The Wisdom of Markets: Why Polymarket Outperforms Traditional Polls in Election Forecasting

TechFlow Selected TechFlow Selected

The Wisdom of Markets: Why Polymarket Outperforms Traditional Polls in Election Forecasting

Throughout the election process, Polymarket was always one step ahead.

Author: Haseeb >|<, Managing partner at dragonfly_xyz

Translation: TechFlow

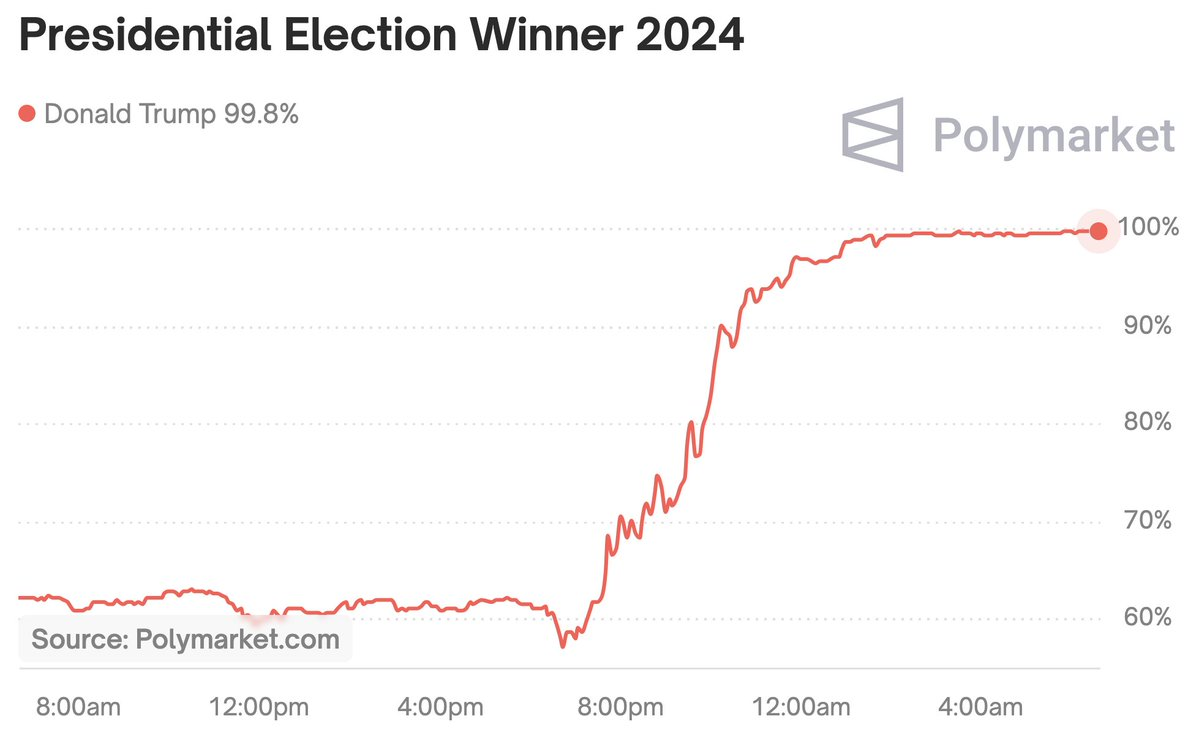

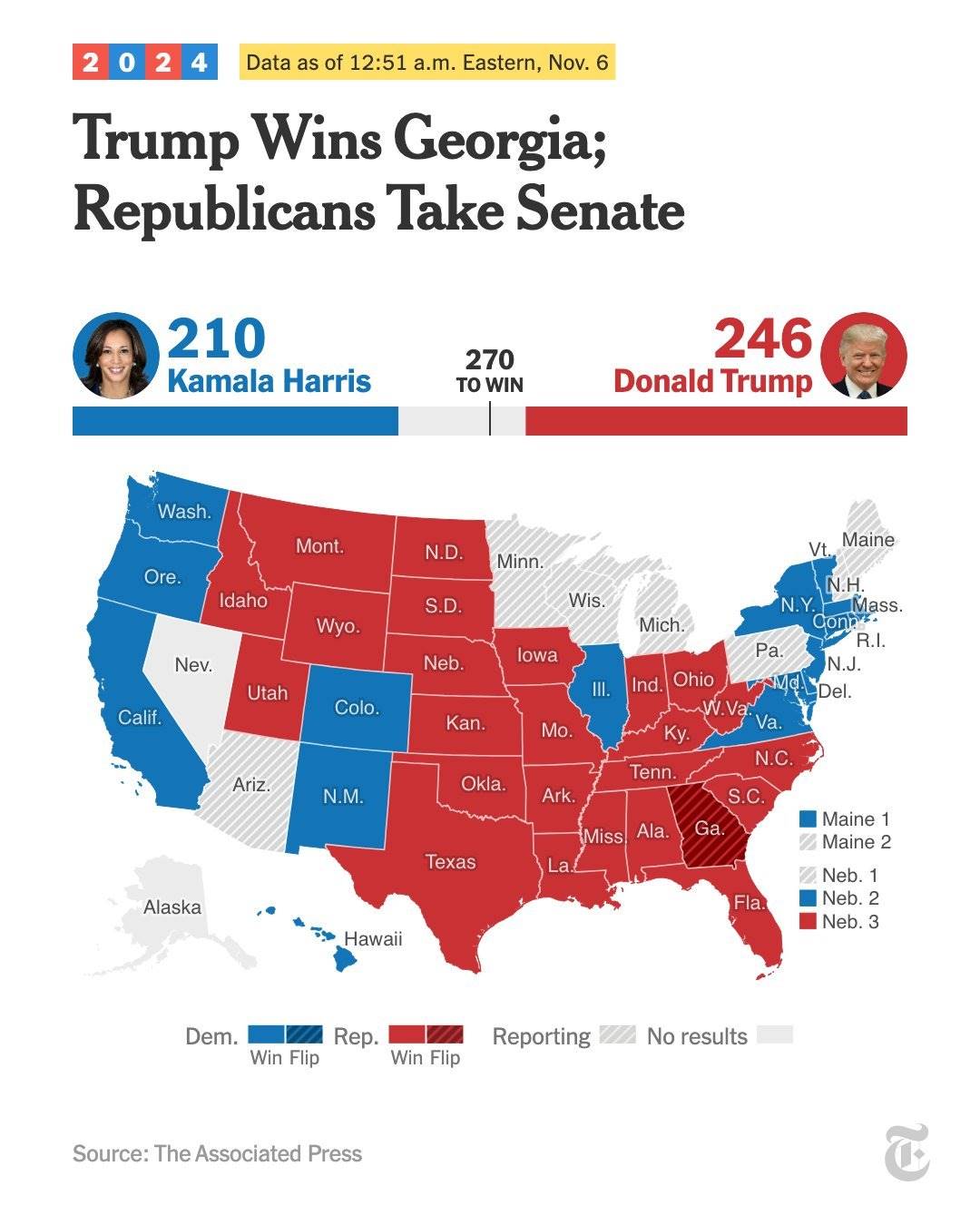

With the election settled, there’s one story neither The Wall Street Journal nor The New York Times reported. While mainstream media focused on televised spectacle and hesitated to project outcomes in key swing states, Polymarket—the world’s largest prediction market—had already made its call before midnight Eastern Time, giving Trump a 97% chance of victory. This was even before any major outlet had declared results in a single swing state.

1. Throughout the election, Polymarket was consistently ahead

I want to explain why this happened, because judging by the feedback I received on Twitter last night, most people deeply misunderstand it.

Polymarket outperformed the media in two fundamental ways.

First, Polymarket's pre-election forecasts were more accurate. Consider polling firms and analysts. Poll-based election models claimed the race was a toss-up, while Polymarket gave Trump a clear edge—assigning him roughly a 62% chance of winning before votes were cast.

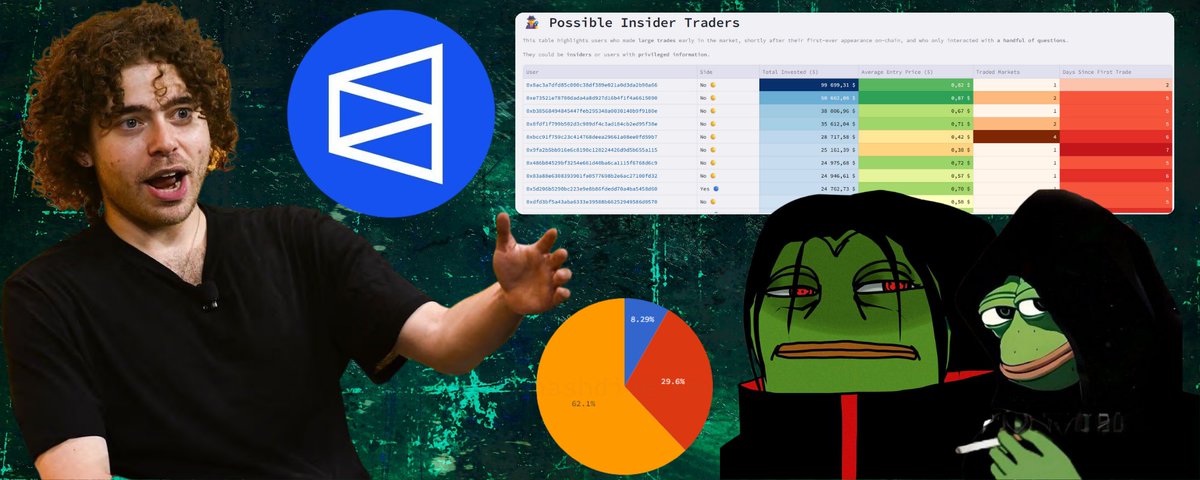

If you recall, the mainstream media mocked Polymarket for diverging from consensus. They insisted Polymarket should align with the modelers! Clearly, the divergence meant Polymarket couldn’t be trusted. Critics argued that Polymarket’s user base was full of pro-Trump crypto enthusiasts, funded by Peter Thiel, dominated by foreign traders, unregulated, and thus likely manipulated by large players inflating Trump’s odds. The criticisms piled up endlessly.

Underlying these critiques is a profound distrust of markets. As if markets cannot be trusted unless their reliability is explicitly proven. Of course, if you truly trusted markets, you might stop trusting the media. And the media’s business model depends precisely on making you distrust other information sources—otherwise, why would you keep clicking through their endless stream of attention-grabbing headlines?

But anyone with market experience knows: who makes up the market doesn’t matter—whether Republicans, Democrats, foreigners, or others. In fact, we know JP Morgan uses Polymarket, some of the world’s largest hedge funds use it (most with non-U.S. subsidiaries). It’s integrated into Bloomberg Terminal and cited on CNN. Yet when discussing Polymarket, the media treats it as if it were little more than a platform like 4chan.

You should know that Polymarket saw **$3.6 billion** traded during the presidential election. This is the **largest volume ever recorded in an electoral betting market**, exceeding all other election markets by an order of magnitude. This dwarfs the career stakes of any individual pollster or modeler. Markets work because so much rides on getting the answer right.

Those alleged biases—like pro-Trump crypto fans or non-Americans—did not impair accuracy. (In hindsight, non-Americans may have been better positioned to assess the election dispassionately.)

But participant identity doesn’t matter. Prediction markets aggregate information from diverse participants, producing prices that transcend bias. Markets don’t care about ideology—they only care whether the outcome is correct.

The truth is, Polymarket was more accurate than any polling firm or modeling outfit.

Now, let me be clear: the difference between 60/40 and 50/50 sounds significant, but statistically speaking, it isn't. Elections are inherently uncertain. According to high school statistics, to determine with 90% confidence whether a coin is biased 60/40 instead of 50/50, you need over 100 coin flips. A single election outcome—“Trump won”—doesn’t prove the underlying probability.

My point isn’t that Polymarket was completely right and prediction models entirely wrong. The gap between them wasn’t enormous. What matters is this: the market consistently priced Trump’s odds higher than polls suggested. Remember, markets incorporate poll results and analyst conclusions. Markets digest all available information, yet Polymarket’s pricing still differed from pollsters’. The only explanation analysts could offer was bias.

They lacked the humility to consider that perhaps Polymarket knew something polls missed.

Polling accuracy has declined sharply—it’s now undeniable. Before the internet era, polling was far more reliable. Back then, landline response rates exceeded 60%. Today, they hover around 5%. This creates massive sampling bias, which simple statistical adjustments can’t fully correct. (Moreover, polling organizations—selling products and protecting reputations—often converge toward consensus forecasts to avoid standing out, distorting collective judgment.)

Additionally, Trump is a uniquely polarizing figure in American politics. For three consecutive elections, polls have significantly underestimated support for him—a phenomenon known as the “shy Trump voter” effect.

Polymarket may have sensed what polls overlooked. Pollsters insist they’ve updated models and adjusted methodologies. Polymarket responded: I don’t believe you. And it turned out Polymarket was right.

Say it again! Polymarket didn’t claim Trump had a 90% chance. 62% isn’t a definitive number—elections are inherently uncertain. What baffles me is that the media showed zero curiosity about this discrepancy. Could it be that Polymarket knew something we didn’t? Or that some signals were being missed—signals not captured by traditional pollsters or outdated online surveys?

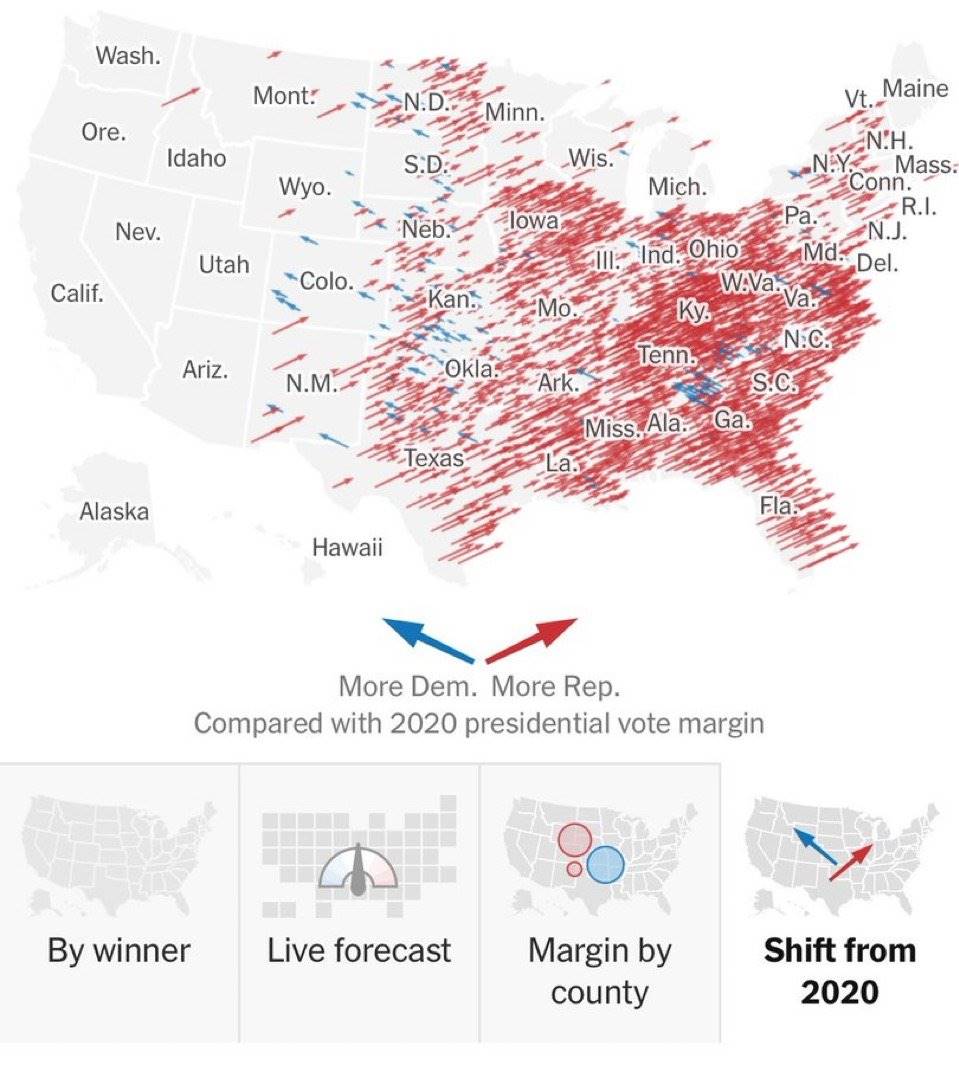

Remember, Trump outperformed polls nationwide, both in Republican and Democratic states. He won every swing state and even the popular vote—an outcome most considered unthinkable.

Are you really confident that no alternative method exists to uncover the true sentiments of tens of millions of Americans beyond legacy pollsters and antiquated internet surveys?

This is what markets teach us. Markets are smart—but they don’t explain why. They just show the result.

2. This leads to the second way Polymarket surpassed the media

Polymarket predicted the real-time outcome before the media did. On election night, the market’s predictive power became fully visible. Polymarket reacted quickly and decisively—even before any swing state results were officially called. By Polymarket’s assessment, the election was effectively decided by midnight, while mainstream outlets waited until 6 a.m. the next morning to formally declare a winner. Why?

First, Polymarket uncovered a crucial correlation that mainstream media refused to explain to viewers. Polling errors are rarely random—they tend to be correlated across states. So when traders observed Trump vastly outperforming polls in non-competitive states—such as New York City (a solidly Democratic area) or Florida (a reliably Republican one)—it signaled that national polling error could be substantial.

Polymarket rapidly absorbed this insight, realizing swing states were no longer competitive. By 11:30 p.m., Polymarket had assigned Trump a 90% chance of winning Pennsylvania—despite only a small fraction of Pennsylvania votes having been counted.

Prediction markets don’t wait for bureaucratic procedures or commentator analysis. They don’t care about preserving the ceremonial ritual of waiting for vote counts. Recall the backlash in 2020 when Fox News prematurely called Arizona for Biden (and turned out to be correct)? Trump threatened to boycott the network. The lesson was reinforced: major media must patiently count votes and avoid appearing too clever.

Yet markets care nothing for dramatic process—they focus solely on outcomes. Clearly, explaining to CNN viewers that the election was already over due to massive polling errors in non-swing states and Kamala’s bleak prospects—and advising them to go to sleep rather than wait for swing state results—would be extremely difficult. It contradicts the narrative media had spent months building. The public wants a simple, digestible story where everyone understands the plot: wait for swing states, watch the colored bar cross the 270 threshold.

At 12:51 a.m., The New York Times was still displaying dramatic charts and headlines. Meanwhile, Polymarket had already priced Trump’s victory at 98%.

So election watchers stayed up all night merely to witness the media complete its meaningless coloring-in ritual.

Polymarket traders weren’t bound by narrative constraints or incentivized to hype drama for ratings—they simply delivered their verdict directly.

@shayne_coplan, Polymarket’s founder, said Trump’s campaign team was monitoring Polymarket to better understand how to interpret odds. Media outlets dared complain that Trump declared victory too early—with just 267 electoral votes tallied—when Polymarket’s odds had already dropped to display 100%.

The beauty of markets lies in their speed in reacting to new information. Traders who integrate information fastest are rewarded—with profits. Traditional media cannot do this, as they must filter events through layers of interpretation, narrative construction, and internal politics (e.g., Murdoch intervening in Fox’s 2020 Arizona call).

Polymarket’s decentralized nature bypasses all such bureaucracy, allowing information to flow freely and unimpeded.

Last night’s events deserve reflection. This election was a sharp rebuke to Democrats, a rejection of the expert class, and an immune response against arrogant media.

For Polymarket, however, this night was a perfect validation of its value. My takeaway: when major world events occur, skip the op-eds and go straight to Polymarket odds. Full disclosure: I’m an investor in Polymarket. I’ve long been passionate about prediction markets, and I’m gratified to see their value finally recognized. Also, I’m quite exhausted now, so I may have made minor factual errors—but you get the point.

This piece is written for people I know who remain skeptical of prediction markets and accept media narratives dismissing Polymarket. If you know anyone with doubts about prediction markets, feel free to share this article with them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News