Rethinking Public Chain Valuation: L1 Premium in Doubt, ETH Sovereignty Questioned

TechFlow Selected TechFlow Selected

Rethinking Public Chain Valuation: L1 Premium in Doubt, ETH Sovereignty Questioned

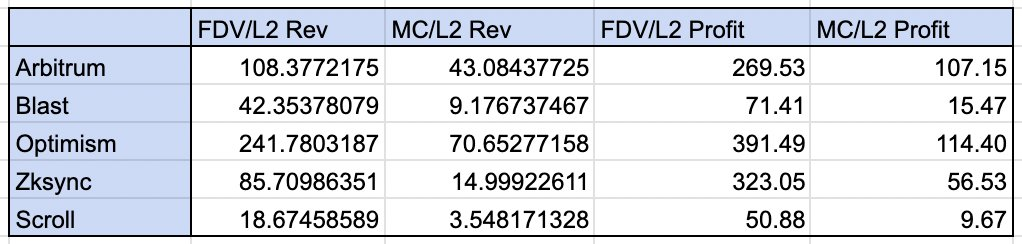

Optimism's transaction multiple is significantly higher than other comparable projects.

Author: taetaehoho

Translation: TechFlow

L1 premium, monetization, xREV/TEV… do these concepts actually exist?

Huge thanks to @smyyguy and @purplepill3m for reviewing and providing feedback on this article.

If you're unfamiliar with REV, check out @jon_charb's article here.

All multiples below are based on valuation data as of noon (Eastern Time, US) on October 30, 2024.

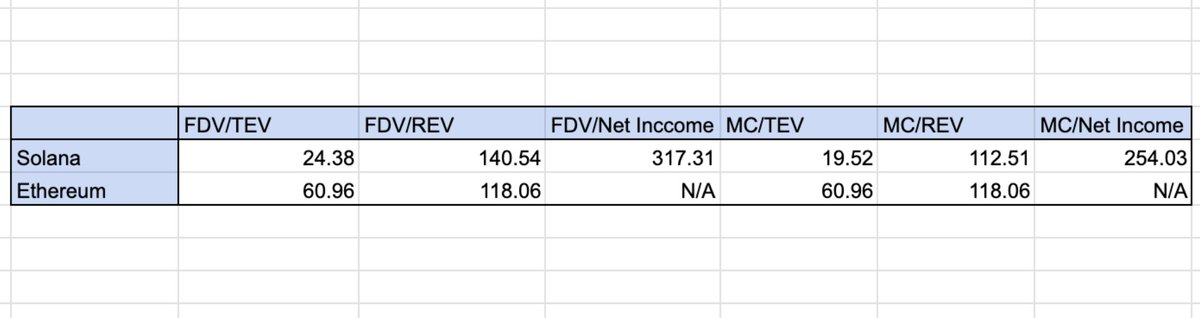

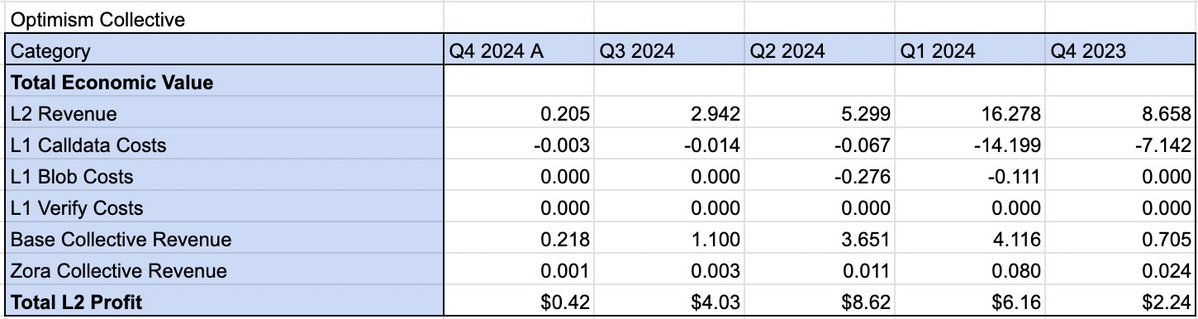

L2 profit is defined as its income (including base fees and priority fees) minus on-chain operating costs (such as L1 data availability calls, blob costs, and validation expenses). Data for Arbitrum, Optimism, Zksync, and Scroll represent the past twelve months, while Blast has only three quarters of data (which inflates its multiples relative to other projects). ETH and Solana data also cover the last twelve months.

Key Notes:

-

REV and L2 revenue are comparable metrics. L2 revenue refers to income before deducting operator costs (i.e., sequencer costs), which aligns closely with how REV is calculated.

-

L2 DAOs distributed large amounts of tokens during their token generation events (TGEs). A portion of an L2’s fully diluted valuation (FDV) can be attributed to governance value—a feature absent in L1 tokens. Therefore, we mentally adjust L2 multiples upward, though we do not make this adjustment when discussing observations.

Direct Observations:

-

In terms of fully diluted valuation (FDV), there is no clear “L1 premium,” although most L2s have not yet reached full token circulation. However, in market cap comparisons, an “L1 premium” does appear evident. (Arbitrum and OP have FDV/L2 revenue ratios around 100–250, whereas Ethereum and Solana have FDV/REV ratios of approximately 118–140).

-

Optimism’s trading multiple is significantly higher than other comparable projects. Investors seem optimistic about its collective expansion strategy.

-

Thanks to collective profit sharing (15% of sequencer revenue and 2% of profits), the DAO has earned more net profit quarter-to-date than OP’s L2 revenue. In terms of total value accumulated into the treasury, the collective strategy has proven successful. Given that Base alone contributed approximately $9 million to the collective treasury, allocating substantial revenue-sharing grants in the future would be a strong move.

-

Restricting block space does not correlate with increased revenue. During peak congestion periods, Arbitrum’s median fee was around $10, yet its L2 profit remains lower than Base’s.

-

Token buyers are not pricing in Scroll’s growth (its market cap is only 3x its L2 revenue).

-

ZKP verification costs on L1 temporarily reduce the profit margins of zk-rollups. Currently, we haven’t seen cost savings from state differences being passed on to users.

View the spreadsheet for detailed data.

This leads me to a few questions:

-

Does monetary premium actually exist? Or would L2s with equivalent on-chain activity command similar valuations?

-

Does ETH truly have a sovereignty premium (SOV) compared to Solana? (Ethereum’s REV was concentrated mainly in Q1 and Q2 of 2024—would this premium still be apparent if comparing only recent quarters?)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News