Why has MSTR's premium suddenly surged if the "borrow-to-buy" strategy hasn't changed?

TechFlow Selected TechFlow Selected

Why has MSTR's premium suddenly surged if the "borrow-to-buy" strategy hasn't changed?

Premium-priced share issuance, "becoming more valuable the more you sell" — MSTR's cheat code.

Author: CMed

In the past few days, both the U.S. stock market and the crypto market have been dazzled by MSTR. During Bitcoin's latest price surge, MSTR not only led the rally but also maintained a steadily increasing premium over Bitcoin, with its price soaring from around $120 just one or two weeks ago to its current level of $247.

Most market participants still interpret MSTR’s sharp rise through the lens of "leveraged Bitcoin." However, this explanation fails to address why MSTR's premium suddenly surged despite no changes in its fundamental strategy of "issuing debt to buy Bitcoin." After all, MicroStrategy has been purchasing Bitcoin for years—such a dramatic premium expansion has never occurred before.

In reality, apart from the well-known debt-financed Bitcoin accumulation, MSTR’s recent premium spike owes much to another secret weapon—a mechanism so powerful that many analysts have dubbed it MicroStrategy’s “infinite money printer,” enabling MSTR to become “more valuable the more it sells.”

Leveraged Bitcoin? That’s Old News

MicroStrategy, originally a business intelligence software company, adopted an aggressive strategy starting in 2020: raising capital through bond issuance to purchase Bitcoin. This approach began in August 2020 when the company announced converting $250 million of its treasury reserves into Bitcoin. The underlying motivation was primarily to counter challenges posed by declining cash returns and dollar depreciation amid global macroeconomic shifts.

To further expand its Bitcoin holdings, MicroStrategy raised funds in earlier years by issuing long-term bonds in the capital markets. These bonds typically have maturities extending to 2027–2028, with some being zero-coupon bonds. This structure allows the company to maintain low financing costs over several years, enabling it to rapidly deploy bond proceeds toward Bitcoin purchases, which are directly added to its balance sheet.

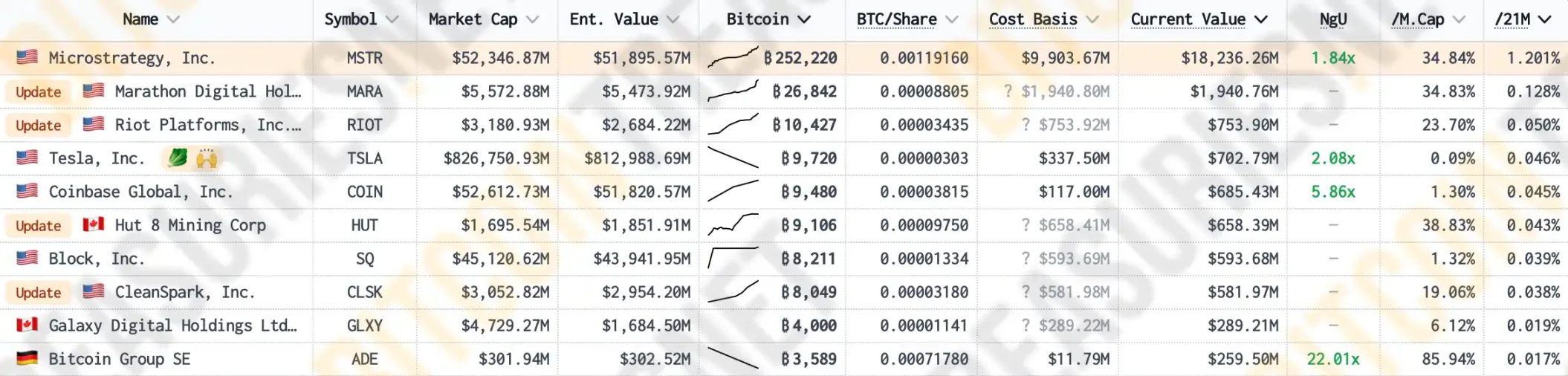

According to data from Bitcoin Treasuries, MicroStrategy currently holds 1.2% of Bitcoin’s total circulating supply—the largest Bitcoin position among publicly traded companies globally—surpassing even Bitcoin-native firms like mining giants Marathon and Riot, as well as leading crypto exchange Coinbase.

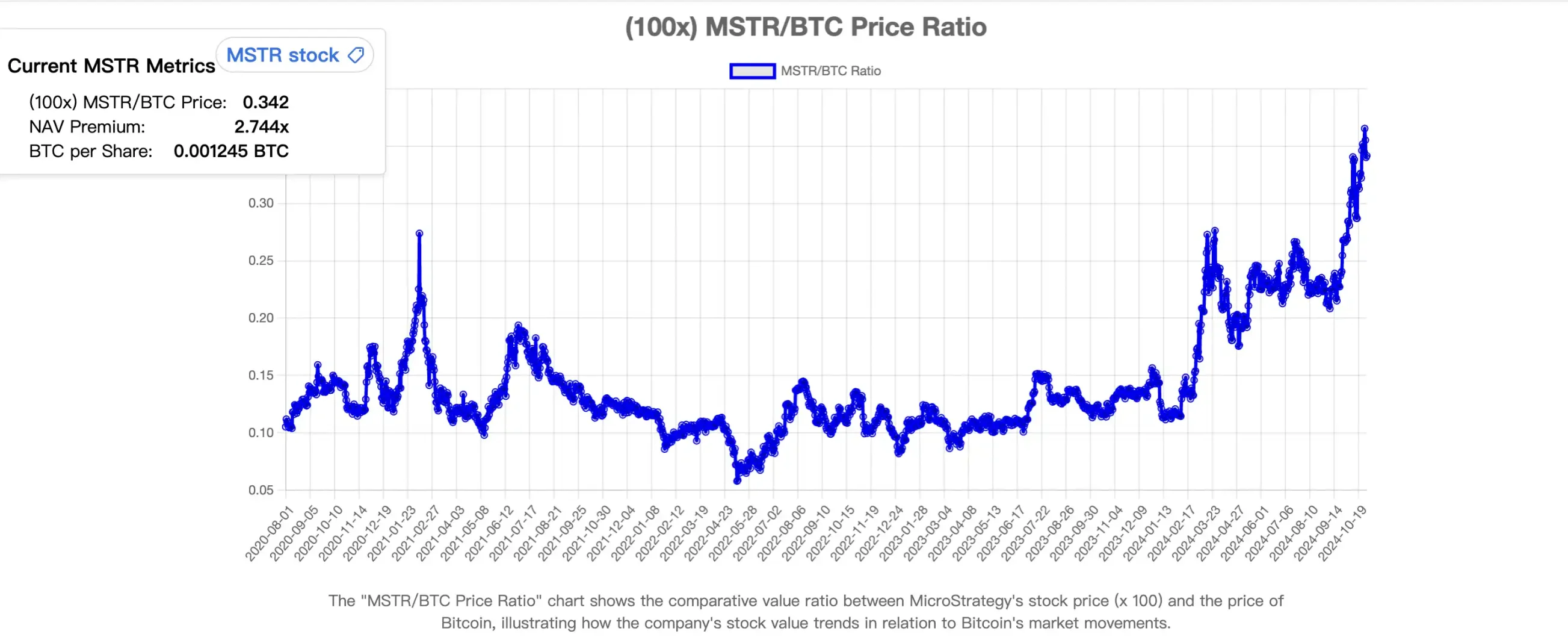

By continuously issuing debt to fund Bitcoin acquisitions, MSTR has not only increased the amount of Bitcoin on its balance sheet but also exerted upward pressure on Bitcoin’s market price. As Bitcoin’s share in MSTR’s asset portfolio grows, the correlation between the company’s stock price and Bitcoin’s price has strengthened significantly. According to MSTR Tracker, the correlation coefficient between MSTR’s stock price and Bitcoin recently hit a record high of 0.365.

This growing linkage means investors bullish on Bitcoin are increasingly inclined to buy MSTR shares, further boosting the company’s market capitalization. Naturally, after four years of market validation, the “leveraged Bitcoin” narrative surrounding MSTR has become commonplace. Whenever MSTR rallies, commentators routinely attribute it to the “debt-to-buy-Bitcoin” logic.

Yet in the most recent Bitcoin rally, MSTR’s market price rose ahead of Bitcoin and subsequently maintained an ever-increasing premium over it. This has left many investors puzzled: if fundamentals haven’t changed, why did the premium suddenly spike?

Premium At-The-Market Issuances: The Cheat Code Making MSTR “More Valuable the More It Sells”

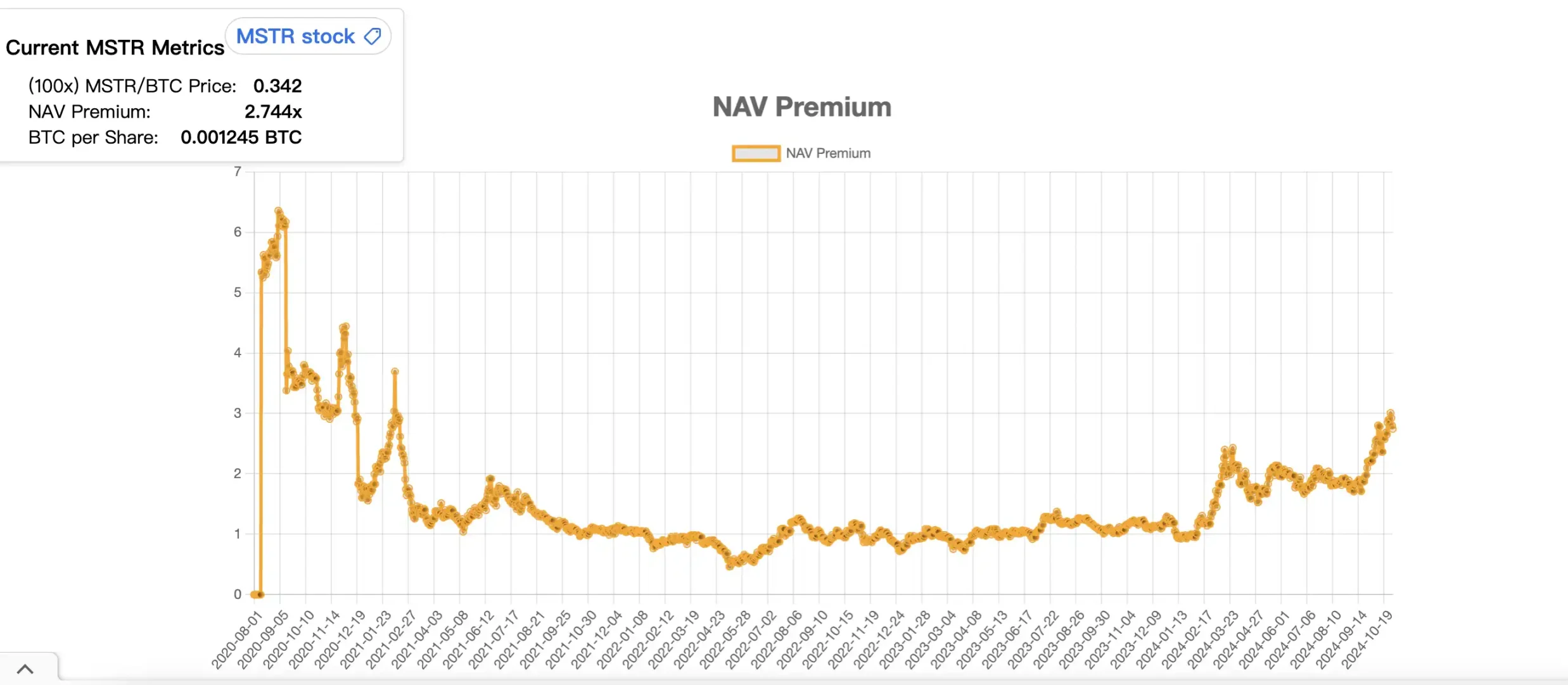

First, let’s examine just how extreme MSTR’s recent premium has become. According to MSTR Tracker, MSTR’s premium over Bitcoin saw a sharp rise between February and March this year, jumping from approximately 0.95 to 2.43 before settling near 1.65. A second surge began just before the recent Bitcoin rally, climbing from around 1.84 to a peak of 3.04, and currently sits at about 2.8.

Notably, although MicroStrategy has accumulated Bitcoin consistently over the past four years, its NAV (Net Asset Value) premium remained largely flat—hovering close to 1:1 for extended periods.

So what caused this sudden explosion in MSTR’s premium? Did something fundamentally change in MicroStrategy’s “debt-to-buy-Bitcoin” model?

The answer is yes—and that change is called “premium at-the-market (ATM) equity offerings.” Starting in the second half of last year, MicroStrategy began employing a new method to acquire Bitcoin: issuing and selling additional MSTR shares to raise capital for more Bitcoin purchases. On the surface, this “sell-stock-to-buy-Bitcoin” strategy may seem counterintuitive, potentially diluting shareholder value and undermining MSTR’s positioning as a leveraged Bitcoin play.

But upon closer inspection, this new model turns out to be nothing short of a supercharged flywheel—a veritable “infinite money printer” for MicroStrategy.

To understand this, we must first clarify the concept of “Net Asset Value (NAV) premium.” Because MSTR holds substantial Bitcoin via debt financing and the market expects strong future appreciation in Bitcoin, MSTR’s stock often trades at a price higher than the intrinsic value of its Bitcoin holdings. This difference is known as the NAV premium, reflecting investor expectations of continued Bitcoin accumulation—and crucially, it enables MSTR to issue new shares at favorable valuations to fund further Bitcoin purchases.

Moreover, when Bitcoin’s price rises, MicroStrategy’s market cap increases accordingly, prompting index-tracking funds to increase their allocation to MSTR based on weighting rules, thereby pushing its stock price and valuation even higher.

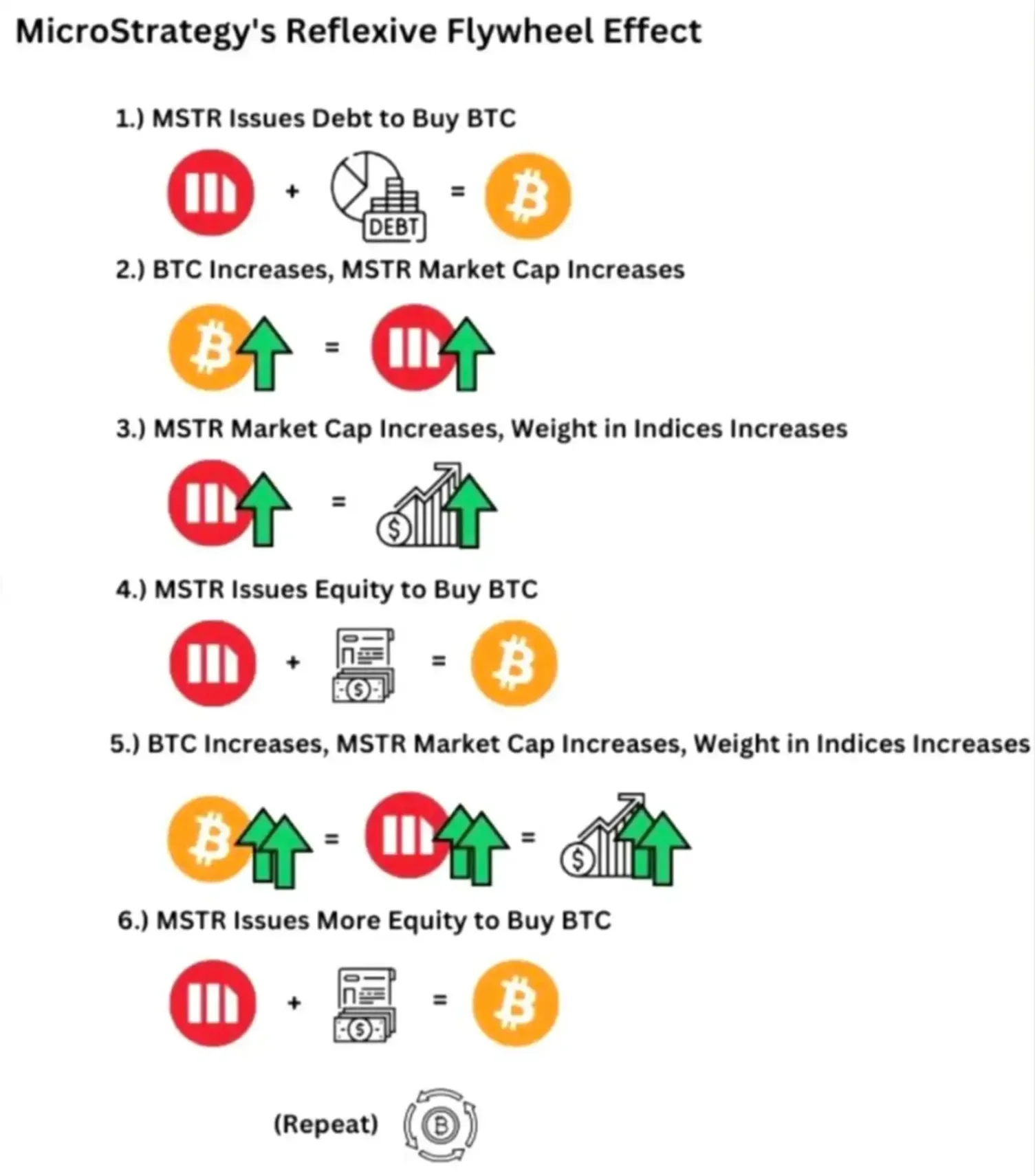

With a significant NAV premium in place, MSTR can now execute “premium ATM issuances.” By continually issuing new shares at prices above NAV, the company raises capital to buy more Bitcoin. This fuels Bitcoin’s price rise, which boosts MSTR’s market cap and financing capacity, creating a self-reinforcing loop known as the “Reflexive Flywheel Effect.”

The brilliance of this flywheel lies in the fact that share issuance no longer depresses MSTR’s stock price—in fact, it makes MSTR more valuable.

When MicroStrategy issues new shares to buy Bitcoin, those shares are typically sold at a price significantly above the Bitcoin value they represent on the balance sheet. Thanks to this premium, each dollar raised from selling MSTR stock buys more Bitcoin than the underlying per-share Bitcoin value would suggest.

For example, based on the current correlation between MSTR and BTC, approximately 36% of each MSTR share represents backing by actual Bitcoin. Without any premium, selling one share would yield only enough capital to buy 36% of a Bitcoin. But with MSTR currently trading at a ~2.74x premium over its Bitcoin NAV, selling one share now generates proceeds equivalent to nearly 98% of a Bitcoin.

This means the company can acquire Bitcoin using capital valued far above the net Bitcoin asset value per share, accelerating the growth of its on-balance-sheet Bitcoin holdings. The core advantage? MSTR uses high-premium equity financing to boost Bitcoin acquisition speed and scale—far surpassing the pace achievable through traditional debt financing alone.

As the flywheel gains momentum, MSTR’s rising market cap brings it closer to inclusion in major U.S. equity indices, attracting even more passive investment flows and expanding its NAV premium further. Part of the decoupling between MSTR and BTC in Q3 stemmed from market anticipation of MSTR’s potential inclusion in the Nasdaq-100 Index, which would trigger massive inflows from passive funds.

Index investors would then be “forced” to allocate capital to MSTR, feeding back into the reflexive flywheel: higher premiums enable larger capital raises, allowing more Bitcoin purchases, driving up Bitcoin’s price, strengthening market optimism, increasing MSTR’s index weight, prompting further index fund buying—a self-sustaining positive feedback loop, effectively forming an “index-buying pressure flywheel.”

Over longer time horizons, each MSTR shareholder effectively gains exposure to an increasing quantity of Bitcoin, reinforcing MSTR’s status as a premier “Bitcoin proxy” investment vehicle and elevating market expectations for its valuation.

“There Will Be More MSTRs in the Stock Market”

In recent weeks, MicroStrategy CEO Michael Saylor has grown increasingly vocal, appearing across podcasts and news programs proclaiming, “There will be more MSTRs in the stock market,” and describing MSTR’s mechanism as essentially an “infinite financial leverage engine.”

Saylor believes the “reflexive flywheel” model possesses immense potential in corporate finance—not only enabling continuous Bitcoin accumulation but also sustaining growth through strategic capital markets engagement. It demonstrates how public companies can actively leverage asset premiums and capital-raising capabilities to expand their balance sheets aggressively. Unlike passive “buy and hold” strategies, this is an active, market-driven expansion model—one that could inspire imitation, especially in capital-intensive industries. Indeed, several companies have already begun emulating aspects of MSTR’s approach.

Despite sounding like a “bootstrapping scheme,” the model appears viable. Current data shows that for every $2.713 raised via new share issuance, MicroStrategy spends $1 to buy Bitcoin. While some view this as ultra-leveraged Bitcoin speculation, MSTR remains financially robust—estimates suggest it would only face liquidation risk if Bitcoin falls below $700 per coin.

For now, the mechanism continues functioning smoothly, with MSTR steadily accumulating BTC. Yet as this model becomes more widespread, U.S. equity indices will inevitably grow more exposed to crypto assets and related derivatives. This linkage acts as a tether, binding the crypto and stock markets together and triggering profound structural shifts. For the crypto market, it introduces massive liquidity spillovers from traditional equities—largely absorbed by Bitcoin. For the stock market, it may amplify volatility risks.

According to Saylor’s vision, by 2050, Bitcoin could reach $500,000 per coin, and MSTR could evolve into a trillion-dollar corporation, playing a pivotal role in advancing cryptocurrency adoption. Whether this seemingly “perfected Ponzi-like” model can endure until then remains to be tested by future markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News