Missing MSTR, the Mega Stock: My Reflection and Cognitive Upgrade

TechFlow Selected TechFlow Selected

Missing MSTR, the Mega Stock: My Reflection and Cognitive Upgrade

Although MSTR's logic is somewhat akin to a Ponzi, in the long run, it is strategically significant for major U.S. capital to accumulate BTC.

Author: Uncle Jian

MSTR (MicroStrategy) has surged from $69 at the beginning of the year to a high of $543 last week, outperforming Bitcoin by a wide margin! What left a deep impression on Uncle Jian was that when BTC pulled back due to the election and got hammered, MSTR kept rising steadily. This made me rethink its investment logic: it’s not merely riding the BTC wave—it has its own unique strategy and mechanics.

Core Strategy of MSTR: Issuing Convertible Bonds to Buy BTC

MSTR originally operated in BI (business intelligence reporting systems), but that's long been a sunset industry. Today, its core strategy is: raising capital through issuing convertible bonds to aggressively purchase BTC, making it a major component of corporate assets.

1. What are convertible bonds?

In simple terms, a company raises funds by issuing bonds. Investors can either collect principal and interest upon maturity, or convert their bonds into company shares at a predetermined price.

-

If the stock price surges, investors will likely choose to convert, leading to share dilution.

-

If the stock doesn’t rise, investors take back their principal plus interest, and the company bears a financing cost.

2. MSTR’s operational logic:

-

Use proceeds from convertible bond issuance to buy BTC.

-

This way, MSTR continuously increases its BTC holdings, while the BTC value per share also grows.

For example: based on early 2024 data, BTC held per 100 shares increased from 0.091 to 0.107, reaching 0.12 by November 16.

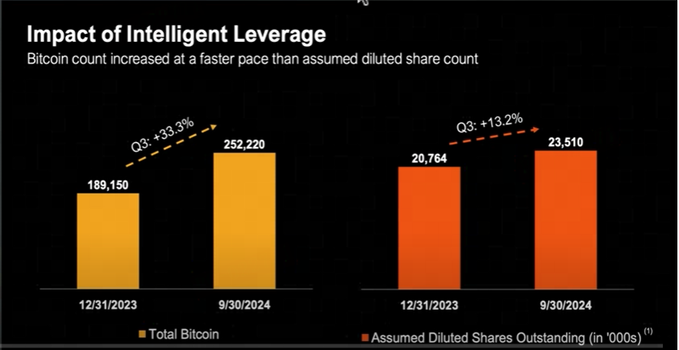

The following chart makes it clearer: the relationship between BTC增持 via convertible bonds and share dilution for MSTR in the first three quarters of 2024.

-

In the first three quarters of 2024, MSTR increased its BTC holdings from 189,000 to 252,000 (a 33.3% increase) via convertible bonds, while total shares outstanding only diluted by 13.2%.

-

BTC per 100 shares rose from 0.091 to 0.107, gradually increasing shareholders’ BTC equity. Let’s calculate using early-year prices: 100 MSTR shares cost $6,900 ($69 per share), while 0.091 BTC (~$42,000) was worth $3,822—only about 55% of the stock’s value. At first glance, this seems unattractive compared to buying BTC directly. But under this growth model, continuous bond issuance means each share represents more and more BTC over time.

3. Latest Data:

On November 16, MSTR announced the acquisition of 51,780 BTC for $4.6 billion, bringing its total holdings to 331,200 BTC. At this pace, BTC per 100 shares is now approaching 0.12. From a BTC-denominated perspective, MSTR shareholders’ BTC “equity” continues to grow.

MSTR is the “Golden Shovel” for BTC

In essence, MSTR’s strategy resembles leveraging Wall Street mechanisms to mine BTC:

-

Continuously issue bonds to buy BTC, diluting shares to increase BTC holdings per share;

-

For investors, buying MSTR stock is like holding BTC indirectly, while also gaining leveraged exposure to BTC price appreciation.

By now, sharp readers may realize this model bears some resemblance to a Ponzi scheme—using newly raised funds to enhance existing shareholders’ equity, passing the parcel round after round through continuous fundraising.

4. When might this model break down?

-

Increased difficulty in fundraising: if the stock price stagnates, future convertible bond issuance becomes difficult, threatening the model’s sustainability.

-

Excessive dilution: if share issuance outpaces BTC accumulation, shareholder equity could shrink.

-

Model homogenization: as more companies copy MSTR’s playbook, competition intensifies and its uniqueness erodes.

MSTR’s Logic and Future Risks

While MSTR’s model may resemble a Ponzi scheme superficially, from a long-term view, large U.S. institutions accumulating BTC carries strategic significance. With a fixed supply of only 21 million BTC, and potential U.S. strategic reserves aiming for 3 million BTC, “stockpiling” is not just an investment move—but a long-term strategic decision for big capital.

However, MSTR currently carries more risk than reward. Proceed with caution!

-

If BTC prices correct, MSTR’s stock could fall even harder due to its leveraged structure;

-

Its ability to sustain high growth depends on continued fundraising success and competitive dynamics.

Uncle Jian’s Reflection and Cognitive Upgrade

In 2020, when MSTR first began stockpiling BTC, I remember Bitcoin rebounded from $3,000 to $5,000. I thought it was too expensive and didn’t buy. Meanwhile, MSTR started buying heavily at $10,000. Back then, I thought they were crazy—until BTC soared to $20,000. Turns out, the clown was me. Missing out on MSTR taught me a lesson: the strategic thinking and depth of understanding among U.S. financial elites deserve serious study. While MSTR’s model appears simple, it reflects a profound conviction in BTC’s long-term value. Missing an opportunity isn’t fatal—what matters is learning from it and upgrading your mindset.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News