RWA 2024: Beyond Speculation, the Rise of Real-World Asset Tokenization

TechFlow Selected TechFlow Selected

RWA 2024: Beyond Speculation, the Rise of Real-World Asset Tokenization

This report focuses on mainstream financial institutions' exploration, adoption, and application of blockchain technology, particularly public blockchains and DeFi.

Written by: Ryan Chen, Louis Wan (Bo Cai Bo Cai)

This article is jointly authored by Ample FinTech and DigiFT

Author's Preface:

Ryan Chen, Head of Research and Innovation, DigiFT

In late 2023, we published a research report on real-world assets (RWA). At that time, the primary market participants were still Web3 natives, with limited institutional involvement. However, 2024 marks a turning point, as top global institutions such as Blackstone, UBS, and Franklin Templeton have entered the space. As industry practitioners, we have witnessed intensifying competition and the convergence of two distinct forces.

This phenomenon reflects the gradual integration between Web2 and Web3, with increasingly diverse and frequent exchanges of data, capital, and human resources. As the regulatory landscape for crypto continues to evolve and return to core financial principles, we believe RWA will become a key direction for future development. Through faster settlement systems, more transparent markets, and collaborative databases, blockchain technology will eventually go mainstream—enhancing capital market efficiency and delivering tangible value to the real world.

Louis Wan (Bo Cai Bo Cai), Head of Research, Ample Fintech

Innovations in technologies such as distributed ledger technology (DLT) and tokenization are significantly improving the efficiency of today’s financial systems. These advancements promise not only to streamline transaction processes but also enable new forms of financial interaction that are more transparent, inclusive, and secure. By reducing reliance on intermediaries, accelerating settlement times, and embedding compliance through programmability, these technologies demonstrate the potential to reshape the foundations of finance.

Today, we are witnessing an unprecedented level of public-private collaboration. The momentum behind real-world asset (RWA) tokenization is no longer driven solely by Web3 industry players, but by joint efforts from governments, central banks, financial institutions, and international organizations. Ample FinTech has had the privilege of collaborating with multiple central banks to explore practical applications of tokenized currencies. Moving forward, Ample FinTech will continue exploring practical solutions based on digital currency and smart contract applications, aiming to extend the inclusive value of programmable payments and finance to more people.

Executive Summary

-

In recent months, the tokenization sector has moved beyond proof-of-concept (PoC) into commercialization, with leading financial institutions taking the lead.

-

Although global regulatory frameworks for tokenized markets remain unclear, major financial centers are developing more comprehensive regulations, with some jurisdictions becoming increasingly welcoming toward tokenization initiatives.

-

This year, financial institutions like Blackstone, UBS, and Franklin Templeton launched tokenized projects on public blockchains, competing directly with Web3-native initiatives.

-

Market opportunities, infrastructure maturity, and licensing for innovative startups are key drivers for institutional adoption of public blockchains.

-

Private-sector financial institutions lead in asset tokenization, while coordination between private and public sectors is increasing in currency tokenization.

-

With rising demand for cross-border payments, the global economy is increasingly aware of the inefficiencies in existing systems. High costs, slow speeds, and lack of transparency have become urgent challenges. The G20 has established a roadmap for cross-border payments aimed at enhancing efficiency, transparency, and accessibility. Currency tokenization has emerged as one of the key pathways to improve payment efficiency and reduce costs.

-

Currency tokenization not only reduces costs and increases efficiency in payment systems but also enables programmability and automation via smart contracts. This technology can provide more innovative, transparent, and faster solutions for complex financial transactions. Public-sector entities globally are now launching large-scale related projects. Introduction: Beyond Speculation

Finance is built on trust—trust in infrastructure, companies, and individuals. The emergence of cryptocurrencies and blockchain technology aims to build a more efficient and transparent financial world, using a globally trusted ledger as its foundation. Looking back at Bitcoin’s original design, its goal was to create a peer-to-peer payment system. Ethereum, meanwhile, aimed to become a smart contract platform for decentralized applications.

Bitcoin[1]:

• Focuses on creating a decentralized digital currency for secure, low-cost peer-to-peer transactions.

• Aims to eliminate financial intermediaries, promote financial inclusion, and establish a trustless financial system.

Ethereum[2]:

• Extends blockchain applications to smart contracts and decentralized apps (dApps).

• Aims to revolutionize the financial system through programmable money, asset tokenization, and decentralized finance (DeFi), enabling automated, transparent, and secure financial services and transactions.

Both Bitcoin and Ethereum leverage blockchain technology to improve traditional financial systems, promoting decentralization, transparency, and efficiency.

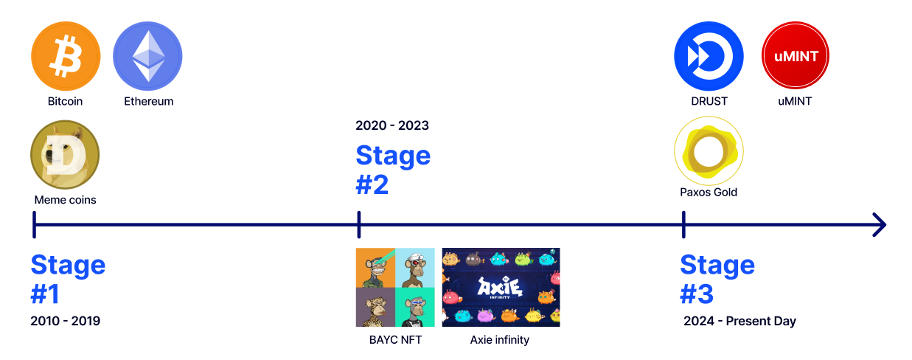

Over the past few years, the native crypto market has rapidly evolved, going through various concept cycles such as ICOs, DeFi, NFTs, and GameFi. Key innovations have focused on asset issuance and trading models, but their impact on the real world has been limited. As the market matures, it's clear that relying solely on crypto-native assets cannot meet investor demands. Furthermore, the advantages of new financial technologies have opened up application scenarios for innovators to further explore. We can clearly divide this technology-driven evolution of digital assets into three stages:

• First Stage: Crypto-Native Assets, 2010 ~ 2019:

Examples include DeFi tokens, meme coins, and native blockchain tokens. These assets are inherently issued and traded on public blockchains, experiencing both the benefits and drawbacks of blockchain technology.

• Second Stage: Digital-Native Assets, 2020 ~ 2023:

Examples include NFTs and GameFi tokens. These assets are linked to digital services or applications.

• Third Stage: Digital Twins, 2024 ~ Present:

Refers to real-world assets represented on blockchains as ledger entries—for example, gold tokens or U.S. Treasury tokens. In this stage, tokens are data entries on public blockchain-ledger systems connected to off-chain entities or assets, enabling faster settlement, real-time transparency, and automated on-ledger processes.

In the first two stages, Web3 resembled more of a casino, where hot money flooded in, causing significant price volatility such as with meme coins. Web3 adoption needs to move beyond the casino model; critically distinguishing between "cryptocurrency" and "blockchain technology" is essential. As we enter the third stage, our main challenges stem from legal and regulatory uncertainty rather than technical issues—challenges that affect the transition of the real world into the Web3 era.

Traditional financial markets have significant room for improvement and innovation, which can be realized through cryptography and blockchain technology. For instance, according to estimates by the Bank for International Settlements (BIS)[3], from 2003 to 2020, participants in the U.S. Federal Reserve Funds Transfer System used an average of $630 billion in intraday liquidity per day, peaking near $1 trillion. In the euro area, average and peak intraday liquidity stood at $443 billion and $800 billion, respectively. Across nine jurisdictions in the sample and over a 17-year period, participants used an average of 15% of daily gross payment values—or 2.8% of GDP—to meet intraday liquidity needs. These large figures highlight the critical role intraday liquidity plays in maintaining financial stability. The cost associated with providing this liquidity is approximately $600 million annually, mainly to satisfy real-time payment requirements, manage timing mismatches, reduce settlement risk, and comply with regulatory standards. This arrangement primarily results from inefficiencies in widely used clearing and settlement infrastructures, where simple transactions take days to complete.

Blockchain-based clearing and settlement systems can shorten settlement times to T+0 [4], or even achieve real-time settlement, significantly reducing the need for intraday liquidity and lowering settlement risk.

In 2024, we see more institutions entering this field—not just conducting proofs of concept (PoCs), but moving toward commercialization. Two main areas dominate blockchain and tokenization adoption: currency tokenization and asset tokenization. In asset tokenization, 2024 has seen several important milestones. Mainstream financial institutions have made significant progress within public blockchain ecosystems. From their perspective, they focus on blockchain technology as a novel, innovative ledger for recording ownership and reconciliation.

Regarding currency tokenization, we are seeing not only stablecoin adoption in crypto markets but also exploration of other meaningful use cases such as purpose-bound money and programmable money.

This report focuses on mainstream financial institutions’ exploration, adoption, and application of blockchain technology—particularly public blockchains and decentralized finance (DeFi)—and is divided into two parts: asset tokenization and currency tokenization. Most mentioned cases are still in early stages, but we can clearly observe how institutions distinguish between cryptocurrency and blockchain technology, along with emerging trends and application paths for these technologies.

Why Tokenize on Permissionless Blockchains? In the fast-evolving environment of digital technologies, permissionless blockchains have emerged as a revolutionary concept, challenging traditional centralized systems and paving the way for a new era of decentralized applications. A permissionless blockchain is essentially a form of distributed ledger technology that allows anyone to participate in the network without approval from a central authority. Bitcoin and Ethereum are the most well-known examples of permissionless blockchains, capturing the attention of technologists, investors, and visionaries worldwide.

The defining characteristics of permissionless blockchains are their open access and decentralized nature. These features differentiate them from traditional centralized systems and from permissioned blockchains that restrict participation.

When discussing permissionless blockchains, people often think of cryptocurrencies—one application of permissionless blockchains—as well as decentralized finance (DeFi) applications. In essence, permissionless blockchains are open shared databases, and we can harness these technologies to improve efficiency. Mainstream financial institutions have recognized that settlements involving cryptocurrencies can be completed atomically within minutes—and this characteristic could likely apply to other assets represented as tokens. Some benefits enabled by these technologies include:

• Higher Liquidity and Faster Settlement

o In traditional markets, standard T+2 or longer settlement cycles have been the norm, primarily due to counterparty settlement risk. This settlement delay ties up capital and increases counterparty risk.

o To shorten settlement times, best practice involves having accounts with counterparties at the same bank or custodian. This enables internal book transfers between parties, allowing nearly instantaneous settlement. However, opening bank accounts isn’t easy, especially for financial institutions. In contrast, blockchain-based systems can reduce transaction settlement to T+0 or even seconds—effectively instant.

• Easy and Low-Barrier Accessibility

o This open architecture is redefining accessibility—a goal long pursued by traditional systems. Anyone with a smartphone can access a full suite of financial services on-chain, fulfilling the promise we’ve long envisioned. Millions excluded from traditional finance are finding new economic opportunities through public blockchain financial services. Small businesses can access funding without enduring endless bureaucratic procedures. Individuals from all backgrounds can invest and earn meaningful returns—without perfect credit scores or formal attire.

• Automation and Trustless Operations

o A key advantage of permissionless blockchains is their decentralized structure. Unlike traditional systems where "power" and "control" are concentrated in a single entity, permissionless blockchains distribute decision-making across the entire network.

o Therefore, it is difficult for any single entity to manipulate or disable the system, since there is no central point of failure. This creates a trustless environment where participants do not need to rely on trust in a central authority. Instead, trust lies in the system itself, governed by transparent rules and cryptographic proofs.

o Smart contracts exemplify this trustless environment—they are self-executing contracts with terms directly written into code. These contracts automatically execute agreed-upon terms, reducing reliance on intermediaries and minimizing potential disputes.

• Global Open Participation

o The open nature of permissionless blockchains allows these networks to operate around the clock, enabling cross-border transactions without constraints from traditional banking hours or international wire transfer limitations. This global accessibility has the potential to revolutionize remittances and cross-border payments, making them faster and more cost-effective.

o For the unbanked and underbanked populations globally, these systems offer a way to participate in the global economy without needing access to traditional banking infrastructure. All that’s required is internet connectivity and a device capable of running a wallet application.

• Transparency and Real-Time Monitoring

o Every transaction on the network is recorded on a public ledger visible to all participants. Compared to traditional financial systems, where transaction records are not easily accessible, this level of transparency far exceeds conventional systems. This public nature enhances trust among users, as anyone can verify transactions and the overall state of the network. Simultaneously, real-time access to transaction data can be granted to different counterparties for monitoring and automation purposes.

Permissionless blockchain technology holds great promise, but like any emerging innovation, it faces limitations and obstacles that must be overcome. As decentralized finance (DeFi) platforms grow and traditional financial institutions follow suit, we witness a dynamic financial ecosystem filled with both potential and challenges. Understanding these challenges is crucial for risk mitigation and fully unlocking the potential of permissionless blockchains:

• Security and Privacy Concerns

o Permissionless blockchains may face certain risks—for example, security vulnerabilities such as 51% attacks (in systems using Proof-of-Work and Proof-of-Stake consensus mechanisms).

o If smart contracts are not properly audited and tested, they may introduce security risks.

o On privacy, transparency is a double-edged sword. All transactions on public blockchains are visible to everyone, which may pose problems for individuals and enterprises requiring confidentiality.

• Regulatory Uncertainty

o The decentralized nature of permissionless blockchains presents significant challenges for regulators, requiring coordinated oversight across jurisdictions. Many governments are still struggling to determine how to classify and regulate cryptocurrencies and blockchain-based assets. We will explore regulatory details in greater depth in the next section.

o Cryptocurrency regulations aim to create stability, protect investors, and prevent illegal activities such as money laundering or fraud. Given the high volatility and largely decentralized nature of crypto markets, regulations help mitigate investor risk and ensure exchanges and other crypto firms operate transparently and fairly.

o Moreover, regulations aim to integrate cryptocurrencies into the existing financial system while maintaining oversight, reducing misuse opportunities, and promoting broader adoption by enhancing trust in the system. The constantly evolving nature of crypto regulation makes it difficult to predict, as each country and region holds differing views on cryptocurrencies.

• Market Volatility

o Cryptocurrencies, typically native assets of permissionless blockchains, are known for extreme price volatility—even Bitcoin, the largest by market cap, can fluctuate 20% in a single day. Tokenized assets coexisting with volatile cryptocurrencies may pass risks into the mainstream financial system, raising concerns from the U.S. Securities and Exchange Commission (SEC). For example, a large trader might use a Treasury token as collateral, but due to severe market fluctuations, he might require liquidation. This could trigger a sell-off of underlying assets in mainstream financial markets.

• Complex User Experience

o Despite numerous potential benefits, interacting with permissionless blockchains remains difficult for many users. Setting up wallets, managing private keys, and engaging with decentralized applications can be challenging for non-technical users.

o The irreversible nature of blockchain transactions means user errors can be costly. Sending funds to the wrong address or losing access to a wallet could result in permanent asset loss. This high-risk environment may deter users and hinder mass adoption.

• Lack of Accountability Mechanisms

o Permissionless blockchains present major challenges for anti-money laundering (AML) and know-your-customer (KYC) compliance—cornerstones of financial regulation. Unlike traditional finance (TradFi), where intermediaries act as gatekeepers, these open networks allow anyone to transact without prior approval or identity verification. While this anonymity appeals to privacy advocates, it also creates an environment conducive to illicit activities. The absence of centralized oversight makes tracking fund flows or identifying parties involved in suspicious transactions difficult, complicating efforts to combat financial crime.

o The rise of decentralized finance (DeFi) on permissionless blockchains exacerbates these concerns. DeFi platforms offer financial services without the safeguards typically found in TradFi, such as identity checks or transaction monitoring. While this provides financial access to underserved populations, it also opens opportunities for bad actors to exploit the system. For example, money launderers could use complex chains of DeFi transactions to obscure the origin of funds, making it hard for law enforcement to trace money flows. As regulators work to address these issues, balancing innovation with security remains a key challenge amid the ongoing evolution of blockchain technology.

• Difficulty Upgrading

o Upgrading permissionless blockchain protocols is a complex and risky process. Unlike centralized systems, where upgrades can be implemented unilaterally, changes to blockchain protocols require consensus among diverse and dispersed participants.

o The difficulty of implementing upgrades may lead to technological stagnation, leaving known issues or limitations unresolved because the community cannot agree on solutions. It also makes rapid responses to newly discovered vulnerabilities or changing technical environments difficult. Permissionless blockchains represent a breakthrough technology with the potential to improve our digital lives and revolutionize the future investment landscape. Compared to traditional centralized systems, their advantages offer substantial benefits. The innovation potential they unlock in areas such as decentralized finance and new economic models is exciting. However, these systems also face significant challenges and risks that constitute substantial barriers to widespread adoption.

Ultimately, the future of permissionless blockchains may involve a process of evolution and improvement. While they may not fully replace traditional systems in the short term, they have already demonstrated their potential to complement and enhance existing financial and technological infrastructures.

As the technology matures and solutions emerge for current challenges, we can expect permissionless blockchain technology to achieve broader integration across various economic and social domains.

This integration will take time and require careful consideration of trade-offs between decentralization, efficiency, security, and user experience. When comparing decentralized finance to traditional finance, it's important to consider the evolution of traditional finance. Internet banking or online brokerage did not appear overnight—today’s online trading and investment platforms evolved over many years, facing numerous regulatory hurdles. Early-mover large banks or participants grew alongside the evolution of traditional finance and ultimately succeeded in the financial industry. This mindset similarly applies to decentralized finance and its integration with traditional financial ecosystems via blockchain, as a path toward broad DeFi adoption.

Changing Legal and Regulatory Trends – Regulatory Frameworks Across Jurisdictions

The global legal environment surrounding real-world asset (RWA) tokenization is fragmented. Legal systems need to establish clear criteria for classifying tokens subject to securities laws. Tokens can substitute for traditional securities, in which case securities regulations must be adapted and applied accordingly. Extending securities laws to tokens that aren't securities may produce undesirable outcomes and stifle economic and/or technological innovation. Some jurisdictions adopt traditional approaches, differentiating security tokens from cryptocurrencies under existing securities laws.

As decentralized finance (DeFi) and tokenization develop rapidly, global regulators are continuously refining legal frameworks for digital assets and related financial activities. This trend not only reflects growing demands from market participants but also shows government emphasis on maintaining financial stability and protecting investor rights. With the booming crypto market and expanding applications of tokenization technology, different regulatory bodies hold varying considerations and requirements for cryptocurrency-based assets and tokenization techniques. We will examine several major jurisdictions and their regulatory stances, including the United States, Hong Kong, Singapore, the UAE, the British Virgin Islands, and the European Union.

United States

Regulators: Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Financial Crimes Enforcement Network (FinCEN).

Crypto Regulation:

-

Security Tokens: Regulated by the SEC under U.S. securities laws. If a token qualifies as a security under the Howey Test, it must comply with registration requirements, exemptions (e.g., Regulation D, Regulation S), disclosure obligations, and conduct standards.

-

Commodity Tokens: Such as Bitcoin (BTC) and Ethereum (ETH), classified as commodities and regulated by the CFTC.

-

Payment Tokens (Cryptocurrencies): Subject to anti-money laundering / counter-terrorism financing (AML/CFT) regulations by FinCEN if used for money transmission services.

Tokenization:

-

Tokenized Securities: Treated as traditional securities and must comply with all SEC regulations regarding issuance, trading, and custody.

-

Digital Asset Custodians: Must register and comply with SEC and CFTC regulations for digital asset custody.

Hong Kong

Regulators: Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA).

Crypto Regulation:

-

The SFC regulates cryptocurrencies qualifying as securities or futures contracts under the Securities and Futures Ordinance (SFO).

-

Virtual Asset Trading Platforms: Must apply for licenses under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) and comply with AML and CTF requirements.

-

Regulatory Sandbox: Allows crypto platforms to operate under strict supervision to ensure compliance with regulatory standards.

Tokenization:

-

Security Tokens: Classified as securities under the SFO and subject to securities laws, including licensing requirements for intermediaries, prospectus obligations, and adherence to codes of conduct.

-

Stablecoins: HKMA is developing a regulatory framework treating stablecoins as stored value facilities (SVFs), requiring licenses and prudential standards similar to payment providers.

Singapore

Regulator: Monetary Authority of Singapore (MAS).

Crypto Regulation:

-

Payment Tokens: Also known as Digital Payment Tokens (DPTs), regulated under the Payment Services Act (PSA). Crypto exchanges and wallet providers must obtain licenses and comply with AML and CTF requirements.

-

Security Tokens: If qualifying as securities or capital market products, regulated under the Securities and Futures Act (SFA). Issuers must comply with prospectus requirements and obtain licenses unless exempt.

Tokenization:

-

Utility Tokens: Generally not regulated under the SFA unless falling into specific categories triggering regulation. They must still comply with AML/CFT and consumer protection laws.

-

MAS supports Security Token Offerings (STOs) and has established frameworks to facilitate tokenized securities issuance under the SFA, providing guidance for regulated entities conducting STOs.

United Arab Emirates

Regulators: Dubai Financial Services Authority (DFSA), Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA), and Securities and Commodities Authority (SCA).

Crypto Regulation:

-

Security Tokens: Regulated under ADGM and DFSA financial market regulations. Issuers and intermediaries must be licensed, adhere to codes of conduct, and comply with AML and CTF requirements.

-

Virtual Asset Service Providers (VASPs): Must register with respective regulators and meet specific requirements (e.g., ADGM’s Virtual Asset Framework and DFSA’s Virtual Asset Regulations).

Tokenization:

-

Fiat-Referenced Tokens (FRTs): Regulated under ADGM’s proposed Stablecoin and Asset-Backed Token Framework. These tokens must be fully backed by high-quality, liquid assets.

-

The UAE encourages Security Token Offerings (STOs) within its financial free zones (ADGM and DIFC), establishing clear rules for compliance, investor protection, and issuance.

British Virgin Islands

Regulator: BVI Financial Services Commission (BVI FSC)

Crypto Regulation:

-

Security Tokens: Regulated under the BVI Securities and Investment Business Act 2010 (SIBA). Issuers and intermediaries must be licensed, follow codes of conduct, and comply with AML and CTF requirements.

-

Virtual Asset Service Providers (VASPs): Entities meeting the definition of VASPs must obtain licenses under the VASP Act. Additionally, the BVI FSC has issued guidance on VASP registration applications ("VASP Registration Guidance") and guidelines on AML, CTF, and proliferation financing for VASPs.

Tokenization:

-

Security Tokens: Tokens constituting securities or other financial instruments must comply with multiple regulations, including (but not limited to) the VASP Act, the Securities and Investment Business Act 2010, and the Financing and Monetary Services Act 2009.

European Union

Regulators: European Securities and Markets Authority (ESMA), European Banking Authority (EBA), and national regulators.

Crypto Regulation:

-

The EU has established the Markets in Crypto-Assets Regulation (MiCA), providing a comprehensive regulatory framework for member states.

-

Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs) must meet requirements related to authorization, reserve management, capital adequacy, and disclosure obligations.

-

Crypto Asset Service Providers (CASPs): Must be licensed and comply with MiCA’s AML/CTF and market conduct standards.

Tokenization:

-

Security Tokens: If qualifying as financial instruments, such as transferable securities, regulated under existing Markets in Financial Instruments Directive (MiFID II).

-

MiCA also covers utility tokens, providing clear guidance on issuance and trading, although utility tokens may fall outside traditional securities regulation.

Summary

Each jurisdiction has its unique approach to regulating cryptocurrencies and asset tokenization. Generally:

-

Hong Kong and Singapore pursue balanced approaches, encouraging innovation while ensuring investor protection and market integrity.

-

The U.S. regulatory environment is more fragmented, with multiple agencies overseeing different aspects of crypto assets.

-

The UAE offers tailored regulatory frameworks within its financial free zones, fostering a regulated environment for digital assets and tokenization.

-

The British Virgin Islands has a clear system, relying on existing securities laws to regulate security tokens and the VASP Act to govern virtual asset services.

-

The EU, through MiCA, is moving toward a unified regulatory framework across member states, focusing on consumer protection, market integrity, and financial stability.

Asset Tokenization: Institutions Entering Web3

Decentralized finance (DeFi) is rapidly gaining attention for its potential to transform institutional financial services through blockchain technology and smart contracts. DeFi proponents envision a new financial paradigm characterized by fast settlement, efficiency, composability, and open, transparent networks.

Despite optimistic prospects, DeFi’s development in regulated financial activities remains cautious, largely due to evolving macroeconomic and regulatory environments and uncertainties in technological development. So far, most institutional DeFi initiatives remain in proof-of-concept or sandbox environments. However, successful implementations are beginning to emerge, and the convergence of DeFi with digital assets and tokenization is expected to accelerate over the next one to three years.

Financial institutions have spent years preparing, recognizing the transformative potential of DeFi. As technology and regulatory frameworks mature, the integration of DeFi with institutional finance is anticipated to unlock new levels of efficiency, transparency, and innovation. In this section, we will focus on a key component of assets—securities—to examine how financial institutions are exploring this domain.

From Concept to Reality: Mainstream Thinking on Blockchain and Tokenization

From an institutional perspective, tokenization is a form of data entry that offers advantages over traditional ledger entries, while blockchain serves as a ledger for recording ownership and facilitating transactions.

As blockchain technology and the crypto industry continue advancing, the term “real-world assets” (RWA) has become increasingly common. RWA encompasses a wide range—from tokenizing physical assets to mainstream financial instruments, even extending to assets tied to environmental, social, and governance (ESG) criteria. Within Web3, the first widely adopted category of real-world assets was stablecoins, which we will discuss in the next section. Following closely are U.S. Treasury-linked products, widely accepted as safe and standardized assets. Over the past few months, we have seen rapid growth in on-chain U.S. Treasuries and money market funds, with total value rising from approximately $100 million in early 2023 to $2.21 billion today.

Tokenization: 2024 Milestones in Mainstream Finance

Ethereum, Bitcoin, and other public blockchains have created an open financial system enabling free asset trading and movement. This openness has spurred numerous financial innovations, but due to their anonymous and open nature, it also poses significant challenges for anti-money laundering (AML) and counter-terrorism financing (CFT). Mainstream financial institutions have invested considerable time and effort researching and exploring solutions, gradually identifying optimal practices.

To address these issues, financial institutions have developed best practices to make regulators more comfortable allowing such flows. Examples include on-chain AML screening, token whitelisting and blacklisting controls, etc.

These practices have facilitated mainstream financial institutions' entry into the DeFi space. 2024 appears to be a turning point, with key milestones including Blackstone Group and Securitize[5] launching the BUIDL token on Ethereum, followed by Franklin Templeton’s tokenization across multiple blockchains[6], and UBS’s partnership with DigiFT[7] to issue a U.S. Treasury fund.

Driving factors behind this progress include operational efficiency on-chain and market opportunities—all enabled by the emergence of compliant on-chain market participants. Securitize, as an SEC-approved transfer agent, leverages public blockchains as infrastructure to register and record asset ownership on-chain. This allows Securitize to serve as Blackstone’s distributor, facilitating the tokenization and distribution of assets on the Ethereum blockchain, integrating Blackstone’s BUIDL token into the DeFi and Web3 ecosystem.

Previously, Franklin Templeton used blockchains like Polygon and Stellar for record-keeping but primarily relied on traditional ledger entries, treating public blockchains as secondary ledgers. In contrast, Blackstone uses the public blockchain as its primary ledger, allowing direct on-chain token transfers and legally valid ownership transfers. Shortly after Blackstone launched BUIDL, Franklin Templeton released its own token transfer functionality, even supporting transfers across other blockchains such as Solana, Avalanche, Aptos, and Arbitrum to expand its customer base.

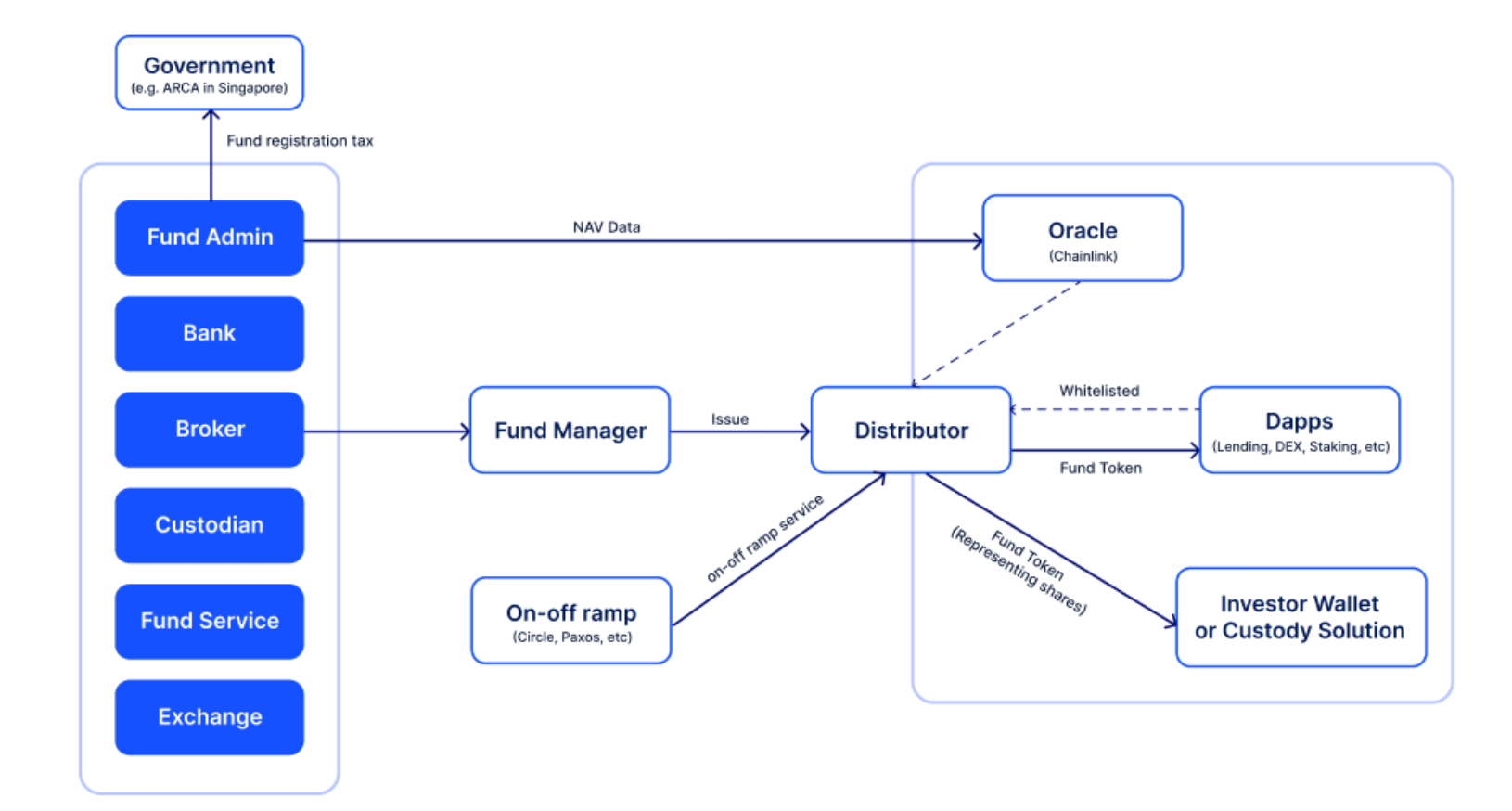

Structure of Tokenization

Although similar funds are common in Web2 markets, achieving tokenization still faces many challenges, as fund operations involve dozens of stakeholders and key processes, as shown in the diagram below:

The process mainly consists of three key components:

-

Fund Management: Fund managers open accounts with institutions such as banks, exchanges, brokers, and custodians to invest and manage assets according to strategy.

-

Fund Administration: Tasks include net asset value (NAV) calculation, accounting and bookkeeping, investor services, compliance reporting, fee management, and audit support.

-

Fund Distribution: Distribution channels bridge investment funds and investors, providing infrastructure for sales, marketing, and delivery. In Web3, distribution channels allocate funds in token format to the Web3 ecosystem.

Within the tokenization process, fund distribution is most directly relevant. However, to complete distribution, activities such as KYC linking, AML checks, data updates, dividend payments, and allocations are closely tied to other stages.

In the above diagram, we can divide the process into on-chain and off-chain parts. The right-side processes are on-chain related, including:

On-Chain AML and KYC

-

Link customer wallet addresses to off-chain KYC and add addresses to whitelists.

Ownership Records

-

Tokens represent fund ownership, guaranteed by legal contracts. Thus, on-chain transfers to another address carry legal validity.

Token Contract Design

-

Token contracts are managed by fund managers, featuring role settings, forced transfers, minting or burning tokens, whitelists, and blacklists.

-

Distributors can add or remove addresses from whitelists and mint or burn fund tokens.

-

End investors typically only have the right to transfer tokens (to another whitelisted address or redemption contract).

On-Chain Data Availability

-

This process usually involves an oracle publishing off-chain data (e.g., NAV of fund shares) onto the chain.

As shown above, institutional asset tokenization involves multiple parties and requires coordinated efforts—it is neither simple nor straightforward. Some institutions have streamlined this process and successfully launched fund tokens in 2024. We view 2024 as a pivotal turning point.

2024: Key Milestones

Blackstone and Securitize Launch BUIDL

Blackstone Group is the first major financial institution to directly adopt fund tokenization, achieved through its collaboration with Securitize.

The fund, named BUIDL (BlackRock USD Institutional Digital Liquidity), is issued by a Blackstone entity in the British Virgin Islands. It is a sub-fund investing in a master fund managed by Blackstone Asset Management. Securitize, as an SEC-approved transfer agent, serves as the fund’s tokenization platform, transfer agent, and sole distributor.

Fund tokens represent shares and can be transferred on-chain between whitelisted addresses. Leveraging this transferability, Circle—the issuer of stablecoin USDC—added a real-time redemption smart contract for BUIDL, providing $100 million in USDC liquidity. Investors can deposit BUIDL tokens into the smart contract and receive USDC liquidity upon transaction confirmation on the Ethereum blockchain. This feature showcases the fast and efficient settlement advantages of public blockchain technology.

To invest in the fund, investors must be qualified purchasers (QPs), with a minimum investment of $5 million. The fund adopts a distribution share class structure, with each BUIDL fund share token always equal to $1, and earnings distributed monthly in the form of BUIDL token airdrops.

Franklin Templeton Launches FOBXX Across Multiple Chains

It is commonly believed that transfers on public blockchains carry legal effect. However, this is not always true. In some jurisdictions, laws require harmonizing general provisions for intangible asset transfers with actual blockchain operations. This is achieved by integrating on-chain transfers into universally applicable rules. Franklin Templeton’s fund tokenization project went through this process.

In 2021, Franklin Templeton tokenized its U.S. Treasury fund on the Polygon and Stellar blockchains, using Benji as the tokenization platform, offering wallet and custody solutions for retail customers. The fund is available to U.S. retail investors.

Initially, Franklin Templeton’s Benji tokens could not be directly transferred on-chain. Benji only used blockchains like Polygon and Stellar as auxiliary ledgers, still relying on its own centralized system.

Shortly after Blackstone launched BUIDL, they activated native on-chain transfer functionality and extended support to other blockchains such as Ethereum, Arbitrum, Aptos, and Avalanche C-Chain.

UBS Partners with DigiFT to Distribute Tokenized Fund

The project originated as a pilot under the Monetary Authority of Singapore (MAS)’s “Project Guardian.” In this initiative, UBS developed internal capabilities for tokenization on public blockchains. Recently, UBS partnered with DigiFT and another distributor (SBI) for token distribution, with DigiFT serving as the DeFi distributor for the dollar money market fund token.

The fund token represents shares in a variable capital company (VCC), a widely used fund structure in Singapore known for its flexibility.

The partnership with DigiFT enables UBS’s money market fund token to reach a broader client base across both Web2 and Web3. DigiFT’s trading smart contract provides real-time redemption capability, allowing all DigiFT users to supply liquidity to meet redemption demands and enabling seamless interaction with the DeFi ecosystem.

DTCC and Chainlink Collaborate on Smart NAV Pilot

DTCC and Chainlink announced the successful completion of the Smart NAV pilot in 2024[9]. The initiative aims to tokenize mutual funds and automate the distribution of net asset value (NAV) data using Chainlink’s blockchain technology. NAV is the daily valuation of mutual fund assets. Traditionally, distributing NAV data is a manual, error-prone, and slow process. The Smart NAV pilot transforms this by delivering on-chain NAV data via Chainlink’s CCIP across public and private blockchains.

The pilot also involved key industry players such as JPMorgan Chase, BNY Mellon, and Franklin Templeton, who tested how blockchain-based automation can enhance transparency and efficiency in financial operations.

Key achievements of the pilot include:

-

Interoperability: Chainlink’s CCIP ensures NAV data can be seamlessly distributed across different blockchain networks, avoiding data silos and improving access and scalability. This cross-chain capability is crucial for the future of tokenization, enabling secure interactions between traditional financial markets and decentralized platforms.

-

Real-Time Data Access: By putting NAV data on-chain, financial institutions gain real-time pricing information, improving market efficiency. This not only accelerates decision-making but also paves the way for tokenizing mutual funds, making them easier to trade and manage.

-

Improved Operational Efficiency: The pilot automated multiple aspects of NAV data distribution, reducing manual errors and operational costs. The ability to deliver historical data on-chain also enhanced transparency and record-keeping, which is critical.

The collaboration between Chainlink and DTCC represents forward-thinking efforts to integrate blockchain technology with traditional finance. By automating the transmission of key financial metrics such as NAV data, this partnership demonstrates the potential to achieve higher efficiency, transparency, and innovation in financial markets. With participation from major financial institutions like JPMorgan Chase, BNY Mellon, and Franklin Templeton, the Smart NAV pilot clearly signals growing institutional interest in blockchain-based solutions.

After Tokenization—What Are the Use Cases?

Why are these mainstream financial institutions interested in tokenization? If issuing tokens on public blockchains is merely about record-keeping and asset ownership maintenance, efficiency gains would be minimal. One direct benefit is access to new markets, thereby increasing their assets under management (AUM). The narrative around institutional DeFi is also an area of exploration, where more use cases for tokenized assets can truly address pain points in traditional financial systems.

Institutional DeFi needs time not only to solve business and technical issues but also legal and compliance challenges. The quick movers are DeFi participants. Beyond tokenization, DeFi players are adding more use cases to tokens issued by these institutions.

Real-Time Settlement Capability

Real-time settlement is the ideal scenario in capital markets. If settlement can be completed in a single atomic transaction, settlement risk can be reduced to nearly zero. But in mainstream systems, only a small fraction achieves this. The barrier lies in clearing, settlement, and reconciliation processes between different parties. These processes take time because each participant maintains their own ledger, lacking mutual trust.

However, on a public open ledger, real-time settlement becomes possible. After Blackstone launched BUIDL, Circle established a real-time redemption contract for any BUIDL holder, providing $100 million in USDC liquidity for instant redemption[10]. They manage received BUIDL tokens and replenish the liquidity pool when needed.

DigiFT has established an internal real-time redemption contract for asset token holders, allowing immediate access to USDC liquidity, while in the background, the smart contract triggers normal redemptions to refill the liquidity pool.

Stablecoin Reserve Assets

Compared to highly volatile cryptocurrencies, security tokens such as Treasury fund tokens and money market fund tokens are better suited as reserve assets for fiat-referenced stablecoins.

Sky (formerly MakerDAO) was the first decentralized stablecoin to adopt off-chain assets, now using tokenized assets as reserves for its stablecoin [11]. Recently, they launched the RWA Grand Prix, planning to allocate $1 billion in USDC to RWA tokens [12], with companies like UBS, Blackstone, and Franklin Templeton competing for allocation.

Other examples include Mountain Protocol’s stablecoin USDm and Ethena’s stablecoin UStb[13].

Asset Wrapping and Fractionalization

In the financial supply chain, distributors lower entry barriers and improve efficiency for specific assets. A Web3 distribution example is Ondo Finance, a distribution channel for Blackstone’s BUIDL, currently with over $200 million in total value locked.

Ondo wraps BUIDL into a fund token called OUSG, accessible to U.S. accredited investors. Unlike BUIDL, which requires a minimum subscription of $5 million, OUSG accepts as little as $5,000 and enables real-time USDC subscriptions and redemptions. In this case, Ondo helps broaden BUIDL’s audience.

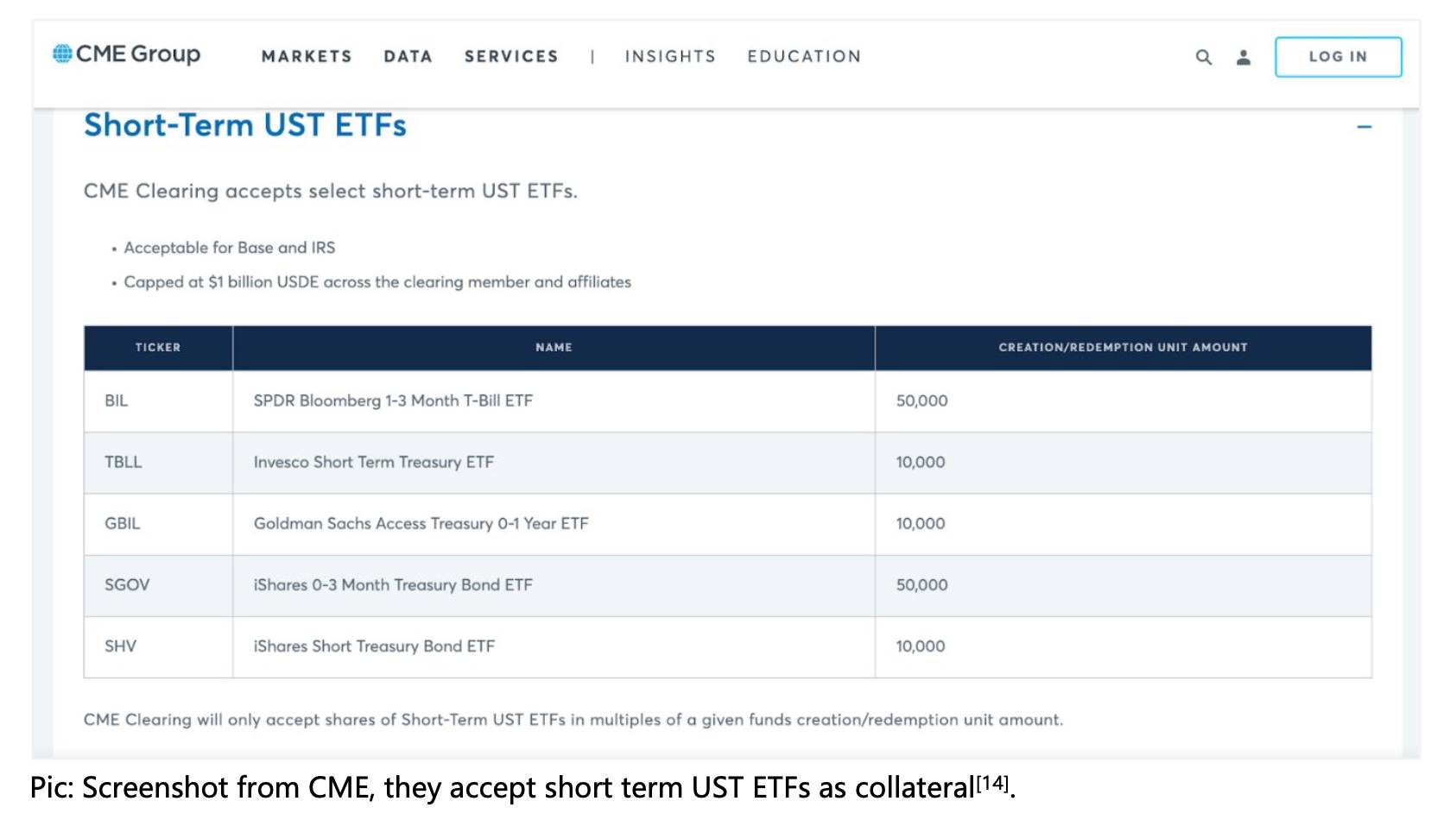

Margin Collateral

In mainstream finance, safe yield-generating assets such as U.S. Treasuries and corporate debt are commonly used as highly liquid collateral for margin and derivatives trading.

Take CME as an example—it accepts various assets as collateral, including bonds, funds, and other securities.

Currently, using short-term U.S. Treasury fund tokens or money market fund tokens as collateral instead of stablecoins or cash can offset the funding costs of margin trading.

In 2023, Binance collaborated with crypto-friendly banks to offer U.S. Treasuries as collateral for institutional clients[15], though the entire system still relies on traditional trading venues like Sygnum Bank.

In Web3, institutions and crypto exchanges are more familiar with tokenized assets. With the emergence of highly liquid and secure assets like BUIDL, they are beginning to accept tokenized assets as collateral for certain trading purposes. Thanks to instant redemption liquidity, the liquidation process is no longer a bottleneck.

Brokers such as FalconX[16] and Hidden Road Partners[17] are already developing such use cases to attract institutional investors.

Asset Tokenization—What’s Next?

As we move into 2024 and beyond, asset tokenization is poised to transform the financial landscape by unlocking unprecedented liquidity, efficiency, and accessibility. We can clearly identify several emerging future trends.

The Web3-native tokenization ecosystem is maturing. Traditional financial markets are mature, with participants playing defined roles. In 2024, we see startups adopting business models and transitioning into Web3. Examples include rating agencies (such as Particula) and accounting audit firms (such as Elven, The Network Firm).

Beyond U.S. Treasuries, as U.S. interest rates begin to decline, Web3 investors are showing interest in high-yield assets. These assets will compete with Web3-native yields to attract investments.

Tokenization platforms and distribution channels are also targeting traditionally illiquid products such as trade finance instruments and venture capital funds. Through this process, traditionally illiquid markets will also be democratized.

Compliance and licensing are another major trend, as we see Web3 companies obtaining licenses in favorable jurisdictions like the UAE and the EU. With compliant participants emerging in the ecosystem, mainstream institutions can collaborate with them to explore new market opportunities.

As institutions adapt to Web3 and blockchain infrastructure, on-chain liquidity and real-time settlement will become realistic at scale, with settlement processes gradually migrating on-chain.

Currency Tokenization

As the global economy continues digitizing, monetary systems stand at the brink of another major transformation. From dematerialization to digitization, and now to tokenization, the form and function of money are undergoing profound evolution. In recent years, we’ve seen how tokenization of real-world assets (RWA) can make asset management and financial services more efficient, with major financial institutions like BlackRock and Franklin Templeton actively exploring application scenarios. However, beyond asset tokenization, currency tokenization is emerging as a significant trend, demonstrating immense potential to transform payment systems and financial markets.

Persistent pain points in today’s payment systems—such as high cross-border payment costs, slow settlement speeds, and complex liquidity management—are driving the financial industry to seek smarter, more efficient solutions. Currency tokenization sits at the heart of this exploration. Using blockchain and smart contract technologies, money can become programmable, automated, and efficiently settled in a transparent manner. Digital currencies introduce new efficiency and flexibility into existing financial systems, accelerating fund flows, enhancing transparency, reducing reliance on intermediaries, and injecting new vitality into the global financial system.

New Horizons: Collaboration and Innovation in Digital Currencies

Discussions about digital currencies and their applications sparked widespread attention during the early days of blockchain technology. As blockchain technology rapidly advanced, the idea of digital currencies became a popular topic in fintech forums and experiments. However, due to immature understanding of blockchain technology and digital currency methods, coupled with a lack of corresponding legal and regulatory frameworks, many attempts failed, causing discussion热度 to gradually fade.

Since 2017, the industry has experienced repeated failures and adjustments in policy and regulatory environments, leading to cooling interest in digital currency and blockchain applications. However, the rise of decentralized finance (DeFi) changed this landscape. The development of DeFi reignited interest in blockchain and tokenization. With continuous improvements in blockchain infrastructure, discussions around digital currencies have regained momentum and entered a new developmental phase.

In recent years, many emerging technologies and standards have matured—for example, cross-chain technology enabling seamless flow of assets and data between different blockchains, zero-knowledge proofs enhancing transaction privacy and security, and new token standards enriching the diversity of asset and currency tokenization. These gradually improving infrastructures have paved the way for practical applications of digital currencies, driving further exploration of monetary innovation and blockchain technology.

In 2020, the G20 signed the Roadmap for Enhancing Cross-Border Payments[18], recognizing the importance of efficient payment systems for global economic growth and financial inclusion. The roadmap’s core goals are to address challenges in cross-border payments, improve speed and transparency, increase service accessibility, and reduce costs. The G20 initiative has accelerated the development of digital currencies, while strong support from major global economies has provided solid policy backing for innovation in this field.

G20 Initiative: Goals and Vision

The G20’s cross-border payments roadmap aims to fundamentally improve the efficiency, transparency, and accessibility of global payment systems—especially in cross-border payments. The plan targets several key objectives[19]:

Cost

-

By 2027, reduce the global average cost of sending $200 in remittances to no more than 3%

-

By 2030, reduce the global average payment cost to no more than 1%

Speed

-

By 2027, ensure 75% of cross-border wholesale payments arrive within one hour of initiation, with the remainder settled within one business day; cross-border retail payments and remittances should follow similar timelines.

Accessibility

-

By 2027, ensure at least 90% of individuals have access to cross-border electronic remittance options, with every end-user having at least one option to send and receive cross-border payments. Financial institutions should offer at least one cross-border wholesale payment option per payment corridor.

Transparency

-

By 2027, all payment service providers (PSPs) must provide minimum information, including transaction costs, estimated arrival time, payment status tracking, and service terms.

Current Pain Points in Payment Systems

Despite the growing importance of cross-border payments, existing systems face numerous challenges that severely impact efficiency, cost, and accessibility. According to analysis by the Committee on Payments and Market Infrastructures (CPMI) of the Bank for International Settlements, major challenges in cross-border payments include[20]:

1. High Costs:

Current cross-border payments involve multiple intermediaries, each adding transaction fees. High costs make small-value payments economically unviable, hindering the widespread adoption of remittances.

2. Slow Speeds:

Cross-border payments often go through lengthy transaction chains, with multiple parties’ clearing and settlement causing delays. Batch processing and lack of real-time monitoring further prolong transaction times.

3. Limited Transparency:

Multiple steps in the payment process lack transparency, making it difficult for users to obtain detailed information about payment status and fees, increasing uncertainty and trust costs.

4. Limited Accessibility:

Many users in certain regions struggle to access cross-border payment services, especially in developing countries where coverage of financial institutions and payment services is inadequate, resulting in widespread accessibility issues.

5. Compliance Complexity:

Cross-border payments involve complex compliance requirements such as anti-money laundering (AML) and counter-terrorism financing (CFT). Inconsistent regulations across jurisdictions pose significant compliance challenges for payment service providers.

6. Legacy Technology Platforms:

Existing payment infrastructures largely rely on legacy technology platforms lacking real-time processing capabilities and unified data transmission standards, leading to inefficient cross-border payments.

Trends in Distributed Ledger Technology (DLT) and Digital Currency Applications

As cross-border payment technology evolves, the application of distributed ledger technology (DLT) in digital currencies is becoming a key trend. DLT offers a reliable solution to effectively address current payment system challenges, particularly excelling in cross-border payments. Through DLT, payment systems can achieve data sharing, transparency, and real-time capabilities—features currently missing in traditional systems.

DLT applications are making three main types of digital currencies increasingly viable: Central Bank Digital Currencies (CBDCs), Tokenized Bank Deposits, and Stablecoins[21]:

1. Central Bank Digital Currencies (CBDCs):

Issued by central banks, CBDCs aim to enhance financial inclusion by providing reliable digital payment tools while reducing reliance on cash. As a technological option for CBDC implementation, DLT-based CBDC architectures can enable efficient, low-cost cross-border payments while ensuring compliance and security. CBDCs are liabilities on the central bank’s balance sheet, representing the central bank’s direct obligation to the public, backed by national credit, ensuring high stability and trust.

2. Tokenized Bank Deposits:

A digital representation of traditional bank deposits, tokenized bank deposits use DLT to enable trading and settlement of deposits in token form. This not only improves payment efficiency but also enables real-time interbank clearing, reducing funding costs. Tokenized bank deposits are liabilities on commercial banks’ balance sheets, similar to traditional deposits, with repayment obligations held by commercial banks. Their value depends on the creditworthiness of the commercial bank and is affected by the bank’s liquidity and regulatory framework.

3. Stablecoins:

Stablecoins are digital currencies pegged to the value of fiat currencies or other assets, designed to maintain price stability. Stablecoins are commonly used in decentralized finance (DeFi) ecosystems to provide fast, low-cost payment solutions. DLT enables stablecoins to be efficiently transmitted globally, reducing friction and intermediary costs in traditional payment systems. Stablecoins are typically issued by private companies, representing liabilities of the issuer to holders, backed by reserve assets. Their credibility depends on the quality of the collateral and the issuer’s reputation, usually pegged to fiat currencies or other assets.

Advantages of Digital Currencies

The rise of digital currencies brings numerous advantages, making them vital components of financial systems. Specifically, digital currencies demonstrate significant advantages in the following areas[22]:

Shared Ledger

Digital currencies utilize distributed ledger technology (DLT) to provide unified infrastructure for domestic and cross-border payments. Compared to information silos in traditional systems, DLT effectively reduces operational costs.

Reduced Transaction Time

The decentralized nature of DLT allows transactions to complete within seconds to minutes. For example, traditional cross-border payments typically take 2–5 days to process, whereas digital currencies can shorten this to seconds or minutes.

Atomic Settlement

Digital currencies and DLT enable atomic settlement, ensuring simultaneous exchange of funds and assets, greatly reducing counterparty risk. Especially in cross-border payments and high-frequency trading, this mechanism ensures execution only when both parties meet conditions, preventing partial failures.

Transparency

DLT’s transparency greatly enhances transaction visibility, with all records viewable and verifiable by all participants. Blockchain platforms can reduce reconciliation time from days to seconds, reducing counterparty risk—especially valuable in multi-party supply chain and trade finance scenarios.

Elimination of Intermediaries

Digital currencies enable peer-to-peer transactions, reducing reliance on intermediaries. For example, traditional international remittances typically go through multiple banks or processors, while digital currencies allow direct transactions between sender and receiver, lowering fees and delays.

Financial Inclusion

World Bank data shows that over 1.4 billion people remain unbanked[23], yet over 60% own mobile phones. Digital currencies can provide low-cost, accessible payment solutions via mobile devices. Especially in regions with underdeveloped financial infrastructure, digital currencies like stablecoins allow users without bank accounts to participate in the global economy, promoting financial inclusion.

Compliance and Security

Digital currencies achieve automated compliance and secure transactions through smart contracts, reducing human error and lowering fraud and security risks via pre-programmed rules. For example, in financial markets, smart contracts can automatically execute KYC and AML processes, ensuring compliance in cross-border transactions.

Programmability

Programmability allows issuers to embed various logic into digital currencies, enabling flexible and efficient payment systems. For example, programmability enables financial institutions to build highly customized payment workflows, increasing efficiency and security in supply chain finance, cross-border payments, and automated investment. Additionally, smart contracts can embed compliance checks, automatically completing AML and KYC requirements during transaction execution, further enhancing payment security and compliance.

A New Paradigm of Programmable Money

Digital currencies not only enable value transfer but also allow issuers to embed various programming logic, bringing multiple benefits—improving user experience, enhancing transparency, efficiency, and accessibility of financial services, and enabling novel, creative applications in payment transactions such as conditional payments, pre-authorizations, conditional escrow deposits, foreign exchange conversion in cross-border payments, and complex financial operations.

This contrasts sharply with traditional fintech definitions of digital currency, where digital currencies are typically database entries. In such systems, achieving “programmability” requires developing an additional technical system independent of the database and connecting it either internally by the entity maintaining the database or externally via APIs for customers. Applications interact with database records through publicly exposed program logic via traditional database APIs[24]. Simply put, in traditional systems, value storage and programming logic are separate. In contrast, in decentralized ledgers (blockchains), “programmable money” integrates value storage and programming logic, creating a new paradigm.

Despite many benefits, the ability to attach programming logic directly to currency units remains controversial, primarily concerning the principle of “singleness” of money. According to this principle, all forms of money—whether stored in bank accounts, paper bills, or coins—must be exchangeable at par value. In other words, dollars in one person’s bank account must equal dollar coins in another’s pocket. The same applies to digital currencies—maintaining fungibility is crucial. Therefore, if we want to implement complex usage logic on programmable money—for example, escrow payments using ERC-20 stablecoins or purpose-specific usage—since the ERC-20 standard does not support such complex capabilities, custom development and new contract deployment are required. This could cause the programmable currency to lose its “singleness.” Imagine whether a programmable currency usable only for purchasing apples is fungible with a standard ERC-20 programmable currency?

Overall, the challenge with programmable payments is that to achieve more complex programming rules, programmable money itself requires customized coding. This not only risks losing the currency’s “singleness” but also raises policy and public trust concerns, potentially leading

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News