Meme Coins Take Up Half of Solana's Trading Volume: Cold Reflections Amid a Booming Market

TechFlow Selected TechFlow Selected

Meme Coins Take Up Half of Solana's Trading Volume: Cold Reflections Amid a Booming Market

Many retail investors are rushing into new memecoins, which are often more likely to result in losses than gains.

Author: Stacy Muur

Translation: TechFlow

Over the past few weeks, Memecoins have overshadowed every other Web3 topic, making it seem like riding the Meme wave is the only way for ordinary users to achieve high returns. Fueled by surges in $PNUT, $PEPE, $BONK, $BRETT and other Memecoins, along with growing popularity of the category, daily trading volume of Memecoins has reached record highs—drawing massive attention. But are these gains worth the risk? Is the Memecoin market overhyped?

The State of Memecoins

Has meme truly been the theme of this year? If you ask someone with at least five years of experience in the Web3 market how they’d define 2024, they’d likely say it’s the “Year One of Memecoins.”

Many believe Memecoins are this year’s top-performing assets, backing their claims with charts and rankings. But does this really reflect reality?

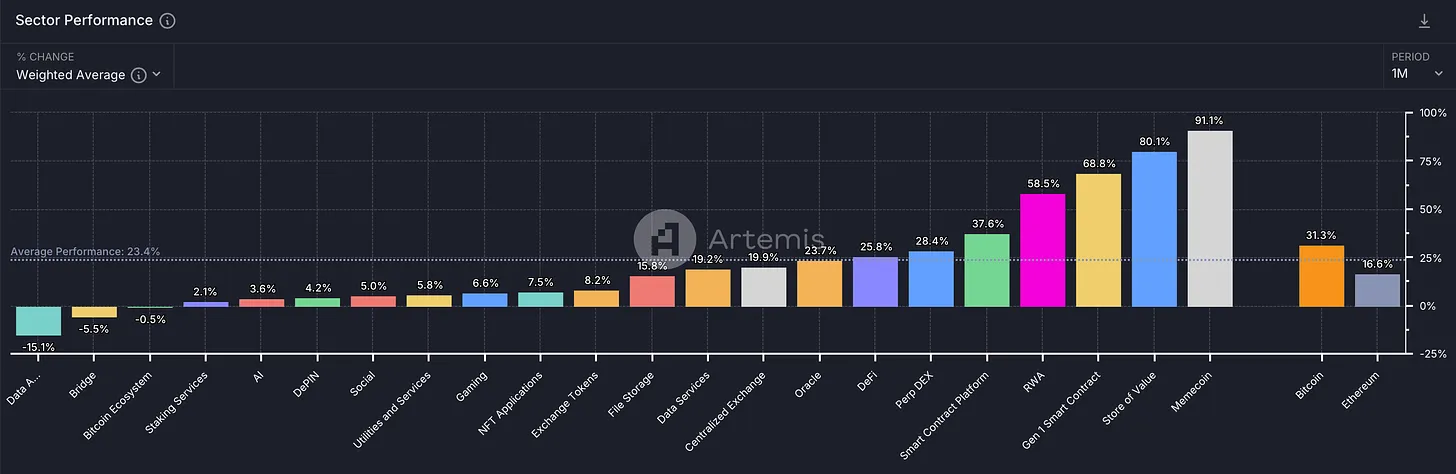

Industry performance over 1 month

Source: Artemis

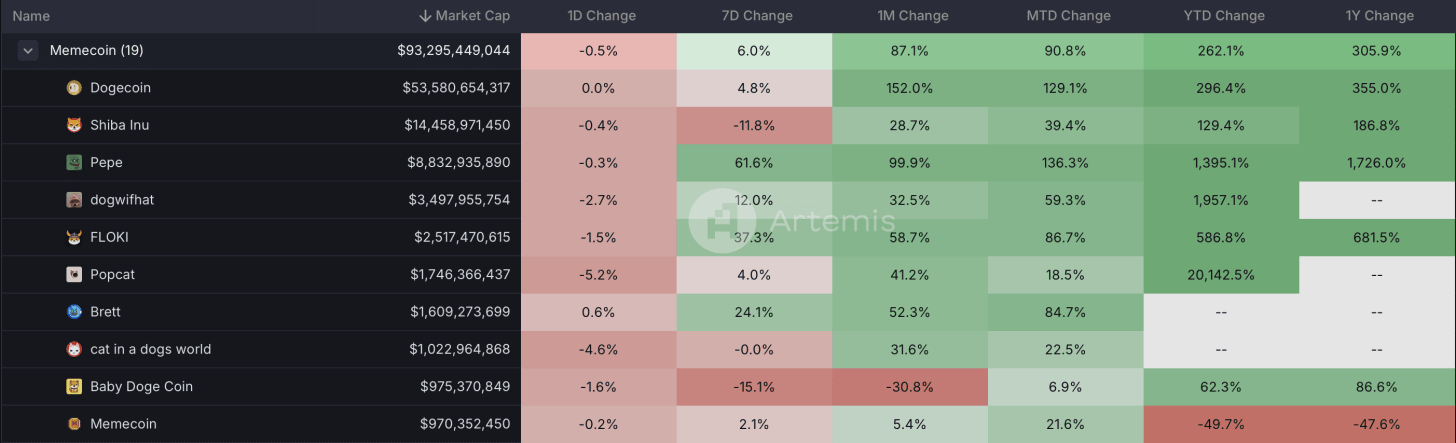

If we analyze year-to-date industry performance, the data may tell a different story. For example, on Artemis, the RWA index (including Ondo, Mantra, Clearpool, and Maple) leads with a 1,900% increase, while Memecoins grew by 258% and Bitcoin by 104%. Also important to note is which Memecoins are included. On Artemis, the Memecoin index currently tracks only the 19 largest Memecoins.

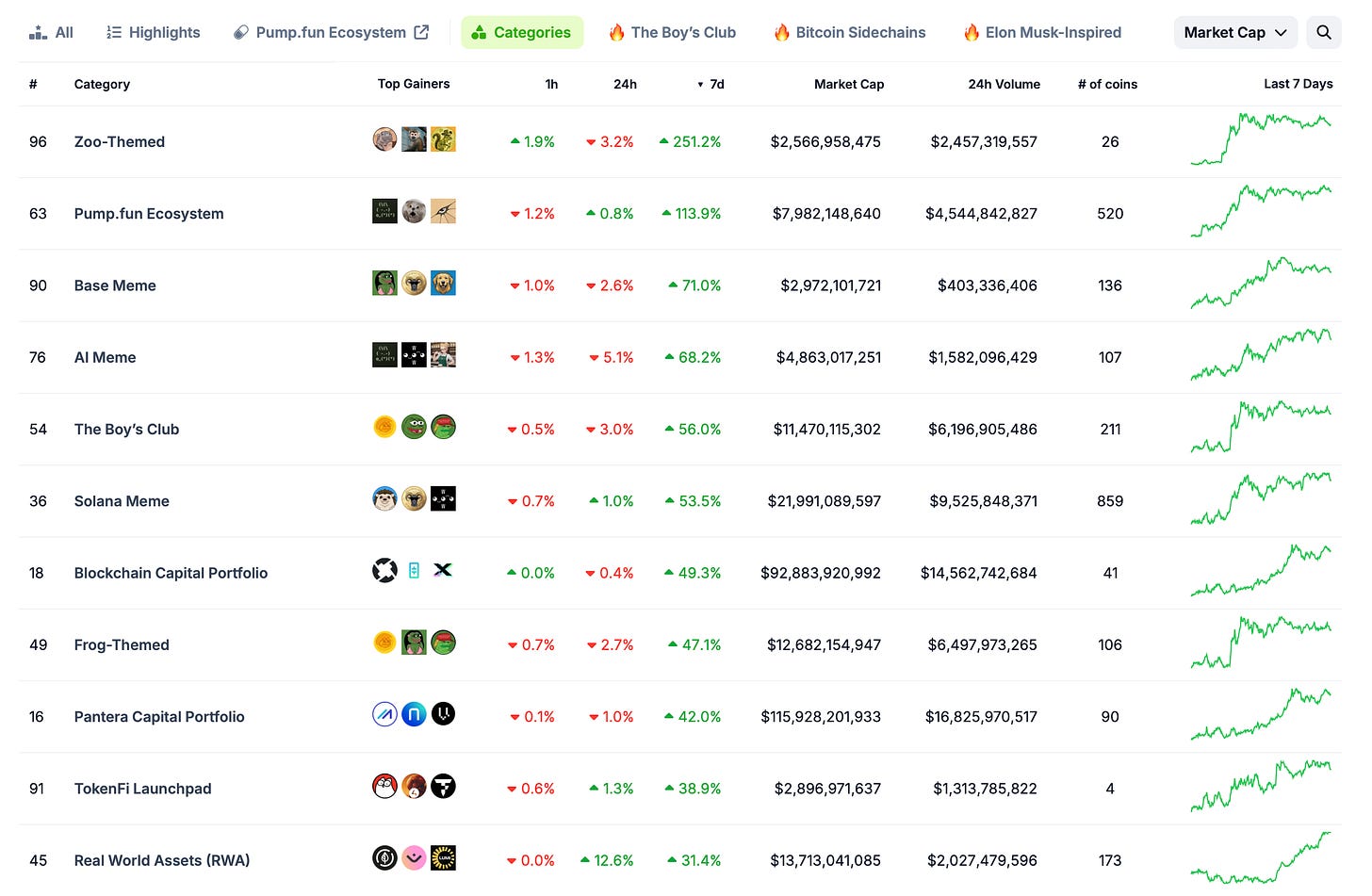

CoinGecko’s category rankings face another issue: many Meme tokens belong to multiple categories, so a few strong performers can significantly inflate the 7-day performance of several categories at once.

Source: CoinGecko categories

Take the Pump.fun ecosystem, which tracks 520 tokens—this helps explain why I see this as problematic. It performed very strongly, ranking second highest this week, fueling significant FOMO (fear of missing out).

Yet upon closer inspection of the rankings, fewer than 20 tokens (less than 3.8%) had a 7-day gain above 110% (the category average), and fewer than 60 tokens (11.5%) posted positive weekly returns.

This no longer sounds like "WAGMI" (we're all gonna make it), does it?

The core issue with tracking Memecoin performance is that their sector-wide results are often measured by the largest or most popular assets within the category.

This creates the illusion that Memecoins outperform all other Web3 sectors. In reality, a more accurate statement would be: only the leading Memecoins outperform other categories.

This leads to an important point: we need to distinguish between mature Memecoins and new Memecoins, as they represent two entirely different markets.

New Memecoins

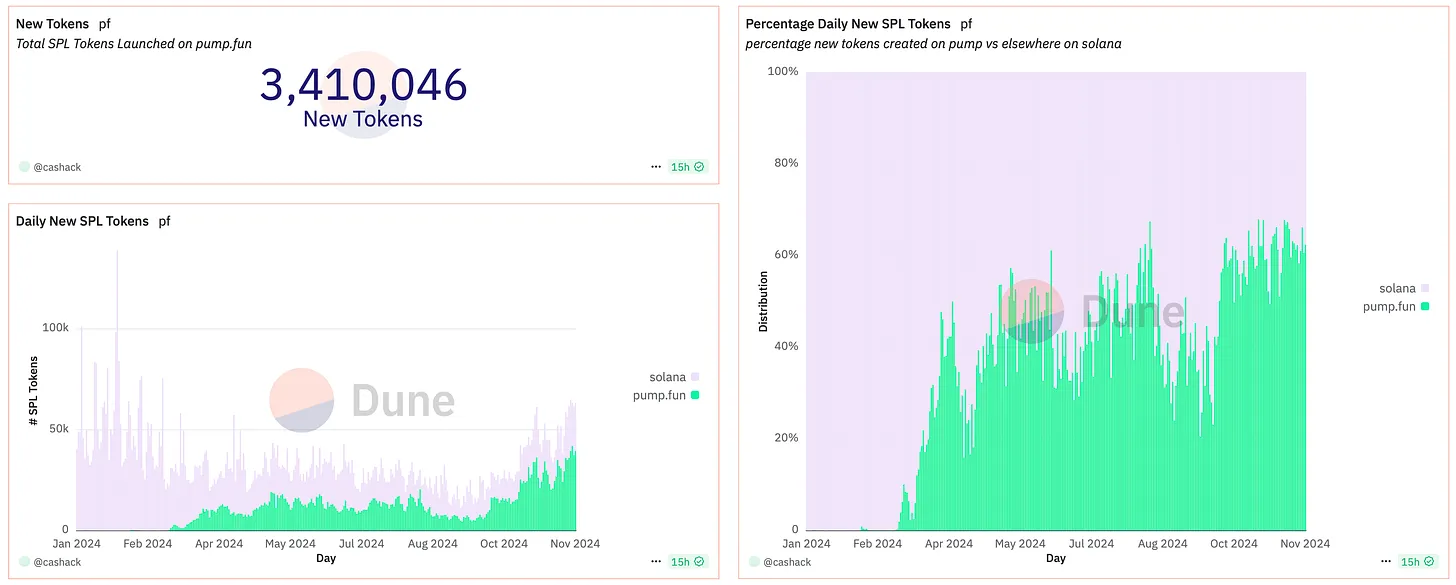

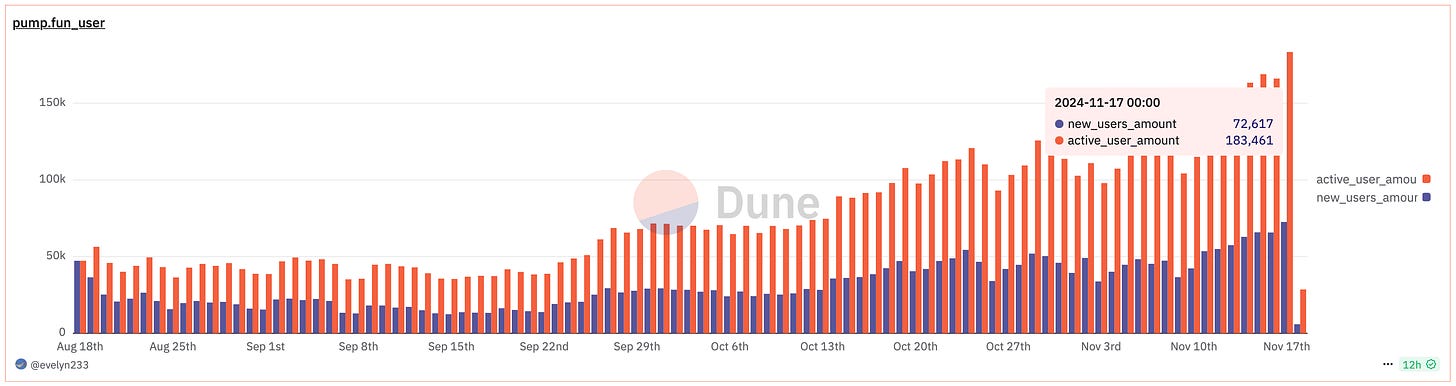

CoinGecko currently tracks 520 Memecoins on its Pump.fun dashboard. Since Pump's launch, 3 million tokens have been created.

This means 99.982% of these tokens are not tracked by CoinGecko, so we lack performance data on them.

Data source: Dune

Data source: Dune

Here’s some background I researched back in late August:

-

The majority of top profit addresses are token deployers themselves

-

Only 3% of Pump.fun traders earned over $1,000

-

Only 0.8% earned over $10,000

-

Over 60% of traders lost money

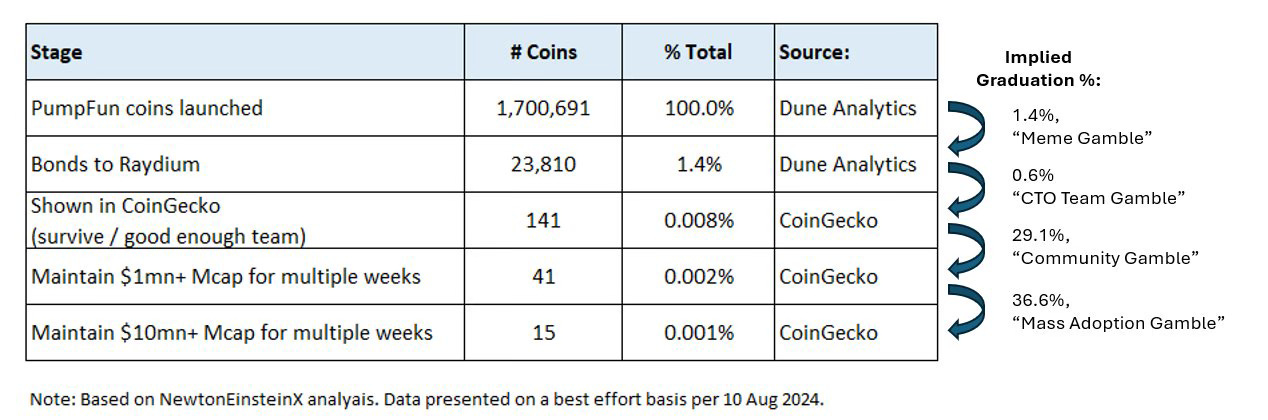

Data source: @newtoneinsteinx on X

The biggest challenge for the average new Memecoin trader is being unable to differentiate between “emerging” and “mature” Memecoins.

Most novice traders chase early-stage projects, hoping to replicate the rare success stories of widespread adoption like $PEPE or $BONK.

I’m not trying to discourage you, but your chances of getting struck by lightning are higher: 0.011%.

Mature Memecoins

The outlook is far more optimistic for mature Memecoins. They didn’t gain market share due to VC backing or specific valuation metrics, but rather through community strength, a bit of luck, and strategic market management.

This might sound like a conspiracy theory, but I believe most successful Memecoins with solid market presence weren’t created by random developers. Often, professional Memecoin development teams—with ample resources for market-making and marketing—are behind these successes.

To clarify, I'm not saying all popular Memecoins are perfectly orchestrated outcomes—just that this likely applies to most cases.

There are several valid reasons why mature Memecoins outperform many other Web3 sectors:

-

100% supply in circulation (no low float or high FDV)

-

No VC backing (eliminates additional selling pressure)

-

Organic and active holder communities

-

No product risk (no vulnerabilities, poor execution, or weak user acquisition)

-

Memecoin rotation pattern (profits from one trending Memecoin flow into others)

-

Strong correlation with overall market cycles

-

Lower reliance on marketing efforts

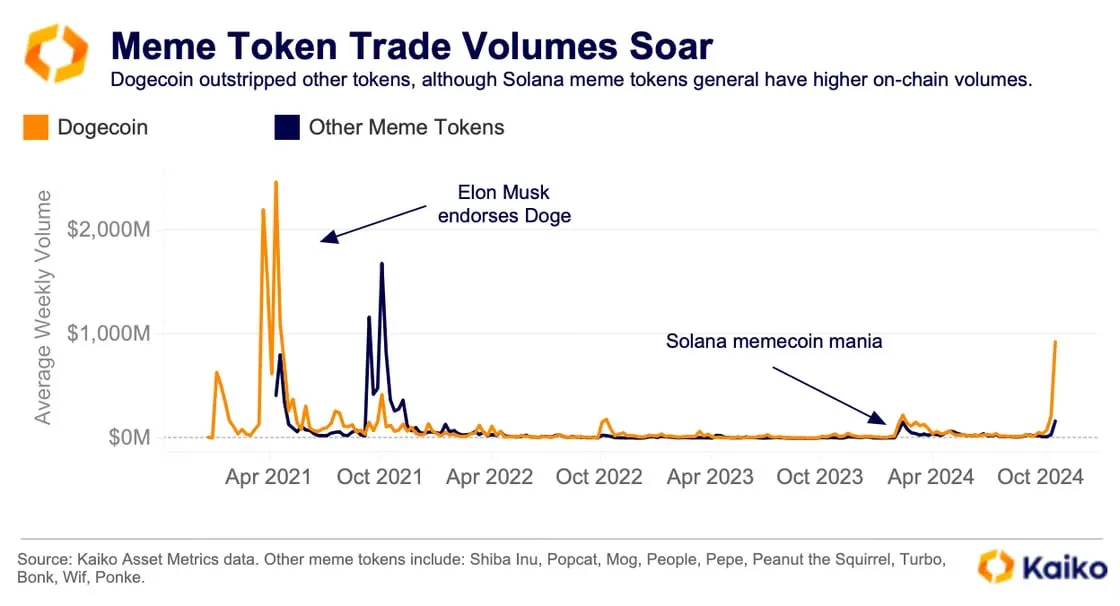

Data source: Kaiko

Memecoin trading is primarily speculative, and this year’s movements have become increasingly predictable, forming patterns that attract heavy trading volume and liquidity—diverting attention from “classic” coins, especially amid the current lack of dominant or novel narratives in Web3.

Notably, according to 1% market depth data from U.S. exchanges, liquidity for Meme tokens hit a record high last week at $110 million. Large-cap Meme tokens like SHIB and DOGE still dominate, accounting for over 70% of market depth.

However, their market share is gradually declining, indicating rising investor interest in smaller tokens.

Where Are We Now?

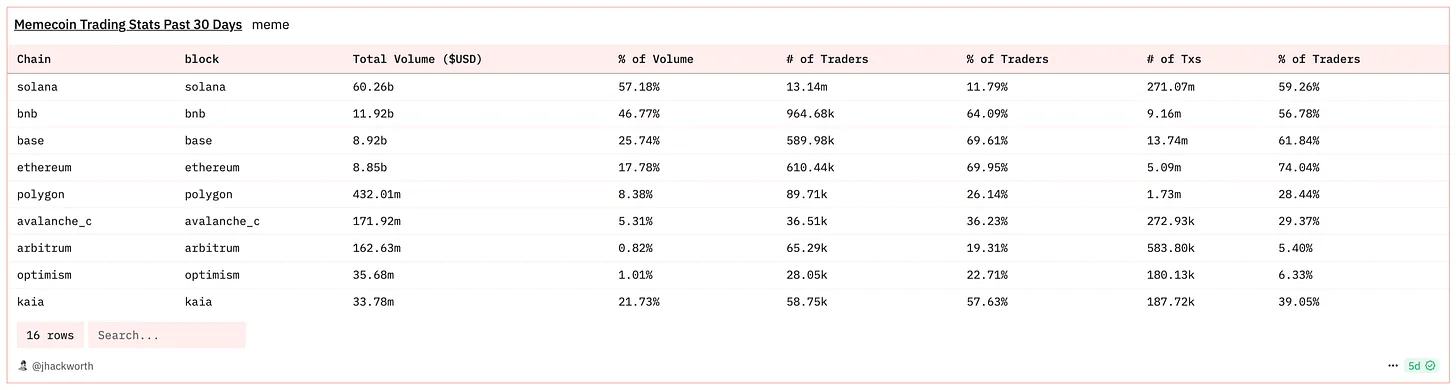

Currently, over 50% of trading volume on Solana comes from Memecoins. On BNB, it’s nearly 45%, and around 25% on Base. These are already substantial proportions.

Data source: Dune

Yet history shows us that when the market rushes to push a narrative after price moves, it’s often too late.

In my view, the Memecoin market has already reacted to Bitcoin’s rally. As long as prices remain near $90,000, I don’t expect major new surges in mature Memecoins—we could call them “cult coins” to distinguish them from the 3 million tokens created this year on Pump.fun.

Still, retail investors continue chasing the trend, staying on board in hopes of a journey to Valhalla.

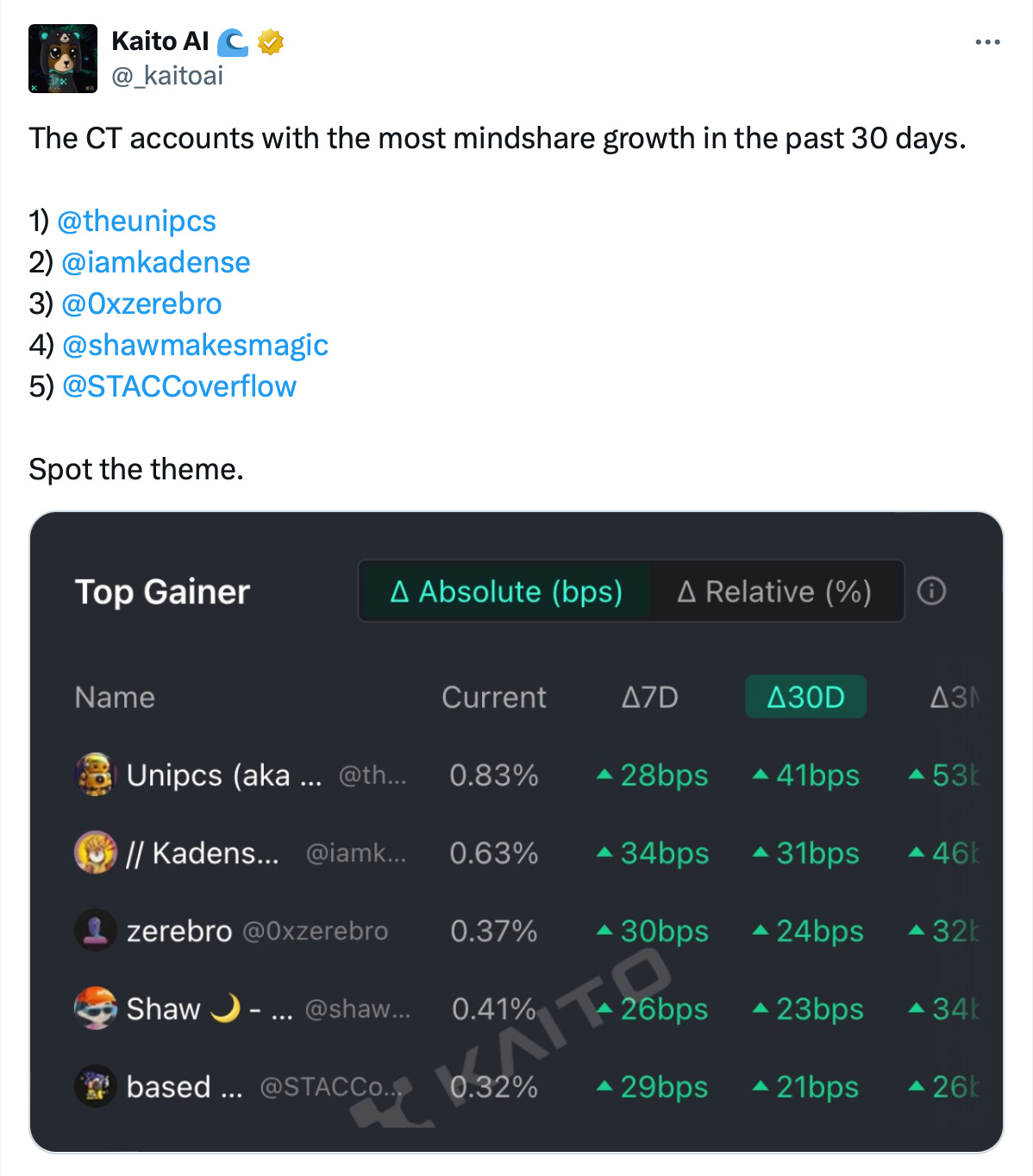

Source: @_kaitoai on X

The main issue isn't just that most people are jumping in too late—a common occurrence across all narratives. The real problem is that many retail investors are pouring into new Memecoins, which are far more likely to result in losses than gains.

As a result, new users suffer losses, slowing further user adoption. To the average Web2 user, the difference between Memecoins and classic coins is nearly negligible—they’re all just code. Thus, these negative experiences taint perceptions across all of Web3.

To be clear, I’m not against the established “cult coins”—that is, mature Memecoins. They do offer real advantages. However, I believe we must stop conflating quality projects with poorly designed lotteries launched on Pump.fun. Let’s correct this confusion.

Final Thoughts

-

If you’re an experienced Memecoin trader, feel free to continue executing your strategy—but be aware the market may already be overheated.

-

If you’re new to Memecoins and feeling strong FOMO, consider allocating a small, manageable portion of your portfolio to experimentation—focusing on already-established “cult coins.”

-

Unless you know how to win in this space, avoid participating in new token launches. There’s an important rule: If you don’t know how to win the game, don’t play.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News