Understanding Usual Money: "Unusual" Stablecoin Innovation with an Interesting and Robust Token Economy

TechFlow Selected TechFlow Selected

Understanding Usual Money: "Unusual" Stablecoin Innovation with an Interesting and Robust Token Economy

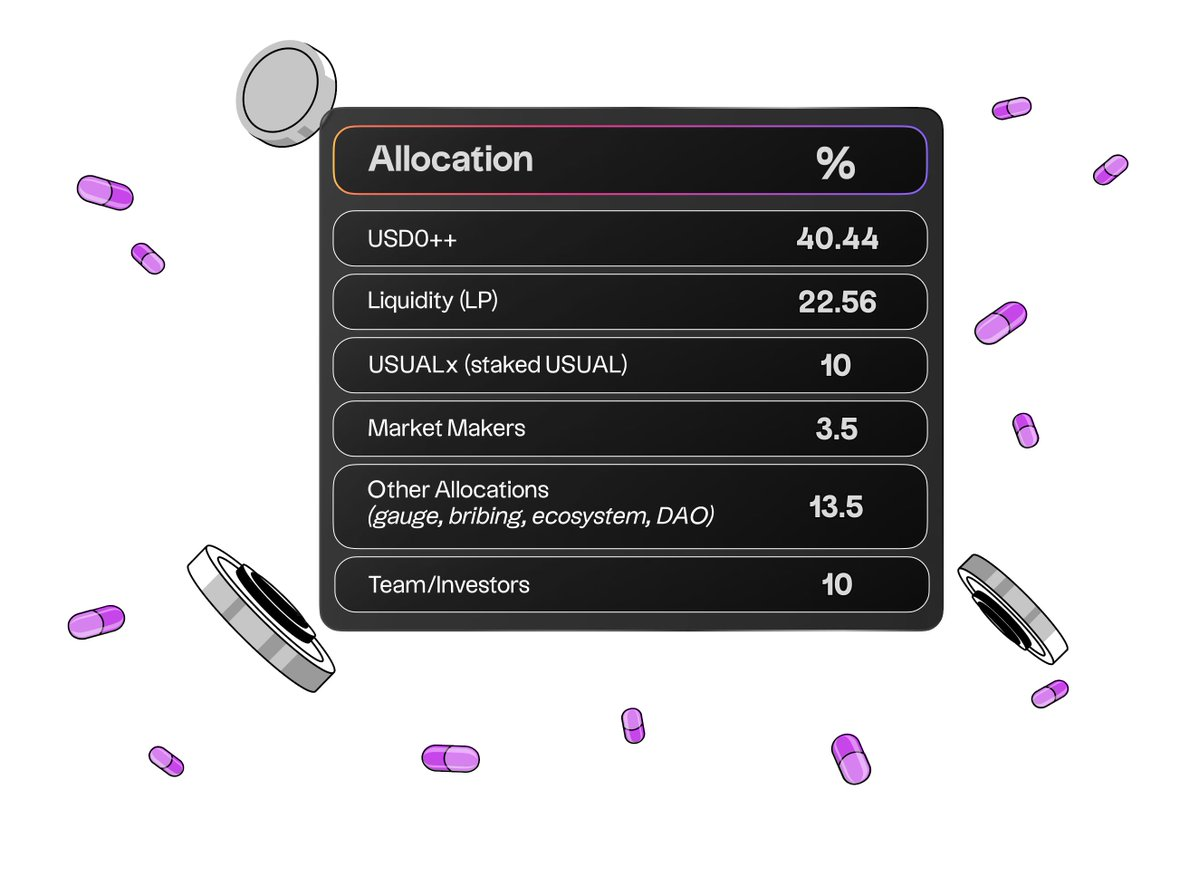

$Usual stakers receive 10% of all minted tokens as rewards, incentivizing users to stake.

Author: Poopman

Translation: TechFlow

*Originally published on 2024.10.28

TechFlow, November 14 — According to an official announcement, Binance will list Usual (USUAL) on Launchpool and Pre-Market.

Another Treasury-backed RWA stablecoin? Ugh, how boring.

This is always the reaction I get whenever I mention @usualmoney to friends.

These days, many stablecoins opt for Treasury bill backing due to their relatively attractive yields and low risk. For example:

-

Tether holds $81 billion in Treasuries.

-

MakerDAO / Sky has heavily invested in Treasuries, generating substantial returns (sorry, I can’t recall the exact figure).

-

More RWA players like Ondo, Hashnote, Blackrock, and Franklin are also entering the space. But honestly, most Treasury-backed stablecoins operate in similar ways.

Institutions that pass KYC can directly mint stablecoins by depositing real Treasuries into designated funds. The token issuer then partners with fund managers to issue a corresponding amount of stablecoins.

Yields may vary slightly depending on the maturity dates of these Treasuries, but differences are generally small—typically between 4% and 6%.

So, is there a way to generate higher yields and make it more interesting?

(This isn't a promotion or deep analysis—just some personal thoughts on Usual’s tokenomics. All views are my own and not investment advice.)

The Problem?

A simple and effective way to boost yield is to issue more governance tokens to attract deposits and grow Total Value Locked (TVL).

However, these tokens often lack real utility and tend to be dumped at launch due to high inflation. More often than not, they serve merely as exit tools for users and investors, or they aren’t closely tied to the actual revenue generated by the product.

-

In many cases, revenue flows directly to the product rather than the governance token. For instance, sDAI earns DAI, not $MKR.

Tokens that *are* linked typically use ve3.3 models to kickstart positive flywheels (shoutout to @AerodromeFi, @CurveFinance, @pendle_fi). When the flywheel spins, they can explode during bull markets. But when it stalls, dilution effects can become problematic.

A newer approach is enhancing token utility or repositioning them as L2 tokens, such as @EthenaNetwork / @unichain. But this strategy usually only works for big players 🤣.

$Usual takes a different route—by allocating 100% of protocol revenue to its governance token, making it “fundamentally backed by real dollars.”

At the same time, they add some PVP elements (early vs. late, staking vs. unstaking) to manage inflation and issuance, making it more engaging.

That said, you might be disappointed to learn that $usual isn’t the high-yield product you imagined—it’s more like a SAFU (Safe Asset Funded Utility) that’s just more fun than its competitors.

To help you better understand, let’s walk through the user flow.

$Usual

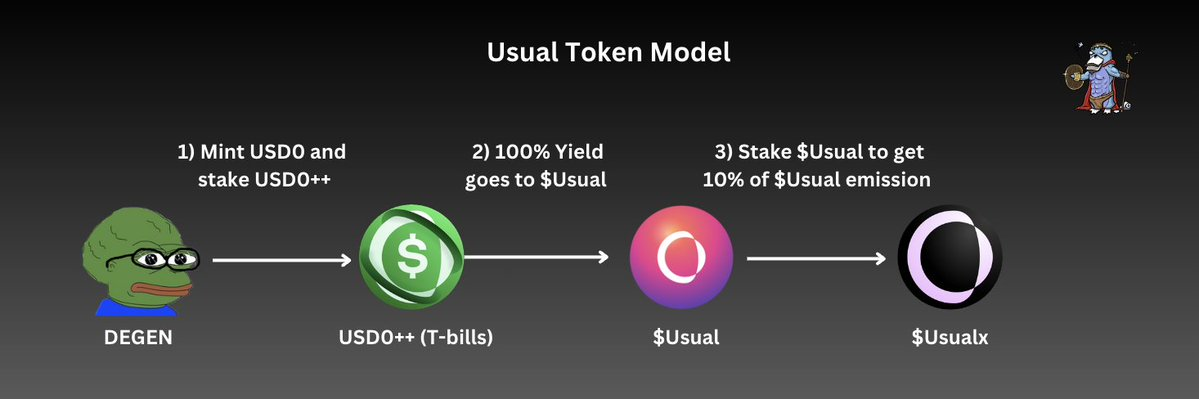

$Usual Tokenomics & User Flow

Usual Money Tokenomics

-

As a user, I can first mint USD0 using stablecoins. If I don’t want to provide liquidity or participate in other yield farms, I can stake USD0 into $USD0++.

-

Once I stake USD0, my $USD0++ earns 90% of $Usual rewards—paid in $USUAL, not USD0 or USDC. The $Usual issuance rate depends on the amount of $USD0++ minted and Treasury yields.

-

100% of Treasury yields earned by USD0++ go into the protocol treasury, while the $Usual token governs that treasury.

-

To earn the remaining 10% of $Usual rewards, I can stake $Usual into $Usualx. This 10% is automatically distributed to stakers every time new $Usual is minted. Additionally, $Usualx holders gain voting rights and influence over governance decisions like adjusting issuance rates.

Throughout this flow, we see that the governance token ($Usual) captures all revenue generated by the RWA product itself, while stablecoin holders and stakers are incentivized via yield-supported rewards.

Since Usual is an RWA product, extremely high APYs or APRs are hard to achieve—the yield is closely tied to real-world interest rates and the supply of USD0++.

More details below.

Token Utility Overview:

-

Token represents 100% of protocol income.

-

Stake to earn 10% of total $Usual emissions and gain voting power over issuance direction.

-

Participate in treasury governance (e.g., reinvestment decisions).

-

(Future option) Burn $Usual to early-unstake LST USD0++.

Fun with Emission Mechanics

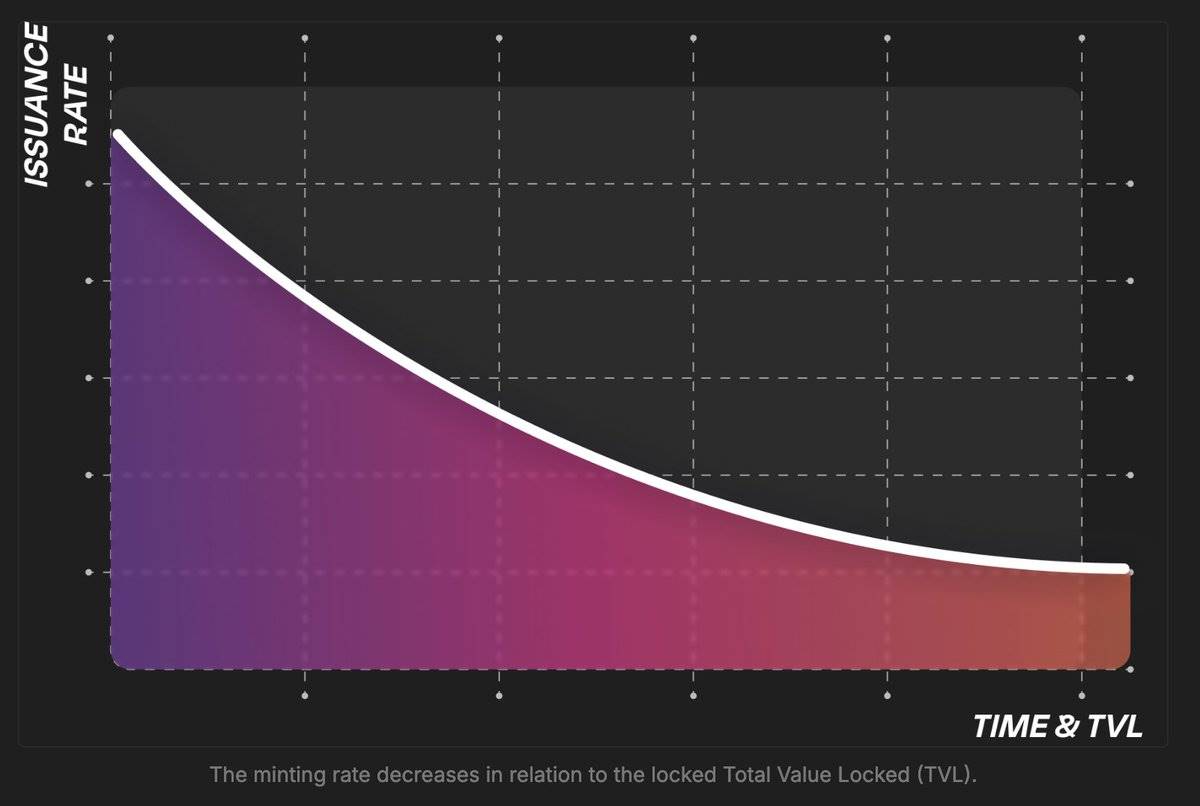

$Usual emissions are dynamically supply-adjusted, meaning:

-

When TVL grows, $Usual emissions decrease.

-

When TVL declines, $Usual emissions increase.

Question:

So Poopman, are you saying Usual doesn’t encourage deposits when TVL is high?

Answer:

No, not at all. When TVL is high, Usual actually earns more from increased Treasury holdings. So as the treasury grows, the value of $Usual should rise accordingly.

Conversely, when TVL is low, $Usual emissions increase because treasury income drops, requiring greater compensation. Higher emissions help Usual attract more TVL back to the platform.

Additionally, to prevent excessive $Usual inflation:

-

Emission rates adjust based on interest rates.

-

A maximum emission cap is set (decided by DAO).

This ensures token growth doesn’t outpace treasury growth, preserving $Usual’s value and aligning with the principle of “protocol growth = token value growth.” Of course, the DAO can adjust as needed.

For Early vs. Late Participants:

In this model, early participants benefit the most—they receive the largest share of $Usual at higher prices during high TVL periods.

Latecomers receive fewer tokens, but aside from opportunity cost, they don’t suffer real losses since they still earn yield.

In short, $Usual is a token that represents the yield generated by Usual.

By introducing PVP dynamics, $Usual adds some fun—users can earn 10% of others’ $Usual emissions via staking, while early adopters profit more from later entrants.

Token Distribution:

$Usual distribution is community-centric:

-

73% allocated to public and liquidity providers

-

13.5% to MM / team and investors

-

13.5% to DAO / buybacks / voting, etc.

It’s refreshing to see DeFi projects prioritizing the community like this. Well done to the team.

Potential Risks to Watch:

$Usual tokens are fun, valuable, and meaningful—with strong emphasis on inflation control. However, Usual and its users should remain aware of certain risks.

-

Liquidity Issues & Depeg Risk for USD0++

Currently, over $320 million USD0 is staked in USD0++, while liquidity on Curve is only around $29 million. In other words, less than 10% of USD0++ is readily available for exit. During large-scale withdrawals, pool imbalances could lead to depegging. While this ratio isn’t terrible (worst-case ~2-3% slippage), it’s a risk worth considering during the TGE window, as short-term investors may choose to exit.

-

Yield Competitiveness in Bull Markets

May sound naive, but during bull runs, attractive yields usually come from crypto assets themselves (like ETH, SOL), not stable real-world assets like Treasuries.

Compared to that, I expect stablecoins like sUSDe to deliver generous returns during market rallies, drawing far more TVL than Usual thanks to yields reaching 20–40% or higher. In such scenarios, without new products to boost USD0’s yield, Usual’s growth could stall.

Still, I believe about 80% of the DeFi community understands the risks USDe holders take. As a “conservative stablecoin,” Usual offers a better, more resilient option for those seeking stability.

-

DAO Issue: Low Participation Rate

Low participation is a persistent problem in DAOs. Since Usual is DAO-driven, ensuring sufficient and effective engagement is crucial. Considerations:

-

Delegation might help, but DAO decisions aren’t always optimal. The wisdom of the crowd supports DAO design, but looking at Arbitrum DAO results, not everyone has the vision or understanding to build a meaningful future for the project.

-

Most participants are self-interested and tend to vote only for things that benefit them personally. This could lead to monopolies or unequal reward distributions.

Therefore, handing too much decision-making power to the DAO carries risks and could ultimately result in suboptimal outcomes.

Conclusion:

-

Robust and interesting token model. The governance token has real value because it's backed by revenue.

-

$Usual stakers earn 10% of total emissions as rewards, creating strong incentives to stake. This brings fresh energy to the RWA stablecoin space—I believe this is the right approach.

-

Excellent inflation control. Emissions are strictly capped by the available supply of USD0++ and real-world interest rates, ensuring inflation won’t dilute $Usual’s value.

However, the downside is that sky-high APYs shouldn’t be expected—this could be a disadvantage compared to other products during bull markets.

-

Liquidity concerns. Currently, USD0 liquidity on Curve is less than 10% of USD0++. This could pose risks to LPs during the TGE window, especially during mass exits.

Still, I believe most holders are in it for the long term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News