Ethereum's Midgame Battle

TechFlow Selected TechFlow Selected

Ethereum's Midgame Battle

Ethereum, beset by internal and external challenges, has its own midfield battle.

Author: 0Alice0

This is not the last time Ethereum will come under attack.

Compared to Solana's bustling activity, Ethereum's autumn has been somewhat unflattering: lackluster Layer2 performance, stagnant ecosystem innovation, and a sluggish price trend.

Even discussions about Vitalik’s personal romantic life have become hot topics in Chinese crypto circles:

"Did V God dump foundation tokens to fund his girlfriend?"

For a long time, Ethereum was the epicenter of blockchain innovation—developers flocked to build their most cutting-edge ideas on this chain and present them to users. Ethereum’s robust community provided fertile ground for these projects to emerge—DeFi’s rise, NFTs’ explosion, and DAOs’ social experiments all proved this point.

Yet, nearly every major highlight during this bull market have taken place not on Ethereum, but on Bitcoin’s ecosystem or newer ecosystems like Solana and Sui.

Amid internal struggles and external pressures, Ethereum now faces its midlife crisis.

The "Mother" Being Drained by Its Layer2 Children

It would be no exaggeration to say that the Layer2 strategy brought Ethereum an era of peace—Layer2s took responsibility for solving scalability issues in technology and market share, shielding the mainnet from the constant waves of so-called “Ethereum killers.” Meanwhile, Ethereum itself leveraged its years of accumulated technical expertise and influence to support various Layer2 experiments across different directions.

Projects like Arbitrum and Optimism successfully addressed the long-standing criticism of Ethereum’s high gas fees, delivering cheaper and more efficient transaction experiences, while also halting advances by chains such as Avalanche and Near into Ethereum’s ecosystem.

However, most Layer2s remain obscure—L2beat currently lists 112 Layer2s, yet the majority are unknown, failing to meet early Layer2 definitions (such as storing data availability on Ethereum), with near-zero TVL and user interaction.

In the brutal Layer2 wars, winner-takes-all has become the only truth.

TVL of the lowest-ranked Layer2s is almost zero

The definition of Layer2 continues to blur.

Despite repeated clarifications and “guidance” from both the Ethereum Foundation and Vitalik himself via blogs and tweets, the term remains widely abused.

New public chain projects now brand themselves as “Layer2,” riding Ethereum’s coattails to attract investors and users. With just one click to launch a chain, paired with polished PPTs and grand visions, they easily gather hordes of enthusiastic backers—no need for architectural or technical reinvention.

Vitalik once expressed his dilemma in a blog post: "...some currently independent Layer1 projects are seeking alignment with the Ethereum ecosystem and may become Layer2s. These projects likely prefer a gradual transition—immediate full migration would degrade usability since the tech isn’t ready to put everything on rollups. But delaying too long risks losing momentum entirely..."

Yet, at the time of writing, Vitalik still expressed strong optimism about Ethereum’s Layer2 future: rapid growth in the EVM Rollup ecosystem represented by Arbitrum, Optimism, and Taiko; Polygon building its own rollup; independent Layer1s like Celo turning toward Ethereum; and new initiatives such as Linea, Zeth, and Starknet.

At that moment, it wouldn't be an overstatement for Vitalik to declare, “All heroes fall within my grasp.”

But reality didn’t unfold as expected.

Overvalued Layer2 tokens plummeted on their first day of exchange listing. VCs and airdrop farmers rushed to dump their holdings—alongside those infamous “insider wallets.”

Meanwhile, the actual vitality of Layer2 ecosystems fell far short of market expectations. Developers bounced between hackathons large and small, rarely committing to building complete projects on sponsor chains, instead adopting a “grab-and-go” strategy.

TVL chasing airdrops quickly scattered after token distributions: staking ETH for yields far exceeding traditional DeFi returns sent whales “rushing from one dark forest to another.”

Legacy ecosystem players also harbored ulterior motives: last month, Uniswap—the most iconic DEX in Ethereum’s ecosystem—announced UniChain, built on the OP Stack.

Like other OP chains joining the Superchain (Base, Zora, etc.), Unichain will return 2.5% of chain profits or 15% of chain revenue (whichever is higher) to the Optimism Collective. A situation where people know “OP” but not “ETH” is unfolding—even though the parent-child relationship between Optimism and Ethereum remains solid, modular narratives open the door to fragmentation within Ethereum’s ecosystem.

Ethereum’s internal weaknesses are now evident: the Foundation’s hands-off approach and excessive focus on external competition lead it to adopt a laissez-faire attitude toward project development—established projects dominate the landscape, forcing developers to seek survival space elsewhere. Layer2 foundations, meanwhile, wield deep pockets to lure developers with cash incentives and full-service support—from incubation to marketing—effectively becoming new Layer1s in practice.

Market enthusiasm for Layer2s has gradually turned to fatigue. Binance’s newly listed “blue-chip” tokens continue to fall, and Ethereum itself wobbles under continuous bloodletting.

"Why buy memes on ETH?"

Many first associated Solana with SBF’s famous line: “Sell me all your SOL now.” After FTX’s collapse, this high-performance chain nearly faced total ruin.

But early groundwork gave Solana the capital to rebuild. Successful Hacker House Series events, pre-arranged integration of USDT/C during the SBF era, early influence from projects like Stepn, and aggressive foundation support helped Solana survive its darkest days and eventually ignite an ecosystem boom.

Ethereum’s ecosystem development resembles a planned economy: the Ethereum Foundation and Vitalik set the direction first, Layer2s follow, then developers trail behind. But this approach also implies abandoning alternative paths—no one wants to lose legitimacy, so no one dares fall behind.

Solana carries no burden of legitimacy.

Unlike the idealistic developer culture seen in Ethereum and Bitcoin ecosystems, Solana’s vibe leans closer to BSC’s cutthroat environment—the Western-friendly “Degen” culture runs through the chain from day one. Less harmony, more PvP. Users realize they no longer need to pay $几十 in gas fees and wait endlessly for network congestion to ease—interactions finalize in seconds, encouraging far more frequent engagement.

High TPS delivers instant, seamless feedback, and mature infrastructure amplifies the thrill of the “on-chain casino” like never before. The emergence of meme coins like PEPE and BOME generates wealth effects while siphoning users from other ecosystems.

Then came Pump.fun.

Pump.fun, solving the “last mile” problem for meme coins, sent the market into frenzy. Traditional crypto narratives require painstaking search, a year of brewing, half a year of breakout, culminating in mainstream media coverage. On Pump.fun, anyone—from celebrities to billionaires to nobodies—can instantly create their own narrative. Expectation, pump, shilling, and dumping become the only four things that matter.

Ethereum had its own version of the casino—Polymarket’s U.S. election odds一度 became a key indicator of the likely winner. But compared to Pump.fun’s simple, brute-force on-chain slot machine, prediction markets feel slow and less stimulating for bettors.

Slot machines don’t need to be in Macau or Las Vegas—they can exist on any touchscreen you encounter, offering bigger rewards than any machine you’ve ever used. That’s the visceral experience Pump.fun delivers. After all, most crypto participants still dream of getting rich overnight.

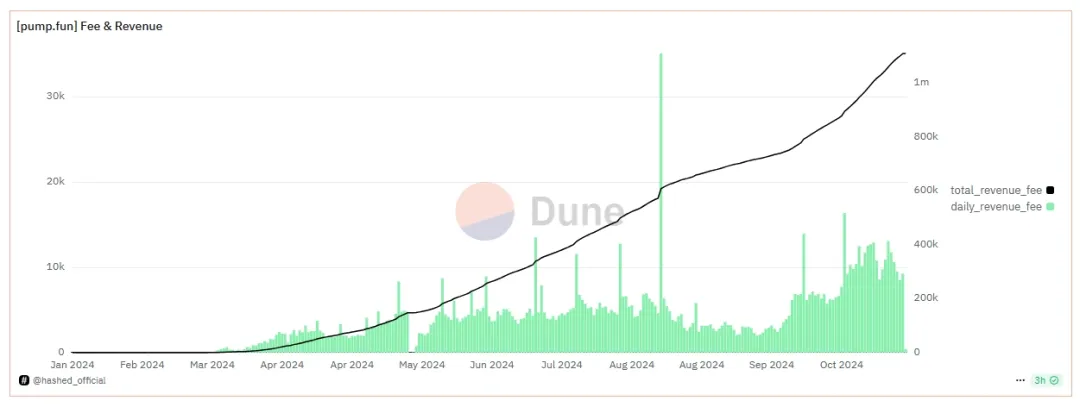

The flip side is chaos. As of writing, nearly 2.95 million tokens have been deployed on Pump.fun, generating over 1.1 million SOL (~$160 million) in total revenue, averaging around 10,000 SOL daily.

Pump.fun’s total and daily revenue continue to grow.

Inner Circles and Inertia

The tradition of “To Vitalik” startups has long existed—given the non-profit nature of the Ethereum Foundation and Vitalik’s immense influence, gaining his endorsement became, for many founders, the sole path to securing investment and attention.

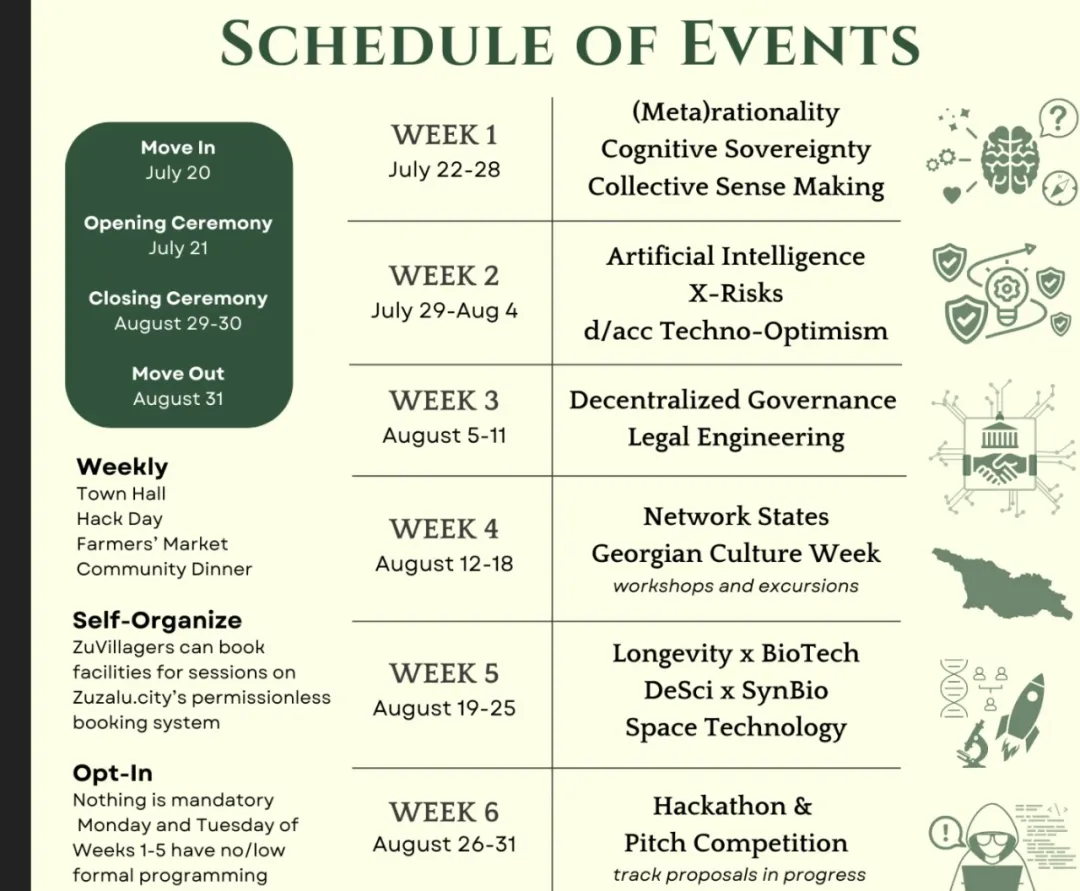

Early financial success gradually distanced Vitalik from what he perceives as the vulgar aspects of the community, leading him to form tight-knit circles based on shared ideals. Over time, the barrier between Vitalik and the outside world thickened: he reportedly refused photo requests in Montenegro with a “No Chinese” remark, engaged in philosophical talks about cognitive sovereignty and irrationality with inner-circle members, worried photos might be exploited for hype, yet never hesitated to promote projects by his close associates—regardless of whether their loyalty was genuine or performative.

Discussion topics list from Zuzalu.

Ethereum Foundation researchers live a different reality—technicians quietly push innovation forward, yet receive far less than they contribute. This gap allowed projects like Eigenlayer to exploit the system: researchers lend credibility to projects with minimal effort in exchange for tokens, forming de facto利益 alliances.

Objectively speaking, neither Vitalik nor the Ethereum Foundation has ever assumed responsibility for ecosystem profitability. His role has always centered on technical advancement and research, while commercialization in past cycles was driven by entities closely tied to Ethereum’s ecosystem—like Wanxiang and Consensys. Yet, their massive commercial success made them lose interest in further pushing Ethereum’s commercialization, shifting instead to more profitable ventures.

And the flood of new crypto VCs emerging like mushrooms lack the capacity to carry this commercialization burden.

The clearest proof lies in the priority list on grant application pages: financial projects, NFTs, and token-launching initiatives are deemed “valuable but ineligible for funding.” This inertia, present since Ethereum’s inception, ensures the Foundation’s absolute neutrality in financial investments.

But the Foundation cannot control personal biases.

Conclusion

Naval wrote on Twitter: "Most crypto projects fail because the founding team gets rich too early—and this problem can't be solved by hiring new talent."

Will Ethereum ultimately fail? Or are all the issues mentioned above merely menopausal pains—temporary setbacks requiring minor adjustments before returning to form? We don’t know yet.

But this is neither the first nor the last time Ethereum will face criticism—the experiment born in 2015 has already traveled nine long years, weathering countless storms, earning endless praise and scorn. Love it or hate it, it remains an inescapable chapter in blockchain history.

Yet, after intense competition, Ethereum has finally reached its unavoidable midlife crisis.

No more thrilling market-share battles, no more adrenaline-pumping ICO fervor. Long-term ecosystem building appears duller, flatter—but this is precisely what Ethereum must do to survive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News