Understanding Azura: Initialized Leads $6.9 Million, A One-Stop DeFi Gateway for Multi-Chain Integration

TechFlow Selected TechFlow Selected

Understanding Azura: Initialized Leads $6.9 Million, A One-Stop DeFi Gateway for Multi-Chain Integration

"The Onchain Interfacing Layer" completes the missing piece of DeFi.

Written by: TechFlow

Amid the fierce battles of Meme PVP, don't forget to keep an eye on new protocols emerging in the market.

As the grand infrastructure narrative gradually becomes fatiguing, projects focused on optimizing trading experiences and centered around asset trading—particularly smaller to mid-sized infrastructure—are gaining traction. Examples include the recently popular meme trading platform Moonshot.

Besides specialized meme trading platforms, some综合性 DeFi trading projects are also beginning to stand out.

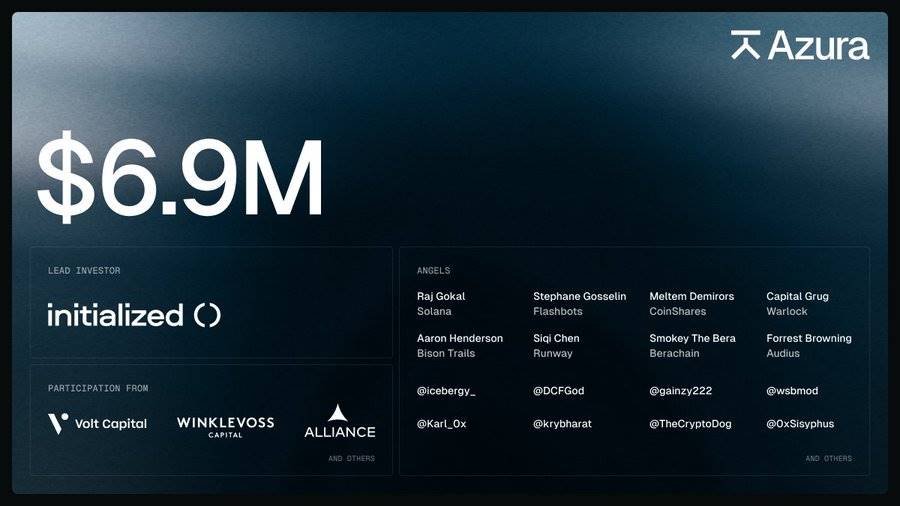

For instance, yesterday, Azura—a protocol positioning itself as a one-stop gateway for DeFi—announced a $6.9 million seed round led by Initialized Capital, with participation from Volt Capital, Winklevoss Capital, AllianceDAO, Raj Gokal (co-founder of Solana), Meltem Demirors (co-chair of the World Economic Forum's Crypto Council), and Stephane Gosselin (co-founder of Flashbots).

Azura’s official self-description is even more stylish and rich in narrative potential:

"The Onchain Interfacing Layer"—completing the missing piece of DeFi.

So here comes the question: what exactly is missing in DeFi? How does Azura differ from other DeFi protocols, and what new benefits does it offer users in on-chain asset trading?

We’ve quickly tested this project and will share key insights with you.

A Single DeFi Gateway: Multi-Chain, Multi-Protocol Integration

What gap exists in today’s DeFi landscape? A statement from Azura’s tweets may indirectly answer that:

Our goal is to enable anyone, anywhere, to trade any asset—powered by DeFi.

Clearly, these three bolded conditions cannot currently be fully satisfied simultaneously in most asset-trading scenarios. This brings us back to several long-standing pain points:

First, fragmentation within the DeFi ecosystem continues to worsen. You trade on Solana; I trade on Ethereum. Different degens stick to DEXs in their respective ecosystems, often juggling multiple wallets and assets.

Second, fragmentation inevitably leads to scattered liquidity. Some platforms have strong liquidity while others suffer from thin order books. When chasing an alpha opportunity, finding optimal routes and sufficient liquidity can be challenging.

Third, the more platforms involved, the higher the risk. As users interact with increasing numbers of smart contracts and platforms, exposure to potential security vulnerabilities grows accordingly.

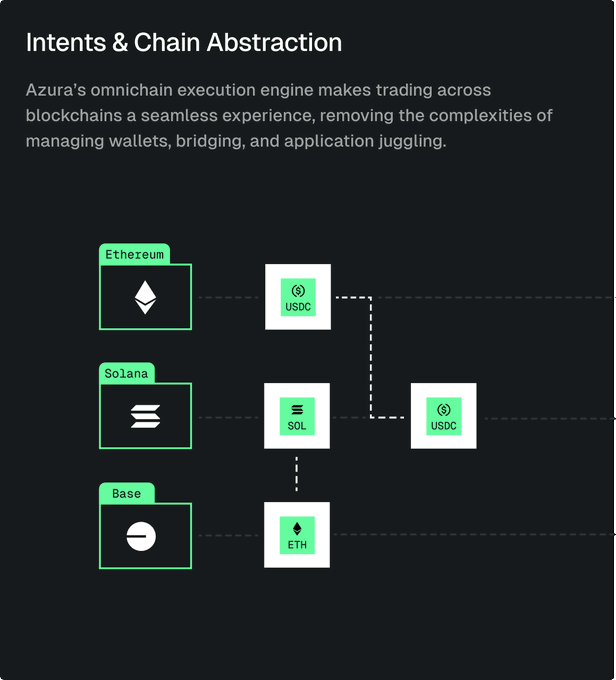

In short, what’s missing in DeFi is actually — a unified, one-stop gateway protocol capable of connecting multiple protocols across multiple chains, enabling seamless trading of any desired asset.

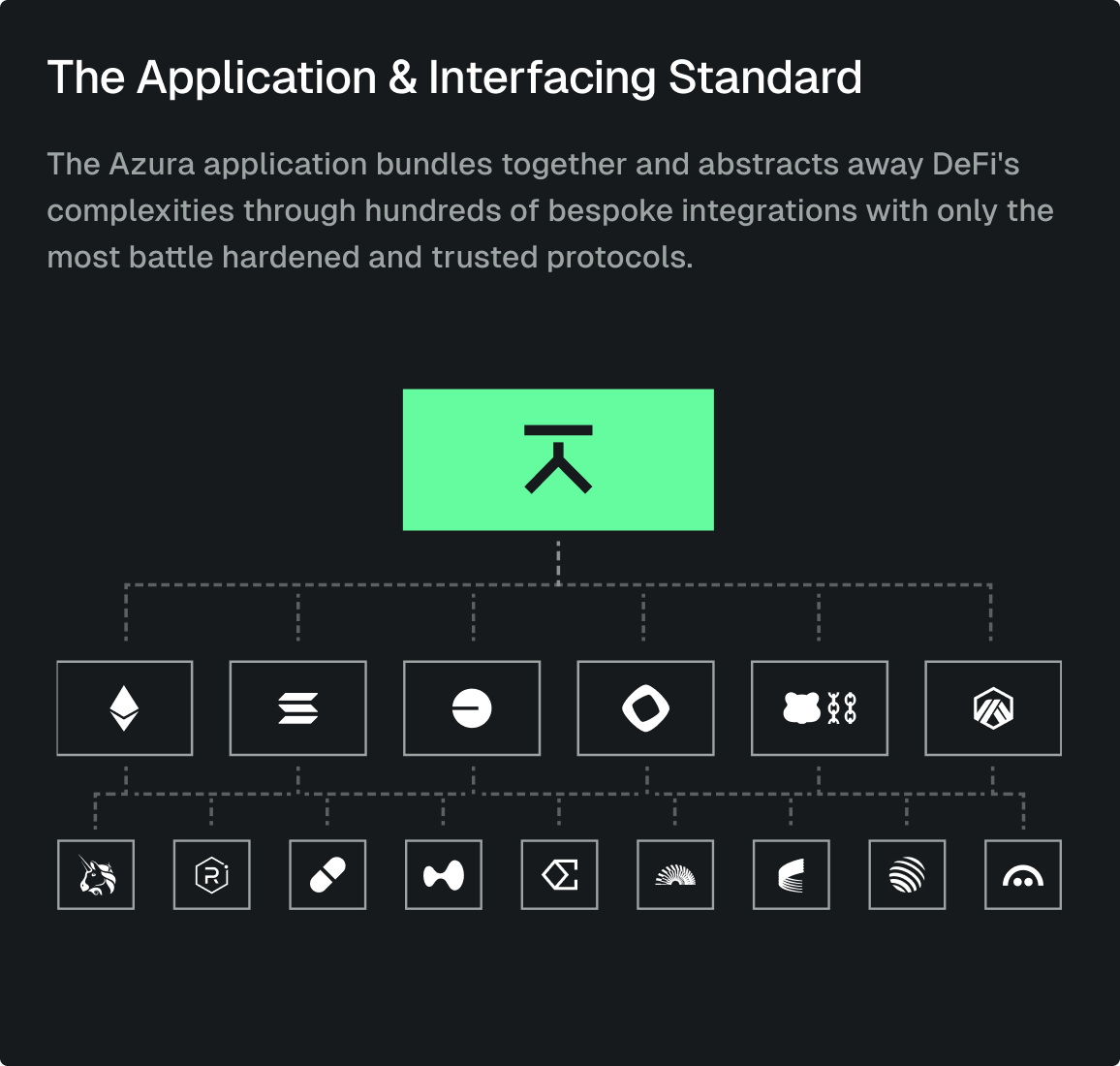

This makes Azura’s concept of an Onchain Interfacing Layer much clearer. In simple terms, it's an application allowing users to log in once and then discover, manage, and trade investment opportunities across all chains from a single interface.

From the product interface on its website, Azura currently integrates hundreds of DeFi protocols across seven EVM chains and Solana, offering users end-to-end experiences including fiat on/off ramps, embedded wallets, advanced order execution and routing, cross-chain swaps, and a unified dashboard for managing entire DeFi portfolios across chains.

It’s like a fusion dish made by combining well-established infrastructure components—such as oracles, DEXs, chain abstraction, cross-chain bridges, aggregators—and putting them all together into a cohesive solution.

At first glance, it resembles Dexscreener, but there are meaningful differences in actual product functionality.

Product Experience

Azura is not a cryptocurrency exchange. Instead, it provides a standardized application and interface layer that allows users to easily interact with open, permissionless protocols such as Uniswap, Curve, or Raydium.

-

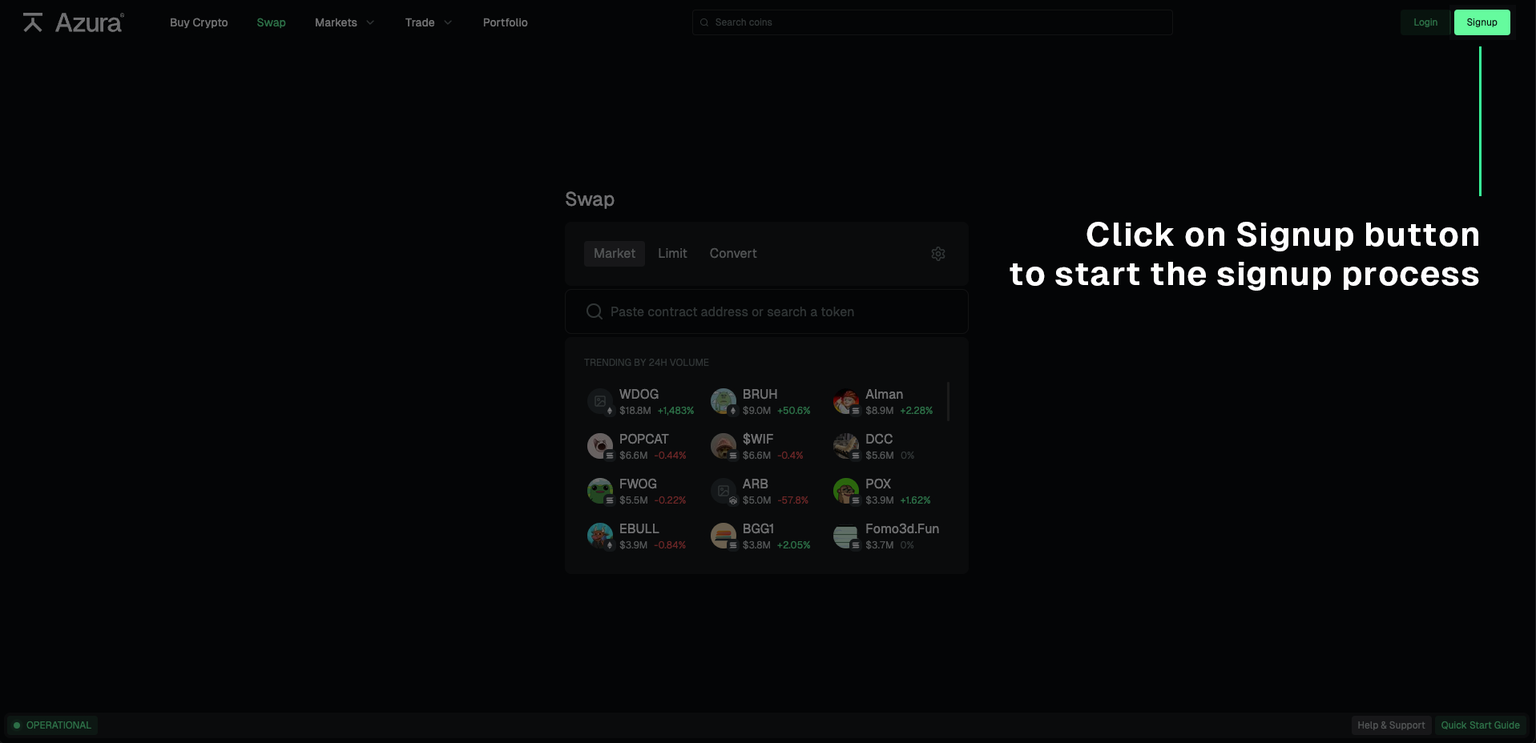

Login / Registration

On the front end, the process begins with registration.

It uses the now-popular Web2-style sign-up/login methods—email or Google account. Upon logging in, users receive a set of randomly generated words similar to a mnemonic phrase, along with a built-in wallet linked to their account.

Notably, this Passkey is generated locally on the user’s own hardware device (e.g., your computer) and supports key recovery via iCloud Keychain and Google Password Manager—similar in principle to MPC wallets using multi-signature and fragmented private key management.

In other words, you still use familiar account credentials to log in, while the mnemonic-like data is securely stored on your local device and recoverable through the cloud when needed.

-

Funding

If the associated wallet has no crypto balance, users can click the "Buy" button to trigger a fiat on-ramp powered by Moonpay. After completing identity verification, they can directly purchase crypto (Note: This service is not available in China; mentioned here for informational purposes only). Currently supported assets include SOL, ETH, and USDC.

-

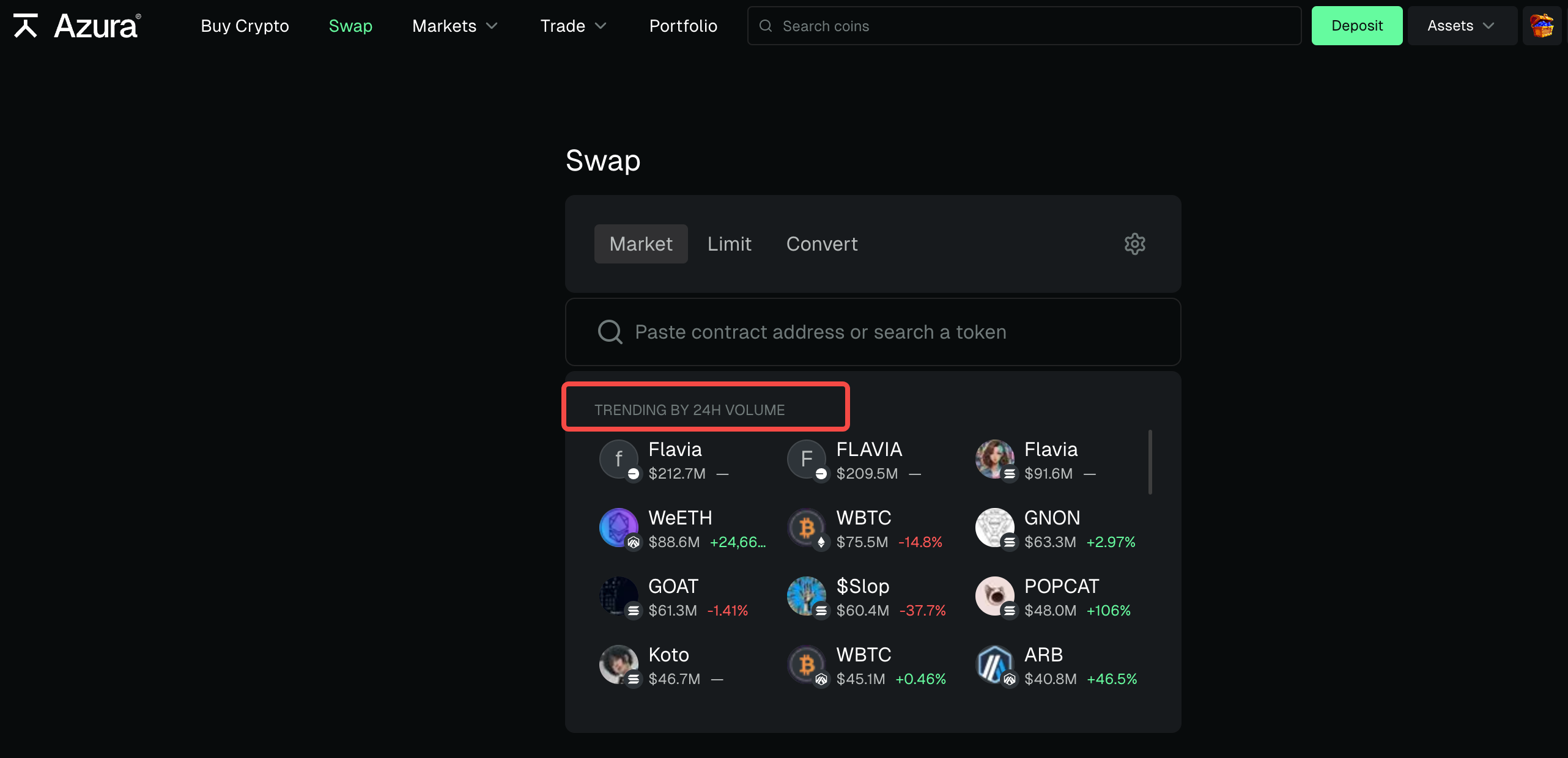

Swap

Similar to other DEXs, you can swap your USDC, ETH, or SOL for tokens across any supported ecosystem.

One area where Azura excels is displaying the hottest tokens across all supported chains during the swap process, supporting quick trades, and offering both market orders and limit orders.

For example, recently trending AI meme coins Flavia and GNON appear directly on the interface—you can click and trade them instantly. Under the hood, chain abstraction technology works to find the best quotes and execute transactions efficiently.

-

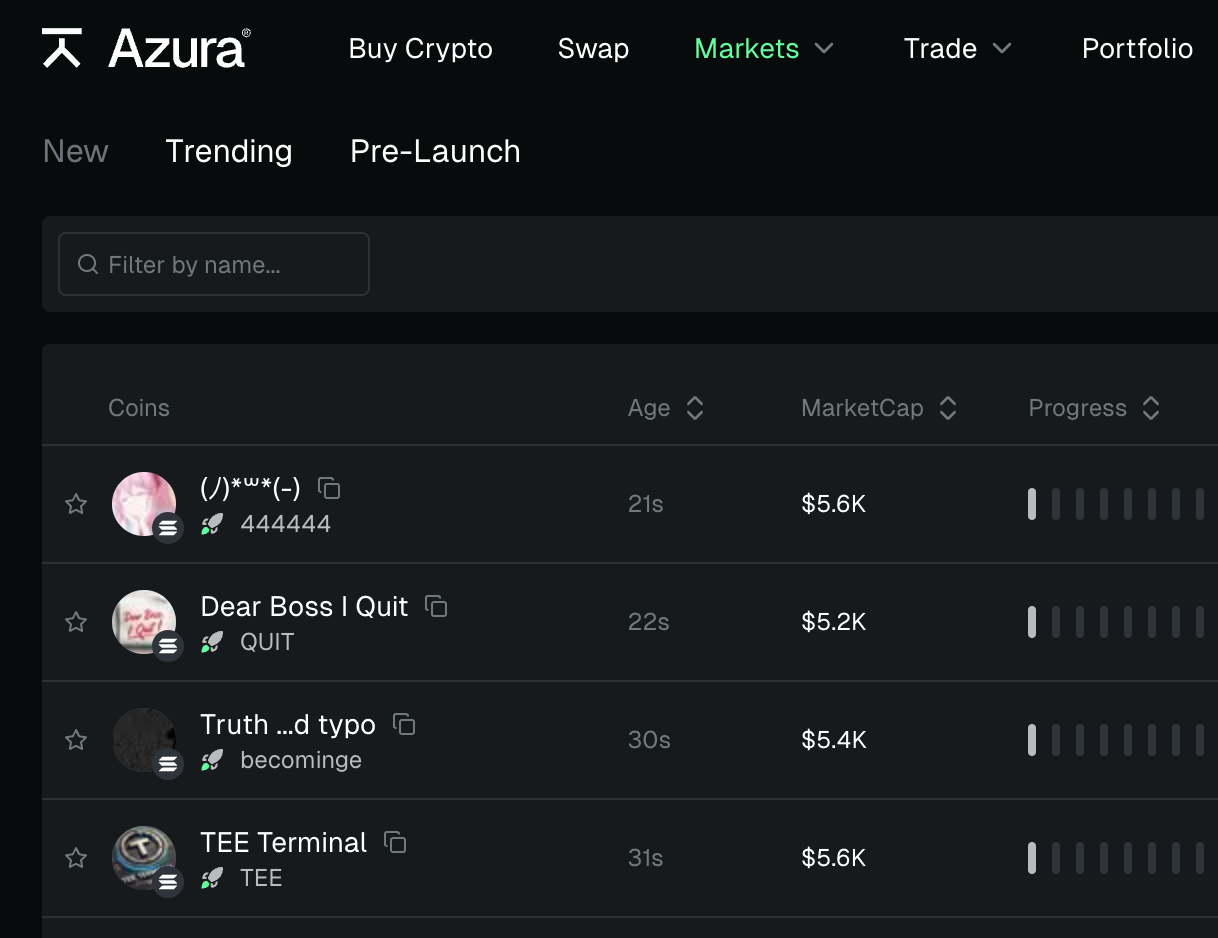

Market Discovery

This section functions like a token recommendation feed, featuring detailed information about newly deployed, upcoming, or trending tokens across all supported chains.

From the specific page view, it’s clear that Azura aggregates data from Pump.fun, synchronizing new token launch information and bonding curve progress.

-

Trading

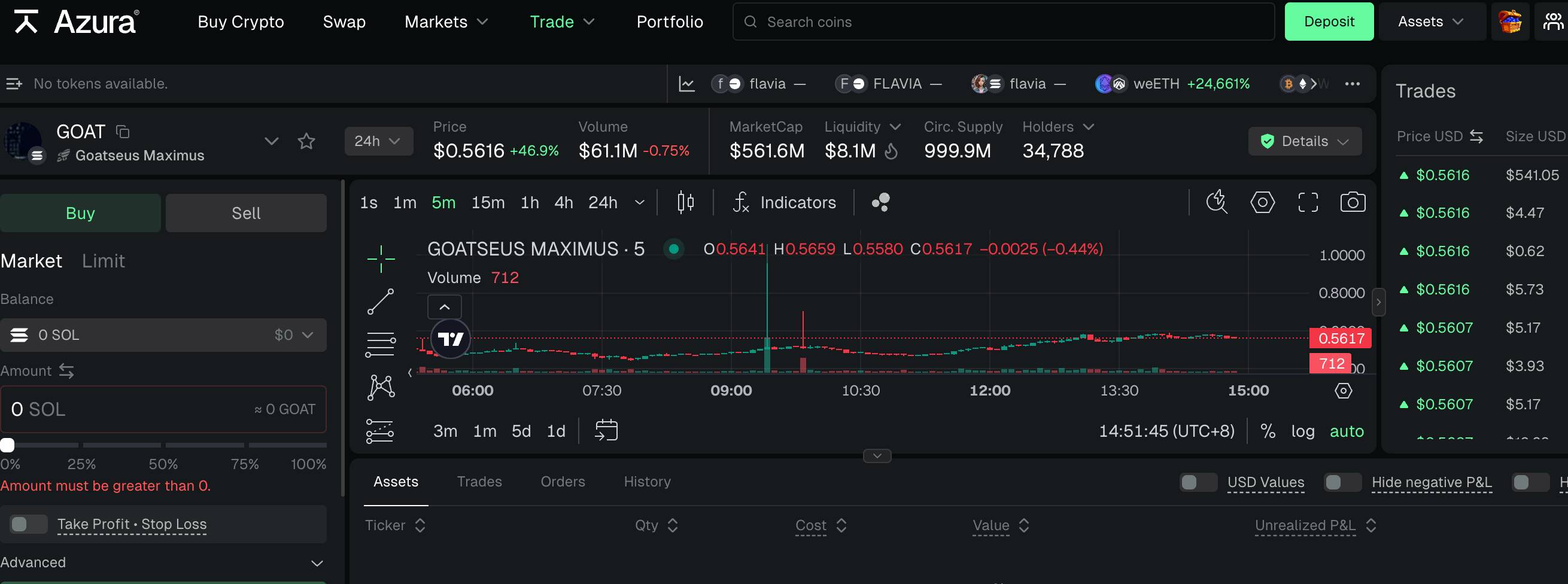

The trading interface appears to be a more detailed version of Swap, showing current price trends, volume, and order book distribution—similar to typical DEX/CEX trading interfaces. Users can also track their PnL and active orders.

The key difference is that you can search for any token across all chains and swap using any supported asset. In contrast, Dexscreener acts more like a pure aggregator—when purchasing, it redirects users to native DEX platforms like Uniswap or Kyber.

Azura, however, handles routing and optimal trade execution internally—it operates as a full-service integrator.

-

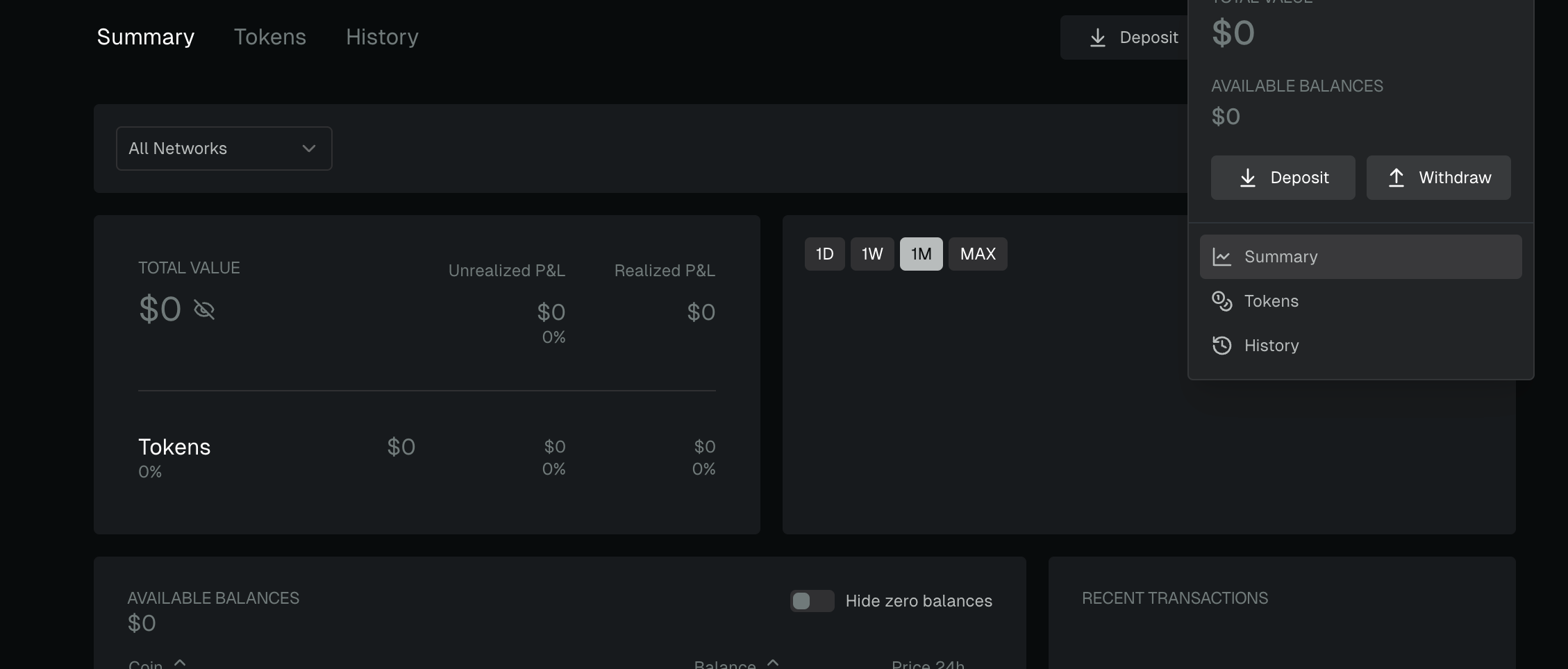

Portfolio Dashboard

Provides a summary of overall trading activity, showing win rate, holdings, and past transaction history—reminiscent of GMGN’s performance tracking pages.

Opportunities for Engagement

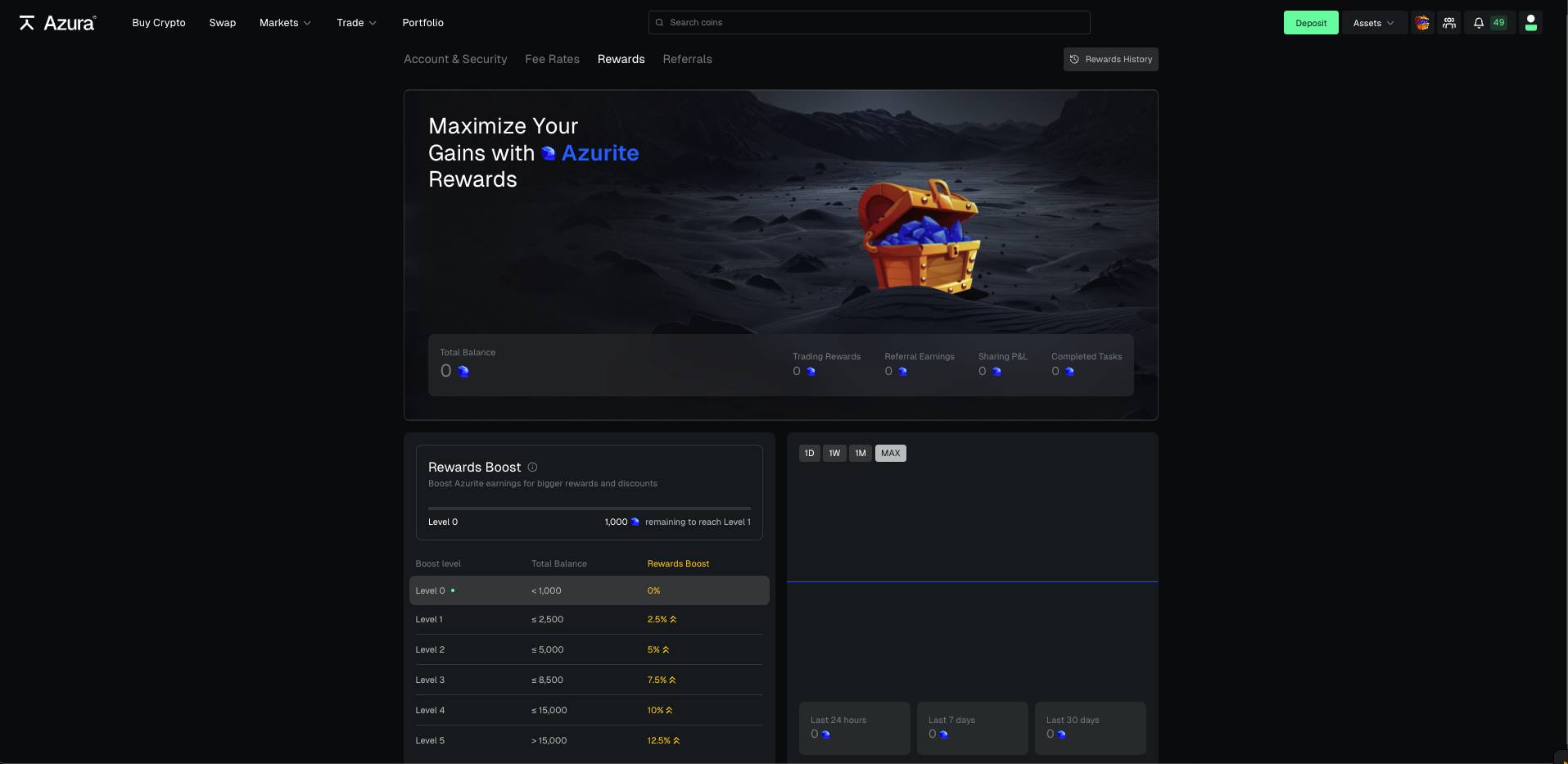

The project hasn’t yet disclosed detailed airdrop rules, so the main way to engage currently is through the Azurite gem system.

Users earn varying amounts of Azurite gems by completing trades, inviting others, sharing trading performance, and finishing other official tasks—think of them as reward points.

Additionally, the higher your account balance, the more Azurite gems you earn for completing the same tasks. For full details, refer to the official documentation.

Overall, Azura’s functionality closely resembles other aggregation-focused DeFi protocols. The real test will be user experience quality and feedback over time.

However, the biggest challenge for such DEX gateway projects lies in overcoming established user habits.

Cross-chain and cross-platform trading may indeed be cumbersome, but when platforms like Pump.fun, Raydium, and Uniswap are already deeply entrenched, getting users to switch to Azura will require stronger marketing efforts and more compelling narratives.

For the team, partnering with top-tier memes and projects and launching more trading-related campaigns could become a key competitive strategy moving forward.

For crypto enthusiasts, safely engaging with small amounts while awaiting potential rewards and actively trying out new innovations remains a daily must-do routine.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News