Interpreting the current development of ai16z and Virtuals: capturing over half of the AI Agent market share, both face challenges of ecosystem centralization

TechFlow Selected TechFlow Selected

Interpreting the current development of ai16z and Virtuals: capturing over half of the AI Agent market share, both face challenges of ecosystem centralization

In this wave of AI Agent craze, ai16z and Virtuals Protocol are undoubtedly the two most prominent representative projects.

Author: Nancy, PANews

With infrastructure steadily improving and application scenarios gradually materializing, the crypto AI Agent ecosystem is flourishing, revealing a new market development trajectory as liquidity and user engagement continue to rise. Amid this AI Agent boom, ai16z and Virtuals Protocol stand out as the two most dominant representative projects, with their ecosystems attracting active investment from capital across the board.

ai16z and Virtuals Lead the AI Agent Market, Contributing Over Half of Total Share

Although the AI Agent ecosystem has rapidly emerged in the crypto market, drawing significant attention and capital inflows, its market structure remains relatively concentrated, primarily driven by a few leading projects.

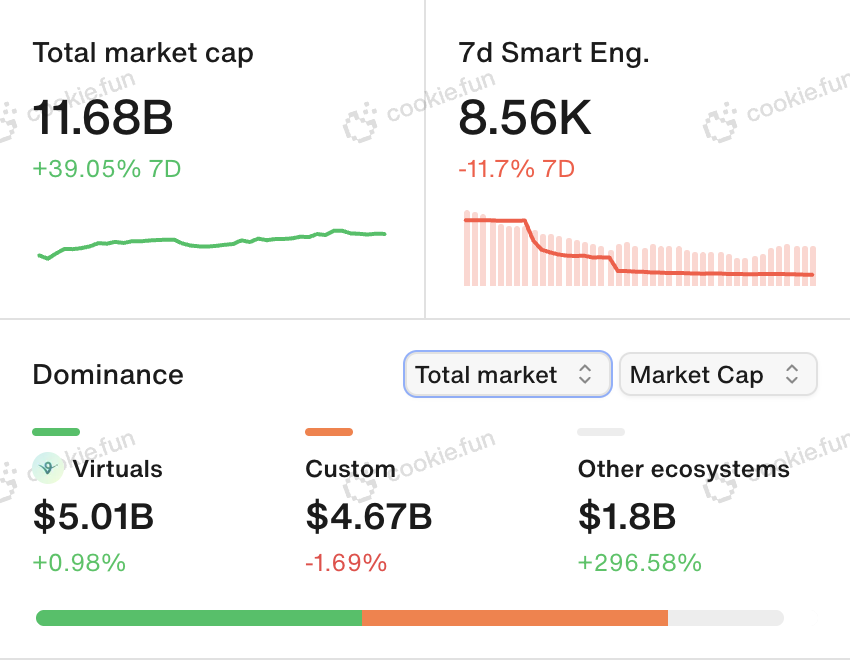

According to the latest data from Cookie.fun, as of December 30, the overall market cap of the AI Agent sector reached $11.68 billion, marking a nearly 39.1% increase over the past seven days—highlighting the rapid growth momentum within the crypto space.

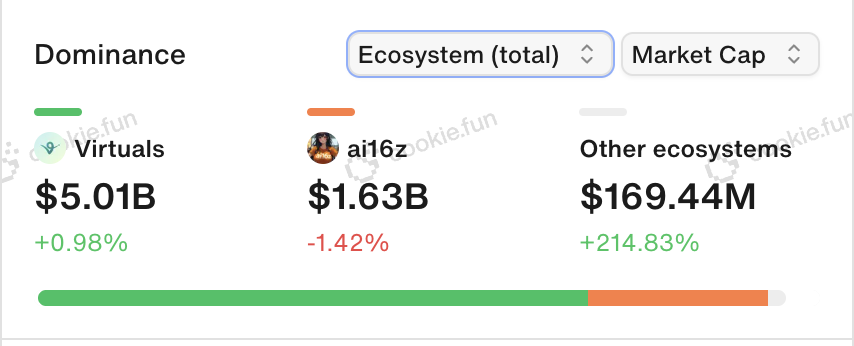

In terms of ecosystem scale, a clear head effect exists in the crypto AI Agent landscape, dominated mainly by Virtuals and ai16z. Specifically, Virtuals holds an ecosystem market cap of $5.01 billion, while ai16z stands at $1.63 billion, together accounting for 56.8% of the total AI Agent market share—indicating that current growth and development largely depend on these two flagship projects.

By category, Virtuals' market cap exceeds that of customized AI Agents, which sits at $4.67 billion, while other categories cumulatively reach $1.8 billion.

From a blockchain distribution perspective, Base and Solana serve as the two primary battlegrounds for AI Agents. The market cap of AI Agents on Base amounts to approximately $5.76 billion, compared to $5.47 billion on Solana. Together, they account for 96.1% of the total market, with all other chains collectively contributing just $920 million—further underscoring that the AI Agent ecosystem is still in its infancy.

While Base and Solana are comparable in overall market size for AI Agents, their ecosystem compositions differ significantly. Virtuals dominates the Base ecosystem, with 86.9% of projects originating from it. In contrast, ai16z accounts for only about one-third of Solana’s market share, suggesting that Solana's AI Agent ecosystem is richer and more diverse than Base’s.

Divergent Ecosystem Development Paths, Yet Both Show High Market Concentration

As Virtuals and ai16z gain popularity, their respective ecosystem projects have become focal points for investor interest and speculation.

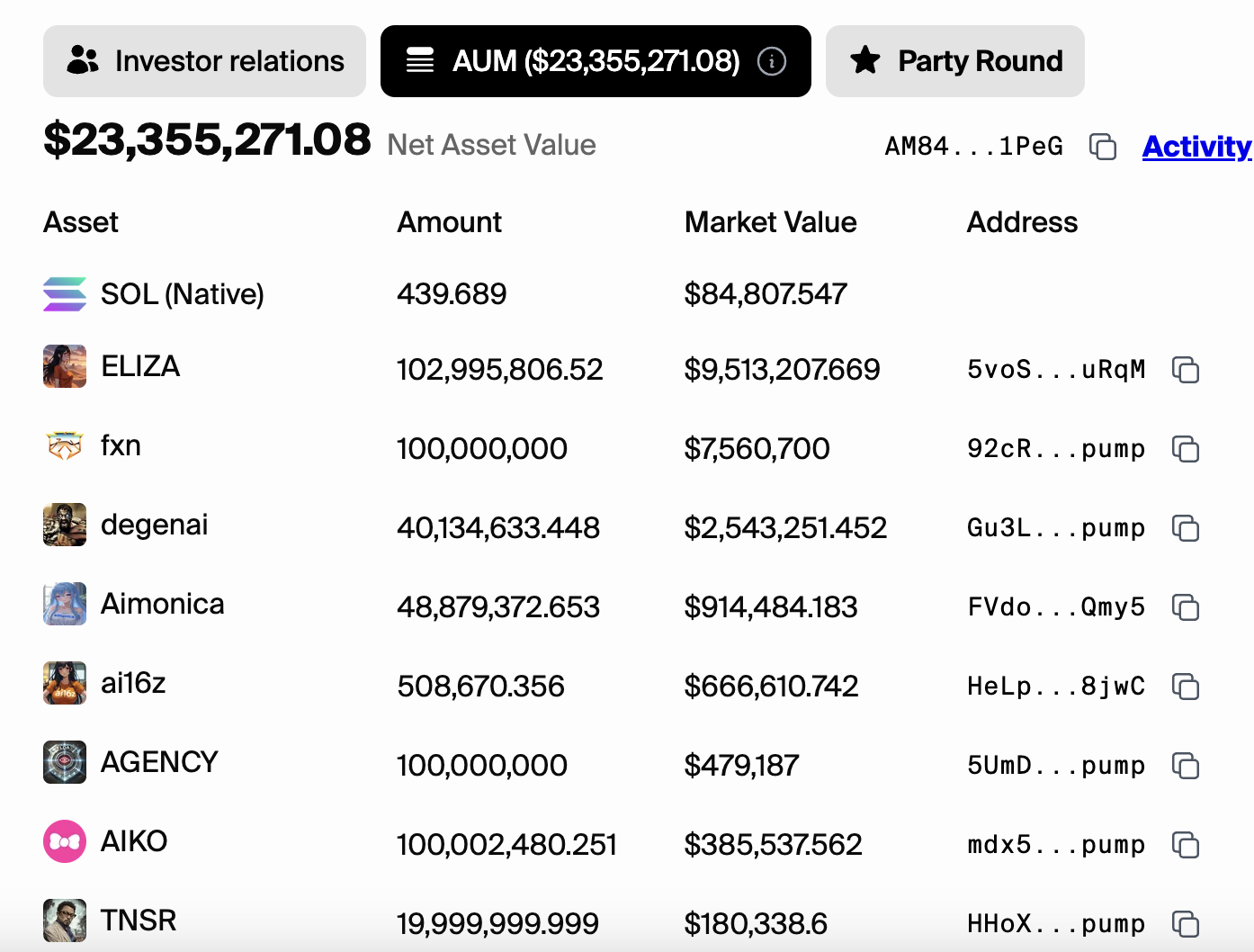

Data from daos.fun shows that as of December 30, ai16z's net asset value (NAV) was approximately $23.355 million, covering over 1,400 tokens. Among them, only three tokens exceed a $1 million market cap: ELIZA, fxn, and degenai, whose combined market caps represent 84.3% of the total. Six tokens fall within the $100k–$1M range, while the rest are below $100k. This distribution reflects a highly centralized token portfolio where a small number of high-value tokens dominate the asset base, while the majority remain fragmented—indicating the ecosystem is still in a state of high fragmentation.

Compared to ai16z, Virtuals’ ecosystem projects generally exhibit higher quality and recently sparked discussion after surpassing the market cap of star AI project Bittensor (TAO). Nevertheless, structural imbalances also exist within the Virtuals ecosystem.

According to the Virtuals official website, as of December 30, there are approximately 510 projects in the Virtuals ecosystem. Four of them have market caps exceeding $100 million—AIXBT, G.A.M.E, Luna, and VaderAI—accounting for 19.2% of the total ecosystem. Ninety-nine projects fall between $1 million and $100 million, while around 60% of the remaining projects have market caps under $100k. While Virtuals enjoys broader market recognition, its ecosystem development still faces issues of concentration.

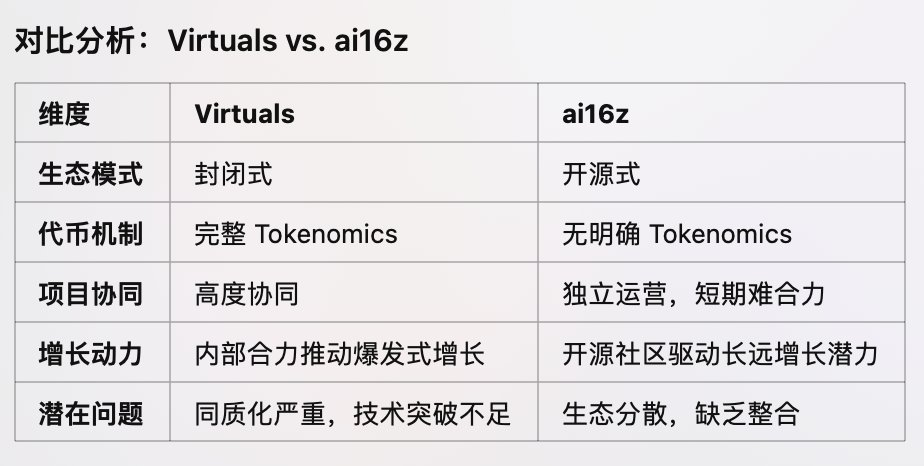

Regarding the differing development paths of ai16z and Virtuals, Web3 independent researcher Haotian previously noted that ai16z is relatively open, resembling an "Android-style" developer ecosystem alliance model. However, because ai16z tokens currently lack any formal tokenomics framework, the entire suite of tokens lacks a reasonable valuation model, preventing short-term synergy. That said, this issue will be resolved once a systematic tokenomics model is introduced. Each member of the ai16z suite demonstrates unique strengths, with long-term potential rooted in the power of its developer community. Founder Shaw’s first priority is to guide this loosely connected suite into a supercharged, technology-driven open-source growth flywheel.

In a recent interview with PANews, Shaw revealed that ai16z will release a new tokenomics proposal around January 1, 2025, including LP pairing mechanisms and DeFi functionality integration.

Comparison between Virtuals and ai16z, source: @0xgangWhat

In contrast, Virtuals adopts a more closed approach. As Haotian pointed out, Virtuals follows an "Apple-style" ecosystem expansion path—an AI Agent "star-making factory." Thanks to its well-established tokenomics from the outset, users must stake the VIRTUAL token to create an AI Agent, and purchasing new AI Agent tokens requires spending VIRTUAL. Thus, the more AI Agents launched on Virtuals, the greater the demand for VIRTUAL, naturally creating a positive feedback loop. However, since Virtuals focuses heavily on being an asset issuance platform with standardized AI Agent frameworks, homogenization among AI Agents becomes pronounced. This emphasis on asset issuance over technological ecosystem breakthroughs reflects the inherent limitations of a closed ecosystem.

From Pure MEME to On-chain Applications: AI Agents Reshape Market Operating Models

The hype behind Virtuals, ai16z, and others stems not only from rising interest in AI Agents but also represents a key evolution in MEME culture.

"AI is the biggest theme for human technological advancement and productivity gains over the next 20 years, capable of integrating into every crypto category—including DeFi, GameFi, NFTs, and Desci. During this period of rapid advancement, numerous new applications and technologies will emerge, all applicable to crypto," said crypto KOL 0xWizard, adding that AI-integrated projects could potentially recreate the entire on-chain asset market cap—or even the entire crypto market cap.

"It started with pure MEMEs like GOAT, evolved into chat-enabled AI Agents, then progressed to on-chain funds like ai16z, and now to new asset issuance platforms such as Virtuals and Spore. With each step, we move closer to real utility. The essence of this on-chain market cycle is that new 'application projects' bypass exchanges and VCs, directly redistributing value through on-chain asset issuance. Projects no longer need to curry favor with VCs, compete for resources, or pay listing fees to exchanges—they can simply launch on-chain and test whether the market will adopt them," noted crypto KOL @Michael_Liu93.

Haotian similarly believes that the environment has changed, and so has the logic of value capture in markets, reflected in several key shifts:

(1) Shifting from stacking infrastructure detached from actual market needs to front-loading AI Agent applications to validate real demand;

(2) Moving away from VC funding rounds that increasingly squeeze secondary market returns, toward building public goods via open-source models that allow direct access to secondary market financing—while enabling AI Agents to autonomously manage assets opens up vast new possibilities;

(3) Replacing traditional airdrop strategies aimed at acquiring early users and traffic—which often lead to operational burdens—with MEME-inspired secondary market launches better suited for sustainable tokenomics (via LP fees, trading taxes, staged reserve releases, etc.);

(4) Breaking the CEX listing endgame, gradually shifting toward DEX-centric models, giving high-quality teams a much greater chance to achieve grassroots success;

(5) Establishing entirely new market operating rules—projects that fail to deeply engage with communities or stay relentlessly focused on product development will find it extremely difficult to gain traction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News