Stablecoin supply reaches $160 billion, near all-time high, with payment上下游 emerging as new value opportunity

TechFlow Selected TechFlow Selected

Stablecoin supply reaches $160 billion, near all-time high, with payment上下游 emerging as new value opportunity

The operation of stablecoins relies on blockchain.

Authors: Andrew Van Aken & Jon Ma

Translation: TechFlow

Summary

-

Stripe has acquired Bridge.xyz for $1.1 billion, just months after the company raised $50 million from Sequoia, Ribbit Capital, and Haun Ventures. This means Series A investors achieved nearly a 10x return in under a year.

-

Yellow Card has closed a $33 million Series C round, plans to pivot toward stablecoin-based B2B payments, and announced it now serves over 30,000 businesses with eight-figure revenue.

-

Meanwhile, on-chain stablecoin data is hitting or approaching all-time highs. In collaboration with Castle Island Ventures and Visa, we present both quantitative and qualitative analysis of these trends.

-

Historically, investors believed stablecoin issuers were the primary beneficiaries of stablecoin adoption.

-

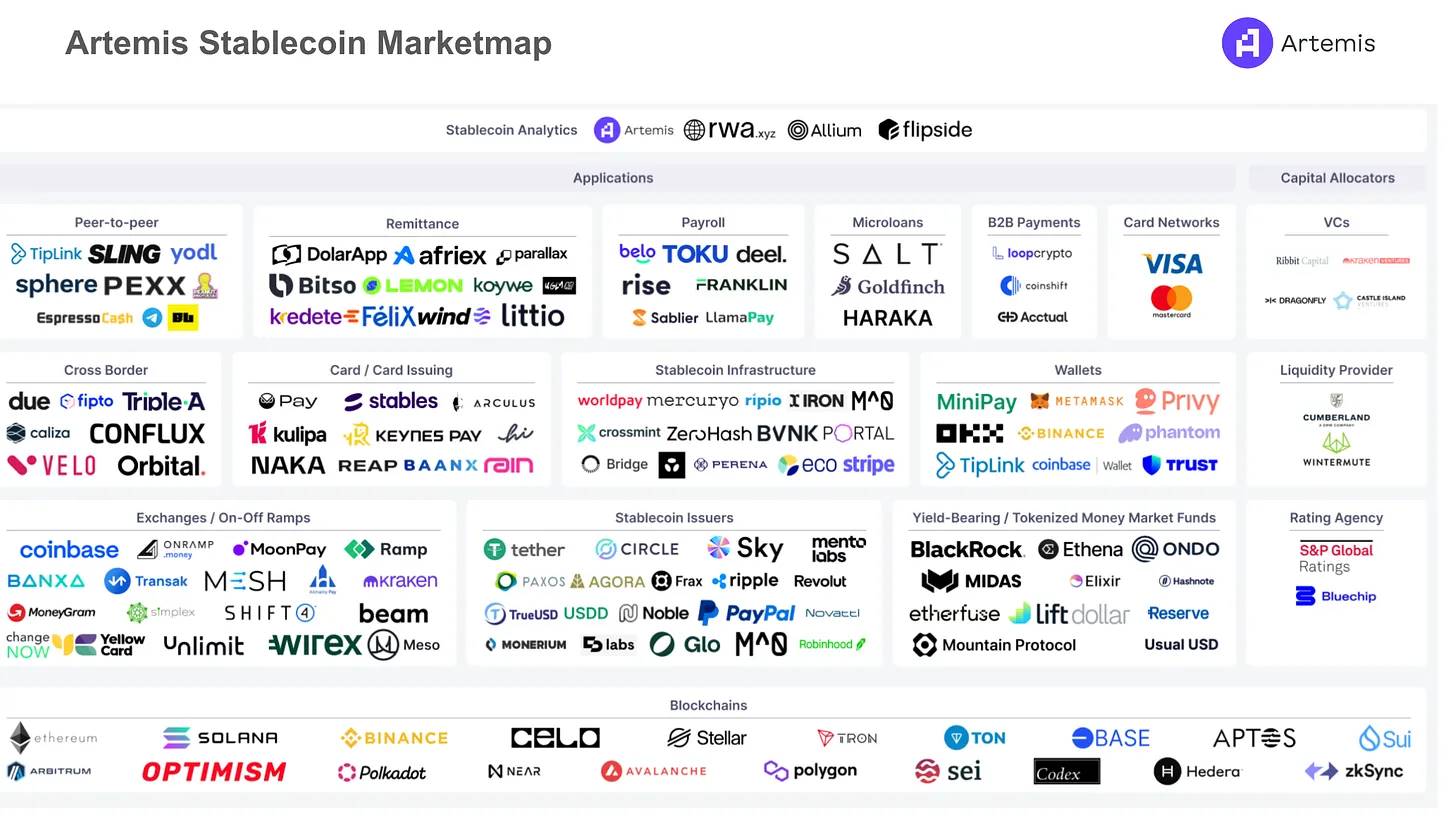

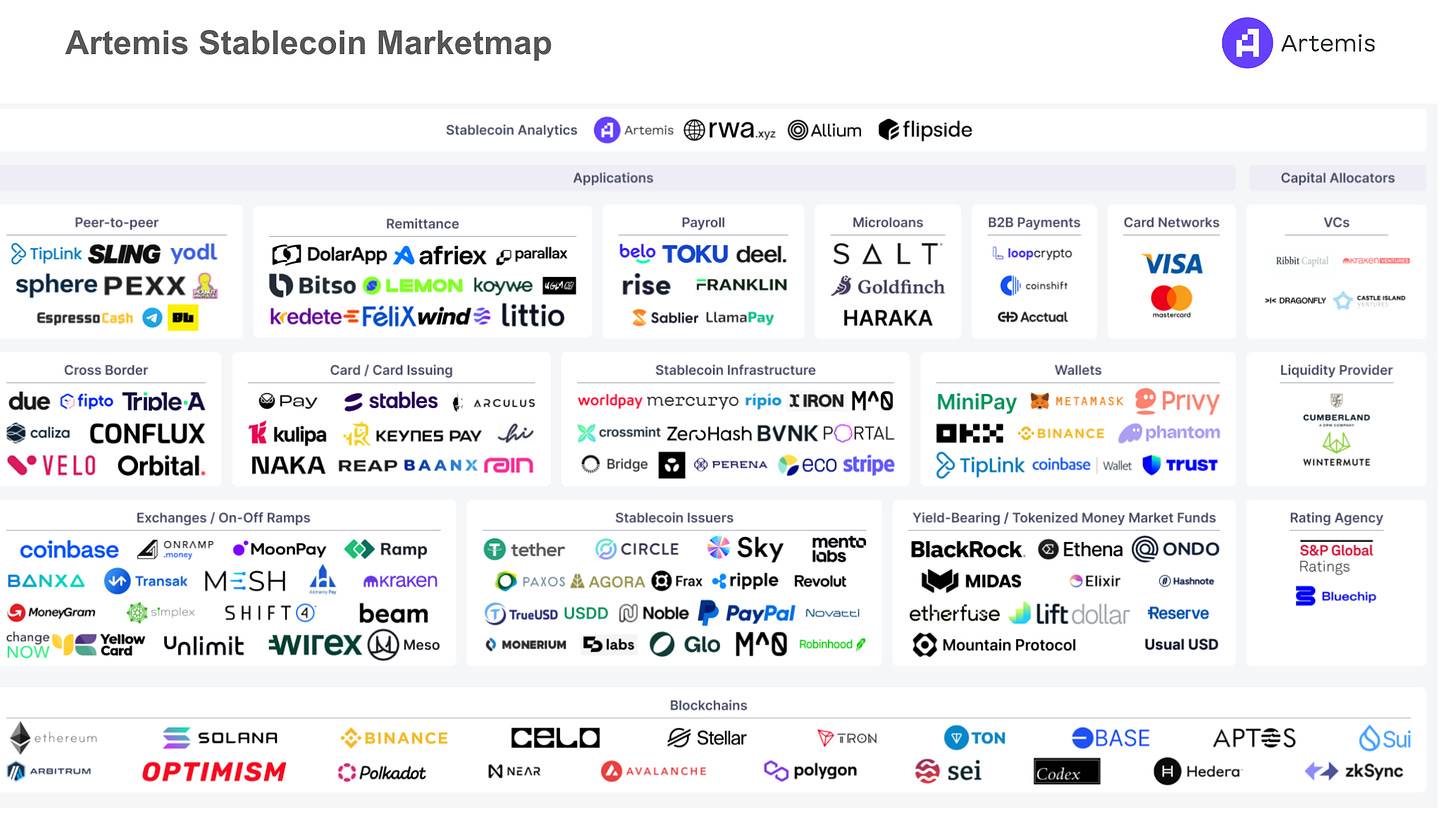

However, 2024 has brought a fundamental shift: as stablecoins gain traction, fintech applications, payment networks, infrastructure providers, fiat on/off ramps, and analytics tools are emerging as key value accrual layers.

-

We’ve identified numerous companies poised to benefit from widespread stablecoin adoption. Today, we’re sharing this research with the broader community.

-

Here is our live-updating open-source market map: If you’d like to recommend a company, please reach out to Crystal Tai.

Introduction

“Even if we only ended up with stablecoins, that would still be a massive win.” — Nic Carter

Satoshi Nakamoto’s whitepaper proposed a fully decentralized peer-to-peer electronic cash system without reliance on central servers or trusted third parties. We believe 2024 brings us closer to that vision, with stablecoins serving as blockchain’s killer application.

Stablecoins enable users worldwide to transfer funds easily, make payments seamlessly, and hedge against high inflation. On-chain data shows significant growth in stablecoin supply, transaction volume, and active addresses. To validate these trends, we interviewed users in Lebanon, India, and the U.S., whose experiences confirm the real-world utility reflected in the data. Castle Island Ventures recently published a report titled “Stablecoins: The Emerging Market Story,” using Artemis on-chain data to illustrate how stablecoins are being used in emerging markets and growing rapidly.

Stablecoins are moving into the mainstream.

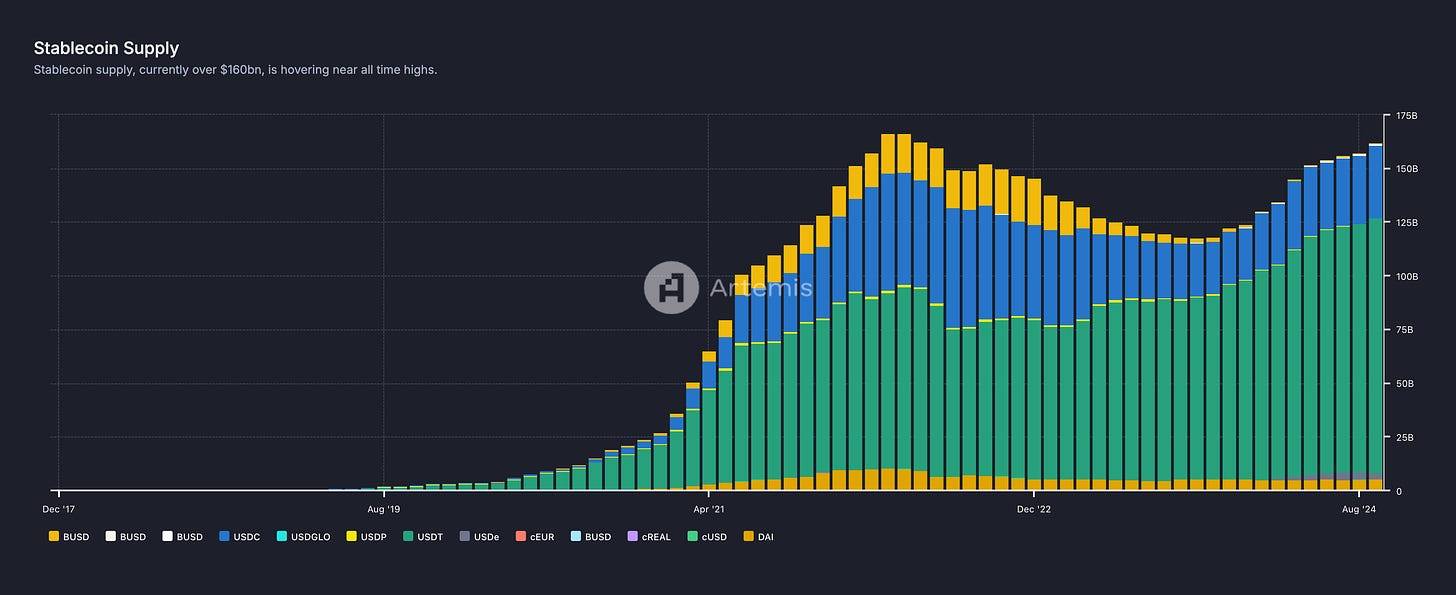

While crypto markets have cycled through bull and bear phases, multiple key stablecoin metrics continue to hit or approach all-time highs:

-

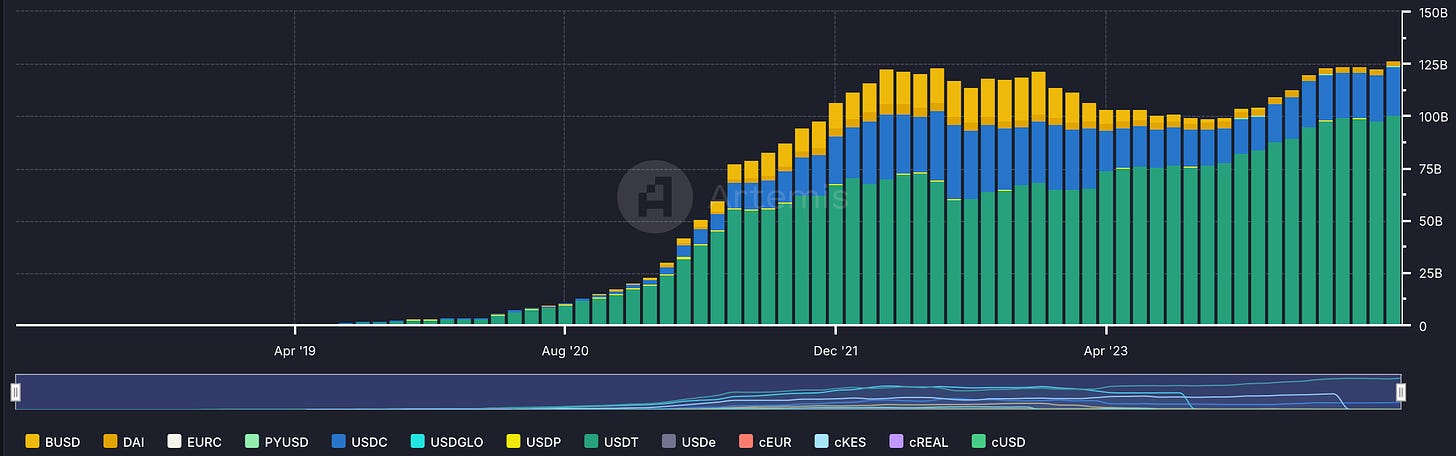

Total stablecoin supply has surpassed $160 billion, nearing its historical peak.

Stablecoin Supply - Live Dashboard

-

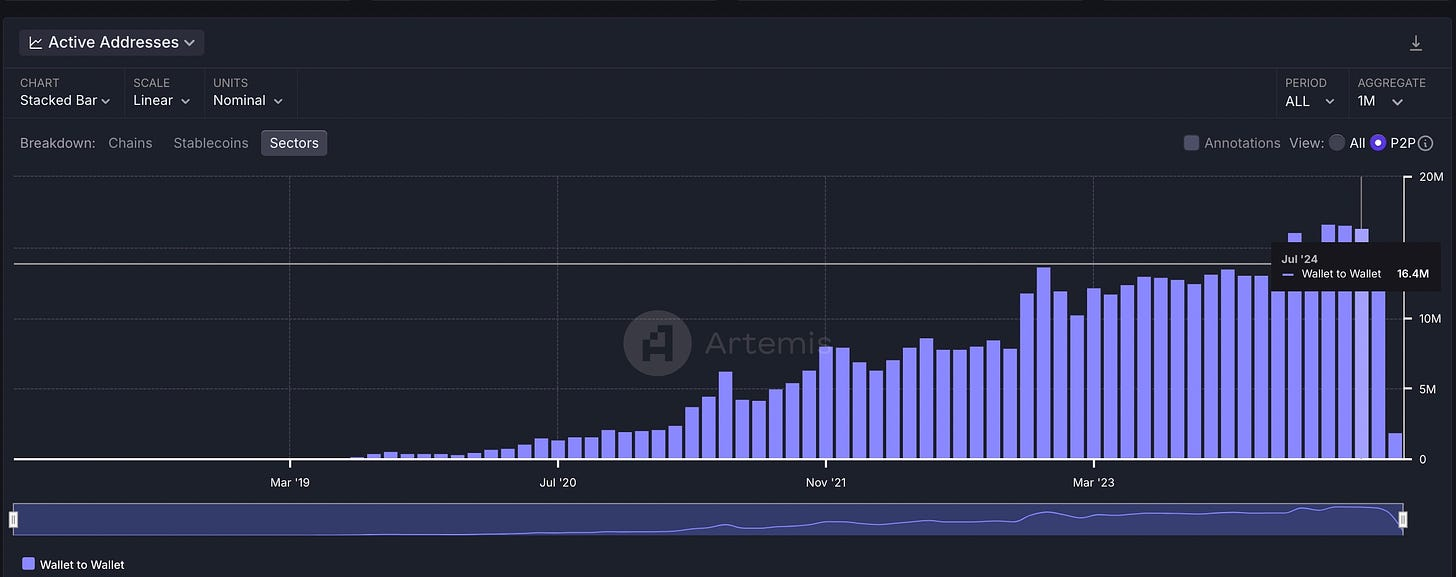

From May to July 2024, there were 16 million monthly active addresses transferring stablecoins between wallets—behavior resembling peer-to-peer payments—setting a new record.

-

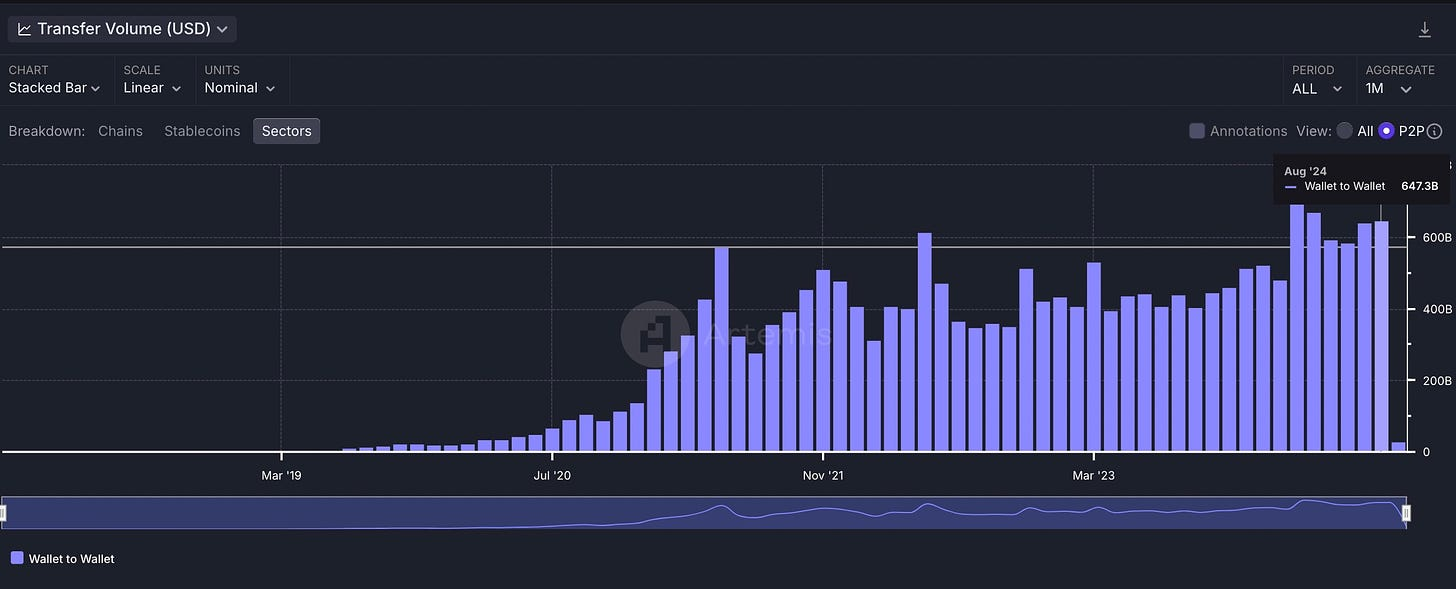

Peer-to-peer stablecoin transfer volume exceeded $700 billion in March 2024, another all-time high.

Investors Are Taking Notice

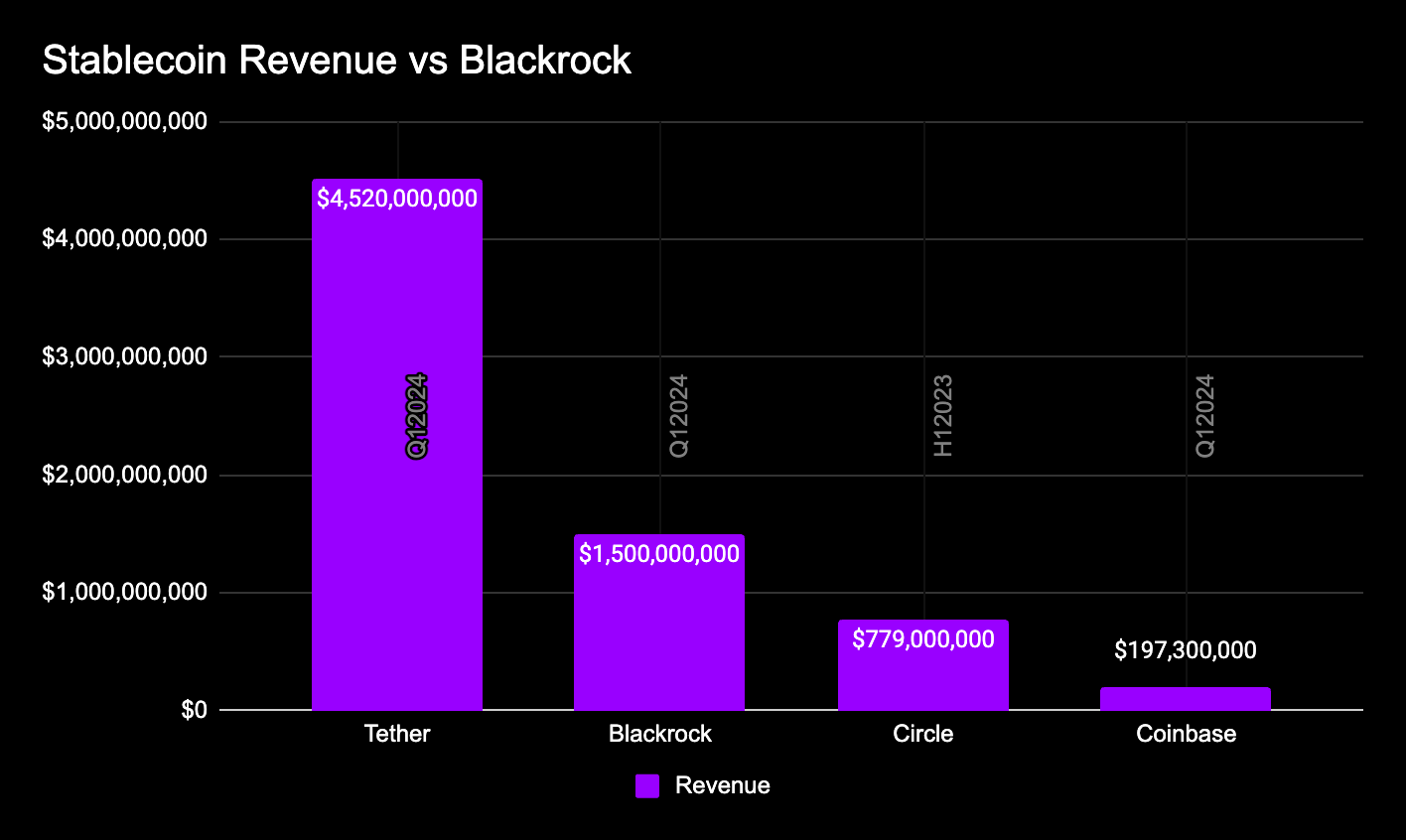

The conventional wisdom holds that investing in stablecoins is difficult because their value is pegged to fiat currencies. In most investor conversations, the focus centers on how stablecoin issuers (like Circle and Tether) capture value.

For example, Circle reported $779 million in revenue during H1 2023, while Tether posted a net profit of $4.52 billion in Q1 2024—triple Blackrock’s $1.5 billion during the same period.

Yet this narrative is shifting. In August 2024, multiple crypto-adjacent payment companies announced funding rounds exceeding $100 million. For instance, Bridge.xyz, which counts SpaceX and Bitso among its clients, signals rising demand for stablecoin-enabled financial products.

Through our research, we’ve identified many companies accumulating value within the stablecoin ecosystem. Today, we share those findings with the wider community.

In our market map, we aim to show investors and builders that supporting stablecoin adoption globally isn’t limited to one path. Beyond private equity, opportunities exist in public blockchains and related tokens.

Stablecoin Value Accrual Stack

Blockchains

Stablecoins cannot function without blockchains.

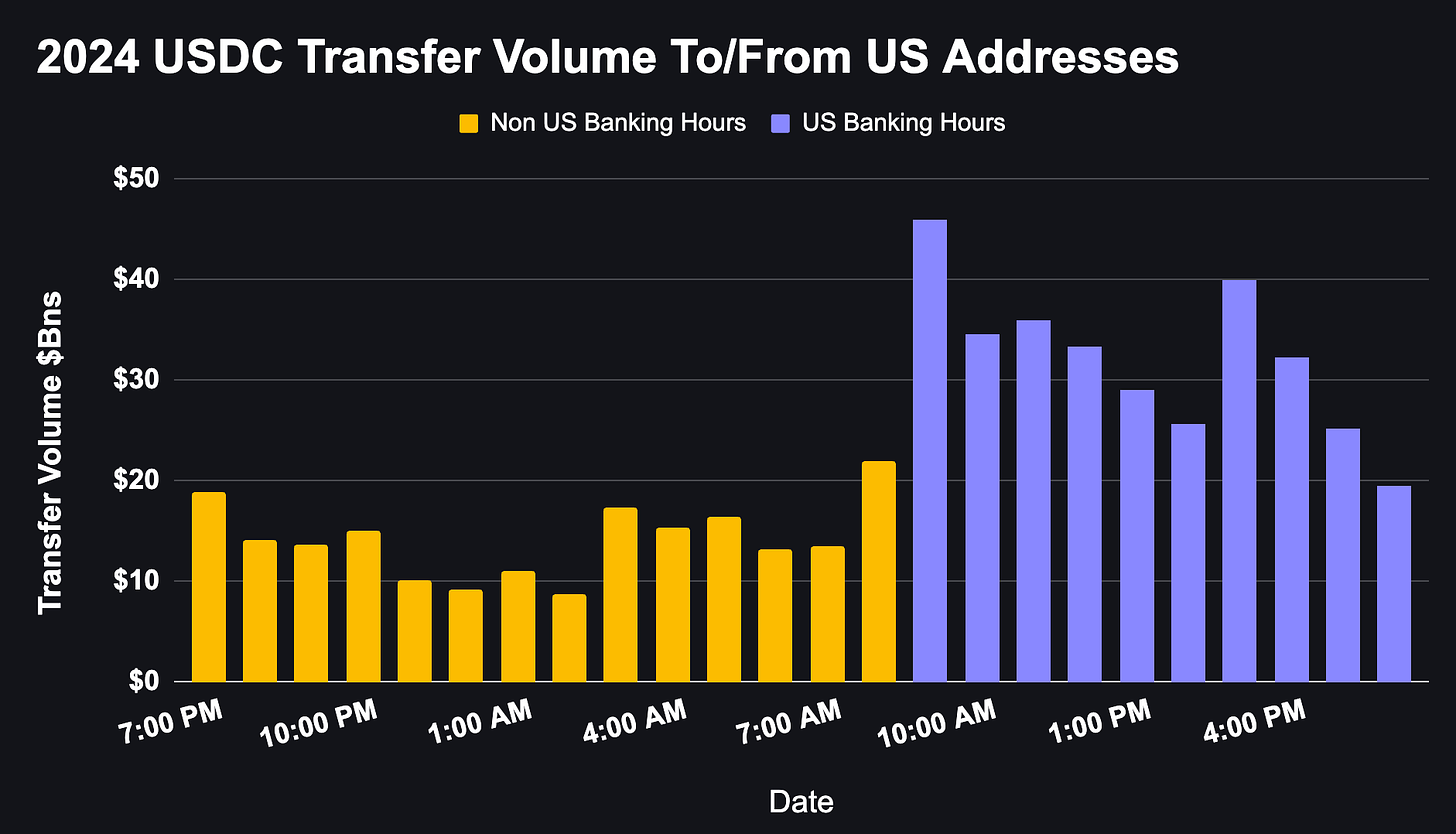

Blockchains play a critical role in stablecoin transactions. As public, transparent ledgers, they facilitate final settlement and allow anyone to verify transaction data. They operate 24/7, without interruption. For example, analyzing USDC transfers in the U.S., we observe peak activity during traditional banking hours—but significant usage continues even when banks are closed.

Source: Internal Artemis Data

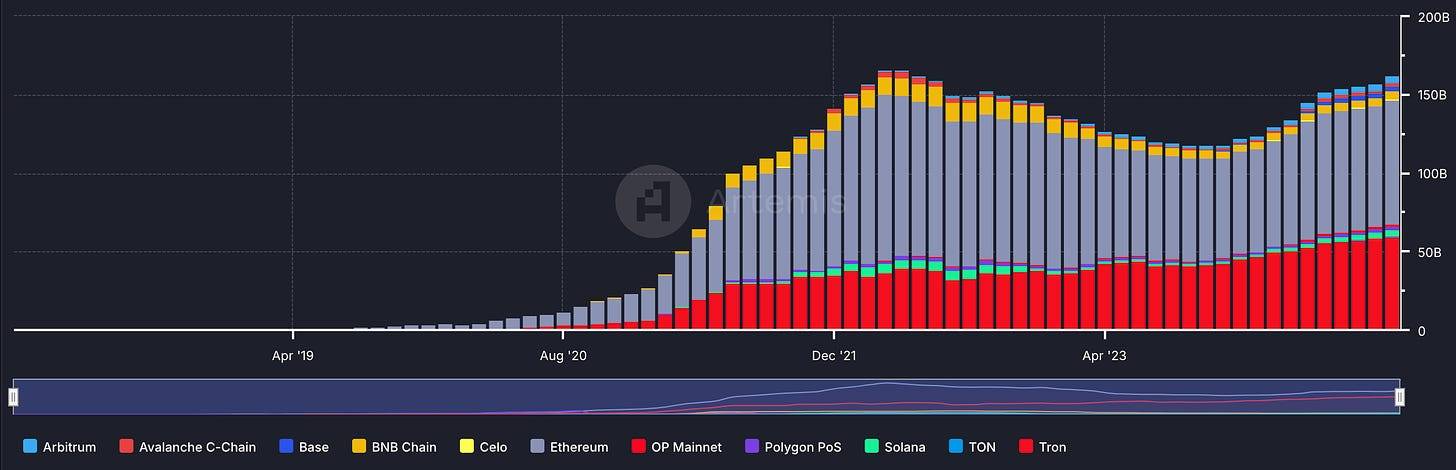

While Ethereum remains the dominant platform for stablecoin transactions, newer chains with faster block times and lower fees are accelerating stablecoin adoption. These include Solana, Tron, TON, Base, Celo, Stellar, and BNB Chain. Additionally, new entrants like Sui have recently partnered with Circle to launch native stablecoin support.

Stablecoin Supply by Chain

Another key question: How do blockchains accrue value? Specifically, does a network increase in value as stablecoin supply grows on it? In the case of TRON, price and circulating supply show strong correlation during periods of stablecoin growth, suggesting a potential positive feedback loop.

Stablecoin Issuers

Stablecoin issuers are institutions responsible for creating, distributing, and managing stablecoins. To maintain price stability, they typically back each coin with reserve assets such as cash or equivalents. Their core responsibilities include issuing and redeeming tokens, managing reserves, ensuring transparency, and complying with regulations.

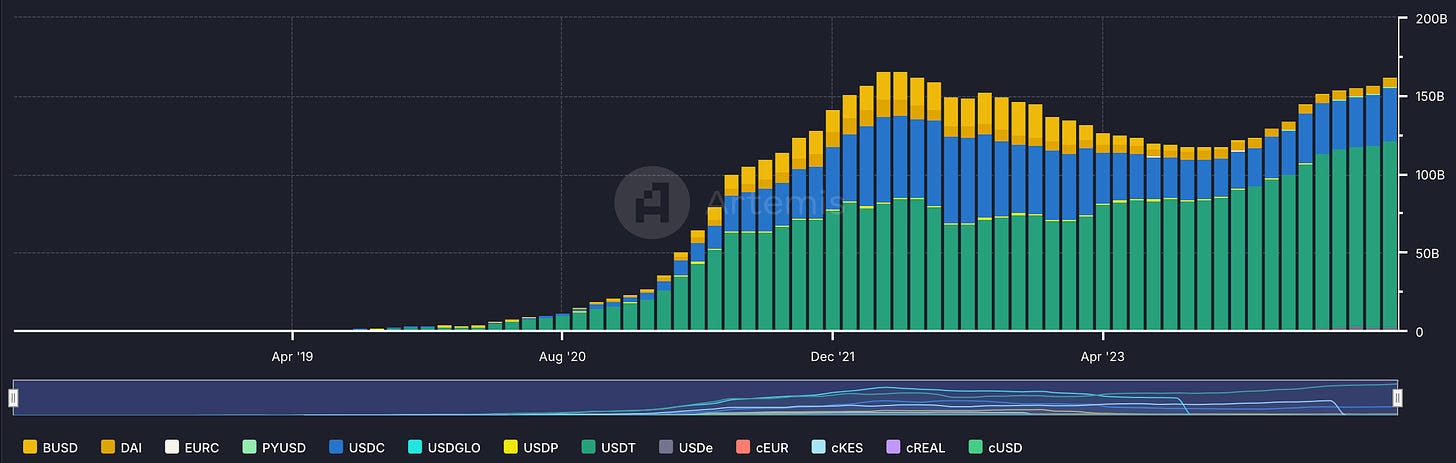

Tether remains a dominant player, reportedly generating over $5 billion in net profit in H1 2024. Meanwhile, Circle is considering an IPO at a valuation near $5 billion.

Additionally, yield-bearing stablecoin issuers like Mountain Protocol (with ~$48 million in circulation) profit from the spread between asset yields and interest paid to holders, offering users enhanced returns.

Stablecoin Supply by Issuer

Stablecoin Infrastructure

To help stablecoin issuers launch compliantly and quickly, and to enable apps to move seamlessly between fiat and crypto, robust infrastructure is essential. These companies form the foundational layer of the stablecoin ecosystem.

On the fiat side, companies like Bridge.xyz and Brale.xyz provide APIs and developer tools that facilitate smooth movement between fiat and stablecoins. These fiat-to-stablecoin infrastructure providers enable cross-border payments, private stablecoin issuance, and streamlined treasury management. They also handle complex regulatory, compliance, and technical work—tasks that are often costly and time-consuming.

-

Time savings: For example, Glo Dollar—a stablecoin focused on funding public goods—launched in weeks using these tools, versus the traditional 6-month timeline.

-

24/7 availability: Users can now transact anytime, with companies like Bridge.xyz operating as backend infrastructure to ensure uninterrupted service.

On the on-chain side, firms like Perena and M^0 use decentralized protocols to help issuers scale while avoiding liquidity fragmentation. Positioned as “capital middleware” for stablecoin issuers, they offer efficient on-chain capital deployment.

On-Ramps

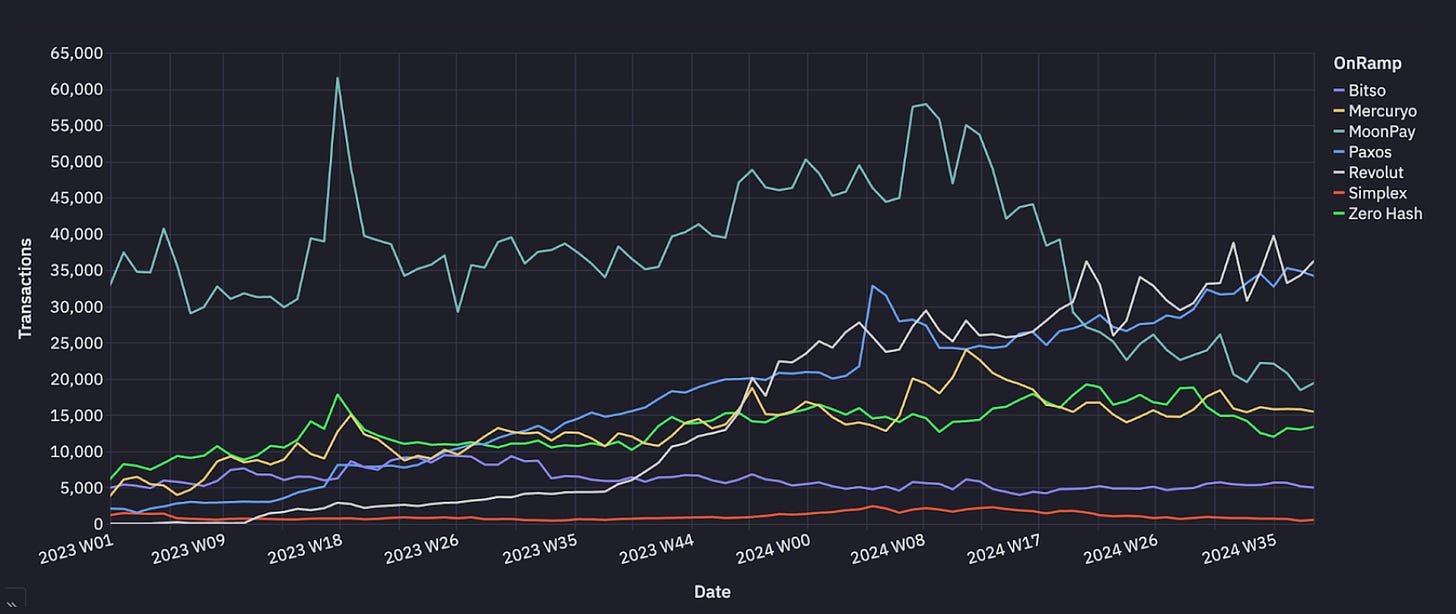

Fiat on-ramps (e.g., MoonPay, Transak) allow users to buy crypto using traditional payment methods like credit cards, bank transfers, or mobile payments. These services often deposit directly into self-custody wallets like MetaMask or Coinbase Wallet—bypassing centralized exchanges. Providers charge small fees to cover operational costs, KYC processes, and infrastructure. As shown below, fiat on-ramp activity on Ethereum has steadily increased since 2023.

Fiat On-Ramp Activity on Ethereum

Source: Internal Artemis Data

Cross-Border Payments / Remittances / P2P

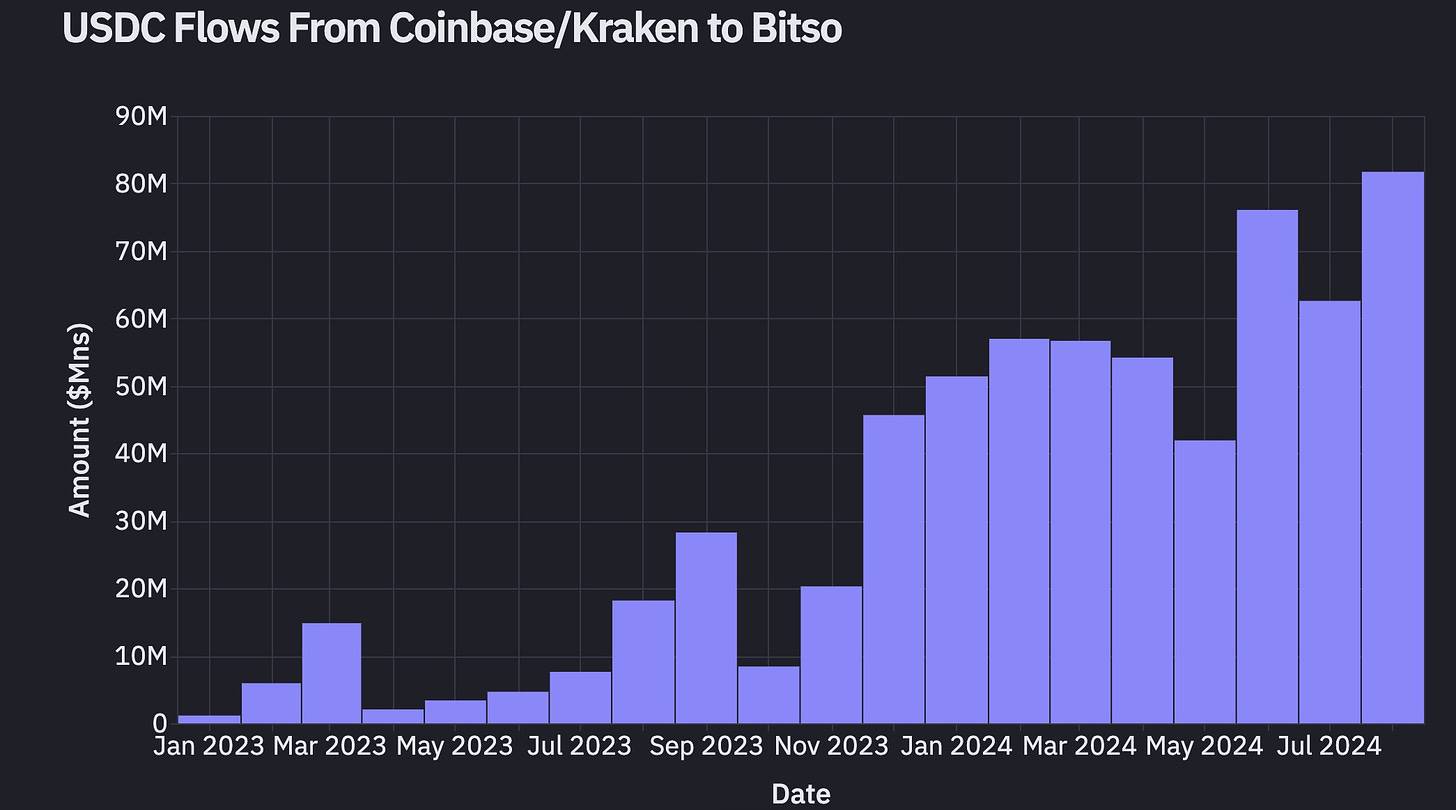

Many companies are streamlining cross-border payments and remittances using stablecoins. These apps are designed to be intuitive, abstracting away the underlying crypto complexity so users don’t need to understand blockchain. Fees are typically far lower than traditional remittance providers, with better exchange rates. For example, stablecoin flows from Coinbase or Kraken to Bitso (a Mexico City-based exchange) are rising, indicating expanding use in international money transfers.

Source: Internal Artemis Data

Peer-to-peer (P2P) crypto transactions—often called the “global Venmo”—offer seamless global money movement. Companies like TipLink and Sling provide simple interfaces enabling anyone to accept payments via crypto networks. Crucially, users often don’t realize they’re using crypto, delivering truly frictionless experiences.

Monthly P2P Stablecoin Transfer Volume by Token

Wallets

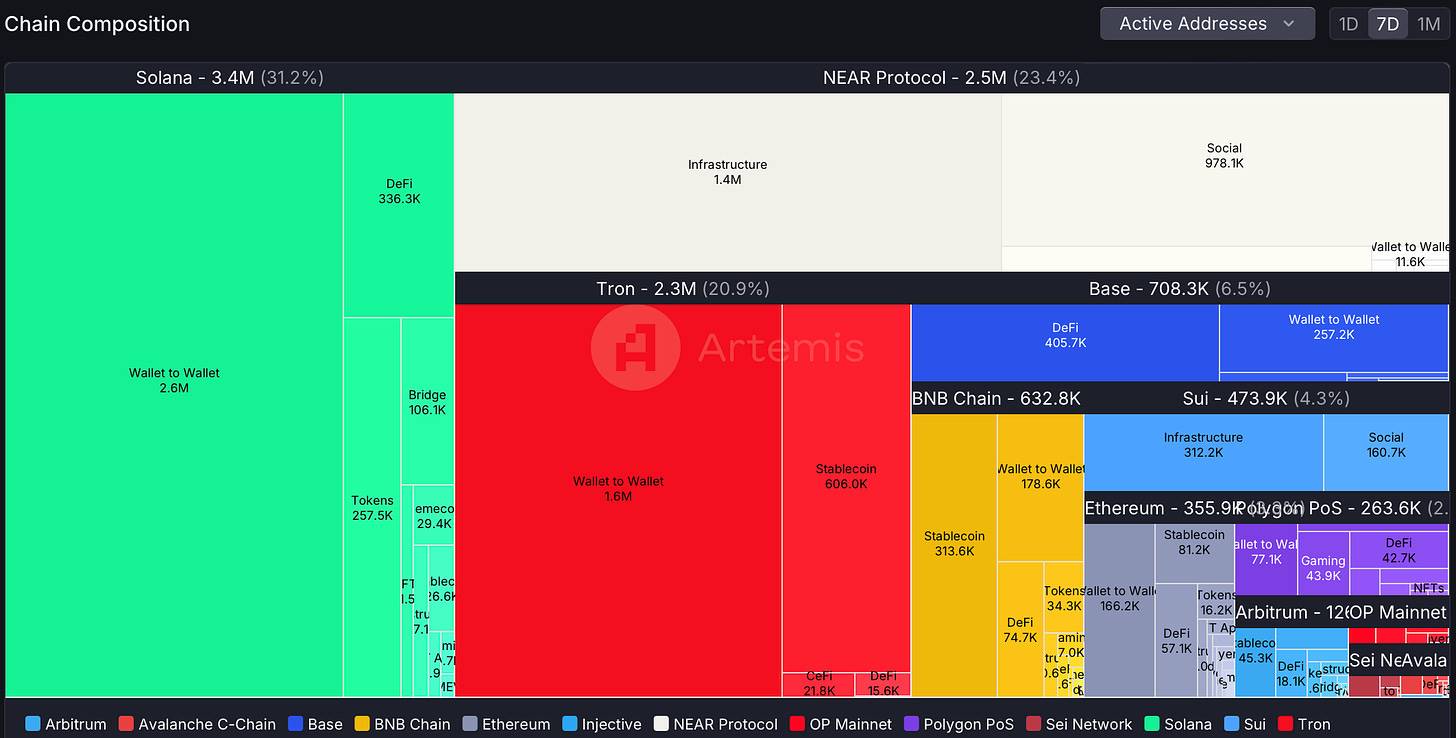

Crypto wallets empower users with self-custody, giving full control over digital assets. Most support multiple blockchains and allow storage of various crypto assets. Many also integrate fiat on-ramps, making it easier to purchase crypto. According to Artemis data, wallet-to-wallet transfers represent one of the largest current use cases for blockchains.

Data Source: Artemis

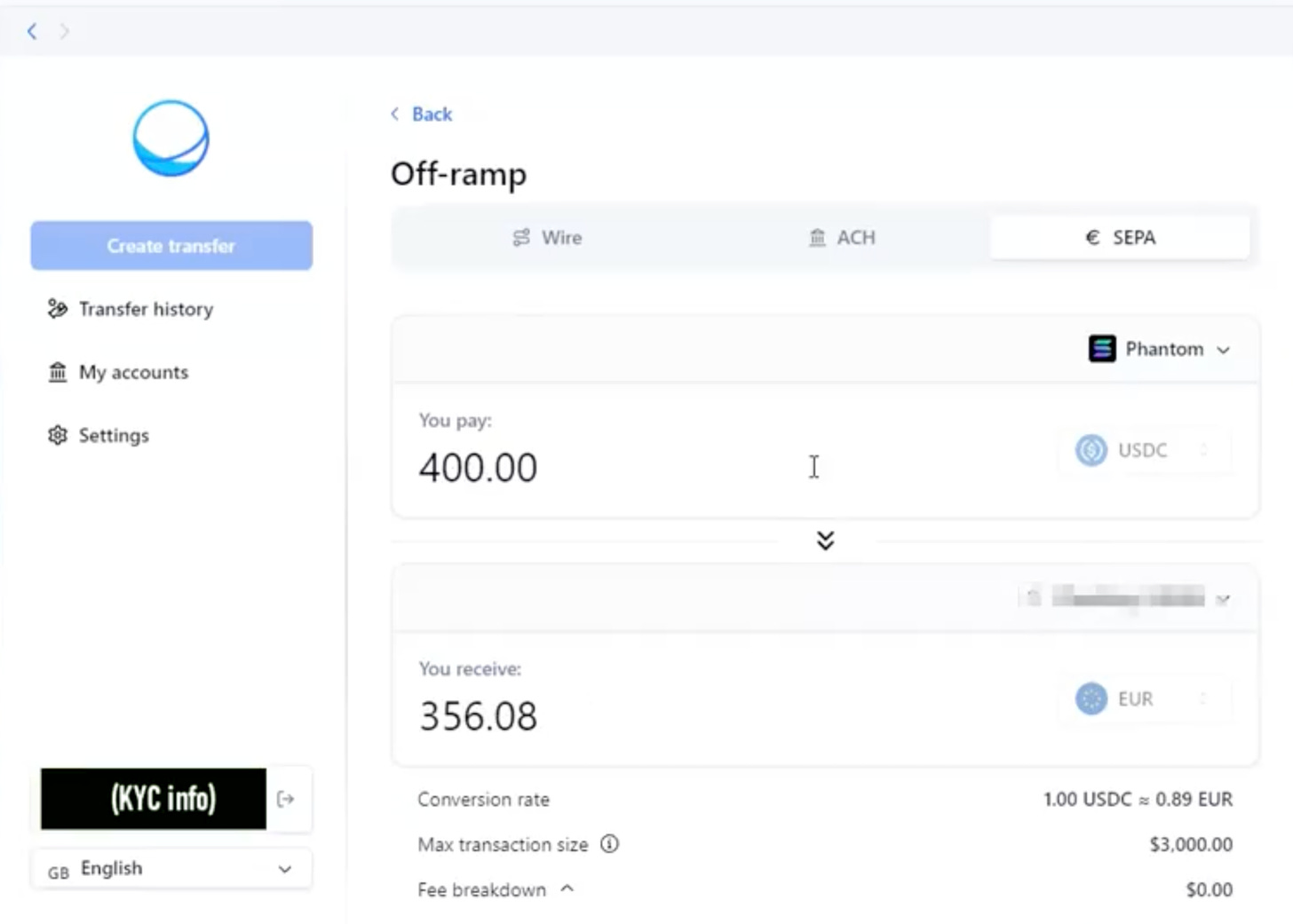

Here’s an example of a seamless transfer via Sphere. Users select transaction type (e.g., fiat-to-crypto or crypto-to-crypto), choose payment method (Wire, ACH, SEPA), and settle in minutes—fast and efficient.

Cards & Payment Processors

Crypto debit cards and payment processors are partnering to enable spending with crypto. The key benefit: users can pay within the crypto ecosystem without converting back to fiat. For example, Visa enables stablecoin settlement between consumers and merchant acquirers.

Last year, Gnosis Pay launched a Visa card allowing European users to spend directly from their Gnosis Safe wallets. While user numbers remain small, key metrics show consistent growth.

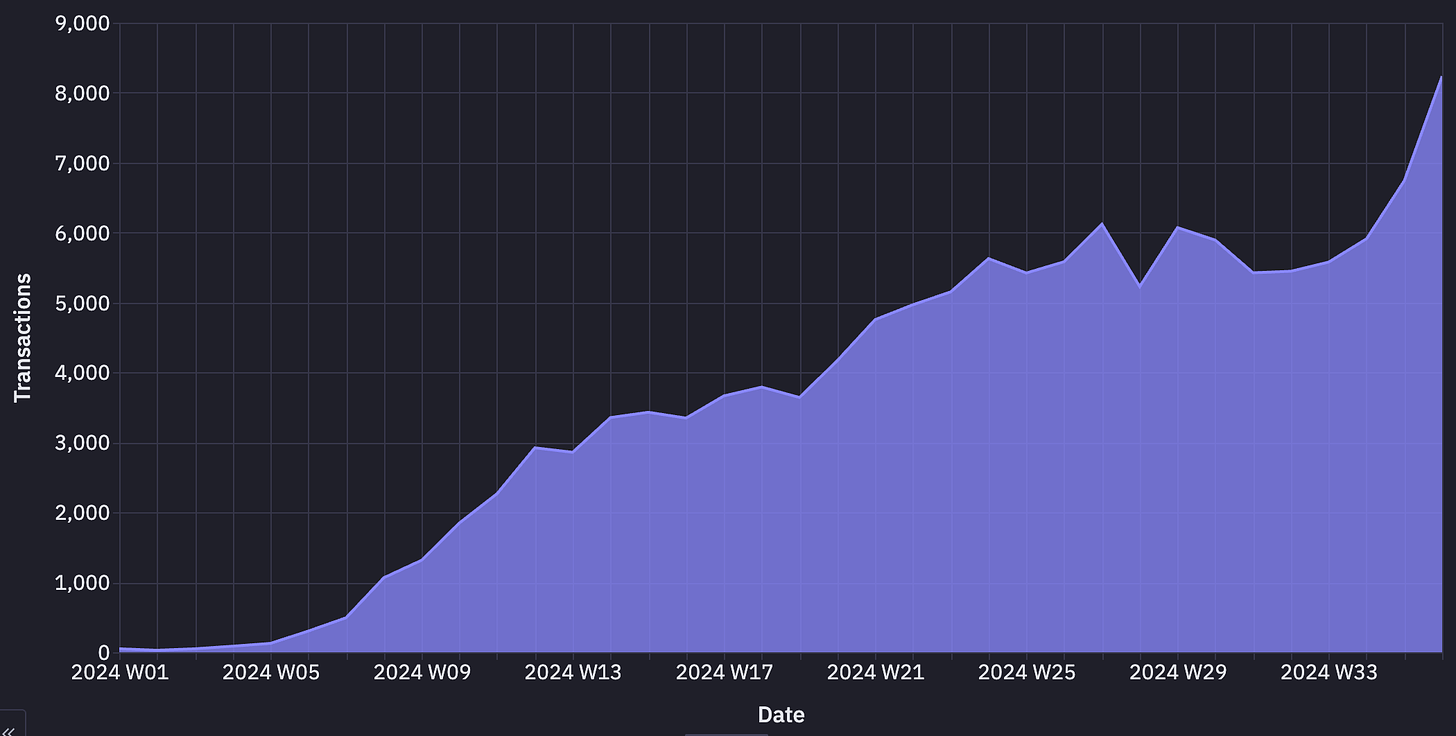

Gnosis Pay Weekly Transaction Volume

MicroLending

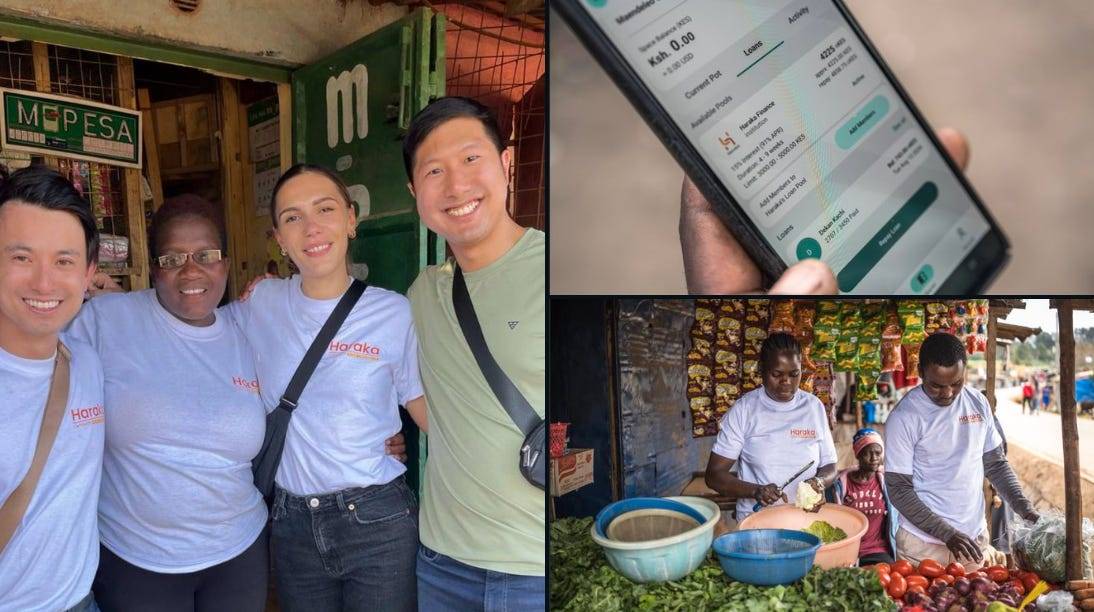

We traveled to Nairobi and witnessed blockchain-powered micro-lending in action—an eye-opening experience.

These platforms use blockchain to lend to individuals and small businesses. Firms like Haraka and Goldfinch focus on providing lower-interest loans in emerging markets. Thanks to blockchain, funds arrive nearly instantly at low cost—offering solutions where traditional banks fall short.

Payroll

An increasing number of companies now allow employees to receive salaries in crypto. As globalization and remote work expand, building a fast, efficient global payroll system becomes crucial. Some platforms are experimenting with real-time payouts—streaming wages hourly, daily, or even per second.

Ravi Kiran (Head of Growth) shared a story about a freelancer opting for stablecoin payments:

“I worked with a freelancer from an emerging country who recently received payment in USDC. She kept saying it was much better than local currency—lower taxes, stable value, and more purchasing power. That moment made me realize every transaction carries a human story. Two months later, she switched entirely to stablecoin payments. I believe as business adoption grows, Circle and Tether will become even more influential.”

Stablecoin Analytics

Artemis partners with Allium, RWA.xyz, and Flipside to deliver deep stablecoin analytics. Allium collaborated with Visa on the Visa On-Chain Analytics Dashboard, while RWA.xyz provides key metrics on stablecoins and their issuers.

We believe as the stablecoin market expands, so will the need to understand the drivers behind its usage.

What’s Next for Stablecoins?

With inflation rising in 2024, stablecoin adoption is accelerating. According to the CIV / Visa / BHD stablecoin report, stablecoins are now the second-largest use case after crypto trading. We expect adoption to keep growing.

This growth may create network effects: when friends, families, or businesses in a region start using stablecoins widely, it pulls in more local users—like a “global Venmo”. Increased user base enhances network liquidity. We also anticipate U.S. regulation supporting stablecoins to sustain global dollar demand.

While most stablecoins today are USD-denominated, non-dollar stablecoins are gaining traction. Euro-backed stablecoins are growing in circulation, and Bitso recently launched MXNB, a peso-pegged stablecoin—highlighting the potential of regional variants.

Meanwhile, yield-generating stablecoins are attracting growing attention. These not only offer users yield but also serve as important sources of capital for U.S. Treasury exposure. Ethena, for example, introduced an innovative “delta-neutral yield generation mechanism,” achieving rapid growth and becoming one of the fastest-growing stablecoins.

How Artemis Can Help

Artemis is dedicated to deep-dive analysis in the stablecoin space, helping users and enterprises understand adoption trends and market dynamics. We partnered with Nic Carter and the Castle Island Ventures team, providing on-chain data for what is likely the most comprehensive stablecoin research report to date.

If you're interested in the stablecoin market or need help analyzing adoption patterns, feel free to reach out! Find us on X.com or email team@artemis.xyz.

Special thanks to Anna from Perena, Isaiah Washington, Peter Schroeder from Castle Island Ventures, EffortCapital, and other friends for their contributions. Also, thank you to everyone on Twitter who provided feedback and suggestions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News