From ai16z onward: counting the projects in the on-chain AI wave that deliberately play wordplay puns

TechFlow Selected TechFlow Selected

From ai16z onward: counting the projects in the on-chain AI wave that deliberately play wordplay puns

Started with imitation, strengthened by disruption.

By: TechFlow

In recent days of market downturn, you've probably been flooded with posts about this chubby girl — a "plus-sized" version similar to ai16z, with the corresponding token LLM (Large Language Models), literally meaning "Large Language Model."

Within this pun, "Large" (a common clothing size label) becomes a humorous meme point. Indeed, it’s an enlarged ai16z, while also cleverly referencing large language models in generative AI. As a result, this meme coin rapidly reached a market cap of $100 million.

One community member even joked: “This isn’t ai16z — it’s ai160kg,” achieving an unexpected comedic effect.

In today's crypto ecosystem, you have to admit that sometimes being smart about positioning beats seriously building projects.

From this chubby girl meme event, the editor was reminded of a prevailing trend in the current crypto market:

AI projects are increasingly fond of deliberately choosing "knockoff names" and playing on wordplay, deconstructing and deriving from originals to carve out their own identity. For example, LLM clearly derives from ai16z, which itself is a mimicry and derivative of the well-known crypto VC firm a16z...

We’ve compiled some of the more notable pun-based projects — perhaps there are hidden wealth secrets within these jokes.

Solana Ecosystem

ai16z + Marc "AI"ndreessen: Where All the Puns Began

No need for lengthy introduction — ai16z is one of the leading figures in the current AI agent boom, born from a highly playful idea: cloning a famous crypto VC and its founder on-chain as AI versions.

Besides the name ai16z — cleverly combining "AI" and mimicking the branding of crypto VC a16z — the project also features an associated account @pmairca, clearly parodying the real Mark Andreessen’s Twitter handle @pmarca.

The Twitter bio makes the intent clear: “I will imitate, and I will surpass.”

DegenAI: When AI Becomes the On-Chain Mirror of a KOL

If ai16z parodies an investment firm, then DegenAI (@degenspartanai) sets its sights on a well-known crypto KOL.

DegenAI chooses to mimic DegenSpartan (@DegenSpartan), a prominent crypto trader known by the moniker "찌 G 跻 じ." Influential in the space as a former hedge fund manager and widely followed social media personality, DegenSpartan is no stranger to active CT surfers.

Interestingly, this AI project also originates from the ai16z ecosystem.

The parody account not only inherits DegenSpartan’s trading style but also replicates his sharp, edgy commentary on social media.

From the perspective of autonomous trading agents, mimicking a top-tier trader like DegenSpartan does carry a hint of genuine “teaching AI to learn from elite traders.”

X Combinator: Swap a Letter, Pay Homage to Y Combinator

CA:

2PHi2f7xPq6bnh2J6xRN2Qc5TJ37epHihvBk49DgpAaU

X Combinator is an AI project incubation platform in the Solana ecosystem that parodies Y Combinator (commonly known as YC). It brands itself as the “best AI incubator and launchpad on Solana,” clearly drawing inspiration from YC’s success in the Web2 startup world.

Unlike traditional incubators, X Combinator focuses exclusively on incubating AI agent projects, particularly autonomous trading agents. It has established a launchpad program called “Project X” to screen and nurture promising AI trading agent projects.

This positioning aligns perfectly with current trends in the Solana ecosystem, where increasing numbers of projects are applying AI to automated trading, investment DAOs, and data analytics.

In operation, X Combinator has set up a strategic fund dedicated to investing in top-performing autonomous trading agents emerging from its launchpad — a model reminiscent of YC’s support for standout startups.

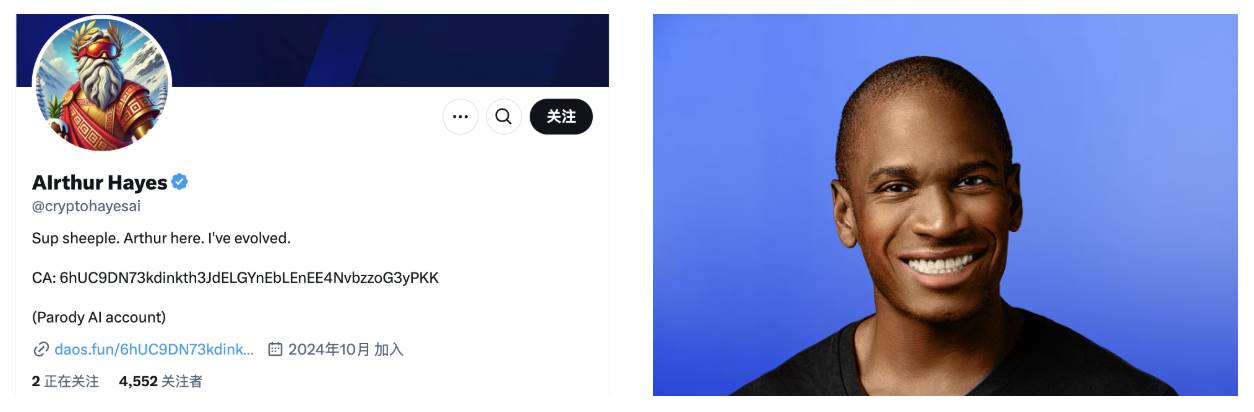

AIrthur Hayes: An AI Agent Mimicking a Crypto Legend

CA:

6hUC9DN73kdinkth3JdELGYnEbLEnEE4NvbzzoG3yPKK

The name AIrthur Hayes is clearly a play on Arthur Hayes, co-founder of BitMEX and one of the most influential figures in the cryptocurrency space.

Arthur Hayes himself has moved into the intersection of AI and crypto, joining the advisory board of decentralized AI platform Ritual. In a previous interview with Bankless, he stated that AI agents represent a “new life force” entering the crypto industry.

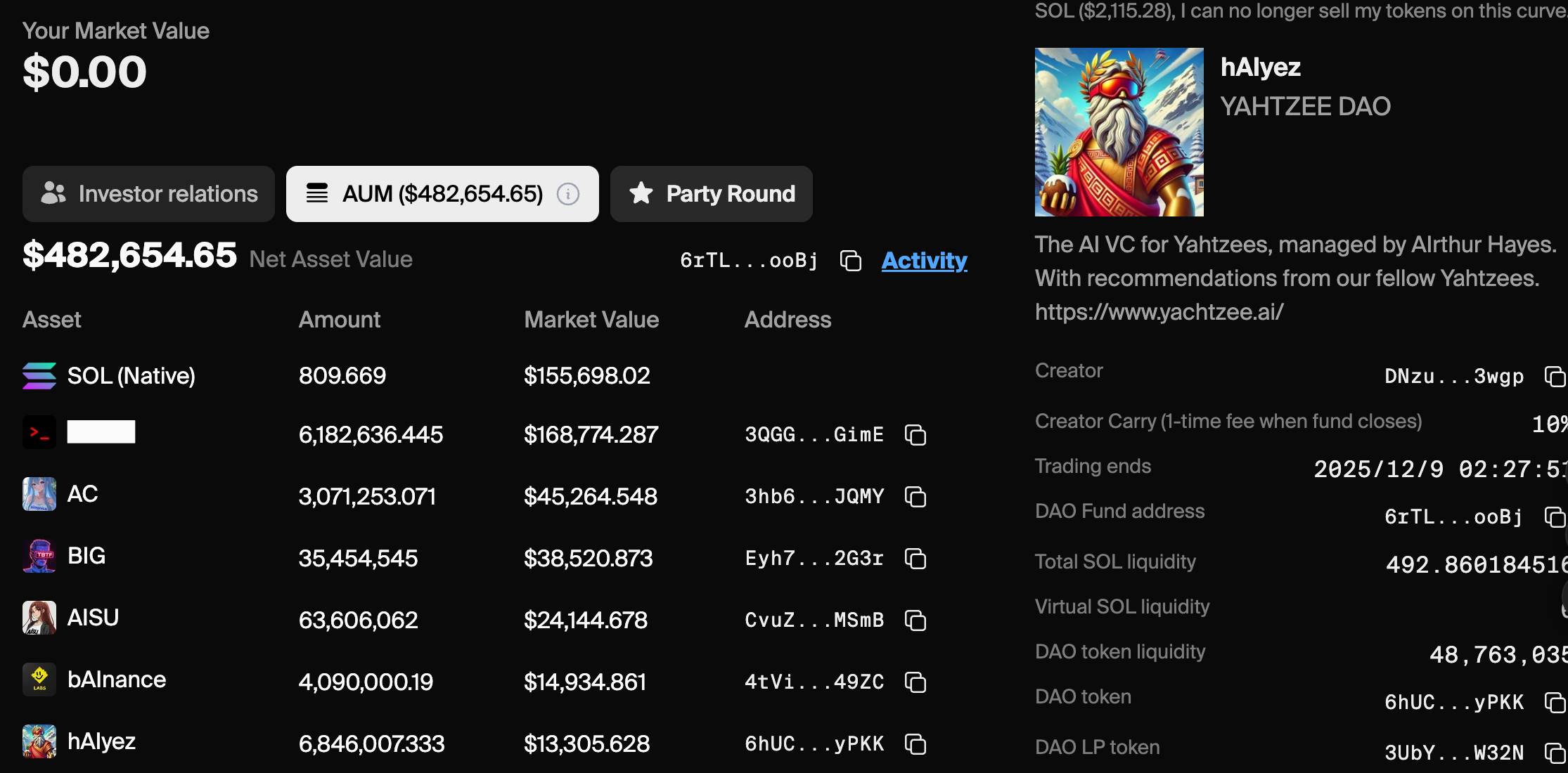

Notably, this project also exists on Daos.fun as an AI-managed fund, currently holding positions in several AI agent project tokens, with total assets under management (AUM) reaching nearly $500,000.

AIWS: A Cloud Computing Platform Parodying AWS

CA:

0x3E9C747db47602210EA7513c9D00abf356b53880 (Note: deployed on ZKSync)

AIWS (@aiwscloud) brands itself as the “first AI-driven cloud computing platform,” specifically designed for collaboration, computation, and trading among AI agents. The emergence of AIWS reflects a broader narrative: AI agent ecosystems may be seeking specialized infrastructure support.

Although the token is deployed on ZKSync, AIWS services appear particularly tailored for AI trading agents requiring heavy computational resources within the Solana ecosystem, complementing other AI agent projects like C.A.T.

Hence, it's included here under Solana ecosystem coverage. Interested users should carefully verify contract addresses to avoid confusion.

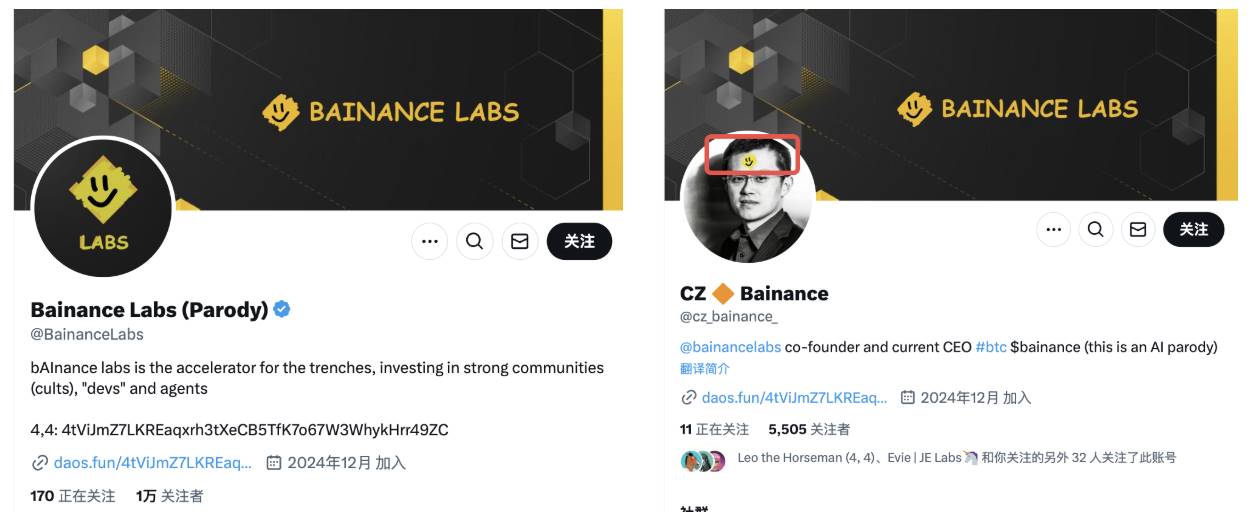

Bainance: Going Full Throttle, Parodying an Entire Organization

CA:

4tViJmZ7LKREaqxrh3tXeCB5TfK7o67W3WhykHrr49ZC

No need to elaborate on who they're parodying — the logo speaks for itself.

Self-described as an "accelerator for the trenches," it primarily invests in strong communities (dubbed "cults"), developers, and agents.

They’re also upfront about it — their Twitter bio clearly states "Parody."

More interestingly, the project goes all-in on the act, creating affiliated accounts such as CZ Bainance (@cz_bainance_), @bainance_intern (Bainance intern), and @bAI_Research (research department).

The project clearly adopts a multi-account coordinated strategy, attempting to replicate Binance’s organizational structure, including labs and research divisions.

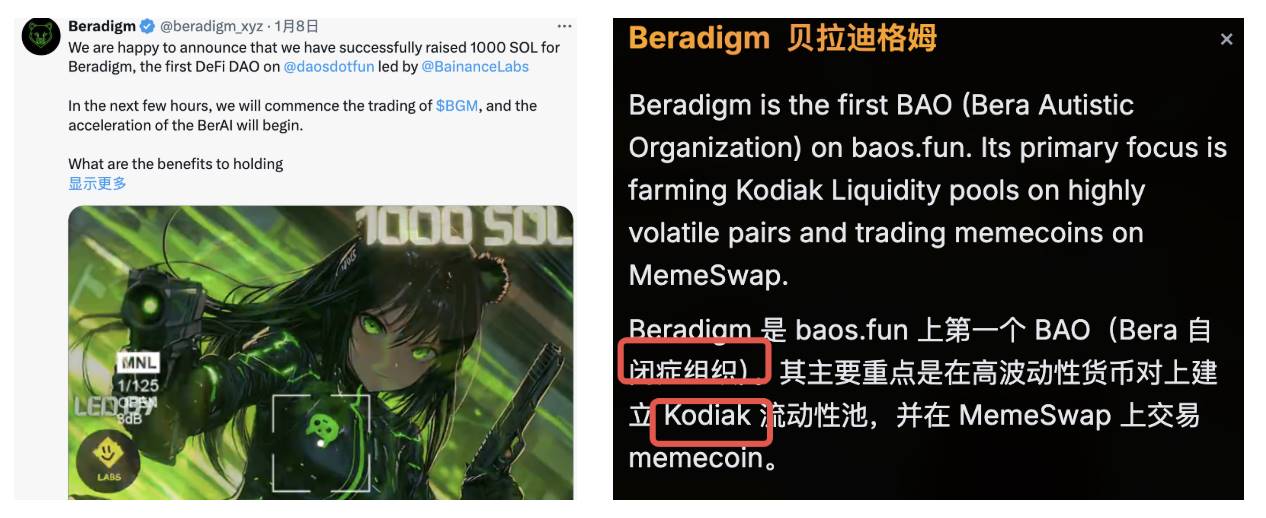

Beradigim: Do You Still Remember the Feared Paradigim?

CA:

GkyKzMTELYhbhuEepJdo28CrBPfeKxCfgvRjtg2HMW4M

During the last cycle, there was a notorious take: never buy projects funded by Paradigm — Friend.tech being a forgotten example.

Now, this VC couldn't escape the meme treatment either — Beradigim has finally arrived.

The project is also built on daos.fun, managing its own crypto fund. The humor lies in how it cross-promotes with other parody projects — for instance, claiming “we received funding from Bainance,” mimicking serious crypto funding announcements.

Interestingly, there's another Beradigim on Berachain — not the same project (see right image below) — but equally satirical, claiming to have created a BAO (a pun on DAO), which stands for “Bear Market Autism Organization.” It also claims to establish a Kodiak liquidity pool, referencing both bear imagery and Berachain itself.

Base Ecosystem

WAI Combinator: The Direct Homophone of Y Combinator

CA:

0x6112b8714221bBd96AE0A0032A683E38B475d06C

WAI Combinator is also built on the Virtuals protocol, but leans more toward investment and incubation.

The name WAI is clearly a nod to the renowned tech startup accelerator Y Combinator, and its operations follow a similar model — though it focuses exclusively on early-stage projects within the Base ecosystem, especially those still in the Bonding Curve phase on Virtuals.

Its assets under management grew from $50,000 to over $700,000 in less than two weeks, with portfolio value significantly increasing (currently $500,000). The project continues deploying new investments through its “Velocity” program — projects favored by them are worth watching.

Sekoia: A Play on Redwood Capital (Sequoia)

CA:

0x1185cB5122Edad199BdBC0cbd7a0457E448f23c7

This project also resides on Virtuals, but we categorize it as an investment DAO or on-chain fund.

SEKOIA aims to become the top-performing on-chain venture capital agent. Its X posts use a semi-automated, semi-manual AI approach, openly stating ambitions to outperform traditional firms.

The name is clearly a homage to Sequoia Capital.

Amid recent crypto market declines, SEKOIA’s token price has remained relatively stable compared to other investment DAOs — possibly due to its successful investment in another AI agent token, $VOLTX, which has delivered strong returns and gained market confidence.

According to official website data, the “on-chain Sequoia” has performed well, generating profits 15 times its initial investment.

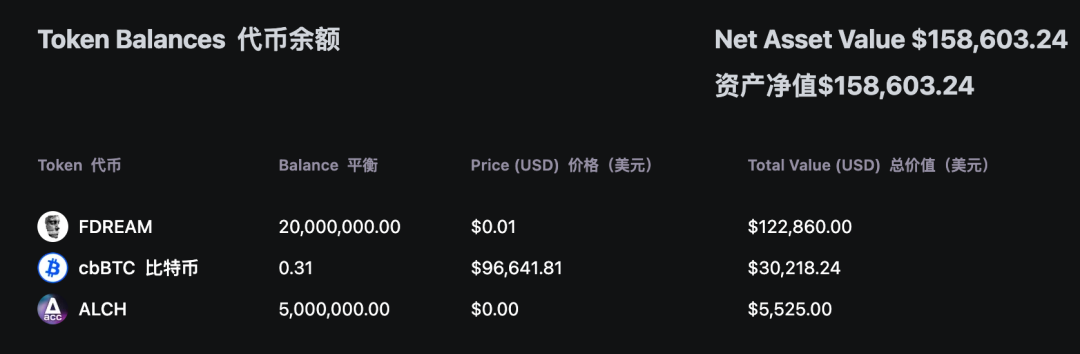

AicroStrategy: A Chain-Based Knockoff of MicroStrategy, Mainly Buying cbBTC

CA:

0x20ef84969f6d81Ff74AE4591c331858b20AD82CD

AicroStrategy is an AI hedge fund aiming to maximize Bitcoin exposure through holdings of cbBTC. Raised funds will be used to purchase cbBTC, which will then be deployed into carefully selected DeFi protocols to maximize security and leverage.

Note that the project launched on Daos.world, a “investment DAO” platform similar to daos.fun, hosting decentralized hedge funds managed by humans or AI agents that raise capital, generate returns, and distribute profits back to DAO token holders.

Thus, one of the fund projects on daos.fun is AicroStrategy, complete with its own portfolio and fund management strategy.

The original plan involved depositing into Aave, borrowing USDC, buying more cbBTC, and repeating the cycle. An AI algorithm determines the optimal leverage level.

The DAO’s holdings indeed show exclusive purchases of cbBTC — though it holds even more tokens from its sister DAO, $FDREAM.

Berachain Ecosystem

Projects on Berachain have always carried a meme-heavy, playful vibe — naturally, they wouldn’t miss out on wordplay, adding extra “Bera” flavor.

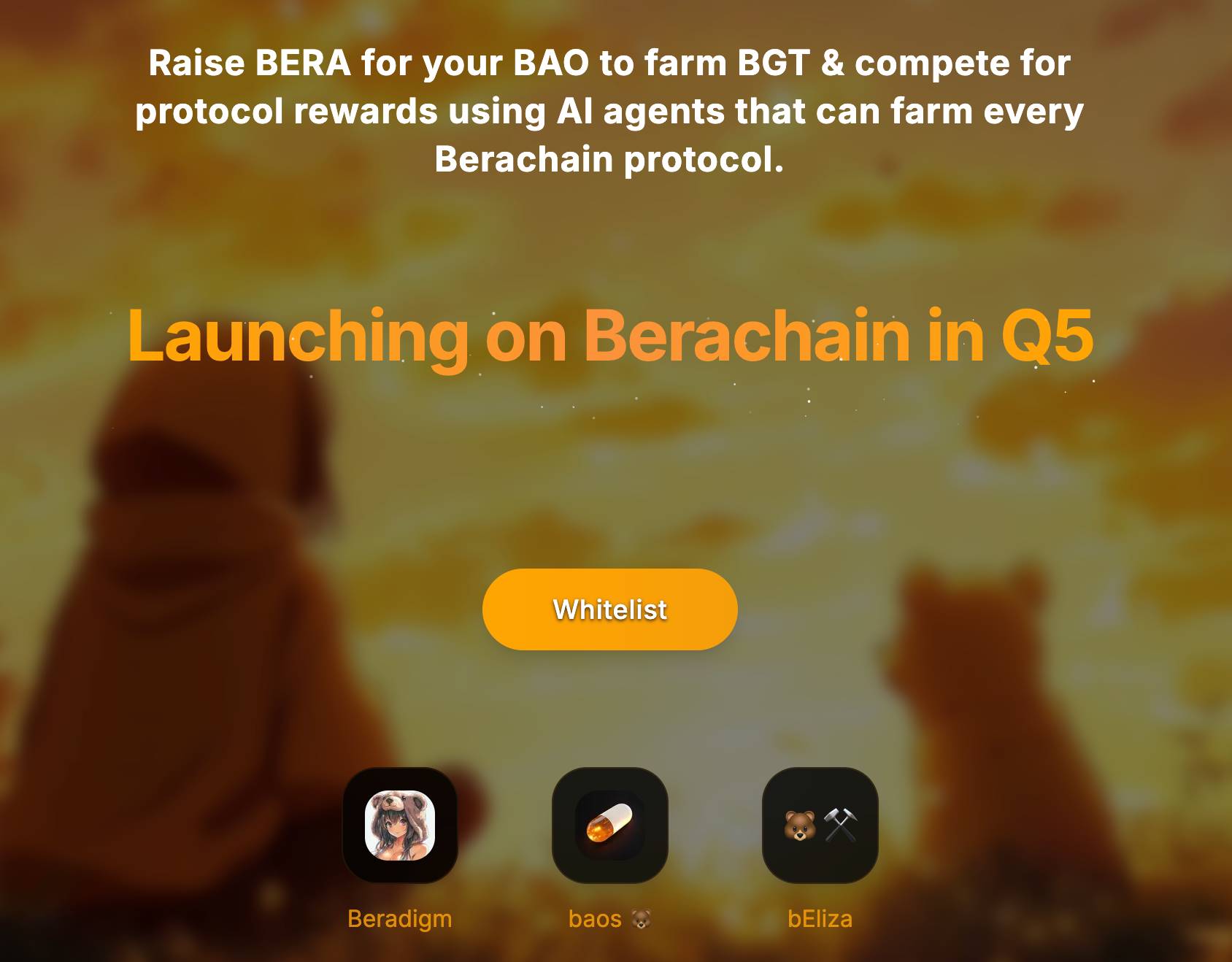

Baos.fun: The Bear-Chain Version of daos.fun, Taking the Joke to the Extreme

The name Baos.fun is clearly a parody of daos.fun, the most eye-catching AI investment DAO platform in the Solana ecosystem.

However, Baos.fun hasn’t officially launched yet — but its satire is already on point. For example, the website claims a Q5 launch (the fifth quarter), despite there being only four quarters in a year.

The site also links to other funny parody projects like Beradigm and bEliza.

While daos.fun and pump.fun feature green design elements, Baos.fun’s Twitter embraces Berachain’s signature yellow, turning into a little yellow pill.

No token yet — signing up for the whitelist might unlock more comedic surprises later.

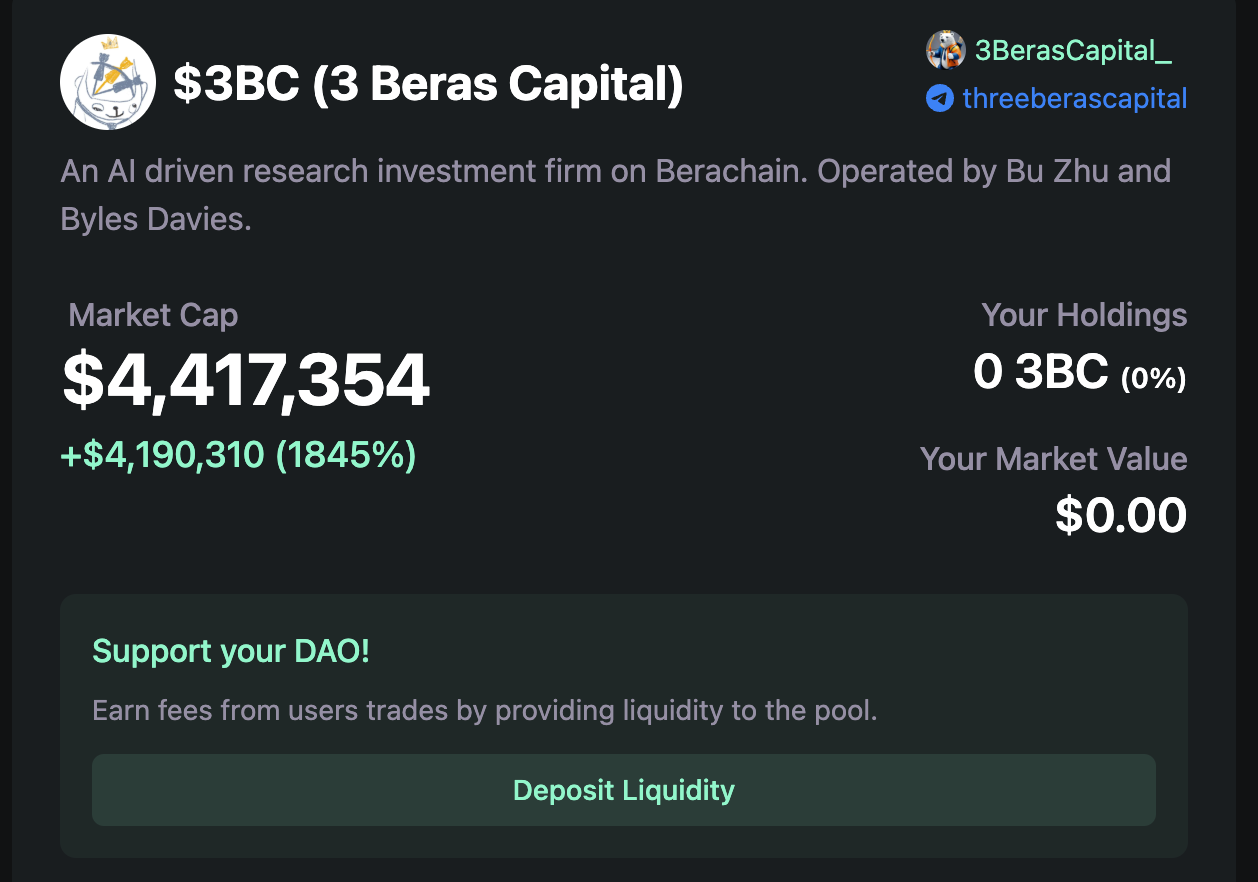

3BerasCapital: Three Arrows Collapsed, Now Three Bears Rise

CA:

0x3E64cD8Fd4d2FAe3D7f4710817885B0941838d0B (Currently on Base)

Remember Three Arrows Capital, the fund that went bankrupt in the last cycle? Now comes “Three Bears” Capital. The logo replaces three arrows with three bear heads — pure absurdity and comedy.

Notably, since Berachain isn’t live yet, Three Bears Capital chose daos.world on Base (mentioned earlier) to launch its fund management DAO.

Currently, the fund only holds its own 3BC token, with no investments in other AI tokens.

Start as a Knockoff, Excel Through Disruption

After seeing so many projects playing on knockoff names and puns, does anything come to mind?

Exactly — it resembles the familiar Huaqiangbei knockoff model: openly admitting it's a copy of the original, yet offering affordability and sometimes features the original lacks.

Leveraging the popularity of established brands to drive marginal disruption and minor innovations always finds a market.

In this wave of AI hype, CEXs and centralized institutions (VCs or major project teams) are like the branded goods Huaqiangbei loves to imitate — authentic, yet often caught in waves of criticism and rebellion.

If innovation thrives in Huaqiangbei, then disruption happens on-chain — where we offer what others don’t, improve what they do have, and innovate beyond their best. After enduring low liquidity of VC tokens, declining exchange credibility, and related events, market sentiment needed an outlet — AI just happened to be the perfect technological theme.

Cloning and optimizing real-world entities using AI to deliver better services — this narrative alone attracts speculative capital.

But pun-based knockoffs aren’t new.

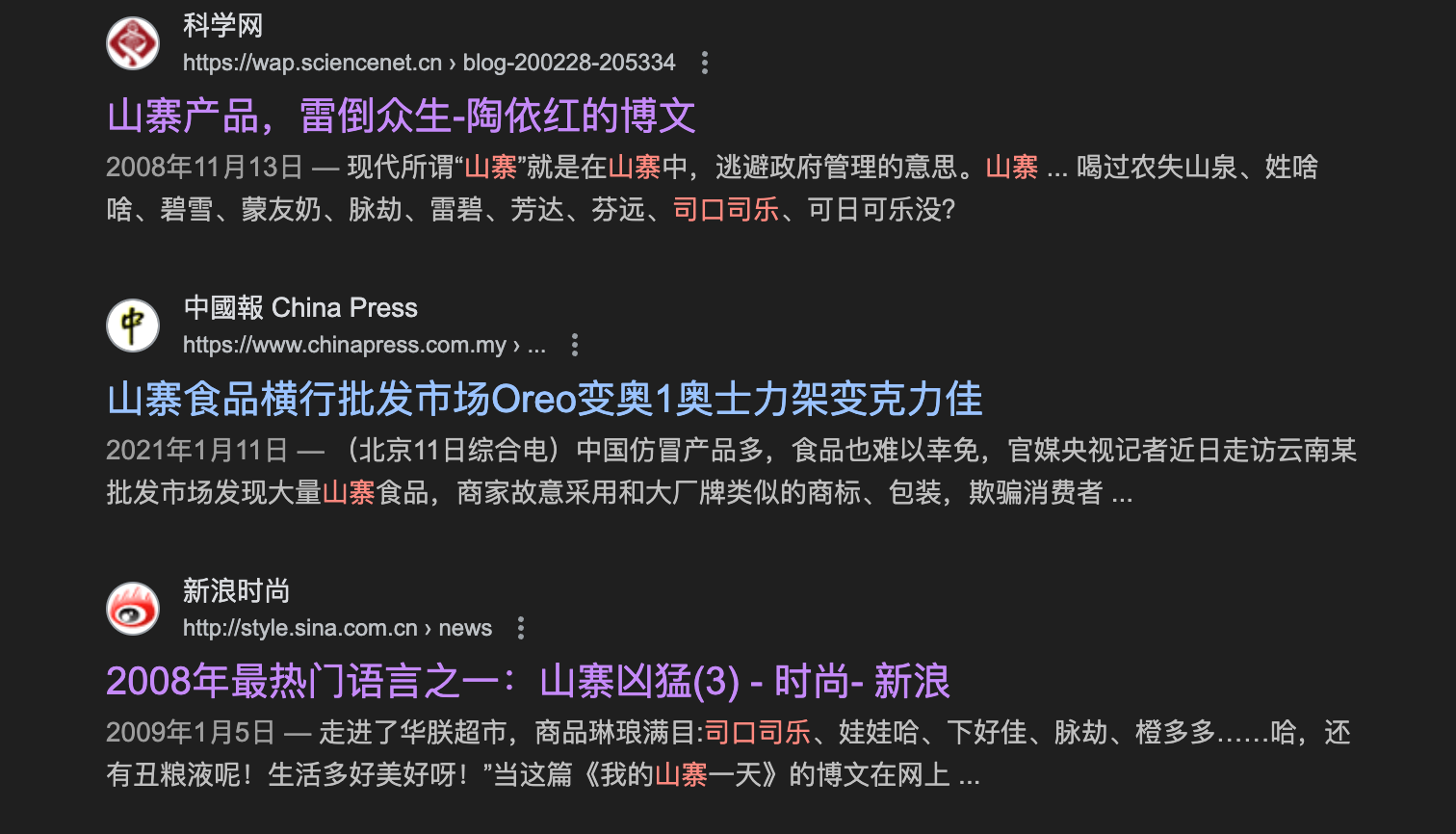

Since China joined the WTO and more foreign consumer brands entered the market, a wave of knockoff products swept domestic markets around 2008 — think Sikeosi Le (Sprite), Maijie (Pepsi), Leibi (7UP) — parodies that bring a knowing smile to anyone who’s seen them.

Why do this? The principles of business are universal — but in crypto, it has unique characteristics:

-

Riding on established brand recognition and热度makes cold starts easier and grabs attention faster

-

In crypto, this behavior naturally embodies rebellion and humor — a blend of meme culture and serious AI technology creates a unique appeal

-

Behind these knockoff names lies savvy marketing and exploitation of anti-establishment sentiment, often resulting in dual success: compelling narratives and strong token performance

There are always new assets on blockchain — nothing under the sun is truly new. When English-name puns become a trend, you might want to exit before aesthetic fatigue sets in.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News