Willy Woo: What are the potential liquidation risks for MSTR?

TechFlow Selected TechFlow Selected

Willy Woo: What are the potential liquidation risks for MSTR?

Convertible bonds might be MicroStrategy's only current liquidation risk.

Author: Willy Woo

Translation: Shaofaye123, Foresight News

On MicroStrategy (MSTR) Convertible Bond Risks

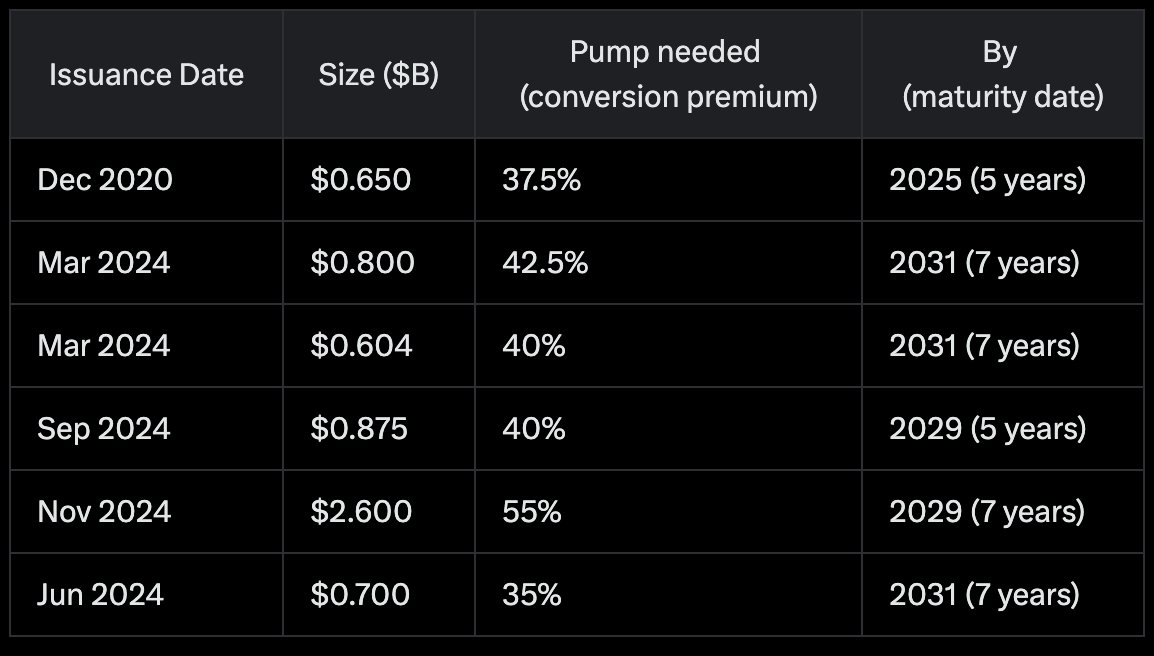

Currently, the only liquidation risk I can see is its issued convertible bonds:

-

If convertible bondholders do not convert into shares before maturity, MSTR will have to sell BTC to repay debt holders.

-

This would occur if MSTR fails to achieve more than a 40% increase within 5–7 years (varies by each bond—see table below). Essentially, either MSTR’s correlation with BTC fails, or BTC itself fails.

Other risks of varying degrees include:

-

Competitive risk—other companies copying and replicating, reducing MSTR's premium over net asset value;

-

Risk of SEC intervention in future purchases, reducing MSTR's premium over net asset value;

-

Custody risk with Fidelity and Coinbase;

-

Risk of U.S. nationalization (seizure of BTC);

-

Key person risk involving Saylor;

-

MSTR operational risk;

Final note: please be aware that the convertible notes table, while providing a general idea, is not accurate as I used Grok AI to generate it.

Other Questions About MSTR

Question One: Why doesn't MSTR have self-custody rights?

Willy Woo: The exact custody arrangements have not been disclosed. As far as we know, MSTR may hold co-signing rights under a multisignature arrangement. This is a prudent approach.

Question Two: Could MSTU and MSTX be liquidated and harm MSTR?

(Translator’s note: MSTU invests in T-Rex 2X Long MSTR Daily Target ETF; MSTX invests in Defiance Daily Target 2X Long MSTR ETF. These two ETFs have accumulated over $600 million and $400 million in assets respectively.)

Willy Woo: MSTU/MSTX = higher risk. The 2x leverage is achieved through paper bets on MSTR, with liquidation levels close to immediate liquidation (also, no claim on actual BTC).

Note: derivative positions dilute BTC value.

Additionally, due to volatility drag, holding long-term does not result in 2x returns (losses are more costly than gains).

Question Three: What if a large number of shareholders simultaneously sell due to external events (e.g., stock market downturn)?

Willy Woo: This is only a short-term impact. In the long run, markets always trend toward higher prices, so this isn't a real risk. Debt holders can wait up to 5–7 years after purchasing the notes to convert. As long as Bitcoin exceeds the initial price by more than 40% within 1–2 macro cycles, there is no issue.

Question Four: Are leveraged ETFs gaining exposure via options rather than swaps?

Willy Woo: Volatility arbitrage desks at TradFi hedge funds perform such operations daily. $70 million is very small—given mispricing in the options market, this amount is sufficient to support trading volume on any given day.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News