Is Polymarket a fleeting phenomenon driven by election fever, or can it sustain long-term existence?

TechFlow Selected TechFlow Selected

Is Polymarket a fleeting phenomenon driven by election fever, or can it sustain long-term existence?

Polymarket has rapidly risen by capitalizing on election fervor and the trading appeal of non-political events, but its future growth still depends on regulatory compliance and market diversification.

Written by: mattsolomon

Translation: Baicai Blockchain

How did Polymarket turn election forecasting into a billion-dollar bet? @animocaresearch's latest report offers some insights—here’s a concise summary.

1. What is Polymarket?

@Polymarket is a blockchain-based prediction market platform where users trade on the outcomes of future events.

Unlike traditional betting, Polymarket allows participants to buy and sell shares in whether an event will occur. The price of "YES" shares reflects the market’s consensus probability of that event happening.

-

Prediction Mechanism: Trading is peer-to-peer, with real-time pricing based on user orders.

-

Token Usage: Transactions use USDC, and ERC-1155 tokens represent predictions.

2. Polymarket’s Popularity and Influence Are Rapidly Rising

Since its founding in 2020, Polymarket has experienced explosive growth—especially during U.S. election cycles:

-

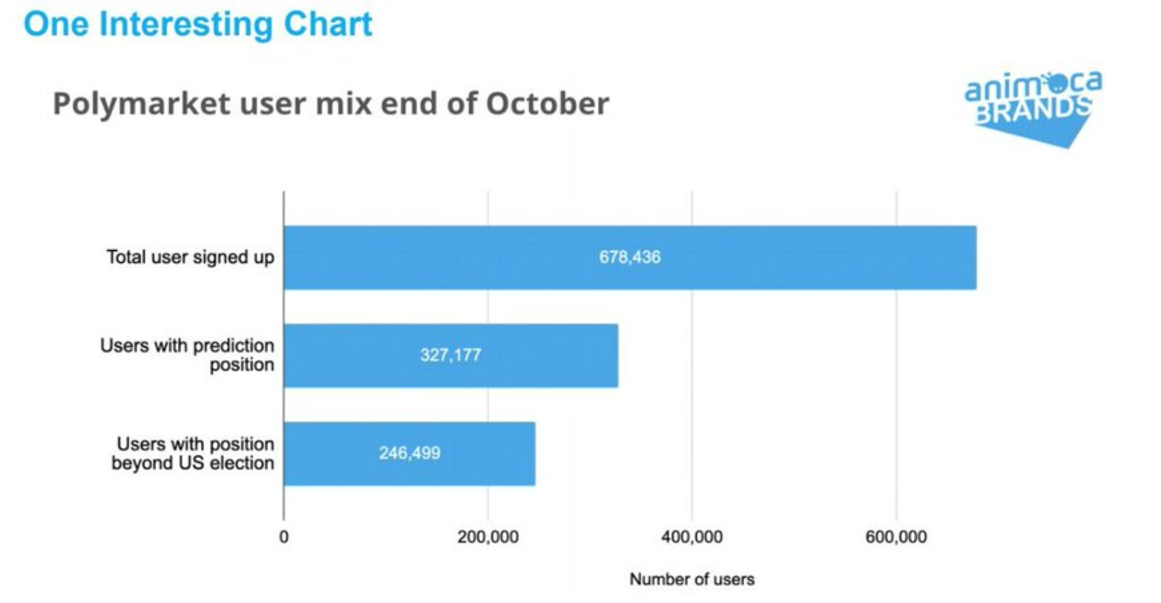

User Engagement: Over 300,000 new users joined in October 2024 alone.

-

Public Attention: Covered by major outlets like The Wall Street Journal and Bloomberg, and even mentioned by figures such as Trump.

-

Traffic: Reached 35 million visits in October, rivaling top-tier gambling websites.

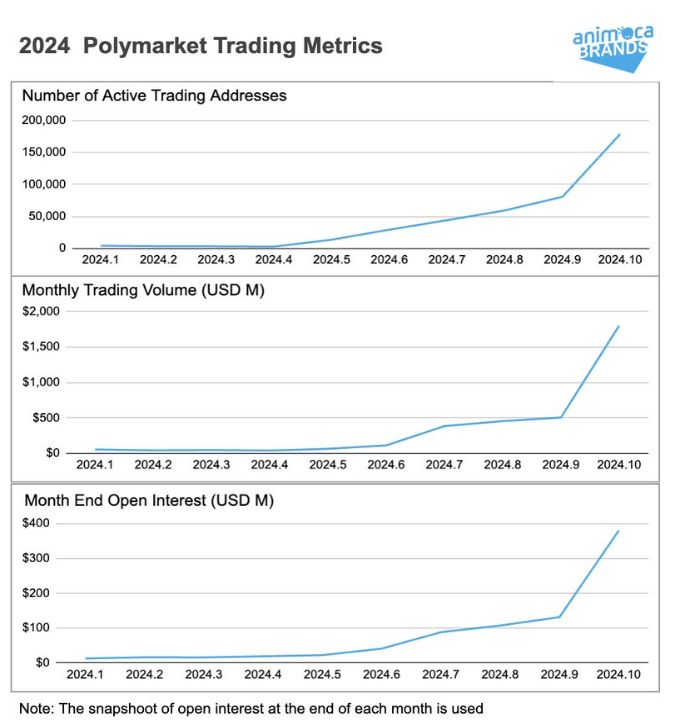

Trading Volume Insights – Polymarket’s trading volume surged dramatically:

• Volume Surge: Jumped from $40 million in April 2024 to $2.5 billion in October.

• Open Interest: Rose from $20 million to $400 million, comparable to major decentralized exchanges (DEXs) like SushiSwap.

• Event Focus: While election markets dominate, non-election categories like sports have also attracted significant trading activity.

3. The Founder’s Story

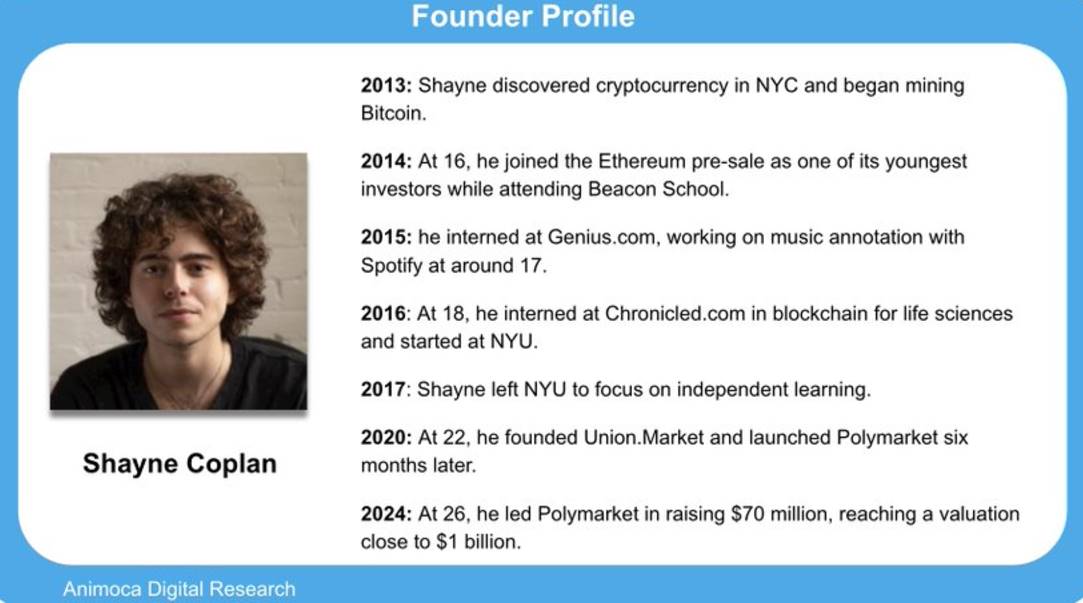

Shayne Coplan, founder of Polymarket, has a compelling background:

-

Early Start: Began mining Bitcoin at age 15 in New York; invested in Ethereum at 16.

-

Entrepreneurial Path: Dropped out of NYU in 2017 to focus on Web3 projects, then founded Polymarket in 2020.

-

Leadership: Guided the company through regulatory challenges and recently reached a near-billion-dollar valuation after new funding.

4. Is Polymarket Just a Temporary Election Phenomenon—or Here to Stay?

Although its growth is closely tied to the U.S. election:

-

Beyond Elections: A large number of users actively trade on non-political events, indicating broader appeal.

-

Regulatory Compliance: Successfully navigating regulatory scrutiny suggests potential for sustained operations.

-

Community and Media Integration: It has become embedded in media consumption habits, signaling long-term viability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News