Understanding Usual Money: "Unusual" Stablecoin Innovation with an Interesting and Robust Token Economy

TechFlow Selected TechFlow Selected

Understanding Usual Money: "Unusual" Stablecoin Innovation with an Interesting and Robust Token Economy

$Usual stakers can receive 10% of all minted amounts as rewards, incentivizing users to stake.

Author: Poopman

Translation: TechFlow

Another treasury-backed RWA stablecoin? Ugh, how boring.

This is always the reaction I get when I mention @usualmoney to friends.

These days, many stablecoins use treasuries as collateral because they offer relatively solid yields with low risk. For example:

-

Tether holds $81 billion in treasuries.

-

MakerDAO / Sky has heavily invested in treasuries and generated significant yield (sorry, I don’t remember the exact number).

-

More RWA players like Ondo, Hashnote, Blackrock, and Franklin are joining the race. But honestly, most treasury-based stablecoins operate similarly.

Institutions that pass KYC can directly mint stablecoins by depositing real treasuries into designated funds. The token issuer then partners with fund managers to issue an equivalent amount of stablecoins.

The yields may vary slightly depending on the maturity dates of these treasuries, but generally fall within a narrow range of 4% to 6%.

So, is there a way to generate higher returns and make it more interesting?

(This isn't promotion or deep analysis—just some quick thoughts on Usual’s tokenomics. All views are personal and not investment advice.)

Problem?

A simple and effective way to boost yield is to issue more governance tokens to attract deposits and grow total value locked (TVL).

However, these tokens often lack utility and suffer from high inflation, leading to immediate dumping at launch. Often, they serve merely as exit tools for users and investors, or aren’t tightly linked to actual protocol revenue.

-

In many cases, revenue flows directly back into the product rather than to the governance token. For instance, sDAI earns DAI, not $MKR.

Tokens that do have strong alignment typically use the ve3.3 model to kickstart a positive flywheel effect (shoutout to @AerodromeFi, @CurveFinance, @pendle_fi). When the flywheel spins, they can explode during bull markets. But when it stalls, dilution becomes problematic.

Another emerging approach is enhancing token utility or repositioning the token as an L2 token, such as @EthenaNetwork / @unichain. But this strategy usually only works for big players 🤣.

$Usual takes a different path—by allocating 100% of protocol revenue to its governance token, making it “fundamentally backed by real dollars.”

At the same time, they add PVP dynamics (early vs late, staking vs unstaking) to manage inflation and issuance, making it more engaging.

But here's the twist—you might be disappointed to learn that $usual isn’t a high-yield product. Instead, it’s more of a SAFU (secure asset fund for users) play that’s simply more fun than competitors.

To help you understand better, let’s walk through the user journey.

$Usual

$Usual Tokenomics & User Flow

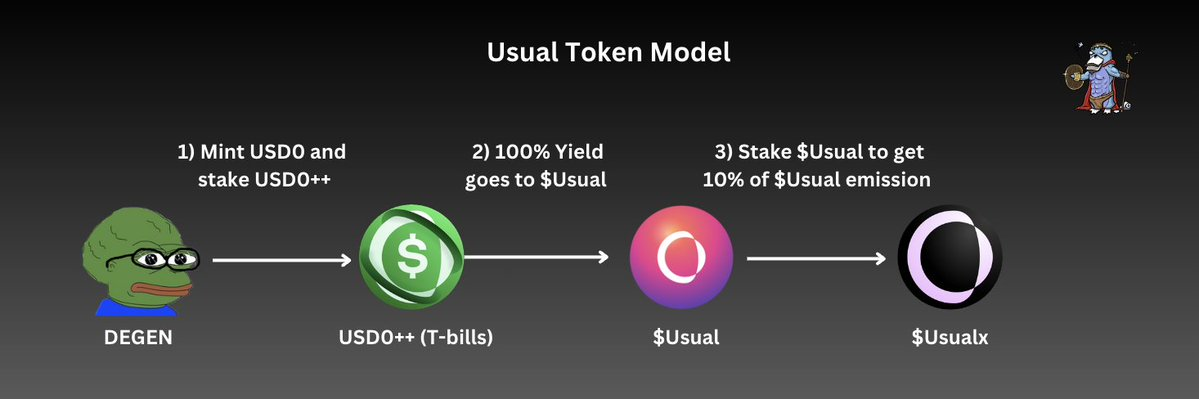

Usual Money Tokenomics

-

As a user, I can mint USD0 using stablecoins. If I don’t want to provide liquidity or join other yield farms, I can stake USD0 into $USD0++.

-

Once I stake USD0, my $USD0++ earns 90% of $Usual rewards—in $USUAL tokens, not USD0 or USDC. The $Usual emission rate depends on the amount of $USD0++ minted and treasury yields.

-

100% of the treasury yield earned by USD0++ goes into the protocol treasury, while the $Usual token governs that treasury.

-

To claim the remaining 10% of $Usual rewards, I can stake $Usual into $Usualx. This 10% is automatically distributed to stakers every time new $Usual is minted. Additionally, $Usualx holders gain voting rights and influence over governance decisions like adjusting emission rates.

Throughout this flow, we see that the governance token ($Usual) captures all the revenue generated by the RWA product itself, while stablecoin holders and stakers are incentivized via yield-backed rewards.

Since Usual is an RWA product, it’s hard to achieve extremely high APY or APR, as yields are closely tied to real-world interest rates and the supply of USD0++.

More details below.

Token Utility Overview:

-

Tokens represent full claims on protocol revenue.

-

Staking grants access to 10% of total $Usual emissions and voting power to influence issuance direction.

-

Participate in treasury governance (e.g., reinvestment decisions).

-

(Future option) Burn $Usual to early-unstake LST USD0++.

Fun in Emission Mechanics

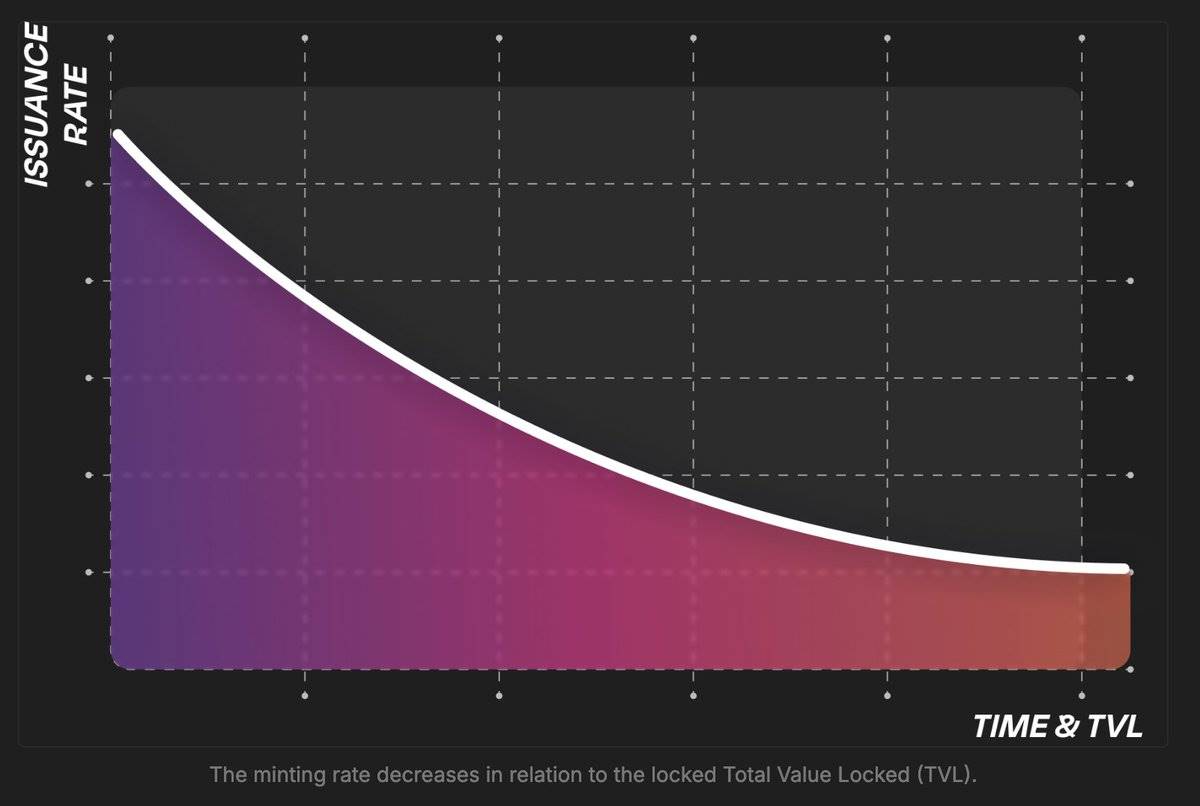

$Usual emissions are dynamically adjusted based on supply, meaning:

-

When TVL grows, $Usual emissions decrease.

-

When TVL declines, $Usual emissions increase.

Question:

So Poopman, are you saying Usual doesn’t encourage deposits when TVL is high?

Answer:

No, not at all. When TVL is high, Usual actually earns more from increased treasury holdings. So as the treasury grows, $Usual should become more valuable.

Conversely, when TVL is low, $Usual emissions increase because treasury income drops, requiring higher compensation. Higher emissions help attract more TVL to the platform.

Additionally, to prevent excessive inflation of $Usual:

-

Emission rates adjust based on interest rates.

-

A maximum emission cap is set (decided by DAO).

This ensures token growth doesn’t outpace treasury growth, preserving $Usual’s value and aligning with the principle of “protocol growth = token value growth.” Of course, the DAO can adjust as needed.

For Early vs Late Participants:

In this model, early participants benefit the most—they receive the largest share of $Usual at higher prices when TVL is already elevated.

Latecomers receive fewer tokens, but aside from opportunity cost, they don’t suffer real losses, as they still earn yield.

In short, $Usual is a tokenized representation of the yield generated by Usual.

By introducing PVP elements, $Usual adds fun—users earn 10% of others’ $Usual emissions through staking, and early adopters profit more from later entrants.

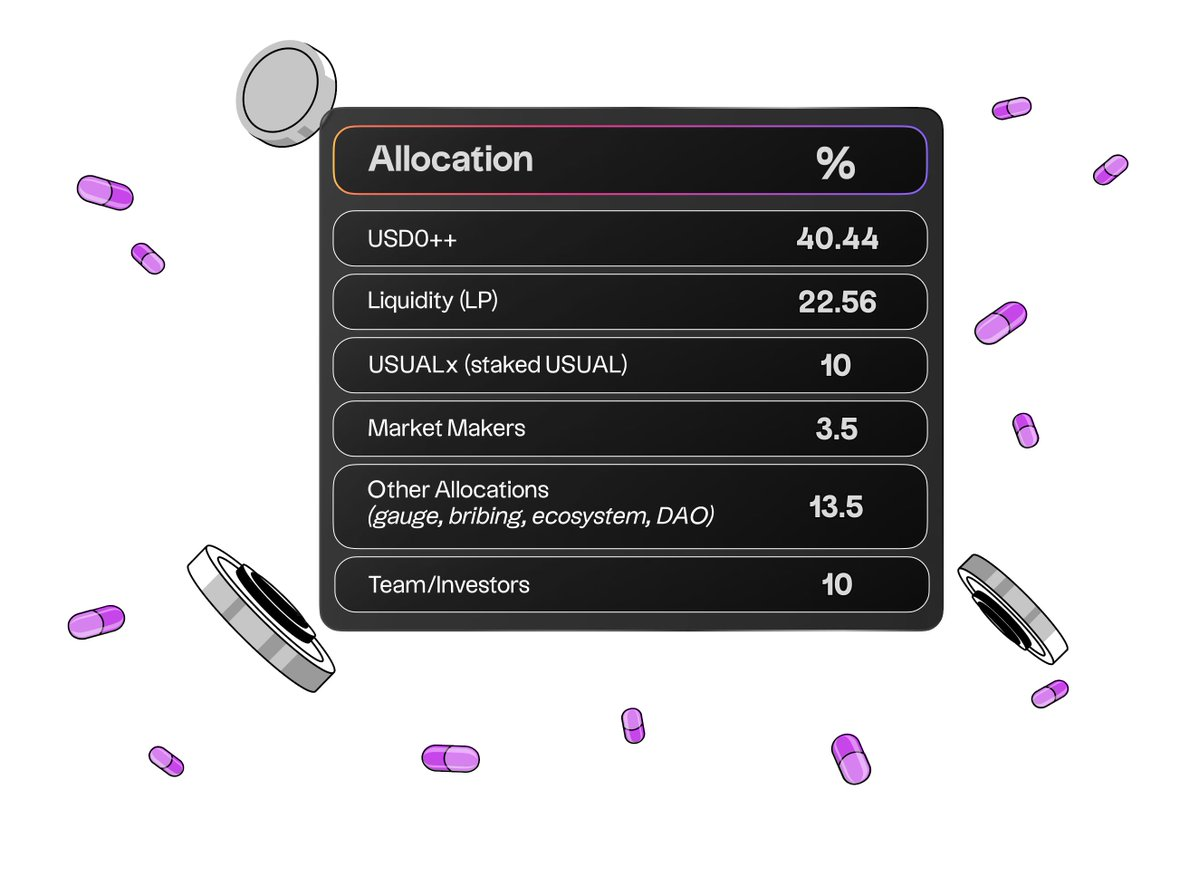

Token Distribution:

$Usual distribution is community-centric:

-

73% allocated to public and liquidity providers

-

13.5% to MM / team and investors

-

13.5% to DAO / buybacks / voting incentives

Great to see DeFi projects prioritizing the community. Well done by the team.

What to Watch Out For?

$Usual tokens are fun, meaningful, and well-structured with strong inflation control. However, risks exist for both Usual and users.

-

Liquidity Issues & Depeg Risk for USD0++

Currently, over $320 million USD0 is staked in USD0++, while Curve’s USD0 liquidity is only ~$29 million. In other words, less than 10% of staked USD0++ is liquid, so large-scale exits could cause pool imbalances and depegging. While this ratio isn’t terrible (worst-case slippage ~2–3%), it’s a risk to consider during TGE windows when short-term investors may exit.

-

Yield Competitiveness in Bull Markets

Might sound naive, but during bull runs, attractive yields usually come from crypto assets (like ETH, SOL), not stable RWAs like treasuries.

For example, I expect stablecoins like sUSDe to deliver massive returns during market rallies, pulling in far more TVL than Usual with yields reaching 20–40% or higher. Without new products to boost USD0 yields, Usual’s growth could stall.

Still, about 80% of DeFi users understand the risks USDe holders take. As a “conservative stablecoin,” Usual offers a safer, more resilient option for those seeking stability.

-

DAO Issue: Low Participation

Low voter turnout is a persistent problem in DAOs. Since Usual is DAO-driven, ensuring sufficient and effective participation is crucial. Considerations:

-

Delegation could help, but DAO decisions aren’t always optimal. Collective wisdom supports DAO design, but looking at Arbitrum DAO results, not everyone has the vision or understanding to shape a project’s future meaningfully.

-

Most participants act self-interestedly, often voting only for proposals that benefit them directly. This could lead to monopolies or unfair reward distribution.

Thus, giving too much power to the DAO carries risks and could lead to suboptimal outcomes.

Conclusion:

-

Robust and interesting token model. The governance token has real value since it’s backed by revenue.

-

$Usual stakers earn 10% of total emissions as rewards, creating strong incentives to stake. This breathes fresh life into the RWA stablecoin space—I believe this is the right direction.

-

Excellent inflation control. Emissions are strictly capped by USD0++ supply and real-world interest rates, preventing inflation from eroding $Usual’s value.

The downside? Don’t expect sky-high APY. This could be a disadvantage compared to other products during bull markets.

-

Liquidity concerns. Currently, USD0/USD0++ liquidity on Curve is under 10%. This poses risks to LPs during TGE, especially during mass withdrawals.

That said, I believe most holders are long-term believers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News