Solana vs Ethereum: A Comparative Analysis Based on Data, Market Sentiment, and Catalysts – Can Solana Stage a Comeback?

TechFlow Selected TechFlow Selected

Solana vs Ethereum: A Comparative Analysis Based on Data, Market Sentiment, and Catalysts – Can Solana Stage a Comeback?

This article will analyze whether Solana has the potential to surpass Ethereum based on multiple factors including data, market sentiment, perception, and narratives.

Author: Michael Nadeau, Founder of The DeFi Report

Translation: Glendon, Techub News

Editor's Note: In this market cycle, Solana has surged forward, with its native token SOL reaching a record high of 264 USDT. By contrast, Ethereum appears to have stagnated. Moreover, compared to July this year, Solana’s market cap as a percentage of Ethereum’s has risen from 17% to nearly 30%. Since the December 2022 lows, SOL has achieved an astonishing 25x increase, while ETH has only gained 1.7x. Is Ethereum losing momentum, or has it simply not yet begun to rise? This is a question worth exploring. This article analyzes whether Solana has a chance to surpass Ethereum—and what catalysts could drive Ethereum’s price higher—based on data, market sentiment, perception, and narrative.

Looking back to January 2023, Solana’s market capitalization was merely 3% of Ethereum’s, a gap that seemed insurmountable. However, by July of this year, that gap had clearly narrowed, with Solana’s market cap rising to 17% of Ethereum’s. At that time, we asked: “Should SOL’s market cap really be 83% lower than ETH’s?” Fundamental data suggested otherwise.

Since then, the market has revalued SOL, pushing its market cap to nearly 30% of Ethereum’s. Faced with this shift, I now ask again: Should SOL’s market cap still be 70% lower than ETH’s?

And is the market still in disarray? Let’s dive deeper.

SOL vs. ETH (and Top L2s):

Data Comparison

When comparing Solana and Ethereum, one critical variable stands out—the Layer 2 networks (L2s): Arbitrum, Base, Optimism, Blast, Celo, Linea, Mantle, Scroll, Starknet, zkSync, Immutable, and Manta Pacific.

Our view is that these L2s not only generate new demand for Ethereum L1 block space but also strengthen ETH’s network effects as a core asset. Therefore, including these L2s in our comparison provides a more comprehensive and insightful perspective when evaluating Solana against Ethereum.

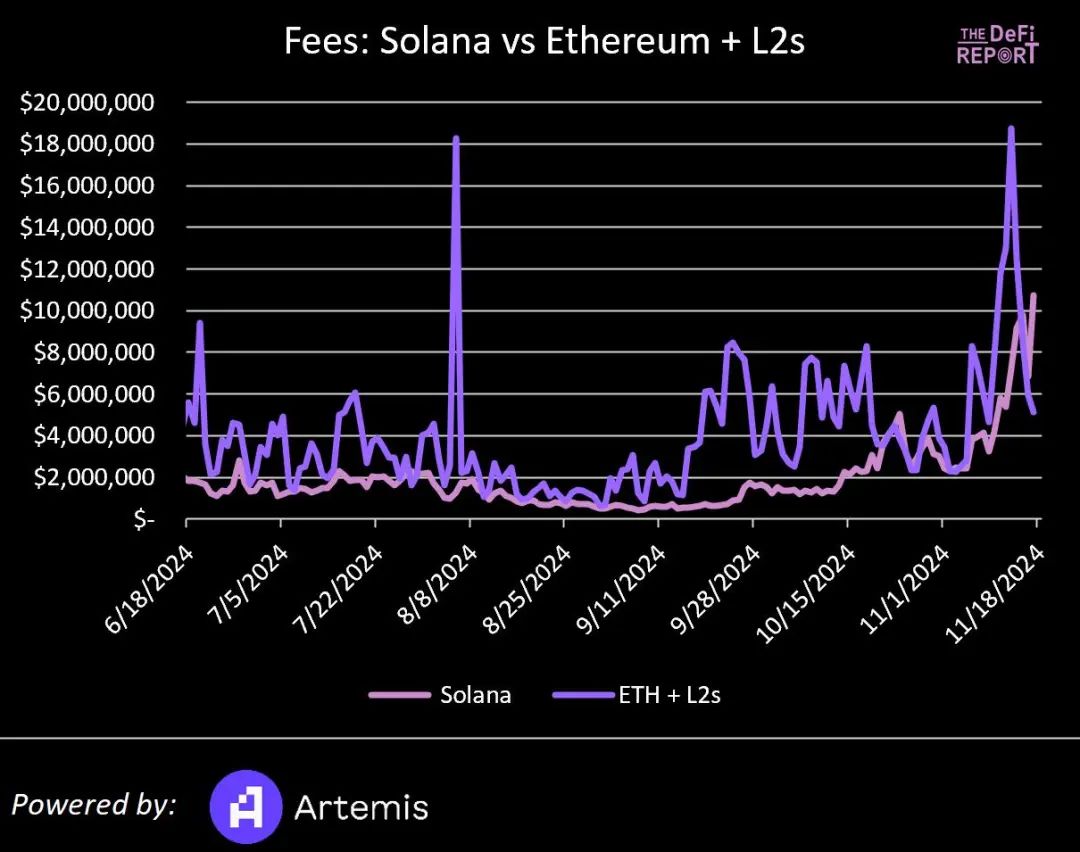

Fees

In Q2 2024, Solana generated $151 million in fee revenue, approximately 27% of the combined fees from Ethereum and top L2s.

Over the past 90 days, Solana’s fee revenue reached $192 million, accounting for about 49% of the total fees from Ethereum ($374 million) and top L2s ($210 million).

Note: These figures include only gas fees, excluding MEV (Maximal Extractable Value).

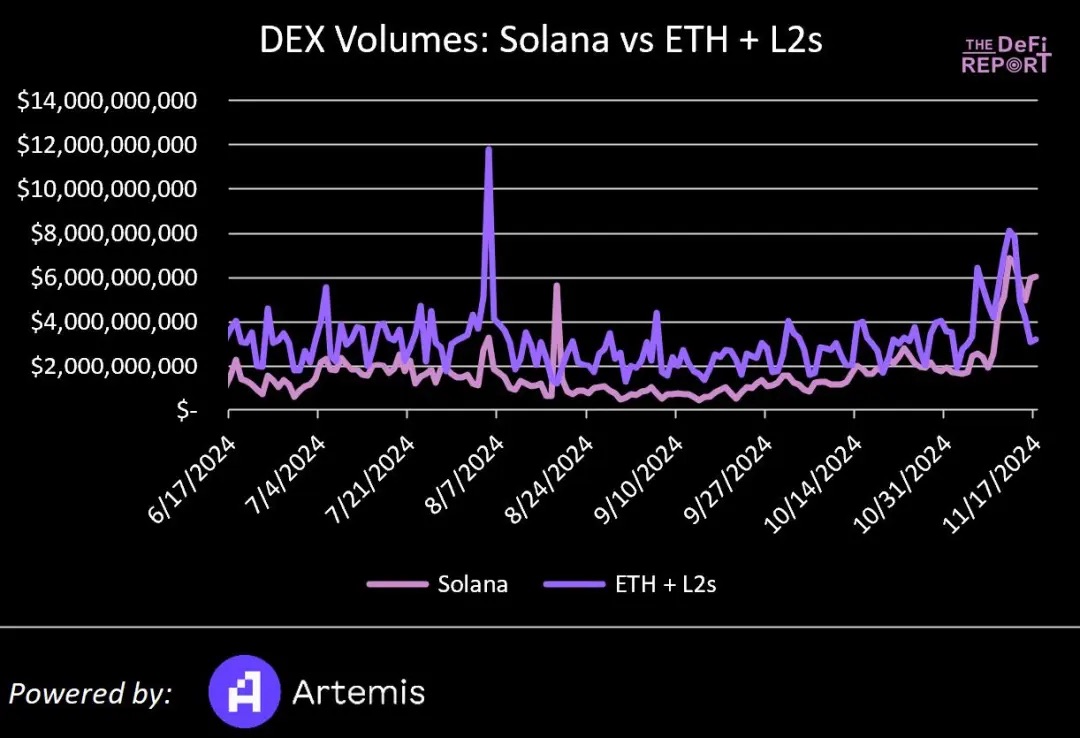

DEX Volume

Solana’s DEX volume reached $108 billion in Q2 2024, roughly 36% of the combined DEX volume on Ethereum and top L2s.

In the past 90 days, Solana’s DEX volume increased to $153 billion, representing about 57% of Ethereum’s ($125.5 billion) and top L2s’ ($145 billion) combined volume.

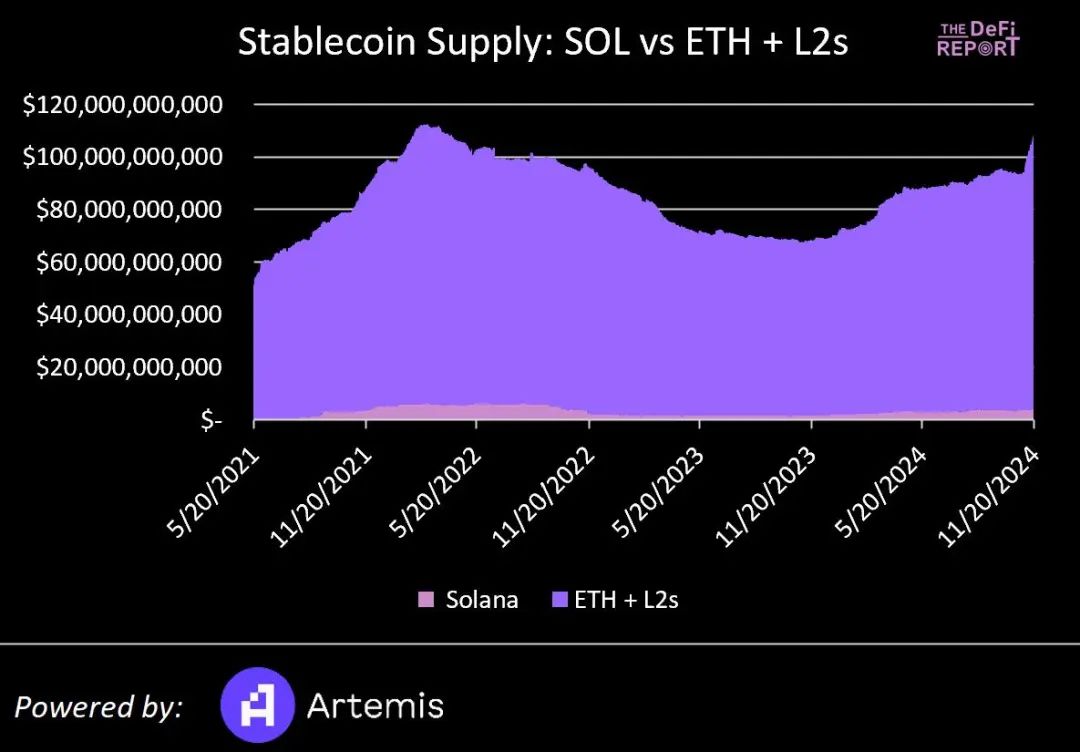

Stablecoin Supply

In July 2024, Solana’s stablecoin supply was approximately $3.1 billion, about 3.5% of the total stablecoin supply across Ethereum and L2s.

Currently, it has grown to $4.3 billion, making up 4.1% of the combined stablecoin supply on Ethereum and L2s.

Note: Arbitrum’s stablecoin supply exceeds Solana’s, while Base’s stablecoin supply reaches 80% of Solana’s.

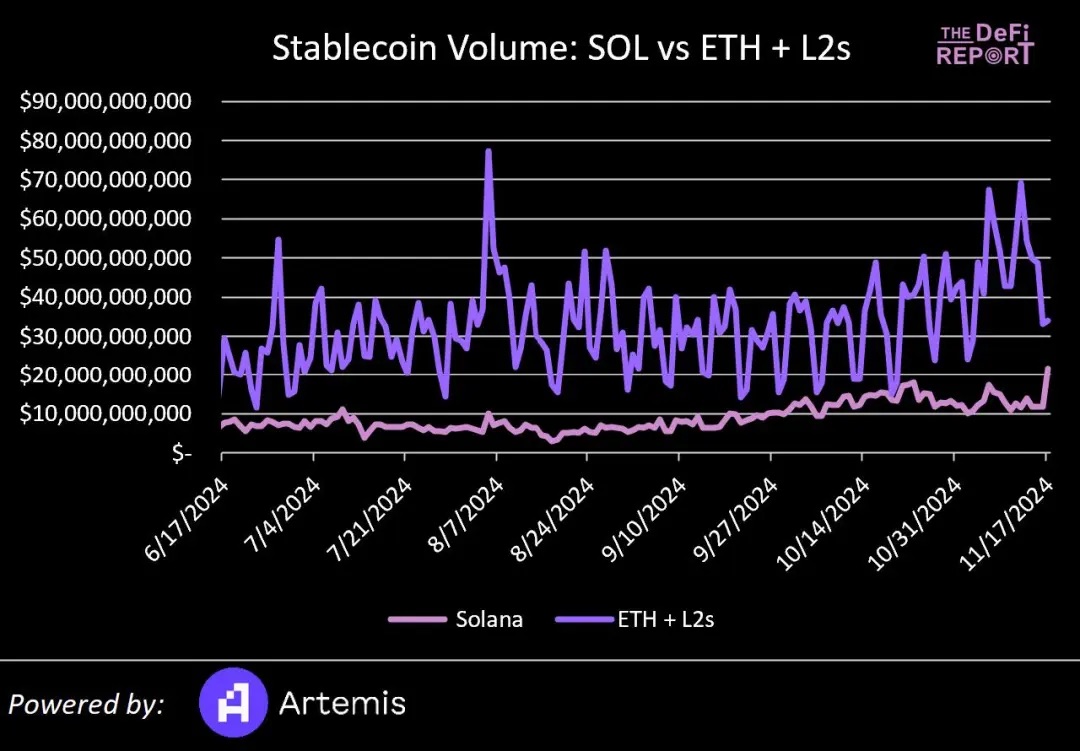

Stablecoin Transaction Volume

Solana’s stablecoin transaction volume hit $4.7 trillion in Q2 2024—1.9 times that of Ethereum and top L2s combined.

However, over the past 90 days, Solana’s stablecoin transaction volume dropped to $963 billion—about 30% of Ethereum’s ($1.9 trillion) and top L2s’ ($1.26 trillion) combined volume.

Why did Solana’s volume decline?

We believe Q2’s surge was primarily driven by wash trading and bot/algorithmic trading.

According to Artemis data, only about 6% of Solana’s stablecoin transactions were peer-to-peer transfers. On Ethereum L1, this figure is close to 30%, indicating significantly higher non-speculative usage on Ethereum compared to Solana.

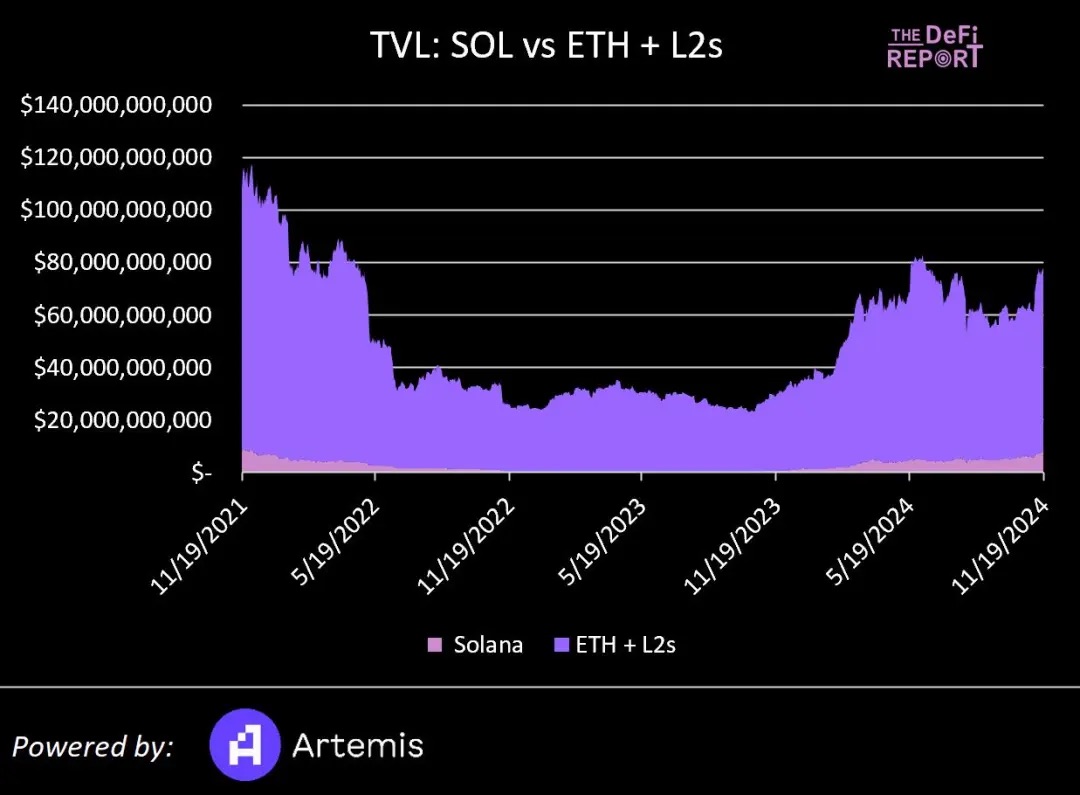

TVL

At the end of Q2, Solana’s TVL stood at $4.2 billion, about 6.3% of Ethereum’s ($60.3 billion) and top L2s’ ($9.5 billion) combined TVL.

Now, Solana’s TVL has risen to $8.2 billion, representing 12% of the combined Ethereum + L2 TVL.

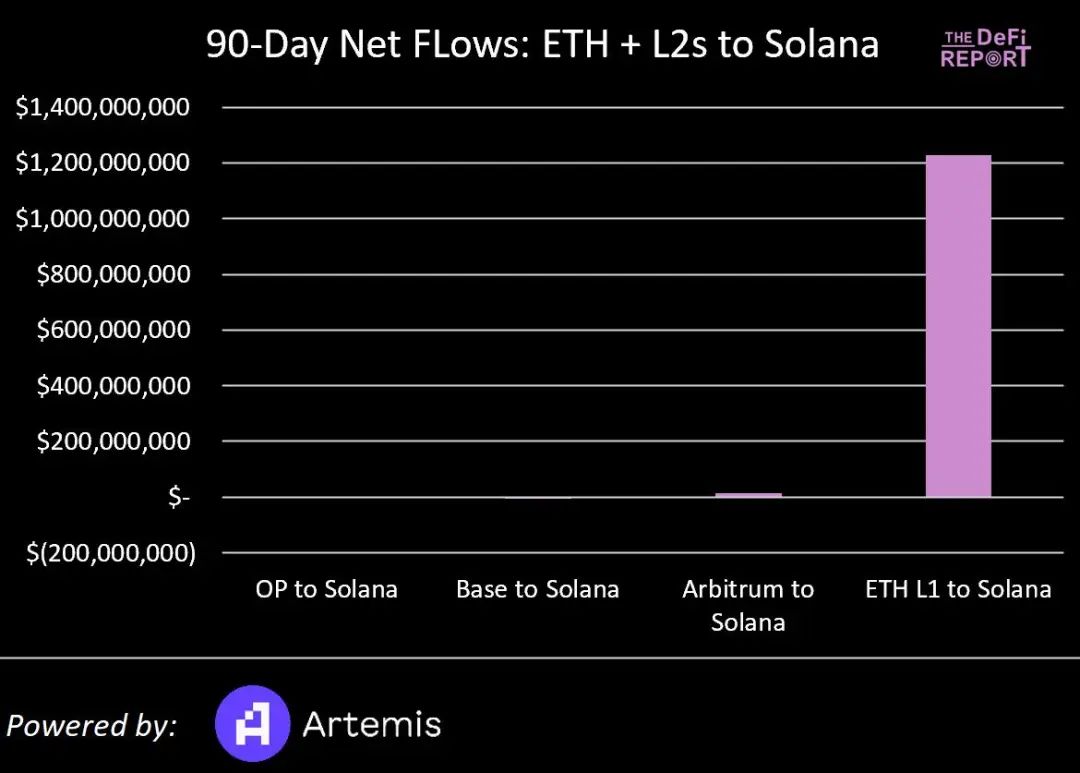

Capital Flows

In the past 90 days, Solana attracted over $1.2 billion in TVL from Ethereum, equivalent to about 2% of Ethereum L1’s TVL. During the same period, it pulled $14 million from Arbitrum.

Meanwhile, Solana lost some TVL to OP ($540k) and Base ($5 million).

Summary of Solana’s 90-Day Performance:

1. Accounts for 49% of Ethereum’s fee revenue (up from 27% at Q2 end).

2. Represents 57% of Ethereum’s DEX volume (up from 36% at Q2 end).

3. Holds 4.1% of Ethereum’s stablecoin supply (up from 3.5% in Q2).

4. Accounts for 30% of Ethereum’s stablecoin transaction volume (down sharply from 190% at Q2 end).

5. Represents 12% of Ethereum’s TVL (up from 6% at Q2 end).

6. Attracted slightly under 2% of Ethereum’s TVL.

Again, the market now prices SOL at nearly 70% of Ethereum’s market cap. We’ll explore the validity of this valuation later. First, let’s turn to more qualitative analysis.

Market Sentiment, Perception, and Narrative

In crypto, price often leads fundamentals, narratives, and awareness. Given the price movements of SOL and ETH, current narratives might suggest Solana is poised to overtake Ethereum.

The reality, however, is that Solana currently functions largely as a memecoin casino. True projects like Helium and Hivemapper do exist on Solana, but the current price action (and fundamentals) are heavily driven by this casino dynamic. Anecdotally, this perception is beginning to influence Wall Street’s view of the blockchain.

Thus, although the current narrative favors Solana, we should anticipate this may soon change. If Ethereum rebounds in 2025, the narrative could swiftly shift from “Ethereum is dead” to “Ethereum is the future of finance.”

Concurrently, Solana’s association with the memecoin casino could negatively impact its broader perception and long-term narrative.

Catalysts

Ethereum

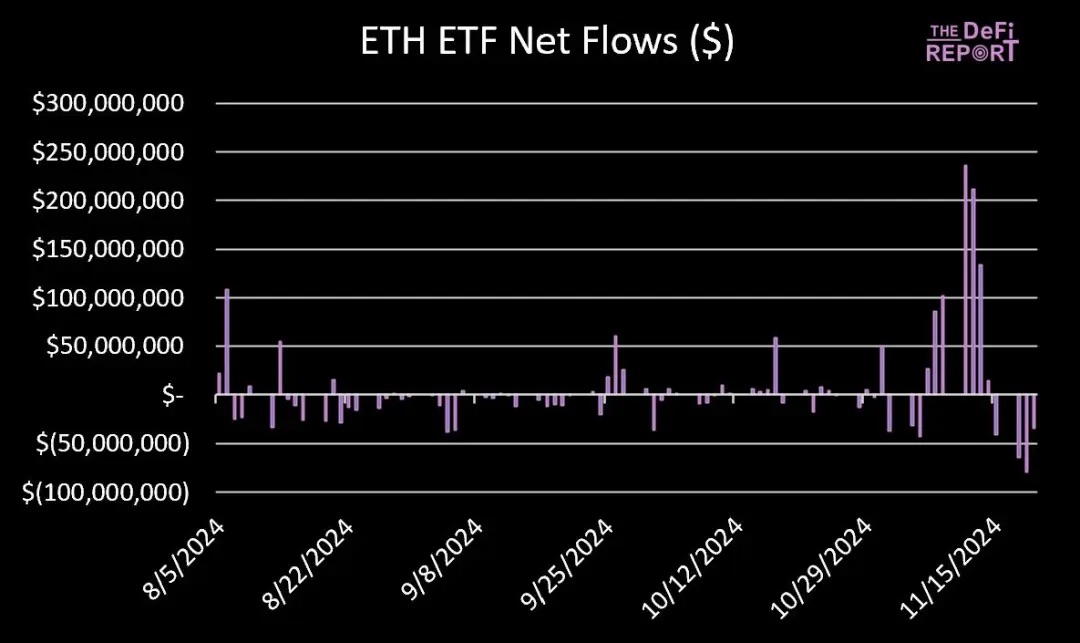

Exchange-Traded Funds (ETFs)

Ethereum spot ETFs have recently started seeing inflows, though modest compared to Bitcoin spot ETFs. As of November 20, net inflows into Ethereum spot ETFs totaled $469 million—just 1.7% of Bitcoin ETF inflows—far below our initial expectation of capturing 10–20% of Bitcoin’s flow.

This divergence from expectations is significant, but unlikely to persist. We still believe capital will rotate into Ethereum as the market cycle matures.

DeFi and Real-World Assets (RWA)

As global regulatory clarity improves, we expect growing interest in DeFi and RWA narratives. If so, firms like BlackRock may push further tokenization of funds on-chain.

There are three reasons: 1. They aim to tokenize existing assets to improve efficiency in blockchain-based accounting and administration; 2. They seek to capture fees tied to transforming traditional financial services; 3. BlackRock has strong incentives to enhance Ethereum’s utility as new financial infrastructure, paving the way for legitimizing its own ETF products.

As more funds become tokenized, we may see new use cases emerge in “permissioned DeFi” focused on asset trading.

In fact, if Ethereum shows strong price momentum now, a new narrative positioning it as “Wall Street’s chain” could quickly take hold.

Coinbase and Base

Among Ethereum L2s, Base stands out with rapid growth in fees, active users, and stablecoin transaction volume—making it the fastest-growing L2. Given Base’s profitability for Coinbase (~$68 million YTD), it may serve as a blueprint for other financial institutions launching their own L2s on Ethereum.

Imagine if giants like JPMorgan Chase (JPM), BlackRock, Fidelity, or Robinhood announced their own Ethereum L2s—what would happen?

Clearly, this would further reinforce Ethereum’s potential as “Wall Street’s chain.”

Solana Memecoin Frenzy

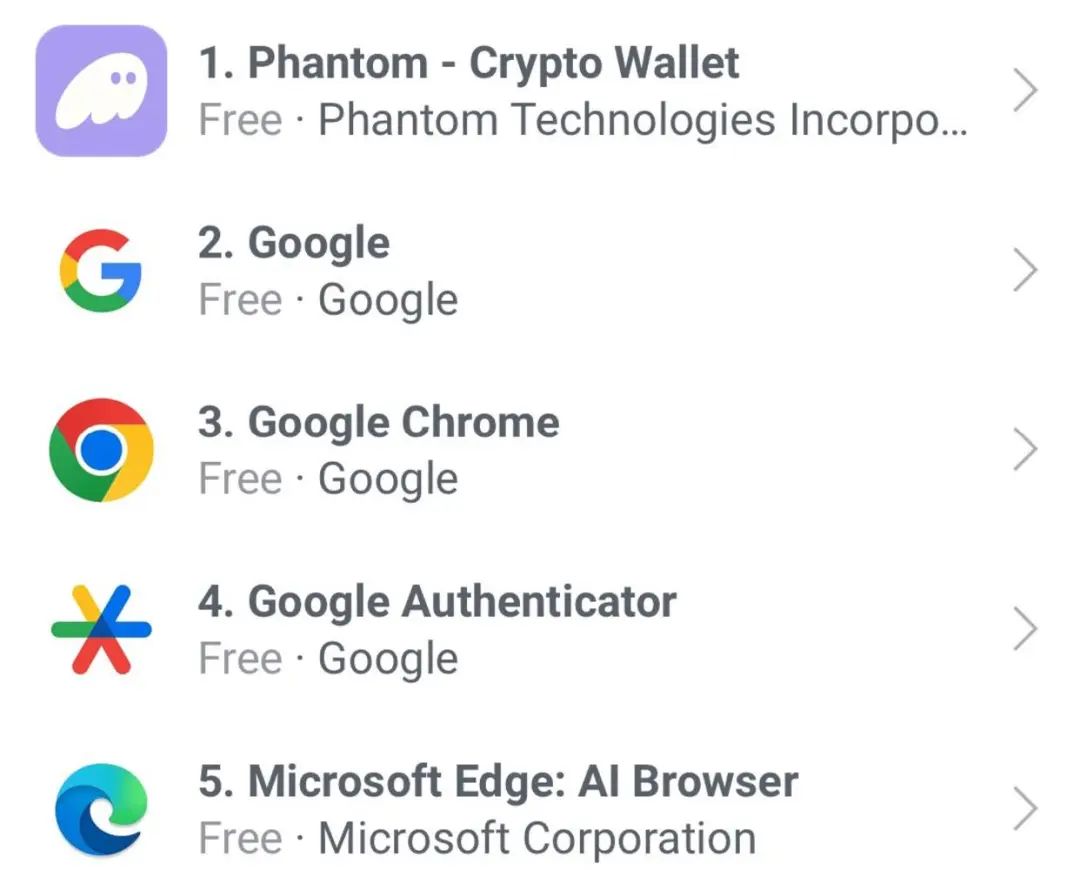

Phantom recently surpassed Google to become the #1 free utility app on Apple’s App Store.

This is a clear signal that Solana is drawing massive new user adoption into crypto. It’s also a sign of market overheating.

The next question: How much room for growth remains?

Retail investors have indeed entered the market, though participation is smaller than in the previous cycle. One way to measure this is through viewership on popular crypto YouTube channels. The chart below shows current activity is still about 50% below peak levels of the last cycle.

While we believe this number could reach extreme levels once Bitcoin hits $100K, we remain cautious in the near term.

SOL ETF?

Regarding a SOL ETF, Cboe has submitted four Solana spot ETF applications to the SEC, filed by VanEck, 21 Shares, Canary Capital, and Bitwise. With anticipated changes at the SEC, we could potentially see SOL spot ETF approvals as early as next year. However, unlike Bitcoin and Ethereum, SOL lacks a regulated U.S. futures market—a key criterion emphasized by the SEC in approving BTC and ETH ETFs.

Thus, the risk here is that positive headlines could become a classic “buy the rumor, sell the news” event—as we’ve seen so far with Ethereum ETFs. (Techub News note: “Buy the rumor, sell the news” refers to a trading strategy where investors act on unconfirmed information or rumors and sell once the news is confirmed, locking in profits.)

Firedancer

Firedancer is crucial for Solana’s future development.

Firedancer is a new validator client for Solana developed by Jump Crypto. It promises significant improvements in performance, reliability, and scalability by supporting concurrent transaction processing. It will also boost overall network efficiency and reduce operational costs for node operators.

Most importantly, Firedancer will eliminate Solana’s current single point of failure (SPOF), reducing the risk of network outages. (Techub News note: A single point of failure is a system component whose failure would bring down the entire system. Solana uses a unique consensus combining Proof of History (PoH) and Proof of Stake (PoS), designed for high performance but potentially introducing SPOF risks.)

Firedancer is expected to be ready for mainnet deployment in 2025. While we believe it will greatly benefit Solana long-term, it may not serve as a major price catalyst within this cycle.

Decentralized Physical Infrastructure Networks (DePIN)

The DePIN narrative has yet to gain real traction. Helium, a decentralized wireless network, is up 147% YTD but still 43% below its all-time high. Hivemapper, a decentralized mapping network, is up 164% YTD but remains 80% below its peak. Compared to July, our confidence in the DePIN sector has weakened. Meanwhile, we observe that memecoins (and to some extent Bitcoin) are siphoning attention and liquidity from other sectors.

Social Media

In July, I wrote that a social media app integrating crypto via celebrities and influencers could break into the mainstream. While this remains possible, “attention economics” is currently being expressed through memecoins. A shift away from this trend seems unlikely in the short term.

Conclusion

Should SOL’s market cap really be 70% lower than ETH’s?

Considering the following:

-

SOL/ETH at all-time highs

-

Market pricing of SOL relative to ETH has increased tenfold over recent years

-

SOL is up 25x from its December 2022 low, while ETH is only up 1.7x

-

Solana’s on-chain fundamentals are largely driven by memecoin trading

We lean toward viewing SOL’s relative valuation as reasonable. But the key question remains: Can SOL continue to outperform—or even surpass—Ethereum?

In our July report, we expected Ethereum ETFs to outperform SOL post-launch and predicted SOL’s market cap would peak around 25% of Ethereum’s in this cycle. However, both predictions proved inaccurate: Ethereum ETFs behaved more like a “sell the news” event (though we still firmly believe demand will come eventually), while SOL continued rising alongside Bitcoin.

Currently, Bitcoin has surged significantly over recent weeks. We expect some volatility and pullbacks before year-end, but overall, the market still holds upside potential into 2025.

Historically, in the last cycle, Bitcoin peaked in Q4 2020, while Ethereum peaked in early February 2021—then rose 5.4x over the first four months of that year.

Again, in crypto, price leads, and narrative follows.

We may see a similar pattern this cycle. If so, we could witness a positive shift in Ethereum’s sentiment and narrative in 2025.

Meanwhile, Solana—as the “retail casino / memecoin chain”—may face headwinds.

Of course, the counterargument exists: “What performs well early in a crypto cycle tends to maintain momentum later”—which supports continued strength in SOL.

In conclusion, we believe the market has already substantially re-evaluated SOL’s valuation relative to ETH, and current fundamentals broadly align with this relative pricing. Yet, the path ahead remains uncertain. What happens next? Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News