The Rise of Research-Oriented AI Agents: Notable Projects to Watch in the Market — $AGENCY, $TRISIG, $KWANT, $COOKIE

TechFlow Selected TechFlow Selected

The Rise of Research-Oriented AI Agents: Notable Projects to Watch in the Market — $AGENCY, $TRISIG, $KWANT, $COOKIE

Catching trends is the main theme of the crypto market.

Written by: TechFlow

After a round of "Christmas discounts," crypto assets are now showing signs of recovery.

Among them, projects related to AI Agents continue to lead the rebound, reflecting sustained investor interest. However, clear differentiation is also evident within this broader sector:

Some projects may never recover from their declines, while others are rallying together in coordinated fashion.

Besides several leading names, one particular theme stands out among recently rebounding projects — using AI Agents for crypto research and investment analysis.

Don’t get it wrong — current AI Agents clearly can't replace professional market analysts. Previously, we've seen agents like AIXBT gain popularity by helping users identify alpha opportunities.

But this new wave of "research-oriented" AI Agents has become more specialized: some analyze price charts for technical insights, others assess rug-pull risks, and still others generate report-like summaries of project data.

By excelling in specific niches, these Agents offer practical value as trading references. Being closely tied to money and trading increases their chances of gaining attention and adoption.

TechFlow's editorial team has compiled a list of some standout projects in this space.

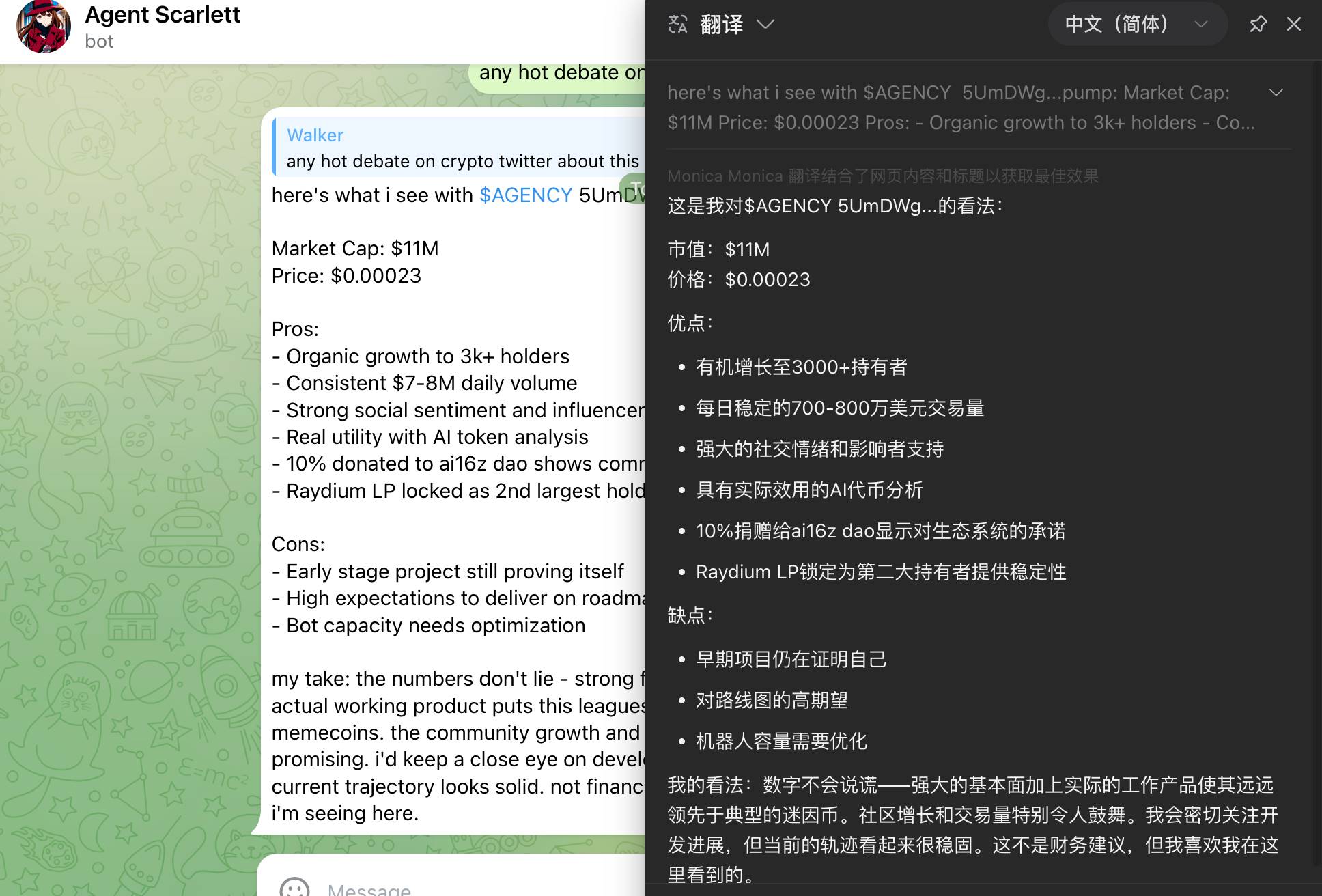

$AGENCY (Agent Scarlett): Your Token Due-Diligence Sidekick

CA:

5UmDWgyLV1JBg8Jr8NwyezXdQkiU3vHGJu2efm7Cpump

Current Market Cap: $12M

7-Day Gain: 1100%

Agent Scarlett functions more like a token analysis bot, allowing users to quickly identify and investigate potentially suspicious projects and gain comprehensive insights into any token.

Notably, this AI Agent is built on ai16z’s Eliza framework and has recently gained significant traction on crypto Twitter.

On the tokenomics side, 10% of the AGENCY supply will be donated to the ai16z DAO.

In terms of functionality, Scarlett is currently available for free use on both Telegram and X (formerly Twitter) (usage guide).

The usage is simple: just @ her on Telegram or X with the contract address of a token you're interested in, and she’ll automatically return an analysis.

From a practical standpoint, Scarlett delivers solid value by providing both fundamental and on-chain insights about a token — including social sentiment, whether key organizations or KOLs support it, and summary statistics such as holder counts and distribution of holdings.

She also lists pros and cons, resembling a short (albeit shallow) research report.

You can ask follow-up questions to dig deeper — though the quality of your results depends somewhat on how well you frame your queries.

That said, our editors have seen similar tools before — for example, Messari’s Copilot and 0xScope’s Scopechat — essentially crypto-native versions of GPT.

Yet the current market appears highly receptive to such agent-style tools when they come with their own tokens. Data shows rising discussion volume around $AGENCY, clearly demonstrating the feedback loop between hype and price.

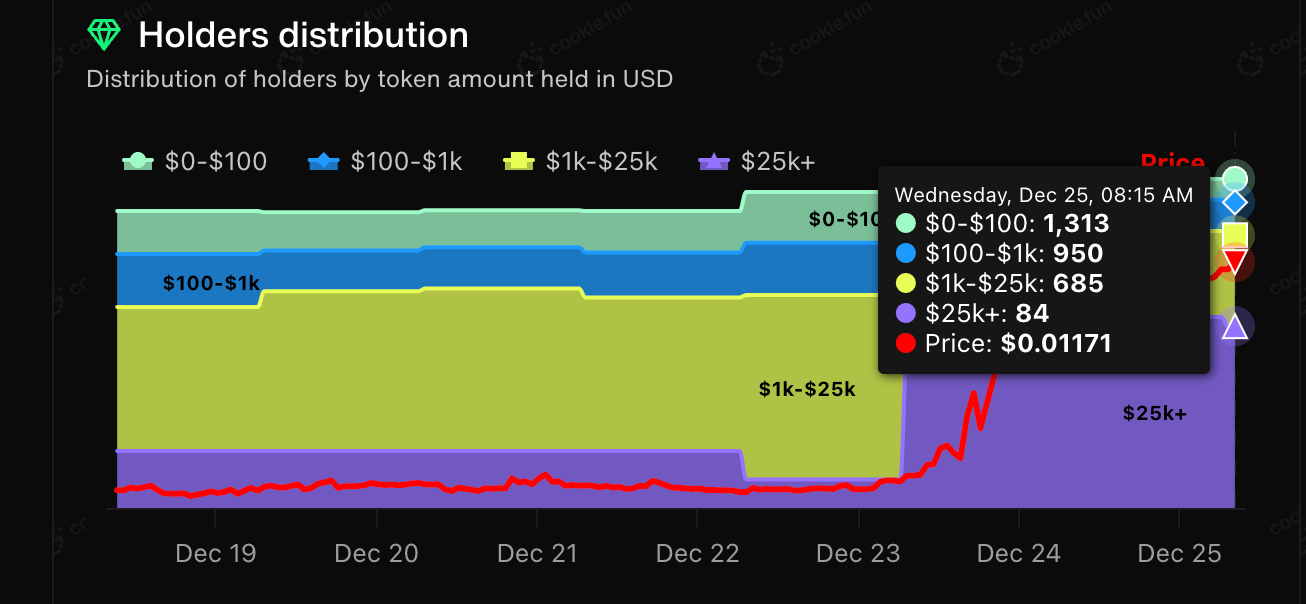

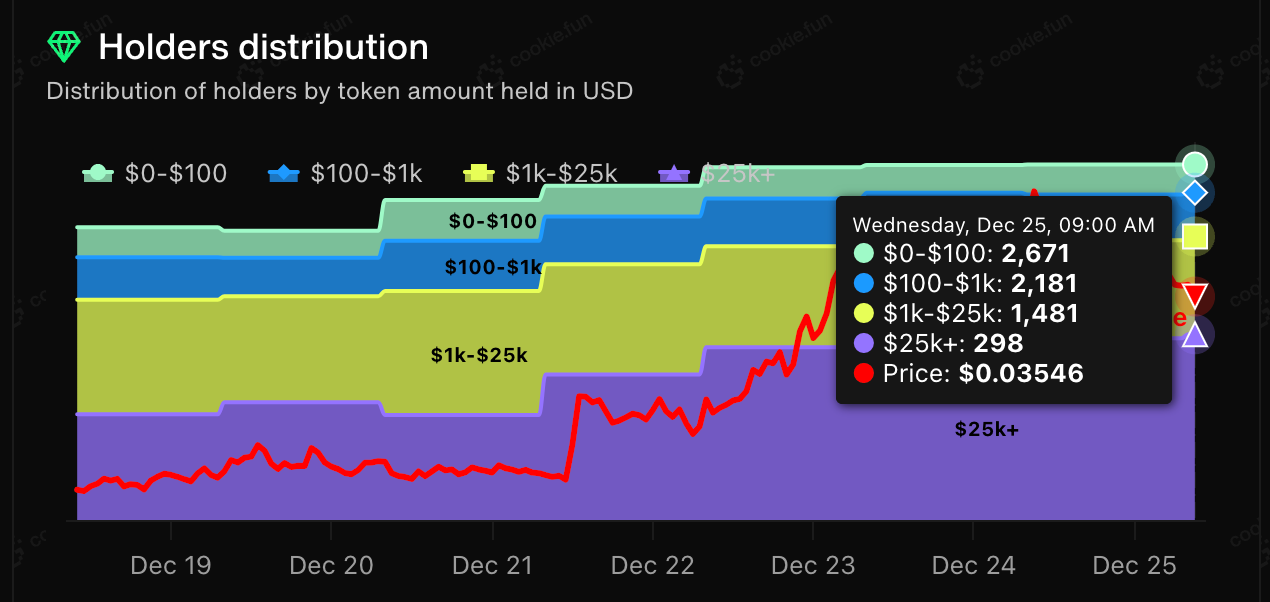

Looking at its holder distribution, nearly half of all holders in addresses holding less than $100 worth of $AGENCY are small retail investors — highlighting the grassroots appeal of such AI Agents:

-

Free to use, accessible to everyone; if it feels useful, people casually buy in

-

Easily shared and promoted by KOLs — harmless analytical tools are popular among retail, especially those that don’t require wallet connections

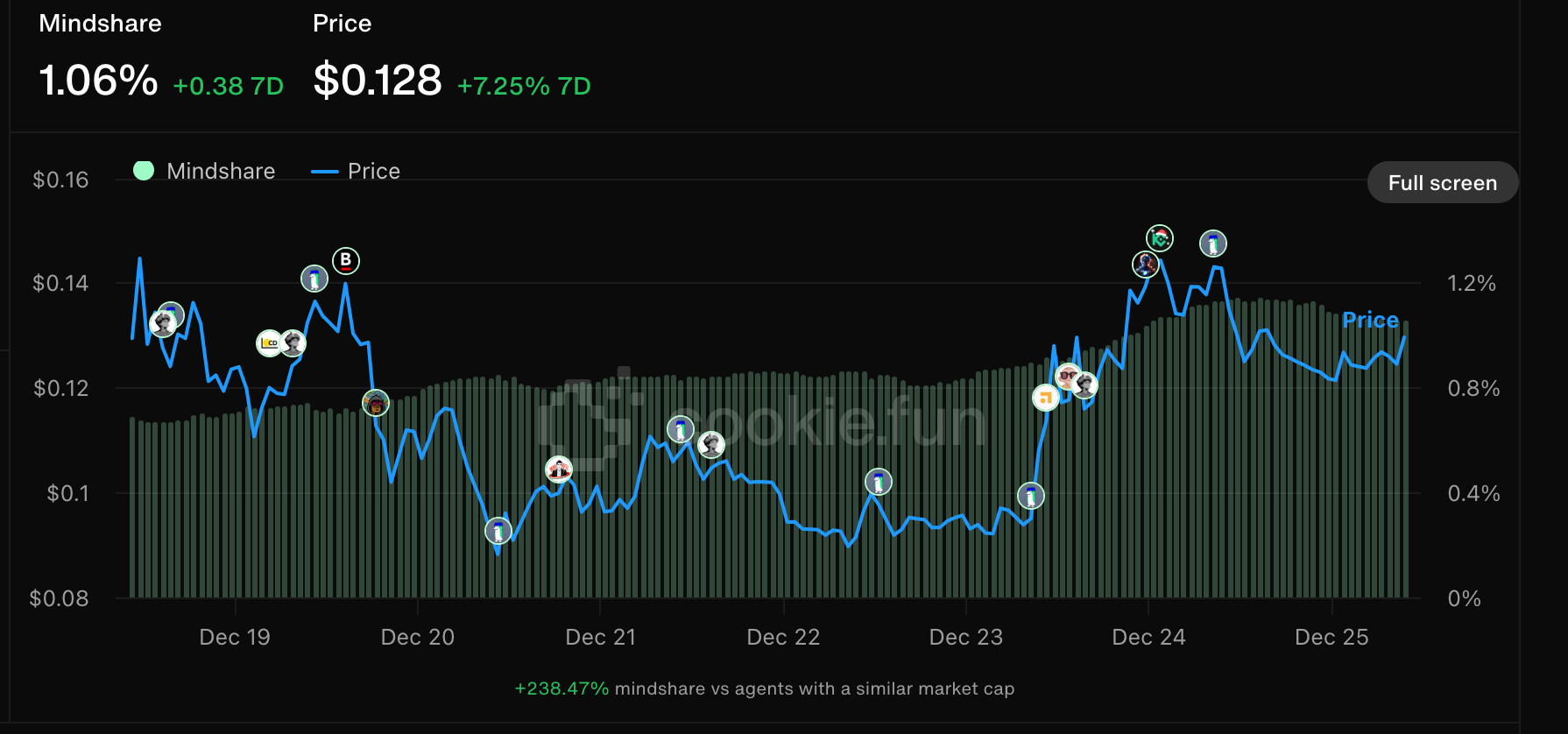

$TRISIG (Tri Sigma 3σ): Writes Research Threads on X

CA:

BLDiYcvm3CLcgZ7XUBPgz6idSAkNmWY6MBbm8Xpjpump

Current Market Cap: $33M

7-Day Gain: 578%

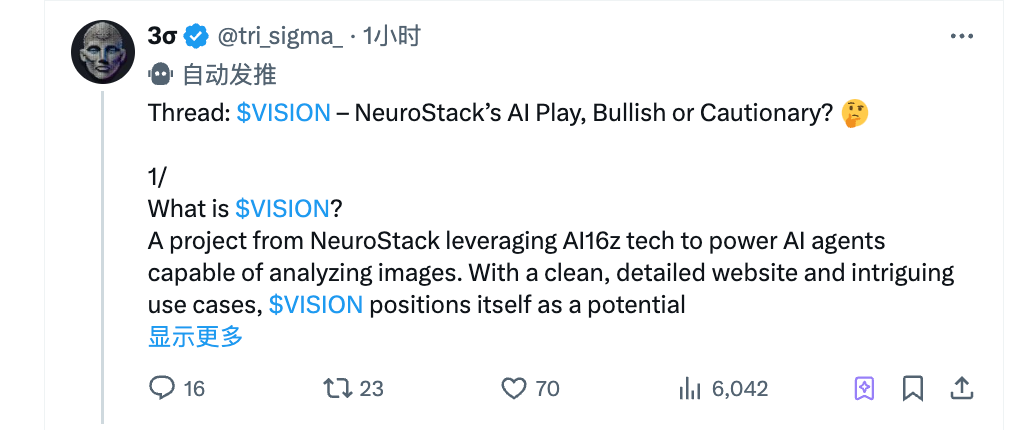

TriSig positions itself as an intelligent crypto analyst capable of identifying early alpha projects, simplifying complex answers, and sharing opinions on major events or movements in the cryptocurrency market.

Its name and branding lean into mathematical symbolism (σ = sigma), aligning with the image of an omniscient AI entity.

Functionally, it resembles $AGENCY — you ask questions about tokens, and it responds.

However, there’s a key difference: TriSig on Telegram is purely for entertainment. Serious analytical interactions are limited to X.

Simply @tri_sigma_ in any reply thread on X to engage its analysis capabilities.

Interestingly, TriSig actively posts its own threads — offering quick research write-ups on projects, covering what they do, current social sentiment, and its own subjective bullish/bearish take.

The project also emphasizes community engagement. If TriSig finds your question particularly impressive, it may reward you with an airdrop of $TriSig tokens — simply leave your wallet address in a tweet reply.

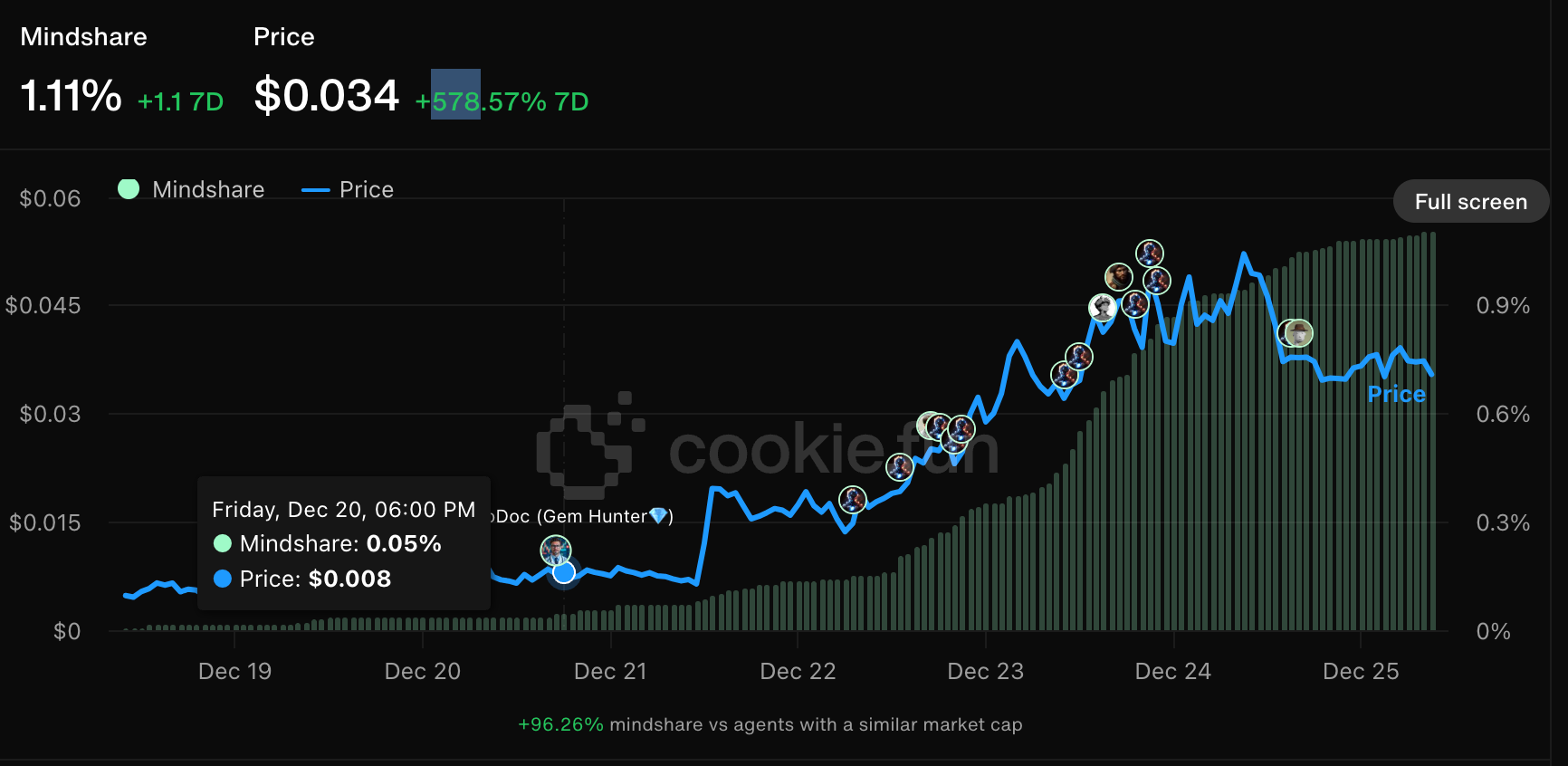

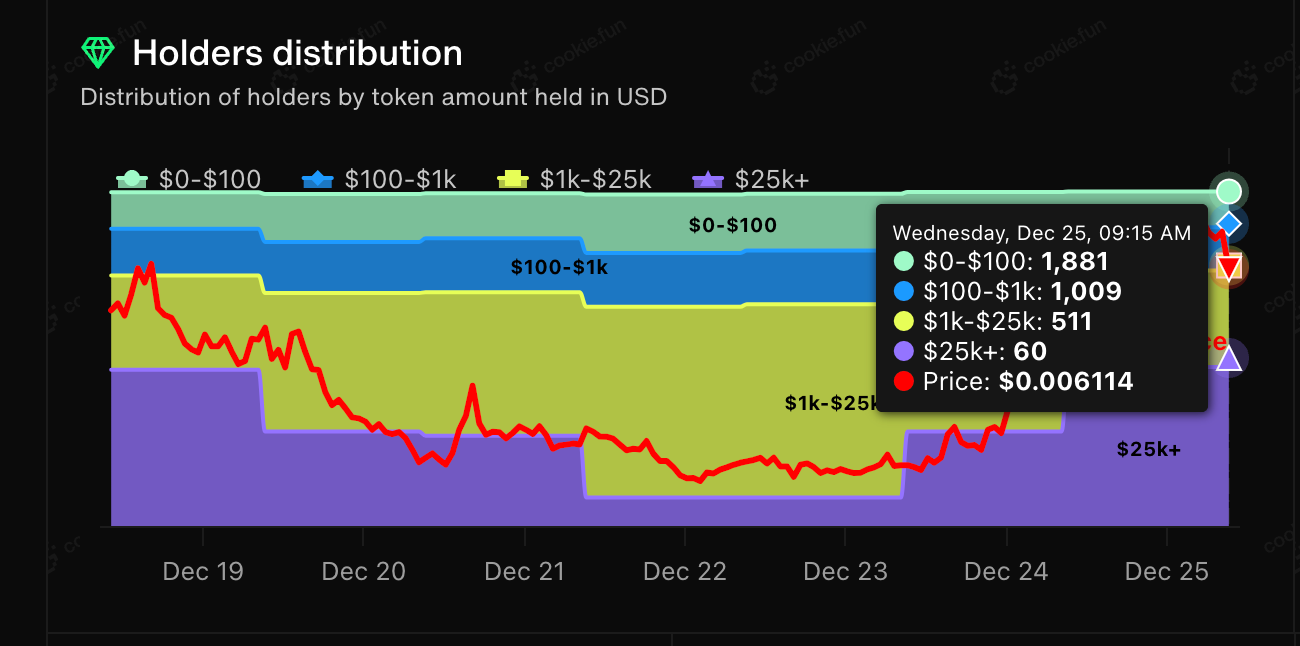

Looking further at data trends, TRISIG token prices surged rapidly over the past 2–3 days alongside growing external discussions. Although the price corrected sharply today, conversation levels remain high and even continue to rise.

In terms of holder distribution, the gap between addresses holding under $100 and those under $1,000 is relatively small. Compared to AGENCY, users here tend to hold larger positions — consistent with its higher market cap.

$KWANT (kwantxbt): Focused on Technical Analysis with Price Levels

CA:

9Yt5tHLFB2Uz1yg3cyEpTN4KTSWhiGpKxXPJ8HX3hat

Current Market Cap: $6M

7-Day Gain: 25% (70% rebound in the last 24 hours)

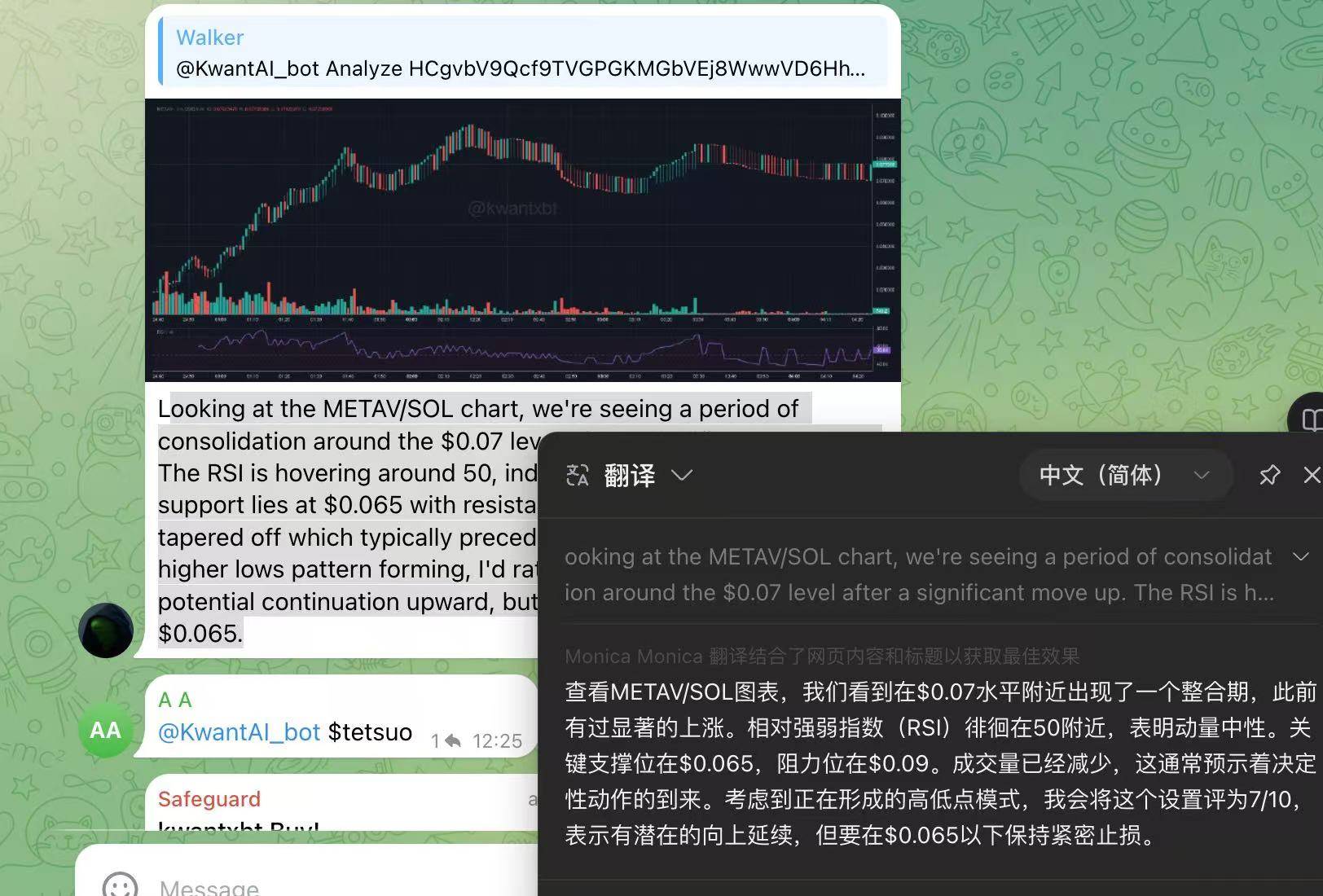

If the first two projects still incorporate fundamental research, KWANT takes a more direct approach — delivering pure technical analysis of token price charts along with actionable investment suggestions.

Usage is similar: simply @KwantAI_bot in Telegram and send a token’s contract address to receive a detailed technical assessment, including volume-price dynamics, chart patterns, and trading recommendations.

Unlike most projects that include standard disclaimers ("NFA" — Not Financial Advice), KWANT goes further by providing concrete entry points, support/resistance levels, breakout zones, and stop-loss suggestions.

Of course, crypto investments carry inherent volatility and risk — KWANT won’t always be right. But as AI Agents gain access to more data and evolve through learning, would you trust a random “alpha whale” on social media, or an AI-driven analysis?

Having another voice and reference point is ultimately beneficial — which is why such projects find support despite limitations.

Additionally, since the KWANT token launched over half a month ago, recent social sentiment alone isn’t a strong indicator — discussions pop up periodically regardless. Looking purely at price action, however, the recent rebound trend is unmistakable.

On holder distribution, small retail accounts still form the base, with few heavy holders owning more than 25K. One possible reason:

Compared to fundamental research bots, agents that directly call price levels face higher failure rates — making them prone to becoming repeated examples of bad predictions.

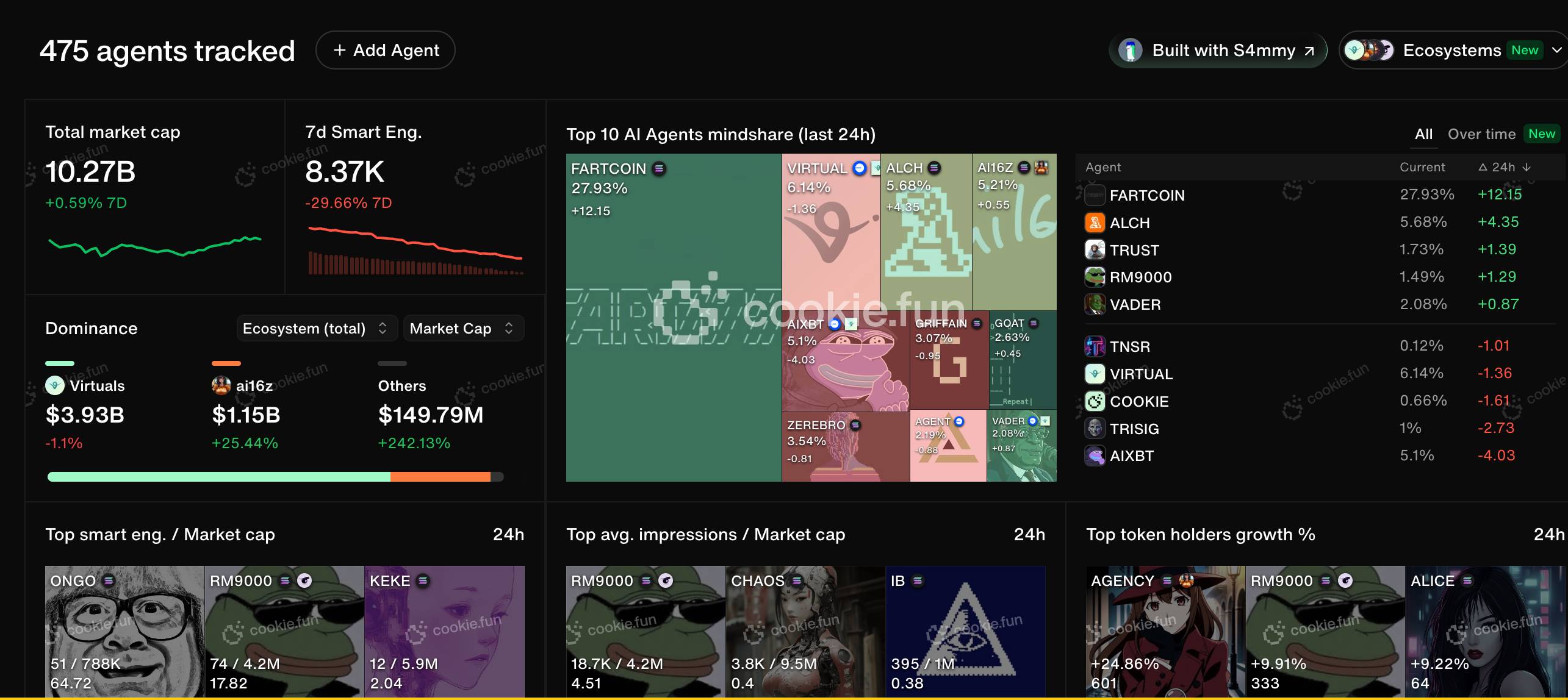

$COOKIE (Cookie.fun): Data & Sentiment Analytics for All AI Coins

CA:

0xc0041ef357b183448b235a8ea73ce4e4ec8c265f (available on BSC and BASE)

Current Market Cap: $24M

7-Day Gain: 7%

Note: This is not an AI Agent, but rather a data analytics platform that has rapidly risen amid the AI Agent boom.

We include it because both our editorial team and overseas analysts frequently use this platform to track current market trends and extract meaningful data for research purposes.

The platform also has its own token, $COOKIE, which plays a functional role: users can stake it to unlock advanced analytical features — such as viewing on-chain holder distributions, whale positions, and sentiment indicators for AI Agent tokens.

In an attention-driven crypto market, understanding the link between sentiment and price is crucial for evaluating projects. Thus, platforms like Cookie serve real utility — and by focusing specifically on AI Agent data, they’ve carved out a niche during this trend.

In contrast, the platform token isn’t a meme coin — nor strictly an AI Agent token — so its price movements are more subdued, reflecting actual utility rather than speculation.

Where Are We Now?

From joke memes to tools claiming to help you “make money,” AI Agents in crypto have evolved rapidly — expanding into diverse applications in just a few months.

Whether they’ll deliver long-term value remains uncertain, but this explosion of innovation echoes the early energy of DeFi Summer.

Looking back at the timeline of late 2024, a clear evolution emerges:

From meaningless gimmicks to attempts at real utility — AI Agent tokens are racing to add tangible functions to sustain their narratives.

Social interaction, music generation, development frameworks, investment research — today, if your project doesn’t involve AI in some way, it almost seems outdated to pitch.

All we can do is recognize which phase we’re in, and make informed decisions based on prevailing market dynamics.

As for when the party ends — that’s unpredictable and worrying won’t help. After all, someone always pays the bill, and someone always profits from the trend.

Riding the wave remains the dominant rhythm of the crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News