Interpreting Messari's 2025 Outlook for the Crypto Industry: Bitcoin Will Shine in 2025, and Meme Mania Will Continue

TechFlow Selected TechFlow Selected

Interpreting Messari's 2025 Outlook for the Crypto Industry: Bitcoin Will Shine in 2025, and Meme Mania Will Continue

The macro environment is expected to provide strong support for crypto assets.

Author: Messari

Translation: TechFlow

Introduction

Another year-end has arrived, a time for reflection and forward-looking insights.

As one of the industry’s top research firms, Messari released its annual "The Crypto Theses 2025" report last week, offering a comprehensive review of crypto developments in 2024 and detailed predictions for 2025.

The report highlights several key points, including expectations that BTC will mature as a global asset next year and that memecoins, as speculative outlets, will continue to attract users.

The report consists of two main parts. It begins with "State of Crypto," featuring shorter essays on the 2024 market landscape, followed by "Thematic Research," which reviews major narratives and forward-looking theses across key sectors.

Given the original report spans 190 pages, reading it in full is time-consuming. TechFlow has distilled the most critical content—especially the forecasts and outlooks from each section—for your convenience.

Macro Environment: Defying Pessimism, Strong Support for Crypto

Key Developments

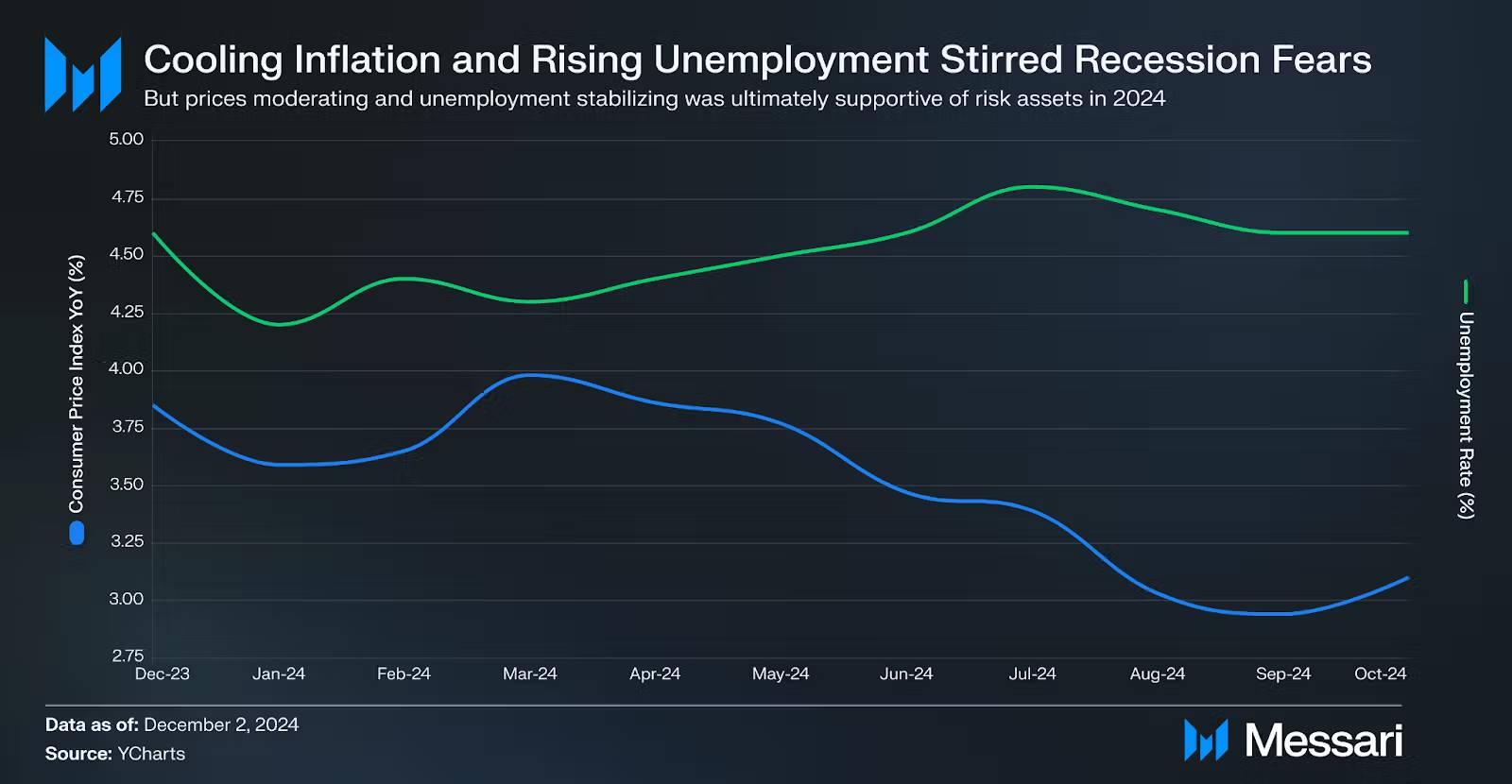

In 2024, economic trends defied widespread pessimistic expectations, with the U.S. economy showing stronger-than-expected resilience. The Federal Reserve was able to implement rate cuts of 50 and 25 basis points in September and November respectively, achieving a relatively smooth policy pivot.

The S&P 500 rose approximately 27% for the year, ranking among the top 20 historical performances, reflecting strong market confidence in a soft landing. Notably, aside from brief volatility caused by yen carry trade unwinding and geopolitical events, markets maintained a steady upward trajectory.

Unique Dynamics in the Crypto Market

Crypto faced dual challenges in 2024: managing risks from traditional markets while overcoming sector-specific headwinds such as German government BTC sales, Mt. Gox token distributions, and investigations into Tether. The market remained range-bound for eight months until the U.S. election acted as a breakthrough catalyst.

Outlook for 2025

The macro environment is expected to provide strong support for crypto assets:

-

The Fed has begun easing its tightening cycle initiated in 2022 but has not yet entered a phase of aggressive monetary expansion. This gradual shift could offer stable backing for financial markets;

-

Post-election, volatility across asset classes declined significantly. Historically, low volatility tends to beget further stability—a favorable condition for assets like Bitcoin and Ethereum;

-

Most importantly, regulatory conditions are fundamentally improving. Even neutral regulation would mark a dramatic improvement over the past four years of strict oversight. This shift could alleviate institutional investors’ concerns and unlock significant new capital flows;

-

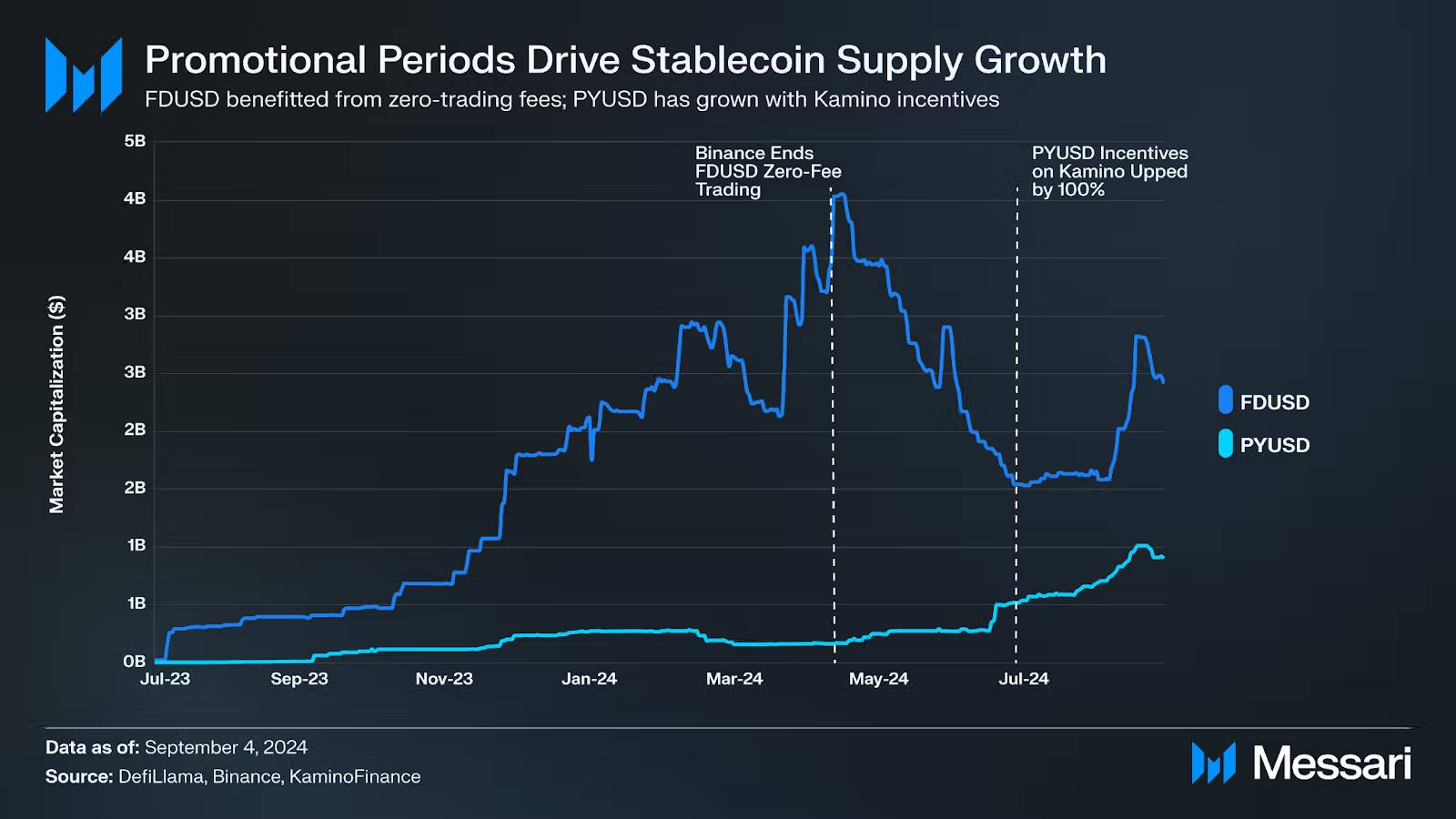

Stablecoins may become a focal point. Bipartisan openness toward stablecoin regulation creates favorable conditions for legislative progress in 2025;

Institutional Capital: Full-Scale Entry

Market Transformation

-

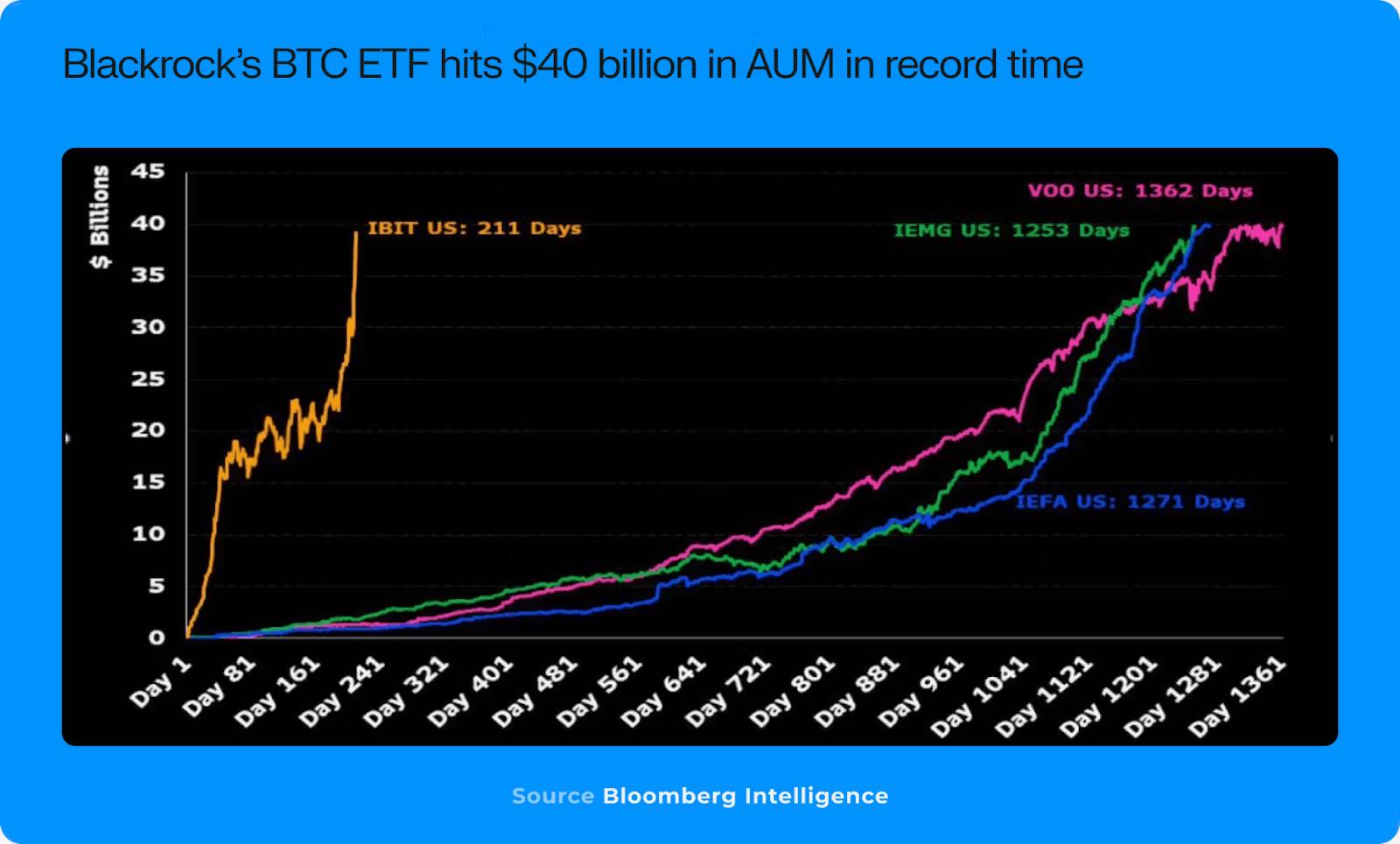

In 2024, institutional participation moved beyond speculation. The approval of Bitcoin and Ethereum ETFs marked formal recognition of crypto as an asset class, providing easier access for both institutions and retail investors;

-

BlackRock's IBIT set records: first ETF to reach $3 billion AUM within 30 days, surpassing $40 billion within about 200 days—highlighting strong institutional demand for crypto derivatives;

Diversification of Institutional Involvement

-

Institutional engagement extends far beyond ETF investments. Traditional financial players are expanding into digital asset issuance, tokenization, stablecoins, and research;

-

Entities like Sky (formerly MakerDAO) and BlackRock have launched on-chain money market funds. Ondo Finance’s USDY (tokenized U.S. Treasury fund) reached ~$440 million in assets under management;

Fintech Convergence

-

PayPal issued its PYUSD stablecoin on Solana in May; Agora, backed by Nick Van Eck, launched AUSD across multiple chains, supported by VanEck and custodied by State Street;

Outlook for 2025

-

The depth and breadth of institutional involvement are expected to expand further. As BlackRock continues positioning digital assets as a small but non-correlated portfolio allocation, steady ETF inflows are likely to persist. More importantly, institutions are exploring innovation across verticals to reduce costs, enhance transparency, or accelerate payment efficiency;

-

JPMorgan, Goldman Sachs, and other traditional finance giants are accelerating their blockchain initiatives, expanding proprietary platforms and product offerings;

-

This trend signals that institutions no longer view crypto merely as an investment vehicle, but are increasingly recognizing its potential as financial infrastructure;

Memecoins: The Heat Continues

Market Landscape in 2024

-

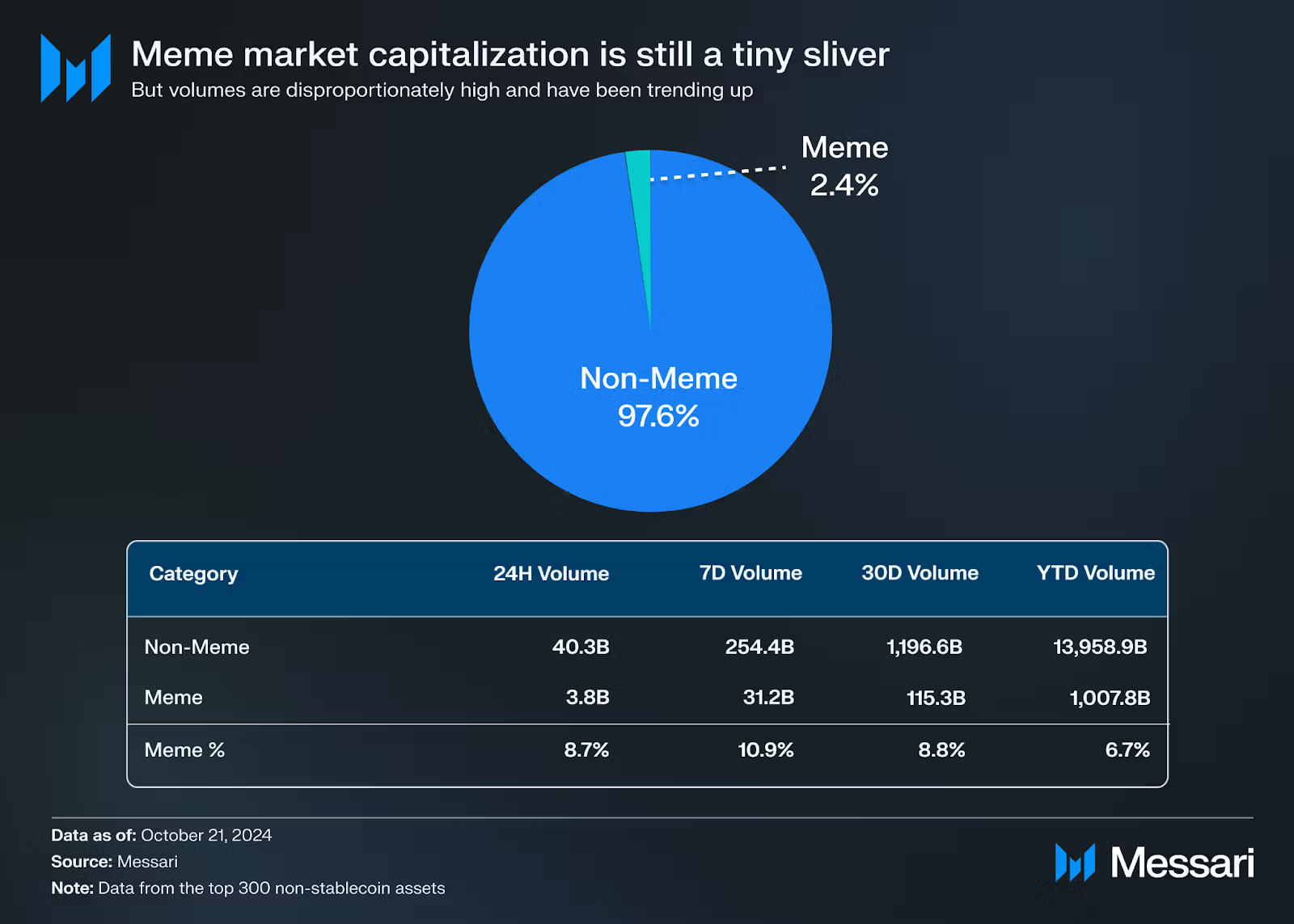

Though memecoins account for only 3% of the market cap of the top 300 cryptocurrencies (excluding stablecoins), they consistently capture 6–7% of trading volume, recently spiking to 11%;

-

After political-themed memecoins like Jeo Boden drove early momentum, TikTok-inspired tokens (e.g., Moodeng, Chill Guy) and AI agent concepts (e.g., GOAT from Truth Terminal) sustained interest;

Drivers of Market Growth

The memecoin boom stems not just from trends or user-friendly interfaces, but from two key enablers:

-

Excess capital: As overall crypto valuations rise, many traders hold substantial funds but lack compelling investment opportunities;

-

Ample block space: High-throughput networks like Solana and Base offer low-cost, efficient trading environments;

This dynamic is especially evident on Solana. Strong performance at the end of 2023 and beginning of 2024 left many Solana users with significant capital reserves.

Evolution of Trading Infrastructure

-

User-friendly platforms have greatly boosted memecoin adoption. Apps like Pump.fun, Moonshot, and Telegram bots simplify the process for retail traders;

-

Moonshot, in particular, bypasses traditional crypto onboarding by accepting Apple Pay, PayPal, or USDC on Solana, drawing in new retail investors through intuitive design and frictionless registration;

Outlook for 2025

Memecoins are poised for continued growth in 2025 due to several factors:

-

Infrastructure support: High-throughput chains like Solana, Base, Injective, Sei, and TON provide ample block space, enabling low-cost memecoin trading;

-

Improved UX: Platforms like Moonshot and Pump.fun will continue lowering barriers to entry, simplifying processes and attracting more retail participants;

-

Favorable macro backdrop: Memecoins serve as speculative outlets akin to gambling, likely continuing to draw users seeking entertainment and profit under current conditions;

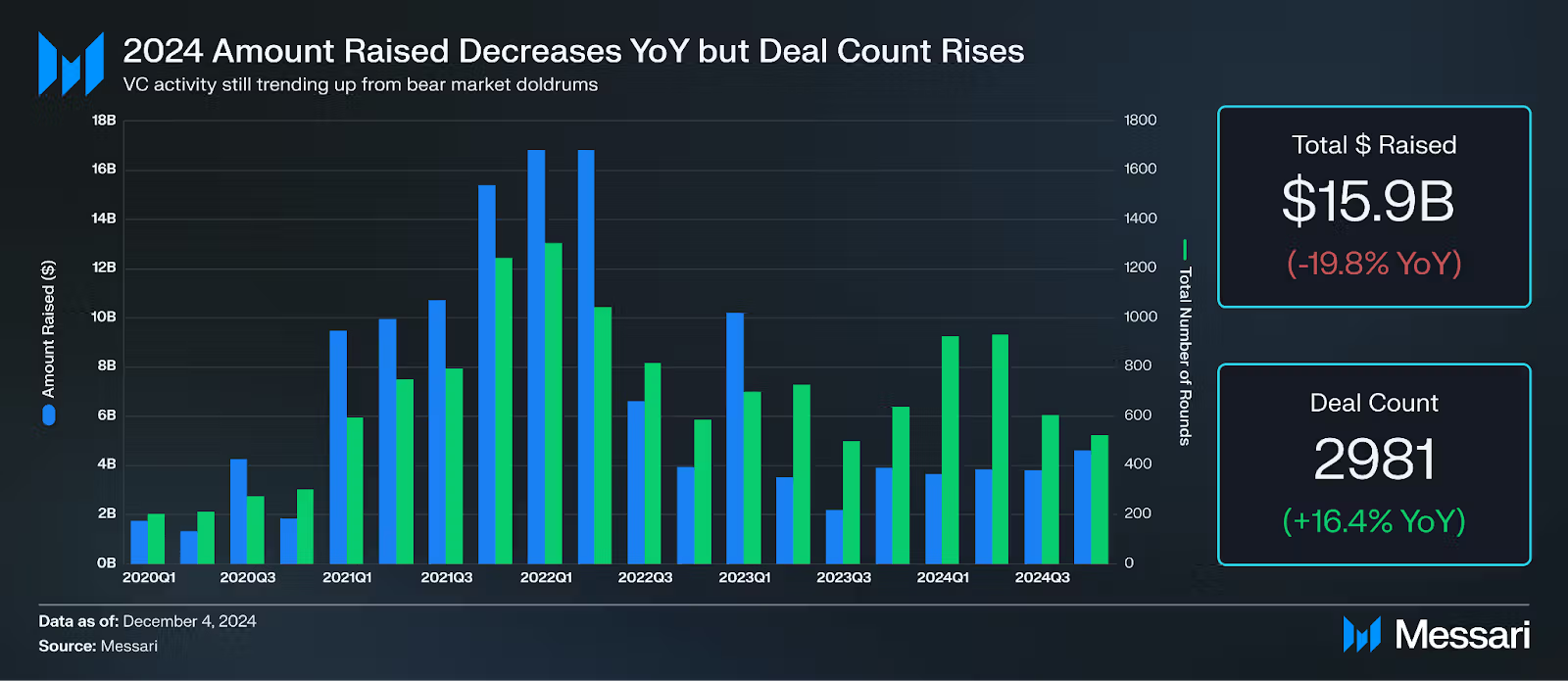

Funding Landscape: AI Leads Emerging Investment Themes

Market Overview

-

Crypto project fundraising showed an upward trend compared to 2023. While total funding for startups and protocols declined ~20% year-over-year (mainly due to outlier activity in Q1 2023), several large rounds were still completed;

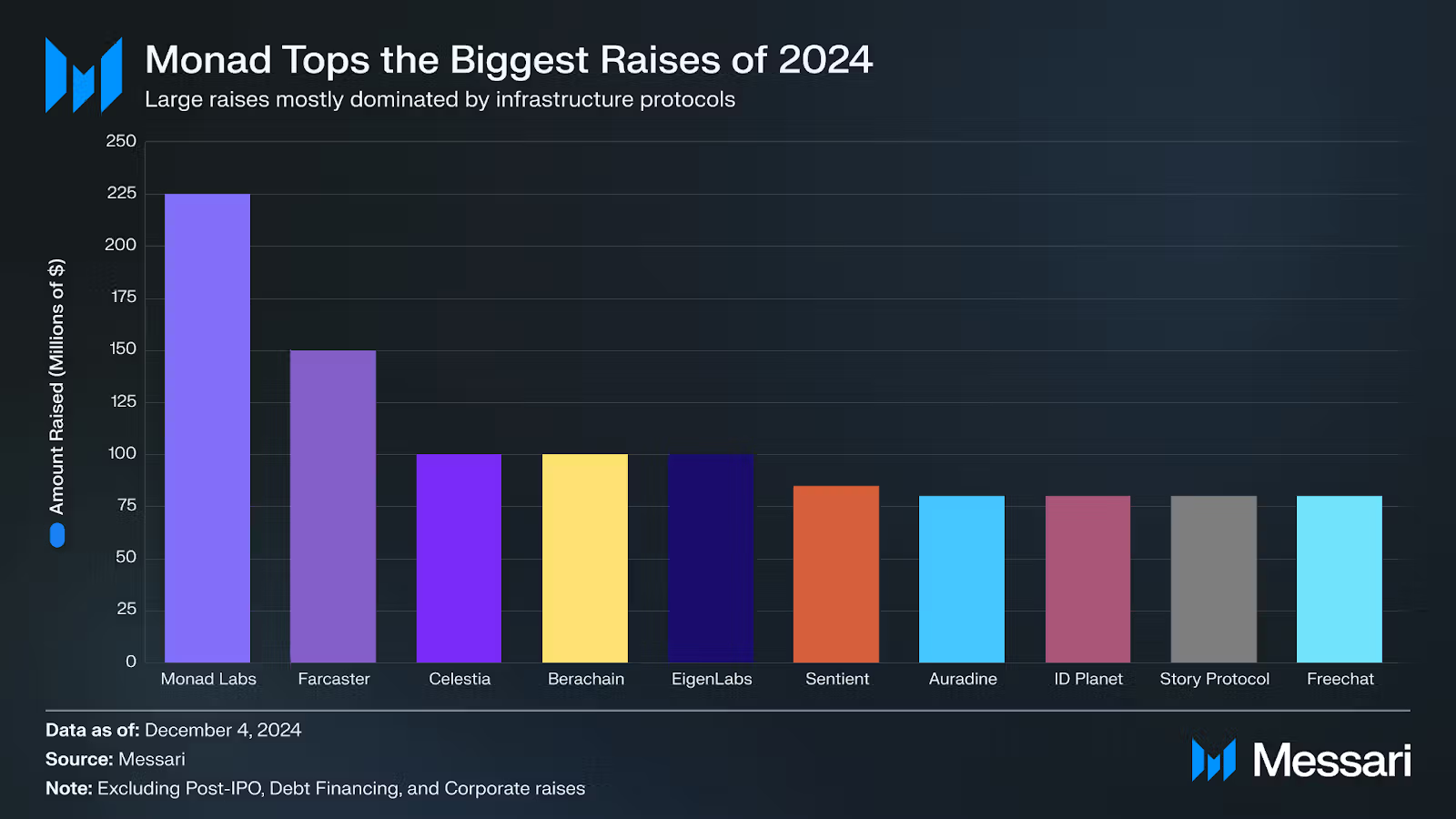

Notable Funding Rounds

-

Monad Labs: Raised $225 million in April, underscoring continued VC focus on infrastructure and L1 projects;

-

Story Protocol: Secured $80 million Series B led by a16z, aiming to make intellectual property programmable;

-

Sentient: Raised $85 million led by Thiel’s Founders Fund, focused on open-source AGI development;

-

Farcaster and Freechat: Raised $150 million and $80 million respectively, indicating sustained investor interest in decentralized social platforms;

Rise of AI and DePIN

-

Funding for AI-related crypto projects grew ~100% YoY, with funding rounds up 138%;

-

DePIN projects saw funding increase ~300% YoY, with rounds up 197%;

AI projects are particularly popular in accelerator programs like CSX and Beacon. Investors show growing enthusiasm for the intersection of crypto and AI.

Emerging Investment Themes

Beyond AI and DePIN, notable funding trends emerged in 2024:

-

Decentralized science (DeSci) gained traction, with projects like BIO Protocol and AMINOChain securing funding;

-

Asia-Pacific VCs favored gaming protocols, especially those built on the TON blockchain;

-

Funding share for NFT and metaverse projects declined sharply compared to 2021–2022 levels;

-

Decentralized social platforms like Farcaster, DeSo, and BlueSky continue experimenting despite limited prior success;

Crypto Users: New Evidence of Growth

Scale Breakthrough

-

According to a16z, monthly active crypto addresses hit a record high of 220 million—comparable to early internet adoption curves. Though this figure may include duplicates (many users hold multiple wallets), filtered estimates suggest **30–60 million** genuine monthly active users;

Key User Growth Cases in 2024

-

Phantom Wallet Breakout: Became the most popular wallet in the Solana ecosystem, briefly ranking in the iOS App Store top 10 ahead of WhatsApp and Instagram;

-

Stablecoin Adoption in Emerging Markets: Sub-Saharan Africa, Latin America, and Eastern Europe began bypassing traditional banking systems, adopting stablecoins directly. Platforms like Yellow Card, Bitso, and Kuna drove adoption via exchange services and payment APIs;

-

Telegram Mini-Apps Explosion: Notcoin attracted over 2.5 million holders; Hamster Kombat drew 200 million users and 35 million YouTube subscribers;

-

Polymarket Real-World Use Case: Surged during the election cycle, adding nearly 1 million new accounts and briefly becoming the second most downloaded news app on iOS;

-

Base and Hyperliquid Onboard CEX Users: Base L2 offers free transfers from Coinbase; Hyperliquid delivers CEX-like performance for perpetual futures traders;

Outlook for 2025

-

The crypto ecosystem is no longer just preparing for mass adoption—it has already begun;

-

User growth is shifting from sudden, noise-driven surges to organic, application-led, and sustained expansion. Memecoins, consumer apps (like Phantom and Telegram), prediction markets, and growing on-chain utility will drive compound growth;

-

The next critical step is making blockchain navigation more retail-friendly, an area likely to improve significantly through innovations like chain abstraction and aggregated frontends;

Bitcoin: A Great Year, Maturing Further in 2025

Key Developments in 2024

Price and Institutional Adoption

-

BTC started the year at $40,000, hit a Q1 high of $75,000 after ETF approvals, and broke $100,000 following Trump’s election win;

-

Bitcoin’s market dominance rose to ~55%;

-

ETF issuers now hold over 1.1 million BTC, with BlackRock and Grayscale accounting for 45% and 19% respectively;

-

Only April saw net outflows post-ETF approval; BlackRock’s IBIT remained the largest net buyer, with ~$8 billion inflow in November alone;

-

MicroStrategy continued aggressive accumulation, buying $2.1 billion worth of BTC between December 2–8, holding ~420,000 BTC—second only to Binance, Satoshi Nakamoto, and ETF issuers;

-

Michael Saylor and MicroStrategy’s BTC-centric strategy inspired other public companies like Marathon Digital Holdings (MARA), Riot Platforms, and Semler Scientific to begin building BTC reserves;

-

2024 was also a halving year, reducing the number of natural BTC sellers over time;

Network Innovation

Rise of Ordinals and Runes

-

Ordinals introduced NFT functionality to Bitcoin; Runes launched as a new token standard similar to Ethereum’s ERC-20;

-

Some Runes projects achieved nine-figure valuations, signaling market validation of Bitcoin’s ecosystem expansion;

Breakthroughs in Programmability and Staking

-

BitVM enables arbitrary computation on Bitcoin, with over 40 Layer-2 projects now live or in testnet;

-

CORE, Bitlayer, Rootstock, and Merlin Chain lead in TVL;

-

Babylon, Bitcoin’s first staking protocol, launched in Q3—the initial 1,000 BTC staking pool filled within six blocks;

-

Liquid staking tokens like Lombard’s LBTC are emerging;

Outlook for 2025

-

Bitcoin ETF inflows have far exceeded expectations. Over time, institutions are likely to become the primary driver of daily BTC price movements;

-

ETFs allow institutions to buy spot BTC without leverage. Smoother, more consistent institutional inflows should reduce reflexive, leveraged volatility, helping Bitcoin mature as an asset class;

-

ETF approval may mark Bitcoin’s entry into the early-mid stage of becoming a leading global store of value. In November, BTC surpassed silver to become the 8th most valuable asset globally, partly due to ETF inflows. Year-end trends suggest inflows will continue rising in 2025, especially as Grayscale’s GBTC turns positive;

-

Regulatory-wise, the incoming Trump administration has shown pro-crypto and pro-Bitcoin sentiment, making campaign promises around Bitcoin. While BTC repriced quickly after his win, the real test will be whether the administration follows through;

-

Though unlikely, a federal strategic Bitcoin reserve would be highly impactful. Markets appear cautiously optimistic; if the president delivers on achievable items, goodwill could sustain positive sentiment;

-

Post-election, clear and positive crypto reform has become a major cross-government issue. We believe bipartisan support is imminent—this would significantly reduce long-standing regulatory uncertainty around Bitcoin;

-

On Runes and Ordinals, we expect the dust to largely settle by 2025, making opportunities attractive;

-

Magic Eden is driving improved Bitcoin UI/UX—if the Bitcoin ecosystem takes off, they’re positioned to be clear winners;

-

Bitcoin programmability and staking remain in early stages. Early TVL growth doesn’t yet reflect real demand. Consumers still favor high-performance networks like Solana and Base. If this trend continues, Bitcoin builders face an uphill battle;

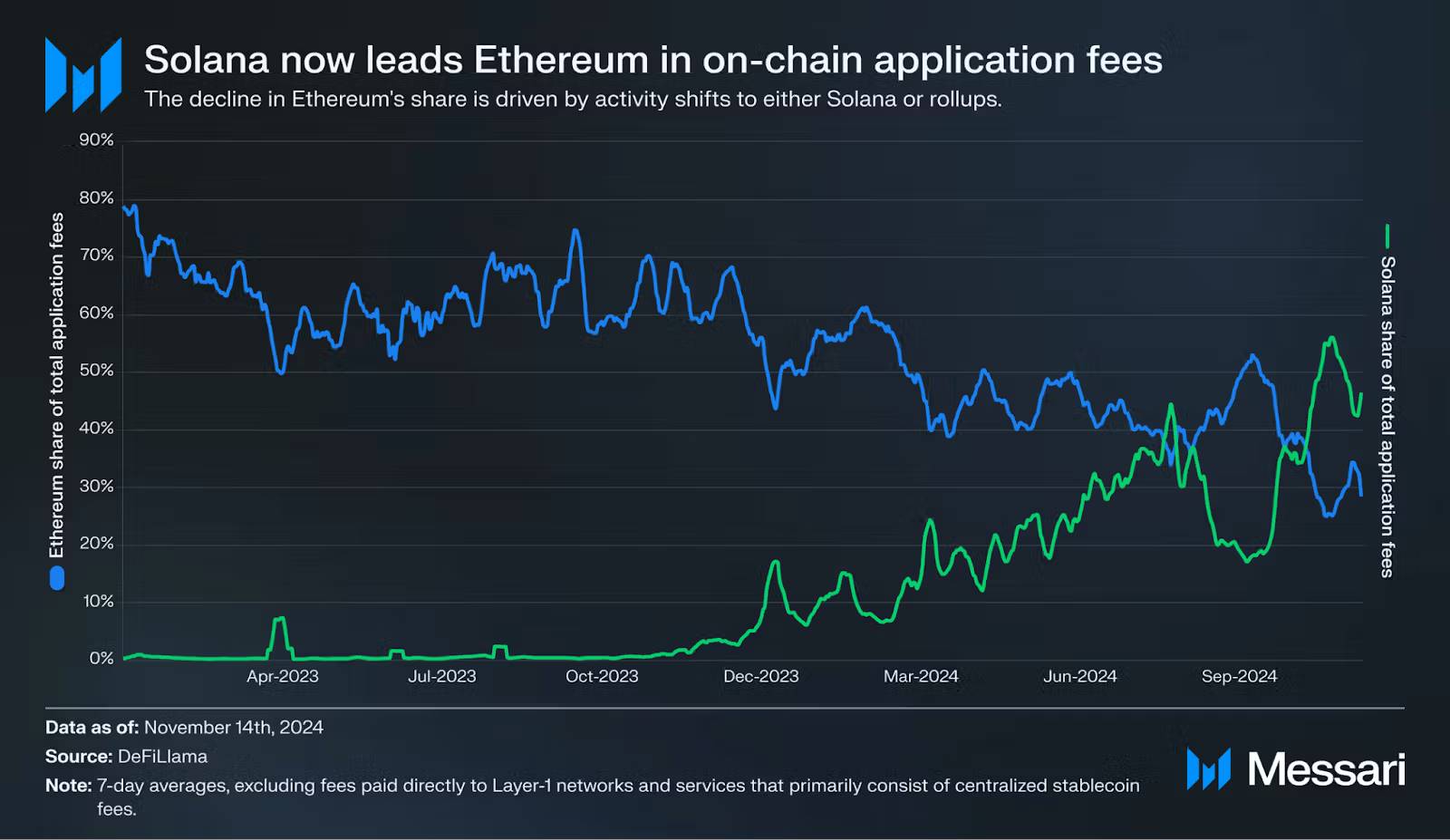

Ethereum: Identity Crisis and Future Opportunities

Overview of 2024 Performance

Ethereum had a turbulent year. As crypto’s “number two,” it competed with Bitcoin for the hard money narrative while facing challenges from newer chains like Solana. Key developments:

-

Underperformed relative to other major cryptos, especially Bitcoin and Solana;

-

Layer-2 ecosystem grew, but mainnet activity declined; ETH experienced sustained inflation instead of the anticipated deflation;

-

Limited initial ETF inflows, though momentum picked up recently;

-

L2 scalability improved 15x, reaching cumulative throughput of ~200 TPS;

-

Base’s rapid growth sparked debate over “Ethereum’s future being Coinbase,” but fragmented L2 ecosystems harmed user and developer experience;

Key Outlook for 2025

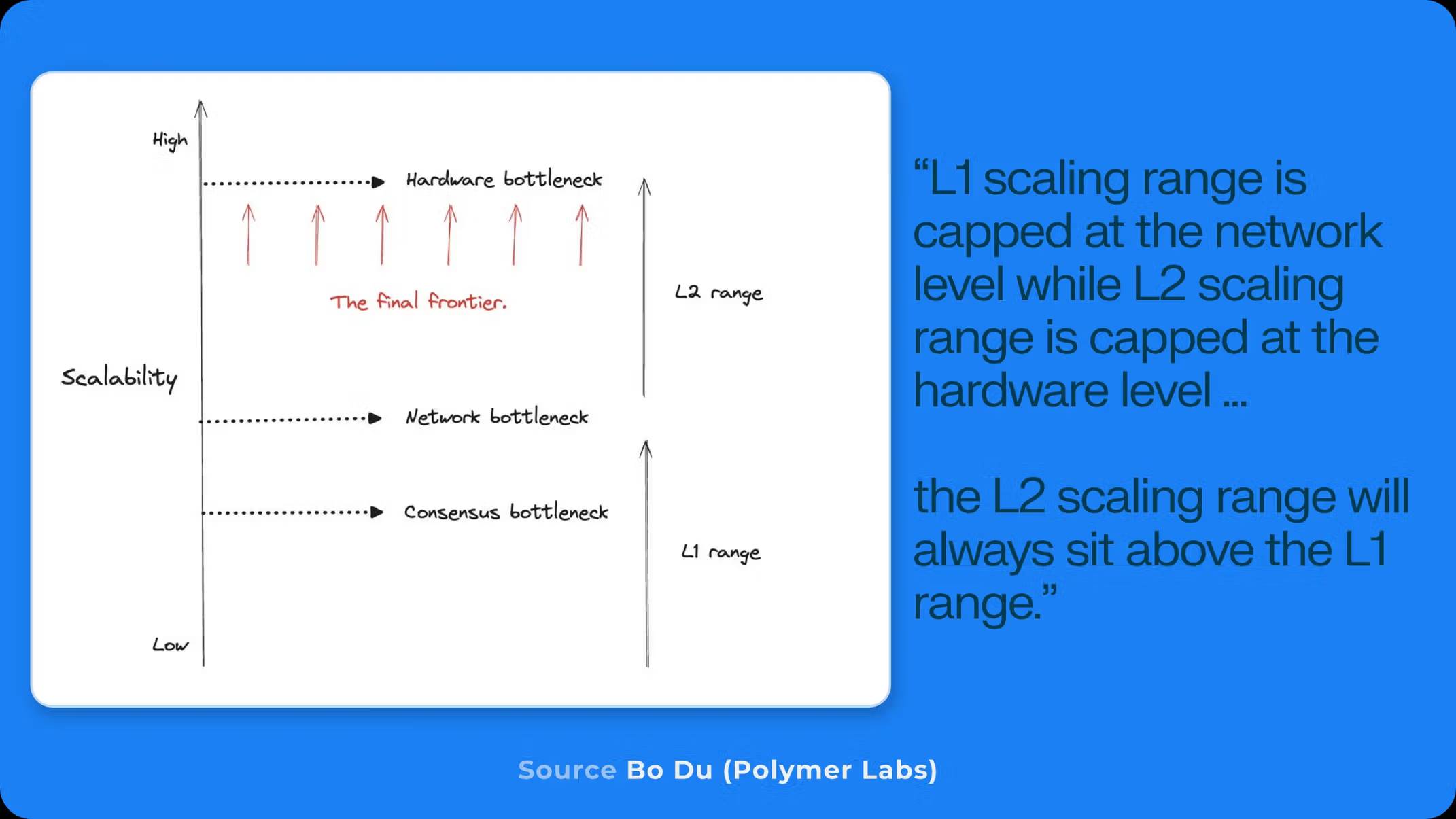

L2 > L1

-

Layer-2 designs offer more flexible execution environments than native L1s; high-throughput L2s (e.g., MegaETH) theoretically outperform fast L1s;

-

App-specific chains allow better trade-offs, such as customized transaction prioritization;

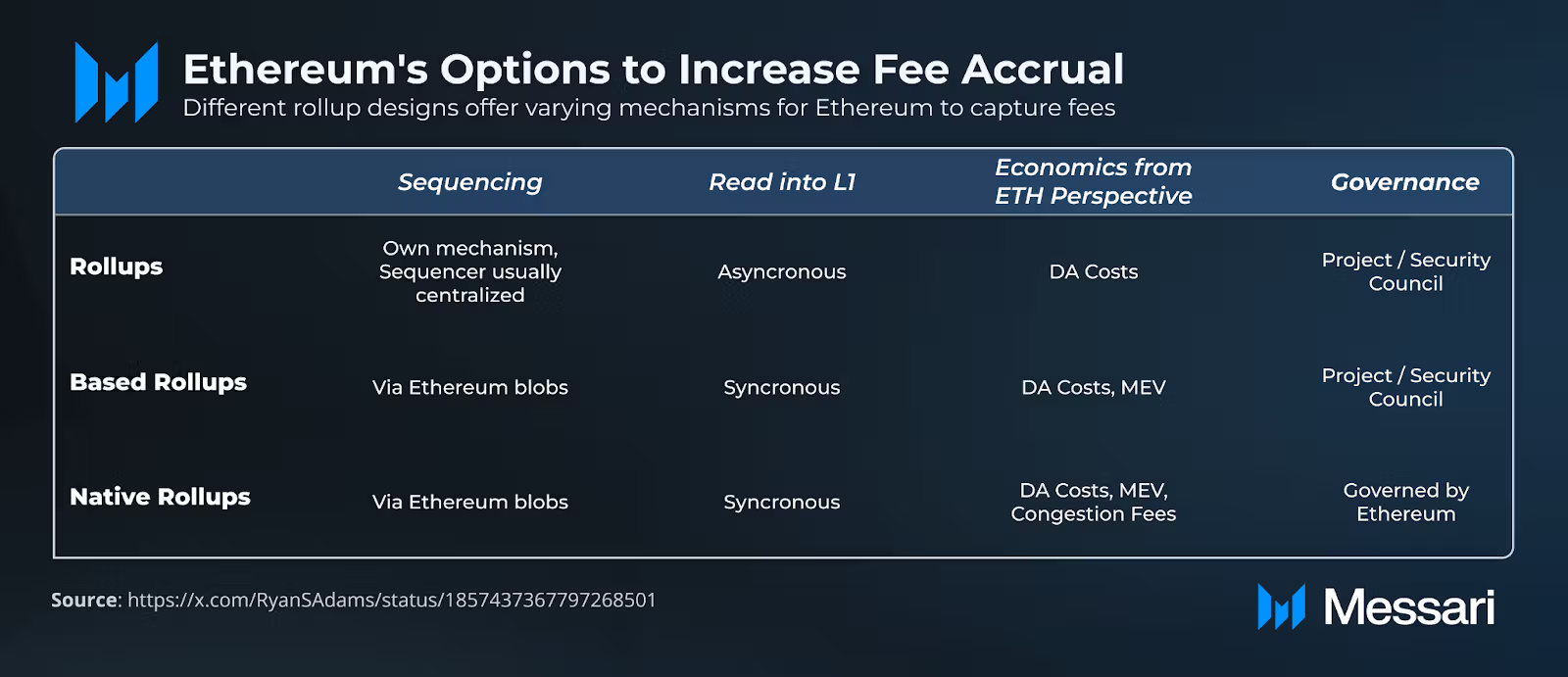

Two Viable Value Capture Models

Ethereum faces two potential paths:

Fees Don't Matter Path

-

Current fees stem largely from speculation, raising sustainability concerns;

-

Token valuation should be based on “security demand”—the largest applications generate the highest security demand, boosting native asset value;

Enhanced Fee Capture Path

-

Native rollups can increase base-layer value capture by boosting data availability fees;

-

Expand base layer capabilities to compete with general EVM L2s;

New Ecosystem Opportunities

-

A super rollup, interconnected based-rollups, or high fee burn could all pave successful paths;

-

Regaining share in native crypto speculation could reignite institutional interest;

-

The ecosystem’s decentralized nature means any participant could catalyze this shift;

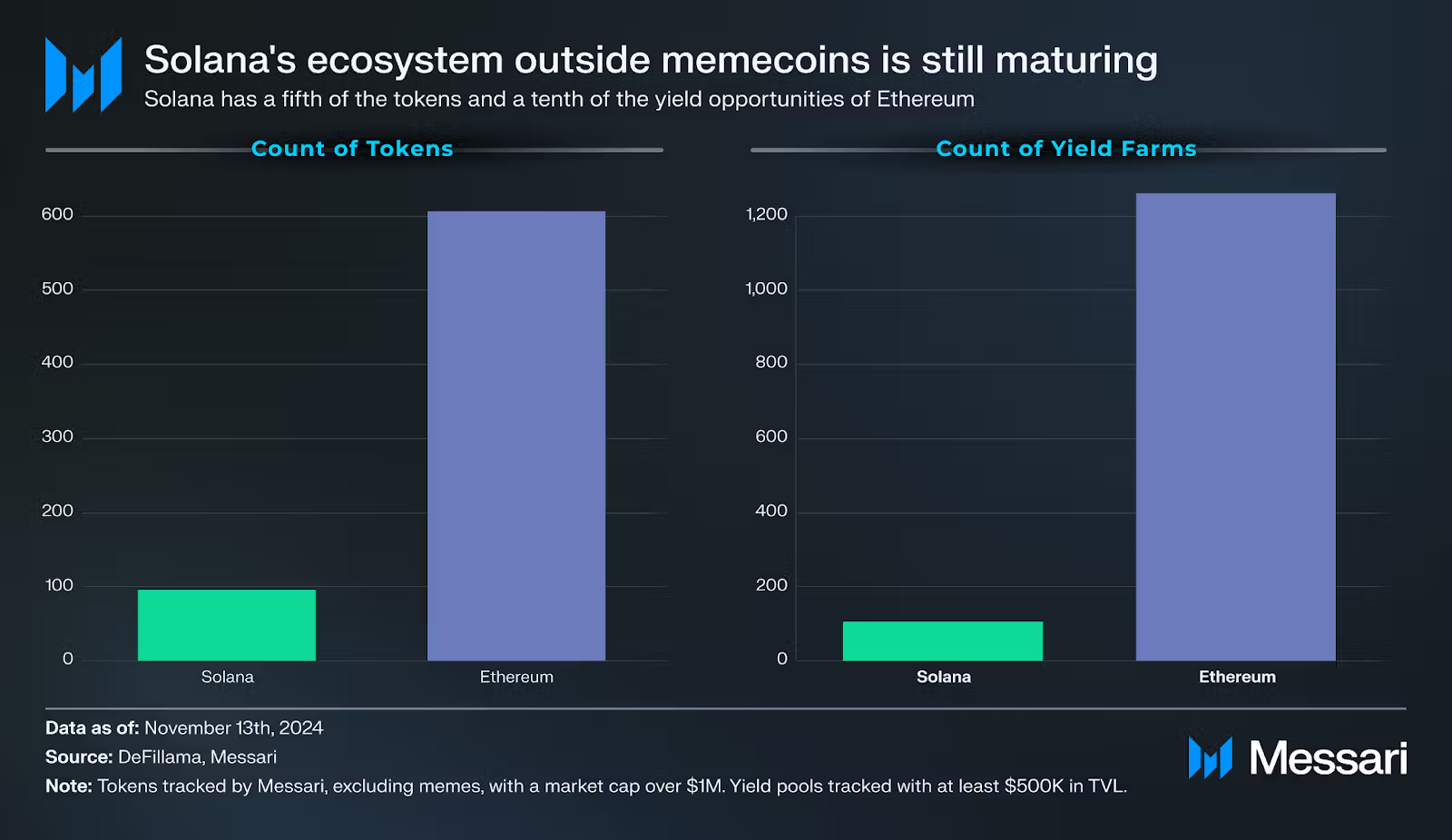

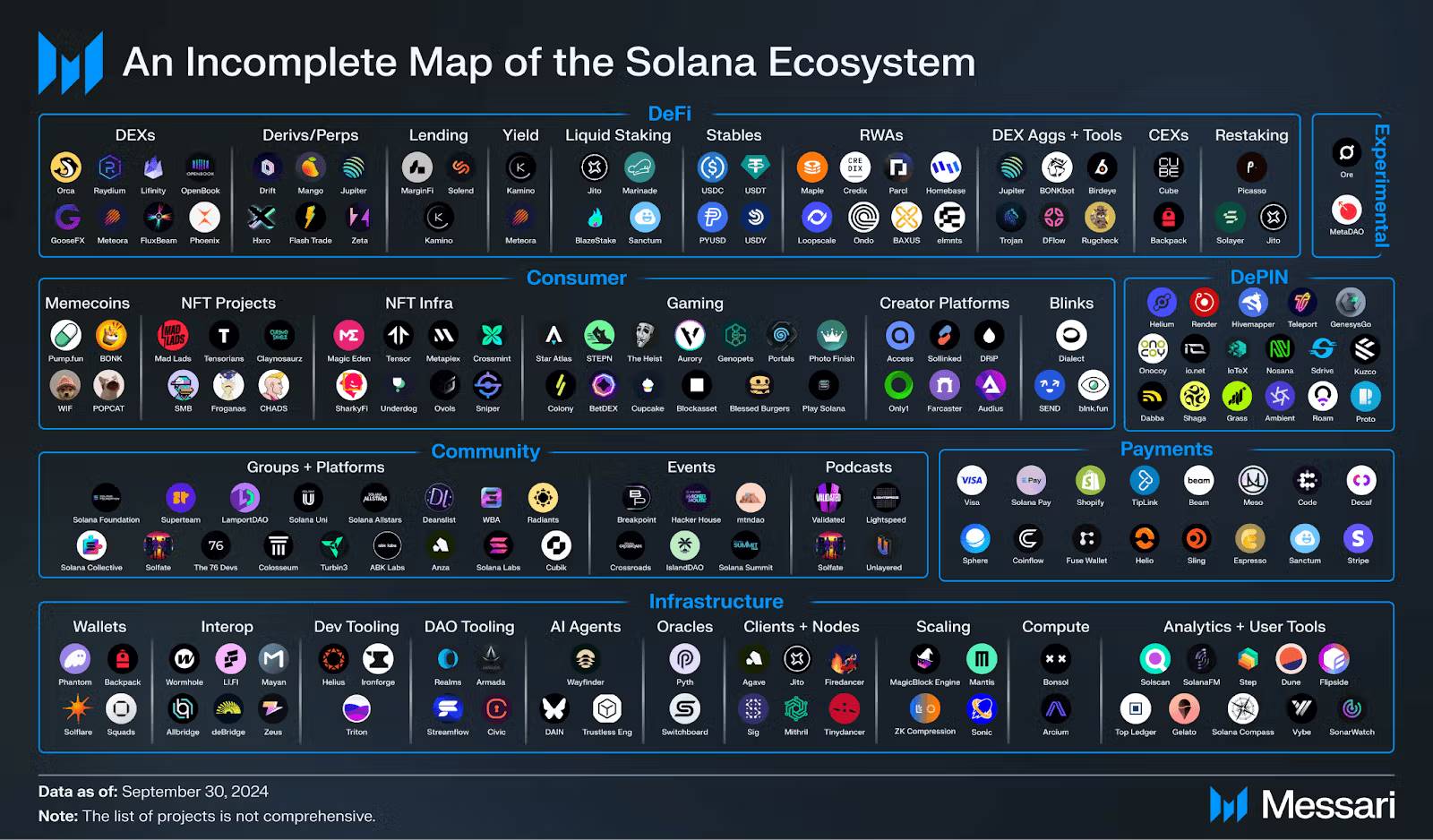

Solana: From Underdog to Mainstream Ecosystem

Key Developments in 2024

Solana has transitioned from “recovering from FTX collapse” to a definitive breakout. Major achievements:

-

Shifted from a Bitcoin-Ethereum duopoly to a “three-way race”;

-

Network reliability improved significantly—only one 5-hour outage all year; DeFi TVL grew from $1.5B to over $9B; stablecoin supply rose from $1.8B to nearly $5B;

-

Positioned itself as a speculative hub, especially via memecoin trading. Seamless wallet experiences and platforms like Pump.fun and Moonshot made token creation and trading easier than ever;

-

This surge in on-chain activity pushed Solana’s daily fees above Ethereum’s at times, highlighting its accelerating momentum and retail appeal;

Key Outlook for 2025

Ecosystem Expansion

-

Anticipating Beyond Speculation: We’re excited about MetaDAO’s prediction markets; emerging Solana L2 ecosystems warrant attention to see if they can effectively compete with Ethereum counterparts;

-

AI Trend Leadership: ai16z has become one of the most trending repositories across GitHub. Solana isn’t just embracing AI x Crypto—it’s leading the movement;

Traditional Finance Interest

-

Under the ETF trend, investors may seek “tech stocks” in the space—Solana is poised to be the fastest horse;

-

A spot Solana ETF launching within the next 1–2 years seems inevitable, setting the stage for a perfect storm in Solana’s growth story;

Intensifying Competition

-

We expect a wave of new L1s (e.g., Monad, Berachain, Sonic) to launch next year;

-

Resurgent DeFi, AI agents, and consumer apps led by Base and other rising L2s;

Other L1s + Infrastructure: 2025 Outlook

TechFlow note: Due to space constraints, from here we focus solely on 2025 outlooks. Summaries of 2024 developments can be found in the original report, consisting largely of publicly available information.

-

We’ll see the launch of Monad and Sonic as two general-purpose, high-throughput, “monolithic” L1s;

-

Both have raised substantial funds (Monad: $225M; Sonic: ~$250M in FTM) to attract developers;

-

Berachain is one of the most intriguing L1 experiments, raising $142M in Series A and B, with over 270 projects committed to building on it—showing strong developer and team interest;

-

Celestia’s Lazybridging proposal and Avail’s Nexus ZK verification layer could establish meaningful network effects for modular L1s by late 2025;

-

If Unichain succeeds, it could spark a wave of protocols bypassing L1s to build app-specific or domain-specific L2s, increasing value accrual and revenue for token holders;

-

Alternative VMs (especially Solana and Move VM) will remain in focus;

-

Avalanche9000, leveraging Avalanche’s strengths in institutional and gaming partnerships, is set for another strong year;

-

Cosmos’ outlook remains uncertain in 2025;

-

Initia will launch as an L1 supporting 5–10 interoperable, app-specific L2 solutions—positioning it to lead the next wave of app chain innovation;

-

In interoperability, watch Across, Espresso, Omni Network;

-

In ZK space, monitor Polygon’s Agglayer. In 2025, we expect nearly all infrastructure protocols to adopt ZK tech;

-

Boundaries between apps and infrastructure blur—modular projects like Celestia, EigenDA, Avail may benefit;

DeFi: 2025 Outlook

-

Solana and Base – Valuable Real Estate: We expect continued growth in DEX market share on Solana and Base relative to other chains;

-

Vertical Integration & Composability: Protocols like Hyperliquid and Uniswap are building their own infrastructures to tailor network features for their apps;

-

Prediction Markets: We expect volumes may decline compared to election-driven peaks. To succeed, other protocols must offer continuously relevant markets and incentivize market makers;

-

RWA: With falling rates, tokenized Treasuries may face headwinds. Idle on-chain capital may gain favor, shifting focus from importing traditional assets to exporting on-chain opportunities. Regardless of macro shifts, RWA holds potential for sustained growth and diversification;

-

Points Programs: Points will remain central for protocols aiming to drive user adoption via token distribution, fueling market and yield-trading protocols. In 2025, protocols may refine point schemes while nurturing early adopter communities;

-

Driven by new yield farming opportunities and speculative appeal of points-based incentives, yield-trading protocols like Pendle are poised for further growth;

AI x Crypto: 2025 Outlook

Bittensor and Dynamic TAO: A New Kind of AI Casino

-

Each existing (and future) subnet will have its own token, linked to Bittensor’s native TAO;

-

The AI race is a talent race—Bittensor has a unique edge in attracting serious researchers; subnets already show early signs of producing high-quality research;

-

Don’t be surprised if Bittensor emerges as the epicenter of cutting-edge AI research in crypto next year;

-

Bittensor is not just a speculative “AI coin casino”—it’s a platform capable of attracting serious AI developers;

Decentralized Model Training: A Hurdle and a Pivot Point

-

Decentralized networks won’t try to train massive foundation models to rival OpenAI or Google, but may focus on fine-tuning smaller, specialized models;

-

We expect increased experimentation in small, task-specific models in 2025;

AI Agents and Meme Coins: Ongoing Experiment

-

Most AI agents will prefer operating on-chain;

-

Growing token valuations can fund AI agent development and boost social media engagement;

-

We believe increasing engineering attention will raise talent density;

-

As AI agent KOLs actively compete for social media attention, this category will outpace “static” memecoins;

-

With ongoing debates around open vs. closed AI, we expect crypto to claim an increasingly prominent role in the conversation;

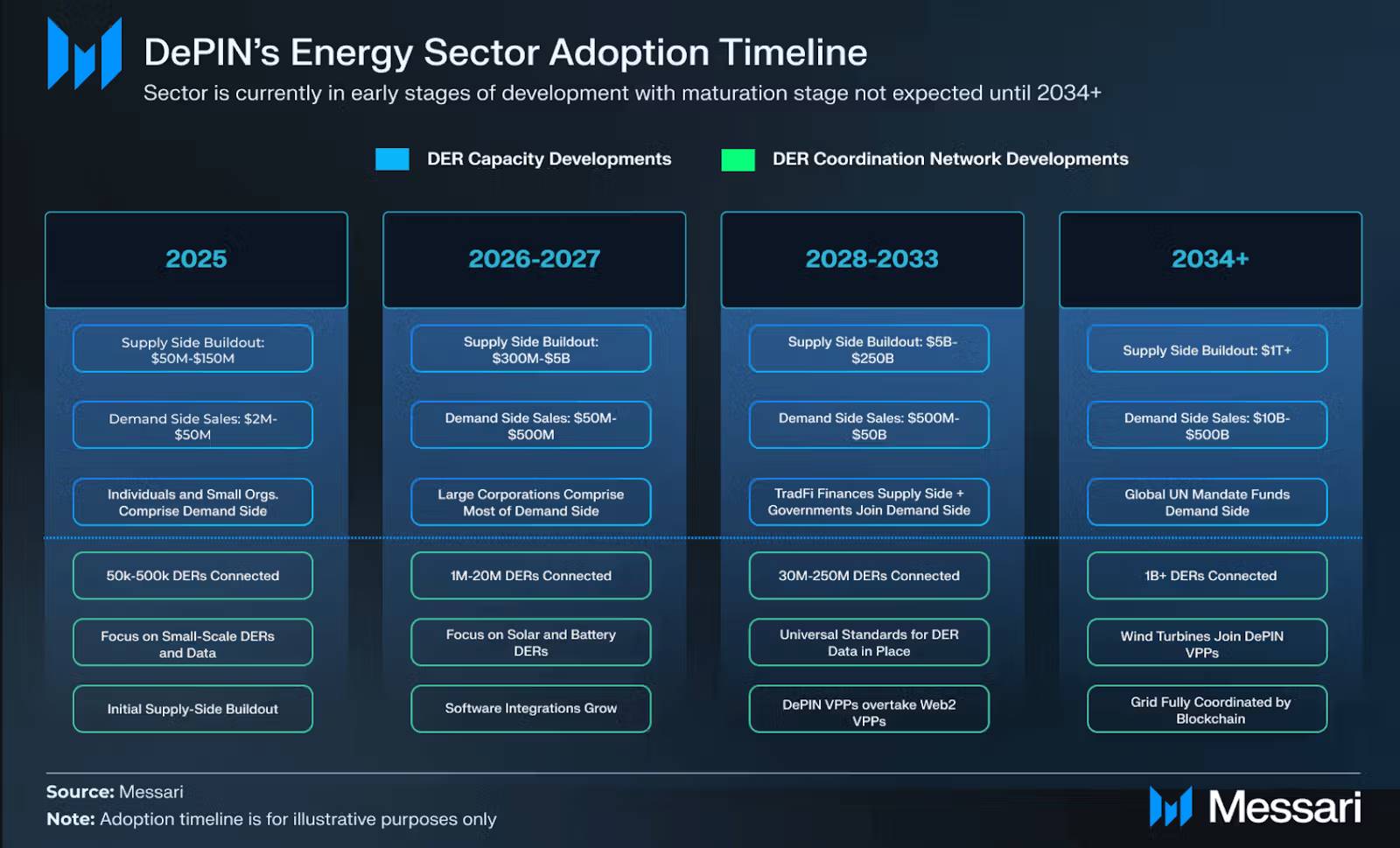

DePIN: 2025 Outlook

-

By 2025, energy DePIN projects are expected to build $50M–$150M in supply-side infrastructure, generating up to $50M in demand-side revenue;

-

With Helium Mobile poised for further growth and DAWN launching its mainnet in 2025, wireless DePIN will solidify its status as a breakthrough use case;

-

Revenue forecast: Industry-wide revenues expected to reach tens to hundreds of millions in 2025;

-

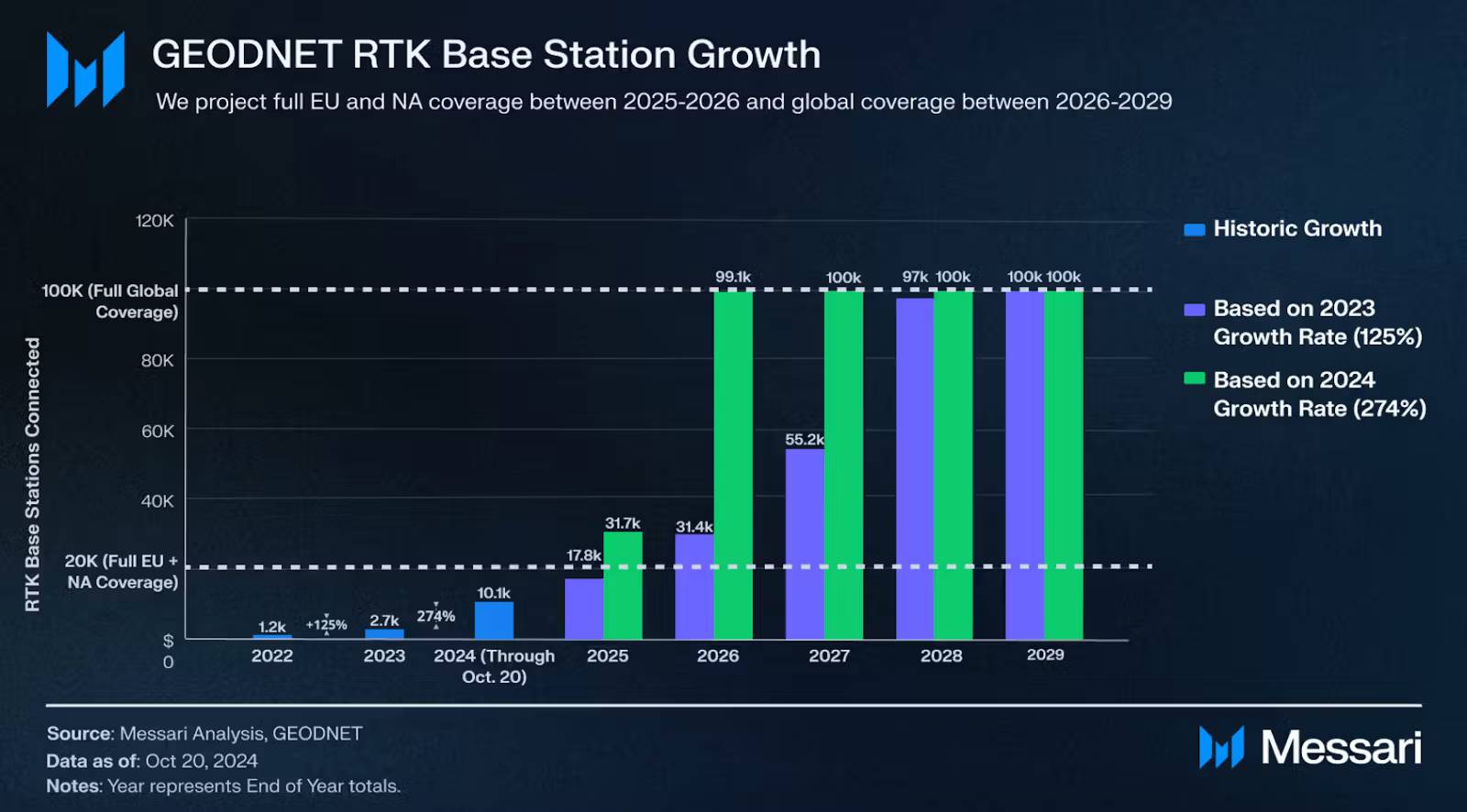

RTK networks like GEODNET are expected to expand coverage, achieving 90–100% coverage in high-value EU and North American regions by end of 2025, with annual revenue potentially exceeding $10M;

-

Weather data collection networks are expected to make significant progress in 2025;

-

Integration between energy and mobility DePIN projects will enhance grid integration and EV battery energy harvesting data;

-

File storage DePIN is projected to generate $15M–$500M in revenue across the subsector in 2025;

-

Data collection DePINs, driven by success stories like Grass, will grow in 2025;

Consumer Applications: 2025 Outlook

-

Playing for airdrops will remain a core mechanism to onboard gamers. “Paid airdrops” may become the new standard in 2025;

-

Mobile apps will be the defining trend in 2025;

-

We expect Solana to maintain the largest share of memecoin trading activity in 2025;

-

Ordinals are expected to remain a high-attention category. Catalysts such as potential CEX listings, wealth-effect-driven airdrops, and growing popularity in Asian markets could drive sustained growth and broader appeal throughout the year;

CeFi: 2025 Outlook

-

With bull market momentum and rising funding rates, Ethena’s supply may continue expanding;

-

Yield-bearing stablecoins are unlikely to take significant market share from Tether soon;

-

Trump’s nominee for Commerce Secretary, Howard Lutnick, oversees Tether’s asset management—U.S. stance toward Tether could shift dramatically from hostile to supportive;

-

Real innovation may occur behind the scenes at orchestration platforms like Bridge. Stablecoin APIs (e.g., from Yellow Card) will empower small businesses to accept stablecoins globally;

-

In exchanges, we’ll see increasing convergence of on-chain and off-chain services. Coinbase and Kraken aim to bring as many users as possible onto their L2s, possibly offering incentives;

-

The new administration may allow exchanges greater freedom in listing assets. With Binance, Bybit, and Coinbase racing to list popular cryptos, this trend could peak in 2025;

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News