RWA by the Numbers: Over $13 Billion in Real-World Assets Tokenized, BlackRock's BUIDL Fund Surpasses $500 Million

TechFlow Selected TechFlow Selected

RWA by the Numbers: Over $13 Billion in Real-World Assets Tokenized, BlackRock's BUIDL Fund Surpasses $500 Million

Over $13.1 billion worth of real-world assets (excluding stablecoins) have now been tokenized on-chain.

Author: OurNetwork

Translation: TechFlow

Real World Assets

BUIDL | PAXG | BCAP | Maple

Over $13.1 billion in real-world assets (RWA)—excluding stablecoins—have now been tokenized on-chain.

-

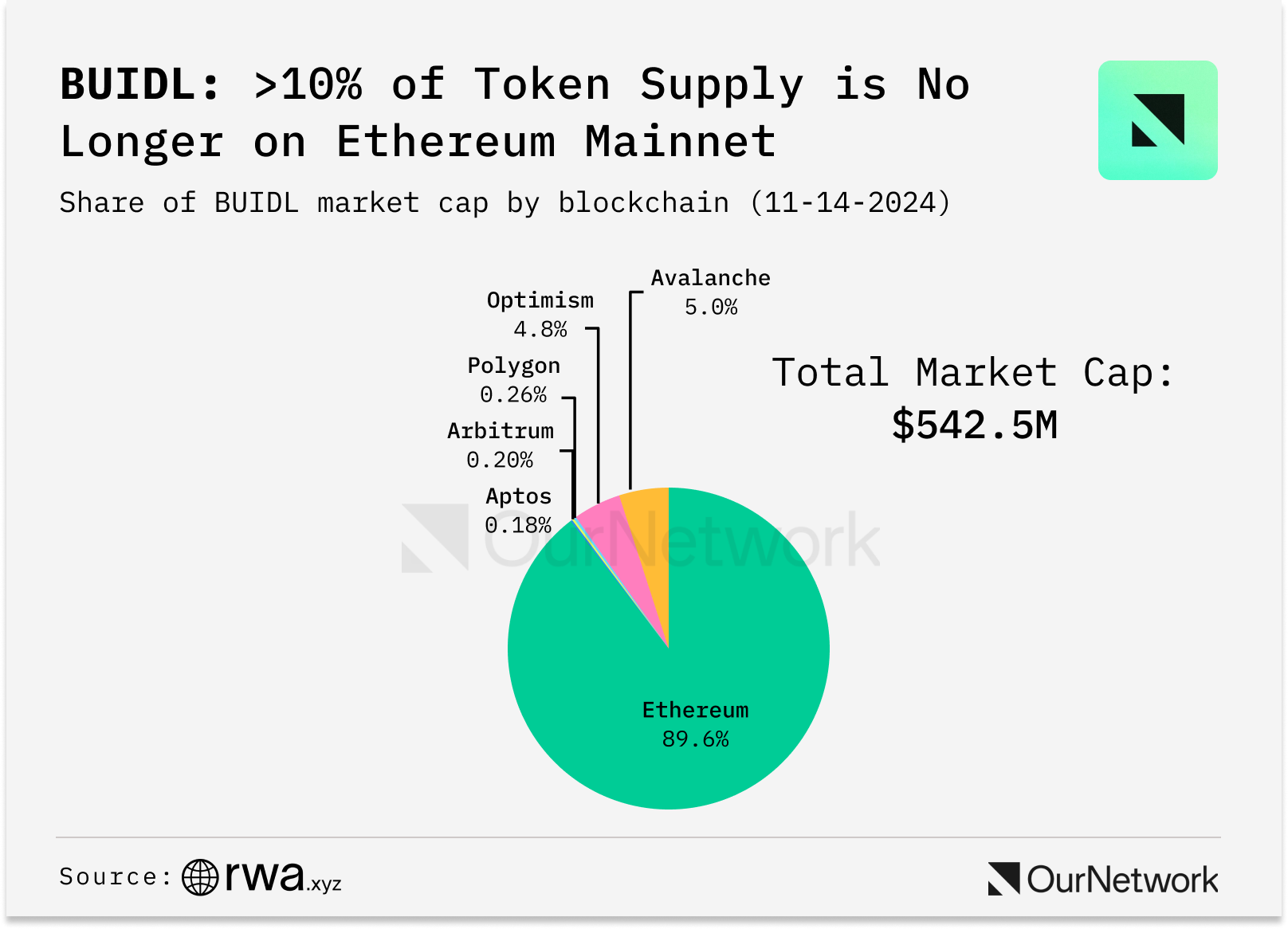

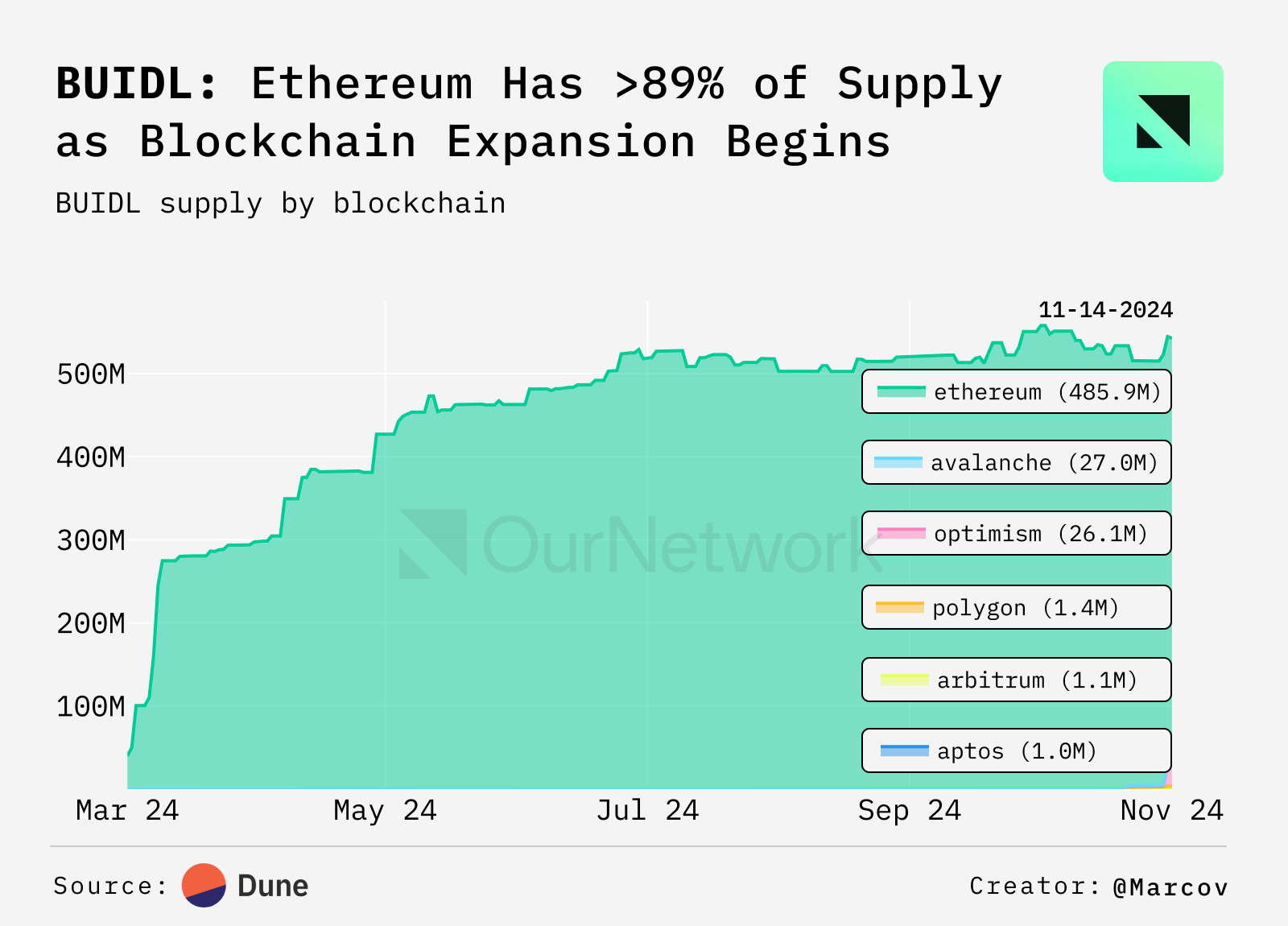

Protocols typically use economic incentives to encourage projects to build within their ecosystems. BUIDL’s launch across Aptos, Polygon, Avalanche, Optimism, and Arbitrum marks the first time these incentives have been directed toward treasury participation: Aptos, Polygon, and Avalanche each agreed to pay BlackRock quarterly fees based on the value of BUIDL shares held on their networks. It's too early to determine success, but as of November 14, total minting across all five networks reached $56.6 million, representing 10.4% of the fund.

-

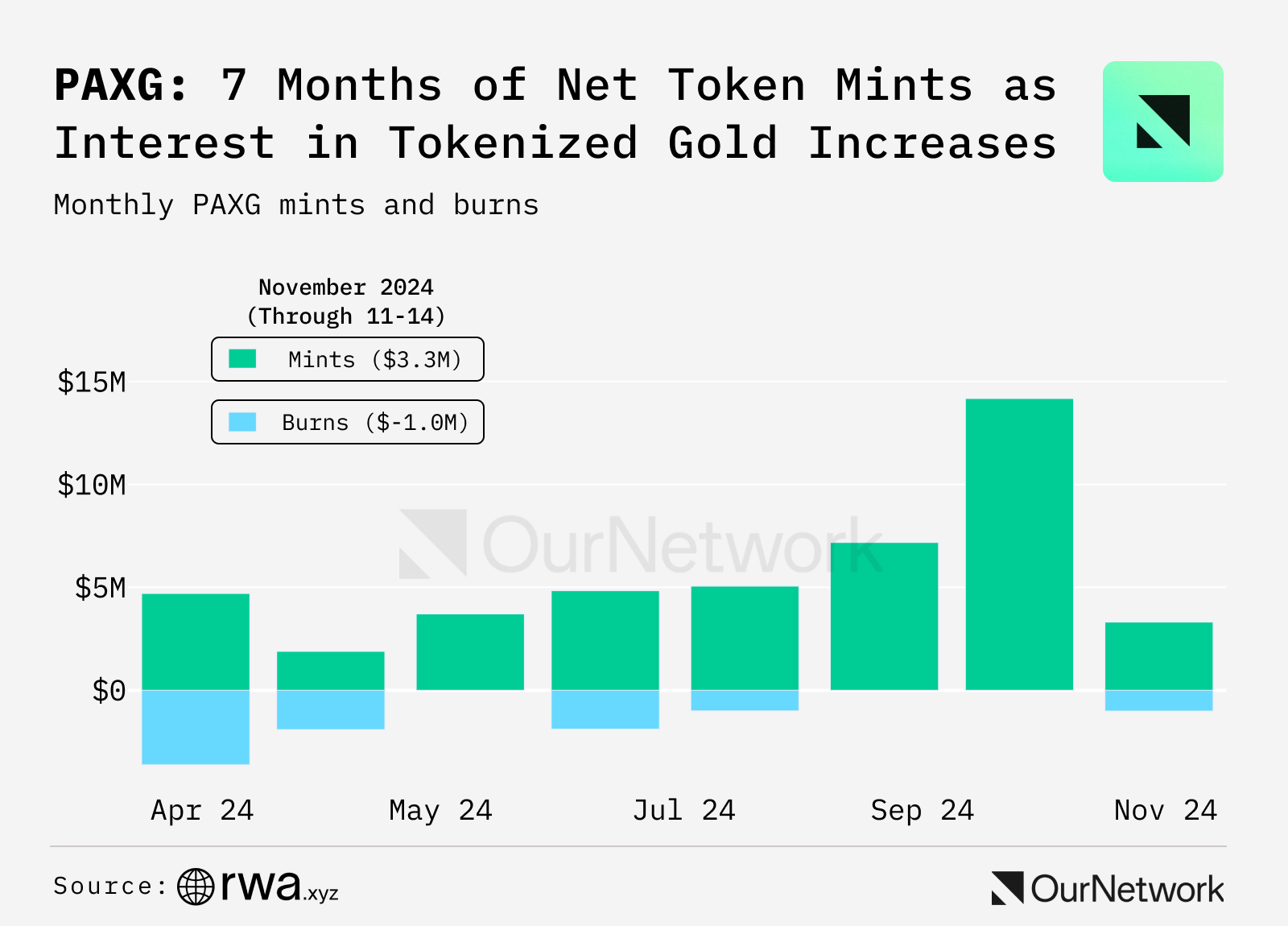

Demand for tokenized gold continues to rise as investors seek exposure to gold. The asset class has grown over 20% since the beginning of 2024. Paxos Gold (PAXG) remains the most widely held, with 52,522 wallets holding the asset. PAXG has also seen net positive minting for seven consecutive months, reflecting sustained interest.

-

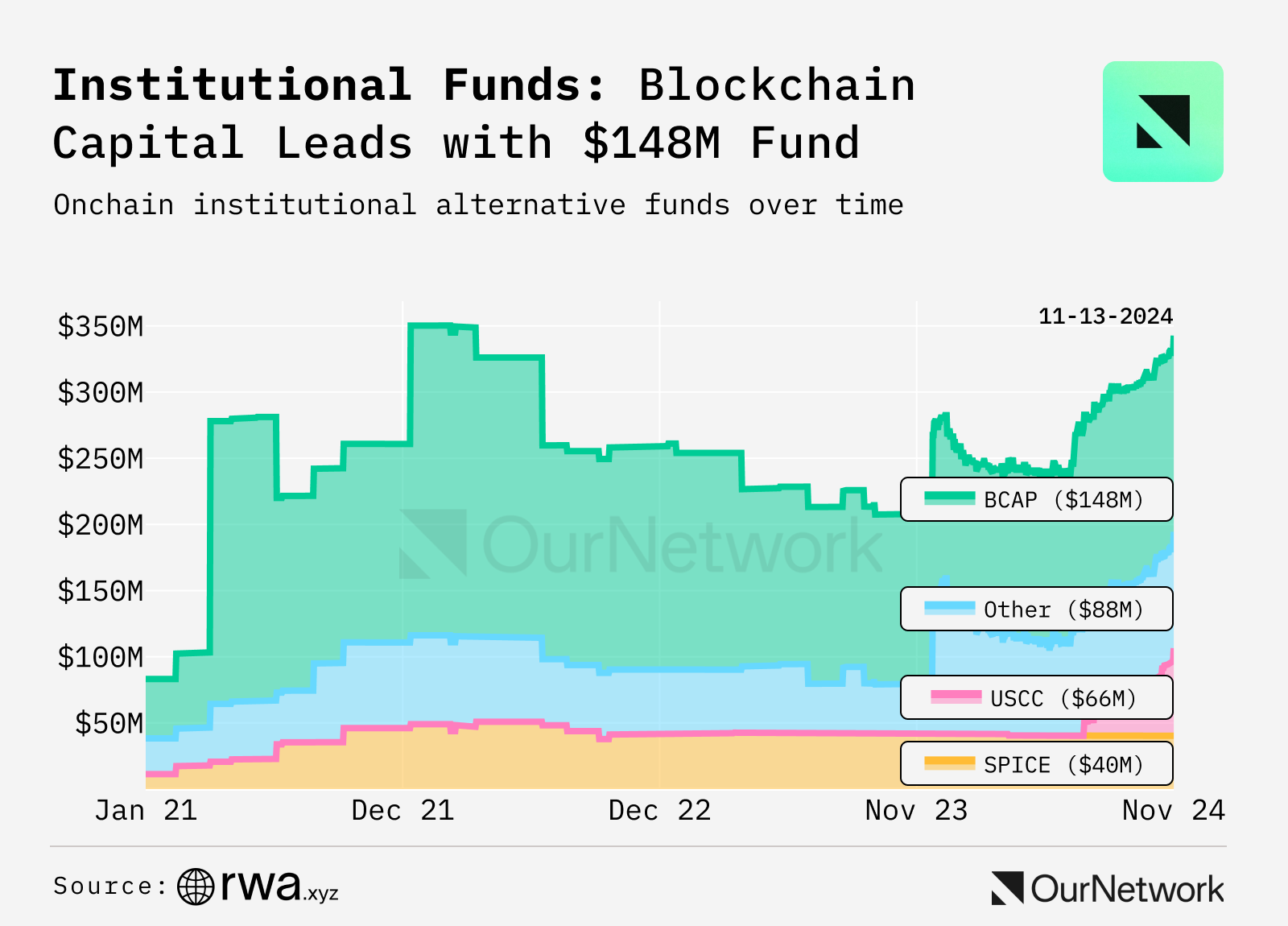

RWA.xyz’s new institutional funds dashboard tracks $330 million in AUM across alternative funds, led by Blockchain Capital ($148 million) and Superstate’s Crypto Carry Fund ($58 million). Since the launch of Securitize Fund Services on October 31, we expect more asset managers to explore tokenized funds to address slow investor onboarding, delayed NAV reporting, and other operational inefficiencies in traditional funds.

-

Transaction Focus: With the BUIDL fund now multi-chain, users are shifting capital to three networks—Aptos, Avalanche, and Polygon—that charge lower management fees. Accounts have moved $25.6 million from Ethereum to Avalanche. During this transfer, 250,000 BUIDL tokens and 25,364,613.13 BUIDL tokens were transferred and burned on Ethereum on the morning of November 15, followed by the minting of equivalent tokens on Avalanche.

Maple & Syrup

Maple & Syrup continue strong growth after surpassing $600 million in total value locked (TVL)

-

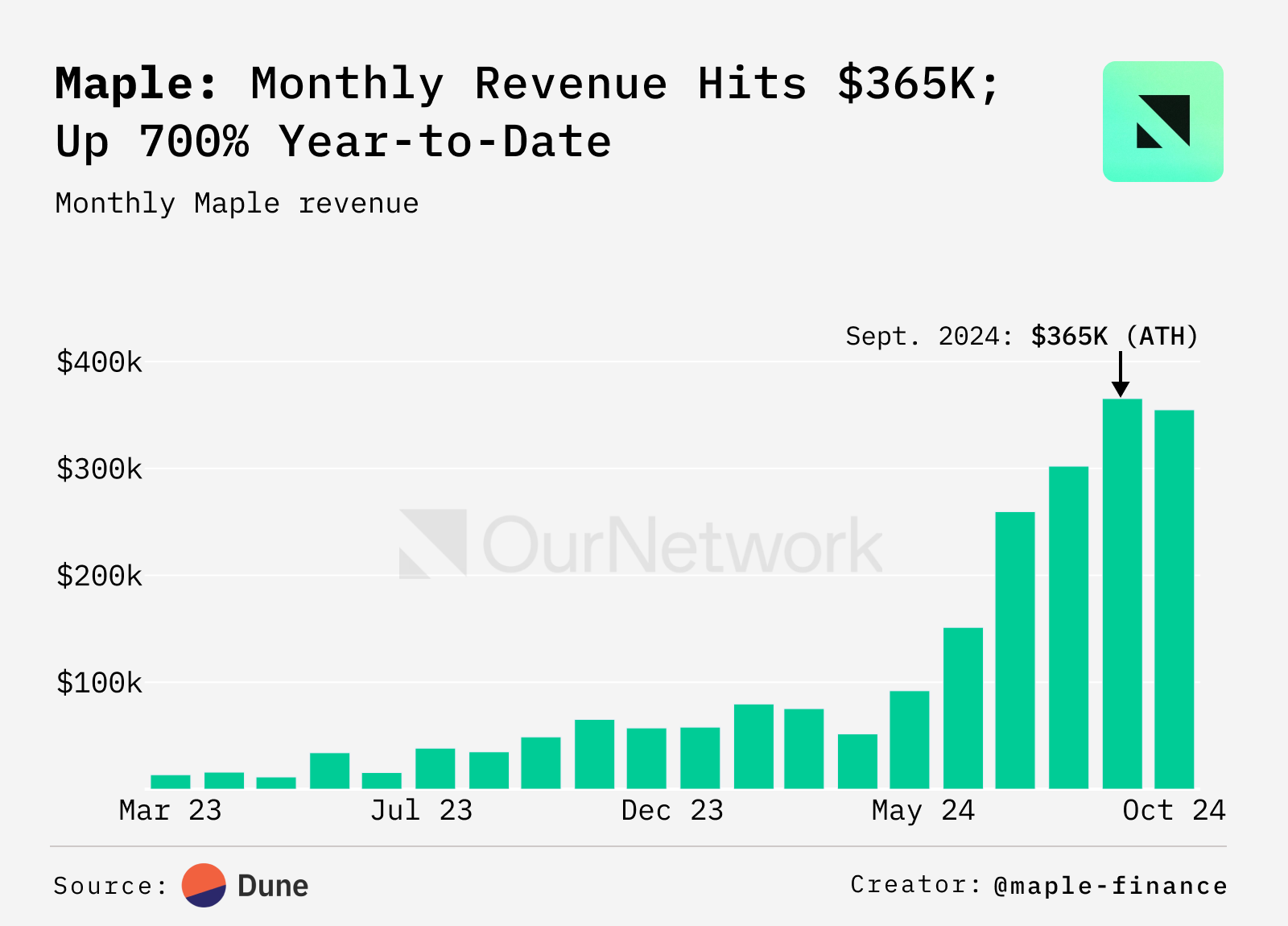

Maple Finance and Syrup provide lenders with access to corporate credit yields by issuing loans to institutional borrowers; these loans are always overcollateralized with liquid digital assets such as BTC, ETH, and SOL. Since launching high-yield secured pools in March and Syrup in June, TVL on the platform has grown over 700%, recently surpassing $600 million. Protocol revenue has followed a similar trajectory, increasing over 700% from January levels by October.

-

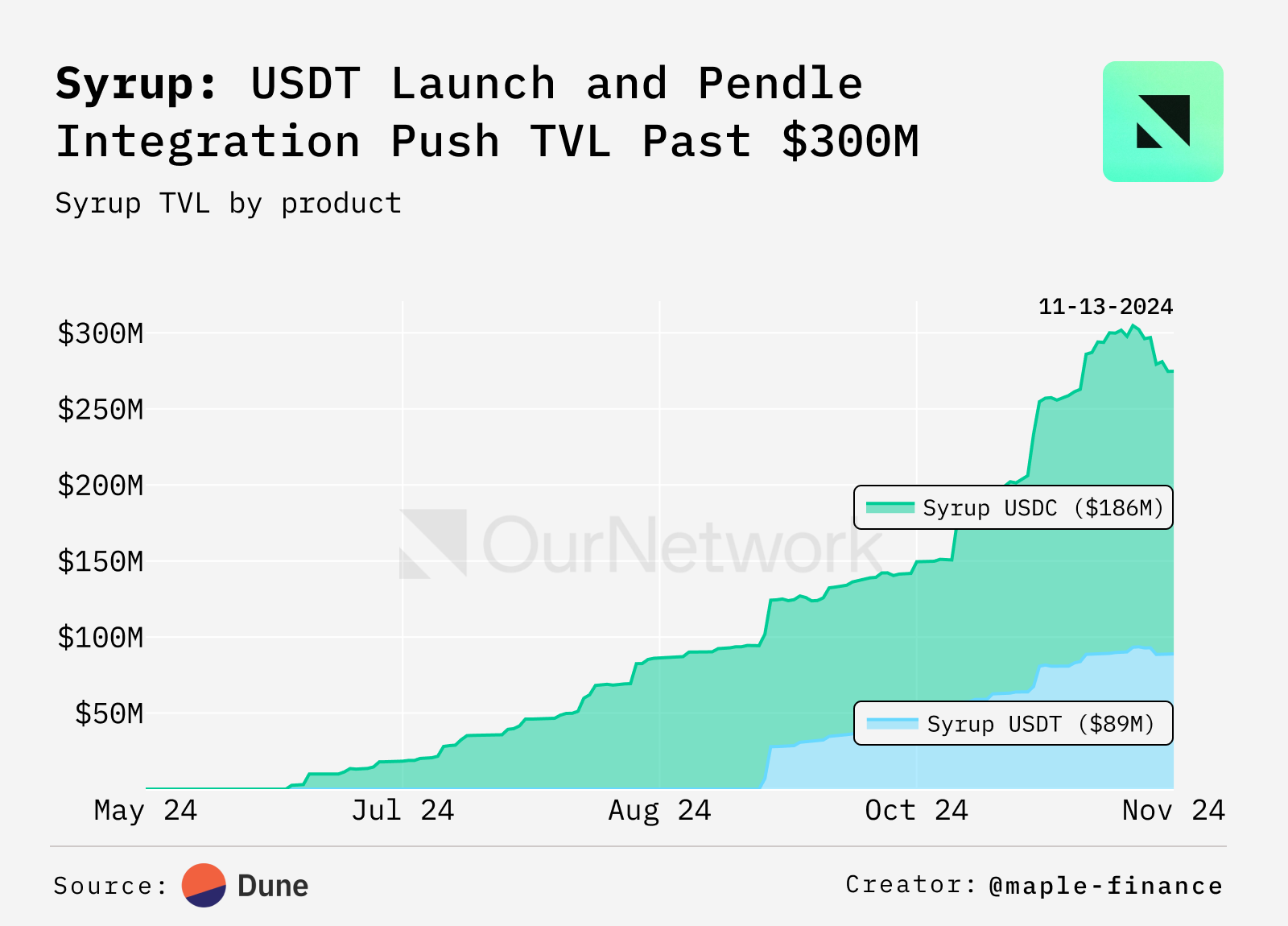

Syrup.fi is the fastest-growing product launched under the protocol to date. Syrup generates returns through fixed-rate, overcollateralized loans to institutional borrowers. The introduction of USDT and integration with leading DeFi applications like Pendle have driven TVL to over $300 million within just a few months.

-

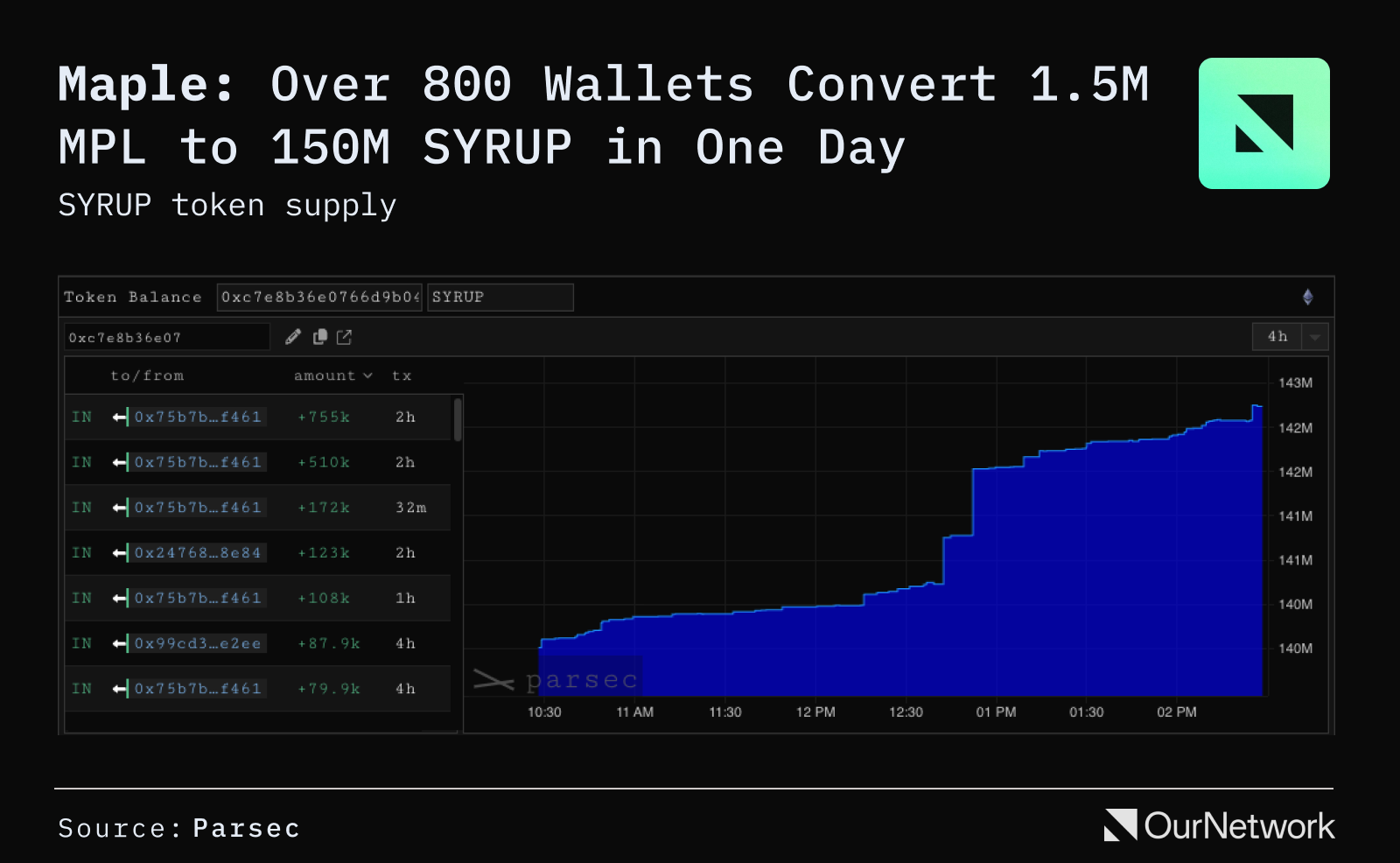

To unify Maple and Syrup under shared governance and share ecosystem growth with the community, the Maple DAO introduced the SYRUP token. 1 MPL token can be converted into 100 SYRUP. Within just one day, over 800 wallets converted more than 1.5 million MPL into nearly 150 million SYRUP.

BUIDL

BUIDL fund goes multi-chain, total value exceeds $543 million

-

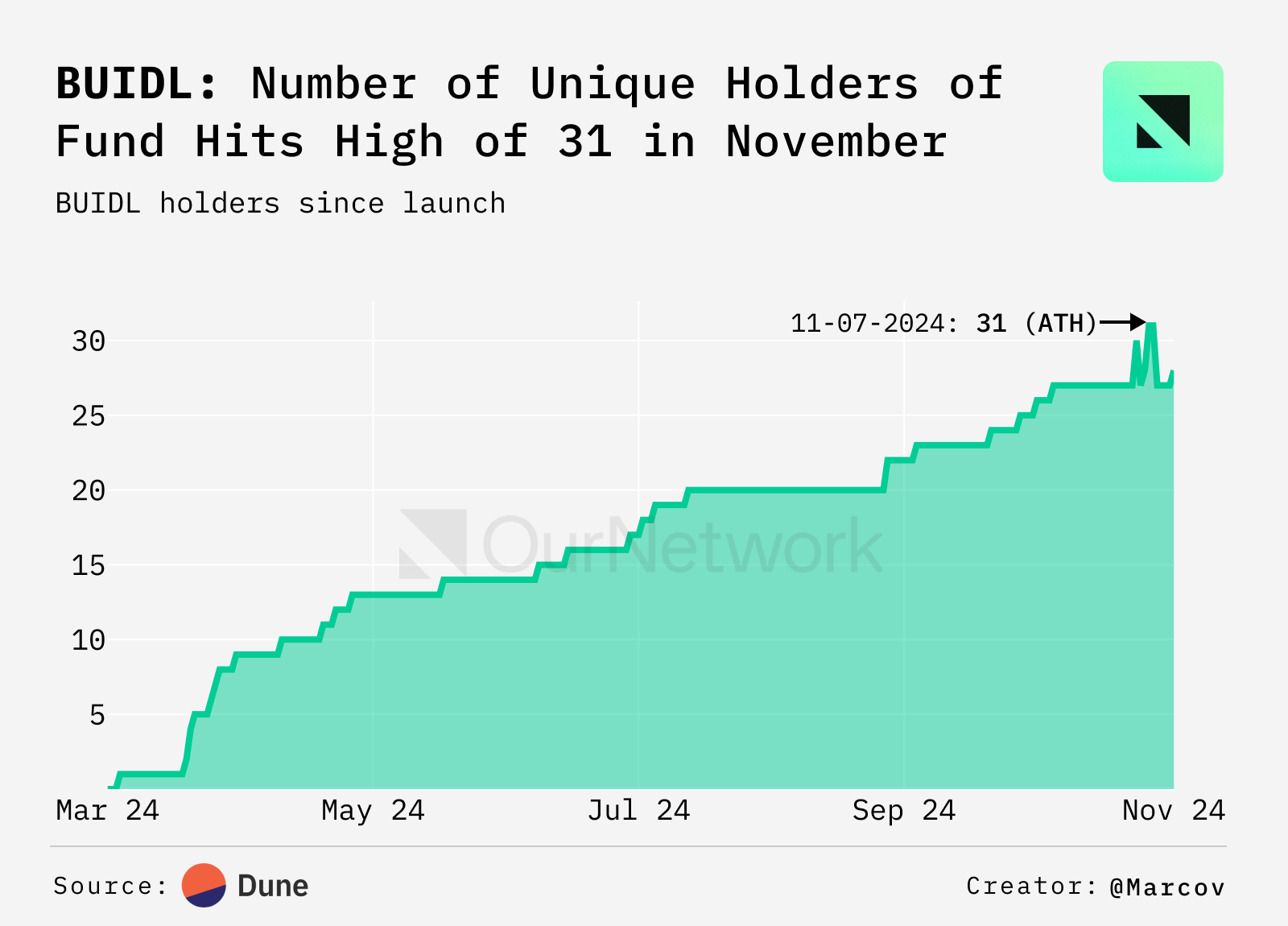

This week, the BUIDL fund—launched by Securitize and BlackRock—expanded beyond Ethereum, going live on Aptos, Optimism, Avalanche, Polygon, and Arbitrum blockchains. BUIDL supply on Ethereum decreased from $557 million to $513 million, but with the addition of these new chains, total supply increased by $30 million as of November 14, reaching $543 million.

-

The number of unique BUIDL holders has slowly increased over time, currently standing at 28. The recent expansion to additional chains did not increase holder count due to overlapping wallets.

-

As shown above, as of November 14, 89.6% of BUIDL supply remains on Ethereum, followed by 5.0% on Avalanche, 4.8% on Optimism, 0.3% on Polygon, and 0.3% on both Aptos and Arbitrum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News