BTC Oscillating Between $66K–$70K – Weekly Precise Level Analysis

TechFlow Selected TechFlow Selected

BTC Oscillating Between $66K–$70K – Weekly Precise Level Analysis

Strategically, maintain flexibility, control position sizing, and primarily adopt a “sell high, buy low” approach while closely monitoring breakout signals triggered by macroeconomic data.

Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization stands at $2.36 trillion, with BTC accounting for 58.3% ($1.37 trillion). The stablecoin market cap totals $30.79 billion, up 2.16% over the past seven days; USDT represents 59.66% of this.

Among the top 200 projects on CoinMarketCap, half rose and half fell over the past week: BTC declined 1.99%, ETH fell 1.5%, SOL dropped 3.64%, PIPPIN surged 229.46%, and H jumped 56.35%.

This week, U.S. spot Bitcoin ETFs recorded net outflows of $358.9 million; U.S. spot Ethereum ETFs saw net outflows of $161 million.

Market Outlook (Feb 16–22):

BTC: $66,000–$70,000

ETH: $1,880–$2,120

SOL: $75–$100

The current RSI stands at 55.7 (neutral zone); the Fear & Greed Index is at 8 (extreme fear, down from last week); the Altcoin Season Index is at 45 (neutral, up from last week).

Markets received a strong rebound this Friday, triggered by regulatory tailwinds—boosting short-term sentiment. However, clear technical resistance looms overhead. Next week, markets are expected to first consolidate before choosing direction, guided by both digesting recent positive news and upcoming macroeconomic data. Traders should therefore remain flexible, manage position sizes prudently, and focus on selling high and buying low—while closely monitoring breakout signals driven by macro data.

Next week’s market action won’t unfold in isolation. Key variables to watch include:

- Macroeconomic Data: Monitor U.S. economic releases and Fed officials’ commentary—any hint regarding interest-rate policy will impact risk assets.

- ETF Flows: Whether Friday’s rebound attracts institutional capital back into ETFs will determine its sustainability. Continued large outflows next week could derail the rally.

- Regulatory Developments: Treasury Secretary’s remarks this week delivered major positive momentum. Next, watch congressional progress on the Digital Asset Market CLARITY Act.

Understanding the Present

Weekly Recap of Major Events

- On Feb 8, crypto journalist Eleanor Terrett revealed details of the White House crypto meeting scheduled for next Tuesday. This marks the second round of such meetings, remaining at the staff level—no CEOs will be invited—but senior policy personnel from major banks will attend.

- On Feb 8, Yi Lihua, founder of Liquid Capital (formerly LD Capital), announced on Trend Research—the research arm under his leadership—that it had fully liquidated its ETH holdings. He stated: “First, acknowledge that market cycles remain valid. In this new phase—where U.S. equities remain robust and digital asset treasuries (DAT) coexist alongside ETFs—the crypto consensus remains intact, despite the market’s susceptibility to manipulation. Conversely, entering a bear market may represent the optimal time to strategically accumulate—just as we reaped rewards from our bear-market positioning in the prior cycle. The future remains bright. We continue to believe strongly in the next bull cycle—and remain committed to building. Pessimists are right; optimists win.”

- Trend Research fully liquidated its ETH position, incurring an estimated total loss of ~$688 million.

- On Feb 8, Etherscan data showed Ethereum’s daily transaction count surged to 2,896,853—the highest ever recorded.

- On Feb 10, Vitalik Buterin, Ethereum co-founder, published a systematic reflection on the convergence of Ethereum and AI. He emphasized that AGI pursuit must avoid “indiscriminate acceleration,” instead deeply integrating crypto and AI values to build an AI future that advances human freedom, security, and decentralized collaboration.

- On Feb 9, even as Bitcoin rebounded toward $70,000, its derivatives market continued flashing warning signs: traders maintained defensive positions, with virtually no new long entries.

- On Feb 9, even as Bitcoin rebounded toward $70,000, its derivatives market continued flashing warning signs: traders maintained defensive positions, with virtually no new long entries.

- On Feb 11, LayerZero officially launched Zero—a new Layer-1 blockchain network.

- On Feb 11, according to CoinDesk, Le Jae-won, CEO of Korean exchange Bithumb, disclosed that due to inadequate internal controls, the platform mistakenly deposited over $40 billion worth of Bitcoin into customer accounts—intending only to distribute ~$428 per user. Most funds have since been recovered.

- Bithumb acknowledged a severe internal system flaw caused an erroneous transfer of ~$40 billion in Bitcoin to customers. The incident briefly triggered a 17% crash in Bitcoin’s price on Bithumb and prompted an investigation by Korea’s Financial Supervisory Service. It also exposed serious weaknesses in Bithumb’s asset-matching and account-isolation controls. While most Bitcoin has been recovered, 1,786 BTC sold before account freezes remain unrecovered—further fueling legislative concerns about regulatory gaps.

Macroeconomic Highlights

- Feb 10: U.S. December retail sales MoM came in at 0%, below the 0.4% forecast.

- Feb 11: U.S. January unemployment rate stood at 4.3%, slightly lower than the 4.40% forecast and unchanged from the prior reading of 4.40%.

- Feb 12: U.S. initial jobless claims for the week ending Feb 7 totaled 227,000—above the 222,000 forecast and revised upward from the prior 231,000 to 232,000.

- Feb 13: U.S. January unadjusted CPI YoY declined to 2.4% from 2.7%, hitting the lowest level since May 2025; the median market expectation was 2.5%.

- Feb 13: According to CME’s “FedWatch” tool, the probability of a 25-basis-point Fed rate cut in March stands at 8.4%, while the likelihood of holding rates steady remains at 91.6%.

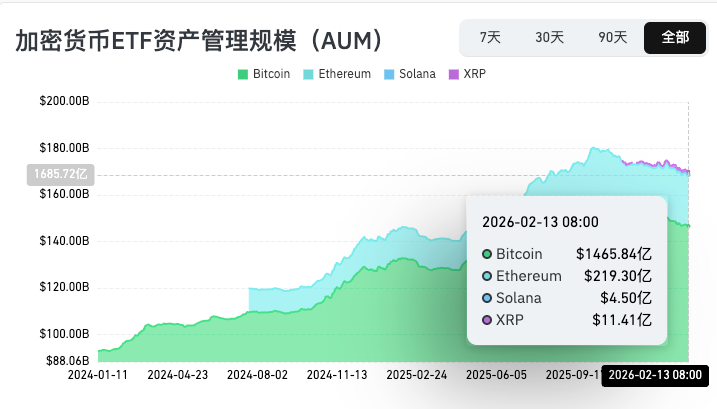

ETF Updates

Data shows that between Feb 9 and Feb 13, U.S. spot Bitcoin ETFs recorded net outflows of $358.9 million. As of Feb 13, GBTC (Grayscale) had cumulatively bled $25.909 billion, holding $10.713 billion currently; IBIT (BlackRock) holds $52.522 billion. Total market cap of U.S. spot Bitcoin ETFs stands at $90.458 billion.

U.S. spot Ethereum ETFs recorded net outflows of $161 million.

Anticipating the Future

Industry Conferences

- ETHDenver 2026 will take place in Denver, USA, from Feb 17–21.

- EthCC 9 will be held in Cannes, France, from Mar 30 to Apr 2, 2026. The Ethereum Community Conference (EthCC) is one of Europe’s largest and longest-running annual Ethereum events, focused on technology and community development.

- Hong Kong Web3 Festival 2026 will run in Hong Kong, China, from Apr 20–23, 2026.

Project Updates

- Bitcoin mining firm Bit Origin’s compliance deadline has been extended to Feb 16, 2026. If Bit Origin fails to regain compliance by then, Nasdaq will formally notify the company of potential delisting.

- Upbit will delist Groestlcoin (GRS). Withdrawals will remain supported for 34 days after trading support ends—through Feb 19, 2026.

Key Events

- Belgian bank KBC announced it will begin offering cryptocurrency buy/sell services to private investors via its online investment platform Bolero starting the week of Feb 16.

- Feb 19 at 21:30 UTC: U.S. initial jobless claims for the week ending Feb 14 (in thousands).

- Feb 20 at 21:30 UTC: U.S. December core PCE price index YoY.

Token Unlocks

- Starknet (STRK): 127 million tokens unlock on Feb 15—valued at ~$5.97 million, representing 4.61% of circulating supply.

- Sei (SEI): 55.55 million tokens unlock on Feb 15—valued at ~$4.12 million, representing 1.03% of circulating supply.

- Arbitrum (ARB): 92.65 million tokens unlock on Feb 16—valued at ~$10.08 million, representing 1.82% of circulating supply.

- YZY (YZY): 62.5 million tokens unlock on Feb 17—valued at ~$20.96 million, representing 17.24% of circulating supply.

- LayerZero (ZRO): 25.7 million tokens unlock on Feb 20—valued at ~$48.33 million, representing 5.98% of circulating supply.

- KAITO (KAITO): 32.53 million tokens unlock on Feb 20—valued at ~$10.25 million, representing 10.64% of circulating supply.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, transforms professional analysis into actionable trading tools. Our weekly Insights Report and in-depth research reports dissect market dynamics. Through our exclusive column Hotcoin Select—powered by dual AI + expert screening—we identify promising assets and reduce trial-and-error costs. Each week, our researchers engage directly with you via live streams to unpack hot topics and forecast trends. We believe empathetic companionship paired with professional guidance empowers more investors to navigate cycles and seize value opportunities in Web3.

Risk Disclaimer

Cryptocurrency markets are highly volatile and inherently risky. We strongly advise investors to fully understand these risks and invest only within a rigorous risk management framework to safeguard capital.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News