AllianceDAO 2024 Startup Report: Startups Still Focus on Infrastructure, Solana Ecosystem Gains Momentum, and North America, Europe, and Asia Remain Crypto Startup Hubs

TechFlow Selected TechFlow Selected

AllianceDAO 2024 Startup Report: Startups Still Focus on Infrastructure, Solana Ecosystem Gains Momentum, and North America, Europe, and Asia Remain Crypto Startup Hubs

Ethereum remains dominant, while Solana and the Bitcoin ecosystem show promise.

Author: AllianceDAO

Translation: Zen, PANews

AllianceDAO is a leading crypto accelerator and founder community. Our accelerator program attracts the most talented crypto startups in the industry, receiving over 3,000 applications annually. Since AllianceDAO runs two accelerator cohorts per year, we divide our data into two parts for reporting. In this report, Alliance shares key trends observed from application data, along with insights these trends may suggest about the broader startup ecosystem.

Key Highlights: Key Trends Observed in Internal Data from 2021–2024

Blockchains

-

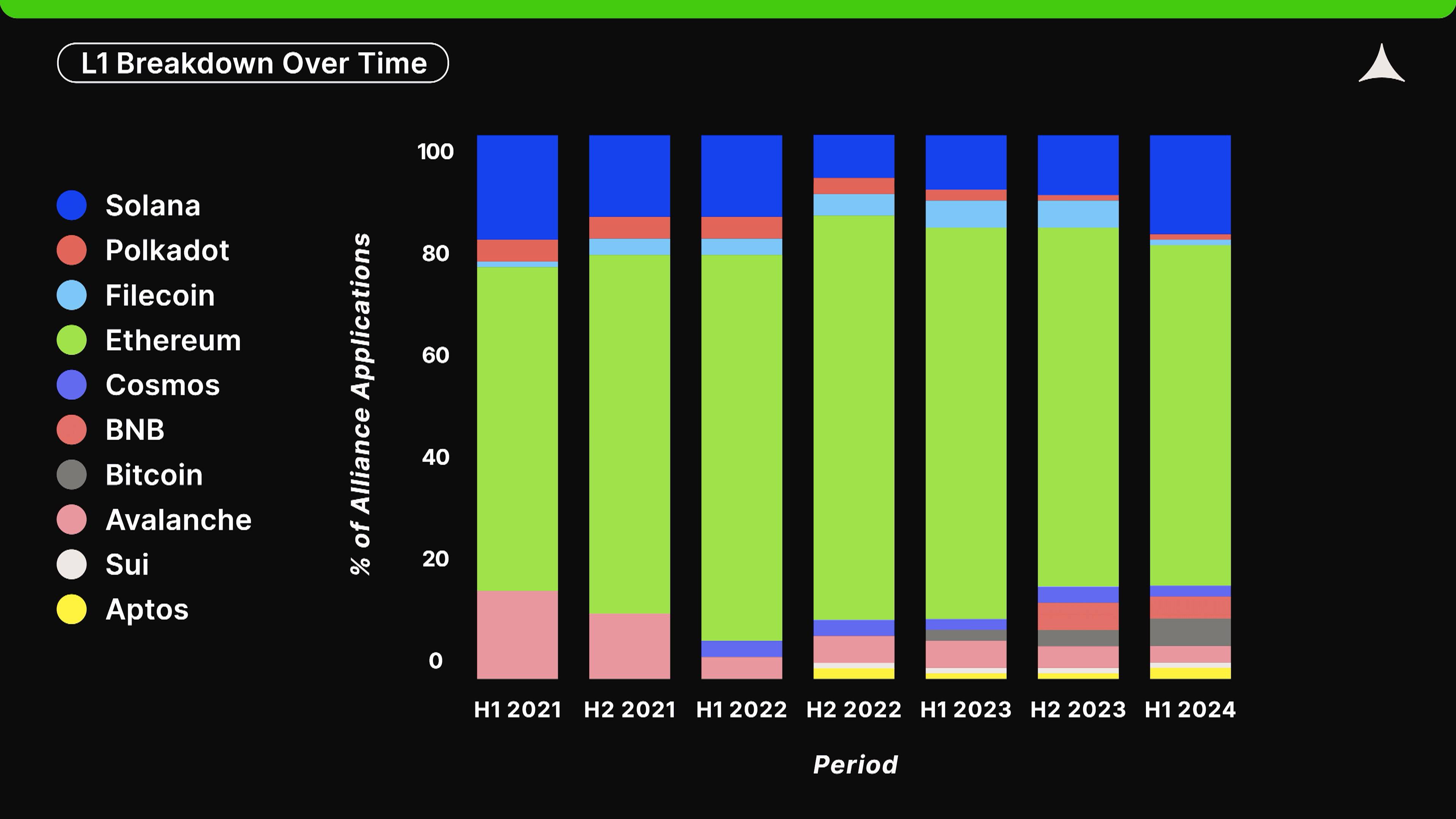

Ethereum remains the primary ecosystem for startups to build on (currently around 2/3 of startups are building there), while Solana (now at 18%, previously dropped to 8% after FTX’s collapse) and Bitcoin (5% today) have grown rapidly over the past 18 months.

-

Within the Ethereum ecosystem, 59% of startups are currently building on Optimism Rollups (Optimism, Base, and Arbitrum).

-

Polygon is gradually losing share among startups, and Polygon zkEVM lags behind Optimism Rollups in the competitive landscape.

-

Base is the fastest-growing Ethereum L2, now capturing over 28% of startup activity—reaching this level from zero in just one year.

What Verticals Are Applicants Building In?

-

Growing verticals: Infrastructure, DeFi, Payments, AI + Crypto.

-

Declining verticals: DAOs and NFTs.

Where Are Founders Located by Continent?

-

Europe (31%), North America (US & Canada at 29%), and Asia (27%) are currently the top three regions where startups are being built.

-

However, the proportion of startups from the US and Canada has steadily declined over recent rounds, while shares from Asia and Africa are rising.

Keywords Increasingly Mentioned by Projects

Popular terms that have grown over the past 12 months include Fully Homomorphic Encryption (FHE), chain abstraction, meme, SocialFi, prediction markets, liquid staking, restaking, RWA, stablecoins, L1, L2, and L3.

Founder Background & Team Composition

-

Currently, 30% of founders applying to our accelerator have experience at big tech companies (S&P 500), and 12% studied at top-tier universities (QS Top 100).

-

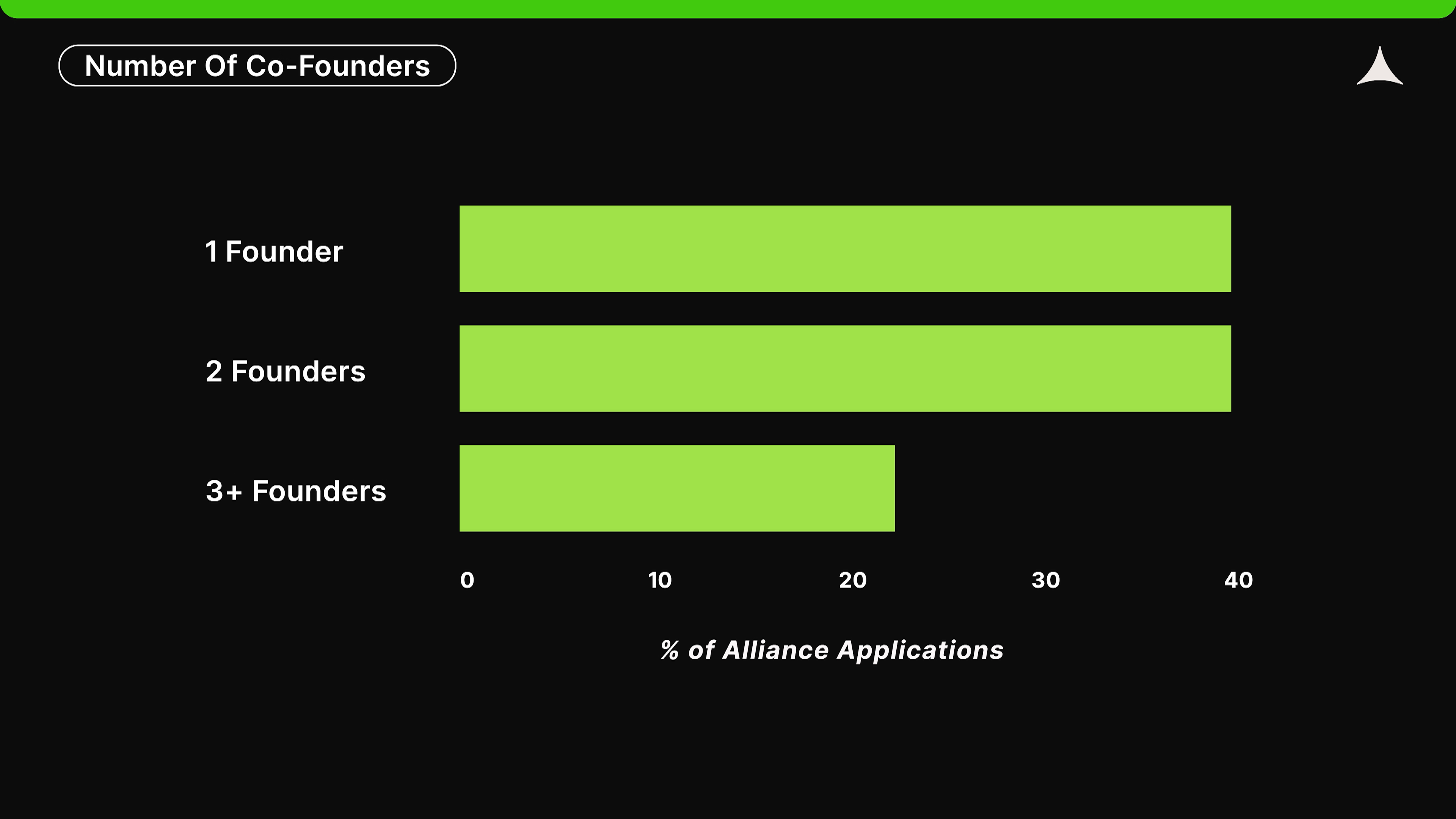

39% of startups are founded by solo founders; among multi-founder teams, equal equity distribution occurs in 50% of cases.

-

72% of startups operate fully remotely (no employees working on-site).

Below is the full report

Layer 1: Ethereum Dominates, Solana and Bitcoin Ecosystems Show Promise

Ethereum remains the dominant ecosystem, attracting 62% of crypto startups applying to Alliance. Additionally, Solana has rebounded since bottoming out in late 2022 and now accounts for 18% of applications. Interestingly, the Bitcoin ecosystem is also drawing increasing developer interest, currently representing nearly 5% of all applications.

The number and quality of startups building on each ecosystem remain the best predictor of its performance over the next 1–2 years. After all, startups build products, and products ultimately drive usage, on-chain metrics, attention, and price movements.

Solana is currently the most momentum-driven ecosystem. According to our data, the number of startups building on Solana hit a low in the second half of 2022—likely tied directly to the collapse of FTX, which played a pivotal role in Solana’s early development. Since then, both SOL’s price and Solana’s on-chain metrics have begun to recover. Many of today’s top products on Solana were actually built during the bear market and FTX crisis. Tensor, Kamino, Solflare, and Pump are popular applications developed by Alliance alumni on Solana. Based on current startup adoption trends, we believe Solana will continue attracting startups and users over the next 1–2 years.

Meanwhile, the Bitcoin ecosystem is attracting more and more startups, starting with the launch of Ordinals in 2023. The initial hype around this non-fungible token standard sparked numerous experiments with fungible token standards such as BRC-20 and Runes. At the same time, efforts aimed at significantly enhancing Bitcoin’s programmability—such as BitVM and dozens of Bitcoin L2 solutions—have emerged. We’re also seeing many DeFi projects first pioneered on Ethereum—like decentralized exchanges, lending platforms, and stablecoins—beginning to be replicated on Bitcoin. While the Bitcoin ecosystem’s momentum may peak following the latest halving in April 2024, this is still the period of highest entrepreneurial interest in Bitcoin’s history.

We are optimistic about Bitcoin’s potential as a startup ecosystem because over $1 trillion in wealth is currently stored on Bitcoin, driving market exploration into how to meaningfully or creatively utilize this capital. However, we must note that Ethereum and Solana still lead by a wide margin, and Bitcoin’s technical limitations may prevent it from delivering differentiated experiences for developers and users.

That said, despite recent gains by Solana and Bitcoin, Ethereum remains the most active ecosystem, capturing the attention of nearly two-thirds of Alliance applicants. Most startups today are building products on highly competitive Ethereum L2s.

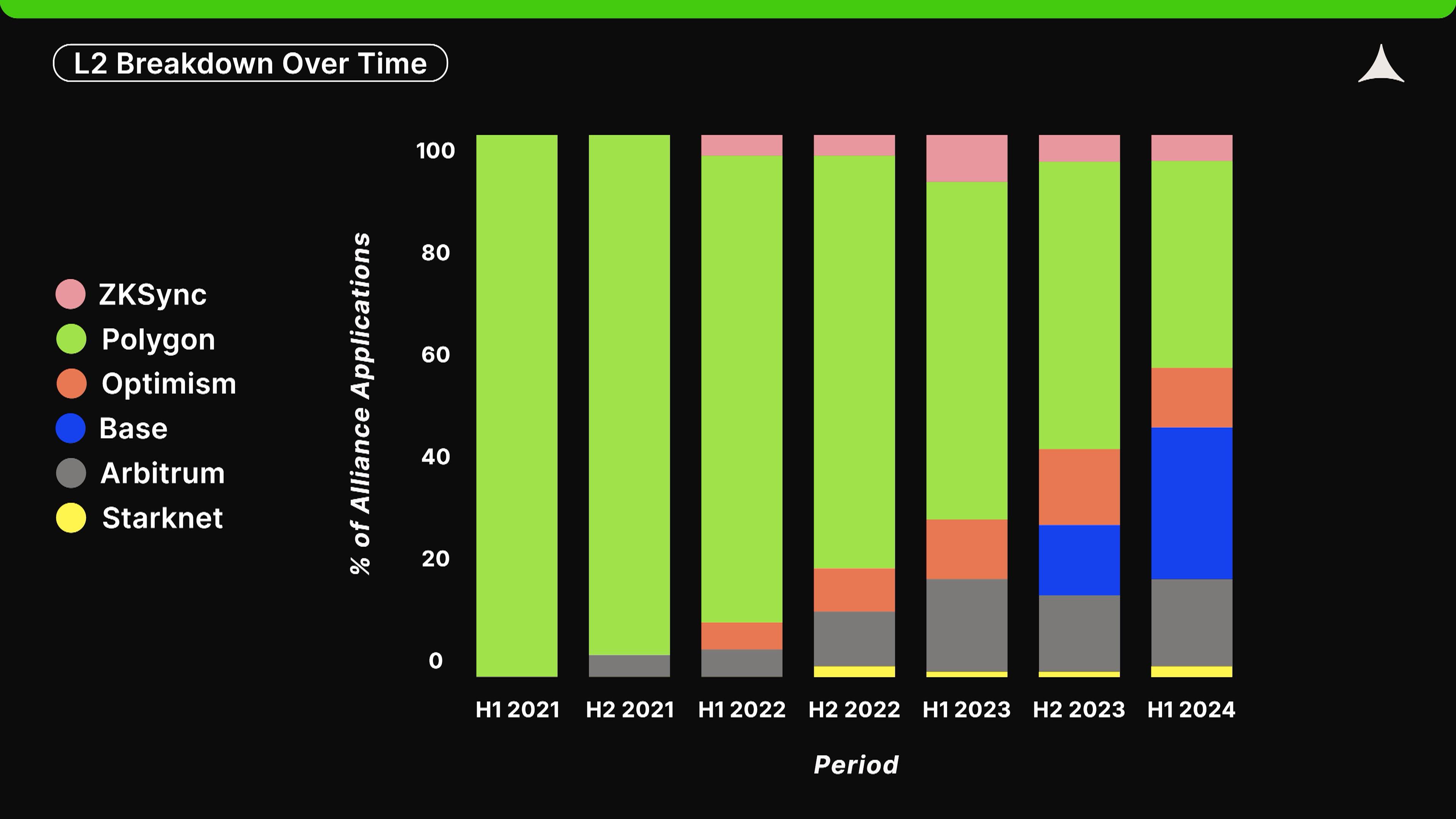

Ethereum Layer 2: Base Emerges Strongly, Optimism Rollup Maintains Lead

In Alliance’s early history, startups built almost exclusively on Polygon. However, Optimism Rollups (such as Optimism, Base, and Arbitrum) have steadily gained traction over the past three years. Today, they collectively account for 59% of startups building on Ethereum L2s. Notably, Base—launched only in 2023—already captures 28% of startup activity on Ethereum L2s.

Based on our own data and data from L2Beat, Optimism Rollups have proven to be a better product than ZK Rollups. Overall, Optimism Rollups offer lower fees and a superior developer experience, which in turn attracts more users and startups. That said, we’ve also met outstanding founders building infrastructure and applications on ZK Rollups (e.g., Starknet and ZKSync). If tooling improves or these founders achieve product-market fit, ZK Rollups could begin attracting more founders and end users—but given the current dominance of Optimism Rollups, this remains to be seen.

Polygon has gradually lost market share among startups building on Ethereum over the past three years. Polygon is not just a blockchain—most startup and user activity occurs on Polygon POS, an Ethereum sidechain. Its declining share is understandable, as Polygon POS was effectively the only mature scaling solution available several years ago. Today, Polygon is investing heavily in Polygon zkEVM, but compared to other ZK Rollups, it still clearly lags behind Optimism Rollups.

Finally, Base deserves special mention. A year ago, we knew Base would become one of the most important L2s, thanks to Coinbase’s brand and distribution power. Yet it has exceeded our expectations, becoming the second-largest destination for Ethereum startups after Polygon.

Vertical Distribution: Infrastructure Growth Continues, DeFi Remains Popular

What products startups are building is another interesting trend we can track from application data. Note that our categorization of product verticals is inherently subjective and therefore imperfect. These categories are not mutually exclusive and are custom-defined—for example, a startup might operate in both gaming and NFTs. So while long-term trends are insightful, please interpret these numbers with caution.

The public perception that there’s too much infrastructure and not enough applications aligns with our application data—in fact, the proportion of startups choosing to build infrastructure has consistently increased over the past three years.

One major reason for infrastructure growth may be that infrastructure tokens have historically commanded high valuations. This incentivizes more startups to pursue infrastructure projects and draws more venture capital into the space, further fueling new entrants. The result is a misallocation of both intellectual and financial capital, but it also leads to more scalable blockchains, which should benefit future application developers.

At the same time, DeFi has become one of the most popular categories over the past year. Despite many VCs claiming “DeFi is dead,” the number of DeFi startups has actually increased over the last 18 months. Meanwhile, DAOs and NFTs remain the least popular product categories. This makes sense—many DeFi projects died in the NFT space (with many DAOs treating their NFTs as governance tokens), and NFTs themselves have struggled to establish lasting value in the market.

Still, NFTs continue to attract interesting startups, especially in art, and we believe this influence will persist. We predict future startups will focus on providing infrastructure for more applications and products—such as SocialFi, Web3 gaming, and on-chain data aggregation—which will further enhance the sustainability of the Web3 ecosystem.

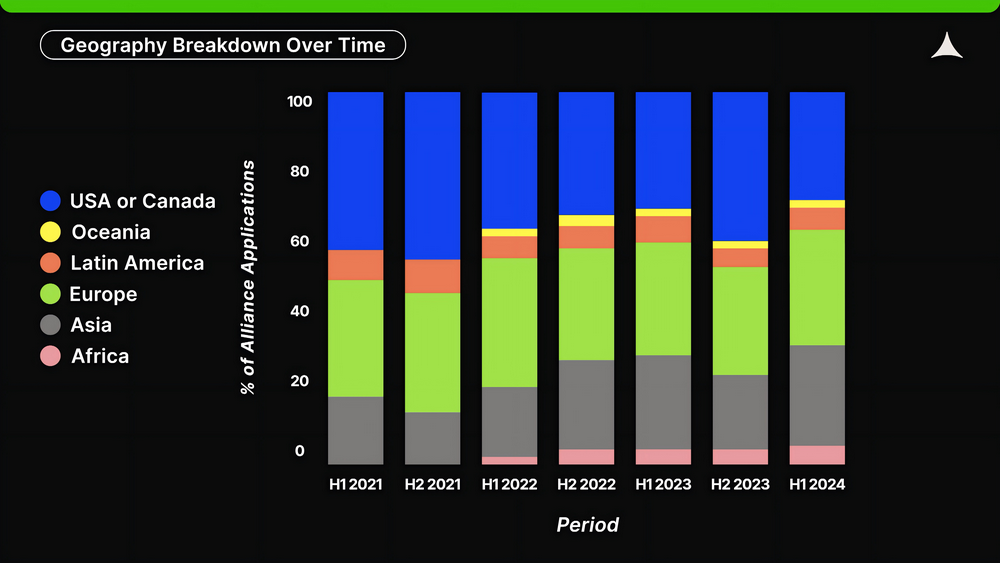

Geographic Distribution: Rise of Europe and Asia, Decline of North American Dominance

One of the most intriguing trends we analyze is the geographic distribution of startup founders.

In the first half of 2024, the share of founders from the US and Canada dropped to a historic low of 29%. This is down from over 45% in the second half of 2021.

Meanwhile, the proportion of startups from Asia and Africa reached record highs of 26% and 5%, respectively. Overall, North America, Europe, and Asia remain dominant, with each region accounting for between 25% and 33% of startup applications. The decline in US-based applicants is a concerning trend, likely driven by two factors. First, increasing regulatory uncertainty in the US, along with the SEC, CFTC, and Treasury Department’s “regulation by enforcement” approach, has led US founders to relocate overseas or shift to other industries like AI. Second, real-world adoption of crypto in developing countries is rising—especially stablecoins as hedges against local fiat currencies and as tools for cross-border, censorship-resistant payments. This is further attracting startups from these regions.

Whether the first trend continues depends on future developments, particularly the outcome of the upcoming November elections. However, the second trend is unlikely to slow in the short term, as stablecoins genuinely solve real-world problems for people in developing nations. This is especially important because public discourse and social media narratives are often US-centric, framing crypto primarily as a speculative tool. While speculation drives adoption in the Global North, stablecoins are driving adoption in the Global South.

Trending Terms Among Startups: FHE, Chain Abstraction, Meme

Crypto has gone through multiple hype cycles, typically every four years. Within each cycle, however, smaller hype waves emerge across different product areas.

By analyzing keywords mentioned in Alliance applications, we gain insight into prevailing trends at any given time. We refer to these as “crypto buzzwords” and group them into categories for clearer visualization. Note that all charts in this section use logarithmic scales. Zero-knowledge proofs (ZK), fully homomorphic encryption (FHE), trusted execution environments (TEE), and multi-party computation (MPC) are key privacy-related technologies used in crypto. Notably, while ZK can be used for privacy (e.g., Zcash, Tornado Cash), its primary use today is for scalability.

Privacy

ZK remains the most frequently mentioned term. FHE has risen over the past year. These trends align with public discourse. ZK’s first major application in crypto was Zcash in 2016, but it didn’t become widely known until 2021. In fact, Vitalik wrote in 2021: “optimistic rollups will probably win out in general-purpose EVM computation, but in the medium to long term, ZK rollups will win out in all use cases.” We believe the consistent rise of ZK from 2021 to 2023 traces back largely to this single statement.

User Experience

Mentions of “bridge” have remained relatively stable over the past three years. Meanwhile, “account abstraction” rose sharply in late 2021, and “chain abstraction” grew rapidly in 2022. “Intent-based” mentions surged recently but appear to have peaked. “Chain abstraction” is essentially a rebranding of cross-chain bridging, so its rise correlates with the stagnation of “bridge.” The emergence of “account abstraction” coincides with Vitalik’s promotion of EIP-4337 in 2021. Many crypto buzzwords originate from Ethereum’s core team.

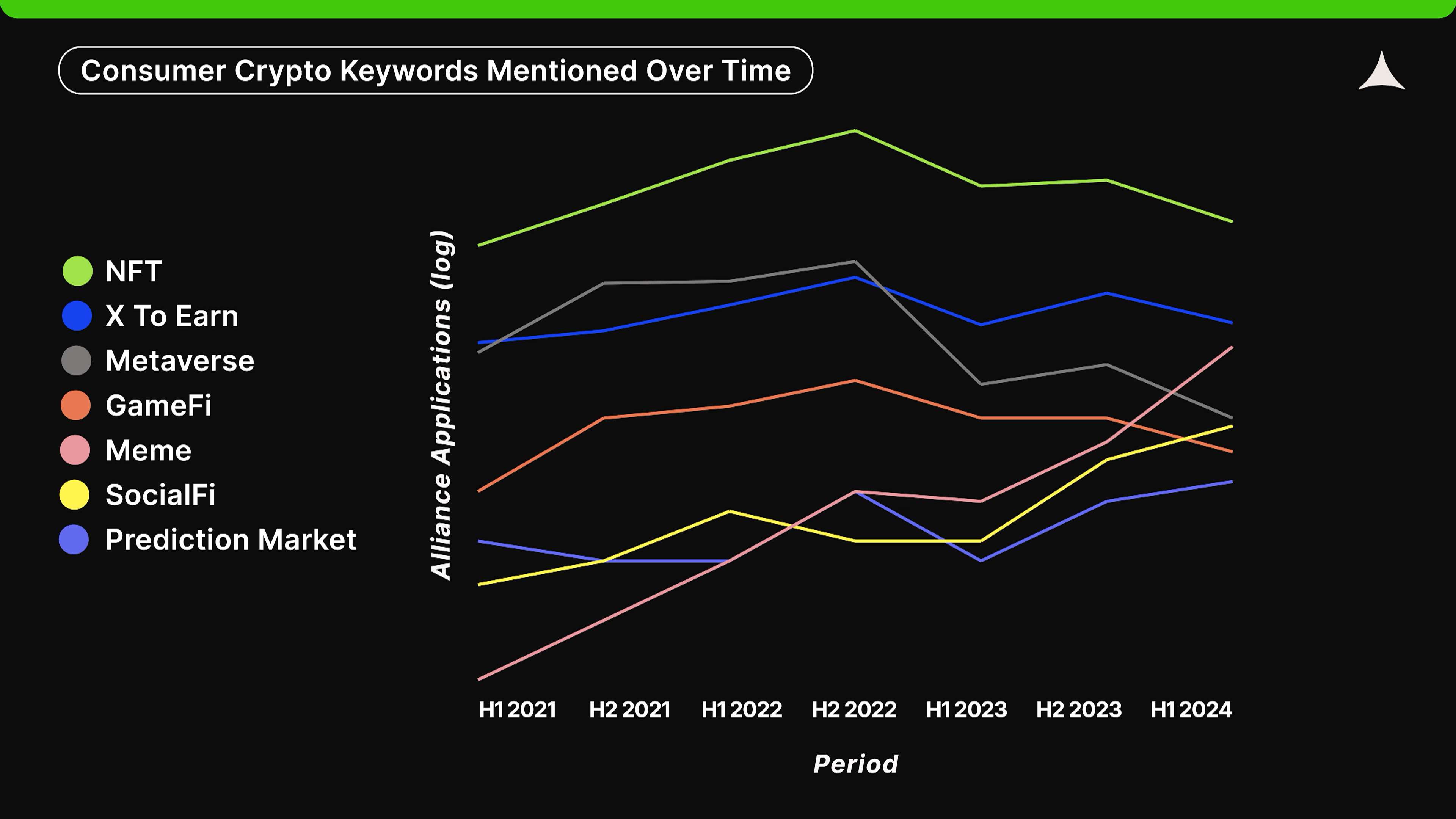

Consumer Applications

In consumer apps and gaming, “NFT,” “metaverse,” and “GameFi” peaked in late 2022 and have since sharply declined. “X-to-earn” followed a similar downward path, though less steeply. “SocialFi” and “meme” are newer terms from 2021 that continue to grow.

The speculative frenzy around NFTs in 2022 has likely been replaced by memecoins, which offer lower price points and higher liquidity due to their fungibility. “X-to-earn” and “GameFi” peaked with Axie Infinity, yet surprisingly, the decline in “X-to-earn” has not been severe. Finally, “SocialFi” saw a revival in late 2023, likely linked to the success of Friend.tech.

Yield

“Liquid staking” has been gaining traction since 2021, while “restaking” has steadily risen since 2022. In contrast, mentions of “lending” have remained relatively stable over time, peaking slightly in late 2022.

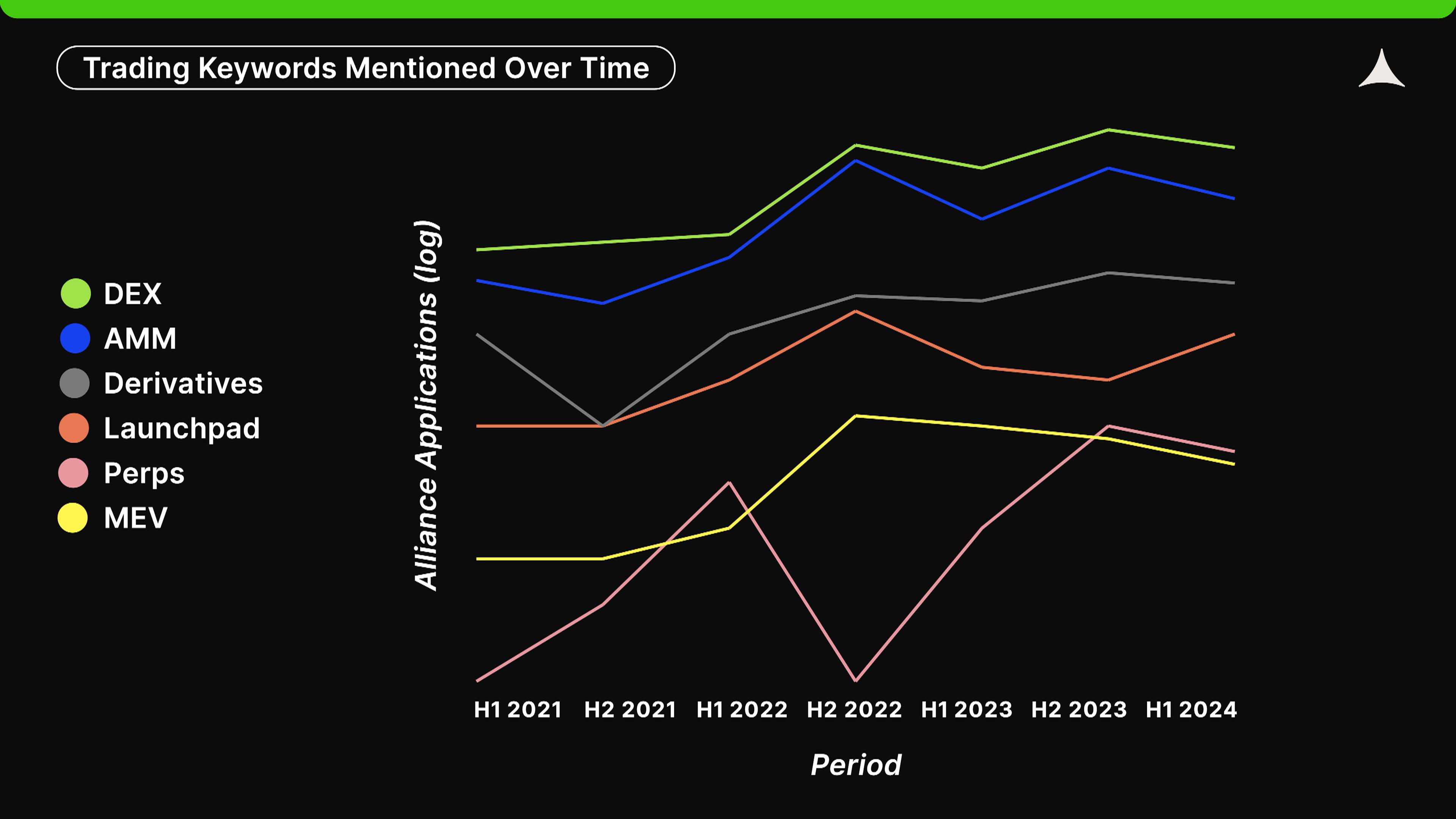

Trading

“AMM,” “derivatives,” and “DEX” have generally shown upward trends over the past 3.5 years. In contrast, “MEV” (Maximal Extractable Value) peaked in late 2022 and has since declined in popularity among founders. Launchpads slowed slightly in 2023 but are regaining momentum. Overall, trading-related keywords are rising, as this is one of the few areas in crypto with clear product-market fit. The recent uptick in “launchpad” may be linked to the success of Alliance alum Pump.fun.

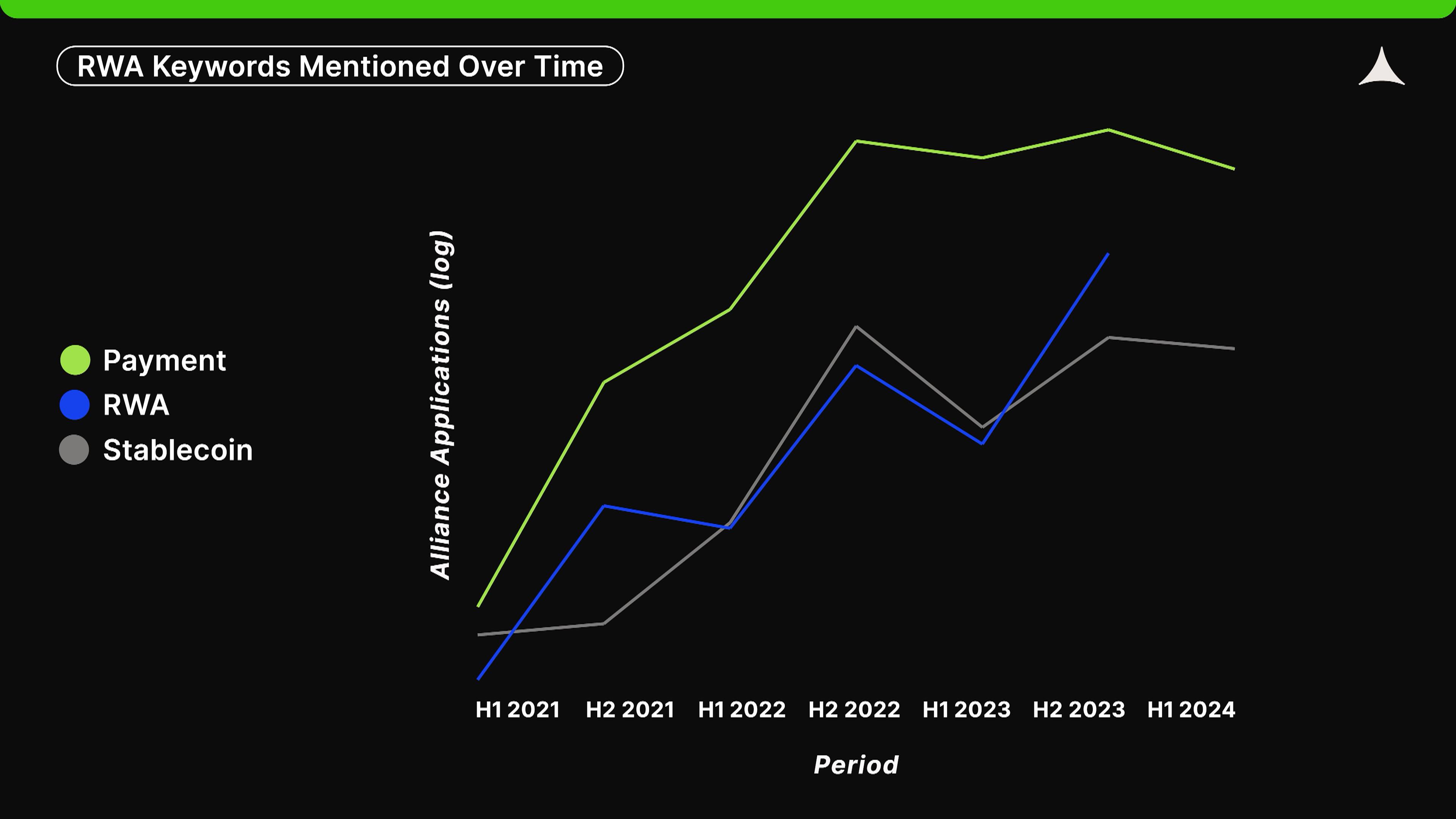

RWA

Mentions of “payment,” “stablecoin,” and “RWA” by applicants continue to rise. As previously noted, stablecoin-based payments represent one of the few proven product-market fit applications in crypto, especially in emerging markets.

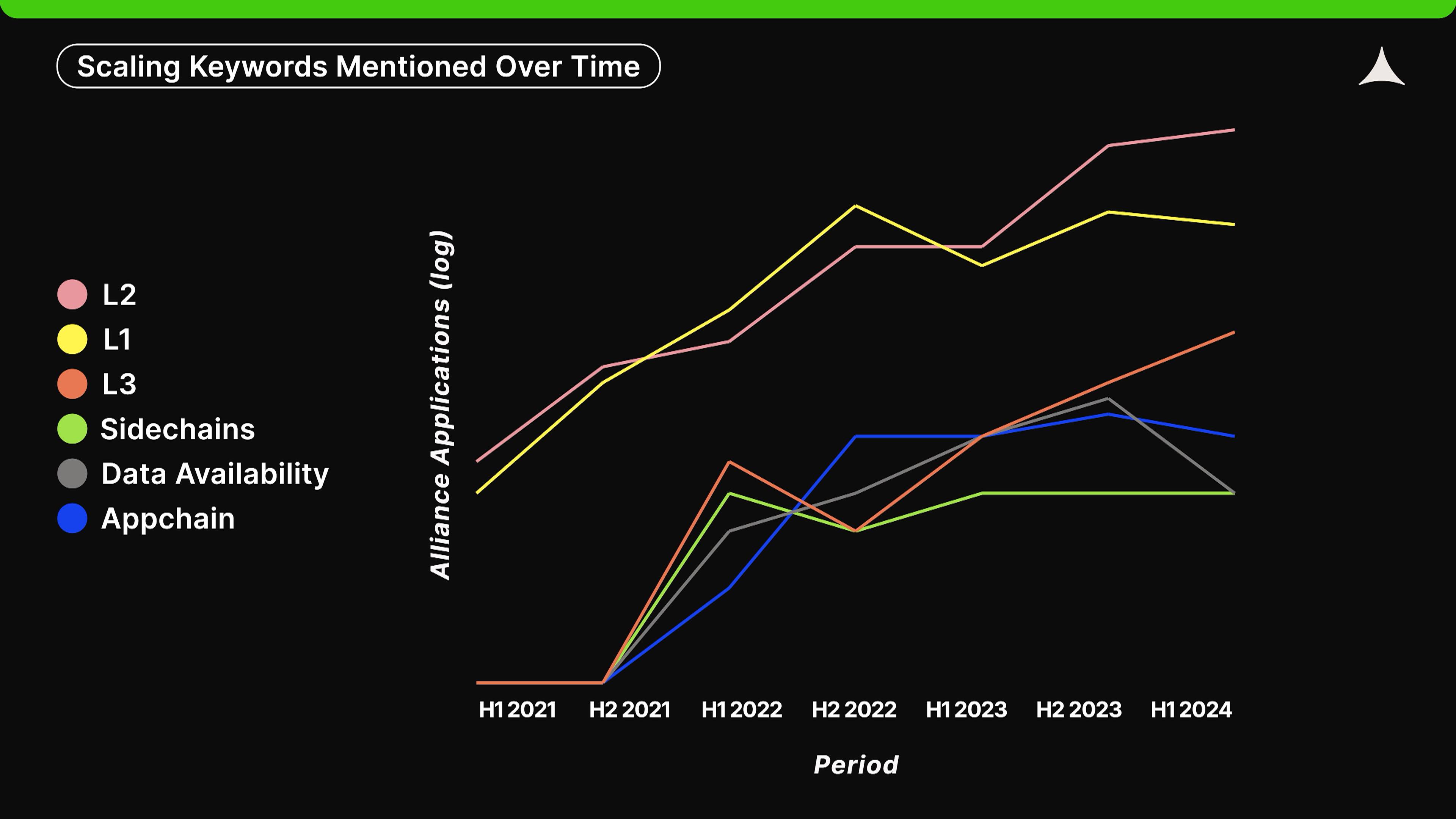

Scalability

In scalability, “L2” and “L3” show strong growth, while “L1” peaked in late 2022 and has since plateaued. Newer terms emerging since late 2021 include “data availability,” “appchain,” and “sidechains.”

Blockchain scalability efforts—especially in Ethereum’s case—have increasingly moved toward modularity in recent years. Vertically, we are progressing toward L2 and L3 layers and extending downward to dedicated data availability layers. Horizontally, more appchains are emerging. Finally, the rise of “sidechain” in this dataset is somewhat surprising, perhaps linked to the successes of Polygon and Ronin.

Founder Background & Team Composition

Founder Background: The Most Successful Founders Rarely Come From Elite Backgrounds

In our latest cohort, approximately 30% of applicants reported prior work experience at big tech companies (defined as S&P 500 tech firms). This ratio has remained largely stable since 2022. However, it marks a significant drop from 2021, when nearly 50% of applicants came from big tech.

Why the decline? It may relate to fewer US applicants due to regulatory pressures (the US being home to most big tech firms). Additionally, the 2021 bull run resembled a “gold rush,” attracting many non-crypto natives seeking quick profits. Lastly, in 2024, crypto’s appeal among tech workers may be rapidly shifting toward other fields like AI. Indeed, during the last bull market, several Alliance startups pivoted to AI.

Additionally, the proportion of founders graduating from “top schools” (QS Top 100 universities) peaked in 2021 and has since stabilized. The trend for elite education closely mirrors that of big tech experience—both have plateaued, showing little change worth noting.

But are founders from elite educational or professional backgrounds more likely to succeed?

If you look across all crypto founders, there is clearly a correlation between attending top schools or working at big tech and future success. However, when we examine the most successful companies in our accelerator and across the entire crypto industry, very few come from elite backgrounds.

We discuss possible reasons in detail in “What Does It Take to Be a Great Crypto Founder?” Briefly, crypto is a counterintuitive technology, and many founders from traditional elite backgrounds may struggle to understand it from first principles. While this may change over time, it remains true today.

Team Structure & Work Model: Nearly 75% Fully Remote

Analyzing team composition in our data helps us understand the structure of crypto startups. While this doesn’t necessarily reveal which structures produce the most successful teams, we share what we consider ideal based on experience.

In our latest cohort, 39% of startups were founded by solo founders. VCs have traditionally been biased against solo founders, yet data shows they can achieve extraordinary outcomes—research indicates about 20% of unicorns were founded by solo founders. Moreover, they often hire key employees who, while not titled co-founders, play equally critical roles.

Among startups with two or more co-founders, roughly half (45%) have equal equity splits, while the other half do not. When equity is unequal, two-founder teams most commonly split 60-40 or similar (e.g., 51-49), followed by 70-30.

In teams with three or more founders, nearly any equity structure is acceptable, though equal splits or a single majority holder (≥50%) are most common. Unequal splits typically reward founders who i) initially funded the startup personally; ii) originated the idea (including effort and contribution); or iii) will hold the most decision-making authority.

We don’t have strong opinions here, but for founders who start around the same time, we generally recommend equal equity splits, as building a successful company is a decade-long journey. That said, we recognize that equal splits aren’t always fair, as outlined above.

Our data shows that nearly 75% of startups today operate fully remotely (no on-site employees). This is a substantial share, though unsurprising given crypto’s global nature and relative scale.

The pandemic may have changed how we work, but at Alliance, we prefer in-person teams—or at least co-located co-founders and key employees. Face-to-face teams communicate more efficiently and quickly, fostering stronger team culture, creativity, and accountability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News