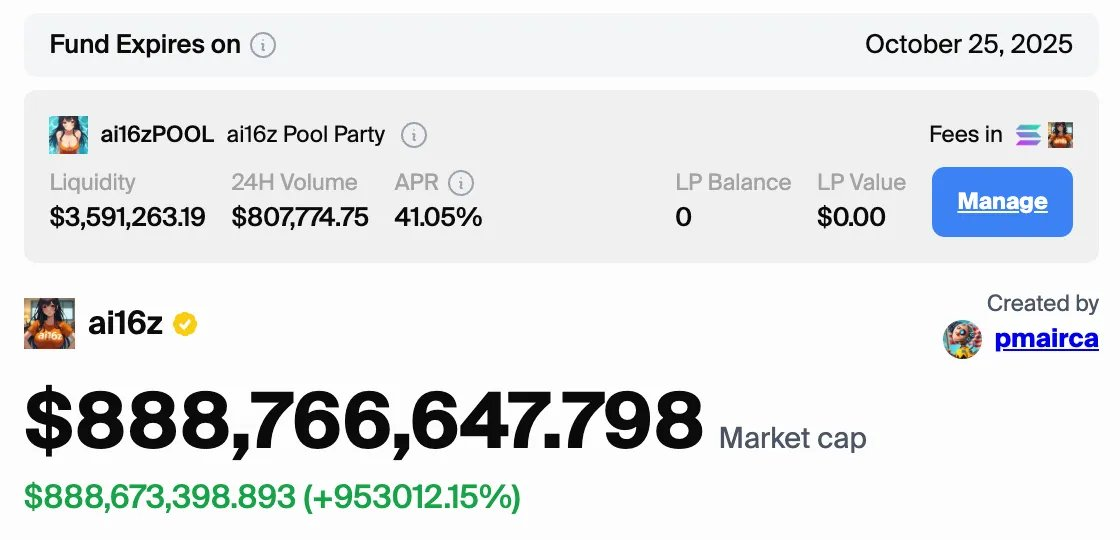

The fund's net asset value (NAV) has already exceeded $20 million.

From a broader perspective, the core of this investment case lies in $ai16z serving as the gateway token to the “agentic AI” narrative. The ELIZA framework has rapidly become the primary infrastructure for launching AI agents onchain, and its open-source model continues to attract more developers. This trend of bringing top-tier AI talent into crypto further fuels network effects, boosts the DAO’s NAV, enhances the narrative premium on the token, and solidifies its market leadership.

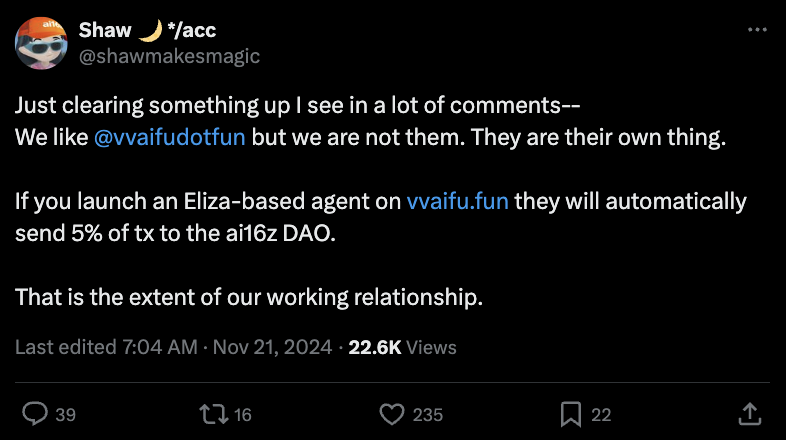

Ultimately, attention and user adoption will be the key drivers of growth. Managing an investment position requires understanding how much success stems from technological merit versus market-driven valuation premiums. Additionally, the impact of derivative projects within the ecosystem should not be underestimated—for instance, vvaifu, a pump.fun-like platform focused on AI agents. Such innovations add layers to the ecosystem and further cement the token’s role as the central hub for agentic AI growth.

Notably, the broader market is already primed for the convergence of crypto and AI. Investors are eagerly pricing in future expectations and speculating on potential impacts. This market enthusiasm provides strong tailwinds for the development of “autonomous AI agents”—especially as people begin imagining the possibility of these agents owning wallets and autonomously conducting transactions onchain, further amplifying excitement.

Catalysts and Re-rating Triggers

The current competitive landscape is intense, especially after Binance unexpectedly listed $ACT before $GOAT, adding further uncertainty. In such an environment, it's likely that “rising tides lift all boats,” and the listing of $GOAT could even provide a positive spillover effect for similar tokens. Many in the market are speculating about which token will be the next to get listed on a top-tier exchange. Exchanges aim not only to profit themselves but also to generate returns for users, so they tend to favor tokens that offer high potential returns for retail investors while generating substantial trading volume to boost fee revenue.

Among all potential catalysts, a Binance listing is the most plausible short-term driver—particularly given that $ai16z was mentioned in Binance’s recent industry report. Binance and other exchanges are racing to list tokens tied to trending narratives, and $ai16z has already proven its value through strong onchain trading volume. A successful Binance listing would bring immediate market validation, unlock massive liquidity, and attract a wider base of retail traders. Notably, $ai16z also enjoys structural advantages such as no token unlocks or VC sell-offs, making it highly attractive to both short-term traders and long-term holders.

Risks and Failure Modes

In the current market environment, competition among early-stage narratives is fierce, and retail investors are highly speculative. Platform risk, dependence on the development team, and the threat of forks represent major risks for $ai16z, any of which could rapidly erode token value. Currently, the market values $ai16z at a massive premium relative to its assets under management (AUM). This valuation gap could either be closed by explosive AUM growth—or result in significant losses for latecomers. At present, the fund’s market cap is slightly above $200 million, while its AUM stands at just $6 million (after deducting an 8% management fee), implying a token premium of nearly 40x.

To break even, the fund’s AUM would need to grow 40-fold within the next 11 months—a highly ambitious target unless the AI narrative explodes further and fund performance vastly exceeds expectations.

The investment thesis behind ai16z is not without risk; even if $GOAT and other tokens perform well, it does not guarantee synchronized gains across the entire sector. The most direct risk is platform dependency: many projects—including AI agents built on the ELIZA framework—rely heavily on centralized platforms like X. Changes in platform policies, or outright bans on related activities, could severely limit agent functionality and damage the project. This is a clear external risk over which the team has little control.

Moreover, unlike memecoins—which typically make no promises and are driven entirely by communities—$ai16z and ELIZA depend heavily on a small, highly specialized development team, introducing execution risk. Any loss of core team members or internal conflicts could lead to delays, loss of market attention, or reduced execution capability. For example, during the launch of the $ELIZA token, accusations arose that a key contributor engaged in insider trading by dumping large amounts of the old token before the new one went live—an incident that could negatively impact the project’s reputation and development trajectory.

ELIZA’s Open-Source Code and Competitive Pressure

While ELIZA’s open-source nature offers flexibility to developers, it also exposes the project to the risk of being forked by competitors. If other developers use ELIZA’s code to create alternative frameworks and gain community support, it could fragment the ecosystem, weaken network effects, and diminish the token’s core value. Additionally, although ELIZA provides a comprehensive development suite, its broad scope means that many use cases may opt to selectively adopt individual components rather than fork the entire framework.

At the same time, competition brings new challenges. For instance, Zerebro’s Zerepy framework—primarily targeting Python developers—is gaining traction and has already been featured on Binance’s official blog. If Binance or another major exchange lists ZEREBRO before $ai16z, it could undermine investor confidence in $ai16z’s dominance and dampen its market momentum.

Furthermore, there are long-term sustainability concerns regarding $ai16z’s DAO model and fund structure. While innovative at the experimental level, this fund structure may struggle to maintain valuations significantly above its net asset value (NAV), especially if fund returns remain limited.

Given the market’s heavy reliance on narrative-driven dynamics, these factors underscore the need for active risk management and continuous reassessment of trading strategies.

Volatility and Trading Strategy for $ai16z

Since launch, $ai16z has experienced significant price volatility. Investors must clarify their positioning to determine how to navigate different market conditions. Long-term holders may need to endure substantial drawdowns and gradually accumulate positions ahead of catalysts, waiting for revaluation-driven rallies. Short-term traders, on the other hand, can capitalize on price swings around key levels using flexible long or short positions.

Central to this investment approach is effective volatility management. By analyzing the relationship between price movements and major events, potential trading opportunities emerge. For example, when Eddy Lazzarin, CTO of a16z Crypto, publicly interacted with the official X account, the token surged 50%. Conversely, during the launch of the second $ELIZA token, controversy led to a 50% price correction. For active traders, such volatility presents opportunities to exploit market sentiment and cyclical mispricings.

By positioning early—before exchange listings—it is possible to capture value and anticipate catalytic events. Given that $ai16z has already generated substantial onchain trading volume, such catalytic effects are foreseeable. The default strategy is to gradually build exposure ahead of major catalysts, such as exchange listings or unexpected ecosystem announcements.

Take $ACT as an example: it spiked tenfold immediately after Binance listing—though given $ai16z’s larger market cap, a similar surge would likely be more moderate.

From a risk management standpoint, investors are advised to employ strict stop-loss strategies (currently relying mainly on mental stops) and closely monitor market trends. If holding for extended periods, profits should be taken or positions reduced after major catalysts are announced.

In summary, this is a speculative trade requiring rigorous risk management. Should market sentiment shift or news fail to generate expected reactions, strategies must be adjusted swiftly. Stay agile, ride the momentum, but avoid overcommitting. The current opportunity is largely narrative-driven rather than rooted in fundamental infrastructure-level progress.

Conclusion and Final Thoughts

Overall, the investment case for $ai16z is highly compelling. As AI agents emerge as a central theme, they are rapidly gaining market attention and aligning perfectly with crypto’s appetite for innovations that blend fun and utility. As a token, $ai16z exhibits a more mature and evolved form of the “memecoin” phenomenon—backed by strong network effects, a growing treasury, and widespread visibility. Moreover, the flexibility and expanding adoption of the ELIZA framework provide solid fundamental support, distinguishing $ai16z from mere tokenized agents fueled solely by hype.

With onchain trading volume continuing to climb and major catalysts such as CEX listings on the horizon, we believe $ai16z stands out as a high-conviction opportunity within the current AI-themed, $GOAT-led risk-on market. It is well-positioned not only to benefit from the AI-driven narrative but also to emerge as a standout performer within this trend.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News