Why the "Platform + Marketplace" Combination Is More Popular: A Case Study of Max and Alchemist AI in the Editor's AI Agent Alpha Methodology

TechFlow Selected TechFlow Selected

Why the "Platform + Marketplace" Combination Is More Popular: A Case Study of Max and Alchemist AI in the Editor's AI Agent Alpha Methodology

The former builds products, the latter trades them.

By TechFlow

Another week dominated by the AI Agent sector—have you found your Alpha yet?

Top tokens like ai16z and Fartcoin keep climbing, while on the long tail, you might see hundreds of self-proclaimed AI Agent tokens appear in monitoring lists in a single day.

With so many options, how do you choose?

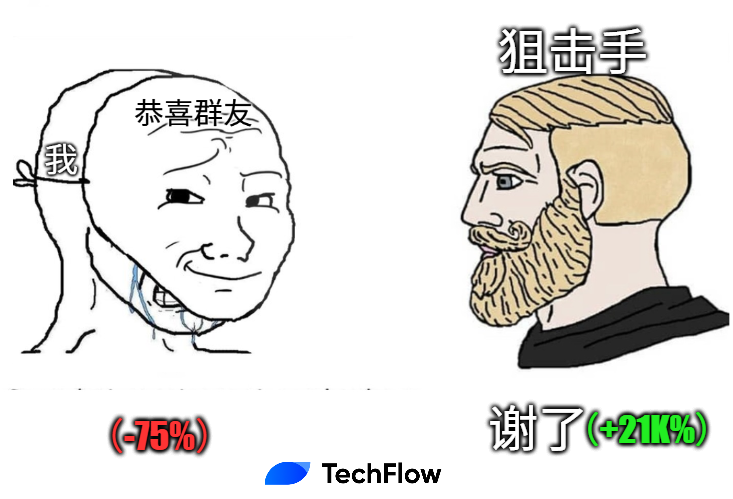

If you're not a professional degen, launch sniper, or well-connected insider in crypto, beyond envying others' win rates, energy management, and information density, jumping in out of FOMO often means ending up paying the bill. So how can you tell whether a project actually has potential?

From the perspective of an ordinary retail investor, you may lack a reliable framework for judgment.

In selecting content and observing the market, this chronically losing writer shares that same sense of helplessness—too much to read, too hard to buy in, impossible to break even, and nearly no complete narratives to be found.

Every second of the market feels chaotic and blurry, yet every now and then, a clear pulse emerges.

Clearly, an average writer attempting to diagnose the entire market would invite ridicule. The following thoughts are merely shared as personal perspectives—these "folk remedies" have at least partially cured my own losing streak.

AI Agent Sector Divergence: Applications to the Left, Platforms to the Right

Starting from the broader market picture, AI Agent has undoubtedly remained a hot sector over the past one to two weeks. In particular, yesterday’s OKX listing of GOAT further boosted enthusiasm across the AI Agent space.

Yet beyond unsustainable broad rallies, projects emerging recently in the AI Agent space are beginning to show signs of divergence:

-

Divergence 1: It's a dedicated AI Agent application solving a specific type of problem, or embodying a distinct identity/style

Representative projects: AIXBT, Truth Terminal

-

Divergence 2: It's not a dedicated AI Agent app, but rather provides a toolset enabling users to build more applications

Representative projects: Virtuals, ai16z (Eliza framework), Empyreal SDK

Roughly speaking, this reflects an evolution between apps versus platforms: from individual AI Agents issuing tokens, to platforms/tools enabling many more AI Agents to issue tokens.

This isn't entirely accurate though—beyond just launchpads, some tools don’t focus on token creation per se, but instead provide environments where AI Agents become easier and more powerful to use. At their core, these still follow platform/ecosystem logic rather than single-point application logic:

Easier to use, more capable—this gives their asset-backed tokens stronger justification and makes them more attractive to speculative capital.

In fact, this logic may simply be history repeating itself.

Back in 2017, ICOs were all the rage—every project could issue tokens via ICO—but eventually Ethereum emerged as the largest ICO platform, allowing any project to deploy smart contracts and launch tokens on its network.

Today’s popular AI Agents allow each agent to autonomously mint a token, yet we’re also seeing framework- and platform-type projects emerge, offering low-barrier, no-code, or natural-language interfaces for rapidly creating new AI Agents.

History doesn't repeat, but it rhymes. Along the主线 of asset creation, the core principle has never changed.

Attention Drives, Capital Stirs

Note: I'm not claiming that platform/framework-type projects in the AI Agent space are inherently stronger than pure AI Agent applications.

Strength isn’t determined by direction alone—it results from capital flows shaped through market博弈. Let’s make a blunt assertion instead: Tokens flow toward places where stories can be told “for longer.”

What does it mean for a story to last longer?

We’ve all seen overnight moonshots, but far more common are short-lived pumps lasting only 1–2 hours. These tokens attract significant capital quickly, but also bleed out just as fast.

Put differently, the market believes, “Your story won’t last.”

The longer a project can sustain its narrative, the more attention it attracts. Attention drives hype; capital drives price swings.

To be more concrete:

-

Meme coins = Judged by their angle

-

AI Agents = Judged by what they claim to do

So the question becomes: which AI Agents’ claimed capabilities seem likely to endure?

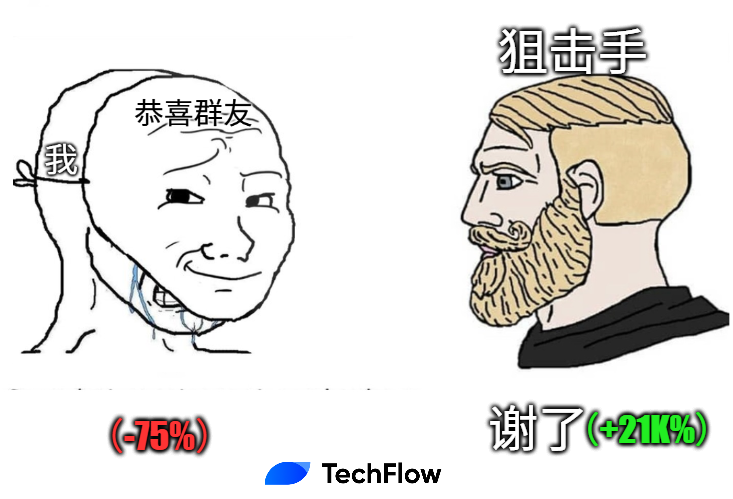

After reviewing numerous projects, I find current AI Agents broadly fall into several categories (original classification inspired by this article):

-

Personalized Impersonators

Simulate intelligence and mimic human behavior through conversation. Their purpose isn’t problem-solving, but making users feel personally seen and emotionally connected.

For these agents, personality is their brand.

Representative example: Bully, a sarcastic-talking bot

-

Efficiency-Driven Managers

Analyze complex workflows and precisely translate human intent into backend actions. These may lack personality, but they deliver efficiency, saving time or solving specific tasks.

Representative example: Simmi AI – tweet one sentence, get a token launched

-

Autonomous Experimenters

Manage wallets, interact with systems, and initiate tasks—even without manual input. However, their autonomy is limited; they await triggers rather than acting fully independently like sci-fi AI.

Representative example: Truth Terminal, where it all began

-

Platforms/Frameworks supporting the above types

You can create a snarky AI or a one-sentence token launcher—regardless of motive, certain components remain essential:

To build an AI Agent, you need models, data, and prompts; to launch an AI token, you need a launchpad.

Representative examples: Virtuals (launchpad), Eliza (creation framework)

If you rank current tokens in the sector by market cap, the leading ones mostly fit within these categories.

Among these categories, which do you think will sustain their narratives the longest?

First, projects driven purely by external events or IPs—if the triggering event is singular, its impact and longevity diminish rapidly, causing the token to bleed value quickly. Bananas (BAN) is a clear example; Luce also shows signs of fading momentum.

Within the AI Agent sector:

-

Projects capable of internal asset generation benefit from UGC-driven assets (Agents), which form a multi-point dynamic. Their influence and staying power come in waves, as new Agents regularly emerge from the platform. For the native token, this means volatility—but an overall upward spiral, ultimately elevating the parent token’s market cap while spawning several top-tier child Agents.

-

Projects that continuously generate content reinforce their personalized brand through ongoing chats and dialogues. If users find them entertaining, engaging, or full of hidden gems, sustained attention follows. And attention translates into capital inflows, driving price increases.

However, among these two, the latter faces higher risk of being cornered—e.g., when “sarcastic AI” immediately brings Bully to mind, attention concentrates on just a few top Agents, making success far less probable compared to platform-type projects.

Therefore, to play the AI Agent game effectively, you generally need a strong concept—a framework, programming environment, or launch platform—that enables the creation of more assets. Capital tends to support such projects for longer durations.

MAX & Alchemist AI: Examples of the Platform + Market Play

The above outlines my methodology when evaluating projects—not necessarily correct, but hopefully useful as a reference for filtering new AI projects.

If we follow the logic of seeking platform/framework-type plays, at least two recent projects stand out—both adopting a “platform + market” combo. (Note: Not financial advice, nor sponsored—just sharing observations.)

Platform: A tool helping users quickly build AI Agents or rapidly develop products using AI Agents

Market: A built-in marketplace where created products can be traded, boosting activity and platform visibility

-

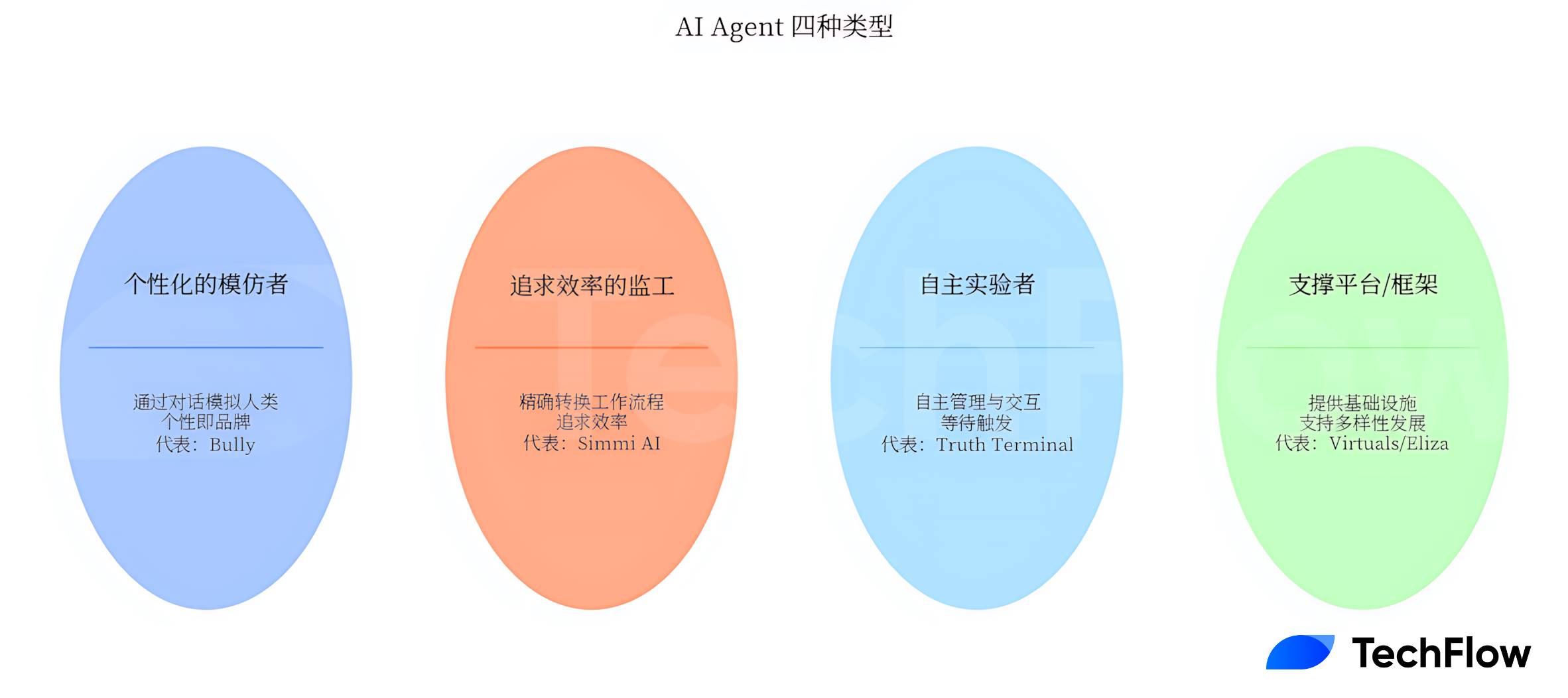

$MAX and Distilled AI: Front-store, back-factory model

Contract Address (CA):

oraim8c9d1nkfuQk9EzGYEUGxqL3MHQYndRw1huVo5h

Market Cap: $28M (up from $6M on Monday—an ~500% increase)

MAX herself is a female AI Agent persona—you can chat directly with her.

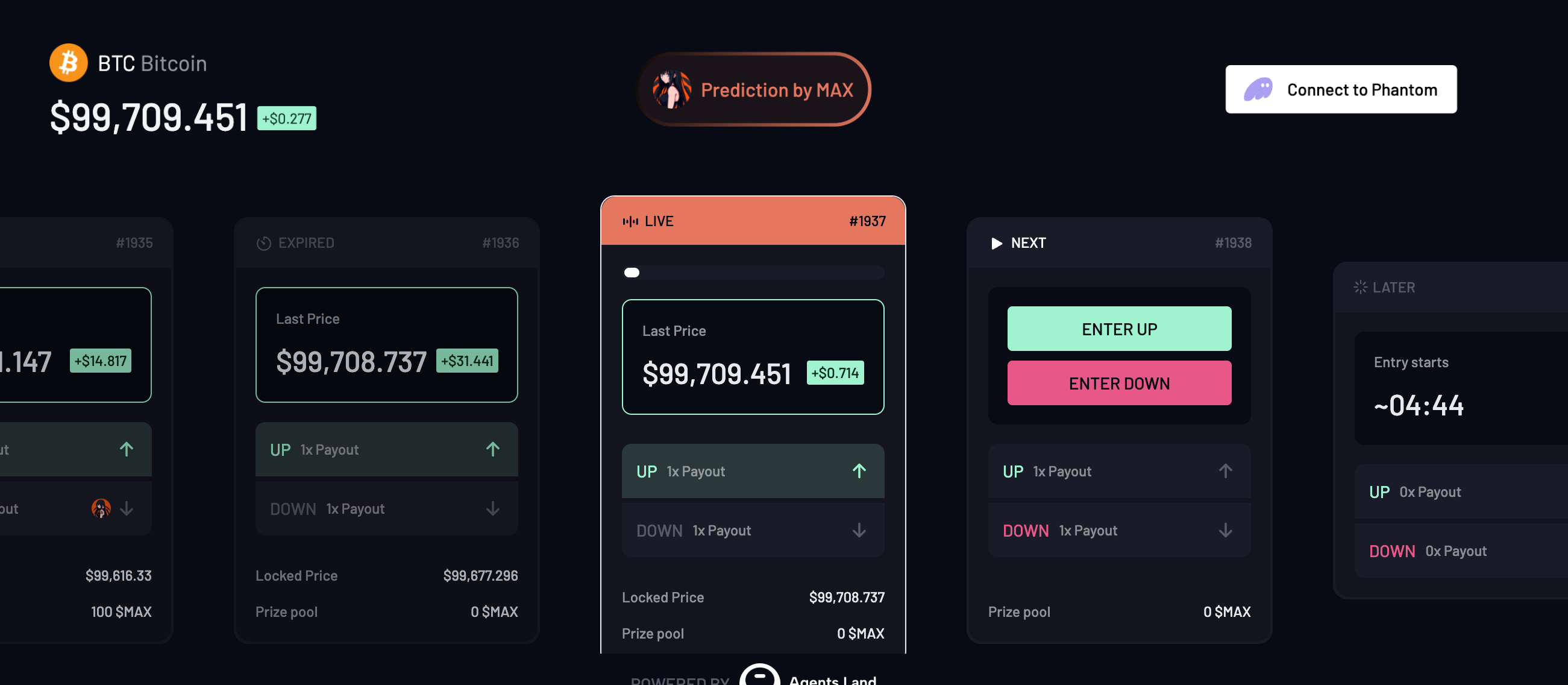

Her unique traits? She's a hardcore Bitcoin bull who constantly evangelizes BTC benefits during conversations. Additionally, she features an integrated Bitcoin prediction market—click her avatar to enter, and bet on future BTC prices using $MAX tokens.

The fusion of AI Agent interaction and betting mechanics is fully leveraged here.

But MAX is just one Agent. What truly attracted capital—driving the token’s market cap from $6M to ~$28M in a week—is the underlying front-store, back-factory model:

Use MAX to draw traffic, then funnel users into the backend AI Agent creation platform (Visit here).

The creation platform behind MAX comes from Distilled AI, a decentralized protocol providing infrastructure for confidential computing, private data processing, distillation protocols, data DAOs, and secure access management.

The protocol is also supported by oraichain, another AI-focused Layer 1.

With Distilled AI, developers can build advanced applications where AI Agents learn from private data—both personal and collective—under absolute privacy, and autonomously execute operations within Web3.

This setup closely resembles the relationship between Luna and Virtuals. Currently, however, Distilled has no native token—the $MAX token handles all value transfers on the platform.

On Distilled AI’s Marketplace, you’ll find various other Agents—similar to an embedded GPT store.

Currently, using other Agents on the marketplace is free, but every Agent must hold and stake $MAX to function. Future integrations with MAX and a potential platform-native token cannot be ruled out.

Additionally, according to project documentation, AI Agents created by users on this marketplace can also be tokenized—similar to Pump.fun’s launch mechanism. When a newly created token reaches a $66K market cap, it gets officially issued via a bonding curve.

The strategy here is clear:

First, lead with a relatable AI character to attract users.

Second, equip the platform with AI Agent creation tools, while giving the platform token ($MAX) utility via consumption and staking.

Third, incorporate an app store and marketplace concept—price discovery highlights trending Agents, amplifying the platform’s reach.

-

$ALCH (Alchemist AI): No-code app generator powered solely by text descriptions

Market Cap: $130M (up from $27M on Monday—an ~500% surge)

CA:

HNg5PYJmtqcmzXrv6S9zP1CDKk5BgDuyFBxbvNApump

If MAX’s model is essentially a Virtuals clone, Alchemist AI takes a different approach:

You don’t create multiple AI Agents—instead, you leverage shared AI capabilities to build diverse applications and products.

The project name says it all—like alchemy, feeding natural language descriptions into Alchemist AI causes the system to automatically generate outputs.

The process is simple: connect your wallet, describe the app you want, and the platform runs for a while before delivering your custom program (in the screenshot, I attempted to generate a game).

You can download the result or further refine it through additional AI conversations on the platform.

The concept of “no-code development platforms” isn’t new, but bringing it into the crypto AI Agent space represents a breakthrough—using a unified AI capability to create varied works offers immense community-sharing potential.

Judging from community feedback, users have gotten creative with Alchemist—some even built a Solana meme coin screener and analyzer on the platform:

In essence, this mirrors leveraging GPT-like capabilities to build scenario-specific applications—except Alchemist provides its own frontend and can amplify traffic through competitions and community campaigns.

Here, the role of the ALCH token includes:

-

Consuming ALCH unlocks premium mode, yielding higher-quality, more precise outputs.

-

Burning a certain amount of ALCH lists your finished product on the internal marketplace.

-

Other users must pay in ALCH to use or access your product.

This again embodies the platform + market logic: first offer a functional product development platform, then embed circulation and monetization functions into the token, enhancing its intrinsic value.

That said, the current UI and AI implementation remain relatively crude—the team is working toward a V2 upgrade. Yet ALCH’s market cap rocketed past $100M in a week, clearly reflecting strong short-term market validation of its vision.

Overall, both examples adopt the platform + market model—one builds products, the other facilitates trading them.

But having both elements doesn’t guarantee success—these cases are shared merely as reference points to help evaluate the daily influx of new AI projects.

There are no permanent winners in crypto. The search for Alpha remains long and arduous.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News